Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/09/2016

Reading time: 8 min

2

7199

One of the categories of citizens who are entitled to receive a long-service pension are federal government employees.

All citizens who belong to this category can, upon the occurrence of certain conditions, apply for its receipt. The conditions and procedure for assigning pensions to civil servants, as well as the procedure for this procedure, will be discussed further.

- Requirements for applicants

- Calculation procedure Average salary for the last 12 months before retirement

- The amount of experience an employee has as a civil servant

Pension provision for federal civil servants

Civil servant pensions are payments provided for long-term work, filling positions in the federal civil service. The parameters of pension benefits depend on the length of stay in the civil service.

Federal employees have the right to receive benefits established by 3 legal acts:

- Law “On State Pension Provision in the Russian Federation” No. 166-FZ of December 15, 2001.

- Law “On State Civil Service” No. 79-FZ of July 27, 2004.

- Law “On Insurance Pensions” No. 400-FZ dated December 28, 2013.

Download for viewing and printing:

Federal Law “On the State Civil Service of the Russian Federation” dated July 27, 2004 N 79-FZ (latest edition)

Federal Law of December 15, 2001 N 166-FZ, as amended. dated 07/03/2016) “On state pension provision in the Russian Federation”, as amended. and additional, intro. in force from 01/01/2017

Federal Law of December 28, 2013 N 400-FZ, as amended. dated 12/19/2016 “On insurance pensions”

Pension for civil servants

This pension is intended to partially compensate for the loss of income from work performed by a federal employee due to medical conditions or age limits.

To receive a long-service pension, a civil servant must have worked for at least the last year as a federal employee, namely in one of those positions that are included in the appropriate list approved by the President of Russia. But this rule is not relevant for those civil servants who were subject to staff reduction or liquidation of a government agency.

Civil servants are also entitled to a long service pension

Since May 2020, Federal Law No. 143-FZ has been in force. It makes changes to some regulations. Thanks to it, civil servants can work until a later age.

From 2020, the retirement age will increase by six months each year. This level will stop rising by 2024. Then she will reach 65 (for men) and 60 (for women) years. The age limit for civil service will also increase to 65 years.

Assignment of benefits to federal employees

People have the right to such security only under certain circumstances (death, disability due to health or due to old age).

Service pensions for civil servants are established in the presence of the following conditions:

- Civil service from 16.5 years (for 2020).

- Resignation for 1 of the following reasons:

- reduction in the number of civil servants or liquidation of government bodies;

- resignation from office due to the person’s resignation;

- reaching the maximum age limit for holding office;

- due to a physical condition that prevents continued service;

- independent dismissal due to departure for a well-deserved rest.

Rights to state support arise for citizens who have worked for at least 12 months immediately before the payment is issued.

Important! This does not apply to those dismissed from a government agency being liquidated or among those being laid off.

Age limits for civil servants in 2020

On May 23, 2016, the State Duma of Russia adopted a normative act increasing the age limit for civil servants to retire.

The law came into force on January 1, 2017. Retirement age:

- 65 years for men.

- 63 years for women.

Raising the age limit applies only to working civil servants.

Upon dismissal from a position, a citizen receives the right to an insurance pension (including early retirement), taking into account the previous age criteria. The age limit for retirement will be increased in stages. From 2020, it increases annually by six months until the required level is reached. The maximum will be reached in 2034 for women, and for men already in 2028.

