Conversion of insured rights into initial pension capital

The insured rights of a citizen in Soviet legislation were determined in the form of length of service and the amount of his salary, on which taxes were paid. Currently, the actual size of these payments has lost relevance: Soviet rubles and salaries are a thing of the past, the method of calculating the labor pension has changed.

The transformation of virtual pension rights into real monetary amounts until January 1, 2020 was regulated by the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ. On its basis, pension rights were calculated according to the rules of Soviet legislation, indexed taking into account the realities of the current time and entered into the personal account of the Pension Fund of the Russian Federation in the form of initial capital.

PC1 was determined using the following algorithm:

- calculation of estimated pension;

- taking away from it a fixed basic part established by law;

- multiplied by the number of years of survival established by law.

The procedure for converting pension rights until 2002

To calculate the old-age pension until 2002, the employee's length of service and salary were used. According to the Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ from 2002 to 2020. Pension rights were determined in accordance with Soviet legislation, indexed, and then transferred to the personal account of the Pension Fund of the Russian Federation in the form of initial capital.

You can calculate the RPC yourself using the following method:

- The length of service coefficient is determined.

- The average monthly earnings coefficient (AMC) is calculated.

- The estimated pension is calculated as of January 2002.

- Valorization is being carried out.

- A correction factor is applied.

How to determine your estimated pension

At the initial stage, you need to determine the experience coefficient. It depends on the gender of the applicant and the duration of employment. Please note that regardless of the calculation results, the maximum value applied is 0.75:

- If a man’s length of service is less than 25 years, and a woman’s is 20 years, the SC value is set to 0.55.

- For each additional year of experience over 25 years for men and 20 for women, 0.01 is added to the SC value of 0.55.

At the next stage, the calculation of the KSZ is carried out. To do this, the average salary for 2001-2002 is calculated. or for another 60 months. The result obtained must be divided by the average monthly salary in Russia for the same time period. Average monthly earnings in Russia from 2001 to 2002. was 1,494.5 rubles.

Regardless of the final result, the marginal KSZ is:

- 1.4-1.9 – for those working at that time in the Far North;

- 1.2 – for all other applicants.

Having all the data, the amount of the estimated pension is determined:

- If the experience coefficient is 0.55:

RP of men = (SC x KSZ x 1,671 - 450) x (annualized experience accumulated before 2002/25)

RP of women = (SC x KSZ x 1,671 - 450) x (annualized experience accumulated before 2002/20)

- 1671 is a constant and corresponds to the average salary in the country in December 2001.

- 450 is the basic pension amount established by Law No. 173-FZ.

Please note that according to Law No. 173-FZ, if RP = SK x KSZ x 1,671 is less than 660, the estimated pension is determined by the formulas:

RP men = 210 x (annualized experience accumulated before 2002/25)

RP of women = 210 x (annualized experience accumulated before 2002/20)

RP = SK x KSZ x 1,671 – 450

Please note that according to Law No. 173-FZ, if RP = SK x KSZ x 1,671 is less than 660, the calculated pension is set at 210.

Calculation of estimated pension

RP is a conditional expression of the cash benefit to which a person would be entitled if he retired in 2002 with a full length of service. The methodology for determining the RP was based on Soviet legal norms:

- the person's highest average monthly earnings for any 5 consecutive years formed the basis of the calculations;

- full length of service (men - 25 years; women - 20 years) gave the right to receive 55% of the optimal average monthly salary, i.e. the experience coefficient (SC) was 0.55;

The definition of the estimated pension in the form of a formula was as follows:

SC – length of service coefficient, which increased by 0.01 for each year worked beyond the length of service, but should not have been higher than 0.75;

KZ – salary coefficient, could not exceed 1.2;

RP – the basis for calculating the estimated pension capital; RP value is not less than 660 rubles.

The estimated pension capital expressed the insurance part of the pension (ISP), therefore its base part was subtracted from the RP: ISP = RP - BP. Federal Law “On Labor Pensions” No. 173-FZ established the BP value at 450 rubles.

The resulting difference was multiplied by the “survival” coefficient T, expressed in months. The state established the number of years of survival in retirement on the basis of statistical data.

In 2002, the T coefficient was 12 years (144 months), in 2014 it reached 19 years, and as of 2020, the survival rate was 20 years (240 months). The formula for converting Soviet-era pension rights into initial capital was as follows: PK1 = SSP x T.

