Who has the right to early retirement if there is a disabled child in the family?

Firstly , if the family is complete and there is only one disabled child in it, then only one of the parents can apply for early retirement on this basis.

If one of the parents first applied for a pension on this basis, and then applied for another type of pension, then the second parent is given the right to retire early.

Secondly , if the family is complete and there are two or more disabled children in it, both parents are given this right.

Thirdly , if a child is raised in a single-parent family, then the parent who is raising him (single mother, single father, guardian) can take advantage of the benefit.

It doesn’t matter whether we are talking about biological parents or adoptive parents or guardians. Also, the retirement of a parent who raised a disabled child is possible even if the latter has already died at the time of application. In this situation, the parent or guardian may retire early if:

- The child's disability is confirmed by a certificate of completion of the medical examination.

- The length of work experience must be:

- at least 20 years – for men;

- at least 15 years – for women.

- The reduced retirement age threshold has been reached:

- 50 years – for women;

- 55 years old – for men.

- Care is provided until the child reaches 8 years of age or more.

During this eight-year period, the child should not stay in boarding schools, orphanages, or other institutions fully supported by the state or under the guardianship of other persons.

Legislatively, the right of parents of children with special needs to early retirement is enshrined in clause 1. Part 1. Article 32 of the Federal Law “On Insurance Pensions” dated December 28, 2013 N 400.

Please note that when applying for a pension, it does not matter in what period the child’s disability was established. It can be confirmed after 8 years (even after adulthood). Let’s say disability was established at the age of 21 with the status “disabled since childhood,” that is, the cause of the disease before the age of 18. There will be a right to an early date. There is also a basis when the child was temporarily disabled, for example, from the age of 3 to 4.5 years.

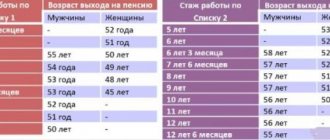

For guardians, the calculation of the retirement age occurs under different conditions.

The retirement age is reduced by 1 year for 1.5 years of guardianship.

| Guardianship period | Number of years by which the retirement age is reduced | Retirement age | |

| Male | Female | ||

| 1 g 6 months | 1 | 59 years old | 54 years old |

| 3 g | 2 | 58 years old | 53 years old |

| 4 g 6 months | 3 | 57 years old | 52 years old |

| 6 years | 4 | 56 years old | 51 years old |

| 7 years 6 months | 5 | 55 years | 50 years |

In this case, the fact of caring for a child under 8 years of age must be officially confirmed. That is, the guardian must take into account the time of fulfillment of his obligations when the child is from 0 to 8 years old .

For example, a guardian raised a disabled child from 10 to 14 years old. There will be no entitlement to pension benefits.

The period of guardianship that reduces the pension qualification must occur during the period when the child was disabled.

Let's imagine a situation: a guardian raised a child from 3 to 10 years old. The child was recognized as disabled from 9 to 13 years of age. A guardian can be registered for only one year (from 9 to 10).

Both the current and former guardian can claim the right to premature retirement, the main thing is that the above conditions are met.

For adoptive parents, the same calculation rules apply as for natural mothers and fathers, that is, a year is counted as a year.

In this case, the period of caring for a child with a disability is counted towards the length of service with an increased pension point (a coefficient of 1.8 is applied).

Information about terms. A disabled child , when in childhood, a disability is established in real time (temporarily or permanently).

Disabled since childhood - disability is established after the 18th birthday, but for reasons (diseases) that arose in childhood (before 18 years of age).

Subtleties of the new legislation

A man (parent) who is raising a disabled child retires 5 years earlier, that is, at 55 years old. As for the woman (mother), she also has the right to switch to pension benefits earlier (for the same period), or more precisely, at 50 years. Few people know, but this rule is valid only until 2020. What is the reason?

From 2020 onwards, the retirement age is increasing, and by 2024 it will increase by three years. To be more precise, every year 6 months are added to the deadline for retirement. Consequently, already in 2020, the pension for parents of a disabled child will be paid from 50.5 years (for women) and from 55.5 years (for men). In 2024, this period will be 53 and 58 years.

