- home

- Reference

- Experience

Work experience is of great importance for the formation of a pension in modern Russia. The larger it is, the more secure the citizen’s old age will be in the future.

The question of entering this period of military service remains relevant. The period of military service is included in it, however, with some features that will be discussed in the article.

What is experience

The concept of “work experience” was previously used exclusively in the context of the number of years of work of a citizen. This also included some other periods (for example, parental leave).

Also in Russia there is an insurance period - the period for which insurance premiums were paid for an employee (by the employer or by himself, in the case of entrepreneurial activity).

Separately, it is necessary to highlight preferential special experience, which should be understood as work in difficult, harmful and special conditions, for which the right to early retirement is provided.

Let's summarize

Moving abroad to a permanent place of residence does not deprive citizens who have earned a Russian pension through their labor of the right to pension payments. In order to apply for a pension abroad or transfer it from Russia, you must contact the Pension Fund and follow the procedure and rules that are clearly stipulated by Russian legislation.

Since 2020, there have been some changes in the registration of pensions (in the form of payment of pensions, certification of being alive), the purpose of which was to modernize the procedure. Registration of pensions for Russian citizens in those countries that have concluded a bilateral treaty or agreement with the Russian Federation is somewhat different from the general rules and provides these citizens with certain benefits.

In what cases is military service included in the total length of service?

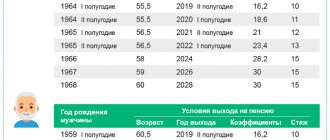

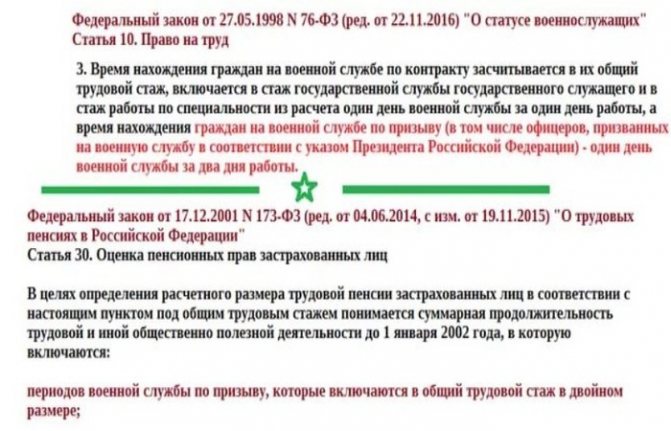

Until 2002, the main criterion determining the size of the pension was the total number of years worked. Now it does not have such practical significance as before, but is still used to calculate individual social payments. So does the period of being in the army coincide with the total time of work?

The Russian Federation provides for two forms of recruiting the Armed Forces:

- compulsory conscription of citizens liable for military service;

- conclusion of a contract.

For conscripted military personnel, the time spent in the army is fully counted.

Contract military personnel should include officers, as well as privates and non-commissioned officers from the persons who signed the relevant document. With a certain length of service, they have the right to count on a special military pension, and therefore the total length of service is not of fundamental importance for them. However, in case of insufficient length of service, they have the right to rely either on an old-age insurance pension, for the calculation of which they must have a minimum working period of 10 years in 2020.

Reference! Since 2019, citizens of pre-retirement age have the opportunity to retire early if they have worked for many years (37 years for women and 42 for men).

There are also a number of structures in which service is equivalent to army service:

- Troops of the Russian Guard;

- FSIN;

- Ministry of Internal Affairs;

- FSB;

- Ministry of Emergency Situations.

Selection criteria

The minimum requirements for candidates are quite reasonable: age from 17 to 40 years, possession of a foreign passport and good health.

When passing the physical fitness test, the candidate must demonstrate compliance with the following qualification requirements:

- 20 push-ups;

- 50 squats;

- long distance running (3 km in 12 minutes).

