Home / Labor Law / Payment and Benefits / Pension

Back

Published: March 30, 2016

Reading time: 9 min

0

5698

A new principle for calculating pension payments was introduced in 2020. This radical change is due to the government’s reform, which is actively introducing pension provision to reduce the burden on the state treasury .

The changes are based on legislative norms reflected in Federal Law No. 400 (as amended in 2015).

- What it is?

- What do the sizes depend on?

- Maximum and minimum values

- Advantages and disadvantages

- How to calculate points?

- Using the calculator

What it is?

The individual pension coefficient (IPC) is the sum of points accumulated over all years of work.

This calculation involves assigning a score to all work periods in which employers contributed certain insurance amounts to the Pension Fund. The formation of such contributions occurs according to the selected tariff. 10 or 16% of your monthly salary may be deducted.

The points accrued for one year are equal to the ratio of the funds in the insurance account of the future pensioner (already placed in the Pension Fund) to the contributions that can hypothetically be obtained from the maximum salary that is subject to contributions according to legal norms.

What do the sizes depend on?

The government annually determines the cost of one point - adjusting it

value is made twice, in February and April. During these months, there is an automatic recalculation of pension funds (without an application from citizens) accrued for all pensioners. This indexation allows you to adjust the cost of the point in accordance with inflation and price increases.

Pension payments are formed from two main components - a fixed part and insurance funds, indexed taking into account the cost of one point.

In 2020, the cost is set at 78 rubles and 58 kopecks per point. And the fixed part is 4,823 rubles and 35 kopecks.

To be eligible for a decent pension, calculated according to the new formula, you must receive a high salary.

In this case, the IPC will be the maximum possible, since everything depends on the amount of insurance contributions for each year of work. When making calculations, points will be calculated for each year included in the insurance period separately.

The essence of the reform and new principles for calculating pension payments is to convert work activity into pension points. In turn, points are converted into rubles. And if the number of IPCs is entirely in the hands of the employee, then the cost of points will depend entirely on the government and inflation indicators, which officials rely on when indicating the annual cost.

Pension calculation in 2020

How will pensions be calculated in 2017?

General parameters that will be used to calculate pension amounts in 2020:

- The cost of one pension coefficient is 78 rubles 58 kopecks (from April 1, 2020).

- The amount of the fixed payment ( FB ) to the insurance pension is 4805 rubles 11 kopecks (from February 1, 2017).

- The minimum required insurance period to qualify for an insurance pension is 8 years (from January 1, 2017).

- IPC value required to obtain the right to an insurance pension is 11.4 (from January 1, 2020).

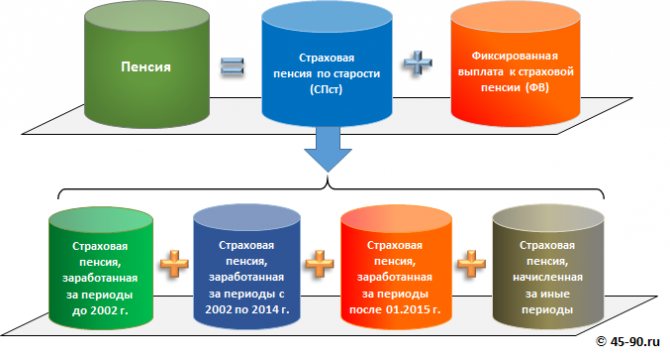

What parts does the pension consist of and how is it calculated.

According to the Federal Law “On Insurance Pensions” - FZ-400, the pension (excluding funded pension) consists of the “Old Age Insurance Pension” and the “Fixed Payment”.

Fixed payment to the insurance pension (IF).

FV is an addition to everyone, without exception, to the accrued old-age insurance pension. Its size in 2020 is 4,805 rubles 11 kopecks. The law (FZ-400) defines this part of the pension as follows: “A fixed payment to an insurance pension is provision for persons entitled to an insurance pension in accordance with this Federal Law, established in the form of a payment in a fixed amount to an insurance pension.” For northerners, disabled people and other beneficiaries, an increase in the size of the fixed payment to the insurance pension is provided, described in Article 17 of the Federal Law.

