Home/Recruitment/Pensioner

Modern realities force citizens to continue working after retirement. The law does not prohibit this. A citizen is free to independently decide when to stop working. For an employer, hiring a retiree comes with a number of additional features. Thus, some categories of citizens who are on well-deserved rest may qualify for additional privileges. WWII participants and combat veterans are entitled to additional annual leave without pay. In most cases, it is legally impossible to refuse a person because of his age. However, a number of restrictions still exist. In order to know in advance all the features of hiring a pensioner, it is worth familiarizing yourself with the latest information on the topic.

Hiring a pensioner of the Labor Code of the Russian Federation

The employment of a pensioner must be carried out in strict accordance with the provisions of the Labor Code of the Russian Federation. The law does not provide special conditions for hiring citizens who are on well-deserved rest. The entire procedure is carried out in accordance with general standards. Article 37 of the Constitution of the Russian Federation states that labor in Russia is free.

Attention

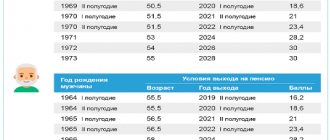

The Labor Code of the Russian Federation prohibits establishing any restrictions in relation to people who have reached retirement age. As a general rule, a citizen has the right to begin working at the age of 16. In some situations, the age limit may be reduced to 14 years. At 55 and 60 years of age for women and men, respectively, a person has the right to begin receiving a pension. At the same time, the prohibition on continuing to work is not indicated in regulatory legal acts.

If an employer does not want to hire a retiree, a written refusal must be provided stating the reason. A similar rule is enshrined in Article 64 of the Labor Code of the Russian Federation. If a company does not want to work with a person because of his age, it will be considered discrimination. However, there are a number of professions for which a maximum age threshold is established.

This category of citizens has certain benefits. Thus, WWII participants and combat veterans have the right to receive additional annual leave of up to 35 working days without pay. You can use the privilege at any time.

Indexing

The common belief that if a person gets a job, his pension will decrease, is not true. The pension will be less than that of non-workers due to the fact that indexed funds will be temporarily frozen.

But they do not fall into the category of material losses, since they are paid in full three months after dismissal.

At the same time, while at work, a person continues to accumulate pension points and increase his insurance period. Recalculations of accrued funds are carried out annually on August 1. The number of points for all years of work is summed up. Information about all changes in employee scores is received by the Pension Fund from the head of the company without fail - this is one of the innovations in 2020.

Step-by-step instructions for hiring a pensioner

The procedure for hiring a pensioner does not differ from the standard one. In order for a citizen on well-deserved rest to be able to start working, the following actions will be required:

- Select a company that requires employees and go through an interview. If the parties have reached an agreement, an application for employment of the pensioner is submitted.

- Prepare a package of documentation and present the required papers to the employer.

- Conclude an employment agreement with the company. The paper must be studied by the employee and signed by him.

- Familiarize yourself with internal regulations and other documents that a pensioner to be hired must know. The person leaves a signature as confirmation of agreement to comply with the established rules.

- Wait for the order to come out. The employer is responsible for processing it. The document is also provided to the employee against signature.

- Complete training on labor protection and sign in the appropriate register.

When all actions are completed, an employee of retirement age is considered hired and can begin working within the agreed period.

Are there age restrictions?

The rules for hiring pensioners by age are no different from the rules applied to ordinary workers, and any number of years lived is not a hindrance.

The sample employment contract can be used exactly the same as for other employees.

However, there are two restrictions related to the age of the elderly applicant.

QUESTION : My name is Lyudmila Vladlenovna Korchevskaya. I am a pensioner, a candidate of philological sciences, a professor, and have many publications and scientific works. Despite the fact that I am already 64 years old, the desire to work at my favorite job does not leave me. Changes are expected soon at the philological faculty of our university: dear Pyotr Maksimovich, our dean, is retiring. Can I apply for the position of dean, given my age ?

ANSWER : In accordance with Part 12 of Art. 332 of the Labor Code of the Russian Federation, being an old-age pensioner, you can be elected to the position of dean of a faculty, as well as rector, vice-rector, head of a branch in any higher educational institution at an age not exceeding 65 years .

Thus, if you are currently 64 years old and will not turn 65 years old before the date of the election of the dean of your faculty, you have the right to apply for the specified position. At the same time, you must take into account that upon reaching the age of 65, persons occupying the above positions and wishing to continue working, with their written consent, are transferred to other positions corresponding to their qualifications.

Anyone can be elected to leadership positions in universities until the age of 65.

QUESTION : I have worked in government agencies almost my entire adult life. And now I celebrated my 65th birthday. The anniversary was a success, but one thing that upsets me is that I will have to say goodbye to my position. I’m wondering if I can get a job in another place that is not related to my main activity, legally, and work a little more?