How does the timing of retirement affect the PKK?

The timing of a citizen’s retirement affects the PKK as follows:

- Persons whose work experience began after 2002 have in their personal account of the Pension Fund the entire amount of payments that make up the pension capital. It is subject to annual indexation established by the government, adjusted for inflation.

- Persons retiring after January 1, 2002 have an estimated capital in their account, consisting of three parts: PC1 = SPP x T (the T value is taken for the year of retirement);

- PC2 - the amount of savings of the pre-reform period;

- valorization amount (SV) – bonus for work under the Soviet regime.

SV = SSP x (10+n)%, where n is the number of years of Soviet experience before 1991, and 10% is added to everyone with this experience. The formula for pension capital for them is: PRK = PC1 + PC2 + SV.

- Persons who were retired as of January 1, 2002 receive benefits based on PKK = PK1 + SV, it depends on their previous salary and Soviet work experience and has an increase in the form of valorization, which has been carried out since 2010 for all non-working pensioners.

Example. Determination of estimated pension capital

- Citizen A. finished her working career in 2008. Total experience – 30 years (SC = 0.55 + 0.1);

- work experience before 1991 – 12 years; valorization coefficient: 10% +12% = 0.22;

- PC1 = (1,303 – 450) x T. For 2008, T = 15 years (180 months), then:

- Pension capital = PC1 + PC2

- Valorization - calculated since 2010 only based on the size of PC1 for 2002, taking into account the length of service until 1991. The insurance part of the estimated pension (853 rubles) must be multiplied by the indexation coefficients (3.678) and valorization coefficients (0.22):

CB = 853 x 0.22 x 3.768 = 707 rub.

- The actual pension of citizen A. in 2010 was:

Obviously, the RIC is a value that depends on many factors, including the insured amount of payments (SIP), the basic pension (BPP), the duration of payment of pension benefits (T), indexation, valorization (SV).

In connection with the entry into force of the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, the calculated capital - reflecting the pension rights of citizens until 2020 - was transferred to points forming the individual pension coefficient, and since then is no longer relevant.

As part of the pension reform ongoing in the country, in accordance with the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation”, which came into force on January 1, 2002, an assessment of his pension rights will be carried out for each insured person (defined estimated pension capital) based on the circumstances existing as of December 31, 2001.

This provision is provided for in Article 30 of the said Federal Law.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

For current pension recipients, the assessment of pension rights in accordance with the new legislation has already been carried out since January 1 of the current year, taking into account the documents on work experience and earnings available in the pension files of pensioners.

The next stage of work on assessing pension rights will concern citizens who have not yet reached retirement age, and will work up to it under the new pension system.

The estimated pension capital will be calculated by him according to a certain formula based on individual (personalized) accounting data or documents on length of service and earnings issued by relevant organizations.

If you have a full total work experience, i.e. 20 years for women and 25 years for men, the length of service coefficient used in the calculation is 0.55 and will increase by 0.01 for each full year of total work experience in excess of the required one.

For persons with incomplete total work experience, the amount of estimated pension capital calculated for full total work experience is reduced by the ratio of the number of months of actual total work experience to the number of months of full total work experience.

On this basis, persons who have not yet reached retirement age will be calculated the so-called estimated pension.

The formula for calculating it is:

RP = SK * ZR/ZP * SZP, where

ZP – average monthly salary in the country for the same period;

SWP – average monthly salary in the country for the third quarter of 2001 (equal to 1671 rubles)

SC – experience coefficient.

In this case, the ratio of ZR/ZP is taken to be no more than 1.2. For persons living in the regions of the Far North and equivalent areas where regional coefficients for wages are established, the specified ratio can be taken into account in an amount not exceeding 1.4; 1.7; 1.9 depending on the size of the regional coefficient established for wages

Based on the estimated size of the pension, the size of the initial pension capital with full service as of January 1, 2002 will be determined by the formula:

PC = (RP – warhead) * T, where

RP – estimated pension amount;

BC – the amount of the basic part of the old-age labor pension (450 rubles);

T - expected pension payment period in months (as of January 1, 2002, 144 months)

If the length of service is less than the minimum established by law (less than 20 years for women and 25 years for men), the size of the pension capital will be reduced in proportion to the length of service. Pension capital for incomplete service is calculated using the following formula:

PC = PKfull * ST / ST full, where

PKpoln - pension capital with full service;

ST - actual work experience as of January 1, 2002 in months;

ST full - full length of service in months, established by law (for women 240 months, for men - 300 months).