Parts of the old age insurance pension (SPst)

The old-age insurance pension consists of four parts - three correspond to the periods of the citizen’s working activity, and the fourth is accrued for other periods equated to the insurance period:

- Parts of the insurance pension earned for periods before 2002.

- Parts of the insurance pension earned for the periods from 2002 to 2014.

- Parts of the insurance pension earned for periods after 2015.

- Parts of the insurance pension accrued for other (non-insurance) periods.

Individual pension coefficient (IPC)

Starting from 2020, the pension rights of citizens are measured not in rubles, but by the value of the individual pension coefficient IPC. Therefore, in order to calculate the size of the pension, it is necessary to determine, calculate, calculate or know the value of your individual pension coefficient - IPC . If the IPC is known, then it is multiplied by the cost of one pension coefficient (point) in the year the pension was assigned and its ruble size is determined.

The individual pension coefficient ( IPC ), in accordance with the pension structure, also consists and includes three main terms with the addition of a fourth, which takes into account pension rights for “other” (non-insurance) periods - military service, periods of child care, etc. :

IPC = IPC before 2002 + IPC for 2002-2014 + IPC after 01/01/2015 + IPC for other periods.

the IPC determined and calculated for each of the specified periods?

Pension rights formed before 2002 (IPC before 2002)

Dependent and completely determined by three “things”:

- Duration of insurance (work) experience up to 2002.

- The average monthly earnings of a citizen either for 2000-2001, or for any 60 months (5 years) in a row in the period up to 01/01/2002 (whichever is more profitable is chosen).

- The duration of the insurance period was until 1991.

Incorrect accounting or underestimation of any of the listed parameters leads to an underestimation of the pension amount. Pension rights for this period are first calculated in rubles and then transferred to IPK . The detailed algorithm for calculating the IPC until 2002 is described in detail in the article . The main problem for those retiring, including in 2020, is that the Pension Fund (PFRF) does not have complete information about citizens and their work activities for periods before 2002. Therefore, information about the IPC before 2002 . , which is issued by the Personal Account on the PFRF website, as a rule, does not correspond to reality. If your calculation using a calculator or based on an algorithm shows a result different from that indicated in your Personal Account, then you will have to prove and confirm your case to the Pension Fund of the Russian Federation on the basis of official documents confirming your experience and earnings (work book, certificates of earnings, archival documents, etc. ).

Pension rights formed in 2002-2014 . ( IPC for 2002-2014 ).

They depend and are completely determined only by the size of the pension capital (PC), formed from the citizen’s insurance contributions over these years.

Neither the insurance period (the duration of the periods in 2002-2014, during which insurance contributions were transferred to the Pension Fund of the Russian Federation for a citizen), nor other parameters have any impact on the size of the insurance part of the pension earned in 2002-2014. provided that the total length of service is sufficient to acquire the right to receive an old-age insurance pension. The calculation and assessment of pension rights formed for 2002-2014, as well as rights acquired before 2002, are made in rubles on the basis of Federal Law No. 173-FZ, and then converted into IPC points.

About how pension rights and IPC for 2002-2014. described in detail in the article.

Information about this period of a citizen’s labor activity and the amounts of insurance contributions transferred for him to the Pension Fund of the Russian Federation is available (personalized accounting has been fully operational since 2002). Therefore, the value of the IPC for 2002-2014 can be found in your Personal Account on the PFRF website or on the State Services website. but you can calculate it yourself using a calculator, or “manually” based on an algorithm.

Pension rights formed after 01/01/2015 ( IPC after 01/01/2015 ).

They depend and are completely determined only by the amount of insurance premiums received by the citizen’s ILS in the Pension Fund of the Russian Federation. Since January 2020, after Federal Law-400 came into force, the method of calculating the IPC has changed. For each calendar year, its value is calculated using the formula

IPC year - individual pension coefficient determined for each calendar year starting from January 1, 2020; SV year - the amount of insurance premiums accrued and paid for the corresponding calendar year for the insured person; NSV year - the standard amount of insurance contributions for the old-age insurance pension, calculated as follows

NSV year = 0.16 x Prev. Vel. Bases.

