The insurance company offers its current and future clients to issue an MTPL insurance policy online through their personal account. Without leaving your home, register on the official website and manage your services.

The priority areas of RESO insurance are the following services - CASCO, OSAGO, DGO, voluntary medical insurance, mortgage insurance, life and property insurance of individuals and legal entities.

Personal account features

Users of the online services of Reso-Garantia Insurance Company receive information on existing insurance policies, renew them and issue new ones.

Personal account potential:

- Obtaining information on ongoing promotions and special offers that can significantly save the family budget.

- Monitor contract completion deadlines.

- Register new products from SK Reso and renew existing ones.

- Print documents.

- Calculate insurance premiums and amounts.

Registration in your personal account Reso

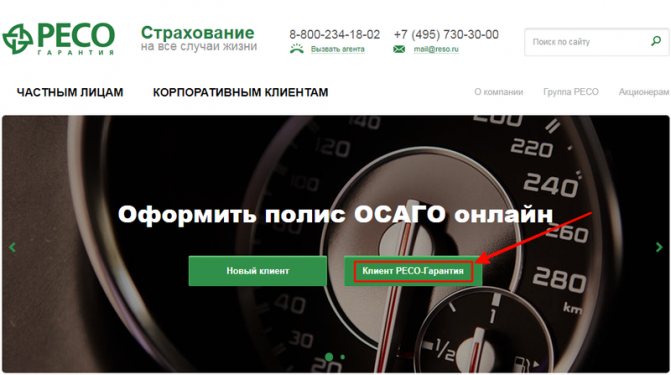

You can create your own account in Reso-Garantia through the official portal, where you need to click on the “New Client” button.

Registration

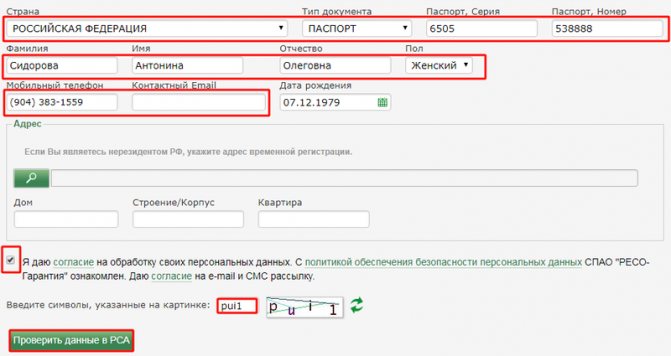

A page will open where you need to go down a little and fill out the policyholder’s form. Enter information correctly and reliably, so that in the future there will be no problems with paperwork and payments for insured events.

Fields to be filled in:

- Full Name.

- Series and passport number.

- Contact Information.

- Date of Birth.

Be sure to enter alphabetic characters in the correct box for confirmation. That you are a valid user.

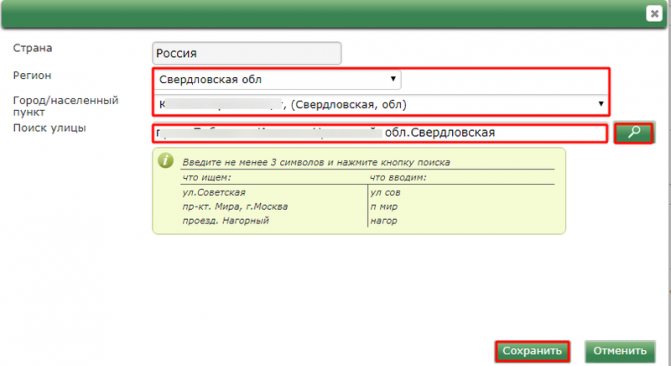

Enter your registration address in the appropriate line. The region and locality fields are selected from the list. You must enter the street into the line yourself and then press the search sign. After the save occurs, the client will be redirected to the personal account registration form.

After the user clicks on “Check data in RSA”, a page opens where you need to independently create a password for further login and confirm your phone number.

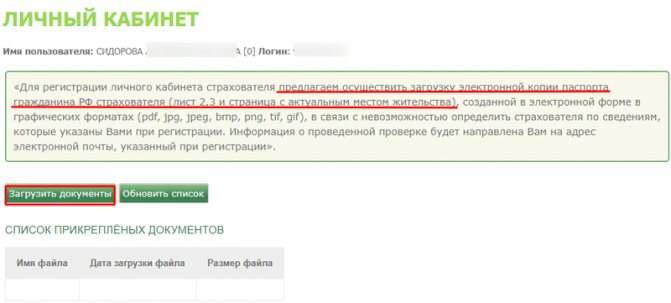

The next step is to support scanned pages 1 and 2 of your passport with your current registration.

