To organize a decent funeral ceremony today requires significant financial costs. It is not surprising that many people of retirement age in Russia try to accumulate savings in advance for their burial, purchase land in a cemetery or a cell in a columbarium, in order to make the task easier for their loved ones in the future.

Unfortunately, not everyone knows that funeral expenses can be compensated by obtaining a funeral benefit and other financial payments, which can be quite large. But such a benefit is an opportunity to make a more dignified burial for a loved one.

Who is eligible to receive funeral benefits?

Any person can apply for a funeral benefit in 2020 if he or she incurred the financial costs of the burial and holding a farewell ceremony. It doesn’t matter whether this person is a close relative or just a friend, colleague who volunteered to help. There are exceptions to this rule. They relate to cases where we are talking about certain supplements to the standard benefit. Here there are already possible restrictions on the degree of relationship and other requirements that will have to be met.

All benefits are available for receipt only once. This right remains for six months from the date of death. If you make a request later, there is a high chance of being refused.

What is the right to compensation for the funeral of the deceased, and what is regulated?

Funeral benefit is a payment due to those who took upon themselves the responsibility of conducting a funeral and organized it at their own expense. Social benefits for funerals are discussed in Article 10 of the Federal Law of January 12, 1996 No. 8-FZ “On burial and funeral business.”

The legislation indicates that the amount of this payment is not more than 4 thousand rubles, but with subsequent indexation of the amount.

In 2020, the benefit amount was 5,562.25 rubles before 02/01/2018 and 5,740.24 rubles after . In Moscow and St. Petersburg the amounts are several times higher. Also, a significantly larger amount will be paid as a funeral benefit for military personnel, veterans, and law enforcement officers.

Funeral benefits are paid by different authorities in different situations. It could be:

- Pension Fund.

- The organization where the deceased or the parent (other family member, legal representative) of the deceased minor worked.

- Social security authority at the place of residence for unemployed people, as well as if a stillborn child is born after 154 days of pregnancy.

- The territorial body of the Federal Social Insurance Fund of the Russian Federation, in which the deceased or one of the parents (another family member, legal representative) of the deceased minor was registered as an insurer.

- The military registration and enlistment office or other law enforcement agencies where the deceased served, if the deceased was a military serviceman, military pensioner, law enforcement officer, veteran, or died during military service.

We consider all the important nuances of receiving benefits, including the question of which organizations are involved in paying them, in a separate material.

What documents are required to receive benefits for the funeral of the deceased?

The first step on the path to funeral benefits is collecting all the documentation. First of all, you need to fill out the appropriate application. You can find the form and sample on the Internet and on the government services website. You need to have documents with you confirming that the person really died and you need money for his burial.

Also, do not forget to take your passport with you and find out your bank details in advance in order to receive money into your account. Another method of receipt is a money order, which is issued at the post office.

In some cases, it is necessary to prepare other documentation. For example, in order to receive a funeral benefit from the Moscow government, you need to confirm that the deceased person was registered in the capital and therefore has the right to an increased benefit.

What should be provided to those who are entitled to payments?

General package of documents:

- application for payment (a sample can be found on the Internet);

- death certificate in form No. 33 (issued at the registry office);

- applicant's passport.

Any additional document will also be required that confirms the relationship between the applicant and the deceased.

If a relative of the deceased is not applying for payment, you will need to confirm the right to payment . You will need to provide, for example, receipts for payment for the services of the funeral home, an agreement with it, etc.

What additional documents will be needed?

To the Pension Fund branch

- Documents confirming that the pensioner was not employed at the time of death (work book or certificate from the employment service).

- A certificate from the Social Insurance Fund stating that the deceased was not subject to compulsory social insurance (if he was an individual entrepreneur or belonged to members of tribal communities of indigenous peoples of the North).

To the social protection authorities

- Medical certificate for a stillborn child.

- Mother's passport.

- Certificate of registration as unemployed (if available).

- Extract from the place of registration of a non-working citizen (not a pensioner).

- Certificate from the Pension Fund about non-receipt of a pension.

- Certificate confirming that the deceased completed full-time studies at a college or university.

- Death certificate with official stamp.

At the place of work

A death certificate will be required. When working part-time, they may also request a certificate from another place of work stating that benefits were not paid.

In such difficult situations as the death of a person, even a small amount will be of help and will not be superfluous. To receive compensation for funeral expenses is the legal right of the one who took upon himself the organization of the funeral send-off. If you follow a number of formalities, receiving this payment is not that difficult.

Basic funeral benefit

The basic benefit amount in 2020 is 6124.86 . This is the minimum amount that every citizen of Russia is entitled to for burial, regardless of his type of activity and social status. This amount is indexed annually. In some regions, regional coefficients and surcharges for funerals from local authorities may be introduced. In Moscow and the Moscow region, residents can count on additional financial support in the amount of 11,616 rubles. and will amount to 17,740.86 rubles .

For many categories of citizens, increased benefits and funeral benefits are provided in addition to the benefit. To receive a basic payment for the funeral of a Russian citizen, you need to come to the social protection department with a pre-prepared package of papers.

How to get back money spent on a funeral?

Often, the person who paid for the funeral wants to get their money back. You can return money in different ways and from different persons, for example, from heirs and the state.

- Reimburse your expenses from your heirs, as described above.