The amount of initial pension capital in rubles will be recorded in the individual personal account of each citizen. Subsequently, the amount of this capital is subject to indexation.

The indexed initial pension capital, together with insurance contributions, which will be subsequently paid by employers in favor of each employee, will constitute the accumulated pension capital for determining the size of the labor pension by the time they reach retirement age.

To fully assess the pension rights of each Russian and determine their initial pension capital, the pension authorities must have all the necessary information at their disposal. For this purpose, the Pension Fund will organize the collection of documents on wages and work experience of citizens.

Since the majority of people in the country today work in organizations, for convenience, such information will be collected through the organizations where the person works.

Thus, the administrations of organizations carry out all contacts regarding conversion with the Pension Fund Administrations at the place of their registration. And each employee should submit to the personnel service of his organization documents about his work experience, and, if necessary, about the salary that he chose to calculate the initial pension capital, for example, while working in another area.

Entrepreneurs, as well as individuals who provide themselves with work, must take care of submitting documents themselves to assess pension rights. For them, the collection of data on existing experience and earnings will be organized at the Pension Fund Offices at their place of residence.

It should be taken into account that when assessing pension rights, the total length of service includes other periods along with work in an institution, enterprise, collective farm or cooperative organization:

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

periods of work as a worker, employee (including hired work outside the territory of the Russian Federation), member of a collective farm or other cooperative organization;

work in the peasant (farm) economy of members of the economy and citizens who have entered into agreements on the use of their labor;

periods of other work in which the employee, not being a worker or employee, was subject to compulsory pension insurance;

periods of self-employment

Work book and other documents issued from the place of work, a higher organization or archive

Work record book together with a document confirming payment of insurance contributions to the Pension Fund of the Russian Federation

Document on the period of payment of insurance premiums

From 01/01/1991 – document on the period of payment of insurance contributions to the Pension Fund of the Russian Federation

Before 01/01/1991 – certificates from financial authorities confirming payment of taxes on income received

periods of creative activity of members of creative unions - writers, artists, composers, filmmakers, theater workers, as well as writers and artists who are not members of the relevant creative unions

Certificate from the organization regarding the period of payment of insurance contributions to the Pension Fund Before the formation of the Pension Fund - certificate from the secretariat of the board of the creative union

service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, internal affairs agencies of the Russian Federation, foreign intelligence agencies, federal security service agencies, as well as in state security agencies and internal affairs agencies of the former USSR (including periods when these bodies were called differently), stay in partisan detachments during the Civil War and the Great Patriotic War

Military ID, certificates from military commissariats, military units and archival institutions, entries in the work book about service

period of stay on disability of groups I and II, received as a result of an injury associated with production or an occupational disease

Extract from the inspection report at VTEK (MSEC)

period of stay in places of detention beyond the period assigned during the review of the case

Certificate from the state body executing sentences regarding periods of stay in places of detention

periods of receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area and finding employment

Certificate from the state employment service

Individual pension capital will become a “tax on financial illiteracy”

The reform of funded pensions will be paid for by Russians.

The Ministry of Finance and the Central Bank have announced a new date for the introduction of individual pension capital (IPC), which will replace the funded part of the pension. Over the years of discussion, no department has published the draft law, but in theory, the main innovations should be the voluntary nature of contributions and the inability of the state to use the savings of future retirees. At the same time, the introduction of the IPC will increase the burden on taxpayers.

Discussion of the idea of the IPC began back in 2014-2015, but was never formalized into a bill. The Ministry of Finance’s proposals for pension reform proposed replacing the mandatory funded part of the pension with a voluntary one – IPC – as early as 2020. Later, the Central Bank predicted that the system would begin operating in 2020, but the authorities never submitted the project to the State Duma.

The document will be published by the Ministry of Finance and the Central Bank within a month, the new deadlines were announced by the media, according to them, the basic scenario was agreed upon at a meeting with the First Deputy Prime Minister. Currently, the employer pays contributions to the Pension Fund in the amount of 22% of the salary. Finance Minister Anton Siluanov said that due to the IPC, the pension size can be increased by 10-20 percentage points from the salary, and additional investment resources in the economy will be replenished by 1.5% of GDP. However, this will most likely be done at the expense of additional burden on pensioners.