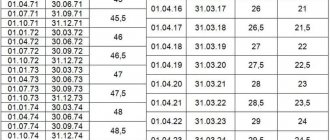

Requirements for old age pension:

| Woman's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1963 | 56 | 2019 | 16,2 | 10 |

| 1964 1st half year | 56,5 | 2020 2nd half of the year | 18,6 | 11 |

| 1964 2nd half year | 56,5 | 2021 1st half of the year | 21 | 12 |

| 1965 | 57 | 2022 | 23,4 | 13 |

| 1966 | 58 | 2024 | 28,2 | 15 |

| 1967 | 59 | 2026 | 30 | 15 |

| 1968 | 60 | 2028 | 30 | 15 |

| 1969 | 61 | 2030 | 30 | 15 |

| 1970 | 62 | 2032 | 30 | 15 |

| 1971 | 63 | 2034 | 30 | 15 |

| Man's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1958 | 61 | 2019 | 16,2 | 10 |

| 1959 1st half year | 61,5 | 2020 2nd half of the year | 18,6 | 11 |

| 1959 2nd half year | 61,5 | 2021 1st half of the year | 21 | 12 |

| 1960 | 62 | 2022 | 23,4 | 13 |

| 1961 | 63 | 2024 | 28,2 | 15 |

| 1962 | 64 | 2026 | 30 | 15 |

| 1963 | 65 | 2028 | 30 | 15 |

Civil servant Sergeeva I.V. Born 09/01/1963 reached the age of 55 years on September 1, 2020. She will have the right to an insurance pension only upon reaching the age of 56 years, that is, on September 1, 2019.

If Sergeeva decides to leave the civil service on September 1, 2020 or move to a job not related to the civil service, then the right to an old-age pension will remain with her as of August 1, 2018.

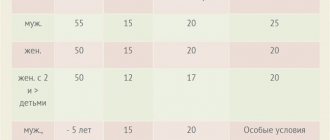

To acquire a service state pension, you must develop special experience.

| Year of assignment of long-service pension | Length of service required to assign a long-service pension in the relevant year |

| 2019 | 16 years 6 months |

| 2020 | 17 years |

| 2021 | 17 years 6 months |

| 2022 | 18 years |

| 2023 | 18 years 6 months |

| 2024 | 19 years |

| 2025 | 19 years 6 months |

| 2026 and beyond | 20 years |

The government sees certain advantages in this step:

- maintaining qualified personnel, who are not easy to recruit due to the constant decline in the working-age population.

- significant savings in the budget.

Calculation of the term of civil service

The civil service period is the summed duration of labor and activity that is taken into account when employees become eligible for such payments and when calculating the parameters of benefits .

Civil service experience includes work:

- in positions of the federal civil service;

- in positions determined by the President of the Russian Federation.

If a legal benefit requires work of some duration, it includes work and other socially useful activities that count towards the required insurance period.

Amounts of benefits

The volume of government subsidies is determined by Art. 14 FZ-166. Such persons are given a state allowance for working 16.5 years (in 2020) at 45% of the average monthly pay of a federal employee, taking into account:

- age (disability) insurance;

- fixed (basic) payments to the insurance pension;

- growth determined by law.

Attention! The service pension increases by 3% of the average monthly pay for each year of civil service over 16.5 years.

Calculation of benefits volumes

The procedure for calculating the parameters of service record is defined in Art.

14 FZ-166: P = (45% SZ - SP) + 3% SZ × St,

Where:

- P—volume of pension service;

- SZ - average wage;

- SP - the amount of disability/age insurance coverage and fixed payments;

- St – more than 16.5 years of experience.

The general parameters of service support and age/disability insurance pension, fixed payments to pension and the increase in fixed payments cannot be more than 75% of the average monthly payment of a civil servant established by Art. 21 FZ-166.

If the duration of service is sufficient to apply for benefits, then it is calculated on the basis of the average pay for the last service year.

Increase in benefits

Northerners and people living in areas with similar climates are awarded an age pension until the period specified in the law.

Such people are provided with increased fixed payments to their insurance pension by the corresponding regional coefficient established by the Government of the Russian Federation, depending on their place of residence, for the entire duration of their stay in this area.

Important! If you change your place of residence, the amount of social security benefits will be calculated without such coefficients.

What is included in accounting for average monthly earnings

The size of the pension of civil servants is calculated based on the data received by the Pension Fund for their last year of work in the public service. Based on data on his salary and contributions that the employer made to the Pension Fund. The calculation is made by dividing all income received during the year by 12.

