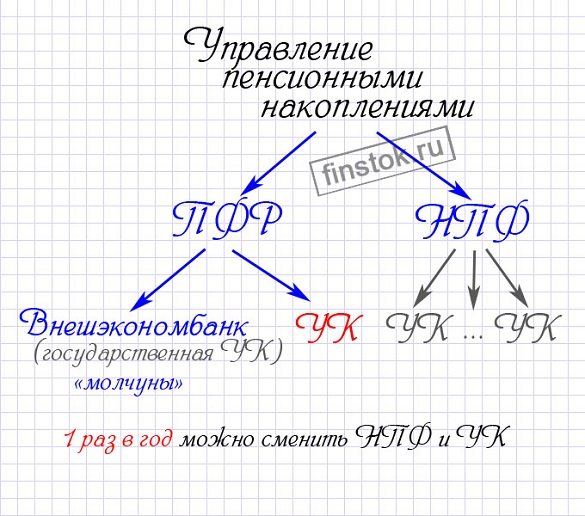

Pension savings are money saved on a person’s personal account. They are stored in the Pension Fund and non-state pension funds. Unlike insurance payments, such finances are not an abstract concept; they are invested in various financial instruments. Thanks to this, they are not only preserved, but also multiplied thanks to the investment activities chosen by the Pension Fund.

This part began to take shape in 2012. It is assigned to such groups.

- People who were born after 1967. For this category of people, the accounting department of the employer company deducts 6% of the payroll.

- Men were born in 1953-1966, and women were born in 1957-1966. Since 2002, contributions have been made for them for three years. Then the deductions were suspended due to rule changes.

- Mothers who received maternity capital and used it to form a pension.

Private management company

Pension savings can be transferred to a private management company. Provided that an agreement on trust management of pension savings funds has been concluded between it and the Pension Fund of the Russian Federation. This agreement is concluded only with companies that have won a special competition.

This procedure is established by subparagraph 1 of paragraph 1 of Article 31 and paragraph 1 of Article 19 of the Law of July 24, 2002 No. 111-FZ.

When moving to a private management company, you can also choose the investment portfolio that, in the person’s opinion, is capable of ensuring the safety of pension savings and increasing them. This can be done provided that the management company offers more than one investment portfolio to choose from. This follows from subparagraph 1 of paragraph 1 of Article 31 of the Law of July 24, 2002 No. 111-FZ.

Situation: is it possible to transfer part of pension savings to one management company, and part to another?

Answer: no, you can't.

The Pension Fund of the Russian Federation transfers all pension savings to the organization chosen by the person (i.e., all funds accounted for in a special part of the individual personal account). This procedure follows from paragraph 2 of paragraph 2 of Article 34 of the Law of July 24, 2002 No. 111-FZ.

This is confirmed by the application form for choosing an investment portfolio (management company), approved by Resolution of the Pension Fund Board of January 21, 2020 No. 9p. It states that all pension savings are transferred to the management company.

Thus, pension savings can be transferred to only one management company.

OPS

Compulsory pension insurance (MPI) is a system of organizational, legal, and economic measures created by the state, which are aimed at compensating citizens for the wages they received before the compulsory insurance coverage - pension.

In Russia, OPS is carried out by insurers - non-state pension funds and the Pension Fund of the Russian Federation.

Necessary insurance coverage is the fulfillment by the insurer of its own obligations to the person who is insured when an insured event occurs with the help of payment of a labor pension, social benefit for the funeral of deceased pensioners who are not subject to compulsory social insurance in case of temporary disability and due to maternity on the day of death.

Personalized (individual) accounting is the maintenance and organization of records of data on all insured persons for the implementation of their pension rights in accordance with the legislation of the Russian Federation.

These data relate to insurance (work) experience, insurance contributions for the funded and insurance parts of the labor pension, and so on.

