Registration of pensions for military personnel is carried out according to a certain algorithm with the availability of a complete set of documents. A necessary condition is that a person has the right to social security.

Pensions for military personnel are assigned on the basis of the law of the Russian Federation of 1992 under No. 4468-1 and provide social security for persons who graduated from the Armed Forces based on length of service, or on other grounds provided for in the law.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Conditions of appointment

Registration of a pension for military personnel is carried out if there are grounds:

- Length of service (the number of years of service specified in the law in the armed forces). People apply for a pension if they have more than 20 years of military service, or more than 25 years , but on the condition that 12.5 years in military service.

- Loss of a breadwinner serving in the Armed Forces. A pension is assigned upon his death if the person has dependents who are unable to work.

- Disability caused by a disease acquired during military service, including injuries. People apply for a pension in case of disability, which is divided into 3 groups depending on the severity of the disease. Social and medical examination bodies are authorized to decide which disability group to assign to a particular person.

Are there any allowances for this category?

The law does not provide for any separate pension supplements specifically for working military pensioners. However, Art. 17 of Law No. 4468-1 nevertheless establishes a number of allowances that are equally applicable to former employees of the Armed Forces of Russia and the USSR, as well as categories of citizens equated to them.

Such allowances, calculated as a percentage of the calculated amount equal to the old-age social pension, include:

- 100% for disabled people of group 1 who have reached 80 years of age;

- 32% for non-working pensioners with 1 dependent;

- 64% if there are 2 dependents;

- 100% if there are at least 3 dependents;

- 64% in relation to certain categories of participants in the Great Patriotic War.

Obviously, for working pensioners, only the bonus indicated first is applicable. In addition, Art. 16 of the designated regulatory document provides for additional payments to the military disability pension.

Registration of pensions for military personnel

- Before applying for a pension, a serviceman is required to register with the military commissariat at the place of his registration.

- From the place of service, he is issued a monetary certificate, which is sent to the military registration and enlistment office.

- In addition, you need a certificate from the Pension Fund stating that the insurance premiums required by law were paid for the employee by a military unit.

- After this, the person applies to the military registration and enlistment office with a package of documents and an application to receive a pension.

- The amount of social security is calculated using a special formula, where the regional coefficient and benefits play an important role.

Where to go

The payment of this social security for pensioners is taken over by the body in which the person served in the military. This could be the Ministry of Internal Affairs, the Ministry of Defense, the Federal Penitentiary Service, the FSB.

What documents are needed

A package of documents is provided to the military registration and enlistment office. The documents required to assign a pension include:

- The main document of a citizen of the Russian Federation is a passport;

- military ID with a mark on military service and discharge;

- prescription of the military unit where the serviceman served;

- monetary certificate;

- clothing certificate;

- SNILS;

- personal file (obtained in the archive located on the territory of the military unit);

- photo;

- certificate from the Pension Fund;

- employment history.

When are payments of labor, social and funded pensions terminated and suspended? Read in the article.

The list of papers is not exhaustive. It is possible that other documents may be needed to apply for a pension.

Deadlines for consideration and appointment

- Regardless of the type of pension, the period begins to be calculated from the moment you apply for a pension . An important concept is the day of application - the date a person submits an application for the establishment of social security together with a package of documents.

- If not all documents are collected, within three months , thus, the pension is assigned from the date of the initial application.

- If a person does not manage to meet the three-month deadline, then it begins to be calculated from the day when all the required documents are provided. Article 53 of the above-mentioned law (No. 4468-1 of 1993) defines pension date:

- disability – from the moment a person is recognized as such;

- upon dismissal from the Armed Forces - from the date of this event;

- in case of loss of a breadwinner - from the date of death, or from the date of acquisition of this right;

- in case of loss of source of income by the relatives of the serviceman (spouse, parents) - from the date of application.

Second pension upon reaching the age limit

Most of the citizens who retired from military service continue to work. In this situation, according to the law, employers are required to pay insurance premiums for them. Thus, employees who are former military personnel have the opportunity to obtain security through the Pension Fund.

But a second pension can be assigned to a citizen only if certain conditions are met . In particular, they include the following concepts:

- Experience _ It is necessary to have insurance experience in organizations that are not related to the military departments. In 2107, the minimum length of service is 8 years .

- Age . For representatives of the stronger sex - 60 years old , for ladies - 55 . If the pension was assigned early in compliance with the conditions specified in the law, the pension payment is established earlier than the age limits specified above.