As for the preferential pension, it depends on several factors - the amount of wages, the child’s disability group, length of service, the availability of rights to receive additional payments, as well as the nuances of legislation in force in a particular region.

There is such a thing as a monthly allowance, the amount of which ranges between 1,478 and 2,527 rubles. The exact amount depends on whether the family uses a social package. If the latter is not applied at all, the premium will be the largest.

Another benefit is provided for pension points accrued to parents of disabled children. For example, if a mother (father) has not been at work for three years due to the need to care for a child, 1.8 units are awarded for 365 days (total - 5.4 points). In addition, the allowance of 5.4 thousand rubles, which is issued when caring for a child with a disability, is not taken away. If the mother switched to a pension at the age of 50, the amount of payments due to her is no less than the funds paid to the guardian or father. The only difference is the age at which early care is available.

How to confirm the fact of leaving?

To confirm that you are caring for a disabled child, you must provide the Pension Fund with:

- An extract from the ITU examination report confirming the child’s disability status.

- Birth certificate, child's passport.

- An extract from the house register (certificate of family composition), confirming the fact that the child and the person caring for him live together. It can be obtained from the local administration, the MFC, the management company or the HOA, and can be issued through the State Services website or through the website of the territorial MFC.

- Certificate of place of residence , which can be obtained from the MFC, the nearest unit of the Main Department of Migration Affairs of the Ministry of Internal Affairs, the management company of a residential building, a homeowners association or housing department.

The decision on whether care was provided or not is made by the district pension commission. In addition, before this, representatives of social protection authorities often pay visits to the applicant’s neighbors to personally verify that the child was not only registered with a parent, but was actually raised by him.

Sometimes the fact of upbringing has to be proven in court. Then the court decision is submitted to the pension authorities.

How to restore a certificate

If there is a need to restore a document in the event of theft, loss, damage, or wear of the certificate, you must contact the local authority that issues disability certificates. You can restore a document with the following package of documents: a written application for the issuance of a duplicate, 3 by 4 photographs; if the original document has become unusable, then it must be returned.

If the document is stolen, you must provide a police certificate confirming the fact of theft. A certificate recognizing the citizen as disabled, indicating the group and the cause of the health impairment, is also required.

Where and how to apply for early retirement?

The right to early retirement for parents of children with childhood disabilities can be used by contacting the pension authority at the place of registration (registration).

There are several ways to contact us:

- personally;

- in your personal account on the Pension Fund website (a mandatory condition is registration on the State Services website);

- by mail;

- through a trusted person.

In the latter case, along with other documents, you will need to provide a notarized power of attorney to the Pension Fund.

Employees of the pension department individually decide to grant such a right or not, based on an assessment of the documents provided and the candidate’s compliance with the requirements listed above.

If the Pension Fund refuses to provide a benefit, you can obtain it through the court by filing a statement of claim. Only in this case, to substantiate your claims, you will have to attach written correspondence with the Pension Fund. Your statements and written responses from officials to them are attached to the claim.

Calculation of preferential payment

There is a formula for calculating the regular insurance pension. It looks like this:

pension points * cost of 1 point + fixed pension amount = pension amount.

Here it is worth taking a closer look at the concept of pension points. A person receives a certain number of points for each year of work experience. But in addition, the mother of a disabled child receives 1.8 points for each full year of caring for the child. If the mother did not work, but cared for a disabled person for all 18 years (before reaching adulthood), then she receives 32.4 points for this.

To these points you should add points for years of work (they are calculated according to the person’s contributions to the Pension Fund). Since a person is rarely interested in these percentages, you should find out the number of points from the accountant at your place of work.

Let's look at an example. Let's assume that the mother cared for a disabled person for 6 years and worked for another 19 years while gaining seniority. Over these 19 years, she earned 36.6 points, and over the 6 years of child care - 10.4 points. The total amount is 47. As a result, the formula takes on the following form:

47 * 78.28 (point price in 2020) + 4805 (fixed size) = 8484.16 rubles.

This is the amount of payments created on the basis of length of service and length of service caring for a disabled person. The following factors are added to this amount:

- social assistance for care in the amount of 5,500 rubles;

- monthly payment ranging from 1478 to 2527 rubles;

- benefits for taxes, housing, etc.

