One-time payments to those born before 1966: legislative and factual justification

In the Russian Federation, each person’s pension consists of three main parts:

- Insurance: monthly accruals that were paid by a Russian during the working period.

- Savings: consists of the money that was deposited into a savings account separately from insurance payments.

- Labor.

Insurance and labor shares are required for payment. Cumulative - at the request of a Russian of working age. This directive is specified in Article 4 of the Law on Funded Pensions. But in the period from 2002 to 2004, the payment of funded contributions was mandatory for all Russians; later the requirement was abolished.

The deposited amounts have not disappeared and are considered unclaimed, since the law obliging them to be paid has lost its effect. Currently, Federal Law No. 360 is in force, as amended in 2011, where mandatory and optional social payments to the treasury are clearly distributed.

The state does not have the right to use funds from savings, so it returns them to their rightful owners - those who paid this money.

This is done either in the prescribed manner along with pension accruals, or one-time compensation contributions upon request of the citizen.

Foreign citizens who legally worked in the Russian Federation in 2002–2004 and made payments to the Pension Fund also have the right to cash payments.

Where to apply

An application for one-time assistance is sent to the institution where such support was generated.

It can be:

- pension fund (state);

- pension fund (private).

To submit an application to the state pension fund, you need:

- personally contact this institution;

- send an application by mail;

- contact the Multifunctional Center;

- use the Internet and submit an application through the State Services electronic service.

Assistance is not provided solely on the basis of an application. A special package of documents will be required.

Amount of compensation and conditions for receiving

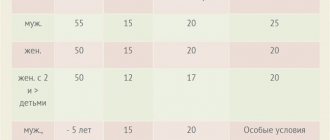

In the period from 2002 to 2010, the boss contributed 26% of the worker’s profit to the state. 20% went directly to the pension fund, which distributed these funds as follows:

- base rate – 6%;

- insurance rate – 10%;

- cumulative part – 4%.

The talk about one-time deductions for Russians born before 1966 concerns only the funded share of the pension of 4%. It is this money that can be received for the period of work in 2002 - 2004. At that time, the average salary in the Russian Federation was about 4.5 thousand rubles; each person transferred approximately 2,160 rubles (4,500 * 0.04 * 12) to the pension fund to a savings account.

The exact amount depends only on the amount of wages in the period 2002 - 2004. Statistics show that the average amount of compensation for the entire period is 7 thousand rubles. An indexation coefficient (depending on the current inflation rate) is also calculated on the specified amount.

The conditions for receiving it are as follows:

- The right applies to persons born before 1966. This does not include those receiving a disability pension.

- The applicant is already retired at the time of applying to the Pension Fund for compensation.

- The funds that were transferred to the funded part of the pension went to the Pension Fund. The law provided for the possibility of transferring funds to private investment organizations. If a citizen paid precisely to such companies, then payment should be demanded from them.

- Over the previous 5 years before applying, the pensioner did not receive any other compensation lump sum payments (the right is granted once every 5 years, not more often). There are no other time restrictions; a citizen can apply for compensation at any time convenient for himself.

- The difference between the insurance and funded parts of the pension is at least 5%.

Application requirements

Please note! The application is drawn up taking into account the requirements of the law:

- the name of the territorial body of the Pension Fund is indicated;

- information about the applicant is provided:

- Full Name;

- Date and place of birth;

- information about citizenship;

- applicant's gender;

- What address is the pensioner registered at?

- information from the passport;

- SNILS;

- contact phone number;

- information about the availability of a pension;

- what method of receiving money is convenient for the applicant, account details where the money will be transferred;

- date of writing the appeal;

- personal signature of the pensioner.

Employees of the Pension Fund enter the pension account number into the application. Don’t forget, if an authorized person is acting on your behalf, enter information about this person in the application (full name, registration address, information from your passport, contact phone number).

ATTENTION! View the completed sample application for a lump sum payment of pension savings:

What scam schemes exist and how do they work?

Law enforcement officers point to 2 main deception schemes that attackers use, using the opportunity to receive compensation:

- Obtaining a notarized power of attorney from the applicant for payment. Subsequently, the fraudsters submit an application, indicating their own bank details. Divorce consists of illegal misappropriation of funds that are due to another citizen.

- Obtaining a notarized power of attorney from the applicant with the subsequent transfer of the pension to a private investment fund. This method was once actively used by regional banks to receive large subsidies.

Citizens born before 1966 are indeed entitled to receive one-time payments. But we are talking about small amounts, in the range of 7 – 20 thousand rubles. All other citizens can rely on these funds after retirement.

Example of EPP calculation

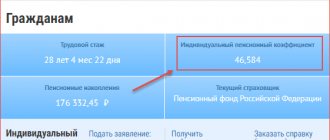

We suggest looking at an example of calculating one-time assistance.

A resident of Russia, citizen N. (born in 1962), had reached retirement age and wanted to retire according to the law. At this time, her accumulative pension balance collected 211 thousand rubles.

The pension that N. would receive due to her age is 28 thousand rubles. Knowing that she has the right to apply for such assistance, N. sent an application to the Pension Fund of the Russian Federation. She wants to receive the entire amount of accumulated funds immediately as a one-time payment.

