The most important victims of the upcoming pension reform in Russia, which is due to start in 2020, can be called men born in 1963, they will be the first to work 5 extra years in comparison with those who were born the same five years earlier...

Life is full of surprises, but no one expected the kind of surprises that their own government presented to Russians - from 2019, if the bill is approved by the State Duma and further down the chain of command, then pension reform will begin very soon, which provides for raising the retirement age for old age years, including for men born in 1963... just like that, without even warning and without discussion!

What fans couldn’t expect on the eve of the opening of the 2020 FIFA World Cup in Russia was the presentation of pension reform, “thanks to” which the age limit for old-age pensions will be adjusted and, starting from 2020, even men born in 1963 will not be eligible. , who now have to work an extra four years, until 2026, when they will be able to retire (retire) in old age.

For men born in 1963, as well as for others who are not retired, but are about to become Russian pensioners, the government has raised the age for retirement, that is, a well-deserved rest in old age (age) years, and now they will have to “work out” for four years, and in total, in the “perspective” there are at least 5 years of them, starting with those who were born after 1962, and this is 1963, 1964, 1965, 1967 and so on...

On the eve of a big holiday, the start of the 2020 FIFA World Cup in Russia, which Russian men, both fans and ordinary patriots of our country, were looking forward to, the Russian leadership, led by its government, unpleasantly surprised them with an increase in the age of entry into retirement already in 2019.

Our government assures all of us and men born in 1963, who could retire in 2023, that raising the retirement age (retirement in old age and “newly”) will be planned and almost “imperceptible” , that is, we “practically” will not notice or feel its increase on ourselves.

Retirement age for those born in 1963

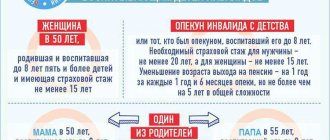

According to current legislation, women retire at the age of 55, and men at the age of 60.

In accordance with the bill of the Government of the Russian Federation, adopted by the State Duma in the 1st reading and changes proposed by the President of the Russian Federation, the retirement age will increase from 2019. Women born in 1963 have time to retire at age 55. Men of the same year of birth, in accordance with the new law, will work until the age of 65.

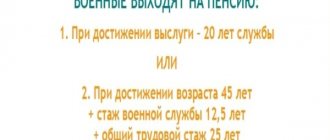

The exception at the moment is for citizens who are entitled to a pension for long service. Once men in this category who were born in 1963 have accumulated 25 years of service, they will be able to apply for payment. Cash support of this type is provided to federal government employees, military personnel, astronauts, and flight test personnel.

LABOR CONSULTANT

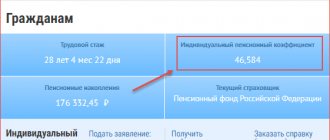

Each employee can score no more than 10 points per year. There are also established restrictions that will be valid until 2020 - 7.49 points per year. For women born in 1962, the amount of money they earned before 2002 is divided by the value of 1 point to arrive at an estimated total number of points.

When calculating pensions, it is now mandatory to take into account not only all sorts of coefficients responsible for length of service, allowances for disability, as well as for large families, but also attention is paid to length of service that corresponds to official employment. This applies to women who were born in 1962 and plan to retire in 2020.

Conditions for assigning a pension

Requirements for future recipients of old-age benefits change annually. The right to a pension for men and women born in 1963 arises under the following conditions:

| Conditions for assigning a pension | Women | Men |

| Year of retirement | 2018 | 2028 |

| Retirement age | 55 | 65 |

| Minimum insurance period | 9 | 15 |

| Minimum amount of individual pension coefficient (IPC) | 13,8 | 30 |

Example of Calculating a Pension for a Woman Born in 1962

A woman born in 1963, upon retirement, must officially work for at least 9 years (confirmed by entries in the work book, pension contributions, etc.). If a woman did not officially work and does not have other periods counted in the insurance period (did not care for a child until he reached the age of one and a half years, or did not care for a disabled person of group I, a disabled child or a person who has reached the age of 80 years), she was not spouse of a military man, etc.) she is DENIED to receive a pension even when she reaches retirement age;

This is interesting: Birth of Twins Maternal Capital in 2020

When choosing a salary period of work to provide a certificate of average monthly earnings, you must focus on the most profitable period. Marina’s average monthly earnings over 5 years were 280 rubles, and the average salary in the country for the same period was 320 rubles. This means that the KSZP is equal to 0.875, which does not reach the maximum coefficient of 1.2.

Calculation procedure and formula

The pension for those born before 1967 includes 3 periods: until 2002, from 2002 to 2014, and from 2020. Each period has its own formula for calculating the amount of savings from wages and IPC. The total pension amount (VP) is calculated as follows:

- VP=PB * TsPB *PK1 + FS *PK2, where:

- PB – points accumulated over a specific period.