To calculate the final amount for the mother of a child with a disability, you need to know the amount of all payments due and add them to the amount calculated using the general formula.

Caring for a disabled child is part of the work experience. That is, if the offspring was disabled for 6 years, and the mother did not work due to caring for him, she only has to work not 15, but only 9 years to obtain the full amount of experience.

When should I contact the Pension Fund for early retirement?

According to the Rules established by Order of the Ministry of Labor and Social Protection of the Russian Federation dated November 17, 2014 N 884n, you must contact the Pension Fund 10 days before the right to early exit arises, that is:

- for women - 10 days before turning 50 years old;

- for men - 10 days before turning 55 years of age.

However, the optimal time to apply can be considered six months to a year before the expected early retirement.

Pension Fund employees will tell you exactly what documents you will need to bring specifically in your case. You will have enough time to prepare them. It may be necessary to confirm periods of work even during Soviet times, which may cause certain difficulties.

If, before the grounds for early retirement arise, the applicant does not contact the pension authorities within the specified time frame, he will not be deprived of his right. You can exercise your right later (at any time).

Example . Kalinina S.E. applied for an early pension at age 51, rather than at age 50, in March 2020. Her pension began to accrue in April 2020 from the age of 51. She will not receive any compensation for the lost year, which is why she should contact the Pension Fund in a timely manner.

The legislative framework

The process of assigning an old-age insurance pension is regulated on the basis of Law No. 400-FZ of December 28, 2013. The articles in the document explain the following points:

- rules for recording work experience;

- calculation procedure;

- age of obtaining the right to maintenance due to reaching the age limit for compulsory employment: normal;

- preferential.

The first paragraph of Article 32 of this law contains a list of persons who are entitled to a reduction in retirement age. In particular, these include people who raised a disabled person from childhood to eight years. The remaining requirements for applicants for early age benefits are as follows:

- presence of family ties with a sick baby (mother or father);

- registration of guardianship over a disabled child until he reaches the age of 8;

- official work experience: 15 years for women;

- 20 - for men.

The benefit is provided only to one of the parents. That is, mom or dad can exercise the right. At the same time, the law does not take into account who actually provided care and with whom the sick child lived. The spouses must decide this issue themselves.

Attention: the right to early old-age benefits was received within the framework of the law by people who fall under the above criteria, from among:

- parents;

- adoptive parents;

- guardians.

Features of legislation

Law No. 400-FZ contains a number of other requirements for applicants for the privilege. Thus, according to general standards, pensions in the Russian Federation are assigned to two types:

- insurance;

- social.

A preferential reduction in the age of compulsory participation in labor activity is taken into account only if there is a right to insurance benefits from the budget of the Pension Fund (PFR). And citizens receive this conditional on accumulating a certain number of points on their personal account. In 2020 the figure is 13.8. It is planned to gradually increase to 30 by 2025.

This rule also applies to beneficiaries. Parents and guardians of disabled people can apply for early maintenance in old age if they have at least 13.8 points in their Pension Fund account in 2018.

There is a special condition for reducing the age for guardians:

- for every year and a half of caring for a child with poor health, the retirement threshold is reduced by one year;

- the maximum reduction occurs for five years, taking into account gender: women under 50 years old;

- men under 55.

Attention: the applicant’s failure to provide proof of one of the above conditions will invalidate the right to preference.

Additional privileges

The legislator took into account that caring for a disabled child is hard work. Often, mom or dad does not have the opportunity to devote full time to the service. Therefore, they are granted the following privileges:

- Disability pension for a child ( RUB 13,410.0 in 2018 >);

- Accrual of preferential coefficients. For each year of care, 1.8 points are awarded . But they are provided only if the person does not officially work;

- An additional payment is issued to a person who is constantly near a disabled minor. Its size for mom/dad and guardian is set at 5.5 thousand rubles. Other relatives are entitled to 1,200.0 rubles.

Important: if a woman sits at home with a disabled minor and does not work, then she has no chance to receive pension benefits early. To do this, you must have at least 15 years of insurance experience.

Required documents

In order not to come to the Pension Fund several times, carefully study the list of documents for obtaining an early pension for the parents of a disabled child:

- Passport.