- Receive your money from the state in the form of compensation.

- If there are disagreements with the parties, you can get your money back through the courts (often disputes between heirs about the distribution of inheritance shares make it difficult to quickly receive expenses, so we recommend that everything be resolved in one process).

The state, based on the legislation on funeral business, can offer 2 options, a social benefit for burial or funeral services. If a person chooses the services of a funeral home, he will not be able to receive a funeral benefit, since he has already received free services from the state.

In order to return money from the state spent on a funeral, it is necessary to determine the status of the deceased, whether he was an employed citizen or not, a veteran, a pensioner, a child, etc. after all, depending on his status, it will be necessary to determine where to apply for payment of social benefits.

To get your money spent on a funeral back through the court, you need to draw up a claim for reimbursement of funds and go to court with the collected evidence.

How to receive benefits for the funeral of a pensioner?

Money for the funeral of pensioners who did not work or worked but received a “salary in an envelope” must be requested from the Pension Fund. This rule also applies to the burial of the indigenous peoples of the North.

You should apply for financial assistance at the same branch of the Pension Fund where the deceased last received his pension. In addition to the standard package of documentation indicated above, you need to take with you a document confirming the fact of relationship between the deceased and the applicant, as well as a document indicating the place of registration of the applicant at a given time.

Who bears the funeral costs?

The circle of heirs of the testator is established by law, with supporting documents. After the heirs have accepted the inheritance, they are presented with all expenses, and until the acceptance of the inheritance, the expenses are presented to the executor of the testator's will. Heirs can also pay for the funeral with funds that they accepted as an inheritance (for example, a current account or a cash deposit in the testator's bank). The heirs can withdraw this money for the funeral before the expiration of six months from the date of opening of the inheritance and no more than one hundred thousand rubles.

Useful : read how to register an inheritance in another city using the link

A person who is himself an heir, who paid for the funeral on his own, can recover money from other heirs, if any, and also if this person is not an heir, but spent money on the funeral (for example, neighbors who do not have any family ties with the deceased ). To recover expenses from heirs, you must have documentary evidence of these expenses, these could be:

- Receipts (for example, wreaths, coffins, clothing purchases);

- Receipts (for example, payment for inheritance protection services, transportation of the deceased to the burial place);

- A contract or agreement for the provision of medical services (for example, treatment before the death of a person in a paid medical organization);

If there are heirs, then based on the above, with the help of supporting documents, you can demand compensation from the heirs by presenting them with evidence. The heirs will be required to reimburse the costs.

If no heirs have been identified, then the person who paid for the funeral must contact the notary at the place of residence of the deceased person, providing a certificate of death and information about the citizen’s place of residence. Based on the documents provided, the notary must issue a document to the person for the issuance of funds to reimburse the expenses incurred. Based on this document, a person can receive monetary compensation at a bank branch or at the Pension Fund of the Russian Federation.

Funeral expenses may also be borne by the state on the basis of burial legislation. In addition to social benefits (funeral compensation), you can receive services from the state. The list of services provided to the person who bury the deceased free of charge:

- Preparation of documents;

- Transportation of the deceased body to the cemetery;

- Burial;

- Provision and delivery of a coffin, as well as other items necessary for burial;

All of the above services are provided by specialized funeral homes, which are paid for from the budgets of the Russian Federation. Payment to the funeral home is made no later than six months from the date of burial of the deceased.

ADVICE FROM A LAWYER : watch the video on registering an inheritance and ask your question in the comments of the video to get a free answer from a lawyer

The procedure for obtaining funeral benefits from the employer of the deceased

If the deceased had an official place of work on the day of death, a request should be sent to his employer with a request to assign a death benefit to the employee. In this case, you can count on payment of the minimum basic benefit. However, be sure to look at the employment contract. If there was a provision for compensation for funeral expenses in excess of the minimum benefits established by the government, the final amount will be higher. Additional funds are paid from the Compulsory Social Insurance Fund.

Keep in mind that any payments from the employer are provided only for officially employed citizens. If the deceased person worked unofficially or under a civil contract, you should apply for benefits to the social protection authorities. There you will receive a basic benefit in the prescribed amount. The procedure for paying funeral benefits will be standard.

In some cases, relatives of the deceased may receive financial compensation from their employer. You can find information about the possibility of such payment in the collective agreement. Members of trade unions can also count on additional financial support, but in this case the degree of relationship for a person who wants to receive money for funeral expenses is often limited.

Social Security Law Test Answers

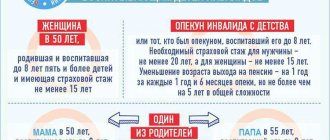

1.What age must a woman reach to acquire the right to an old-age pension on a general basis:

A) 60 years

B) 45 years old

B) 55 years old

D) 35 years old

2. Recipients of funeral benefits are:

A) the spouse of the deceased, his close and other relatives, legal representative or other person who has assumed the responsibilities and expenses of burial

B) the spouse of the deceased, his close and other relatives

C) only the deceased’s spouse, father or mother

3.What is the relationship between the concepts of “social security” and “social protection of the population”?