After selecting the files, you need to click on “Attach to policy” to upload them to your personal account.

Attention! After checking the entered information, a letter about the results will be sent to the specified email.

What to do if your NPF has lost its license

From the moment the NPF’s license is revoked, within the same three-month period, the funded part of pensions is transferred to the Pension Fund of Russia. After this, the Client can leave his savings with the Pension Fund or send them to another NPF. When a license is revoked, the funded part of the pension does not expire. The guarantee of the safety of pensions is provided by the deposit insurance agency, if the fund was a participant in the pension guarantee system. Otherwise, the difference will be reimbursed by the Central Bank of Russia.

Moving from one NPF to another is the right of future pensioners. However, this can be done without losses only once every five years, otherwise the future pensioner may lose investment income for the last year. Those NPFs that will not be able to function will transfer the Clients’ savings to the Pension Fund, and then citizens have the right to make a decision on transferring to another NPF. If there are insufficient funds, the NPF will be declared bankrupt, and the difference in insufficient funds in this case will be covered by the Central Bank of Russia. Subsequently, such savings are transferred to the Pension Fund.

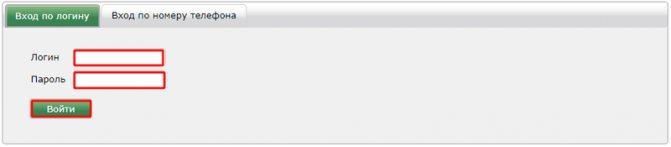

Login to your Reso personal account on reso.ru

Users visit the Reso-Garantia personal account through the main page of the portal.

Online login to the agent's workplace

Reso-Garantia employees log into their personal account through a special page. The login is your name, and the password is issued upon registration.

Login to your personal account

Important! If the agent does not have access to the account, then he needs to contact his managers .

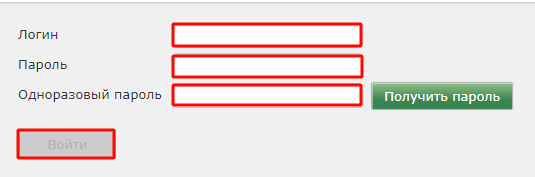

In the next step, a one-time code will be sent to the specified mobile phone, which must be verified by entering it in an additional cell.

How to log into a client's personal account

Authorized users enter the Reso-Garantia account through a page where they enter a login (their cell phone number starting with the number “9”), a password (created during registration), and a one-time code (received via SMS).

Personal Area

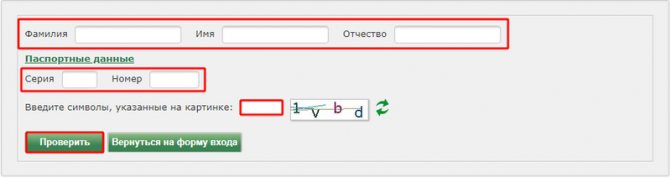

I can’t log in: how to recover my login and password

If the client has lost his input information, he can use the form to restore it. To do this, you need to go to the special Reso-Garantiya page.

Password recovery

Indicate in the appropriate cells:

- Personal information.

- Series and number of the passport of a citizen of the Russian Federation.

- Enter captcha symbols.

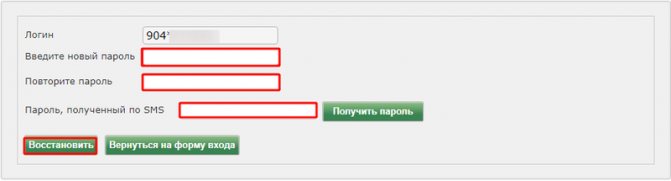

After verification, a form will open where you need to come up with a new password and confirm the code received in the message.

To restore your login, which is your cell phone number, you need to contact technical support in writing.