- Employment history.

- Insurance certificate of state pension insurance.

- Certificate of average monthly earnings of a citizen for any 60 consecutive months during his working life until 01/01/2002 (average monthly earnings for 2000–2001 are confirmed by an extract from an individual personal account in the compulsory pension insurance system, which is at the disposal of the Pension Fund of Russia).

- Marriage certificate (if you changed your last name).

- Child's birth certificate.

- An act of the guardianship authority establishing guardianship and appointing a guardian (for guardians).

- MSEC certificate confirming disability.

- A document confirming the fact of caring for a child under 8 years of age.

- Statement.

Prepare copies signed by the notary, but be sure to take the originals with you when you go to the Pension Fund department. They are also needed.

If something is missing the first time, the documents can be submitted within three months from the date of application, but no later than this period.

Disabled person and driver's license

For people with disabilities, a vehicle is sometimes the only way to get around. However, there is a list of diseases that make it impossible to obtain an international driver's license. It includes the following pathologies that prevent driving a car: mental disorders, neurotic disorders, mental retardation, epileptic seizures, vision group 1, complete deafness, achromatopsia.

There is a list of diseases for which it is possible to use only a manually controlled car. It includes:

- deformed foot;

- shortened leg;

- stumps of both legs, thighs;

- deformed lower limbs, spine, pelvic area, leading to difficulty walking;

- paralysis of the lower limb;

- damaged neurovascular bundle of the lower extremities.

There are also medical conditions in which a person drives only a car equipped with an automatic transmission: absence of an arm or hand, absence of a leg or foot, deformed hands or feet, absence of fingers or phalanges, damage to the central nervous system. To obtain a license, disabled drivers must provide the following package of documents to the traffic police department:

- certificate of completion of a specialized school indicating passing exams in the traffic police;

- statement;

- passport;

- medical certificate;

- receipt of payment of state duty.

The state provides many benefits to people with disabilities. They are designed to make life easier for people with disabilities. But you need to remember that to obtain them you must contact the relevant authorities, where you will need to provide a disability certificate.

Pensions for the mother of a disabled child: are they entitled to the father?

Most often you can find information on the Internet about the early retirement of the mother of a disabled person, so there may be a misconception that only women are entitled to such a benefit.

The abundance of information regarding mothers of disabled children is due to the fact that it is primarily they who provide child care and benefit from this benefit. There are not so many single fathers, and if we talk about two-parent families in which there is a disabled child, then in them, too, according to statistics, it is usually the mother who takes out early retirement.

However, according to the law, any of the parents, that is, including the father, can take advantage of the benefit.

The essence of this preference for citizens.

The essence of this preference for citizens.

At its core, early retirement for parents of disabled children is a legal right, which represents the opportunity to receive a pension earlier than the period specified in the law. In addition to this reason, there are a number of other circumstances that provide this preference. An example is:

- serving in the army;

- working in dangerous positions;

- work in certain government areas, etc.

At the same time, the period for which a citizen has the right to retire early also varies in different situations. For parents of disabled children, this period is 50 years for women and 55 years for men. This issue is regulated by Article 28, paragraph 1 of the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 N 173-FZ. In accordance with this legislative act, the following procedure for receiving an early pension applies:

| No. | Condition name | The essence of the condition |

| 1. | There is one disabled child in the family. | Under these circumstances, only one of his parents or guardians has the right to early retirement. |

| 2. | There are two disabled children in the family. | Under these circumstances, both parents or guardians have the right to early retirement. |

| 3. | Having a certain amount of experience. | This condition implies the presence of the required work experience of 15 (20) years, depending on the gender of the applicant. |

However, there are circumstances in which this preference will not be provided:

- Parents or guardians of a disabled child were previously deprived of parental rights.

- One of the parents has a criminal record for causing harm to health. Moreover, who the injured persons were in this case is not significant.

Important! It does not matter which disability group the child is assigned to. Parents or guardians of a disabled child of any disability group have absolutely equal conditions when retiring early, namely five years earlier.

Can parents of disabled children lose their right to early retirement?