Average monthly earnings consist of various payments that the employer made to the relevant employee. The list of payments that are included in the average monthly salary of an employee is as follows:

- monthly salary of a civil servant (MC);

- MO in accordance with class rank;

- monthly bonus to the Ministry of Defense for length of service;

- monthly bonus to the Ministry of Defense for special working conditions;

- monthly bonus to the Ministry of Defense for working with classified data;

- monthly bonus to MO;

- bonuses for working with particularly complex tasks;

- one-time payment when going on annual leave.

How is a pension indexed?

The accrual of service state support, the recalculation of its parameters and the transition from the 1st formation to another are carried out in an application manner. This occurs regardless of the time after the emergence of powers and without time limits.

The exception is disability social benefits. Recalculation of the amounts of service-related state subsidies is carried out when:

- dynamics of parameters of disability/age payments;

- increasing the length of civil service experience;

- federal increase in wages for employees.

In other situations, there is a transition from the 1st subsidy type to another type of state pension provision.

Attention! Service-related government payments are indexed to the federal increase in wages of federal civil servants in the manner established by the Government of the Russian Federation.

Eligibility for Benefits

Civil servants with an awarded service pension with 15 years of experience, including the periods determined by Part 2 of Art.

19 FZ-400, upon reaching the required age limit, they acquire the age-related security established for the service pension. The total IPC for the working year after the establishment of a service subsidy is also taken into account. After the release of the new law, already in 2020, in order to acquire the corresponding powers, men must be 61 years old, and women - 56. The insurance period includes:

- activities defined by Art. 11 Federal Law;

- as well as work taken into account when calculating the length of service in the civil service for applying for service grants in accordance with Art. 19 FZ-166;

- activities taken into account for the assignment of an age pension, for which a service payment has been established.

How is the length of service of civil servants calculated?

Watch until the end! — In Russia, prices for new housing may rise by 15%

The length of service of civil servants is calculated by summing up all periods of work of a Russian in positions that are specified in the CP. All of them are summed up to achieve the minimum size of work in government agencies. Based on the data obtained, the size of the pension of civil servants is calculated. The minimum length of service for civil servants from January 1, 2020 will be seventeen years. This means that the total calculated length of service of a civil servant pensioner must be at least 17 years. Before the relevant law was issued, it was 15 years. The length of service has begun to increase progressively since 2020, and by 2020 it will already be 17 years. By 2026, it is planned that the minimum length of service for civil servants will be 20 years.

Registration of service pension

Without time restrictions, people have the right to apply for registration of this type of payment after the corresponding powers arise.

The application is submitted to the Pension Fund or through the MFC. Serve it:

- personally;

- through an authorized representative;

- by mail.

Download for viewing and printing:

Sample application for a pension

In the latter case, the application period will be considered the day indicated on the postmark at the time it was sent by the applicant. If the application is submitted through the MFC, then the day of application will be considered the day the document was accepted by the MFC staff.

Advice! An application for pension payments can also be submitted to the human resources department at the place of work.

Payment deadlines

The legal period for consideration of a submitted application cannot exceed 10 days from the date of its submission along with a complete set of documentation. If some documents are missing, PF employees notify the applicant about this and provide additional time (up to 3 months) to transfer the remaining documents to the PF. If the applicant for social security meets this deadline, then the pension is assigned from the moment the application is submitted. If there is not enough time, they may assign a pension based on the available documents or suspend the consideration period for another 3 months.

Pension amounts for state and municipal employees

The level of pension payments directly depends on the salary before dismissal. And for both civil servants and municipal employees.

The total amount is calculated based on average earnings over the last 12 months. The pension amount is 45% of the average salary, with the deduction of the old-age insurance pension (pension amount) or disability and a fixed payment to the insurance pension. For each full calendar year over 15 years, 3% is added to the pension of state and municipal employees. But at the same time, the total amount of the pension (including insurance) cannot exceed 75% of the pension for state and municipal employees.