If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Task 13.

Determine the sentence in which NOT and the highlighted word are written CONTINUOUSLY.

Open the brackets and write down this word. The journalist called future pensioners who (UN)DECIDED in the choice of a non-state pension fund “silent”. The motives for his action are by no means (NOT)NOBLE. Long (UN)CUT hair got in the way and got into my eyes. The project is still (NOT) AGREED. The 21st century will be an era of battle for (NON-RENEWABLE) natural resources. We consider each sentence, determining the part of speech of the highlighted words and applying the rule for their spelling. The journalist called future pensioners who (UN)DECIDED in the choice of a non-state pension fund “silent”. – participle with dependent word with choice

, separately.

The motives for his action are by no means (NOT)NOBLE. – a short adjective with the combination not at all

, separately.

Long (UN)CUT hair got in the way and got into my eyes. – participle with a dependent word for a long time

, separately.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The project is still (NOT) AGREED.

- short participle, separately. The 21st century will be an era of battle for (NON-RENEWABLE) natural resources. – a complete adjective, there is no opposition and dependent word, together. Examination. Be sure to parse each word from the proposed options to avoid making a mistake. In response, write down the chosen word in capital letters, opening the brackets. Choosing a pension option Until December 31, 2020, citizens born in 1967 and younger must choose a pension option for themselves - keep only the insurance part of the pension and refuse the funded one, or keep both parts of their future pension. Options for pension provision Insurance part + Savings part Insurance part The insurance part is the basic form of state pension provision.

The pension is guaranteed, but its size depends on the situation in the country at the beginning of payments, first of all, on the ratio of the number of working citizens and pensioners and on the situation with the state budget. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The funded part is a means of mandatory pension savings, which is managed by professional market participants in the interests of the future pensioner. The combination of the funded and insurance parts allows you to create the most reliable pension option. Such a “combined” pension consists of at least two elements - budgetary and market, which helps protect potential payments from risks of various natures. Components of the future pension of Russians Savings Insurance In monetary terms In points, the value of which may change in accordance with the number of working citizens and pensioners As a result of investing pension funds by professional managers From contributions active at the time of payment of employees What it represents

If you have any questions, you can consult for free chat with a lawyer at the bottom of the screen or call (consultation is free), we work around the clock.

Funds recorded in the pensioner’s individual account in rubles State obligation to distribute funds to future employees Depends on the profitability of the portfolio Taking into account the current demographic and economic situation.

In 2020, by decision of the government, the insurance pension will be indexed by 4%, while for 2020 inflation, according to preliminary estimates, will be 12% Can be inherited before the pension is assigned Not inherited under any conditions Options for placing the funded part of the pension Russian Pension Fund Non-state pension funds A pensioner has the right to choose a management company to which to entrust his funds.

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

After concluding an agreement, the NPF itself chooses which management company to transfer the pensioner’s funds State Management Company (Vnesheconombank) Numerous non-state management companies

How to place your funds? In a management company, including the state management company (Vnesheconombank) In a non-state pension fund Submit an application at any branch of the Pension Fund (in person or through an authorized representative, by mail or by courier) 1. Submit an application to the Pension Fund 2. Conclude an agreement directly with the NPF (for choosing a management company for this agreement is not required) Features of calculating pension savings to be transferred upon applications for early transfer

If you have any questions, you can consult for free in a chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

according to applications submitted by insured persons in 2016 Both the Pension Fund of Russia and the non-state pension fund, which is part of the system of guaranteeing the rights of insured persons in the compulsory pension insurance system, can invest pension savings. The Pension Fund invests pension savings through the state management company Vnesheconombank and private management companies, one of which a citizen can choose independently. A change of insurer occurs only when moving from the Russian Pension Fund to a non-state pension fund, from one non-state pension fund to another, as well as from a non-state pension fund to the Russian Pension Fund. When transferring pension savings from one management company to another, there is no change of insurer - the Pension Fund of Russia remains the insurer. You can exercise the right to change insurers annually. However, investment income is retained only if funds are transferred no more than once every five years. It is also possible to change the insurer by early transfer, however, in the event of a negative investment result, this may entail a reduction in pension savings (nominal value of insurance premiums) by the amount of the investment loss. The exception is for insured persons who have submitted an application for early transfer to the year of five-year fixation of pension savings by the current insurer. Loss of a citizen's pension savings when filing an application for early transfer in 2016 From what year do you form pension savings?