This is the bare minimum. If some of the selection participants show the best results, they will be accepted. They are much more willing to hire those candidates who meet the following requirements:

- age from 20 to 25 years;

- presence of an applied profession (documentary confirmation will be required);

- sports achivments.

The recruit must have well-developed attentiveness and memory (these qualities are tested separately). As for health, candidates who have been ill may receive a negative assessment:

- jaundice, measles;

- have undergone one or more operations;

- had fractures or severe injuries.

The candidate must have good teeth, excellent hearing and vision.

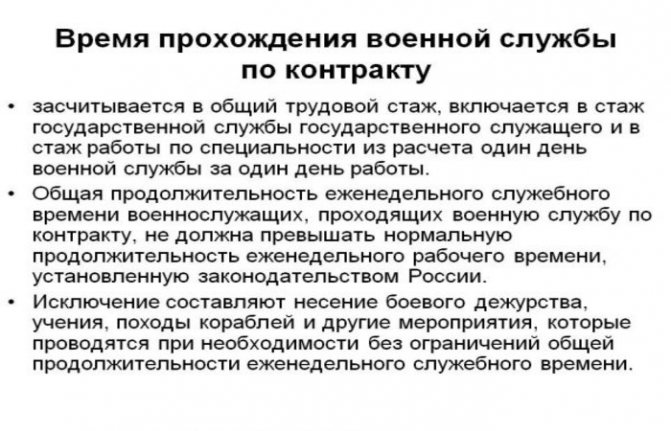

The principle of calculating the length of service of those who served in the army

As a general rule, service in the Armed Forces and structures equivalent to them is counted on the basis that 1 day of being there is equivalent to 1 day of work. In other words, it is taken into account depending on its duration in calendar days. However, there are exceptions. Thus, for conscripted military personnel, 1 day in the army or navy is equivalent to 2 days.

Example 1

The contract soldier served for less than 3 years, after which he left the army, subsequently working in civilian positions. Thus, he did not earn the right to a military pension, and the entire period of his stay in the army is equated to ordinary work. Accordingly, during the period he was in the army, he accumulated 3 years of work experience.

Example 2

A conscript soldier served the statutory period of 1 year and after demobilization worked in civilian life. Taking into account the increasing coefficient, the period of work experience accumulated during service is 2 years.

When applying for a pension, PFR specialists may request documents confirming that the citizen is in the army. These include:

- military ID;

- work book with a record of its owner being in the army;

- certificate from the military commissariat;

- certificates from military units and other places of service.

Insurance part: calculation features

The insurance period is more important, determining both the right to retire and its size.

For conscripted military personnel, being in the army is included in the insurance period only if, before this time or immediately after it, he had an official job (or was engaged in entrepreneurial activity) and contributions were made to the Pension Fund for him.

Important! The duration and nature of the work activity in this case does not matter at all; it is only important that it coincides in time with the period of being in the army.

If this condition is met, for each year that a citizen serves in the military, he is awarded 1.8 pension points.

For contract soldiers (including officers) who cannot qualify for a long-service pension, military service is included in the insurance period.

As for military pensioners who are going to apply for a second “civilian” pension, the time spent in the army, taken into account when calculating length of service, cannot be included in the insurance period.

Preferential length of service: nuances

As a rule, preferential service requires early retirement due to difficult and harmful working conditions. Staying in the army may be included in this period, provided that the citizen worked in hazardous work before being in the army or immediately after discharge and returning to civilian life. However, this applies to those workers who worked under special working conditions before January 1, 1992.

As for the special experience of health care and education workers, only compulsory military service before October 1, 1993 is included in it.

The situation is different during the period of contract service. It can be counted as special service provided that 1/3 of its citizen was in the army, and 2/3 worked in relevant positions in healthcare and educational institutions.

Military service in most cases is still of great importance for the formation of various types of length of service and, as a result, affects the size of future pension benefits, which, undoubtedly, is one of the incentives for completing it.