The transition to the IPC does not involve replacing the 6% funded part, which is currently invested by NPFs and VEB, with voluntary contributions from employees, but a redistribution of payments. 22% contributions will be sent to the distribution system and will become the insurance part of the pension (currently only the insurance part is formed by the “silent ones” who left their money in the Pension Fund). The employee will be offered to additionally contribute up to 6% from his salary received to the funded part.

Previously, the authorities announced their readiness to provide citizens with the opportunity to refuse to “save for retirement” or independently set the desired percentage of contributions. However, in what format the law will be presented is a big question: back in 2016, the Ministry of Finance wanted to force all taxpayers to join the IPC; if the employee did not independently set the amount of the contribution, he would automatically start saving 6% of his salary.

In the current version, the IPC will become an additional burden on taxpayers, says Otkritie Broker analyst Timur Nigmatullin .

“Contributions will actually be paid in addition to the regular rate of insurance contributions to the Pension Fund. They will be made by the employee himself, the contribution will increase from 0 to 6% by 1 percentage point per year, but can be canceled at the request of the employee. As a result, the IPC is nothing more than a tax on financial illiteracy. It is obvious that such contributions will be paid primarily by citizens who are not aware of such a reform and do not control their payments to the state. Nevertheless, we must admit that the innovation will effectively increase the size of the average pension in the future,” the analyst told Nakanune.RU .

The idea of the existing funded part, which at one time was agitated to be transferred to a non-state pension fund, is also to increase future pensions. But at the behest of the state, Russians’ money has been “frozen” since 2014, when deductions in the amount of 6% of Russians’ salaries were allocated to payments to pensioners. A decision was made to extend the measure until 2020, which in a three-year period will bring an additional 551.3 billion rubles. Pension Fund.

The money transferred under the IPC will be the property of the citizen himself, similar to a bank deposit. But in the absence of a project, it is difficult to say whether the state, after the transition to the IPC, will be able to make decisions regarding Russians’ money similar to the “freezing” of the funded part of pensions, adds Nigmatullin.

“Theoretically, this is possible in terms of payments received annually, rather than the amount of savings. For example, they can be forced to pay off the Pension Fund deficit. It may not even require a new law,” he says.

According to market participants, the IPC will help balance the pension system. According to calculations by the Association of Non-State Pension Funds (ANPF), the deficit in insurance pension contributions in 2017 is estimated at 34%, and its reduction is possible due to an increase in the insurance premium rate from the current 22% to at least 34%. If the president's order to increase wages is fulfilled, an even higher tariff will be required. The introduction of the IPC will solve the problem only in the case of maximum coverage of the population, but not less than 25% of employees with a taxable income of at least 50 thousand rubles, the alliance notes. They are in favor of increasing the tariff above 6%.

Conditions for the attractiveness of the IPC: ownership of funds, succession of pension funds in the event of the death of a participant before the assignment of his pension and the pension itself, early receipt of funds in case of serious illness, injury or destruction of property, guaranteed investment income, the possibility of suspending participation in the program.

The transition to a new system will not be able to immediately cover the Pension Fund deficit, says Associate Professor of the Department of Human Resource Management of the Russian Economic University. G.V. Plekhanova Lyudmila Ivanova-Shvets , it will exist for quite some time.

“The transition to the IPC will lead to the fact that the state will pay only the mandatory part, and this will not happen immediately, but as those who have switched to such a system reach retirement age. This will most likely lead to greater differentiation of pension payments, since citizens will react very differently to the transition to the IPC - some will try to earn more or their income will allow them to save more, respectively, and their pension may be larger, while some will still either will remain in the shadows, or will not really trust the new system, and will receive only the bare minimum. But the most dangerous thing about this scheme is that working citizens with low wages will not be able to save up for a decent pension,” she told Nakanune.RU .

The low level of trust in the state in the matter of pension formation (here it is worth remembering not only the “freeze”, but also the refusal of the second indexation in crisis years, stopping the growth of pensions of working pensioners, raising the retirement age) will force workers to think about the advisability of voluntarily saving. The authorities are already coming up with incentives; for example, there is a solution to exempt the funded portion from personal income tax. The idea was put forward by market participants in 2020, and the regulator supported it. However, there are risks that Russians, if possible, will go on a five-year holiday to make payments or set 0% contributions. The ANPF notes that income tax benefits are a significant factor only for highly paid workers, and for a significant part, the decrease in real income will significantly exceed the effect of state support.