Prev. Vel. The base is the maximum value of the base for calculating insurance contributions to the Pension Fund - the “ceiling” (upper threshold) of the annual salary, from which insurance contributions are calculated in the amount of 22%, of which 16% goes to the formation of the insurance pension. From amounts exceeding this threshold, insurance premiums are also transferred to the Pension Fund, but at a different rate - in the amount of 10% and they go not to the individual personal account of the citizen, but to the “common pot” of the Pension Fund. The maximum value of the base is established annually by government regulations. Its values for the last three years: 2020 - 711,000 rubles; 2020 - RUB 796,000; 2017 — 876,000 rub.

To calculate and evaluate your annual IPC earned after 01/01/2015, you can use simpler formulas

- IPK 2020 = (average monthly salary in 2020 / 59,250) x 10. Cannot exceed 7.39. If more, then 7.39

- IPC 2020 = (average monthly salary in 2020 / 66,333) x 10. Cannot exceed 7.83 If more, then 7.83

- IPC 2020 = ((earnings for 2020 until retirement) x 0.16 / 140,160) x 10. Cannot exceed 8.26. If more, then 8.26.

IPC for other periods.

For socially significant periods - military service, child care and some others, points are also awarded and the IPC is formed for other periods . It is charged if the citizen did not work during these periods. The number of points for non-insurance periods, according to paragraph 12, article 15 of the Federal Law “On Insurance Pensions”, is as follows.

- The coefficient (IPC) for the period of military service under conscription, as well as periods of service and (or) activity (work) provided for by Federal Law of June 4, 2011 N 126-FZ “On pension guarantees for certain categories of citizens” is 1 ,8.

- The coefficient (IPC) for a full calendar year of another period provided for in paragraph 3 of part 1 of article 12 of the Federal Law-400 is:

1) 1.8 - in relation to the period of care of one of the parents for the first child until he reaches the age of one and a half years;

2) 3.6 - in relation to the period of care of one of the parents for the second child until he reaches the age of one and a half years;

3) 5.4 - in relation to the period of care of one of the parents for the third or fourth child until each reaches the age of one and a half years.”

Final calculation of the pension amount

After the IPCs for individual periods have been calculated or become known, they are added up and the final IPC value is determined:

IPC = IPC before 2002 + IPC for 2002-2014 + IPC after 01/01/2015 + IPC for other periods.

With a well-known IPC, the size of the pension assigned in 2020 is easy to calculate. To do this, the IPC is multiplied by the cost of one pension coefficient and a fixed payment is added to the resulting amount

Pension = IPK x 78 rubles 58 kopecks + 4805 rubles 11 kopecks

PS.

1. This algorithm for calculating pensions has been used from January 2020 to the present day, and if pension legislation does not change, it will be in force in the coming years.

2. The most important period, from the point of view of the possibility of influencing the size of the pension accrued to you, is the period of working activity until 2002. The size of the pension can be influenced by choosing the most favorable salaries (for 60 months in a row) and the length of the insurance period (of course, confirming his necessary documents). To do this, you will have to carefully study the algorithm for calculating pensions for periods before 2002.

3. It will not be possible to influence the size of the pension accrued for other periods (after 2002) - all information on the amount of insurance contributions is recorded on the ILS in the Pension Fund of the Russian Federation and is “not subject to appeal.” What is transferred there will be returned in the form of a pension.

4. Algorithm of old-age insurance pension. In each specific case (early exit, northern features, etc.) additional questions may arise. Many of them are discussed and sorted out on our forum in the “Communication” section. This is a collective treasury of knowledge and a “treasury for mutual information assistance”, where you can get an answer from those who have already walked this path.

5. Site users are well familiar with the described algorithm. However, we found it useful to put together and once again make a memo-instruction for beginners in order to show them the shortest path to knowledge of the “truth” and save them from long wandering around the site in search of the necessary material and knowledge.

Maximum and minimum values

In 2020, the maximum IPC value is 8.26.

According to Article 55 of Federal Law No. 400, a gradual increase in the maximum value of the coefficient is provided (such changes will occur annually):

- 7.83 for 2020;

- 8.26 for 2020;

- 8.70 for 2020;

- 9.13 for 2020;

- 9.57 for 2020 and so on.