If you have any questions, you can consult for free in a chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

with your current insurer? Positive investment Negative investment From 2011 and earlier Loss of investment income Loss of pension savings in the amount of investment loss for 2020 No loss of pension savings From 2013 to 2020

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call (consultation is free), we work around the clock.

Loss of investment income for 2015–2016 Loss of pension savings in the amount of loss from investment for Loss of investment income Loss of pension savings in the amount of loss from investment for 2020

Required documents for filing an application Insurance certificate of compulsory pension insurance (SNILS) Identity document (passport citizen of the Russian Federation) Application for choosing a management company WHAT IS THE DIFFERENCE BETWEEN THE INSURANCE AND ACCUMULATION PART? Both the insurance and funded parts of the pension are formed from insurance contributions charged by the employer for its employees.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

At the same time, contributions to the insurance part are recorded on an individual personal account with the Pension Fund in the form of pension rights guaranteed by the state and are regularly indexed by the state. But the money itself goes to pay pensions to current pensioners. Contributions to the funded part of a pension live a different, more complex financial life. These are real funds that can be transferred to the management of a company; this company will invest in investment projects and thereby increase the amount over time. Instead of a management company, you can choose a non-state pension fund that works with several management companies, monitors the status of a citizen’s account, and reduces the risk of losses.

Is this system in effect now?

Yes and no. Since 2014, the funded part of the state pension has been frozen. This means that new mandatory contributions from employers do not replenish it, but go to the general budget of the Pension Fund for the payment of insurance pensions to today’s pensioners. But the person himself can still replenish his individual pension account. Yes, and employers, of their own free will, can make additional contributions for their employees in order to increase the funded part of their pension.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Funds and management companies continue to invest pension savings that were previously transferred to them for management. And their clients can, as before, freely transfer their savings - from the Pension Fund to the Non-State Pension Fund and back, from one Non-State Pension Fund to another, from one management company or specific investment portfolio of a management company to another.

Funded pension

According to statistics, about 50% of Russians belong to the so-called “silent people”. This is the name given to people who have not submitted a corresponding application to a non-state pension fund or management company for pension investment. In this case, the Russian Pension Fund (PFR) makes the decision for the “silent people”. Officially, the Pension Fund invests savings through the state management company (MC) Vnesheconombank (VEB).

Also, according to the law, citizens can write an application to redirect this 6% to a non-state pension fund. Depending on the profit received, the funded part of the pension will increase.

The funded pension is accumulated in the citizen’s personal account. By law, it can be replenished with additional funds. Maternity capital can also be transferred to this account.

From the beginning of 2020, the right to choose a pension option for the first time (save a funded pension or refuse to form it) remains only for people to whom insurance premiums have been calculated since 2014.

How to increase the funded part of your pension:

- Choose a management company or non-state pension fund (NPF).

- Conclude an agreement on compulsory pension insurance and write an application for transfer to a non-state pension fund or an application for choosing an investment portfolio of a management company, according to which a citizen entrusts his funded pension to this organization.

This must be done strictly within the agreed time frame.

If I never choose a non-state pension fund, can my savings be taken into the “common pot” of the Pension Fund?

No, they can't. Contributions that have already been made to your individual retirement account will remain there in any case. The confusion often arises because at one time choosing a pension option was voluntary. By the end of 2020, people were asked to decide: to return to an insurance pension - a “common pot”, as it was before, or to leave a combined option - partly insurance, partly funded pension. You can read more about the types of pensions in the article about how the pension system works. If you consciously chose the insurance option or simply did not take any action, then from 2020 your pension began to be formed as a classic distribution pension. That is, the contributions that your employer makes for you go entirely to the general budget of the Russian Pension Fund.