The majority of Russians with low incomes simply do not have the opportunity to save a significant part of their salary for retirement in the long term, says Deputy Director of the Institute of Social Analysis and Forecasting of the Russian Presidential Academy of National Economy and Public Administration Yuri Gorlin . Now about 70% of Russians receive wages below average, he notes.

“If with a salary of 40 thousand rubles. If a person has a family and children, then the per capita household income is lower and there are more imperative expenses. This is confirmed by the relatively small savings of Russians. At the same time, for a funded pension to be meaningful, we should be talking about accumulating not tens or even hundreds of thousands of rubles. The second point of doubt is the infrastructure of the NPF. Over the previous years, the funds have not shown themselves to be an institution capable of providing returns at least commensurate with inflation. For a number of reasons, the profitability of NPFs was one and a half times lower than inflation. If the IPC is introduced forcibly, people will be forced to pay contributions, but this will reduce their already falling incomes and will negatively affect the economy, as effective demand will decrease,” he told Nakanune.RU .

Tax breaks, according to him, will increase the profitability of non-state pension funds by several tenths of a percent, but the lost income will be received by entities that are personal income tax administrators. In addition, income tax benefits will again go to Russians with high incomes - they are the ones who may be interested in IPC - this will make the flat tax scale actually regressive.

Since for many workers the need to make additional contributions may cause a protest, the IPC system will most likely become compulsory, says Lyudmila Ivanova-Shvets: “Most likely, the levers of pressure can be transferred to employers, that is, provide for a scheme in which it would be beneficial for the employer so that its employees are included in this system.”

She adds that outreach to the population on the issue of pensions is not enough; stability of the pension system is needed, which cannot be said about it at present.

“Over the past 13 years, so many reforms of the pension system have taken place that citizens have ceased to trust the state, but due to high inflation and low incomes, they do not have the opportunity and do not see the point in making pension savings on their own. The state must act as a guarantor of stability,” the expert notes.

How to read information about the status of an individual personal account

The formation of pension rights in coefficients began in 2015.

The first block contains information about periods of work before 2015, and after 2020 information about the period of work, as well as the amounts of payments of other remunerations and the amounts of accrued insurance contributions for the insurance pension, on the basis of which the value of the IPC is calculated. If you started your career before the specified year, then all your generated pension rights are transferred to pension coefficients for assigning a pension to you in the future according to the new formula.

The second block indicates the number of pension coefficients and its components earned before 2020 (if any).

Controversial issues

There are several of them, but the main two are:

- The mechanism for connecting to the system has not yet been developed. At first, automatic connection was proposed, but this project was rejected by the majority of members of the Government. The option of including citizens with high wages automatically, with the possibility of refusal, and citizens with low incomes based on an application, is currently being considered;

- distribution of savings. The government proposes to dispose of them depending on the place of storage: those transferred to the NPF are transferred to the IPC, but those stored in the Pension Fund of the Russian Federation are used to form an insurance pension.

We remind you that the bill on individual pension capital has not been fully developed, it has not even been submitted for public discussion. Therefore, it is possible to make a wide variety of changes to the IPC system.

“13th pension”: what is the fate of the law on increasing the level of pension provision?

Is it possible to receive the estimated pension capital in a lump sum?

The payment of lump sum benefits to pensioners is regulated by the Government of the Russian Federation.

List of required documents One-time payment to pensioners has an application form. T is the average indicator for all pensioners of the period of payment of the old-age labor pension established on the date of assignment of the pension.

As we noted, the size of each labor pension now includes a basic part (BP), which is assigned to all insured persons in the state pension system upon reaching retirement age if they have at least five years of insurance included in the pension insurance system and paid for.

The estimated pension capital (PC) is the basis for determining the size of the insurance part of the labor pension (SP).

Everything about conversion and valorization of pension rights

For citizens who began working after this date, the estimated pension capital will be taken into account from the amount of actually paid contributions to the Pension Fund. For all other citizens with work experience both before and after January 1, 2002, the estimated pension capital will consist of two parts - pension rights and insurance contributions.