- Points . In 2107, the IPC (individual pension coefficient) was equal to 11.4 . By analogy with experience, the IPC will increase until it reaches a coefficient of 30 by 2025.

- Availability of the right to a pension from the military departments.

To exercise a person’s right to a second pension, he must provide the following documents to the Pension Fund:

- passport;

- SNILS;

- pensioner's certificate;

- employment history;

- bank details for transferring payment;

- a certificate from the commissariat about the time of service, which will be taken into account when calculating military pensions.

Read on for the rights and obligations of participants in legal relations under the legal liability agreement.

How to apply for a survivor's pension for a child of a military personnel? Details at the link.

Legal services

The President simply doesn’t know about these certificates; you need to bring them to him, and he will decide everything. For ordinary citizens, it is possible to obtain this document through an employer, but military personnel can only rely on obtaining this document independently.

Now let’s not issue IDs to pensioners; certificates on paper, and all this is much cheaper than IDs. It should be a shame for the pension fund to issue such a document, I agree with Lyudmila, it’s very inconvenient, carrying this white ticket to the next world saves money on pensioners.

Is this crust really that expensive? When and how to receive a pension certificate and first pension? This sheet cannot even be laminated; in one year it will turn into a rag. Calling it a shame would be putting it mildly.

Payment and delivery

Former military personnel can receive a pension in various ways (through the Ministry of Internal Affairs, the Ministry of Defense, as well as other law enforcement agencies):

- Transfer to an account in a banking organization. This is one of the most common methods. The bank attaches a bank card to the account and activates the SMS notification service that a certain amount of money has been credited to the account balance. The person will be notified via SMS notification that a pension has been deposited into his account.

- By mail . Depending on the pensioner’s choice, the payment can be delivered to their home, or the money can be located at the post office, which is attached to the place of registration of the pensioner. The date of accrual of the pension and its delivery may differ in time: the pensioner should know about this in order to avoid misunderstandings.

The law allows a third party to receive a pension, but only if a power of attorney for this action is issued by the pensioner.

Video consultation on the topic

How to get a military pension

When we talk about military pensions, we often mean payments for long service. Everyone understands the following: the specifics of military service are such that any citizen serving in the army is directly bound by large obligations that entail considerable risk to his life. Only the military can clearly understand how dangerous and difficult service can be at times.

This is interesting: Long service pension customs 2020

Ordinary life does not allow an ordinary citizen to look behind the curtain of military secrets. But you can imagine what military personnel experience from films and eyewitness accounts. Therefore, the pension that must be paid to military personnel differs significantly from other types of pension provision. In addition, its design promises considerable trouble.

Features of receiving government support from the military

ATTENTION! From the previous text of the article it is clear that the “military pension” is paid not only directly to military personnel, but also to employees of law enforcement agencies, structures involved in eliminating the consequences of emergency situations, protecting criminals, etc. Therefore, in the future we will use the words “military” and “military personnel” in the general sense. Everything that concerns military personnel of the Ministry of Defense equally applies to firefighters, rescuers, police officers, prison guards and other employees on the list.

If the right to a social pension is given solely by age (work experience and other details affect only the amount of payments), then to receive a military pension, length of service is necessary. Even missing a few months is enough to prevent a military pension from being granted.

The right to a long-service pension arises:

- If a citizen has served a full 20 years. The start time of the service does not matter. A person who began service at the age of 19-20 already has the right to retire at 39-40.

- If a citizen has served for 12.5 years, and at the same time he has 25 years of general work experience. In this case, the retirement age starts at 45 years.

In other words, the minimum length of service to receive a military pension is twelve and a half years. But in this case, 2 additional conditions are required:

- total work experience 25 years

- age over 45 years

That is, for example, a warrant officer who, after completing compulsory military service, began serving under a contract, at the age of 40 can receive a pension with full years of service. And a military doctor who graduated from a civilian medical institute, completed an internship, and only joined the army at the age of 30, can either retire at 45 years of age with mixed service, or serve until 50 in order to receive the right to a pension with full years of service.

ATTENTION! The military pension has no effect on wages, retirement pension or old age pension. Having received a pension, a serviceman can continue to work and receive a salary at the same time as the pension. Upon reaching the general retirement age (for 2020 in Russia this is 60 years for men), he will receive an additional right to an old-age pension.

Who is entitled to a military pension?