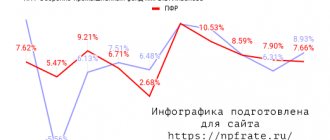

If you decide that the combined option is more suitable for you, your company would have to transfer part of the mandatory pension contributions to the “common pot”, and part to your individual account. This would allow the funded portion of your state pension to grow. This would have been the case if it weren’t for the “freezing”. Since 2014, no new mandatory contributions are made to replenish the funded part - everything is sent to the “general cash desk” of the Pension Fund. But this choice only affected your employer's future contributions for you. And all previous savings that were made over 12 years, from 2002 to 2013, still remain in the individual pension accounts of citizens. Nobody forcibly takes them and transfers them to the general budget of the Pension Fund. If you remain “silent” and never choose a non-state pension fund or a management company, your pension savings in the Pension Fund will continue to be managed by the state management company - Vnesheconombank. At the beginning of 2020, about 35 million people chose private funds and management companies. More than 40 million “silent people” chose to trust the state company. VEB, like other non-state pension funds and management companies, regularly reports on the return on investments. If it seems acceptable to you, there is no need to transfer your savings anywhere. For example, the profitability of VEB’s expanded portfolio of pension savings (used, among other things, for “silent people”) at the end of 2020 was 8.6% with annual inflation of 2.5%. The average profitability of NPFs at the end of 2020 was approximately at the same level.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The profitability of NPFs and private management companies for several years can be checked on the Bank of Russia website. To do this, you need to look at the statistics on compulsory pension insurance. But it is worth remembering: past performance does not guarantee the same profitability in the future. In addition, these statistics indicate the return on investment. Then the fund or management company also deducts its commissions from this figure. As a result, a smaller amount is credited to a specific account.

Where do NPFs invest my money? Could they be investing it in some kind of scam?

The Bank of Russia very strictly regulates what NPFs and management companies can invest pension money in, and very strictly monitors compliance with these requirements. Future pensions can only be invested in reliable financial instruments. However, any investment carries risk and can result in both profit and loss. At the same time, the amount of investment income is determined not so much by chance as by the professionalism of the experts who manage the NPF money. If a certain fund has been showing returns above the market average for several years, then there is a high probability that its specialists know how to competently plan investments.

Answers to common questions about the amount of non-state pension

Question No. 1: How not to make a mistake when choosing a non-state pension fund?

Answer: There is a special rating compiled and updated by the Expert RA agency. Organizations are engaged in the formation of a list based on long-term forecasts.

Question No. 2: Are there any disadvantages to forming a pension under an agreement with a non-state pension fund?

Answer: The only drawback of making payments to a non-state pension fund is the lack of control over the investment portfolio, which is managed by the company’s financiers, trying to earn additional amounts from the investor’s money.

However, in some companies the investor is allowed to learn about the composition and condition of his investment portfolio, so the disadvantage can be considered relative. Rate the quality of the article. Your opinion is important to us:

What if the fund does fail?

Savings in the mandatory insurance system are protected by the state system of guaranteeing the rights of the insured. This means that whatever contributions you or your employer made to your IRA will be retained regardless. If something happens to the NPF or management company you have chosen, this amount will be returned to the Russian Pension Fund. You can then either leave the money with the Pension Fund or transfer it to another fund of your choice. But as for investment income, no one guarantees its safety. If the fund goes bankrupt, you may lose income for the entire period of accumulation, including the money that previous NPFs earned you. If you have already started receiving a pension, then its size will not change, even if the NPF in which you kept your pension savings goes bust.

How does non-state pension provision work?

The operating principle of the non-state pension fund is similar to the operating scheme of the Russian Pension Fund. The only thing is that no one forces employees to contribute funds to the NPF, and contributions to the Pension Fund are mandatory. In addition, when a pre-agreed significant amount of money accumulates in a citizen’s account, NPF financiers invest it in some direction. That is, an investment portfolio is being formed that can bring profit to the investor. Investment is another advantage of NPFs because:

- invested money is additionally protected from inflation;

- the transferred funds are multiplied and provide an even more significant pension than previously assumed.