A) Social protection of the population is a narrower concept than social security, it concerns only disabled citizens

B) Social security is an integral part of social protection of the population

C) Social security and social protection of the population exist in parallel, without intersecting either in the circle of persons provided for or in the types of security

D) Social security and social protection of the population - 2 identical concepts

4. Survivor pensions are:

A) This is a state-guaranteed minimum social assistance provided to persons specified in the law, regardless of their work experience, payment of insurance contributions, paid upon reaching a specified age

B) Monthly payments from the Pension Fund of the Russian Federation, as well as from the Federal budget for the disabled, assigned in amounts commensurate with the earnings of the deceased (unknown) breadwinner who was dependent on the deceased

C) Monthly cash payments assigned to citizens who have persistent impairment of body functions, both with and without the necessary work (insurance) experience

D) A monthly cash payment established for citizens in connection with long-term work or professional activity defined by law and assigned, as a rule, regardless of the age of the recipient upon leaving this job

5. Social pension assigned to citizens who have reached the ages of 65 and 60 years (men and women, respectively) during the period of their paid work:

A) 1/3 of the social pension is paid

B) Not paid

C) Only half of the social pension is paid

D) Paid

6. Does the degree of disability affect the size of the disability pension:

A) Yes, it affects the size of the basic and insurance parts

B) Yes, it affects the size of the insurance part

B) Yes, it affects the size of the base part

D) No, it does not affect

7. Pensions for federal civil servants are indexed:

A) With an increase in their monetary content

B) With increasing work experience

B) With increasing length of service in public service

D) Not indexed

8. Upon entering into a new marriage, labor pension in case of loss of a breadwinner:

A) Not saved in any case

B) Not saved

B) Preserved in any case

D) Retained only if it was established before entering into a new marriage

9. What are the financial sources of payment of state benefits:

A) Part of state benefits is paid from the funds of the Social Insurance Fund of the Russian Federation, part - from appropriations from budgets of various levels

B) State benefits are paid from all compulsory social insurance funds

C) All benefits are paid from the funds of the Social Insurance Fund of the Russian Federation

D) That's right

10. Citizens of the Russian Federation and foreign citizens and stateless persons permanently residing in the territory of the Russian Federation who meet the following conditions have the right to a disability retirement pension:

A) They must have at least 2 children

B) They should be listed as missing

C) They must be the sole breadwinner in the family

D) They must be registered in the compulsory pension insurance system of the Russian Federation

11. Pension savings accounts take into account:

A) Employee's earnings

B) All labor income (earnings) of the employee

B) All employee income

D) All income of able-bodied family members of the employee

12. What is the minimum insurance period required to assign an old-age pension on a general basis:

A) 5 years

B) 1 year

B) 20 years

D) 1 day

13. The following cannot be recognized as unemployed:

A) All of the above are true

B) Able-bodied citizens who do not have work or income

B) Convicted by a court decision to punishment in the form of imprisonment

D) Citizens who have been assigned a pension

14. In pension savings accounts, the employee’s earnings (labor income) are taken into account for the period:

A) Only for the last 24 months before applying for a pension

B) For any 60 months before applying for a pension

B) For the entire period of working activity

D) For the last 10 years before applying for a pension

15. Which groups of social relations, from those listed below, are included in the subject of social security law (regulated by the norms of social security law)?

A) Relations regarding the formation of funds allocated for social security of citizens

B) Procedural relations

C) Relations regarding the provision of certain types of social security to citizens

D) Relations regarding the organization of social security management

16. Pensions for long service are assigned to the following employees:

A) Federal government employees

B) Judges (including judges of the Constitutional Court of the Russian Federation) - monthly lifelong allowance for retired judges; some other employees (for example, cosmonauts and civil aviation flight test personnel)

C) Civil servants of the constituent entities of the Russian Federation and municipal employees; military personnel, persons who served in internal affairs bodies, in institutions and bodies of the penal system, tax police and customs authorities

D) All of the above categories

17. Financing of labor pensions is carried out by the Pension Fund of the Russian Federation at the expense of one of the funds:

A) State budget

B) Insurance contributions (social tax) of employers

B) Budget of municipal (local) entities

D) Insurance contributions of entrepreneurs without forming a legal entity

18. The day of application for a labor pension is considered to be the day:

A) in all of the above cases

B) When a pensioner applied for a pension

C) When did the pensioner become entitled to a pension?

D) When the pensioner received a corresponding application from the body providing pensions

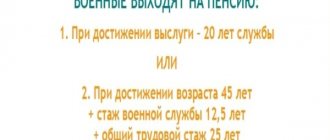

19. On the basis of which legal acts do military personnel who served under a contract receive pension benefits:

A) Federal Law of December 15, 2001 “On state pension provision in the Russian Federation”

B) All of the above are true

B) Law of the Russian Federation of December 12, 1993 “On pension provision for persons who served in military service in internal affairs bodies, the state fire service, institutions and bodies of the penal system, and their families”

D) Federal Law of December 17, 2001 “On labor pensions in the Russian Federation”

20. Pensions for long service are:

A) Monthly cash payments assigned to citizens who have persistent impairment of body functions, both with and without the necessary work (insurance) experience

B) A monthly cash payment established for citizens in connection with long-term work or professional activity defined by law, and assigned, as a rule, regardless of the age of the recipient upon leaving this work or completing this activity

C) This is a state-guaranteed minimum social assistance provided to persons specified in the law, regardless of their work experience, payment of insurance contributions, paid upon reaching a specified age

