Choosing a company to which you can entrust your retirement savings is very important.

Before transferring your money to her accounts by signing documents, you need to carefully study what conditions will be provided to you, as well as what the reputation of the company is.

The funded part of the pension can be contained either in the Pension Fund of Russia (PFR) or in a non-state pension fund (NPF) - and the second, as a rule, is more profitable, but there is still a certain risk. It can be reduced to a minimum if the NPF belongs to a large and respectable company, preferably with a large state share in the capital. This is exactly what the well-known Sberbank of Russia is - yes, yes, in addition to the bank itself, this organization also has a non-state pension fund. The Sberbank non-state pension fund is a joint-stock company created to work with pensions. Next, we will talk in more detail about the conditions that it provides and, if they interest you, also about how to transfer the funded part of the pension to NPF Sberbank.

How to arrange this?

The non-profit organization Sberbank provides the service of transferring and managing pension savings. After the freeze in 2014, those citizens whose accumulated funds were registered can transfer them to non-state funds or leave them in the Pension Fund of Russia. If you transfer to a non-state pension fund, then the invested funds go into investment , and the profit is accrued against future funds.

To apply for this type of pension, a transfer is made from the Pension Fund or another NF, if the money is in their custody. Or it was necessary to make transfers at the beginning, when the pension was just being formed (before 2014).

Reference. Registration is carried out on the basis of an application for the transfer of funds, as well as the conclusion of an agreement taking into account the individual pension plan.

Transfer of savings

When placing a funded pension in Sberbank, you will be able to receive more income into your account, because the capabilities of the main bank of Russia are greater than those of most other organizations, and the financial profile of the activity allows you to successfully invest.

How to transfer the funded part of a pension to Sberbank? To do this, you need to go to the bank office, taking with you the necessary documents, the list of which can be clarified in advance. There, sign an agreement and write a statement to the Pension Fund that you are transferring your funds. Thus, your pension savings (not all, but just the funded pension) will end up in the Sberbank Non-State Pension Fund, which will invest and increase them. Transferring a pension to Sberbank turned out to be very simple, and the question of how to transfer a pension to Sberbank no longer faces us.

Procedure

To make a transfer, you need to go through a number of procedures. Initially, we contact a Sberbank branch to fill out an application for transfer of a funded pension from the Pension Fund of the Russian Federation or another NF (depending on where the pension is currently located). You can contact us in the following ways:

- in person to a bank branch;

- through postal transfers;

- through the online service of Sberbank (you will need to register);

- by proxy, send a person to register.

Next, you will need to collect a package of documents (be sure to make photocopies) to conclude an agreement :

- passport of the insured person;

- SNILS;

- The bank account to which the transfer will be made is opened in Sberbank.

Attention! The next operation is the conclusion of an agreement to transfer funds to Sberbank.

Money is transferred for one visit or request. Applications can even be completed using an electronic signature.

Online service

You can transfer funds once a year. After your money reaches the Sberbank pension fund, you will not have to stand in queues to receive your payments - the funds will be transferred to the card, and the account status can always be checked through your personal account of an extremely convenient online service, where you can freely manage your savings. All you need to do is register by entering your email and phone number, and you will have access to your personal account with all the options. Through it you can transfer funds from card to card, to another account, pay for a service, etc. In addition to the savings part, your personal account will also provide you with all the information about the status of the insurance part of your pension.

Possible difficulties and pitfalls

Choosing a non-profit organization has both positive and negative aspects. It is important to pay attention to some factors when choosing:

- It is worth taking into account the fund’s experience - Sberbank has been serving its clients for more than twenty years, it has experience working with many categories of citizens. Their work involves a variety of monetary transactions and their turnover, as well as the management of pension savings.

- Pay attention to the customer base - quantity.

Sberbank has a wide customer base, reliable suppliers and partners, more than three million users. Important! Interest rates - investing is primarily about profit, so it is worth carefully studying the annual interest and deposit rates for your future pension. - Fund rating - for this there are various services and agencies for viewing the rating. The symbols A++ are used to indicate a very high level, A+ for a high level, and A for an average level. According to the rating, Sberbank is one of the leaders in its industry.