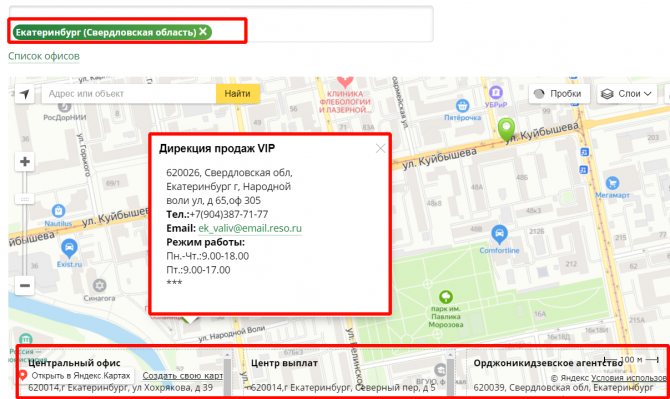

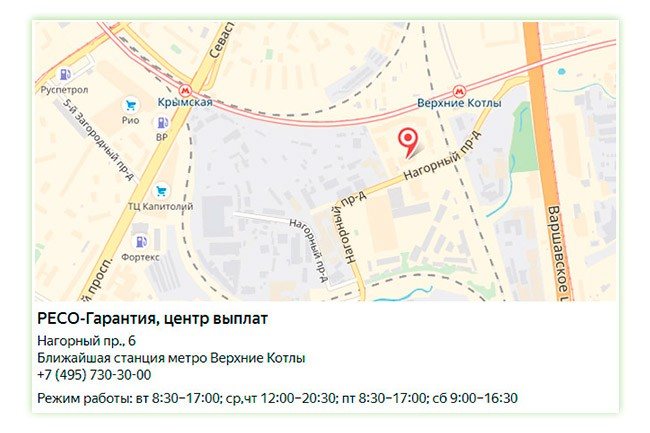

Addresses of offices and branches of the insurance company RESO

The RESO-Garantiya company has offices in all major regions of Russia. You can find out their address, telephone number and work schedule on the official resource in the “Contacts” section.

View addresses

Office hours

Opening hours and lunch times are different for each office and branch of RESO-Garantiya. You can find out the operating mode on the official resource, as we described above. You need to enter the name of the city in the search bar and select the appropriate location on the map. A window will appear with complete information.

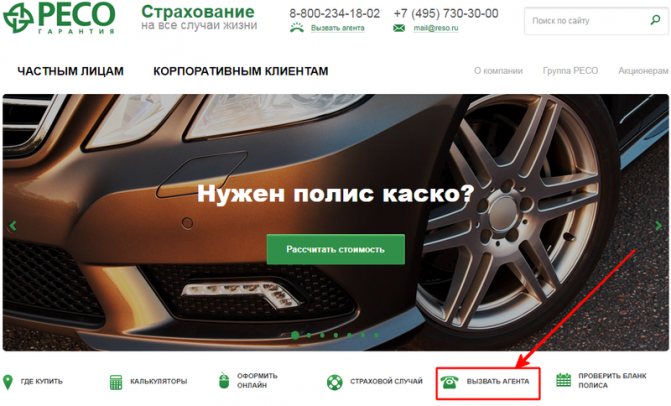

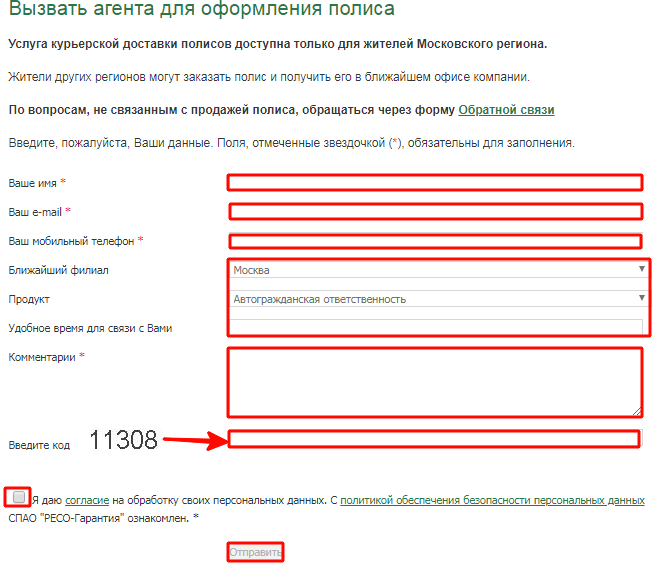

Calling an agent through your RESO personal account

If a client wants to call a company employee to his home, this can be done through his personal account. On the main page, go to the “Call an agent” form.