D) Monthly payments from the Pension Fund of the Russian Federation, as well as from the Federal budget for the disabled, assigned in amounts commensurate with the earnings of the deceased (unknown) breadwinner who was dependent on the deceased

21. Which of the following periods is not included in the length of service:

A) The period of care provided by an able-bodied person for a disabled person with a 3rd degree limitation in the ability to work, a disabled child or a person who has reached the age of 80 years

B) The period of military service, as well as other service equivalent to it

B) Period of receiving unemployment benefits

D) The period of care of one of the parents for each child until he reaches the age of one and a half years without limitation

22. Compulsory health insurance is:

A) An integral part of state social insurance and provides all citizens of the Russian Federation with equal opportunities to receive medical and pharmaceutical care provided at the expense of compulsory health insurance funds

B) There is no correct answer

C) Part of state social insurance, providing all citizens of the Russian Federation with the opportunity to receive medical and pharmaceutical care provided at the expense of compulsory health insurance funds

D) An integral part of medical insurance for citizens of the Russian Federation to receive medical and medicinal care provided at the expense of compulsory medical insurance funds

23. Recalculation of the basic part of the labor pension can be made on the following grounds:

A) Due to an increase in insurance premiums on the individual personal account of a pensioner

B) In connection with the pensioner reaching the age of 80 years

B) Due to the increase in insurance period

D) Due to changes in financial assistance

24. When calculating insurance and general length of service, it is taken into account in calendar order (according to actual duration):

A) Period of being on long vacation

B) Work for a full season in organizations of seasonal industries

B) Period of service in the army

D) Work during the Great Patriotic War

25. Federal civil servants have the right to a pension for long service if they have length of public service:

A) At least 15 years

B) At least 10 years

B) At least 25 years

D) At least 20 years

26. Amounts of disability pension under state pension provision due to a disease acquired during military service or military injury:

A) Disability pensions due to military injury are greater than disability pensions due to a disease acquired during military service

B) Same

C) Disability pensions are set individually for each person

D) Disability pensions due to a disease acquired during military service are greater than disability pensions due to military injury

27. The amount of maternity benefit is set as follows:

A) All of the above categories

B) In the amount of average earnings (income) at the place of work for women subject to state social insurance, as well as women from among the civilian personnel of Russian military formations located on the territory of foreign states

C) A scholarship established by an educational institution (but not lower than the pension amount established by the legislation of the Russian Federation) - for women studying off-the-job in any educational institutions of vocational education

28. The most severe degree of disability is recognized as:

A) Disabled persons with a 3rd degree limitation in the ability to work

B) Disabled persons who have a 2nd degree limitation in their ability to work

C) Disabled persons with a 4th degree limitation in the ability to work

D) Disabled persons who have a 1st degree limitation in their ability to work

29. Indexation of the basic part of the old-age labor pension is carried out:

A) The indexation coefficient and frequency are determined by the Federal Assembly

B) By the amount of inflation - once a quarter

C) The indexation coefficient and frequency are determined by the Federal Budget

D) Indexation coefficient and frequency are determined by the Government of the Russian Federation

30. Which of the stages does not take part in the procedure for calculating pensions under state pension provision:

A) Verification of documents submitted for granting a pension

B) Determination of the pension amount in rubles, including the application of the regional coefficient to wages

C) Pension indexation and pension recalculation

D) Establishing a method for calculating pensions, including its size as a percentage of earnings (depending on length of service)

31. How many witnesses are needed to confirm insurance and general work experience with testimony:

A) At least 5

B) At least 3

B) At least 1

D) At least 2

32. In your opinion, is the point of view correct that:

1) social security law is one of the branches of Russian law.

2) social security law is one of the components of Labor Law.

3) social security law regulates the procedure for assigning pensions and benefits.

4) social security law regulates social relations, establishing the amounts of pensions and benefits.

33. Social security is:

1) the procedure for assigning pensions and benefits, as well as other benefits and payments to the elderly, the sick, children, dependents, those who have lost their breadwinner and the unemployed.

2) the form of distribution of material goods in order to satisfy the vital personal needs (physical, social, intellectual) of the elderly, the sick, children, dependents, those who have lost their breadwinner and the unemployed.

3) the procedure for assigning and determining the size of pensions and benefits, as well as other benefits and payments to the elderly, sick, children, dependents, those who have lost their breadwinner and the unemployed.

4) the form of distribution of physical, social, intellectual benefits to the elderly, sick, children, dependents, those who have lost their breadwinner and the unemployed.

34. The social security law system includes:

1) general and special branches of social security law.

2) general, special and special branches of social security law.

3) the system of social security law is not divided into branches.

4) highlight the same sectors as in Labor Law.

35. Legal relations regarding social security are:

1) specially arising relations regarding the redistribution of material benefits from the state to a specific person.

2) relations arising on the basis of legal facts regarding the provision of various monetary payments, services, benefits to their participants by state and other authorized bodies.

3) special relations regarding the provision of monetary payments, services, and benefits by the state to their participants.

4) relations arising on the basis of legal facts regarding the provision of pensions and benefits to their participants.

36. Subjects of social relations regulated by social security law may be:

1) citizens of the Russian Federation, refugees and internally displaced persons.