ANSWER : Indeed, in accordance with paragraphs. 4 paragraphs 2 art. 39 of the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation”, you, unfortunately, cannot continue your career as a civil servant, and also do not have the right to apply for a new job in a similar position.

However, you have every right to apply for any other position not related to public service or elected leadership positions in universities . The employer, according to Labor Law, does not have the right to refuse you because of your retirement age.

Anyone can work in public service until the age of 65.

Necessary documents when applying for a job as a pensioner

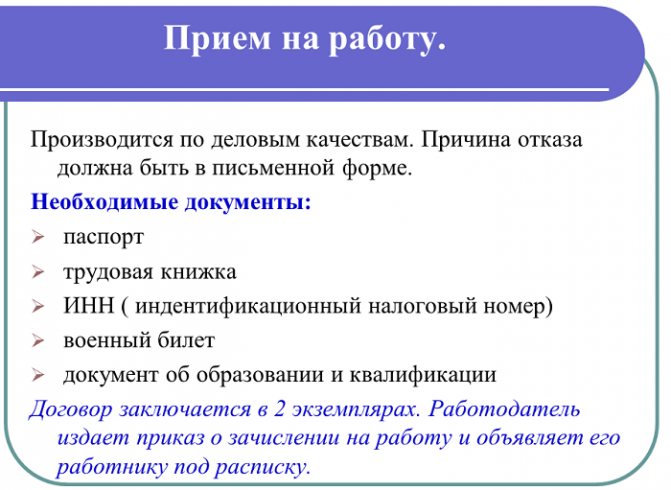

In order for an employer to agree to start cooperating with a pensioner, the citizen will need to prepare a package of documentation. It must include:

- passport;

- pensioner's ID;

- SNILS;

- document confirming qualifications - diploma, certificate, etc.;

- work book;

- TIN, if available.

When hiring for some positions, a pensioner will additionally need to provide a document that allows them to get an idea of the person’s health. In some situations, a medical examination may be required. Such requirements mainly apply to persons who want to carry out activities in the field of medicine, food sales, catering, and the food industry. The presence of harmful working conditions also requires a preliminary medical examination. If a citizen of retirement age refuses to take action, the employer will not hire him for the chosen position.

What does an employer need to know?

Let's look at some circumstances and situations that may arise and what you need to pay attention to.

- You cannot be fired because of age . When concluding open-ended employment contracts with pensioners, the employer must understand that he does not have the right to dismiss a person because of his age if the elderly employee regularly goes to work, does not show up to the workplace drunk and there are no other reasons for dismissal provided for by the Labor Code. legislation for an ordinary employee.

- It is important to talk about the conditions when concluding a contract . It is necessary to inform the employee in advance that vacation and sick leave are not paid.

- You cannot terminate an open-ended contract and enter into a fixed-term contract upon reaching retirement age . In accordance with Part 1 of Art. 5.27 of the Code of Administrative Violations, an organization may receive a fine for violating labor and labor protection laws.

- For a fixed-term contract for seasonal work, it is necessary to provide vacation or compensation at the rate of 2 working days per month of work . If the employer did not provide leave to the pensioner (for example, there was an emergency, and the short term of the contract expired during this time), compensation still must be paid, since the employee has the right to claim this and can prove it in court.

- You cannot insist on a fixed-term employment contract . Restricting an employment contract with a pensioner by force is unacceptable. The employer does not have the right to insist on concluding a fixed-term contract if the volume of work to be done and working conditions allow concluding a contract for an indefinite period. If it is proven in court that a person of retirement age was forced to enter into a fixed-term contract, this contract may be recognized as unlimited (Clause 13 Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2).

- Not wanting to employ a pensioner for an indefinite period, the employer cannot employ him several times in a row with the same job function as before . The company can be fined in the amount of 30,000 to 50,000 rubles and, as punishment, the organization’s activities can be suspended for up to 90 days (Part 1 of Article 527 of the Code of Administrative Offenses of the Russian Federation).

- A probationary period can be established and specified in the contract . This is possible, since pensioners are not included in the list of persons for whom a test for employment is not established (Part 4 of Article 70 of the Labor Code of the Russian Federation). However, such a period can only be established by agreement (Part 1 of Article 70 of the Labor Code of the Russian Federation). Otherwise, it will be considered that the pensioner was hired without a probationary period, and he can prove in court his right to continue working even if he fails the test.

- It is possible to hire a pensioner on a part-time basis in certain situations . The employer can initiate this mode of work only temporarily - for a period of up to six months, if the company is threatened with massive layoffs (Part 5 of Article 74 of the Labor Code of the Russian Federation).

A work team filled with employees of different ages is a condition for a warm family atmosphere and continuity. Retired workers can perform labor functions on an equal basis with young people, and also take on work that is less interesting to young people, which in any case will benefit the common cause.