So, we determine the amount of the monthly payment. We use the formula for calculating the size of a lump sum payment, in which EB is the monthly payment, PS is pension savings, PPP is the period of expected payments (in 2020 they were 240 months).

Attention! There is a special formula that is used to calculate the lump sum payment

EB = PS : PPV

We convert all this into numerical values by substituting the specified data.

211,000/240. We get 879 rubles. 16 kopecks

By adding up the savings and the insurance part of the pension, we get the total amount of pension payments:

879.16 + 6929.50. We get 7808 rubles. 66 kopecks

Let us now calculate the ratio of the share of the pension, which is paid from part of the pension savings, to the pension accrued by age:

879.16 /7808.66 x 100%. We get 11.25%. This figure is at least 5%.

Thus, pensioner N. will not be able to receive all her pension savings in the form of a single payment.

Comparative analysis

In light of recent events, it is rational to find out how the new bill will affect the financial situation of the population and whether the promised 5 thousand rubles will be able to compensate for indexation.

To do this, it is necessary to simulate two situations: issuing citizens with a “classic” indexation of pensions and a lump sum payment. What are the results of the count?

The pension supplement is paid twice a year. Presumably, the citizen receives state assistance in the amount of 13 thousand rubles.

After the first recalculation, the amount increased by 4%:

13 thousand rubles +520 rubles (additional payment after indexation) = 13,520 rubles

Note. Payment occurs within seven months, which is 94,640 rubles.

At the beginning of autumn, residents of the Russian Federation expect a second indexation.

Its estimated size at last count is 8.9%:

13,520 rubles + 1,203 rubles (additional payment after indexation) = 14,723 rubles

Note. The presented amount is paid within five months, which is a total of 73,615 rubles.

Thus, a citizen must receive 181,255 rubles (13,000 + 94,640 + 73,615) during the year.

In the case of a lump sum payment, things are different. Initially, the calculation is identical, since the first indexation was carried out. But this amount is paid over twelve, not seven months, which is 162,240 rubles.

In the second half of the year, the government allocates 5 thousand rubles for all people of retirement age. For the year, a pensioner receives 180,240 (13,000 +162,240 +5,000).

Thus, as a result of the cancellation of indexation, citizens lose 1,015 rubles. A payment of 5 thousand rubles does not compensate residents of the country for the amount of the premium during indexation.

Will there be such support in other regions?

The idea itself arose not only in the Moscow region. It was proposed to help single pensioners or other categories of pensioners in the most difficult situation in the Yaroslavl, Rostov regions and in a number of other regions of the country. So far, assistance has been reduced to targeted social assistance. The Moscow region became the first region that decided to introduce a more significant surcharge for single pensioners.

It is quite possible that other regions will follow this example, and in the near future more pensioners will be able to count on additional support. Be sure to find out information from social security authorities.

Additional payment for pensioners of 3,300 rubles - who can receive it?

(more details).

Thank you for attention!

Will there be EDV for pensioners in 2020?

The previous payment was a replacement for the failed indexation of pensions. Thus, according to the statement of the Prime Minister of the Russian Federation, all elderly unemployed Russians received a one-time compensation for the increase in prices for goods and services resulting from inflation. Amount paid 5000 rub. was calculated based on the size of the average pension and inflation rates.

The EDV for pensioners receiving a small pension was beneficial; for others, compensation of this nature turned out to be less than the amount of expected indexation. Today, pensioners who do not work have already had their insurance pensions indexed by 3.7% as of 01/01/2018. Social pension provision was recalculated by 04/01/2018 by 2.9%. The issue of receiving one-time payments is still under consideration.

- How to find out the tariff on MTS

- Burmese cat - description and breed standard, coat color, characteristics and habits, diet

- Gel against mosquito bites - a review of the most effective medicinal products for children and adults

Who can apply

Since indexation has already taken place, a lump sum payment to pensioners in 2020 is possible only for certain groups of citizens:

- non-working pensioners receiving state support in old age;

- disabled people;

- military;

- those who receive survivor benefits.

Comments (1)

Showing 1 of 1

- Nina Fedorovna 07/30/2018 at 17:33

Thank you for the decree, the resolution. But what about those children who were born in November, December, January 1943, 1944, who starved together with their parents. They forgot about them again! I remember 1945-46 very well, how hungry I was.answer

Share your opinionCancel reply

Read other news on this topic

- 1 363 17.08.2020

One-time payment of 15,000 rubles.

Many Russians are facing financial difficulties due to the coronavirus pandemic.

- 1 306 07.02.2020

Payments to veterans and rear service personnel for Victory Day

By May 9, 2020, veterans of the Great Patriotic War, as well as home front workers, will receive a lump sum payment towards their pension.

- 2 912 26.11.2019

Military pension from January 1, 2020

Pensions for military pensioners will be increased in 2020 by indexing the allowances of military personnel and law enforcement officers (Ministry of Internal Affairs, Federal Penitentiary Service, National Guard, etc.).

All news