2) citizens of the Russian Federation, stateless persons and foreign citizens, constantly

Living on the territory of the Russian Federation.

3) Ministry of Labor and Social Development, health authorities, authorities

Education, executive authorities, ministries and departments,

Trade unions, enterprises, institutions and organizations.

4) all of the above.

37 Continuous work experience is maintained if the break in work does not exceed three months in the following cases (indicate the wrong answer):

1) when entering a job after the end of temporary incapacity for work, which resulted in dismissal from the previous job in accordance with current legislation.

2) upon entering a job after dismissal of one’s own free will in connection with the transfer of the spouse to work in another locality.

3) upon admission to another job of persons who worked in the regions of the Far North and equivalent areas, after dismissal from work upon expiration of the employment contract.

4) when persons are hired as a result of the liquidation of enterprises, reduction in the number or staff of employees.

38. The following have the right to a state pension and a labor pension:

1) citizens of the Russian Federation.

2) foreign citizens permanently residing on the territory of the Russian Federation - on the same basis as citizens of the Russian Federation, unless otherwise provided by the legislation of the Russian Federation or international treaties of the Russian Federation.

3) stateless persons permanently residing on the territory of the Russian Federation - on the same basis as citizens of the Russian Federation, unless otherwise provided by the legislation of the Russian Federation or international treaties of the Russian Federation.

4) all of the above categories of citizens.

39. Disability pensions are:

1) a monthly cash payment established to citizens in connection with long-term work or professional activity defined by law, and assigned, as a rule, regardless of the age of the recipient upon leaving this work or completing this activity.

2) monthly cash payments assigned to citizens who have persistent impairment of body functions, both with and without the necessary work (insurance) experience.

3) monthly payments from the Pension Fund of the Russian Federation, as well as from the Federal budget for the disabled, assigned in amounts commensurate with the earnings of the deceased (unknown) breadwinner, to disabled family members who were dependent on the deceased.

4) this is the state-guaranteed minimum social assistance provided to persons specified in the law, regardless of their length of service in paying insurance contributions, and is paid upon reaching a specified age.

40. Social pensions are:

1) a monthly cash payment established to citizens in connection with long-term work or professional activity defined by law, and assigned, as a rule, regardless of the age of the recipient upon leaving this work or completing this activity.

2) monthly cash payments assigned to citizens who have persistent impairment of body functions, both with and without the necessary work (insurance) experience.

3) monthly payments from the Pension Fund of the Russian Federation, as well as from the Federal budget for the disabled, assigned in amounts commensurate with the earnings of the deceased (unknown) breadwinner, to disabled family members who were dependent on the deceased.

4) this is the state-guaranteed minimum social assistance provided to persons specified in the law, regardless of their length of service in paying insurance contributions, and is paid upon reaching a specified age.

41. Financing of all long-service pensions:

1) is made from federal budget funds.

2) is made from the budget of the constituent entity of the Russian Federation in which the pensioner lives.

3) is made from the funds of the Pension Fund of the Russian Federation.

4) is paid from the federal budget, with the exception of civil servants of the constituent entities of the Russian Federation and municipal employees, whose pension is paid from the budget of the constituent entity of the Russian Federation.

42. The following are not recognized as disabled family members of a deceased breadwinner:

1) parents and spouse of the deceased breadwinner, if they have reached the ages of 60 and 55 years

(men and women, respectively) or are disabled people with limited ability to work.

2) one of the parents or spouse or grandfather, grandmother of the deceased breadwinner, regardless of age and ability to work, as well as a brother, sister or child of the deceased breadwinner who has reached the age of 18 years, if they are caring for the children, brothers, sisters or grandchildren of the deceased breadwinner, not who have reached 14 years of age and are entitled to a labor pension in the event of the loss of a breadwinner and do not work.

3) children, brothers, sisters and grandchildren of the deceased breadwinner, regardless of age, studying full-time in educational institutions of all types and types, regardless of their organizational and legal form.

4) grandparents of the deceased breadwinner, if they have reached the ages of 60 and 55 years (men and women, respectively) or are disabled people with limited ability to work, in the absence of persons who, in accordance with the legislation of the Russian Federation, are obliged to support them.

43. Indexation of pensions of military personnel and members of their families with an increase in their salary is carried out:

1) by the index of increase in their monetary content.

2) in the manner prescribed by the Law of the Russian Federation “On pension provision for persons who served in military service, service in internal affairs bodies, institutions and bodies of the penal system, and their families.”

3) on the index of increase in the minimum wage.

4) on the index of increasing the cost of living.

44. Indexation of pensions of military personnel who served in conscription, pensions of participants in the Great Patriotic War, pensions of citizens affected by radiation or man-made disasters, pensions of family members of the listed categories of citizens, pensions of disabled citizens is carried out:

1) by the index of increase in their monetary content.

2) in the manner established for indexation of the base part of labor pensions provided for by the Federal Law “On Labor Pensions in the Russian Federation”.

3) on the index of increase in the minimum wage.

4) on the index of increasing the cost of living.

45. Social security benefits have the following characteristics:

1) they provide material support to citizens in cases of social significance.

2) are paid for a fee.

3) are assigned only to citizens of the Russian Federation.

4) are not caused by work activity.