Registration agreement

As in the classic situation, cooperation with a citizen who is on a well-deserved rest is carried out on the basis of an employment contract. If a person continues to work in the company in which he worked previously, the need to enter into an agreement in connection with reaching retirement age does not arise. If a pensioner joins a new company, one of the following agreements will be concluded:

- urgent;

- unlimited;

- part-time agreement;

- contractor;

- civil law.

The choice of type of agreement depends on the specifics of the work to be done and the agreement reached. You can sign up for an employment contract for a pensioner here.

When do they have the right to refuse?

Professions and areas of activity with an age limit of 65 years:

- Rectors and vice-rectors of universities, directors and deputy heads of scientific organizations.

- Civil servants.

- Managers and their deputies in federal, regional and municipal medical organizations.

Causes

Refusal to hire a pensioner is possible if the candidate does not meet the employer’s requirements. For example, a citizen is going to get a job as a security guard, but does not have the skills and training or the appropriate certificate. This application withdrawal option is legal and is considered a general case of personnel selection.

- Uzbek lagman recipe with photos

- 10 pieces of clothing that will age any woman

- When will the cameras start checking the OSAGO policy?

The rule applies to all workers, not just retirees.

An employer's refusal to hire candidates who are over the age limit for this profession is legal. In this case, employment will be impossible even if the applicant meets other requirements for the position (certain length of service, special education, etc.).

Refusal procedure

The procedure for rejecting a pensioner’s candidacy is not prescribed by law. Often this is an oral message about non-compliance with age requirements for civil servants, etc. The person hiring him will voice it during the interview. The pensioner may demand to justify the employer's refusal in writing and challenge his decision in court.

If the reasons are justified, you will not be able to win the process.

Hiring a pensioner under a fixed-term employment contract

Concluding a fixed-term contract only because of a person’s age is unacceptable. This ruling was made by the Constitutional Court in 2020.

IMPORTANT

If an employer forces a person to enter into a fixed-term contract only because the citizen is retired, he violates labor rights, the principles of equality and discriminates against the applicant for the position.

The grounds for concluding a type of agreement are enshrined in Article 59 of the Labor Code of the Russian Federation. The list includes the following features:

- a person carries out seasonal work;

- the citizen replaces the main employee;

- labor activity will be carried out abroad;

- a citizen is hired for temporary work, the duration of which does not exceed 2 months;

- the pensioner was hired to perform actions that are not related to the main activities of the company;

- the employee was hired to carry out specific work (cooperation with the person ends at the moment of signing the certificate of completion of work).

If none of them are available in the current situation, the employment of a citizen on well-deserved rest under a fixed-term contract can only be carried out with the consent of the person wishing to get a job. In the classic situation, a permanent employment contract is drawn up with a pensioner.

Attention

If an employer has entered into a fixed-term agreement without the person’s consent, the supervisory authority, having learned about this, will reclassify the agreement as permanent. It is impossible to conclude a fixed-term contract without grounds. However, the rules generally apply if a person receives an early pension. In a classic situation, the employer can still ask the applicant for the position to sign a fixed-term employment contract.

What is the difference between a civil law contract and an employment contract?

Some employers replace the standard document with a civil liability agreement. If the employee and the employer are parties to the employment contract, then the civil liability document is signed by the principal and the attorney, the seller and the buyer, the customer and the executor.

The difference in working under a contract without a work book relates not only to the terms, but also to the responsibilities of the parties.

One of the main differences between the documents is the absence of social guarantees in a civil contract, whereas in an employment agreement the parties are required to spell them out in detail.

For example, there is no social package, the opportunity to receive remuneration, a fixed salary, or special clothing (if required). The employer is not required to provide a safe workplace, tools to do the job, purchase suitable materials, or monitor the number of work breaks.

In the employment contract, the parties are required to stipulate that employees comply with the rules of the work schedule and work schedule. It establishes the main function of a person, for example, driver or administrator.

The civil law agreement does not specify the functions of employees. If they are there, the court has the right to determine that the document is an employment contract and the employer violated human rights.

Hiring a pensioner without a work book

In a classic situation, the employer makes an entry in the employee’s work book about the beginning of interaction. In practice, a situation may arise when, for some reason, a pensioner cannot provide a document. In this situation, an employer who wants to officially record the fact of interaction with a citizen can enter into an employment contract without a work book.

The agreement will serve as evidence of work activity and experience. However, the absence of an entry in the pensioner’s work book is a violation. The need to record in a document the fact of the start of labor activity is enshrined in Article 66 of the Labor Code of the Russian Federation.

Additional Information

It is possible to work without making an entry only if the citizen carries out part-time activities or has entered into a GPC agreement. Information is not recorded even if cooperation is carried out with a private person. In this situation, the pensioner simply does not have the right to independently make an entry in the document, although legal relations arise in this situation.

If a person does not have a work record, there are several ways to solve the problem. They may vary depending on the reasons for which a person does not have the necessary documents. The employer can:

- Get a new work book for a pensioner if the previous one was lost.