The Pension Fund of the Russian Federation opens a personal individual account (IAL) for all insured persons. The size of the pension in relation to compulsory pension insurance depends on the funds that have been accumulated on the ILS. The longer a citizen’s work experience and earnings, the more funds will be reflected in his personal individual account.

Investment of money by the Pension Fund of the Russian Federation

If a person has never transferred pension savings either to a private management company or to a non-state pension fund (NPF), or has not submitted an application to select an investment portfolio in a state management company, then the Pension Fund of the Russian Federation invested them by default:

- into the investment portfolio of government securities of a state management company (for those who began forming pension savings before August 2, 2009);

- into the expanded investment portfolio of a state management company (for those who began forming pension savings after August 2, 2009).

This procedure follows from paragraph 4 of Article 14 and paragraph 1 of Article 34 of the Law of July 24, 2002 No. 111-FZ, parts 4–5 of Article 4 of the Law of July 18, 2009 No. 182-FZ.

Transfer of inheritance

Over the course of your life, you have created certain assets and liabilities. Real estate and movable property, business, securities, cash. They were objects of your use or brought you income.

Unfortunately or fortunately, when leaving on the “last journey”, “baggage” is not provided. Therefore, a sensible and responsible person will definitely order the transfer of property in advance.

What is inheritance?

Inheritance is the property and some personal non-property rights and obligations of the testator, which after his death pass to the heirs.

Options for disposing of inheritance.

You have the right to dispose or not dispose of your inheritance. If you did not leave a will, the inheritance will be passed on to your heirs according to law. You can even sell all your property and spend it on yourself, without leaving a penny for your loved ones.

However, I hope you are a sensible person who loves your loved ones. Therefore, you will dispose of your property in a timely and fair manner.

How to properly manage your capital.

If you truly love your loved ones, then you will thoughtfully approach the issue of distributing your assets. Only you can decide how to properly manage your capital. However, there is a certain principle: do not burden your loved ones with your problems, even when you leave.

How to arrange your life if you cannot take care of yourself independently?

How to provide care for yourself if you become unable to do so yourself is something you should consider as you plan for your retirement. You should calculate in advance the average cost of such services. Even if you make a mistake and there are not enough funds, it will not be so scary. You will still not burden your loved ones as much as they would have to bear the full burden of the costs.

How to prepare for a worthy transition to the “other world.”

Prepare a stash (in the old days they were called “coffin stash”) in advance, sufficient to cover all costs. You can even stipulate this in your will. Such a worthy transition to the “other world” will only do you honor and leave a bright memory of you in the hearts of those you loved and who loved you!

Change of management company

Management companies and investment portfolios can be changed annually (clause 1, article 32, clause 2, article 34 of the Law of July 24, 2002 No. 111-FZ).

Your choice between investors for the next year must be made before December 31 of the current year (submit an application to the Pension Fund of the Russian Federation). For example, before December 31, 2020, you need to decide who to entrust pension savings for 2020. This follows from paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

An exception is provided for citizens who decide to pay additional pension contributions, but do not have pension savings or they are not invested. Such citizens have the right to decide on an investor at the stage of submitting an application for payment of additional pension contributions. This procedure is established in Article 11 of the Law of April 30, 2008 No. 56-FZ. For more information about paying additional pension contributions, see How to start making additional contributions to a funded pension.

Summary

Based on the results of our article, we will make a small cheat sheet for ourselves so that we can always have it at hand and, if necessary, quickly remember everything that we talked about today.

Of course, the story about the pension system does not end there. In addition, the process of active reform of the system is currently underway, and therefore quite significant changes are quite possible. We will definitely tell you about them. To avoid missing anything, subscribe to our news. And also don’t forget to share with friends using special social network buttons. Best wishes!

Application for choosing a management company

Submit an application for choosing an investment portfolio (management company) to your branch of the Pension Fund of the Russian Federation. For information about which branch of the Pension Fund of the Russian Federation residents of Moscow and the Moscow region should apply to, see the table.