Despite the fact that not all companies inform investors about what kind of investment portfolio has been formed, the contract must stipulate the schedule of future payments, the amount of indexation, and possible adjustments. Work with a non-state pension fund is based on the following principle:

- A citizen writes a sample application in one of the nearest offices of the non-state pension fund of his choice.

- Company employees study the submitted documents and information about the investor, form a list of programs suitable for a particular applicant that would allow them to increase the invested amounts and receive a pension benefit in the future.

- The applicant studies the proposed options, selects the option he likes, asks questions and signs an agreement with the NPF.

- When the applicant has the opportunity, or when a pre-agreed deadline arrives, the depositor makes a contribution. Its size can also be determined in advance. Next, the future pensioner regularly sends some amounts of money from his income to the fund.

- When a predetermined date arrives, or when a person reaches retirement age, the fund will begin to accrue a pension benefit to him in a predetermined amount (or an increased amount if there was income from an investment portfolio).

Which NPF should you choose to ensure you don’t lose money?

Any investment is a risk. Even the same fund can earn more than others in one year, and then go into the red the next. But there are several indicators that are worth paying attention to:

- Check the return on investment of the fund's pension savings over several years. If these returns have been consistently at or slightly above the market average, without significant dips, this is a good sign.

Look at the number of clients and the amount of pension savings of the fund. The larger the fund, the more professional team of investment experts it can hire. On the other hand, small funds are more flexible in choosing investment projects - and their instruments may turn out to be more profitable. All this data is publicly available on the Bank of Russia website. Look who the owners of the fund are. If these are large and reliable structures, for example leading banks or corporations, this may indicate the stability of the NPF. A good sign is if the fund is managed by people with extensive and successful experience in the financial market. And vice versa: if there is no information about managers on the fund’s website, you should be wary.

Is it possible to switch from one NPF to another?

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Yes, of course, the fund can be changed. For example, if you are afraid that your NPF will go bankrupt or the fund will invest your savings unsuccessfully from year to year - with little profit or even losses. In the same way, once a year you can transfer money from the Pension Fund to a non-state pension fund or vice versa. In addition, within the framework of the Pension Fund, you can transfer savings from one management company to another or change investment portfolios. But the benefits of the transition need to be carefully assessed. By law, NPFs are required to record investment income every five years from the date of concluding an agreement with a client. Moreover, even if the fund invested money unsuccessfully and received not income, but losses from investments, at the end of these five years the person will definitely not be in the red. At the time of recording, the amount in his account must be no less than that which was at the beginning of this period, plus all contributions that he or his employer transferred to the account during this time. If you want to suddenly change the fund and fall between fixations, you may lose investment income and even part of the savings themselves.

What determines the size of a non-state pension?

As already mentioned, a future pensioner, using the services of a non-state pension fund, can count on the fact that the pension will be formed not only from the amounts of his investments, but also from the income received from the investment portfolio.

Money invested in a non-state pension fund “works” for the investor through management by company specialists. If the Pension Fund can only be expected to index pension benefits (which is “frozen” every now and then), then the Non-State Pension Fund forces contributions to make a profit. In this regard, the amount of the pension from the NPF will be significantly higher than the state benefit. The main thing is to comply with the terms of the contract and make payments on time.

How can I get money from the NPF when I retire?

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

There are three payment options:

One-time payment.

In some cases, all savings are paid out at once: for example, if the funded part turns out to be very small - no more than 5% of the total pension.

If there are more savings, then a one-time payment is not possible. Other cases when you will receive pension savings in one amount are listed on the Pension Fund website. Lifetime payment.

The most common case is a lifetime pension: every month for the rest of your life you receive a state pension, one part of which is insurance and the other part is funded.

Moreover, the insurance part is always paid by the Pension Fund of Russia, and the funded part is always paid by the NPF or Pension Fund of your choice. These payments may even arrive in your account on different dates of the month. Payment over several years.