- Request a certificate from another employer and execute a part-time contract if the document is located at the citizen’s main place of work.

- Conclude a contract or civil contract, informing the employee that sick leave and vacation will not be paid.

The decision depends on the wishes of the employer and the specifics of the current situation.

Retired workers

Retired employees are responsible and reliable. A qualified and experienced employee is a real treasure for any employer. In this article we will talk about some of the features of labor relations with pensioners.

Russian legislation distinguishes three categories of pensioners:

— old-age (age) pensioners;

— military pensioners;

- disabled people receiving a pension.

In the article we will look at the features of labor relations with old-age pensioners.

Who is considered an old-age pensioner?

According to paragraph 3 of the Determination of the Constitutional Court of the Russian Federation dated May 15, 2007 N 378-O-P, old-age pensioners include persons who have reached retirement age and who, in accordance with pension legislation, have been assigned an old-age pension. If a pension is assigned due to other circumstances, such a citizen is not considered an old-age pensioner.

Men who have reached the age of 60 years and women who have reached the age of 55 years have the right to an old-age labor pension (Clause 1, Article 7 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”).

However, in some cases, an old-age labor pension is granted before reaching the specified age:

- persons working in special conditions. Lists of relevant jobs, industries, professions, positions, specialties and institutions are listed in Decree of the Government of the Russian Federation of July 18, 2002 N 537;

- some categories of workers listed in Art. Art. 27 and 28 of Law N 173-FZ (for example, men upon reaching the age of 55 years and women upon reaching the age of 50 years, if they have worked for at least 15 calendar years in the Far North or at least 20 calendar years in equivalent areas and have insurance experience of at least 25 and 20 years, respectively);

- unemployed citizens who were dismissed due to the liquidation of an organization, a reduction in personnel or staff and who, regardless of interruptions in their work activity, have a length of service that gives the right to an old-age pension, but not earlier than two years before the retirement date established by the legislation of the Russian Federation ( Clause 2 of Article 32 of the Law of the Russian Federation of April 19, 1991 N 1032-1 “On employment in the Russian Federation”).

Please note: a citizen who has reached retirement age, but who has not been assigned a pension for various reasons, is not considered a pensioner (clause 3 of the Determination of the Constitutional Court of the Russian Federation of May 15, 2007 N 378-O-P).

Peculiarities of employment of pensioners

According to Art. 3 of the Labor Code, everyone has equal opportunities to exercise the right to work. For example, no one can be limited in labor rights and freedoms or receive any advantages due to age (Part 2 of Article 3 of the Labor Code of the Russian Federation). Therefore, in general cases, the rules for hiring age pensioners are similar to the rules applied to ordinary employees.

However, the law provides for two restrictions related to the age of the applicant. For civil servants, the age limit for civil service is 65 years (clause 4, clause 2, article 39 of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service of the Russian Federation”). Candidates under the age of 65 can be elected to the positions of heads of universities (rector, vice-rectors, heads of branches, deans of faculties) (Part 12 of Article 332 of the Labor Code of the Russian Federation). Upon reaching this age, employees occupying these positions should be transferred, with their written consent, to other positions that meet their qualifications.

What agreements can be concluded with a pensioner?

With a senior citizen, the employer can conclude:

— employment contract for an indefinite period;

— fixed-term employment contract (including a contract for a period of up to two months);

— a civil law agreement (for example, a contract or paid services). When concluding such an agreement with a pensioner, the employer must warn him that vacation and sick leave will not be paid in this case.

A pensioner can work part-time in an organization.

Let's consider what rights a pensioner will have depending on the type of employment contract.

Indefinite employment contract

The legislation does not provide for any specific features of concluding an employment contract for an indefinite period with retired employees.

The list of documents required to conclude an employment contract is given in Art. 65 Labor Code:

— passport or other identity document;

- employment history;

— insurance certificate of state pension insurance;

— military registration documents (for pensioners liable for military service).

If a pensioner enters a job that requires special knowledge or special training, he must also provide a document on education, qualifications or special knowledge. In some cases, taking into account the specifics of the work, it may be necessary to present additional documents, for example, about the state of health (Part 2 of Article 65 of the Labor Code of the Russian Federation).

An elderly employee candidate is not required to present a pension certificate.

Fixed-term employment contract

Fixed-term contract - only by agreement. If a pensioner wants to get a job, the employer can enter into a fixed-term employment contract with him. In this case, a fixed-term contract can be concluded only by agreement between the employee and the employer (Part 2 of Article 59 of the Labor Code of the Russian Federation).

Please note: if an employee working in an organization has become a pensioner, he does not need to be fired and a fixed-term employment contract is signed. Otherwise, in accordance with Part 1 of Art. 5.27 of the Code of Administrative Violations, an organization can be fined for violating labor and labor protection laws.