A pension for a woman with a disabled child, as well as for a man who is a father, is awarded only if there are grounds for it. If there are none, it is denied. They don’t even accept documents for registration when:

- the applicant did not raise a child under 8 years of age for any reason;

- the applicant was deprived of parental rights until the pension was issued;

- the other parent took advantage of the benefit;

- the insurance period is below the established threshold;

- the age at which you can take early leave has not yet reached.

In these cases, the right is lost, and the Pension Fund immediately refuses to issue such a labor benefit.

But if the mother or father was deprived of parental rights after the pension was awarded (that is, at the time of its registration they met all the criteria), then the right to further receive a pension is not lost. They continue to receive it further.

When they can refuse

Early retirement benefits may be refused due to the applicant’s non-compliance with the established legal norms.

They are:

- placement of a minor in a state institution for full state support;

- deprivation of a person's parental rights;

- revocation of guardianship or adoption;

- death of a child before reaching 8 years of age;

- lack of necessary indicators: work experience;

- points.

Hint: an unlawful decision by Pension Fund employees can be appealed to a higher authority or court.

Amount of preferential pension

The size is determined by analogy with the algorithm for calculating the usual old-age insurance pension (not preferential) and depends on:

- the total amount of insurance premiums received by the Pension Fund of the Russian Federation for the insured person;

- the amount of pension rights acquired before January 1, 2002.

That is, essentially the size will depend on:

- the employee’s salaries in the past (the higher the salary, the higher the pension subsequently);

- duration of insurance period;

- age of application for an insurance pension;

- number of pension points.

Early pensions for the unemployed are subject to all indexation of the insurance pension.

Guardians of disabled children.

Guardians of disabled children.

Guardians of disabled people from childhood or persons who were guardians of disabled people from childhood, who raised them until they reached the age of 8 years, apply the situations that I described with the parents of disabled children, with the only difference that the old-age insurance pension is assigned with a decrease in the age provided for in the article 8 of this Federal Law, for one year for every one year and six months of guardianship, but not more than five years in total, if they have an insurance record of at least 20 and 15 years, respectively, men and women.

Are parents of disabled people entitled to only one pension?

Currently, pensioners in the Russian Federation receive two types of pensions:

- insurance benefits received by able-bodied persons;

- social benefits received by disabled persons.

Above we discussed the conditions for assigning an insurance pension, which able-bodied parents with a certain length of service can receive on preferential terms.

Only parents who do not have a single day of insurance coverage can receive a social pension. Also, this type is received by disabled people and incompetent persons due to the loss of a breadwinner, but we do not even consider these categories, since they cannot, by law, be representatives of a disabled child.

That is, in fact, there is only one pension, the official recipient of which is the parent. But our help to families with a disabled child or childhood disability does not end here.

They also receive support not only in the form of pensions, but also in the form of social benefits, namely:

- to the parent or guardian of a disabled child (under 18 years of age) or a disabled person from childhood of group I (over 18 years of age) - in the amount of 5,500 rubles ;

- other persons – 1200 rub .

Parents of groups 2 and 3 disabled since childhood do not receive such care benefits.

In addition, the child himself, due to his disability, receives a social pension and EDV, and since the parents are legal representatives, in fact they are the ones who receive these payments.

| Social payment | Disabled children | Disabled since childhood | ||

| 1 group | 2nd group | 3 group | ||

| Monthly cash payment (MAP) | 2701,62 | 3782,94 | 2701,62 | 2162,67 |

| NSO (in monetary equivalent) | 1121.42 rub. | 1121.42 rub. | 1121.42 rub. | 1121.42 rub. |

| Social pension | 12432,44 | 12432,44 | 10360,52 | 4403,24 |

*in the bottom line in brackets the maximum amount of EDV is indicated, subject to refusal to use NSO in kind

Payments are indexed several times a year. As a rule, their size increases after this.

What are the grounds for receiving

The provision of a certificate of disability occurs if there are certain grounds. First of all, the applicant must have a disability officially registered by a medical commission. She issues a certificate indicating the disability group. To be assigned the status of a disabled person, several stages must go through:

How to restore a disability certificate

- Diagnosis of a disease or injury leading to disability.

- Conducting a treatment course in a medical institution.