Fill out the application as completely as possible to select the right specialist. Indicate your name, email address, phone number, city, and the insurance product you are interested in. In the comments, you can write data on the previous contract, especially regarding car insurance (MTPL, CASCO). Be sure to check the box that allows the company to collect and store your personal information.

List of NPFs deprived of their license in 2020

Two funds that were prohibited from attracting new client funds were resources called Savings and Sunny Beach. To clarify, the Central Bank prohibited them from concluding new agreements and transferring funds to management organizations. Organizations can correct the situation only by changing the policy regarding the investment of pension deposits.

Interesting to read: Sample complaint to the prosecutor about the inaction of the bailiff regarding the collection of alimony

Regarding non-governmental organizations that ceased operations due to the fact that, at the request of the client, they did not transfer funds to the new company, here the Pension Fund of the Russian Federation reflects these same clients as remaining in the old funds. Therefore, these clients are guaranteed a transfer of the nominal amount of funds to the Pension Fund, that is, the procedure is the same as in the case if the person did not try to leave the NPF under the leadership of Motylev. To decide where to transfer your savings, you need to know the non-state pension funds included in the list of organizations that guarantee the safety of funds.

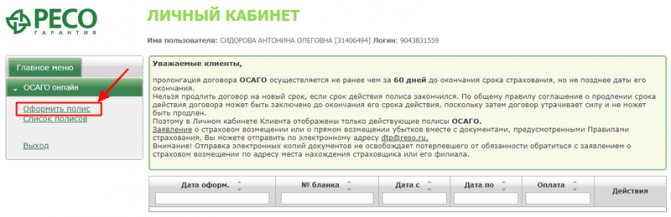

Purchasing an electronic OSAGO policy online

According to the Law on Motor Vehicle Liability, starting from January 1, 2020, you can draw up an agreement on the Internet. It is equivalent in strength to a document produced by printing. This innovation allows car owners to enter into car insurance contracts online. Payment is made cashless via the Internet.

For registration you will need scans:

- Driver's license.

- PTS.

- Certificates of registration.

- Passports of a citizen of the Russian Federation.

- A document confirming the completed technical inspection (diagnostic card).

- TIN.

By logging into your personal account, select “Apply for a policy” in the side left menu.

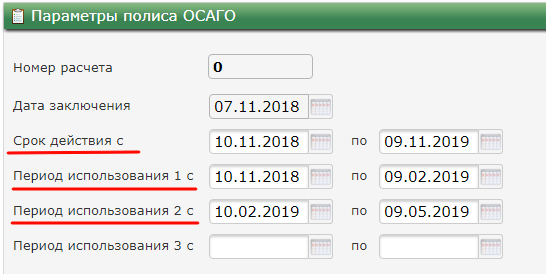

In the “Policy Parameters” section, fill in the start and end dates of the document and the period of use. In the case where the vehicle is used all the time, these dates coincide. If not, then the lines Period 1, Period 2 are filled in.

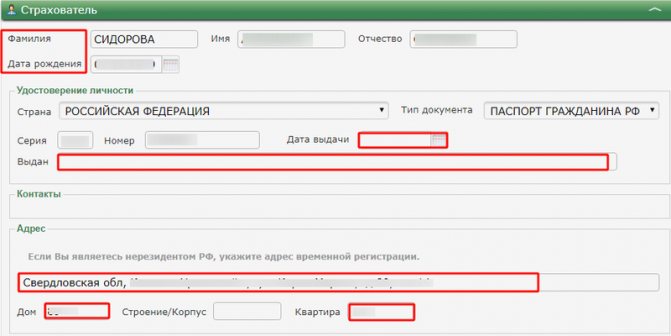

Section "Insured". By default, the data from the questionnaire is displayed. Some fields need to be completed: date of receipt of passport and department. If the address is not correct, it can be changed. It is necessary to check the accuracy of all the information provided so that there are no problems with payments and points accrual in the future.