If the coefficient determined by calculation is higher than the permissible value for the current year, all further calculations are made taking into account the maximum value. For example, the calculation yielded a value of 8.5, but the current value for 2020 is only 8.26. In further calculations, the maximum value for the current year (8.26) will be taken into account, and not the previously obtained value (8.5).

The minimum value is planned to be set by 2025.

It will reach 30 points or IPC. The transition period lasts until the specified year, which provides for the accrual of pension payments at lower values:

- 6.6 for 2020;

- 9 for 2020;

- 11.4 for 2020 and so on.

The annual increase is 2.4 points.

Completeness

The IPK-3 delivery set includes technical means and documentation presented in Tables 2 and 3, respectively. The specific composition of the IPK-3 delivery set is determined by the execution and the supply contract.

| Verification complex | a ъ n W "Н 0^0 S then a03 £ b' si SS | Eg Tf | Deadweight pressure gauge MP-60M TU 50.418-84, pcs. | Verification installation UKDUP-AM MFIL .401229.002- | Set of tools and accessories | ||

| Designation | .T w, 01 | Designation execution | Col., PC. | |||

| IPK-3 TsAKT.466219.007 | — | 1 | 1 | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/1 TsAKT.466219.007-01 | — | 1 | 1 | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/2 TsAKT.466219.007-02 | — | — | 1 | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/3 TsAKT.466219.007-03 | — | — | 1 | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/4 TsAKT.466219.007-04 | — | 1 | — | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/5 TsAKT.466219.007-05 | — | 1 | — | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/6 TsAKT.466219.007-06 | — | — | — | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/7 TsAKT.466219.007-07 | — | — | — | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/8 TsAKT.466219.007-08 | 1 | 1 | 1 | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/9 TsAKT.466219.007-09 | 1 | 1 | 1 | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/10 TsAKT.466219.007-10 | 1 | — | 1 | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/11 TsAKT.466219.007-11 | 1 | — | 1 | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/12 TsAKT.466219.007-12 | 1 | 1 | — | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/13 TsAKT.466219.007-13 | 1 | 1 | — | TsAKT.468934.007, TsAKT.468934.008 | 1 1 | |

| IPK-3/14 TsAKT.466219.007-14 | 1 | — | — | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/15 TsAKT.466219.007-15 | 1 | — | — | TsAKT.468934.007, TsAKT.468934.009 | 1 1 | |

| IPK-3/16 TsAKT.466219.007-16 | — | 1 | 1 | TsAKT.468934.008 | 1 | |

| IPK-3/17 TsAKT.466219.007-17 | — | 1 | 1 | TsAKT.468934.008 | 1 | |

| IPK-3/18 TsAKT.466219.007-18 | — | — | 1 | TsAKT.468934.009 | 1 | |

| IPK-3/19 TsAKT.466219.007-19 | — | — | 1 | TsAKT.468934.009 | 1 | |

| IPK-3/20 TsAKT.466219.007-20 | — | 1 | — | TsAKT.468934.008 | 1 | |

| IPK-3/21 TsAKT.466219.007-21 | — | 1 | — | TsAKT.468934.008 | 1 | |

| Verification complex | a^o 5^o and "5 § ® ° a | Deadweight pressure gauge MP-60M TU 50.418-84, pcs. | Verification installation UKDUP-AM MFIL.401229.002-01, pcs. | Set of tools and accessories | |