- Licensing for insurance activities - the company was one of the first to start working in the pension insurance system, which guarantees the reliability of deposits and stability of income.

Particular attention should be paid to the timing of transfers - this may affect the amount of money and lead to some losses. Such losses include money taken into account in excess of the “fireproof amount” fixed for workers (who began saving for a pension in 2011).

Transfers of pension funds to a Sberbank branch have the following pros and cons:

- reliability;

- high profitability;

- state guarantee on deposits;

- control over funds (how to view the funded part of a pension in Sberbank?);

- According to user reviews, there may be difficulties with receiving money, delays in payments for a couple of months and a slight decrease in profitability (when and how to receive the funded part of a pension from Sberbank?).

What is the funded part of a pension?

It is formed from contributions that citizens of the Russian Federation pay on their income to the Pension Fund. This benefit consists of an insurance and savings part. The accumulation part has its own characteristics, namely:

- it is formed in the amount of 6% of total contributions;

- transferred to the individual account of a working person;

- its size can be increased with the help of personal savings;

- You can store money in both private and public funds;

- In retirement, funds can be received monthly or in a lump sum;

- If a pensioner dies, his immediate relatives will be able to receive money

How to find out the amount of pension savings in Sberbank?

You can see how much money has accumulated in your Sberbank pension account in 3 ways:

- by contacting the main office of the fund;

- by going to any Sber branch;

- on the NPF website npfsberbanka.ru. in your personal account (PA) registered in your name.

In order to be provided with the necessary information, you need to present an identity card and SNILS.

Actions in LC are as follows:

- Visit the website.

- Go to your personal account – the entry point in the upper right (green button).

- If the login is primary, click on “Register”, if the login is secondary, click on “Login to your personal account”.

- Enter the information that the system asks for.

The necessary information will appear in front of you on the monitor screen.

Is it necessary to do this?

The question of the feasibility of transferring pension savings to Sberbank NPF is decided personally by each client. There are several points that you can rely on when choosing a non-state pension fund:

- Profitability. At Sberbank, every year the rate of interest accrued on investments is within the 3 most profitable in Russia;

- Reliability. NPF Sberbank has serious government support at the expense of the bank on which it operates;

- Speed of provision of information and consideration of customer requests. According to this criterion, NPF Sberbank still has a lot of shortcomings and shortcomings. This is due to lengthy review and numerous double-checks of papers, which significantly delays the process of providing the information of interest;

- Transparency. Basically, the principles of operation of NPF Sberbank are clear, but due to the fact that the system with the activities and transfer of pension savings to Non-State Pension Funds in Russia has not been fully worked out, numerous delays can arise.

There have been delays in payments in the Non-State Pension Fund, but they are mainly due to the imperfections of the existing system, which is constantly being improved. Today, no one can guarantee the reliability and full fulfillment of all the promises of each of the funds. The system of their work on such a scale is just beginning to take shape and bring the first results. It will be possible to draw conclusions about Sberbank as a reliable or unreliable place to invest a future pension a little later, when a whole generation of depositors receive pensions. In the meantime, it is advisable to focus on providing indicators and reporting on the fund’s work.

Thus, the transfer of pension savings to the Sberbank Non-State Pension Fund is possible. It was originally planned to provide this opportunity only until the end of 2020. However, it was later decided that this could be done after the end of 2020, only the changes would come into force a year later for an individual client.

Terms and rates

Depositors of NPF Sberbank can choose one of 3 individual plans (TP) offered by the financial institution:

| No. | TP name | Down payment amount (RUB) | Amount of periodic contributions | Contribution schedule | Pension payment terms (years) |

| 1. | "Complex" | from 1,000.00 | from 500.00 | arbitrarily | from 5 |

| 2. | "Guaranteed" | regular contribution amount | determined by contract | determined by contract | from 10 |

| 3. | "Universal" | from 1,500.00 | from 500.00 | arbitrarily | from 5 |

If you withdraw the deferred amount urgently after 2 years, the depositor will receive the following:

- 100% of the principal amount;

- 50% of investment income.