It is quite logical that both the military personnel themselves who served in the Ministry of Defense of the Russian Federation and their widows (there are exceptions and payments are due to the widower) of military personnel in the event of their premature death by air defense while on duty can count on such state support and provision.

In addition, especially dangerous work performed by a military personnel in order to prevent accidents at nuclear power plants, as well as service on ships and other dangerous types of military service can be taken into account.

What are military pensions like?

The legislation establishes several types of military pensions for military personnel of the Russian army.

These include:

1. Pension for long service;

2. Disability pension;

3. A pension that is assigned to family members of a person liable for military service in the event of his premature death.

Briefly about the main thing

Before thinking about applying for a military pension, it is worth considering an important point - you need to register with the commissariat in whose territory the serviceman lives.

To complete this procedure, you will need to prepare a certain package of documents.

Namely:

·A passport with confirmation of registration is required;

·A prescription will be required;

·You will need to have a personal file;

· If it is by courier, he will demand to present a token (or at least a personal number);

· You will be required to provide a military ID or other identification that will contain accompanying notes that the serviceman served, surrendered his weapons, and was discharged.

All available records must be certified by the relevant official, his signature, as well as his seal.

How to apply for a pension at the military registration and enlistment office?

As soon as the required documents for registration with the military registration and enlistment office have been collected, and the event itself has taken place, it is necessary to draw up a written application for a military pension. To apply for it at the military registration and enlistment office, you will need to provide the following documents:

· Of course, first of all, it will be a passport (the original, as well as a certified copy by a notary of all its significant pages);

·Secondly, this will be a military serviceman’s ID with a mark of military registration;

· Thirdly, it will be a monetary and material certificate (make sure that all dates of dismissals, deferments, and provision of benefits coincide in the documents);

· Fourthly, it will be a 3x4 matte photograph in a single copy;

· Fifthly - it will be SNILS;

· Sixthly, this will be a work record book.

Other documents may be required that confirm the special conditions of military service. It’s better to take them with you as well. In addition, you should definitely take a certificate from the Pension Fund in advance that the former military man there does not receive a pension. If a military man has ever changed his last name or first name, he should also inform the military registration and enlistment office about this.

To obtain a certificate, a serviceman should go to the accounting department at his place of service with a written application for its issuance. Let us note that recently a cash certificate has not been issued in person, but is sent to the military registration and enlistment office at the place of registration of the serviceman.

Registration deadlines

You should know that the registration of a pension begins from the moment the military registration and enlistment office receives the military personnel’s monetary certificate. From this moment, about three months are counted and the first pension is awarded to the military man.

Pension Fund and military pension.

It is quite acceptable to apply for a military pension at the regular PRF department at your place of registration. Only here, along with the standard set of documents, you will also need to attach a certificate of the amount of average monthly earnings accrued over the last five years. It is issued by the government agencies in which the military man served.

How can a widow receive a pension?

To apply for a survivor's pension for a widow, you will need to fill out an application for a military pension, as well as provide a copy of your marriage certificate, or a document that confirms close family ties. In this case, you will also need to calculate the length of service of the military man. You will need to provide a photocopy of the death certificate. The package of documents will also include an extract on the exclusion of the serviceman from the troops in connection with his death and a medical report on the causes of his death.

The widow will need to obtain a certificate of non-receipt of a military pension, or termination of payments from the Pension Fund. You will also need to present copies of certificates for receiving benefits, a monetary certificate, and an agreement that will allow the processing of personal data.

You can start applying for a military pension at the Pension Fund or at the place of your last military service. There is no point in delaying after you are fired. Since this process has a legal period. After dismissal, this will need to be done within ten days.

Amount of military monthly payments

All types of military pensions are calculated using different formulas. Before we get to them, one term needs to be defined. We are talking about the so-called “reduction factor”.

What is a reduction factor? Some time ago, military pensions were calculated based on the full amount of salary due to the military personnel (equivalent to civilian wages). As “military salaries” increased, a significant budget deficit arose, and since 2012, in order to eliminate it, in accordance with Federal Law No. 309, military pensions began to be calculated with a reducing factor. That is, not in the amount of approximately 50% of the monetary allowance, as before, but lower. In 2012, the reduction factor was 54%, and has been increasing since then. At the beginning of 2020, it amounted to 72.2%. The average annual increase in the coefficient is 2%, so it is planned that in 14 years it will reach 100%, that is, it will self-liquidate. In 2020, the reduction factor was canceled for all categories of WWII participants. It is still valid for other military pensioners.