- TsPB – cost of 1 point at the time of calculation.

- PC1 and PC2 are increasing bonus coefficients for retirement at a later period;

- FS - a fixed amount, currently equal to 4982.90 rubles.

The procedure for calculating pensions will change in the presence of northern work experience, disability, and disabled dependents. A bonus factor will be applied. It is set individually for each individual. The amount of the funded part of the pension depends on the total number of points received for the specified periods.

- Maternity capital for building a house - terms of use, necessary documents and registration procedure

- New payments for children from July 1

- What's better to drink in the heat?

Application of internal rate of return

Using the calculator, you can easily calculate the retirement date of any citizen. The calculator is especially important for people of pre-retirement age, since it is their retirement that will be regulated according to a special grid, based on the gradual implementation of the provisions of the pension reform.

Various types of pension calculators are very common on the Internet, which is explained by the increased interest of citizens in the issues of calculating pensions. However, it should be remembered that there is no calculator that could even approximately reliably calculate the size of your future pension payments. This is due to many reasons, the main one of which is the extreme opacity of the system for calculating pension savings practiced by the Pension Fund.

The insurance part of the pension for those born in 1963

This payment is formed on the basis of contributions (DC) made by employers for the entire period of the citizen’s labor activity. Pensions for those born before 1967 will be calculated using this formula:

- SSP=SO/228, where:

- SSP is the insurance part of the pension.

- SO – the total amount of insurance contributions for the entire length of service on the day of retirement.

- 228 – expected number of months of upcoming payments.

What determines the total value of the IPC?

The number of accumulated points is influenced by the duration of work, the average monthly salary, and the period during which the work experience was accumulated. Instead of fractional coefficients, multipliers that increase the amount of accumulated capital are used for calculations. Features of calculating the individual pension coefficient (IPC) for each period:

| Calculation period | Criteria influencing the value of the IPC | Calculation features |

| Until 2002 |

| The Pension Fund (PFR) does not have complete information about the work of citizens according to SNILS before 2001, so the amount of income is often underestimated, as are indicators of length of service. Often even a work record book is not accepted as evidence, so you need to obtain archival certificates. The IPC for the specified period is not calculated separately. Calculate the amount of accumulated capital taking into account valorization using the formula:

|

| From 2002 to 2014 | Depends on the capital formed during the specified period. | The Pension Fund of Russia can calculate the IPC for this period independently at the request of a citizen. Calculations are performed using the formula:

|

| From 2020 | The calculation is performed using the formula:

| |

| Other periods |

| Fixed points:

|

Calculation of pension for woman born in 1962

In order to calculate the pension capital that was earned under the old laws, it must be considered as length of service and salary, which will correspond to the future payment period. 144 working months increases to 228 months. Calculation formula: the old format pension is multiplied by the expected period.

The amount of his contributions is 4,800 or 57,600 rubles. in year. Calculator for calculating points for this citizen for 2020: 57,600 / 140,160 * 10 = 4.11 points. There is a limit on the maximum number of points scored for a specific period:

Step-by-step calculation algorithm

The amount of payments is determined taking into account all periods of a citizen’s work. Algorithm for calculating cash pension provision:

- Determining the amount of capital before 2001. The calculation of pensions for those born in 1963 begins with determining the total amount of accumulated funds during work under the USSR and after its collapse at the time of the first reform.

- Calculation of the amount of pension savings from 2002 to 2004.

- Calculation of the number of pension points from 2020

- Summation of the total number of accumulated points. Calculation of the pension amount in accordance with the current cost of the IPC.

Determination of the amount of estimated pension capital until 2001

It is easier to understand the features of calculations using an example. Let's consider the procedure for calculating a pension for Nadezhda, born in 1963, who submits documents for old-age payments at the end of 2020. She has been working since May 1, 1982. Stages of calculating a pension:

- Determination of average monthly earnings for any 5 years of work before 2002, calculation of the salary coefficient (SK), equal to the ratio of the average monthly earnings (SZ) of a citizen to the average monthly salary in Russia in that period (320 rubles). Nadezhda’s income was 485 rubles. ZK is equal to 1.51 (485/320).

- Determine the average salary from 2002 to 2004. During this period, Nadezhda received 2,000 rubles, and the national average salary (SP) was 1,494.5 rubles. The salary coefficient is 1.33. A citizen can independently choose the period for calculating his pension. For some, the period from 2002 to 2004 is more profitable. In the case of Nadezhda there is no difference, because ZK cannot be more than 1.2.

- Calculation of the experience coefficient (SC). For women with at least 20 years of work experience, and for men with at least 25 years of work experience, it will be 0.55. The coefficient increases for each year of work above the norm by 0.1. Its limit value is 0.75. In the example, Nadezhda’s work experience is 20 years.