46. Recipients of benefits for citizens with children are:

1) citizens of the Russian Federation living in Russia.

2) citizens of the Russian Federation performing military service under a contract, serving as privates and commanding officers in internal affairs bodies, in institutions and bodies of the penal system, and civilian personnel of military formations of the Russian Federation located on the territories of foreign states in cases provided for by international treaties of the Russian Federation.

3) foreign citizens and stateless persons, including refugees living in Russia.

4) all of the above categories.

47. The right to a one-time benefit for women registered in medical institutions in the early stages of pregnancy is granted:

1) women registered in medical institutions up to 10 weeks.

2) women registered in medical institutions up to 12 weeks.

3) women registered in medical institutions up to 15 weeks.

4) women registered in medical institutions before 21 weeks.

48. The following have the right to a monthly allowance for the period of parental leave until the child reaches the age of one and a half years:

1) only mothers living together with the child.

2) mothers and other close relatives.

3) persons actually caring for the child.

4) all of the above categories.

49. Unemployment benefit is:

1) a measure of social support for all unemployed citizens, assigned and paid in a monetary amount as a percentage of the citizen’s previous earnings or in the amount of the minimum wage from the State Employment Fund of the Russian Federation.

2) one of the main measures of social support for unemployed citizens, assigned and paid in a monetary amount as a percentage of the citizen’s previous earnings or as a percentage of the cost of living from the State Employment Fund of the Russian Federation.

3) a measure of social support for all unemployed citizens, assigned and paid in a monetary amount as a percentage of the citizen’s previous earnings or in the amount of the minimum wage from the federal budget.

4) one of the main measures of social support for unemployed citizens, assigned and paid in cash from the State Employment Fund of the Russian Federation.

50. Compulsory health insurance is:

1) part of state social insurance that provides all citizens of the Russian Federation with the opportunity to receive medical and pharmaceutical care provided at the expense of compulsory health insurance.

2) an integral part of state social insurance and provides all citizens of the Russian Federation with equal opportunities to receive medical and pharmaceutical care provided at the expense of compulsory health insurance in the amount and on conditions corresponding to compulsory health insurance programs.

3) an integral part of medical insurance for citizens of the Russian Federation to receive medical and medicinal care provided at the expense of compulsory medical insurance.

4) there is no correct answer.

Funeral benefit for a minor

And in this situation you will have to make a request to the employer. There are some nuances here: one of the parents must make a request to their employer. It is no coincidence that a death certificate is issued in one copy. This is done to eliminate the possibility of receiving money multiple times.

The calculation and processing of payment of benefits for the funeral of children occurs according to the principle described above: the base rate plus payments from the Compulsory Social Insurance Fund, if this is provided for in the collective labor agreement. If parents do not have an official place of work, they will have to contact the Social Protection Center. Here you can only count on the minimum amount of financial assistance for burial.

In both cases, in addition to the standard list of documentation, you will need to take with you the child’s birth certificate.

Regulatory and legislative framework

Accruals due to relatives, family members and other persons after the death of a pensioner are regulated by the legislation of the Russian Federation. For ease of reference, the regulations with explanations are presented in the summary table:

| Federal Law of the Russian Federation (hereinafter referred to as the Federal Law of the Russian Federation) dated January 12, 1996 No. 8-FZ | |

| Art. 9 | About the guaranteed list of funeral services and their cost |

| Art. 10 | About social benefits for burial, its amount |

| Federal Law of the Russian Federation dated December 28, 2013 No. 400-FZ | |

| pp. 1 clause 1 art. | On the termination of the accrual of security from the first day of the month following the one in which the death of the pensioner occurred |

| clause 4 art. 26 | On the procedure for receiving the unpaid portion of the insurance benefit to the deceased |

| On the procedure for calculating payments to military pensioners: | |

| RF PP dated September 22, 1993, No. 941 | |

| Decree of the Government of the Russian Federation (hereinafter referred to as the RF PP) dated 05/06/1994 No. 460 | and standards for spending money on their burial |

| Art. 63 Law of the Russian Federation of February 12, 1993 No. 4468-I | and relatives in the event of their death |

| RF RF dated August 18, 2010 No. 635 | On payments of pension savings to the legal successors of a deceased insured person, inheritance procedure |

| RF PP dated 07/07/2012 No. 694 | |

- How to weave bracelets from rubber bands for beginners

- Vitamin C tablets for adults and children. Instructions for use of vitamin C and daily dosage

- Permanent eyebrow makeup hair technique

Benefit for disabled people and participants of the Great Patriotic War

The largest supplements to the minimum benefit are provided for this category of citizens. In Moscow, the benefit can reach up to 38,400 rubles . With this money you can have a very decent burial. The principle of calculation is simple: the amount is equal to 35 minimum wages for the current calendar year. In this case, you can fully cover the funeral expenses.

There are no restrictions on the degree of relationship here. To receive a funeral payment, if you are dealing with this issue, you should contact the social security department.

Also, the funeral ceremony can be entirely organized by the War Memorial Institution, taking into account the wishes of the loved ones of the deceased person. No one will argue that WWII veterans have special services to the state. To pay tribute to the deceased, in addition to the standard list of ritual services and burial paraphernalia, it is planned to install an honorary sign or a worthy monument, the funeral ceremony takes place with an honor guard and orchestral accompaniment.