So, let's look at the formulas by which the size of military pensions is calculated.

Full service pension

The pension is calculated based on three indicators:

- A – monetary allowance. The amount of salary depends on the rank, position, awards and some other factors.

- B – years of service beyond twenty years of service

- C is the same reduction factor that we talked about above

The formula is as follows

(A * 50% + AB * 3%) * C.

Pension for mixed service

Letter indicators A and C correspond to those used in the previous formula

- B – years of service beyond the required 12.5 years

The formula is as follows

(A * 50% + AB * 1% ) * C.

Disability pension

The indicators for its calculation are as follows:

- A – monetary allowance

- C – reduction factor

- B – percentage of monetary allowance due for payment depending on the cause of disability and disability group

The formula is as follows

A*B*C

The size of indicator B can be as follows:

- 85% - disability groups I and II after injury or trauma

- 50% - group III disability after injury or trauma

- 75% - disability groups I and II due to occupational disease

- 40% - disability group III due to occupational disease

Survivor's pension

The survivor's pension provides 40% of the deceased service member's pay for each eligible family member. And 30% - if the serviceman died as a result of the disease.

Registration of a military pension

The determination of pensions for military personnel differs from the determination of pension payments for civilians.

Pensions for military pensioners are established provided that the citizen is registered with the commissariat at his place of residence.

After leaving service, a serviceman can continue to work in civilian life, and if the requirements of the law are met, he has the right to receive an insurance pension payment . At the same time, the payment of military pension will not be stopped .

Conditions for assigning pensions to military personnel

A serviceman can apply for the establishment of a military pension upon acquiring the rights to it. These are:

- length of service (required number of years in service in law enforcement agencies);

- loss of a breadwinner who was a military man;

- establishment of disability (due to a disease acquired in service or due to a military injury).

| Type of military pension | When to apply for an appointment? |

| For length of service | The serviceman's length of service is ≥ 20 years, or the total length of service is ≥ 25 years, of which 12.5 years of service in law enforcement agencies. |

| By disability | Determination by medical and social examination bodies of disability of groups 1, 2 or 3. |

| On the occasion of the loss of a breadwinner | Upon the death of a serviceman who had disabled dependents. |

Which relatives can receive a pension after the death of a military personnel?

In the event of the death of a citizen, his relatives can apply for cash payments for the loss of a breadwinner under insurance or social security. However, if a military man dies, a special payment is established for his family members - state support in the event of the loss of a breadwinner.

Disabled relatives of deceased military personnel who served under conscription or contract may become recipients of such material support. It can be:

- minor children;

- adult children under the age of 23 studying full-time;

- adult children who have become disabled under 18 years of age;

- grandchildren, brothers and sisters, if they do not have able-bodied parents (along with the children of the deceased);

- spouse;

- parents;

- grandfather, grandmother (if they do not have relatives obligated to support them).

It is worth noting that the payment can be established for relatives if they were dependent on the deceased serviceman. However, at the same time, the legislation of the Russian Federation in some cases provides for the establishment of pensions for family members regardless of their dependent status. These are:

- children;

- an unemployed father (mother, spouse, grandfather, grandmother, brother or sister) of a deceased serviceman, caring for his children, brothers or sisters under the age of 14 (regardless of his age and ability to work);

- parents of a deceased conscript;

- a widow of a conscript who has not remarried;

- disabled parents and spouse of a deceased contract worker who have lost their source of livelihood.

The procedure for registering a military personnel pension after dismissal

Before applying for a military pension, it is worth considering a very important point - the serviceman will have to register with the commissariat at his place of residence. a monetary certificate from the place of service (since 2014 it has been sent to the military registration and enlistment office) and receive a certificate from the Pension Fund stating that insurance premiums were not paid for it.

This is interesting: Minimum pension for years of service in the Ministry of Internal Affairs in 2020

After completing the above steps, you should contact the military registration and enlistment office with an application and a complete package of documents to establish a pension payment.

The same applies to ordinary pensioners when military personnel receive pension benefits. The totality of all bureaucratic procedures takes 2-3 months and depends on how quickly the serviceman receives his monetary certificate.

Where do you apply for a military pension?

Pension payments to military personnel come from the budget of the body where they served, for example: the Ministry of Internal Affairs, the Ministry of Defense, the Federal Penitentiary Service, the Federal Security Service.