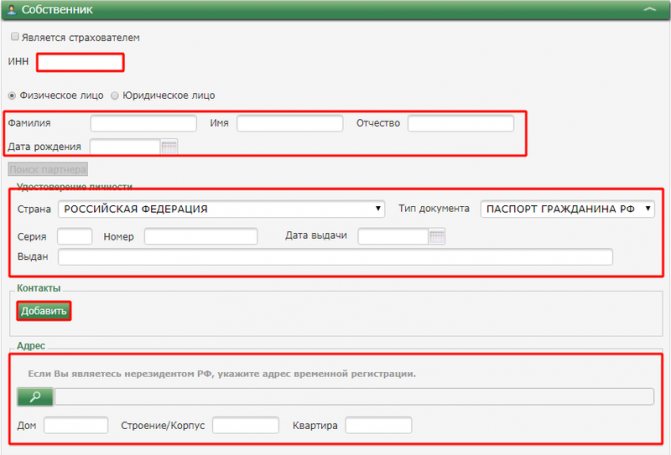

Section "Owner". By default, it is indicated that the policyholder and the owner are the same person. If in reality the owner of the vehicle is another person, then you need to uncheck the box and fill out all fields of the form.

Enter: personal information, identity card, registered address, contact information.

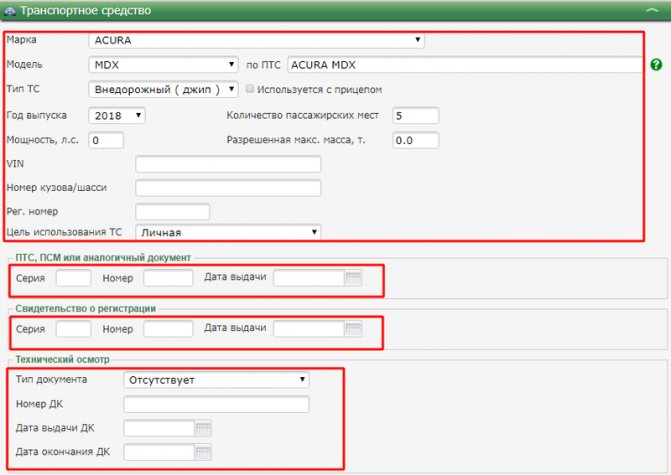

Section "Vehicle". Enter the data from the documents for the car, indicate the series and number of the PTS, the Registration Certificate, as well as information about the technical inspection.

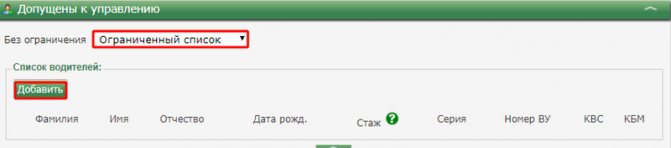

Section “Approved for management”. Here choose one of the options:

- No limit. All drivers are welcome. In this case, the KBM is calculated for the specified vehicle. When selling a car, the bonus-malus coefficient is lost and will be calculated again.

- Limited list. A certain number of persons admitted to management is entered.

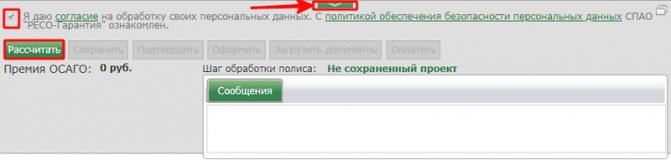

Click on the arrow in the middle of the bottom field. A calculation window will open, where you must first check the box to consent to the processing of the entered data.

The insurance premium amount will appear. After this, save the document.

Attention! If you have not passed the AIS RSA control, then you need to check all the entered data. A single digit error may indicate a discrepancy. It is also possible that the previous policy was filled out incorrectly by the agent. In this case, you will have to contact the insurance company with a statement. .

If all the data is entered accurately and the check in the PCA database is successful, then the payment must be made before 00:00 the next day. Otherwise, the application will be cancelled.

After funds are received into the company’s account, a PDF file with eOSAGO will appear in your personal account. It is equivalent in strength to the official auto insurance form.