To transfer pension savings to a private management company, Vnesheconombank, or change the investment portfolio, an application can be submitted:

- on paper in the form approved by Resolution of the Pension Fund Board of January 21, 2020 No. 9p;

- electronic.

This is established in paragraphs 2 and 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

Fill out the application in accordance with the Instructions approved by the Resolution of the Board of the Pension Fund of Russia dated May 12, 2020 No. 157p.

The paper application for the selection of an investment portfolio (management company), in particular, indicates:

- applicant's details (full name, date of birth, insurance certificate number);

- data of the management company where pension savings are transferred;

- name of the investment portfolio (if the company offers more than one option).

The Pension Fund of the Russian Federation places the application form and instructions for filling it out no later than September 1 of the current year on information stands in its territorial branches, as well as on the Internet. For example, on a single portal of state and municipal services. At a citizen’s request sent to the Pension Fund of the Russian Federation via the Internet, the application form and instructions for filling out will be sent in the form of an electronic document.

This procedure follows from paragraph 3 of Article 32 of Law No. 111-FZ of July 24, 2002, paragraphs 2–3 of the Procedure approved by Order of the Ministry of Finance of Russia of August 30, 2005 No. 109n, Instructions approved by the Resolution of the Board of the Pension Fund of Russia of May 12, 2020 city No. 157p.

Situation: is it necessary to submit an application for choosing an investment portfolio (management company) if a person wants to leave pension savings in the same management company for subsequent years under the same conditions?

Answer: no, it is not necessary.

Last year's statement will be valid for all subsequent years until the person wants to make changes. All newly received amounts of pension savings will be transferred to the selected management company. This follows from paragraph 1 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

Situation: what should a person do who has submitted an application to choose a management company for pension savings, but later decided to change his decision? The deadline for submitting applications to the Pension Fund has not yet expired.

Submit another application to your branch of the Russian Pension Fund.

The Pension Fund of the Russian Federation will consider the application with the latest submission date. Provided that it is submitted before December 31 of the current year. The department will ignore the remaining applications (no matter how many there are).

This follows from paragraph 4 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Attention: the Russian Pension Fund will refuse to satisfy all applications received on the same day.

This rule applies if the following were received at the same time:

- several statements about the choice of investment portfolio (management company);

- application for choosing an investment portfolio (management company) and application for transfer to a non-state pension fund.

This follows from paragraph 7 of paragraph 3 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

How to place a funded pension in Vnesheconombank?

It is necessary to take into account the fact that the Pension Fund is Vnesheconombank’s insurer. Therefore, the application for the placement of benefits must be submitted accordingly to the last option. To submit, you must go to this branch in person. But this can be done without leaving home (then you will have to “tinker” with the papers so that the notary can sign).

In addition to the application to the Pension Fund, you must provide:

- a document identifying the person (in most cases this is a passport of a citizen of the Russian Federation);

- SNILS.

It is possible to deliver documents by a trusted person (official representative). Then he will need the following:

- passport of this person;

- a power of attorney certifying the right to dispose of the insured persons.

Application methods

An application can be submitted:

- personally;

- through a representative (legal or authorized);

- through a transfer agent;

- through an organization (employer);

- by mail;

- through the MFC;

- in electronic form, by filling out an interactive form on the Unified Portal of State and Municipal Services or in the Personal Account on the website of the Pension Fund of the Russian Federation.

This follows from paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ and paragraph 3 of the Instruction approved by the Resolution of the Board of the Pension Fund of Russia of May 12, 2020 No. 157p.

Situation: is it possible to submit an application for choosing an investment portfolio (management company) for pension savings, handwritten, typed on a typewriter or computer?

Answer: yes, you can.

However, in this case it is necessary to proceed from the application form for the selection of an investment portfolio (management company), approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 21, 2020 No. 9p. That is, list all the necessary details and take into account the location of this data in the original form.

This follows from paragraph 2 of the Instruction, approved by Resolution of the Board of the Pension Fund of Russia dated May 12, 2020 No. 157p.