Fixed-term employment contracts include those concluded to perform seasonal work. When drawing up such an agreement, the employer should warn the employee that paid leave is provided to him or compensation for unused leave is paid at the rate of two working days per month of work (Article 295 of the Labor Code of the Russian Federation). If the employee does not use the vacation or is not granted vacation with subsequent dismissal, he will receive appropriate monetary compensation (Part 1 of Article 126 of the Labor Code of the Russian Federation).

If the employer insists on a fixed-term employment contract. A forced limitation on the term of an employment contract with a retired employee is unacceptable. That is, the employer does not have the right to insist on concluding a fixed-term contract if the nature of the work to be done and the conditions for its implementation allow concluding an open-ended employment contract. If the court subsequently finds that the employee was forced to enter into a fixed-term contract, such a contract will be recognized as open-ended (concluded for an indefinite period). This is stated in paragraph 13 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2.

In addition, the court recognizes a fixed-term contract as indefinite if, at the end of its validity period, the organization enters into a similar fixed-term contract with the pensioner with the same labor function as before. For violating the rules for drawing up a fixed-term employment contract, the company may be fined. The fine for a legal entity ranges from 30,000 to 50,000 rubles. In addition, suspension of the organization’s activities for up to 90 days is used as a penalty (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Entry in the work book. In the work book of a retired employee, an entry about hiring should be made in the general manner (that is, without indicating that a fixed-term contract has been concluded) in accordance with clause 3.1 of the Instruction approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 N 69.

Probation

The possibility of establishing a probationary period when hiring is provided for in Art. 70 of the Labor Code.

You can test a pensioner. Pensioners are not included in the list of persons for whom no testing is imposed upon hiring (Part 4 of Article 70 of the Labor Code of the Russian Federation). This means that the general rules apply to them:

— a probationary period can be established only by agreement of the parties (Part 1 of Article 70 of the Labor Code of the Russian Federation);

- the condition of the probationary period must be included in the text of the employment contract (otherwise it is considered that the pensioner was hired without a probationary period) and in the order for employment (parts 1 and 2 of article 70 and part 1 of article 68 of the Labor Code RF).

The duration of the test depends on the type of contract concluded.

Employment contract for an indefinite period. As a general rule, the probationary period should not exceed three months (Part 5 of Article 70 of the Labor Code of the Russian Federation). But if a pensioner gets a job as a manager, his deputy or chief accountant, the duration of the trial can increase to six months (Part 5 of Article 70 of the Labor Code of the Russian Federation).

Fixed-term employment contract for a period of two to six months or for the period of seasonal work. The probationary period cannot exceed two weeks (Part 6, Article 70 of the Labor Code of the Russian Federation).

Fixed-term employment contract for up to two months. When concluding this agreement, a probationary period cannot be established (Article 289 of the Labor Code of the Russian Federation).

Part-time pensioner

In the employment contract with a part-time worker, it is necessary to indicate that the work is a part-time job. This is stated in Part 4 of Art. 282 of the Labor Code.

Part-time pensioners are entitled to the same guarantees and compensation as regular employees. For example, they are entitled to annual paid leave, sick leave pay and compensation for unused vacation upon dismissal.

Information about part-time work can be entered into the work book at the place of main work (Part 5, Article 66 of the Labor Code of the Russian Federation).

A certified copy of the work record. When applying for a job as an external part-time worker, the pensioner must present the documents listed in Art. 283 Labor Code. The list of these documents differs from the list of documents presented when concluding the main employment contract. Thus, it is not necessary to present a work book and military registration documents (Part 1 of Article 65 of the Labor Code of the Russian Federation). However, to assign temporary disability benefits, you will need a copy of the work record certified at the place of your main job.

Why is it worth presenting a certificate of insurance from state pension insurance? The list of documents required to conclude a part-time employment contract does not include an insurance certificate of state pension insurance. However, in the interests of a part-time pensioner, the employer may ask to present him for the purpose of calculating pension contributions. The calculation of pension contributions and their proper accounting in the compulsory pension insurance system will allow an older worker to qualify for a subsequent recalculation of the pension and an increase in its size.

Pension insurance for a working pensioner

Working pensioners, just like ordinary employees, are subject to compulsory pension insurance (Clause 1, Article 7 of Federal Law No. 167-FZ of December 15, 2001 “On Compulsory Pension Insurance in the Russian Federation”, hereinafter referred to as Law No. 167-FZ). In this case, it does not matter under which contract they work - an employment contract or a civil law contract (Clause 1, Article 7 of Law No. 167-FZ). This means that the employer is obliged to pay pension contributions for wages and other remunerations paid to working pensioners (clause 1 of Article 236 and clause 1 of Article 237 of the Tax Code of the Russian Federation, clause 2 of Article 10 of Law No. 167-FZ).

In 2009, contributions are calculated according to the tariffs established in paragraphs. 1 item 2 art. 22 of Law No. 167-FZ. For employees born in 1966 and older, contributions are transferred at a rate of 14% and only to finance the insurance part of the pension (clause 2 of Article 22 of Law No. 167-FZ).