It is also called

emergency pension

. This option is not available to everyone. It can be chosen by those who themselves made voluntary contributions to their individual account, in particular, transferred maternity capital to it, or their employers made additional contributions for them. The payment of these voluntary pension savings can be extended over a certain fixed period. You determine it yourself, but this period must be at least 10 years. You can combine a fixed-term pension with a lifetime pension: use part of these savings for payments for a fixed number of years, and part for lifetime payments. If you do not write a special application to the Pension Fund or Non-State Pension Fund, one of the previous options will be automatically selected: a one-time or lifetime payment.

What will happen to the money if I don’t live to see retirement?

If a person dies before the pension is assigned, then all the money from his individual pension account goes to his heirs.

To do this, legal successors must contact the Pension Fund or Non-State Pension Fund within six months after the death of the fund client. If the heirs miss the required deadline, they can restore their rights to this money, but only through the court. You can determine your own heirs. To do this, it is enough to submit an application to the Pension Fund (if your savings remained there) or to the Non-State Pension Fund (if you transferred them). Heirs can be any people, not necessarily relatives. If there are several legal successors, you must indicate in what shares the savings will need to be distributed among them. There is no need to write a statement regarding the heirs. In this case, pension savings will first go to immediate relatives: children, spouses, parents. If they are not there, brothers, sisters, grandparents and grandchildren come second. All relatives in the same line will receive money in equal shares. In some cases, loved ones will be able to inherit your savings, even if you have already received the right to a pension and have been assigned it. But here it all depends on the timing of the payments: If a person was entitled to a lump sum payment, but he did not have time to receive it himself, then all the money will be given in full to the heirs. If a pensioner chose payments for several years (the so-called fixed-term pension), but did not live to see the end of this period, then the heirs will receive the rest of the savings. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

If you have a combined option (you used part of your savings for a fixed-term pension, and part for a lifelong pension), your loved ones will only be able to inherit the fixed-term portion. If a person was assigned only a lifetime pension payment, then the heirs will not be paid anything. The state guarantees that your contributions to the compulsory pension insurance system will be maintained, but no one promises investment income. Therefore, it is important to choose NPF responsibly. After all, investment income over a couple of decades can increase your future pension significantly - or not increase it at all if your money was poorly managed. It also makes sense to diversify risks as much as possible by combining different financial instruments for savings in order to make your old age comfortable and secure. >>>

What exactly will change for millions of pensioners from September 1

Background: The Pension Fund clarified about payments for pensioners with 40/50 years of experience

Important changes await Russian pensioners with the arrival of autumn. Several new rules will apply to senior citizens from September 1. They relate to the calculation of pension payments, as well as the provision of benefits.

So, in the first month of autumn, many pensioners have to make an important choice. On September 30, the Pension Fund of the Russian Federation ends accepting applications from federal beneficiaries who want to refuse a set of social services or, conversely, resume their provision in 2021. Senior citizens need to decide in what form to receive services - in kind or in cash.

Now the cost of the set is 1155 rubles per month. It includes medical, sanatorium-resort and transport components. You cannot change the method of receiving benefits during the year.

With the arrival of autumn, the special procedure for assigning old-age payments will continue to apply. Until September 30, the length of service of medical workers, which gives the right to early receipt of an insurance pension, will be calculated in a new way. One day of work for citizens who provide medical care to patients with COVID-19 and suspected infection will be counted as two days of service.

In the fall, the procedure for calculating pension payments for a number of older citizens will also change. Until September 30, pensioners who receive money on their bank cards must receive Mir cards. The transition to the national payment system is completed in the first month of autumn; the “October” pension for senior citizens will be credited to new cards.

If they are absent, the money will go to a special account. And if after 10 days the pensioner does not come to the bank for these funds, then they will be returned to the Pension Fund. And starting next month, payments will be suspended.

Let us remind you that earlier it became known that a new rule was being prepared for the indexation of pensions of Russians. A special system of calculating payments will allow increasing the income of older citizens.

Russians were explained how they can achieve a pension of 90 thousand rubles Experts offered future pensioners 2 options to achieve the desired capital

RELATED LINKS:

Already for sure: there is clarity on the new payment of 36,390 rubles

Pensioners born 1953–1957 and younger were told about new payments

Which working pensioners will receive increased payments?

Continuation: “To continue receiving a pension”: the Pension Fund made a statement for pensioners