Estimated pension capital (RPC) is the total amount of insurance contributions and other income to the Pension Fund for the insured person and pension rights in monetary terms acquired before January 1, 2002, which are the basis for determining the size of the insurance part of the labor pension. Pension capital (PC) is the amount of the estimated pension capital of the insured person, taken into account as of the day from which he is assigned the insurance part of the labor pension.

Free legal assistance

The applicant can receive money:

- to a bank account or cash desk at a bank.

- in an organization that delivers funds;

- at the post office;

Transfer of funds is carried out within 2 months after receipt of the relevant application.

Note! After providing the money, the pensioner has the right to apply for a new lump sum payment after 5 years. Can non-pensioners take advantage of this opportunity Although the law allows people who have already reached retirement age to use accumulated funds, there are some cases when non-pensioners can receive money:

- Legal successors. When the investor dies, his heirs have the right to withdraw funds. But this is possible if the legal successor has a power of attorney.

Unfortunately, they cannot receive a lump sum benefit.

7.1. The amount of estimated pension capital (PC)

Pension capital is accounted for in the individual personal account of each insured person, opened with the territorial body of the fund.

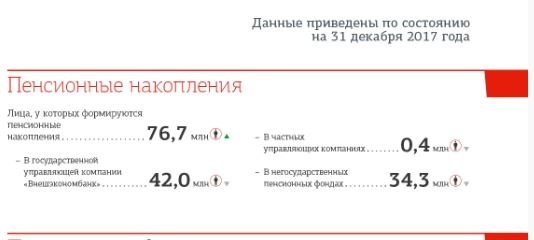

Information about the status of a personal pension account in the personalized accounting system is the main data for assigning a labor pension. To citizens who worked for more or less a long time according to the norms of the old pension legislation, the state has an obligation to convert pension rights earned under the old model into rights taken into account in the new model, and to constantly carry out indexation until the citizen retires. To current pensioners, the state has obligations increase the pension amount to the level of the pensioner’s subsistence level and constantly index pension payments. The amount of pension capital (PC) since 2010

consists of: PC = PC1 + PC2 + SV, where PC1 is the initial pension capital - these are pension rights in monetary terms acquired by citizens before January 1, 2002.

Individual pension capital in 2020

The need to maintain such a system with pension capital is due to several factors.

- Decrease in the level of material security in old age. Citizens' interest in creating a secure individual budget. Difficulties in raising funds sufficient to ensure a normal standard of living for retirees. Automation, modernization of industrial production. This reduces the number of jobs available, especially for older people and those with other disabilities.

In the case of the IPC, there are several important differences from the system that was in effect previously: the rate is from 0 to 6%; it is possible to suspend participation at 0% for up to 5 years or more, or it is permissible to use rates less than 6% (in the case of old systems there were no such possibilities); IPC offers the opportunity to receive payments before retirement age, albeit with some restrictions;

Keep saving! A lot and voluntarily!

Back in the middle of summer, Deputy Prime Minister Tatyana Golikova, in a long interview for central channels, spoke about the new system of individual pension capital, but it is still unclear in what form the IPC will return. Its key ideas are being rethought and refined, so it is premature to talk about specifics.

The Deputy Prime Minister emphasized that everything that citizens have accumulated will remain. The main difference from the old mechanism will be that all savings will automatically be turned into the property of citizens, which they can dispose of at their own discretion. The scheme for working with pension savings that ended up in NPFs (non-state pension funds) will undergo modifications.

The new format will replace the funded pension, frozen in 2013. Mandatory contributions will be replaced by voluntary ones. At the moment, it is extremely important for the government to find the right motivation and develop the infrastructure of a new savings system so that Russians believe that what they contribute and accumulate will actually increase their future pension.

Previously, it was planned to launch the updated individual pension capital in 2020, but in the fall, Finance Minister Anton Siluanov said that the launch of the new format was postponed for a year, that is, to 2020.

On October 9, the press service of the Pension Fund expressed hope that the State Duma will be able to discuss individual pension capital before the end of the year, when the bill finally reaches deputies. After the project is reviewed and approved, the Central Bank promised to issue a special leaflet on the conditions of participation and features of the IPC, as well as the new operating principles of non-profit pension funds.

What is estimated pension capital and how to calculate it

The amount is determined by multiplying the number of PB earned during work activities by the cost of one point on the date the pension is calculated. PB began to be calculated only after the 2015 reform.