In accordance with paragraph 2 of Art. 24 of Law N 167-FZ, the employer is obliged to transfer insurance premiums for the previous month by the 15th day of each month. If contributions are paid late, then for each calendar day of delay, penalties will be charged starting from the day following the established day for payment of insurance premiums (clause 4 of Article 26 of Law No. 167-FZ). And for non-payment or incomplete payment of pension contributions, the employer may be fined in the amount of 20% of the unpaid amounts of insurance contributions (clause 2 of Article 27 of Law No. 167-FZ).

Please note: from January 1, 2010, the above procedure for calculating and paying insurance pension contributions changes due to the entry into force of Federal Law dated July 24, 2009 N 213-FZ. We will tell you more about this in upcoming issues.

The employer, at the request of working pensioners, is obliged to provide them with information about the transfer of contributions to the Pension Fund (Clause 1, Article 15 of Law No. 167-FZ).

Working hours and working conditions

The working hours for pensioners can be flexible and depend on what job the pensioner is applying for.

Full working time. Normal working hours should not exceed 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation). This applies to permanent, temporary and seasonal workers, as well as workers hired for the duration of certain work.

Part-time work. According to Part 1 of Art. 93 of the Labor Code, part-time work is established in the form of a part-time working week or part-time working day (shift).

Pensioners are not among the persons for whom the employer is obliged to establish such a working time schedule in accordance with Part 1 of Art. 93 of the Labor Code. But this is possible at the request of a working pensioner.

However, part-time working hours can also be established at the initiative of the employer. The latter has the right to unilaterally introduce this regime for a period of up to six months if, due to organizational and technical measures carried out in the company, which entail significant changes in working conditions, there is a possibility of mass layoffs of workers. This is stated in Part 5 of Art. 74 Labor Code.

Wages for pensioners working part-time are calculated in proportion to the time actually worked or depending on the amount of work they perform (for piecework wages) (Part 2 of Article 93 of the Labor Code of the Russian Federation). The work of part-time workers is also paid (Part 1 of Article 285 of the Labor Code of the Russian Federation). This means that their wages may be less than the minimum wage. At the same time, the wages must take into account all additional payments and allowances to the salary, that is, all types of payments listed in Part 1 of Art. 129 of the Labor Code, namely:

— additional payments and allowances of a compensatory nature, for example, for work in special climatic conditions;

— incentive payments (additional payments and bonuses of an incentive nature, bonuses, etc.).

In addition, according to Part 3 of Art. 93 of the Labor Code, part-time work does not entail any restrictions on the labor rights of employees. For example, the employer is required to provide basic paid leave of 28 calendar days to both full-time and part-time employees.

Reduced working hours. If a working old-age pensioner is also a disabled person of group I or II, the duration of his working time should be no more than 35 hours per week (Part 1 of Article 92 of the Labor Code of the Russian Federation). Such employees are paid the same amount as for full weekly work. This follows from Part 3 of Art. 23 of the Federal Law of November 24, 1995 N 181-FZ “On the social protection of disabled people in the Russian Federation.”

A 40-hour work week should also be reduced to 36 hours for workers employed in hazardous and hazardous industries, if the special nature of working conditions is confirmed by the results of workplace certification (Part 1 of Article 92 of the Labor Code of the Russian Federation).

The condition for reduced working hours must be specified in the employment contract (Part 2 of Article 57 of the Labor Code of the Russian Federation).

Work exceeding the duration of a shortened week or shift will be considered overtime for such workers (Part 1 of Article 99 of the Labor Code of the Russian Federation). A working pensioner who is disabled can be involved in overtime work only if two conditions are met:

— availability of his written consent;

- such work does not harm his health for medical reasons. At the same time, he must be familiarized with the right to refuse overtime work (Part 5, Article 99 of the Labor Code of the Russian Federation).

Work from home. The employer can use the services of retired homeworkers, who, regardless of the type of pension assigned, have a preferential right to conclude an agreement to work from home (clause 4 of the Regulations approved by the Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated September 29, 1981 N 275/17-99).

Homeworkers regulate their own working hours. In the working time sheet, forms (NN T-12 and T-13) are approved by Resolution of the State Statistics Committee of Russia dated 01/05/2004 N 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”, an eight-hour working day is recorded. If a retired homeworker decides to work overtime, at night, on weekends, etc., he must be warned in advance that he is not entitled to any additional payments or time off for this.

Working conditions for retired workers

The legislation does not establish special requirements for working conditions for workers of retirement age. But the employer, when hiring such an employee, must take into account that working conditions, in particular the working hours and rest periods, must correspond to the working capacity of a particular elderly person.