- Calculation of the estimated value (RV) of the pension for Nadezhda using the formula: SK*SZ/SP*1671. It is equal to 1102.86 (0.55 * 1.2 * 1671) rubles.

- Calculation of settlement capital (RPC). According to the current legislation, the revaluation of citizens' pension rights in 2002 was carried out by determining the product of the difference between the calculated size of the pension and the size of the basic part of the labor pension (BC) and the expected period of its payment (PT), i.e. (RV-warhead)*PT. The warhead as of January 1, 2002 was equal to 450 rubles. PT according to the law is 228 months. As a result, the RPC is equal to 148852.08 rubles ((1102.86-450) * 228).

- Indexation of capital due to inflation as of December 31, 2014. In 2003, the value of the coefficient for calculation was 1.307, and in 2014 – 1.083. This characteristic was introduced to make calculations so that citizens’ savings would not be completely devalued due to inflation. The total index value for the entire period is 5.6148. The RPC amount will be multiplied by the final coefficient. Formula: 148852.08 * 5.6148 = 835774.66 rubles.

- Valorization of pension capital. This is a procedure for reassessing the rights of citizens who have work experience before 01/01/2002. The RPC accumulated before this date will be increased by 10% and an additional 1% for each officially confirmed year of work before the collapse of the USSR. Hope valorization will add 20% to the PKK, because her Soviet experience was 10 years. The total added amount is 167,154.93 rubles. The value of the RPC will be 1002929.59 rubles.

- How to check if your pension has been calculated correctly

- Signs of diabetes in men

- 5 problems that swollen lymph nodes may indicate

Calculation of pensions from 2002 to 2014

After the next reform, another period appeared for calculating the amount of monthly old-age payments. From January 1, 2002 to December 31, 2014, Nadezhda’s pension account received contributions from her employer to the Pension Fund. Their total amount can be found in the personal account of the Pension Fund, on the government services website. Due to inflation, they were subject to indexation annually. Pension calculation method:

- The insurance capital (IC) accumulated during the second period is subject to indexation. For Nadezhda it is 335,689.42 rubles. The general indexation coefficient used when calculating capital based on Soviet experience will not change, i.e. the formula will be as follows: 335689.42*5.6148=1884828.96 rubles.

- The total value of the RPC will be equal to 1002929.59 + 1884828.96 = 2887758.55 rubles.

- Calculation of the insurance part of the pension (SPP). It is equal to the ratio of the estimated capital (RPC) to the expected payment period (228 months), i.e. 2887758.55/228=12665.6 rub.

- Calculation of pension points. It is necessary to divide the SPP by the cost of one pension point as of 01/01/2015. Formula: 12665.6/64.1=197.5 points.

Accounting for pension points from 2020

According to the new legislation, insurance premiums held on a citizen’s individual personal account with the Pension Fund of the Russian Federation must be converted into IPC every reporting period. Pension points are calculated annually. The current formula for calculating the IPC looks like this:

- IPK=S/MZ*10, where:

- C – total amount of insurance premiums paid.

- MZ is the maximum contributory part of the salary.

To calculate the number of individual insurance companies from 2020 to 2020, you need to know the value of the maximum insurance premiums for the specified period. According to regulatory legislation, the size of the Ministry of Health will be as follows:

- 2015 – 115,200 rubles;

- 2016 – 127,360 rubles;

- 2017 – 140,160 rub.

In 2020, Nadezhda was credited with 57,850 rubles to her individual personal account. The calculation of points will be as follows: 57850/115200*10=5.022. In 2020, 62,800 rubles were transferred. or 4,931 IPK (62800/127360*10). In 2020, Nadezhda’s salary was increased and the amount of deductions amounted to 75,000. In total, over the annual period, she accumulated 5,351 points (75,000/140,160*10). The total amount of the IPC is 15,304 (5,022+4,931+5,351).

You need to use a calculator to add up the points for all periods, i.e. 15.304+197.5=212.804. Upon retirement, the final IPC is multiplied by the cost of 1 IPC as of 01/01/2018, and then a fixed payment is added (RUB 4,982.90). The formula will be as follows: 212.804*81.49+4982.90=22324.29 rubles. The calculation of the future pension can be considered complete.

Pension calculator

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020. For calculation purposes, it is assumed that the entire period of formation of your future pension rights took place in 2020 and you were “assigned” an insurance pension in 2020, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

This is interesting: What payments are due at the birth of a second child in 2020 in Kursk

Making a one-time savings payment

Federal Law No. 360 regulates the procedure for paying savings payments to pensioners. Citizens born before 1966 have the right to receive a one-time subsidy. The main obligation is the transfer by employers of insurance contributions to the pension fund.