Comments (41)

Showing 41 of 41

- Vera 03/11/2017 at 07:18

I have savings in the Non-State Pension Fund. I also want to form a pension in the Pension Fund of the Russian Federation in the state company Vnesheconombank. Can I have a funded pension in two state and non-state funds at once?answer

- Alina 03/11/2017 at 11:29

- in the State Pension Fund (PFR);

No you can not. In accordance with the legislation of the Russian Federation, you can form your future savings provision only by choosing one of the proposed options:

in a non-state pension fund (NPF).

Specifically in your case, you can transfer savings funds to another non-state pension fund or to the Pension Fund of the Russian Federation by choosing any management company with which the Pension Fund has a trust management agreement (including the State Management Company Vnesheconombank). It is not possible to form several funded pensions simultaneously in several funds or companies.

You should also take into account that if you transfer funds from a non-state pension fund to a state management company (GMC), then you are changing the insurer, that is, what was a non-state pension fund will become a Pension Fund. Therefore, it is better to do this five years after you entered into an agreement with the current fund, as there is a risk of losing investment income.

answer

Is there any way to expand on the phrase “Therefore, it is better to do this five years after you entered into an agreement with the current fund, since there is a risk of losing investment income”? What is the risk of loss associated with?

answer

With the fact that if you transfer funds earlier than 5 years from the date of concluding an agreement with the fund, then when you transfer to another fund, the funds will be transferred without taking into account the investment income received by the first fund.

answer

I want to start contributing money to my future pension (funded pension). Only the state Pension Fund is interested; I don’t trust non-state funds. Which management company is better to choose?

answer

- Alina 03/17/2017 at 11:33

- GUK is a state-owned management company, currently and for many years now it is Vnesheconombank;

There are two types of management companies (MCs) with which the Russian Pension Fund has a trust management agreement. This:

CHUK is a private management company.

Which one to choose is decided by the citizen himself, based on available information about companies. There is not much difference between them. The state controls the activities of both public and private companies. All companies are interested in maximizing investment income, since their remuneration directly depends on this.

However, private companies, compared to state management companies, are allowed to use more financial instruments (shares, shares, etc.). This can bring good income, but at the same time there is a certain risk.

answer

Hello. I am in the VEB UK pension fund. For the past four years, I have not received any notification (by mail) about the status of my retirement account. Why?

answer

- Alina 04/25/2017 at 11:26

Hello! The Pension Fund has stopped sending letters with personal account status since 2013. Now the extract can be obtained on the Pension Fund website or through the State Services portal, as well as by personally contacting the Pension Fund branch.

answer

That is, VEB Management Company is not obliged to send notifications by mail or SMS about savings? How then to receive a pension?

answer

Hello! I'm interested in the structure of VEB's conservative and expanded portfolio. Those. specifically what percentage of the portfolio is made up of bonds, mortgage-backed securities, etc.

answer

Hello! My savings are in VEB, extended package. Where can I see how my pension is indexed when it is with you? Is this column called “the amount of pension savings through investment”? Those. How can I understand where my contribution was from my salary, and where is the profit from being with you? Thank you.

answer

- Nadezhda 05/07/2019 at 16:29

I retired in March of this year. Can I receive the funded part of my pension in a lump sum? The money is in Vnesheconombank.

answer

Hello. It is possible if, when calculating, the amount of the monthly payment of the funded part of the pension is 5% or less in relation to the old-age insurance pension. If more than 5%, then only in the form of an urgent payment or monthly. You can read more here.

answer

From April 1, 2016, due to the liquidation of the Non-State Pension Fund Strategy, my savings were transferred to VEB. I want to find information about investment returns for 2016-2018.

answer

I want to go out and pick up my savings. How to do it?

answer

My savings are in VEB, extended package. Where can I see how my pension is indexed?