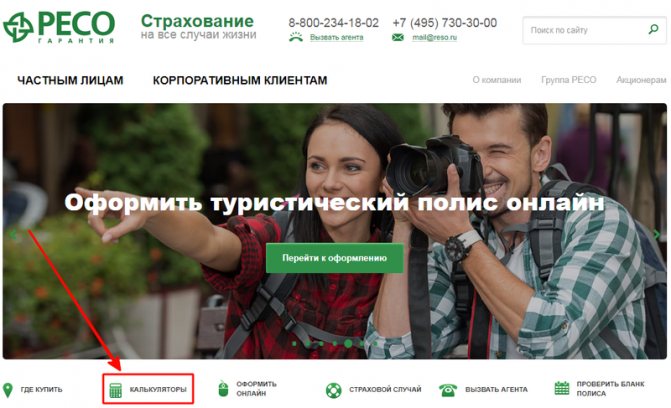

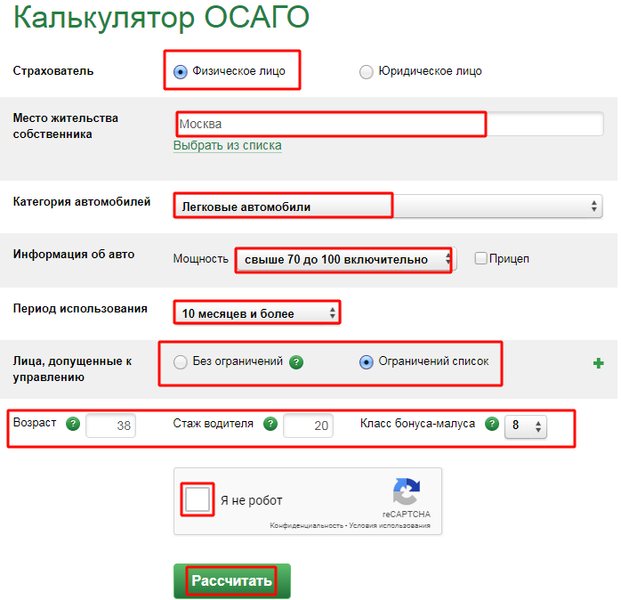

OSAGO calculator

Before executing a vehicle insurance contract, you can make a preliminary calculation to clarify the amount of the accrued premium. The calculator is located at the bottom of the main page of Reso-Garantiya.

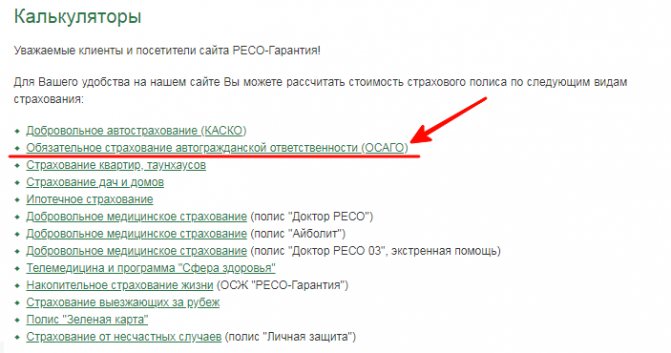

In the list that opens, select the MTPL calculator.

General information is entered into the form and an approximate calculation is made. The following fields must be filled in:

- Type of policyholder (individual or legal entity).

- Place of residence.

- Information about the vehicle.

- Operating period.

- List of persons admitted to management.

- Age, experience and KBM.

Be sure to check the box that you are not a robot and calculate the cost of the premium.

Pension funds are leaving insurers for bankers

The structures of banker Anatoly Motylev, who is actively acquiring pension funds, together with other investors received control over another non-state pension fund - Sberfond RESO, which will be renamed Sberfond Sunny Beach. Bankers continue to show significant interest in the pension business, while insurers are getting rid of it.

As Kommersant learned, the non-state pension fund Sberfond RESO is no longer controlled by the RESO group. The deal to sell 100% of the shares of RESO Pension Investments LLC, which is the sole shareholder of Sberfund RESO, was closed on November 24, sources told Kommersant. “RESO Group continues to concentrate financial and management resources in those areas in which it has the greatest competitive advantages - insurance and car leasing. The transaction for the sale of the pension business is a continuation of the implementation of this strategy,” explained Andrey Savelyev, CEO of RESO holding.

Control over NPF Sberfond RESO passed to a consortium of investors, which includes the main shareholder of Rossiysky Credit Bank Anatoly Motylev, his former colleague at Globex Bank Sergei Magidov, former vice-president of Rossiysky Credit Bank Andrey Kulikov and others , sources close to investors told Kommersant. Mr. Kulikov confirmed this information, adding that the fund will be renamed Sberfond Sunny Beach, and former Minister of Communications Leonid Reiman may be among the investors.