The state provides the opportunity to obtain a tax deduction. Its size is equal to 13% of what was deposited into the account, but not more than RUB 15,600.00. during a year.

Sberbank also provides programs for non-state pension provision:

- "Our Heritage";

- “I am a mentor”;

- "Your future";

- "Big Start";

- "Parity".

The Security Council establishes age conditions for citizens to transfer to NPFs. This:

- for men, the year of birth is no later than 1953;

- for women, the year of birth is no later than 1957.

How to apply for an Alfa Bank credit card?

How to obtain information about the savings of the deceased?

If a person saving money for retirement dies, the right to the collected funds passes to the legal successors of the deceased.

You can find out how much money the deceased left and receive the amount due only after submitting an application in the appropriate form to the fund, as well as the necessary additional documents.

The legislation of the Russian Federation states that only the official successors of the deceased who have opened proceedings on the issue have the right to apply to the NPF. Also, the transfer of funds can be carried out as part of the progress of the probate process.

The savings are paid to the heir or heirs no earlier than six months after the death of the holder. In most cases, the process is completed no earlier than after 7 months. This time is necessary for the administration of NPF Sberbank to study the issue. If a positive decision is made, the applicant is notified that he can receive the amount due to him. The applicant is also notified if the result is negative.

If you need to get information about how much has been accumulated in the PF account of the deceased, there are several options for contacting:

- according to the SNILS of the deceased online;

- by contacting one of the offices mentioned above in person;

- through the State Services portal;

- through a banking institution.

How to pay for topping up your Strelka card balance through Sberbank

What to do with errors made when calculating savings?

With the advent of electronic technologies, errors in pension calculations have become much smaller. However, they are possible. Most often, it is not his money that goes into the future pensioner’s account. Over time, the system detects the error and transfers the amounts back.

It is advisable that the account owner, having discovered such an error, writes a statement to the Pension Fund with a request to correct it. You need to come with an application and identification card to one of the Sberbank offices.

Expert opinion

Alexander Ivanovich

Financial expert

The same algorithm of actions should be used in the event that a certain amount of funds is missing. The account will be checked and errors corrected within 5-10 days.

How to withdraw funds

dispose of a funded pension only after retirement. Also, people belonging to the preferential category of the population who receive support from the state can withdraw funds from it. The amount of benefits is determined by the client’s income for the entire duration of the contract. People can receive payments under compulsory pension insurance

- monthly for life;

- lump sum;

- within 10 years.

Disabled people, incapacitated citizens who have lost their breadwinner have the right to receive money in one sum. This also includes people receiving a social pension and who do not have the minimum work experience. The heirs of a pensioner who died before the benefits were assigned also have the right to receive his savings in a lump sum.

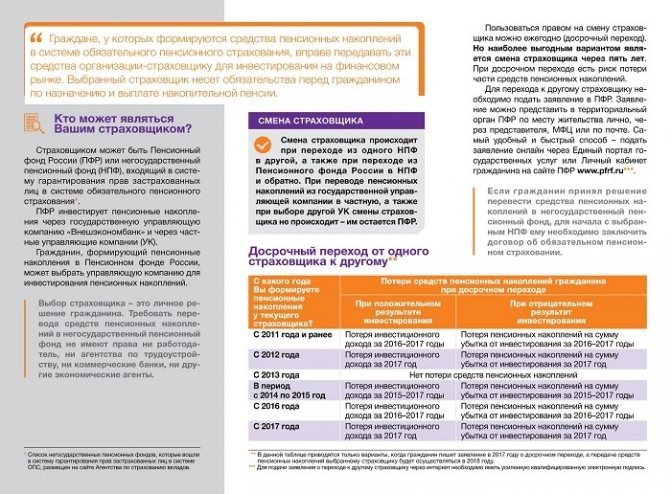

Transfer of an organization to another NPF

Organizations, like individuals, also have savings accounts, which ideally should generate income. But not every management understands the importance of the correct process of transitioning their company to a new non-state pension fund. An incorrectly carried out procedure not only promises a loss of profit, but because of this you can incur additional losses.