answer

We recently applied for a pension, figured out the essence (in terms of the funded part), and it turns out to be a real legalized robbery. In most cases, our money (the savings part) remains in the funds. People receive small percentages in the form of an addition to their pension, and after the death of the pensioner, the money is transferred to the fund, free of charge and irrevocably. For those who are retiring soon, I recommend studying this topic in advance; you will learn a lot of “interesting” things.

answer

Good evening! I would like to know where my contract is, I didn’t sign any papers, how can I contact VEB and find out what’s going on?!

answer

Good day! I would like to know where my contract is, I didn’t sign anything, I don’t have any papers. How can I contact VEB Management Company (extended) and find out what’s going on?!

answer

- Love 08/02/2019 at 12:14

The father retired. His funded part of the pension is located at VEB UK. How can I get it now? There is no agreement. The hotline number was not found, nor was there a personal account.

answer

VEB is only a management company. To schedule payments, you need to contact the Pension Fund of the Russian Federation.

answer

Hello! I would also like to know the fate of my savings in the funded part, how can I contact VEB Management Company (extended) and find out what is happening? Can I have the telephone numbers of representatives in Novosibirsk if available?

answer

Hello! How can you withdraw your savings? Did I retire early due to disability? Where can I find the agreement? I only have reports on my savings in VEB.

answer

I want to transfer the savings part from VEB UK (extended package) to a non-state pension fund. How to do it?

answer

In 2020, without my knowledge, the savings portion and co-financing were transferred to the NPF Soglasie. On what basis were they transferred to a non-state fund? Send me an application with my signature! I ask you to return everything that was transferred to NPF Soglasie from VEB UK. Waiting for an answer.

answer

Hello. Can I withdraw my savings?

answer

I am submitting an application to the Prosecutor General’s Office and the court for the fraudulent actions of VEB UK, extended. Over 18 years of investment savings - 0.07 rubles (7 kopecks), and according to reporting, officially no less than 8% per annum. According to my savings, this is over 30,000 a year, and over all the years it is millions. Where's the money?

answer

- Alexey 09.25.2018 at 19:58

So what, they filed a lawsuit? How is it going?

answer

How can I receive the funded part of my pension in the amount of 45811.48?

answer

Hello! Pension funds are invested in VEB Management Company (EXPANDED), I have never received a letter about the status of my personal account. How and where can I find out? Thank you.

answer

Recently retired. Tell us how you can receive the funded part of your pension?

answer

Hello. I am interested in the following question: where can I view the pension savings of VEB Management Company (ADVANCED), and why was I automatically redirected there? How can I now receive a one-time funded part of my pension?

answer

My insurer, the Pension Fund of the Russian Federation, has been placing funds for investment in VEB Management Company (ADVANCED) since March 16, 2016. Over the past year, I have twice requested from the Pension Fund, but have not received information about the income received from investing. If my pension savings are generating income, how can I find out?

answer

My insurer is the Pension Fund of the Russian Federation, which has been placing funds for investment in VEB Management Company extended since 04/01/2016. During this time, I have not received information about the income received from investing. How to find out about this?

answer

- Vladimir 07.26.2019 at 10:23

They reprinted my question, but essentially there is no answer.

answer

Since July 26, 2019, the question I asked has remained unanswered. Why?

answer

Did they answer you? Tell me please)

answer

Hello. I am interested in the following question: where can I look at the pension savings of VEB Management Company (extended).

answer

The amount of pension savings, taking into account investment, can be viewed in your personal account on the Pension Fund website or you can request a statement directly from the Pension Fund branch. VEB is only a management company that invests your funds, and your insurer is the Pension Fund. Therefore, all information regarding pension savings can be requested from the Pension Fund.

answer

Where can I get a copy of the application for transfer to VEB - Pension Fund?

answer

- Dasha 08/01/2019 at 15:33

Request to the Pension Fund.

answer

Share your opinionCancel reply

Submitting an application through an organization

Only persons who have decided to pay voluntary pension contributions and submit an application in the form DSV-1 (approved by Decree of the Government of the Russian Federation of July 28, 2008 No. 225p) can submit an application for choosing an investment portfolio (management company) through an organization (employer).