Benefits for military personnel

This category includes not only active military personnel, but also employees/veterans of internal affairs bodies and the penal system, fire and customs services.

If the deceased had the status of a military pensioner, the maximum benefit amount this year will be 27,016 rubles . Applicants have an alternative: instead of the base rate, they can receive an amount equal to the deceased’s pension for 3 months, and use this money to make a funeral.

If the deceased had the status of an active military personnel, members of his family have the right to receive insurance payment and a lump sum benefit in cases where the deceased died under the following circumstances:

- During military training;

- While performing military duties;

- Due to injury received during military service.

Among other things, you can receive partial or full compensation for the cost of a tombstone. The amount of this payment cannot exceed 20% of the total amount of money for burial.

Features of receiving funeral compensation: categories of citizens who can receive benefits

The list of citizens entitled to receive compensation from the pension fund and other institutions includes the following categories of people:

Home front workers. The fund provides assistance to citizens who worked in the rear during the period from June 22, 1941 to May 9, 1945 for a period of 6 months or more, excluding the period of work in the territories of the USSR that were temporarily occupied. Also, payment of financial expenses during burial is carried out to relatives of persons awarded medals and orders of the USSR for their work during the Second World War.

Labor veterans and persons equivalent to them as of December 31, 2004. This category includes citizens from among pensioners who have been awarded medals, orders or honorary titles of the Russian Federation and the USSR, as well as departmental insignia in the field of labor or who have the length of service required to assign a pension for long service or old age. In addition, relatives of citizens who began working as minors during the Second World War and have 35 years of experience (women) and 40 years (men) can count on payment of compensation.

Rehabilitated persons, that is, citizens who were repressed and deprived of freedom, sent to special settlements or exile, forced labor under conditions of limited freedom, or had other rights limited. Also, compensation for expenses is provided to persons who, as children, were with repressed parents or relatives, or who, as minors, were left without the care of relatives, who were unreasonably repressed and subsequently rehabilitated. Other persons receiving benefits are the spouses, children and parents of persons who were shot or died in prison and were posthumously rehabilitated who suffered from political repression.

Relatives of heroes of the Russian Federation, the Soviet Union, Socialist Labor, full holders of the Order of Labor Glory and Glory are also reimbursed.

Disabled people of the Second World War, military operations and persons who are equivalent to them. Including military personnel who were transferred to the reserve and served during the Second World War in combat areas, as well as partisans, members of underground organizations, workers who operated in combat areas and were wounded during the war. In addition, private and commanding military personnel of the internal affairs department and state security agencies, the state fire service, fighters of fighter battalions, detachments and platoons of people's defense who became disabled due to injuries during combat operations while performing combat missions for the period from June 22 are eligible for preferential burial. 1941 to December 31, 1951 and when demining objects on the territory of the Soviet Union or other states in the period from June 22, 1941 to December 31, 1957. Persons with injuries to private and commanding personnel of internal affairs bodies, state security and state fire service, as well as citizens serving military units of the USSR and the Russian Federation who were located in the territories of other states.

Participants of the Second World War, which include retired military personnel who served or were temporarily in military units operating during the civil war and the Second World War armies; partisans, members of underground organizations operating in the occupied territories of the Soviet Union during the Second World War and the Civil War. This category also includes military personnel transferred to the reserve from internal affairs and state security bodies who participated in the defense of cities during the Second World War, which is counted as length of service and implies the assignment of a preferential pension under the conditions established for military personnel in the active army. In addition, the category includes civilian employees who held regular positions in military units, headquarters and institutions of the active army during the Second World War or participated in the defense of cities, which is counted as length of service and implies the assignment of a preferential pension on the terms established for active duty military personnel. army. Preferential conditions in the fund can be obtained by counterintelligence and intelligence officers who carried out special assignments during the Second World War, as well as employees of various departments, enterprises and military facilities who were transferred during the war to the position of persons in the Red Army and performed tasks in the interests of the army. In addition, the list includes employees of cultural and art organizations, correspondents of central media, sent to the active army during the war, as well as citizens who carried out activities at air defense facilities, were engaged in the construction of defense structures and other important military strategic objects. Persons awarded the medal “For the Defense of Leningrad”, “Resident of Siege Leningrad”, as well as disabled children who became disabled during the fighting during the Second World War, can also be buried on preferential terms.

Combat veterans who served during the Second World War, the war in Afghanistan, military personnel working in the Ministry of Defense of the USSR and the Russian Federation, government bodies who took part in hostilities, performing official duties in the states where the war was fought, as well as on the territory of Russia. Persons sent to work in Afghanistan in the period from December 1979 to December 1989, who completed the period established upon deployment, or were sent ahead of schedule, also belong to this preferential category. It also includes former minor prisoners of ghettos and concentration camps that were created during the Second World War by the Nazis and allies of Germany.

Disabled people of the first, second and third groups, disabled children under 18 years of age.