NPF Sberfond RESO was founded in 2002, and since the beginning of 2008 it has been part of the RESO group. According to the Central Bank, as of October 1, the fund ranks 26th in terms of the volume of its own property (16.3 billion rubles), pension savings of NPFs amount to 15.7 billion rubles, reserves - 1.3 million rubles.

NPF Sberfond RESO was sold a long time ago. “They first started talking about this back in 2009, almost immediately after the RESO group purchased control over the fund. However, later sales developed, growth rates increased, and the idea of selling the fund was postponed,” recalls the head of a small non-state pension fund. We returned to it two years ago after government announcements about the possible abolition of pension savings. According to representatives of three NPFs from the top 20, in particular, they considered the possibility of purchasing Sberfund RESO, the structure of the former shareholder of AFK Sistema, Evgeniy Novitsky. But the asking price was too high (15-20% of assets plus 10% of growth over two years).

Mr. Motylev’s structures bought the fund at a high price, market participants believe. The parties did not disclose the financial parameters of the transaction, but several pension market participants put the amount at 20-30% of the fund’s assets, that is, 3.2-4.8 billion rubles. The average market price of a non-state pension fund is considered to be 15% of assets. “In our opinion, Sberfond RESO is one of the most interesting private pension funds on the market, with a high-quality client base and excellent prospects for development,” comments Sergei Magidov on the acquisition.

The structures of Anatoly Motylev and related investors, according to market participants, are actively buying non-state pension funds (see Kommersant on November 14). “In conditions of limited liquidity and closed Western markets, pension funds remain virtually the only source of long-term funding,” explains bankers’ interest in NPFs, executive director of NPF Mosenergo JSC Sergei Zytsar.

“The deal reinforces the trend of insurers exiting the pension business in favor of bankers. This is already the second NPF that Mr. Motylev or persons close to him buy from the insurance company). Only NPF RGS remains; other attempts by insurers to build a pension business (Ingosstrakh, Alliance) have not yet been successful,” notes CEO of the consulting company Sergei Okolesnov.

Maria Yakovleva

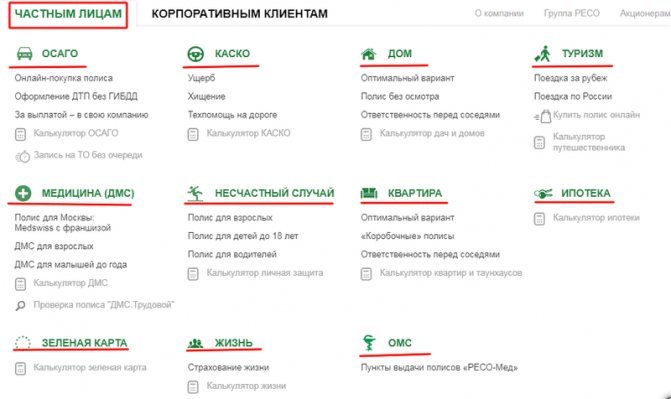

Online insurance in your personal account

IC Reso-Garantiya provides services to the population and organizations in the field of insurance in all types of areas: property (movable and immovable), life and health, travel, additional and compulsory health insurance, mortgage. Almost all policies can be issued online.

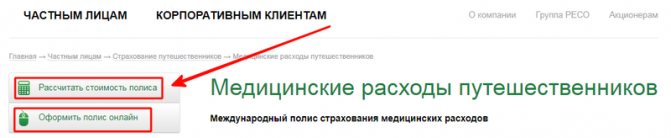

For example, we need insurance for traveling abroad. Then select “Tourism” and “Trip Abroad”. In the page that opens on the left, you can pre-calculate the cost of the premium, then draw up an agreement.

You will need to reliably fill out the form and transfer funds from a bank card. The electronic policy will be sent to the specified E-mail.

If you have questions about the design or use of a document, you can open the “Questions and Answers” form on the right.