General advice to employers on improving the working conditions of retired workers and the production sector is given in paragraph 13 of Recommendation No. 162 “On older workers”, approved by the International Labor Organization on June 23, 1980. For example, employers are advised to:

— change forms of work organization if they lead to excessive stress on older workers, in particular by limiting overtime work;

- adapt the workplace and tasks to the capabilities of a working pensioner, using all available technical means and, in particular, the principles of ergonomics, in order to maintain health and performance and prevent accidents;

— organize systematic monitoring of the health status of older workers;

— ensure the safety and health of pensioners.

Increased guarantees for working pensioners compared to ordinary employees can be provided for by a collective agreement, agreements, local regulations, or an employment contract.

Vacations

Let's consider what types of vacations and for what duration working pensioners are entitled.

Annual basic paid leave

All pensioners working in an organization under an employment contract are entitled to annual leave of 28 calendar days (Article 115 of the Labor Code of the Russian Federation).

If a pensioner has just started working in an organization, then the right to the first vacation arises after six months of continuous work (Part 2 of Article 122 of the Labor Code of the Russian Federation). A retired employee can take vacation for the second and subsequent years at any time in accordance with the vacation schedule.

Let us recall that some categories of workers of retirement age have the right to go on vacation at any time convenient for them, for example, participants of the Great Patriotic War and combat veterans (clause 13, clause 1, article 15 and clause 11, clause 1, article 16 of the Federal Law of January 12, 1995 N 5-FZ “On Veterans”), pensioners who suffered as a result of the Chernobyl accident (clause 5 of Article 14 of the Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation due to disaster at the Chernobyl nuclear power plant").

If the employee is an external part-time worker, he is also entitled to annual paid leave. Leave for a part-time pensioner must be granted simultaneously with leave for the main job. Therefore, if an employee has not worked at a part-time job for six months, he must be given leave in advance (Part 1 of Article 286 of the Labor Code of the Russian Federation).

Leave without pay

The employer is obliged to provide working old-age pensioners with leave without pay for up to 14 calendar days a year (paragraph 3, part 2, article 128 of the Labor Code of the Russian Federation). Moreover, this leave is provided regardless of the type of employment contract concluded with the pensioner.

The time of such leave is counted towards the employee’s total continuous work experience. The number of vacation days at your own expense exceeding 14 calendar days is excluded from the length of service giving the right to annual paid vacations (Part 2 of Article 121 of the Labor Code of the Russian Federation). This means that the end date of the working year for which the employee is granted annual paid leave will be postponed by the corresponding number of days of unpaid leave. Therefore, it is recommended to notify the employee of this circumstance in advance.

Additional holidays

For some categories of employees of retirement age, the employer is required to provide additional paid leave, for example:

- for those working in the regions of the Far North - 24 calendar days, and for persons working in areas equated to the regions of the Far North - 16 calendar days (Part 1 of Article 321 of the Labor Code of the Russian Federation);

- retired employees engaged in heavy and dangerous work, the special nature of which is confirmed by certification of workplaces (Article 118 of the Labor Code of the Russian Federation). The list of categories of employees and the minimum duration of leave (seven calendar days) were approved by Decree of the Government of the Russian Federation of November 20, 2008 N 870;

- workers injured as a result of the Chernobyl accident - 14 calendar days (clause 5 of Article 14 of the Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”);

— retired employees with irregular working hours — at least three calendar days (Part 1 of Article 119 of the Labor Code of the Russian Federation).

Leaves for special categories of pensioners

If a retired employee is disabled (regardless of the disability group), he has the right:

- for an extended main leave of 30 calendar days (Part 5, Article 23 of the Federal Law of November 24, 1995 N 181-FZ “On the social protection of disabled people in the Russian Federation”). To do this, the employee must write a corresponding application;

— leave without pay — up to 60 calendar days a year (paragraph 5, part 2, article 128 of the Labor Code of the Russian Federation).

Leave for home-based pensioners is provided according to the general rules - 28 calendar days (Part 4, Article 310 of the Labor Code of the Russian Federation).

Author: O.V. Negrebetskaya Scientific editor of the magazine “Salary”

Remuneration for a pensioner

A pensioner's salary is calculated on a general basis. Its size depends on:

- employee qualifications;

- volume of manufactured products;

- time worked.

An employer does not have the right to reduce an employee's salary because of his age. This will be a gross violation of the Labor Code of the Russian Federation. If a pensioner discovers that he is not being paid extra, he can go to court to restore his violated rights.

Working hours and working conditions

The working hours for pensioners can be flexible and depend on what job the pensioner is applying for. Full working time. Normal working hours should not exceed 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation). This applies to permanent, temporary and seasonal workers, as well as workers hired for the duration of certain work.

Pensioners are not among the persons for whom the employer is obliged to establish such a working time schedule in accordance with Part 1 of Art. 93 of the Labor Code. But this is possible at the request of a working pensioner. However, part-time working hours can also be established at the initiative of the employer.