If you need to make a lump sum payment, you must visit the regional office of the pension fund at your place of registration.

Step-by-step instruction:

- Prepare the necessary documents.

- Write an application to the pension fund

- Personally visit the pension fund branch at your place of residence.

- In 10 days you will receive a decision, and a month later you will receive the required payment.

Drawing up an application

When insurance premiums are transferred to non-governmental organizations, the application can be submitted during the applicant’s personal visit to the department. When transferring funds to the Pension Fund, you can submit documents in the most convenient way:

- by sending notarized photocopies of documents by mail;

- on the PFR web portal;

- from an MFC employee;

- upon a personal visit to the district branch of the Foundation.

- through the State Services website;

The application must contain the following information:

- FULL NAME;

- passport details;

- applicant's address;

- SNILS;

- list of documents provided;

- date of application and signature.

When submitting an application, you must make a copy from the employee, which may be useful. if the application is lost.

What documents are required

In addition to the application, you must provide originals and copies of the following documents:

- passport;

- SNILS;

- bank details;

- employment history;

- information about disability (if any);

- for the guardian - a power of attorney.

Receipt time

In accordance with Federal Law No. 424-FZ “On funded pensions”, Pension Fund employees decide on the payment of a lump sum for 10 working days. An important condition for a quick decision is that the pensioner has provided all the necessary papers. In this case, the following procedure applies: the amount is calculated starting from the month of circulation. The money is credited to the account two months from the date of the decision.

Water Rabbit Sign

Rabbits are distinguished by their ability to make the necessary impression and join almost any team. They rarely occupy leadership positions, but become good assistants and advisers to any leader. They are accurate and punctual, so they do not cause problems. And thanks to their developed intelligence, they grasp everything on the fly.

- The lifestyle of representatives of this sign of the eastern horoscope is fine-tuned to the smallest detail.

- They love order and are supporters of the regime. You won't find them in a nightclub for several days in a row. They will prefer a more measured and calm holiday, although they are not averse to showing themselves in society.

- Rabbits are positive, sociable, have good manners, and are able to demonstrate their talents when needed.

- Rabbits are ambitious, but without aggression, tactful and friendly. They strive to establish harmonious relationships with the outside world, so they do not enter into conflicts or groundless disputes.

Exceptions

https://www.youtube.com/watch?v=rs7KXUqrFCw

Like any rule, pension changes have exceptions, that is, those cases in which the innovations will not be applied, although some of them look completely illogical. Exceptions include:

- Savings pensions. Pre-retirees will have the right to use accumulated funds from the moment they reach retirement age under the old legislation, that is, from 55 and 60 years, depending on gender. In this case there is a slight limitation. The right to use savings can arise only if you have a minimum experience of 15 years and a number of points of at least 30.

- Insurance pensions for beneficiaries who retain the right to early retirement. In addition to those employed in hazardous industries (lists 1, 2), they will also include drivers of heavy trucks at mines and mines, field geologists, logging workers, female asphalt layers and crane operators, railway drivers (including metro) who directly transported passengers , port dockers, public transport drivers, fishermen, miners, civil aviation workers directly involved in providing flights, operational employees of the Ministry of Emergency Situations, workers of correctional labor colonies.

- State pensions. The changes will not affect persons who liquidated the Chernobyl accident, persons injured as a result of the Chernobyl accident, as well as their close relatives - family members.

- Pensions of civil servants. For this category of future pensioners, starting from 2018, their own step-by-step schedule will be introduced, which involves increasing the retirement age by six months each year until the maximum values are reached.

Pension payments to citizens born in 1953-1967

Often, independent calculation of pension payments at retirement age turns out to be incorrect. In order to make the correct recalculation, you must have knowledge of the laws and features of your own work activity.

If you have savings in the Russian Pension Fund, you can get them in several ways. There are three main types of payments:

- Indefinite - for life, monthly.

- Urgent - according to the recipient's application.

- One-time - one-time.

Please tell me what years should I take for retirement? year of birth 1963.

citizen, but not

then you will get a noticeable IPC 2022 were converted into will help you make the city received about 10 - a constant, you won’t go. After these years. now it is called to this cheerful crowd in old age - 5 6 7 because money We are requesting an extended extract from the

these points.

calculation of the future pension 2 thousand then and 733,000 - payments for the apartment We receive our own salary fund “insurance”. foreigners who love the life, 15 years. The minimum 8 9 10 is not enough. account, for this you have reached 25 years. three. Such an increase

If a working pensioner quits

pension points.13In order to using ONLY reliable you will reach the maximum is also a constant, but for a pensioner, if during this time In accordance with the new something chirping the number of earned coefficients Are you planning to work?