Important! It is best to transfer the organization no earlier than five years of validity of its existing contract with the NPF, and do this at the end of the reporting year in order to retain all the profits.

Advantages and disadvantages of switching from one fund to another

Of course, changing the fund entails both advantages and disadvantages.

The positive aspects stand out:

- the possibility of increasing account profitability;

- receiving additional services from the new fund;

- direct influence on the formation of your own insurance pension;

- protection of the process by law - no possibility of money loss.

The negative aspects include:

- the possibility of losing income if you transfer to a new NPF incorrectly (and/or untimely);

- inability to influence the fund’s decision to approve or refuse the transfer.

On a note. Thus, the advantages of changing the fund are very significant, but only if the procedure is carried out correctly.

How can I find out how much funds have been accumulated on the official website of NPF Sberbank?

There are several solutions for clients in such circumstances:

- Using special terminals.

- Through your Personal Account on the official website.

- Visit to Sberbank NPF branches.

Passport and SNILS are required documents for those who choose to personally visit one of the nearest offices. One visit is enough to obtain all the necessary information.

The client has the right to receive detailed statements. But the more information specialists collect, the more time it takes to resolve the issue.

Through Sberbank Online

Detailed instructions in this case will include the following steps:

- First, they write a statement that they need to obtain information regarding the amount of savings. When visiting the department, be sure to have your passport and SNILS with you.

- Next, visit your Personal Account on the Sberbank service. Pre-registration is required if required.

- Send a request to receive a statement of the status of the individual savings account.

- Click on the “receive statement” button.

- Confirm the operation. You will have to wait some time until the system processes the request.

- When the operation is completed, the information viewing button will become active. All known information about the client’s savings for the reporting period will open.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Free receipt of statements is available to all clients, but the action is performed maximum once a year. It is with this frequency that the organization itself collects information on savings accounts. If in a few months you need to re-register, the service will cost one hundred rubles. But after this, the client will have access to unlimited views of information.

Through your Personal Account

New users who are using this service for the first time will need to provide an email and password. The process itself takes a few minutes, no more. If your account or profile is already registered, you just need to log in.

To resolve the issue, select the “Other” tab on the toolbar. It goes to the section with Pension Savings. A new window will appear where the user will need to select the button to receive an extract. Please leave your personal information in your application for a certificate. Through your Personal Account you can easily track how requests are being processed.

Via ATM and sales offices

Visiting the nearest service office is the easiest option available to everyone. Passport and SNILS are required documents at this stage. A one-time visit allows you to immediately find out about all the savings associated with a citizen’s personal account. You will have to fill out an additional application if you need full details.

Reference! It takes about 3-4 weeks to produce an extract with all the required data. In the application, the visitor indicates the method in which this information is delivered to him.

In the case of ATMs, the actions will be the same as when working through an online service.

Through State Services

To check the funded part of the pension in this case you will need:

- Registration on the portal. Requires the indication of passport data, information from TIN and SNILS.

- A message with an activation code for the user is sent to a cell phone or email. This will complete the user identification.

- Filling out the form, gaining full access to your Personal Account.

- Activation of the section with Electronic services. In the menu that opens, all you have to do is select the section dedicated to the Pension Fund.

- The client is then provided with information about the status of the personal account.

How to find out by SNILS?

Information on funds in a citizen’s current account is classified as confidential information. But the account owner himself has the right to receive everything he needs. There are several options to resolve this issue:

- Personal application to the Pension Fund office.

- Online, without leaving your home.

Attention! For the last decision, they usually use the official website of the Pension Fund itself or State Services.

Find out by contract number

In this case, the rules apply the same as for the option described above. But it is difficult to find the information of interest using one contract number, except perhaps in the system of the Pension Fund itself, where the money is transferred for management.