Citizens who suffered radiation sickness and other pathologies due to exposure to radiation during the Chernobyl disaster. This category also includes teenagers and children who suffer from pathologies due to radiation exposure of their parents at the Chernobyl nuclear power plant, military and civilian nuclear facilities during their tests, exercises or other work. This category also includes persons who eliminated the consequences of the Chernobyl disaster in the period from 1986 to 1990, and participants in the elimination of the consequences of the accident that occurred at the Mayak production facility in the period from 1957 to 1961. Citizens evacuated from the exclusion zone, children, including those who were at that time in the period of intrauterine development, and citizens who lived from 1949 to 1956 in settlements that were contaminated with radiation due to the dumping of waste into Techa River and having a radiation dose of more than 35 cSv are also entitled to compensation for funeral expenses. This also includes persons who were exposed to radiation due to nuclear tests that took place at the Semipalatinsk test site and received a radiation dose of more than 5 cSv.

Veterans of special risk units, which include civil aviation flight and engineering personnel and service passengers who performed flights for radiation reconnaissance purposes in the period from 1958 to 1990.

Citizens who participated in the defense of the capital, awarded the medal “For the Defense of Moscow”, who worked continuously in the city from July 22, 1941 to January 25, 1942, as well as members of families rehabilitated due to repression, people who prevented the Cuban Missile Crisis in 1961.

Pensioners who do not fall into all of the categories listed above.

Benefit for Chernobyl survivors

Additional benefits are provided for the burial of Chernobyl victims and those who took part in eliminating the consequences of the accident at the Chernobyl nuclear power plant, as well as at Mayak. You can count on an increased amount of benefits only if the deceased had a disability resulting from an accident at the specified facilities, or died as a result of a disease, the development of which was contributed to by the accident.

In addition to standard documents, you must provide a document that confirms the deceased’s right to receive social assistance for burial. The amount of the supplement to the funeral benefit in 2020 will be 11,848.75 rubles .

Benefits for foreigners

Few people know, but you can also count on benefits if the deceased is a citizen of another country. This is possible if several conditions are met:

- A foreign citizen died on the territory of the Russian Federation;

- The persons responsible for organizing the burial are blood or legal relatives of the deceased;

- The burial takes place on the territory of the Russian Federation.

Such requests for benefits are considered on a case-by-case basis. In addition to the standard list of documents, the applicant may be required to provide an explanatory note.

Benefit or free funeral

It is also useful to know about the possibility of organizing a burial not on your own and completely free of charge. This is available to the following categories of people:

- Children who were stillborn when the mother's gestational age was at least 154 days;

- WWII veterans;

- Officially unemployed persons, in particular pensioners;

- Disabled people of groups I, II and III;

- Deceased people who have no relatives (as well as when relatives refuse to organize a funeral).

If the deceased falls under one of the listed categories, his relatives have the right to choose: to conduct the burial at their own expense and benefits, or to request a free social burial. In the latter case, the citizen loses the right to receive benefits.

Who are the recipients and to whom is it issued?

The law provides a list of persons who can receive funeral benefits. This is a spouse, close or other relatives, the legal representative of the deceased or another person who has assumed the responsibility to carry out the funeral.

Who is not eligible and under what conditions is it not paid?

Almost anyone who undertakes to fulfill their last duty to the deceased can receive a payment.

To receive payment you must:

- collect and submit a package of documents to the authority where you plan to receive benefits;

- draw up an application correctly;

- apply for benefits within six months after receiving the death certificate.

You can find more information about the payment procedure here.

After six months, those who were entitled to compensation for funeral expenses lose this right and can no longer claim payment.

If everything is provided correctly and on time, then you should not be denied benefits . What to do if you suddenly receive a refusal? It is necessary to find out its reason (first orally, then, if necessary, you can make a written request). Then decide whether the refusal is legal and whether it is necessary to go to court or the prosecutor's office.

On our website you will also find information about the rules for receiving benefits through Sberbank, and also learn about the taxation of such payments.

Do I need to prove funeral expenses?

Despite the fact that a receipt for payment for funeral services in many cases is not among the mandatory documentation that must be provided to those wishing to receive benefits, a payment document may be additionally requested from you at any time. That is why it is worth not only keeping all receipts, but also choosing a reliable funeral service that has state accreditation and can provide a cash receipt or form BO-13.

If you would like to clarify the possibility of receiving a funeral benefit and the procedure for processing the payment, please contact our funeral service staff. We provide comprehensive assistance in organizing the funeral and in resolving related issues.

Claim for reimbursement of expenses for a decent funeral

If a person is not reimbursed for funeral expenses by the testators, or the state refuses to pay social benefits for burial, then one must seek judicial protection of one’s rights and obligations. To protect your rights, you need to file a claim for reimbursement of expenses that were spent.

You should go to court for reimbursement of expenses even when, for example, the notary who is handling this inheritance case did not make a ruling in your favor on reimbursement of funeral expenses, having doubts about your relationship or your expenses.

If you sent a demand to your heirs to reimburse you for expenses for a decent funeral, but there was no response, then you also need to go to court.

The peculiarity of this claim is that the person who files it may not be an heir or a relative of the deceased, but carried out the funeral of the person. The claim should also be accompanied by a demand that was sent to the heirs for payment of compensation to you. If the guilty party is a notary, then you should attach the decision that the notary made not in your favor. If the bank refuses to pay you money, you should attach a written decision on the refusal to pay.

In a statement of claim for reimbursement of expenses for a decent funeral, you need to reasonably describe your costs, collect evidence (checks, receipts, there may also be witnesses). You need to correctly state your requirements for which you believe you should receive compensation.