This is established by paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ, part 1 of Article 4 and part 2 of Article 11 of the Law of April 30, 2008 No. 56-FZ.

The receipt of the application must be confirmed.

Applying in person

If you bring an application to the Pension Fund of the Russian Federation in person, through a representative or employer, agency employees are required to issue a receipt indicating that they received it. The form of the receipt was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated May 2, 2007 No. 101p.

The services of a transfer agent are free for the applicant - they are paid for by the Pension Fund of the Russian Federation (Section 7 of Appendix 1 to Order of the Ministry of Finance of Russia dated August 21, 2003 No. 79n).

Submitting an application electronically

An application for choosing an investment portfolio (management company) can be submitted electronically by filling out an interactive form through a single portal of state and municipal services or a Personal Account on the website of the Pension Fund of the Russian Federation. The procedure for filling out the interactive form is prescribed in the Instructions approved by Resolution of the Board of the Pension Fund of Russia dated May 12, 2020 No. 157p.

The conditions that must be met for one or another application method are given in the table.

Advantages of the savings part

Most experts agree that the funded part of the pension should be preserved. It makes the budget system more stable and reduces risks for future retirees

“The insurance and savings parts balance each other”

It is incorrect to say that a choice is made between an insurance and funded pension.

If a person chooses a funded account, he does not lose his insurance coverage. He has two types of pension: insurance and funded. An insurance pension reduces the risks of a funded pension under possible negative financial market conditions. That is, they balance each other. It is clear that it is simply impossible to predict which part (insurance or savings) will show higher profitability after 20-30 years. That’s why financiers advise applying the standard investment principle “Don’t put all your eggs in one basket” to your retirement savings. Moreover, the savings part has one undoubted advantage - it can be passed on by inheritanceKonstantin Ugryumov, President of the National Association of Pension Funds (NAPF)

“If a person does not live to see retirement, the savings pass to the heirs”

Now the law specifies the institution of legal succession. That is, if a person does not live to see retirement, all funds from his account go to his heirs. To do this, you can write an application to the Pension Fund, where you indicate the legal successors. If this is not done, then the money can be received in the usual manner, according to the law of inheritance. But this is a longer process

Sergey Skorokhodov, pension system expert

- The funded part must be preserved from an economic point of view. It’s like a long-term investment resource - the only one, especially in the current conditions, when there are simply no other sources. Long-term investments by the State Management Company provide new opportunities for the development and modernization of infrastructure. It is the pension savings funds managed by the State Management Company that are practically the only real source of “long-term” money in the economy. The structure of the expanded investment portfolio of the State Management Company allows for long-term investment. Our longest investment is 35-year bonds of the Federal Grid Company. We are talking about corporate bonds whose coupon yield is tied to inflation. This is a very important and very necessary type of investment instrument. They provide a constant, real positive return for the portfolio, thereby stabilizing the return as a whole. These instruments correspond to both the interests of the investor and the interests of borrowers

Alexander Popov

“Let me remind you that the insurance pension, unlike the funded pension, is annually guaranteed to be indexed not lower than the inflation rate”

Olga Golodets, Deputy Prime Minister for Social Affairs (in an interview with KP on December 22, 2014)

- When a pension fund invests money in new production, new jobs are created. New jobs mean new taxes, including new contributions to the Russian Pension Fund. That is, it is a self-reproducing system. The more money is invested, the more income the state receives. And in fact, by blocking this channel, we reduce the opportunities for growth, for self-reproduction, so that this money brings income to both citizens and the state.

In addition, another important advantage of the funded part of the pension is that it is calculated in real money, and not in pension points (like the insurance part). The disadvantage of the latter is that their denomination depends on the situation with the country’s economy and the state of the budget

Evgeniy Yakushev

Decision of the Pension Fund of the Russian Federation

Having received an application for choosing an investment portfolio (management company), the branch of the Pension Fund of the Russian Federation can:

- satisfy the application;

- refuse the application;

- leave the application without consideration.