| Designation | Designation execution | Col., PC. | |||

| IPK-3/22 TsAKT.466219.007-22 | — | — | — | TsAKT.468934.009 | 1 |

| IPK-3/23 TsAKT.466219.007-23 | — | — | — | TsAKT.468934.009 | 1 |

| IPK-3/24 TsAKT.466219.007-24 | 1 | 1 | 1 | TsAKT.468934.008 | 1 |

| IPK-3/25 TsAKT.466219.007-25 | 1 | 1 | 1 | TsAKT.468934.008 | 1 |

| IPK-3/26 TsAKT.466219.007-26 | 1 | — | 1 | TsAKT.468934.009 | 1 |

| IPK-3/27 TsAKT.466219.007-27 | 1 | — | 1 | TsAKT.468934.009 | 1 |

| IPK-3/28 TsAKT.466219.007-28 | 1 | 1 | — | TsAKT.468934.008 | 1 |

| IPK-3/29 TsAKT.466219.007-29 | 1 | 1 | — | TsAKT.468934.008 | 1 |

| IPK-3/30 TsAKT.466219.007-30 | 1 | — | — | TsAKT.468934.009 | 1 |

| IPK-3/31 TsAKT.466219.007-31 | 1 | — | — | TsAKT.468934.009 | 1 |

| Notes 1 PC, signal generator and receiver FPS-3 TsAKT.468173.006, level gauge emulator PMP 201 6PMP201, adapter LIN-YAZH32 LLC NPP SENSOR are included in all versions of IPK-3 in the amount of 1 pc. each name. 2 PC components: • computer Kraftway Credo KS36 (Parameters no worse than: Intel Core 2 Duo E7200 2.53 MHz; Keyb.Kraftway PS/2; RAM - 1 Gb; Mouse Optical PS/2; OS: Windows 7 Professional Rus; Microsoft software Office 2003, CD/DVD-ROM; at least 7 USB ports; 1 PCI slot, Far Manager 1.75 build 2629) - 1 pc.; • TFT 19″ BenQ FP992″ monitor — 1 pc.; • network filter FS1 TsAKT.468822.002 - 1 pc.; • Samsung Laser A4 ML-2015″ printer – 1 pc.; • communication adapter A4CL20 APS R4 — 1 pc.; • USB-to-CAN compact adapter - 1 pc. 3 It is allowed to replace devices with other devices that have similar or better characteristics. 4 It is possible to replace “Microsoft Office 2003” and Far Manager 1.75 build 2629 with newer versions. | |||||

Table 3

| Name | Quantity |

| Verification complex IPK-3 Manual. TsAKT.466219.007 RE | 1 |

| Verification complex IPK-3 Form. TsAKT.466219.007 FO | 1 |

| Verification complex IPK-3 Verification methodology. TsAKT.466219.007 D1 | 1 |

| Operating documentation for separately supplied devices and units IPK-3 | 1 |

carried out according to the document “Calibration complex IPK-3. Verification method. TsAKT.466219.007 D1”, approved by the head of the GCI SI FBU “Penza CSM” on December 21, 2012.

The list of main recommended verification tools is given in Table 4. Table 4

| Name and type | Basic metrological characteristics |

| 1. Power supply B5-8 | DC output voltage range from 0 to 50 V; Output current range 0 to 2 A |

| 2. Universal voltmeter Shch31 | Upper limits of DC voltage measurements: 10 mV (accuracy ± 0.02%); 100 mV (accuracy ± 0.01%) |

| 3. Universal voltmeter V7-54/3 | Upper limits of DC voltage measurements 10 and 100 mV, error no more than ± 0.0015% |

| 4. Pulse generator G5-82 | Limit: T=10-6-10 s; t=10-7; Dt=± [0.03-t + 0.04] µs; DT=±0.003-T |

| 5. Programmable calibrator P320 | Measurement limit: from 10-9 to 10-1 A; from 10-5 to 103 V |

| 6. Measuring resistance store P327 | Range 0.1-99 999.9 Ohm, cl. 0.01 |

| 7. Megaohmmeter F 4102/1-1M | Measuring limit: 5 to 100 MΩ voltage (500 ± 25) V |

| 8. Oscilloscope S1-55 | Measurement limit: 0-10 MHz, 35 ns, 10 mV/div - 20 mV/div, 0.02 µs/div - 20 ms/div, 10% |

| 9. Mechanical stopwatch SOSpr-2b-2 | 1 class, division price 0.1 s; measurement limit: from 0 to 60 min. |

| 10. Universal breakdown installation UPU-10M | Cl. 5; 3 kV, 10 kV Limit: 500 V |

| 11. Programmable electronic counting frequency meter Ch3-64/1 | Limit: F,T=5-10-3 - 150-106 Hz, s at Ivh=0.15 - 10 V (_G1_) t=10-10-9 - 2-104 s G 7 10-9 ^ at Ivh-0.3-10 V 5ft= 5 -10-7 + V ^count 0 |

Advantages and disadvantages

The new procedure and principles for calculating pension payments are perceived ambiguously by society, since, along with obvious advantages, the point system has tangible disadvantages for citizens.