Wages for pensioners working part-time are calculated in proportion to the time actually worked or depending on the amount of work they perform (for piecework wages)

Additional leave

If a person continues to work, he has the right to receive standard leave. An employee can take a break from work after six months from the date of commencement of work in the company. However, the legislation provides for a number of benefits for citizens receiving an old-age pension. According to Article 128 of the Labor Code of the Russian Federation, a pensioner has the right to receive 14 days of annual unpaid leave. Provision of required rest is carried out in accordance with the established schedule or on the basis of an agreement with management.

Is it possible to work without registration?

Unofficial employment is illegal. In fact, organization leaders often offer citizens to work without registration (in this case, the employee does not need to pay insurance premiums, etc.). By agreeing, the pensioner deprives himself of the guarantees defined by the Labor Code of the Russian Federation (for example, paid leave or compensation upon dismissal due to reduction).

Additional disadvantages:

- Failure to pay personal income tax on income received, from the point of view of the law, is classified as tax evasion.

- The insurance period of such an employee will not increase due to the lack of contributions, so the pension will not increase after annual recalculation.

There is a moratorium on the indexation of labor pensions for working pensioners on the territory of the Russian Federation.

For those who perform duties without official registration or work under someone else’s name, this requirement does not apply and their payments are increased every year by a set amount (for example, in 2020 - by 7.05% or an average of 1,000 rubles per month ).

Dismissal of a pensioner

If a pensioner wants to complete his work activity and retire, dismissal will be carried out on a general basis. However, the employer will have to comply with a number of nuances. So, if a pensioner resigns of his own free will, he may not work for 2 weeks. This rule is enshrined in Article 80 of the Labor Code of the Russian Federation.

If the employer is the initiator of termination of the employment relationship, it must be taken into account that he does not have the right to fire a person because he has reached retirement age. This is reflected in Article 3 of the Labor Code of the Russian Federation. If a violation has occurred, the citizen can go to court. Typically, in this situation, the claims are satisfied, and the employee is reinstated at his previous place of work. If the company is liquidated, the dismissal of the pensioner is carried out on a general basis.

For your information

If a person cannot cope with his responsibilities, the employer may offer him a change of position or switch to part-time work.

Can I be hired after retirement?

According to Part 2 of Art. 3 of the Labor Code of the Russian Federation, every person has the right to work without any age restrictions. Therefore, pensioners can continue to perform job duties at their previous workplace, as well as re-employ themselves in another organization, changing working conditions in connection with their new interests, family circumstances, or health status (the reasons in this case have no legal significance).

Based on this, employers can legally hire an elderly person of retirement age, often finding in him a reliable and responsible employee with extensive life and professional experience.

How to determine the health status of an applicant

The employer has the right to determine whether a pre-retirement employee is suitable for the work performed due to health reasons or personal qualities. To do this, they conduct a medical examination of applicants, their psychological testing, as well as polygraph (lie detector) testing.

You cannot refuse this if you are applying for a position for which the employer has determined that a test is required. The employer has the right not to hire those who do not provide the necessary documents, refuse the offered position or undergo an examination (Article 64 of the Labor Code of the Russian Federation).

A medical examination is necessary when work requires stamina and well-being. This often applies to professions related to the management of transport, equipment, and machine tools. The examination is carried out at the expense of the organization.

Persons classified as pensioners

A person may acquire pensioner status for various reasons. The ruling of the Constitutional Court of the Russian Federation No. 378-O-P dated May 15, 2007 states that old-age pensioners include persons who have been assigned a pension due to reaching a certain age. Therefore, the mere fact of reaching the appropriate age does not constitute grounds for a citizen to be considered a pensioner.

In accordance with the current Federal Law No. 173-FZ of December 17, 2001, the following are entitled to an old-age pension:

- Women over 55 years of age;

- Men over 60 years of age.

However, this document will be replaced from 01/01/2015 by a new law, adopted on 12/28/2013 No. 400-FZ “On Insurance Pensions”. This document provides for several types of insurance pensions:

- Due to old age.

- Due to disability.

- On the occasion of the loss of a breadwinner.

Article eight of the new law contains a condition on the possibility of assigning an old-age insurance pension when a person reaches the appropriate age, has a certain insurance period, and has a pension coefficient.

Today, in accordance with paragraph 2 of Art. 32 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation”, unemployed persons dismissed due to the liquidation of an enterprise or layoff have the right to an old-age pension. The main condition in this case will be the presence of appropriate work experience and no more than two years remaining until retirement in the manner established by the legislation of the Russian Federation.

Is it possible to refuse employment?

Refusal is possible, but only if the employee’s retirement or pre-retirement age does not correspond to the position, lack of experience for some professions, lack of necessary documents for employment, or if there are medical contraindications.

A person’s age should not impose restrictions on registration with an organization; for refusal, the employer may be held administratively liable.

If a working employee reaches retirement age, he has the right to continue working under the same conditions; the employer cannot fire him on his own initiative. A person can only voluntarily leave work.