Providing pensions for a citizen discharged from military service, family members of a deceased (deceased) serviceman, establishing military benefits for these citizens and making other payments is the responsibility of the military commissariat (Decree of the President of the Russian Federation of December 7, 2012 No. 1609 “On approval of the Regulations on military commissariats”) .

A conscript soldier who has received a disability, or his relatives, in case of applying for payment, must provide documents to the territorial bodies of the Russian Pension Fund .

What documents are needed to apply for a military pension?

To obtain support, a serviceman must submit a fairly voluminous package of documents :

- passport of a citizen of the Russian Federation;

- military ID, which contains a mark on completion of service and dismissal;

- prescription of the military unit in which the military man served as assigned by order;

- clothing and monetary certificate;

- SNILS;

- personal file from the archives of a military unit;

- photograph of the established sample;

- certificate from the Pension Fund;

- employment history.

Other documents confirming the special conditions of military service (if any, they must be carried with you when applying for a pension). If a military man has ever changed his first or last name, then this must also be reported to the military registration and enlistment office.

Deadline for reviewing documents and assigning payments

When applying for a pension payment, regardless of whether it is an insurance pension, state pension or military pension, a very important concept is the day you apply for this payment. In general, the day of application is the date of submission of the application for the establishment of a pension to the pension authority along with a package of necessary documents.

If a citizen has not provided all the documents that are necessary, he has another 3 months from the date of application to submit a complete set of papers. In this case, the appointment occurs from the date of application. If the applicant does not meet this deadline, then payment is assigned when all required documents .

Pension authorities consider the application within ten days from the date of application, or from the moment the complete package of papers is submitted.

- if a military person is diagnosed with a disability - from the moment he is recognized as disabled;

- upon dismissal from military service - from the date of dismissal;

- in the event of the loss of a breadwinner - from the date of his death, or from the date of acquisition of the corresponding pension right;

- in case of loss of sources of income to the parents or spouse of a serviceman - from the date of application.

If a citizen’s application for payment was untimely, then for the past time it is assigned from the moment the right to it becomes available, but no more than 12 months from the date of application.

Free legal assistance

Should there be a pension certificate if there is a labor veteran certificate. Stavropol No pension certificate may not exist.

Expert opinion Antonov Viktor Sergeevich Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

A veteran of labor is assigned on his own, and a pension on his own, subject to the conditions of Art. Stavropol Hello, dear Evgeniy! If according to Art.

N 5-FZ “On Veterans” If you are a labor veteran, this does not mean that you must have a pension certificate. The title of labor veteran is assigned if the conditions provided for in Art.

N Federal Law “On Insurance Pensions” is implemented regardless of receiving the title of labor veteran. These are unrelated things.

N 5-FZ “On Veterans”: Article 7.

The Pension Fund talked about receiving an electronic pension certificate

This is normal practice: after a certain period, the bank card needs to be renewed. The press service of the Pension Fund of Ukraine reported this today, June 10.

EPU is a document that pensioners use as a pension certificate and as a bank card

The department explained that it is important to know: the EPC is issued by the bank, which determines its validity period as a bank card

EPU as a bank card has been issued for 3 years now and its expiration date is actually approaching. An EPU, like a bank card that needs to be replaced, will be valid until you receive a new one.

The validity period of the EPU as a pension certificate is generally indefinite, for example, if the pensioner receives an old-age pension.

The latter applies to cases where the petition is submitted by a person you trust to restore the document. In the power of attorney, you transfer to him the right to draw up documents and represent your interests in the Pension Fund branch.

Expert opinion Antonov Viktor Sergeevich Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

Since this issue is quite important, we decided to dwell on it again. The minimum period for issuing a certificate is two weeks, the maximum is one month.

The countdown starts from the day the application for the issuance of a new pension is submitted.

Second (insurance) pension for military personnel upon reaching 60 years of age

Quite often, military pensioners who receive payments from law enforcement agencies continue to work in civilian life after leaving service. In this situation, employers pay insurance premiums for them, which is why the former military man, subject to certain conditions, has the opportunity to apply for security through the Pension Fund of the Russian Federation .

To establish a second pension, the following requirements must be simultaneously met:

- Experience. It is necessary to have insurance experience in civil organizations; in 2020 it is 10 years, and will gradually increase until it reaches 15 years by 2024.

- Age. For men it is 60 years, for women - 55 years. However, if the conditions for early appointment are met, the pension payment may be established earlier than the generally established age.

- Points. In 2020, the individual pension coefficient (IPC) should be equal to 16.2. Like length of service, the IPC will increase until it reaches 30 by 2025.