Employees of the Pension Fund of the Russian Federation must notify the person about the decision made by March 31 of the year following the year in which the application for choosing an investment portfolio (management company) was submitted. If a person submitted an application via the Internet, then the Pension Fund of the Russian Federation also sends a corresponding notification in the form of an electronic document.

This procedure is established in paragraph 2 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

For reasons for refusing to approve or consider an application, see the table.

Situation: what should a person do if the Pension Fund of the Russian Federation did not notify him of the decision made on the application to select an investment portfolio (management company) for pension savings?

Please contact the Russian Pension Fund with a written request for clarification of the situation.

Employees of the Pension Fund of the Russian Federation must notify the person about the decision made by March 31 of the year following the year in which the application for choosing an investment portfolio (management company) was submitted. Moreover, if a person submitted an application via the Internet, then the Pension Fund of the Russian Federation also sends a corresponding notification in the form of an electronic document. This follows from paragraph 2 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

The Pension Fund of the Russian Federation may not notify a person about the decision made on the application to select an investment portfolio (management company), for example, if:

- the application is granted;

- the application was not received by the Pension Fund of the Russian Federation;

- The applicant’s data is incorrect (it is unknown to whom and where to send notifications).

Therefore, in order to find out the reason why the Pension Fund of the Russian Federation did not notify a person of its decision, you need to contact him with a written request. Employees of the Pension Fund of the Russian Federation are required to provide a response within three months from the date of receipt. This procedure is provided for by paragraph of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Situation: what to do if the Pension Fund of the Russian Federation unlawfully refused to accept (left without consideration) an application for investing pension savings?

Submit a written complaint to the branch of the Pension Fund of the Russian Federation that refused to satisfy the application (leaving it without consideration) or to a higher division of the Pension Fund of the Russian Federation (Articles 2 and 8 of the Law of May 2, 2006 No. 59-FZ).

You can file a complaint:

- on paper;

- electronic.

This follows from paragraph 1 of Article 4 of the Law of May 2, 2006 No. 59-FZ.

Regardless of the method of filing a complaint, state the current situation and give your arguments.

When filing a complaint electronically, be sure to include the following:

- your last name, first name, patronymic (if any);

- your postal or email address (depending on which of the specified addresses you want to receive a response to).

Please attach to your complaint:

- application for the selection of an investment portfolio (management company), which was submitted to the Pension Fund of the Russian Federation;

- notification of refusal to satisfy the application (about leaving the application without consideration), which was sent by the Pension Fund of the Russian Federation.

When filing a complaint on paper, attach the documents as copies.

If the complaint is submitted electronically, submit the documents:

- in electronic form along with the complaint;

- separately on paper in the form of copies or originals.

This follows from Article 7 of the Law of May 2, 2006 No. 59-FZ.

The Pension Fund of the Russian Federation is obliged to respond within 30 days from the date of registration of a person’s written request. In exceptional cases, the period may be extended by no more than 30 days with notification of the citizen who filed the complaint. This procedure is provided for in paragraph 3.1 of the Instruction, approved by Resolution of the Pension Fund Board of November 2, 2007 No. 275p, Article 12 of the Law of May 2, 2006 No. 59-FZ. In addition, the Pension Fund of the Russian Federation, based on the results of consideration of the appeal, must take measures if the applicant’s rights have been violated (clause 1 of Article 10 of the Law of May 2, 2006 No. 59-FZ).

Life in retirement

You are well prepared for life in retirement. And here is the long-awaited moment! You are retired, you are free!

What is the “Golden Age”?

“Golden age” is the age when you can fulfill all your dreams for which you never had enough time.

This is how pensioner and poet Valentina Nikolaevna Tairova assesses this time.

A wonderful age, a wonderful time!

After all, you are now free like a bird.

Create, write, read even until the morning,

And if you want, fall in love!

How to live in a dream?