The positive points include:

- reducing the burden on the state budget;

- stimulating employees to work longer (the longer you work, the more you will earn in old age);

- correlation of the cost of one point depending on the economic situation in the country.

The obvious disadvantages are:

- the inability for citizens with low wages to earn a sufficient number of coefficients (about 1.2 million people are in such an unpleasant situation!);

- difficulty in calculations - in fact, it is impossible to accurately determine the amount of pension payments until the very moment of retirement (such calculations can only be made by specialists from the Pension Fund).

The increase in the minimum insurance period also raises some concern..

Instead of five years, you need to work for fifteen!

This is exactly the minimum that will be reached by 2024 (an increase of one year occurs with each coming calendar year).

How to calculate points?

When making calculations, indicators for the insurance part for the past year (as of December 31) and the amount of maximum contributions established in the coming year (from January 1) are taken.

For example:

Last year, the management of the enterprise contributed 80,000 rubles to the Pension Fund for an employee. Calculations are made as follows:

- 80,000 must be divided by 187,200 (the maximum amount of contributions received from the salary subject to contributions in the current year);

- and then the resulting figure is multiplied by 10 (0.43 times 10) - the coefficient will be equal to 4.3.

The size of the insurance rate also matters. With equal wages, but different rates, different coefficients will be obtained.

For example:

With a salary of 20,000 rubles per month and a rate of 10%, the calculations will be as follows: 24,000 rubles (insurance contributions) divided by 187,200 (the maximum allowable contribution), and then multiplied by ten (0.128 times 10). The coefficient is 1.28.

With the same salary, but at a contribution rate of 16%:

Divide 38,400 rubles (insurance contributions) by 187,200, and then multiply by ten (0.205 times 10). The coefficient is 2.05.

How to get maternity leave if you don’t work - the complete instructions in our material will help you. Calculating your sick leave is not an easy procedure. You will learn how to do this correctly in the material at the link.

Do you want your sick leave to be paid even though you are no longer working? Read the article you need.

Specifications

IPK-3 provides:

— generation and transmission of frequency signals via two channels with a frequency reproduction range of two double sequences of electrical pulses from 0 to 1857 Hz.

The limits of the permissible relative error in setting the frequency of a double sequence of electrical pulses are ± 0.2%;

— imitation of acceleration1 by changing the speed of frequencies of double sequences of electrical pulses in the range from minus 22.281 to plus 22.281 Hz/s.

The limits of the permissible absolute error in reproducing changes in the speed of frequencies of dual sequences of electrical pulses are ± 0.045 Hz/s;

— simulation of the distance traveled2 100 m and 20000 m for a tire tire diameter of 600 (1350) mm by reproducing 2228 (990) and 445633 (198059) electrical pulses, respectively.

Limits of permissible absolute error in reproducing 445633 (198059) electrical impulses (simulating a path of 20000 m):

♦ for a bandage diameter of 600 mm - ± 150 pulses (± 6.7 m);

♦ for a bandage diameter of 1350 mm - ± 70 pulses (± 6.7 m).

Limits of permissible absolute error in reproducing 2228 (990) electrical impulses (simulating a path of 100 m):

♦ for a bandage diameter of 600 mm - ±4 pulses (± 0.17 m);

♦ for a bandage diameter of 1350 mm - ± 2 pulses (± 0.17 m);

— formation and transmission of rectangular pulses with a frequency from 200 to 4000 Hz through four channels.

The limits of the permissible relative error of frequency formation are

± 0,2 %;

— output of seven analog current signals of the following values: 0; 0.5; 1.0; 2.0; 2.5; 3.0; 4.0; 5.0 mA;

— output of six analog current signals in the range from 4 to 20 mA with a resolution of 0.05 mA.