RESO Mobile - personal account on your phone

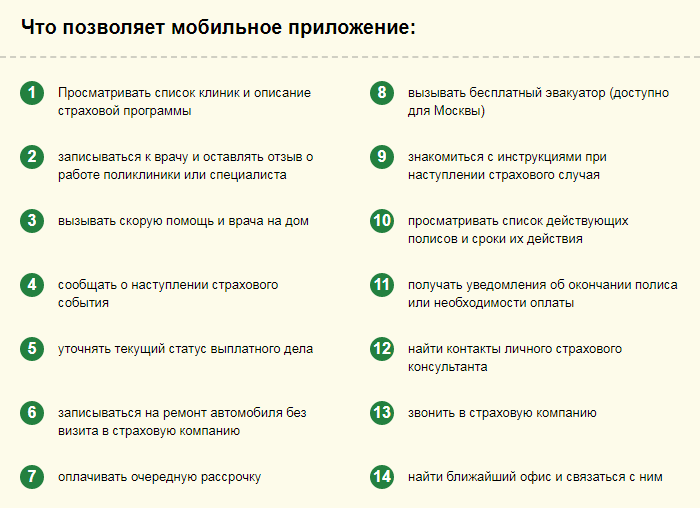

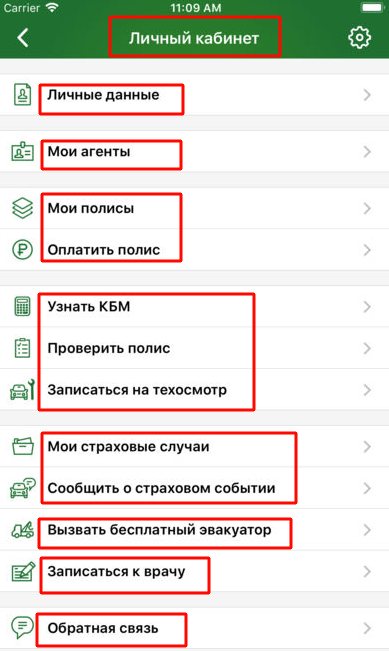

For those who constantly use gadgets, the company offers to download the convenient mobile application RESO Mobile. The version is available for iOS and Android operating systems, which can be installed through stores on your device.

Application potential:

Your personal account is quite simple and easy to navigate. In it you can:

- change or correct personal information;

- call the nearest agent;

- obtain all information about existing contracts;

- clarify information on compulsory motor liability insurance;

- report to the company when an insured event occurs;

- call a free tow truck;

- make an appointment at the clinic;

- Get advice from hotline specialists.

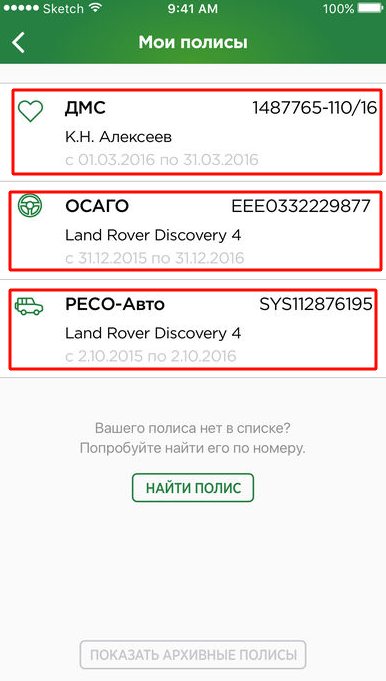

In the mobile version of IC Reso-Garantiya, all policies (current and archived) will always be at hand. They can be viewed in a special section and presented if necessary.

Download the Reso-Garantia application for your Android phone

You can install the program for RESO Mobile gadgets through Google Play:

Reso-Guarantee for iPhone, iPad and iPod Touch

The mobile version for Apple devices is available in the AppStore located on the device:

Reso-Garantiya hotline phone number

Reso-Garantia technical support operators work around the clock. They provide consulting services on all types of insurance. They also accept suggestions from clients to improve service and complaints about company employees.

Residents of Moscow and the region can contact the hotline by calling +7 495-730-30-00. Payment for calls is made according to the operator's tariffs.

Residents of Russian regions can call the multi-channel toll-free number 8 800-234-18-02.

Briefly about

RESO-Garantiya has been providing insurance services on the Russian market for more than 25 years. The name of the company stands for “Russian-European Insurance Company”, which is explained by close ties with several large European companies. The parent company RGI Holdings BV is located in Holland. Effective management, an extensive list of products offered, as well as a competent client policy, allowed RESO to become a systemically important player in the Russian insurance market.

Activities primarily take place in branches and sales offices. The number of divisions exceeds 800, thanks to which almost all Russians have access to the company’s services. The central building is located in Moscow. There are a number of representative offices of RESO-Garantiya in the countries of the Middle East, Asia and Europe. In total, the insurer employs more than 20 thousand employees and agents, whose services are highly paid due to their significant demand.