How to confirm that you are alive

Confirmation that the pensioner is in good health is a necessary condition for the continuation of pension payments. This procedure is carried out annually, starting from the next year after the assignment/restoration/resumption of the pension. Such confirmation could be:

- act of personal appearance - issued after a personal visit to the Pension Fund or its territorial body in Russia, diplomatic mission, consulate of the Russian Federation in the country of residence;

- a document confirming that the pensioner is among the living from a notary in the Russian Federation, from an authorized body in the country of residence.

An important condition is the proper execution and legalization of documents.

All official foreign documents must be certified: the authenticity of the signature, seal, the authority of the person who signed the document, and compliance with the requirements of the legislation of the host country are confirmed.

This is possible as a result of affixing an apostille to the authorized body of the country of residence - a party to the Hague Convention or consular legalization (for certification, you should contact the consulate or Embassy of the Russian Federation in the country of residence of the applicant).

In addition, all documents provided, as well as seals and stamps in a foreign language, must be accompanied by a translation into Russian with the signature of the translator and certification by a notary or consular office of the Russian Federation.

If there are international agreements with the Russian Federation on the abolition or simplification of legalization, when the submitted documents are considered official and have evidentiary value in the territory of another state, this procedure is not required.

USA

American soldiers and officers enjoy a number of benefits:

- Civil education for employees and their family members.

- Insurance loans for construction.

- Medical support.

- Providing assistance in finding a job.

- Psychological help.

- Those who have served for more than 20 years have the right to dismissal. Their pension is calculated based on rank and length of service, and is multiplied by a factor of 2.5%.

- Service beyond the level established by law is encouraged financially.

- In addition to monetary support, a serviceman has the right:

- To purchase goods at a discount in special stores.

- Refueling at military gas stations.

- Free accommodation in publicly owned houses

- Receiving unemployment benefits for 2 years.

Each country provides for those received during service.

About early retirement

A preferential (early) pension is a monthly cash benefit paid by the state to a person who has not reached the mandatory retirement age. Such preferential provision of UBD may be claimed in the following cases:

- The duration of mixed service is 25 years. With the condition that at least half of this period the veteran worked as a military specialist or special service employee. The retirement age for Afghan soldiers in this case is 45 years.

- Veterans who have become disabled as a result of wounds or injuries received during their service. Based on clause 3 of Art. 32 Federal Law No. 400 retirement age for Afghans in Russia who have become disabled: 55 years for men, 50 for women. But with the condition of having an experience of 25 and 20 years, respectively.

These provisions do not currently apply to other combat veterans.

Great Britain

Military salaries in the UK are constantly adjusted by law.

Members of the armed forces of the United Kingdom have the right to:

- Cash salary, which depends on length of service and various bonuses. As for length of service, it is: for those who have the rank of “colonel” - “major” - 8 years, “captain” - 6 years, “lieutenant” - 4 years. The allowances include: for service abroad, for swimming, for paying for garages and parking, for paying utility bills, and assistance with accommodation.

- The required service life for military personnel is 16 years. Time worked beyond this term is rewarded financially (charged from 2.6% to 3.9% of the basic rate every month).

- A one-time payment equal to 3 years' salary is paid. (For example, a colonel who left the post of chief of a brigade of ground forces will receive 40-42 thousand euros.)

- Those who were transferred to the reserve or retired are guaranteed to receive part of their pension several years in advance.

- If the contract was terminated not at the initiative of the military man, he will receive up to 18 months of salary.

- Various societies that protect the rights of military personnel and their interests are very popular and effective.

- The Housing Fund is constantly replenished with new comfortable apartments for this category of citizens. In addition, if an employee immediately pays the entire cost of the purchased housing, then he will receive 30% of the full price from the state. There is also a special one: for those who took out an apartment or house on credit, the government awards at least 200 euros every month.

- Military pensioners or members of their families are treated free of charge in medical institutions and receive vouchers for resort treatment.

Not only the Ministry of Defense, but also a number of others are involved in caring for German military personnel.