Try to free your brain from existing dogmas. Look around. Search your soul. And start an active life on new principles. This will give you a new boost of energy and strength.

What to do in retirement.

So what to do in retirement? The range of possibilities is quite wide. From doing nothing to serious work for the good of the country.

Listen to yourself. Unlock your untapped potential. You can:

- continue to work for hire in the same place, but in a new capacity;

- change jobs;

- you can work remotely from home;

- engage in mentoring;

- get creative;

- travel;

- and many, many more things...

Should I work for hire in retirement?

Whether to work for hire in retirement is up to you. Some people want to quit a job they hate as soon as possible, while others don’t want to leave a job they love. If you don’t want to change your usual lifestyle and work brings you joy, work! After all, no one has ever been bothered by additional income in retirement.

Creating multiple additional sources of income.

Creating multiple additional sources of income in retirement is suitable for those people who want variety in their activities, a creative approach to life, and at the same time increase their retirement income.

What you can do in this direction:

- rent out your vacated apartment after moving;

- grow vegetables, berries and fruits for sale on your plot;

- create any small business;

- organize a workshop in your garage;

- create websites if computer literacy allows you to do so;

- and many, many more things to do….

What does this give you:

- feeling of fullness of life;

- feeling of usefulness to society;

- the aging process is inhibited;

- additional income.

Health and relaxation in retirement.

Health and relaxation in retirement must be prioritized. When you were employed or running your own business, you did not spare yourself and did not take very good care of your health. It is so? Now is the time to move on to a healthy and moderate lifestyle.

Traveling in retirement.

Now you can travel because you have time for it. After all, a change of environment and learning new things is the best way to restore mental health. Communication with new people will also only have a positive effect on your condition.

Creativity and hobbies.

Various kinds of hobbies and creative activities promote peace and encourage philosophical thoughts. You will involuntarily begin to rebuild your lifestyle to a calmer one that matches your state of mind.

Creativity and hobbies, under certain conditions, can bring additional income.

Preparing for the transfer of cases.

We are not all eternal on this Earth. You can be depressed about this and not want to remind yourself of it with any actions. But, this is the law of Existence and nothing can be done about it.

Therefore, if you are responsible and do not want your loved ones to fight (as a rule, this is what happens) after you leave, think in advance about transferring affairs and inheritance.

Satisfaction of the application

If the Pension Fund of the Russian Federation has satisfied the person’s application, then no later than March 31 of the year following the year in which the application was submitted, the pension savings will be transferred to the selected management company (clause 1 of Article 34 of the Law of July 24, 2002 No. 111- Federal Law).

The pension savings of citizens who submitted an application for choosing an investment portfolio (management company) simultaneously with an application for payment of additional pension contributions will be transferred within three months from the day the Pension Fund of the Russian Federation received the corresponding application (Part 3 of Article 11 of the Law of 30 April 2008 No. 56-FZ).

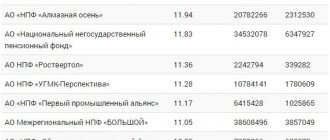

Profitability of VEB pension savings

The return on investment of savings funds is calculated in accordance with Order of the Ministry of Finance of the Russian Federation No. 107n dated August 22, 2005 and is a relative indicator of the growth of funds. There are four profitability indicators:

- year to date;

- for the previous 12 months;

- for the previous 3 years;

- average (for the entire period of validity of the trust management agreement).

Information on the profitability of savings of the state management company is not classified and is publicly available on the official website of Vnesheconombank.

Notice from the Pension Fund of the Russian Federation

The Pension Fund of the Russian Federation sends notification about the status of an individual personal account and about the results of investing pension savings only when a citizen applies for this information. This information must be sent within 10 days from the date of application and can be provided both on paper and in the form of an electronic document.

This procedure is established in paragraphs 2 and 3 of Article 32 of the Law of July 24, 2002 No. 111-FZ and paragraph 9 of Article 16 of the Law of April 1, 1996 No. 27-FZ.