- Pension. Availability of pensions from law enforcement agencies.

You should know that military pensioners receive pension insurance without taking into account a fixed payment.

Receiving a second pension

In modern practice, one can often encounter situations in which military personnel have already received a long-service pension, but are still at a fairly young age. That is why many citizens, in this case, are engaged in performing professional duties “in civilian life.”

In such a situation, these persons have a legal right to additionally receive a second pension.

If we talk about the procedures for assigning civil and military pensions, it can be noted that they are quite similar to each other. However, there are still certain differences between them.

First of all, to obtain a legal opportunity to apply for a second civilian pension, a military person will first need to register in the current OPS system. As you know, absolutely all insurance deductions regularly made by responsible persons are subject to mandatory recording in a personalized accounting system.

After completing the standard registration procedure in the OPS system, the serviceman will be assigned an individual number, and will also be issued a corresponding SNILS certificate. You can initiate this procedure through a personal visit to the territorial office of the Pension Fund or to the local department of the MFC.

In addition, often these responsibilities are taken on by representatives of the personnel department of the organization in which the military person works.

In addition to the mandatory completion of the standard registration procedure with the OPS, the interested person should be aware of some additional conditions, under which the assignment of a second pension will become possible. To do this, the following conditions must be met:

- It is mandatory for a citizen to reach the retirement age established in the country.

- The presence of at least the minimum duration of insurance experience available to an individual. The minimum length of this period of time is 9 years.

- Having at least a minimum amount of pension points. This value is 13.8 units.

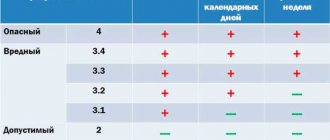

It should be noted that in some special cases the above requirements for obtaining a second pension may be changed. In particular, this includes situations in which a citizen’s work was associated with the presence of dangerous or harmful working conditions.

In addition, certain benefits will also be available to pensioners who were exposed to dangerous man-made impacts during the direct performance of their official duties.

If we talk about some of the features of the procedure for calculating the second pension for military personnel, it is necessary to mention one important nuance. It consists in the absence of a fixed part of the payment

It should also be taken into account that the applied procedure for calculating the second pension provision provides for the exclusion of certain periods of professional activity from the total insurance period. This, for example, includes service that was carried out by an individual until he received disability or other legal grounds for obtaining a pension.

Payment and delivery of pensions to military pensioners

Persons who have received pension benefits through the Ministry of Internal Affairs, the Ministry of Defense of the Russian Federation and other structures can receive it in the following ways:

- By transfer to a bank account . Nowadays, the most common method: most often, a bank card is immediately attached to the account, and SMS notifications about changes in the balance on it are connected, so that when a pensioner receives a message from the bank, he will immediately know that he has received a pension.

- Via Russian Post . Depending on the pensioner’s choice, the payment can be received either at home or at the post office itself. Here it is worth considering that the delivery time via mail and the date of accrual of pension payments may differ, and in order to avoid misunderstandings and unpleasant situations, the pensioner must take this into account in advance.

- The legislation provides for the possibility of a third party if a corresponding power of attorney has been issued to him by the pensioner.

Comments (8)

I am a military pensioner. I receive benefits based on my length of service. Will this payment continue if I now get a job at a government agency (in my case, St. Petersburg University)?

Payment of pensions through law enforcement agencies will be suspended if you re-enter service in the Ministry of Internal Affairs, the Ministry of Defense, the Federal Penitentiary Service, etc. In other cases, it will continue to be paid.

Hello! A certificate of assignment of a military pension is required to establish an insurance pension. Which agency issues it?

You should contact the military commissariat where you are registered.

Civil pensioners, in accordance with the law, through the Pension Fund of the Russian Federation receive pensions and additional payments to it with a breakdown of all components. Why doesn't the law apply to me as a military retiree? The Military Commissariat of the Moscow Region refuses to provide me with a transcript of all components of my pension and additional payments to it (additional payments and cash compensations of 6 items) through the city’s cash payment delivery department, through the Russian Post. The law must be the same for everyone - both civilian and military pensioners! Thank you.

This is interesting: Increase in pensions for military pensioners in 2020 2020

I was fired for health reasons and am receiving a disability pension. He was injured (beaten) while on duty. Where should I go to establish a military injury? What are the first steps: write a statement to the military unit?