- Conducting a rehabilitation course.

- Appointment and conduct of medical and social examination (MSEC).

- Assignment of disability status and determination of group.

Only after this can a certificate be issued. Citizens of the Russian Federation who are experiencing a systematic deterioration in their health and who need help from third parties due to an underlying disease or injury can apply for it. The following segments of the population can receive a disability certificate: participants in combat operations during which they were injured, military personnel who were injured while performing official duties.

Also, the certificate is received by civil servants who became ill while performing their duties, disabled people during the Great Patriotic War, participants of the Chernobyl Nuclear Power Plant, and all persons with limited vital functions. This certificate is also given to a disabled child.

Disability certificates are also issued to children

Procedure and rules for registering disability due to health

The procedure is divided into several stages. If the patient is bedridden, to register the disability you will need a notarized power of attorney for the representative. Registration procedure:

- A citizen undergoes a medical examination in a hospital.

- Registration with the ITU Bureau. The pensioner fills out an application and attaches documents along with copies. The originals are registered, verified, and then returned to the applicant.

- Setting a date for passing the ITU. The examination can be carried out in a month or six months. The date of completion depends on how busy the bureau commission is.

- Passing the ITU . On the appointed day, the citizen comes to the bureau. Bedridden patients undergo MSA at home or in the hospital (with preliminary hospitalization for a couple of days).

- Obtaining examination results.

What documents are needed

To undergo a medical examination you will need:

- passport;

- referral to ITU;

- survey results;

- patient's outpatient card received against signature;

- employment history;

- characteristics from the last place of work;

- act of injury at work or occupational disease (if health problems arose due to work).

Referral to ITU

The registration procedure begins with a visit to the attending physician. The specialist issues a referral for tests and prepares medical documents for medical examination. The research results are sent to the hospital commission. After its approval, the patient is given a referral for medical examination. The mailing list states:

- data on the patient’s health status;

- past illnesses (heart attack, stroke, cancer, etc.);

- test results;

- necessary rehabilitation equipment (stroller, hearing aid, etc.)

Medical and social commission for disability

The ITU date is determined by the citizen’s health. In case of temporary incapacity without the possibility of improving the patient’s condition, an examination is carried out after 4-5 months. If the prognosis is favorable, the ITU will be appointed 10 months after submitting the application. In case of a rapidly progressing disease, the examination is carried out within 1 month. The medical and social commission includes 3 doctors:

- Clinical pharmacologist.

- 2 medical specialists (profile depends on the nature of the disease or injury) with higher medical education.

The chairman of the commission is the head of a medical organization or one of his deputies with a higher medical education. The procedure for conducting the examination:

- Citizen survey. His physical condition is being assessed.

- Study of submitted documents.

- Analysis of social and everyday skills. The patient is asked questions and his behavior is assessed. An employed citizen submits a reference from his place of work to the ITU for examination. The document is needed to establish the degree of disability. The boss can indicate in the characterization deviations in behavior that appeared after receiving an injury or that the citizen has always had.

- Making a decision by voting.

Expert opinion on group assignment

The commission can assign or deny disability to a citizen. In both cases, a conclusion is issued. When a group is assigned, the patient is given a certificate of disability and an individual rehabilitation program (IPRA). The latest document states:

- rehabilitation means;

- drugs to restore health;

- types of sanatorium-resort treatment necessary for a disabled person.

- 9 products for the prevention of heart and vascular diseases

- Lymph node under the arm

- Goose with apples and prunes - how to cook delicious baked or stewed goose according to step-by-step recipes with photos

Disability is established indefinitely or for a certain period. In the conclusion, indicate the time of passing the commission to confirm the status. When the document expires, the status is canceled. To restore it, you need to go through the ITU again. In case of lifelong disability, re-examination is not necessary. This is also indicated in the document. Standard frequency of re-examination:

- disabled people of group 1 every 2 years;

- disabled people of 2-3 groups annually.

Diseases for which permanent disability is recognized:

- oncology in the last stages;

- complete deafness and blindness;

- paired hip amputation;

- diabetes mellitus with many functional disorders;

- schizophrenia;

- epilepsy with severe mental disorders, etc.