The limits of the permissible absolute error in the formation of a current signal on a load with a resistance from 100 to 500 Ohms are ± 0.02 mA. Control of analog outputs is independent;

— output of eight binary signals that provide a logical one level (10 ± 1) V, a logical zero level of no more than 0.4 V, an output current of no less than 10 mA;

— issuance of thirty-six binary signals that provide a logical one level (50 ± 2) V, a logical zero level of no more than 1 V, and an output current of at least 10 mA. Binary output control is independent;

— the limits of the permissible absolute error in the formation of a time interval in the range from 1 to 30 minutes are ± 1 s;

— direct current measurement via two channels:

♦ current measurement range from 0 to 5 mA with limits of permissible absolute measurement error ± 0.005 mA;

♦ current measurement range from 4 to 20 mA with limits of permissible absolute measurement error ± 0.02 mA;

— setting the rate of change of the DC signal:

♦ range of setting the speed of change of the DC signal 150; 75; 50 µA/min and 75 µA for three seconds;

♦ the limits of permissible absolute error in changing the DC signal are ± 6 µA/min for speed 150; 75; 50 µA/min and ± 5 µA for three seconds for a rate of 75 µA for three seconds;

— output to the display and printing device of information recorded in MPME-64 (MPME-128, MPME-1.0) (information recording format KPD-3V (KPD-3P, KPD-3PA, KPD-3PV));

— receiving and processing information about the state of external signaling circuits (hereinafter referred to as binary signals) from BU-3V, BU-3P, BU-3PA, BU-3PV, BUS, BUS-M;

— transmission and reception of messages via Controller Area Network (hereinafter referred to as CAN) specification 2.0 and IRPS channels;

— verification of rotation angle sensors type L178;

— verification of the STEK-1 overpressure sensor;

— setting the rotation speed of the UKDUP-AM shaft:

♦ range of setting the UKDUP-AM shaft rotation speed from 0 to 2122 rpm;

♦ the limits of the permissible relative error in setting the UKDUP-AM shaft rotation speed in the range from 25 to 2122 rpm are ± 1.5%;

— measurement of the angle of rotation of the UKDUP-AM shaft:

♦ measurement range of the UKDUP-AM shaft rotation angle from 0 to 360° in the rotation speed range from 280 to 2122 rpm;

♦ The limits of permissible absolute error in measuring the shaft rotation angle are ± 0.3° (± 18′).

The output stage of the frequency channels is made according to the scheme - a common collector, operating voltage (50 ± 2) V, maximum current not less than 0.02 A.

IPK-3 is powered from a single-phase AC network with a voltage of 187 to 242 V and a frequency of (50 ± 1) Hz.

Power consumption without connecting the products being tested and the control PC is no more than 60 VA.

The power supplied to the products being tested is at least 100 VA at a supply voltage of (50 ± 2) V.

The electrical insulation of the IPK-3 power circuits at an ambient temperature of plus 25 ° C and a relative air humidity of up to 80% can withstand a test voltage of 500 V (amplitude) of a sinusoidal current with a frequency of 50 Hz for 1 minute.

The electrical insulation resistance of the power supply circuits relative to the IPK-3 housing must be at least 40 MOhm at a temperature of plus 25 °C and a relative air humidity of up to 80%.

The resistance between the grounding element and each touchable metal non-current-carrying part that may be energized does not exceed 0.1 Ohm.

The degree of protection provided by the enclosure is IP20.

Electromagnetic compatibility corresponds to class A information technology equipment according to GOST R 51318.22-2006 (CISPR 22-97).

The readiness time for operation is no more than 15 minutes after supplying the supply voltage.

Overall dimensions (excluding PC and incoming devices and units) -217 x 273 x 270 mm.

Weight (excluding PC and incoming devices and units) - no more than 10 kg.

Terms of Use:

— ambient air temperature (20 ± 5) °C (in a closed production area);

— relative air humidity from 30 to 80%;

— atmospheric pressure from 84 to 106 kPa (from 630 to 795 mm Hg).

Transportation conditions:

— transportation by any type of transport under conditions for group L according to GOST 23216-78;

— exposure to temperatures from 0 to plus 40 °C;

— exposure to relative humidity (80 ± 2)% at temperatures up to plus 25 °C.

Storage conditions in warehouses:

— temperature from 0 to plus 40 °C;

— relative air humidity no more than (80 ± 2)%;

— no effect of vapors of acids, alkalis and other harmful impurities.