Good evening. Is it possible to get a pension if you are deprived of the rank of lieutenant colonel, because you are registered with the military registration and enlistment office with the military rank of private. If you don’t receive a pension, therefore, you shouldn’t be registered with the military.

He studied at a military school, and during his studies he received a chronic illness due to hypothermia. I graduated from college, but was not given disability and, accordingly, a military pension. After a long period of treatment at medical institutions, a 2 degree disability was issued. as a civilian. Can I receive a military pension as acquired through service in the SA?

Registration of a second military pension: what documents are needed

Military pensions are assigned in a manner different from the rules for registering insurance pensions.

They are issued by those government agencies in which the pensioner served, and not by the Pension Fund of Russia. Military pensions are regulated by legislative act No. 4468 of February 12, 1993.

Normative base

Relations related to pensions for both the military themselves and their families are regulated primarily by the Law of the Russian Federation No. 4468-1 of February 12, 1993 “On pension provision for persons who served in military service...” . It is interconnected with other regulations:

- No. 166-FZ dated December 15, 2001 “On pension provision in the Russian Federation”;

- No. 306-FZ dated 07.11. 2011 “On the monetary allowance of military personnel and the provision of certain payments to them”;

- No. 173-FZ dated December 17, 2001 “On labor pensions”;

- Decree of the Government of the Russian Federation dated September 22, 1993 No. 941, establishing the rules for calculating length of service and the amount of payments (hereinafter referred to as the Procedure).

It must be said that changes are constantly being made to pension legislation. Thus, taking into account the economic situation in the country, the Government of the Russian Federation, starting from 2012, annually adopts a legislative act suspending the indexation of military pay, their pensions and pensions of their family members (for 2020, this provision was introduced on December 19, 2016 by Law No. 455-FZ ).

Stages of obtaining a basic military pension

The procedure for assigning pensions to military personnel is divided into 2 stages: preparatory and basic. At the preparatory stage, it is required to register with the military registration and enlistment office at the registration address. After this, the pensioner can apply for pension benefits.

List of documents

To register with the military registration and enlistment office, a former serviceman will need the following papers:

- a passport containing a registration mark;

- prescription;

- personal file of a pensioner;

- military ID. If it is missing, you will need to present another document that confirms the fact of military service, surrender of weapons and ammunition, or leaving the army.

At stage 2, the applicant, in addition to the application for payments, will need:

- passport and its photocopies, certified by a notary office employee;

- military ID, which contains a record of registration;

- monetary and clothing certificates. Today it is impossible to obtain a monetary certificate; government agencies themselves send it to the required institution;

- passport size photograph;

- SNILS;

- employment history;

- an extract from the Pension Fund of Russia, which confirms that the army employee did not apply for a pension there.

Fringe benefits

The maintenance of senior citizens includes not only additional cash payments. Pensioners of different categories are entitled to:

- Allocation of living space, summer cottages or land plots. If you have minor children as dependents, it is possible to participate in a construction cooperative without a waiting list.

- Examination and treatment in military hospitals. Former military personnel are provided with free medications.

- Preferential travel on public transport. Free trips are provided with a renewable limit of 1 time per month.

- Discounts on housing and communal services.

Help for pensioners is provided in various ways. You can find out the exact list of discounts, benefits, and surcharges at your local Pension Fund office. Some additional charges require a separate application.

Registration of a second pension for the military - nuances

Having reached the appropriate age, former military personnel have the right to apply for a 2nd pension. In 2020, this will require a minimum of ten years of experience and a total coefficient of at least 16.2.

Unlike the calculation for ordinary citizens who receive an old-age insurance pension, when calculating the insurance pension for the military, the fixed part is not taken into account. The minimum that a former military personnel can receive from the Pension Fund is 1,413.29 rubles.

To start receiving a 2nd pension, a former army employee must meet the following criteria:

If a retired military man applies for his first pension upon reaching a certain army (20 years) or mixed (12.5 years) service or disability, then the opportunity to apply for insurance payments appears only when the citizen reaches retirement age.

Age category.- Experience. One of the most important criteria that influences both the possibility of obtaining an insurance pension and the amount of payments. The minimum required work experience in 2020 increased to 10 years. In the future, its value may increase to 15 years. The maximum length of service is unlimited.

- Pension points . The more contributions an employer makes to the Pension Fund, the more pension points a citizen will receive. The minimum number of pension points for processing insurance payments is 16.2.

It is worth saying that the registration of the 2nd pension is of a declarative nature. Therefore, without providing the necessary papers and an application, payments will not be processed.