The number of points for the period up to 2020 can be determined by knowing the estimated pension capital. It is formed from the total amount of insurance premiums and other transfers to finance the insurance part of the pension.

Payments are received for the insured person to the PFR budget based on personalized (individual) accounting data.

- the amount of valorization and insurance contributions transferred by the employer to the Pension Fund after this date.

- pension rights converted in monetary terms acquired by insured citizens before 01/01/2002;

To calculate the old age pension until 2002.

The employee's length of service and salary were used.

How did the pension reform affect the size of the pension?

The reform of the 21st century has now negatively affected the new method of calculating pension payments. The amount of the insurance part is determined by the estimated pension capital, which consists of the initial and the amount of insurance payments. The initial one was formed before 2002, and the second after this year until the end of work.

The insurance part of the pension began to be calculated in 2002

One of the concepts is the fixed part of the pension. This is the basic part that a person who has worked for at least 5 years can count on. This value was established only by the state and did not depend in any way on wages, as well as on the employee’s accumulated experience. It will be the same for absolutely every citizen.

It is also necessary to note the second concept, such as the insurance part of the pension. This is a certain part of the deductions from wages every month, which will be counted for the entire period of work. It is this part that forms the pension capital. It determines what kind of pension a person deserves. The greater the salary and length of service, the greater the amount of savings that will ultimately be in the account in the Pension Fund. The size of the pension in this case will be much larger than that of a person who has worked a little for a low salary.

The size of the pension depends on the employee’s length of service and the amount of his salary.

Important! Accounting for insurance pensions has been carried out since 2002. If we talk about the time before this, then the person simply earned the right to a pension, which was calculated using other methods.

How to calculate estimated pension capital

All funds that the employer transferred to the pension fund for a certain employee are deposited in his account.

It must be said that the calculated pension capital has its own characteristics. These may include:

- Currently, the owner has the right to receive a lump sum payment from the calculated pension capital, at the request of the recipient;

- The RPC is aimed at forming only the insurance part of the pension and cannot be aimed at incriminating other types of pension provision;

- Currently, the concept of calculated pension capital does not exist as such, but it has the name “Individual personal account of the insured person.”

- The amount of the estimated pension capital directly depends on the moment of the employee’s retirement;

Equation with unknowns

Earlier, Finance Minister Anton Siluanov promised that in 2020 his department would submit to the government a draft law on individual pension capital. Its concept was presented 2 years ago at the Moscow Financial Forum. But the minister's new promise shifted the presentation date by a year.

Probably, instead of the employer, the employee himself will make contributions to the funded part of the pension, or perhaps they will leave alternative options - through the employer. The recommended payment amount is up to 6% of the monthly salary, but the contribution will be allowed to be increased or decreased.

Important! The recommended contribution amount will increase gradually, every year by one percent, from 1 to 6%.

The Ministry of Finance is working hard to find incentives so that participation in the system is beneficial to both employers and employees. So far it is known that money sent to the individual industrial complex will allow you to receive a deduction from the income of individuals and tax breaks on the profit of the organization.

At the moment, no consensus has been reached on the nature of inclusion in the system: whether it will be absolutely or conditionally voluntary. The Central Bank and the Ministry of Finance continue to insist on the so-called auto-subscription - the automatic inclusion of working citizens in individual pension capital with explanations of how to refuse and exit the system in the future.

The social bloc of the government and the Ministry of Labor are against the idea. They proposed an alternative – auto-registration. With this approach, employees will be required to submit a special application to transfer savings to the IPC through the employer.

On a note! If initially 6 months were given to make a decision on participation in the program, now we are talking about one and a half or even two years. Only after this will the person be counted among the so-called “silent people” who are planned to be automatically included in the IPC.

In mid-summer 2020, First Deputy Chairman of the Central Bank Sergei Shvetsov presented another mechanism for the concept of individual pension capital being developed. Instead of auto-subscription/auto-registration, the following is proposed: the citizen accepts or refuses the conditions put forward for the conversion (!) of existing savings, thereby saving or not for retirement from his own salary. Existing savings become an initial contribution to the IPC. If there are no savings yet, the NPF will give a bonus for the first contribution and entry into the system.

It is possible that participation in the program will be allowed to be suspended an unlimited number of times, that is, people will be able to take breaks in their contributions. The maximum duration of a “vacation” is 5 years.