Having reached a certain age, a retired military man has the right to submit an application for insurance payments to the Pension Fund of the Russian Federation or a multifunctional center. In addition, it is possible to send documents through the post office or the personnel department of the employer company. If the former military member is registered on the government services website, he can submit all the papers online.

What documents are needed to apply for a second pension for military personnel?

In order to apply for an insurance pension, a retired military personnel will need the following papers:

- passport;

- SNILS;

- employment history;

- other papers that confirm the presence of work experience;

- extracts on the provision of military pensions.

After payments are assigned, the applicant has the right to choose how the money will be delivered to him. In the application, you can choose delivery through the post office or a company that has entered into an agreement with the Pension Fund of the Russian Federation. You can also make payments to a bank card.

When should you apply for a civil pension?

Military pensioners can apply for a civil pension at any time without any time limit, but not before the right to it arises.

It should be remembered that the right to a second payment arises if all the conditions necessary for the assignment of an insurance pension are met. In 2020, the general requirements are as follows:

- reaching the age of 60.5 years for men and 55.5 years for women;

- the minimum insurance period not taken into account when assigning a military pension should be 10 years;

- the minimum sum of individual points must be 16.2;

- the fact of granting a pension through the law enforcement agencies.

The general procedure for applying for an insurance pension, which is also applicable in this case, involves a written request for payment.

According to paragraph 1, art. 22 Federal Law No. 400 “On Insurance Pensions”, civil payment is assigned from the date of application for it, provided that the right arises by that time.

In order not to miss the appointment of the second pension, documents can be submitted earlier than the date of entitlement to it, but no more than a month before the age of sixty.

Where to apply for a civil pension?

You should apply for a civil pension to the territorial department of the Pension Fund of the Russian Federation:

- at the place of registration;

- at the place of residence (in the absence of a place of residence confirmed by registration);

- at the place of actual residence (in the absence of a registered place of residence and place of stay in our country).

An application for a second pension is strictly of an application nature, that is, it must be issued in the form of a written notification.

You can submit an application in several ways:

- independently or through a legal representative to the client service of the PFR district office;

- through your employer's HR department;

- by sending the necessary documents by mail;

- personally or through a representative by contacting MFC specialists.

In addition, recently a new method of submitting documents electronically has become increasingly popular. This can be done using an Internet system such as the Unified Portal of Public Services. This will require preliminary registration in the system, but in the future the ability to use the portal will save wasted effort and time.

What documents are needed to apply for a second pension for a military pensioner?

To apply in writing for a second pension, a military pensioner will need to prepare a set of documents. The general requirements for them are practically no different from the rules for submitting the necessary papers for an ordinary citizen.

The required documents when assigning the second payment include the following:

- passport (or other registration document);

- insurance certificate (SNILS);

- a document confirming the fact of assignment of a military pension;

- employment history;

- certificates of length of service not recorded in the work book before the date of registration in the personalized accounting system (from the employer, and in case of its liquidation from the archive);

- salary certificate for 60 consecutive months of employment (if there are periods of work before 2002);

- information about the presence of dependents (children under 18 years of age, and if they are full-time students, this age is extended to 23 years of age).

In addition, due to certain circumstances, military pensioners may require additional documents, for example:

- documents confirming the change of surname (or other personal data);

- data on the presence of disability (extract from the expert commission’s conclusion indicating the validity period);

- preferential clarifying certificates indicating the special nature of the work performed, in the presence of preferential length of service;

- documents confirming the identity of the legal representative, if the application is submitted through him.

Insurance part of pension for military personnel

The formula for calculating the insurance part of pensions for retired Russian army employees has been truncated when compared with the formula for calculating payments to civilians. Individual pension points are multiplied by their current price. The product will indicate the size of the insurance part of the pension for a former military man.

The amount of insurance payments for employed former military personnel has not changed. However, it is planned to increase it slightly at the end of summer. The increase is planned to be carried out by increasing the price of pension points that were earned in 2020.

A significant increase in pensions is planned in mid-autumn 2020, when the state will recalculate the long-service pension provision. Military pensions will increase by 6.3 percent due to an increase in pay by 4.3 percent and two percent indexation.

A former military man has the right to apply for an insurance pension. However, its size will be smaller than for civilians. This is due to the fact that military pensioners already receive a good basic pension; the state cannot afford to allocate additional funds for their maintenance, especially with the current pension reform.