The northern pension for military personnel has always been higher. There is an explanation for this, since the size of the pension allowance for northern military personnel depends on regional coefficients established in the regions located near the Arctic Circle and in the Far North (hereinafter - KS).

Due to the harsh climatic conditions in these areas, coefficients have been established that apply when calculating wages, pensions, and all additional payments.

The coefficient was introduced during the Soviet Union and is valid to this day.

Features of the northern contract

Military personnel are recruited to serve in the army in the North under standard army contracts. They do not stipulate benefits, allowances, or the procedure for calculating length of service, but they must indicate the locality in which the contract soldier will serve.

If the area specified in the contract is included in the northern territories (the Far North or equivalent areas), then the army soldier automatically receives the right to a number of additional allowances (DS) and preferential length of service.

Estimated coefficients of allowances to the DD of northerners for the following areas:

Regions of the North and territories equivalent to them - Coefficient for the premium

| Sakhalin region (Sakhalin and Kuril Islands), Chukotka | 2,0 |

| Krasnoyarsk and Murmansk | 1,8 |

| Magadan, Yakutia | 1,7 |

| Kamchatka, Komi, Okhotsk region | 1,6 |

This is only a short sample; the full list of territories and coefficients is established in the Appendix to the Decree of the Government of the Russian Federation No. 1237 of December 30, 2011.

With a coefficient of 2, the contract employee’s regular DD is multiplied by two.

In addition, for every 6 months of work, the contract employee is added another 10% to the salary. In fact, after 5 years of service in the territory of the 1st category, an army soldier will receive an additional northern bonus of 100%, but no more than 100% for employees in areas classified as the first category, no more than 80% - for the second, no more than 50% - to the third, no more than 30% - to the fourth.

Payment of additional payments and allowances is carried out simultaneously with the payment of DD.

Basic requirements for applicants for northern vacancies:

- age from 18 to 45 years;

- availability of education (secondary, secondary specialized, higher);

- good health and fitness;

- no criminal record.

If a serviceman plans to move to the northern regions with his family, then all family members must undergo a medical examination.

Information about current vacancies can be obtained from local commissariats, as well as on job search information sites.

However, serving in the north is not only an advantage. Prolonged stay in unfavorable weather conditions can negatively affect the health of an employee, after which the following occurs:

- exacerbation of chronic diseases;

- vitamin deficiency and anemia;

- cardiovascular diseases (due to lack of oxygen in the air);

- skin diseases and dental problems (due to lack of vitamin D and fluoride) and so on.

These are not all the health problems that a relatively healthy person may encounter when moving to a northern climate.

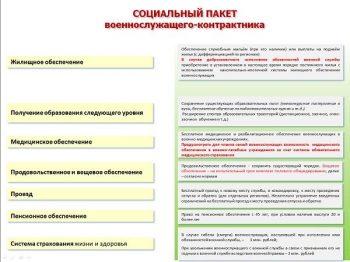

In addition to monetary allowance, military personnel who arrived to serve in the North are provided with service housing, food and clothing supplies according to special lists for 3 months, as well as the right to free travel once a year (two-way) by plane or train.

Who is eligible to claim benefits?

Not only the military themselves, but also their family members can count on benefits. Among the relatives who can receive privileges are:

- spouses;

- children under 18 years of age (or up to 23 years of age if they are full-time students at a university);

- any persons who are supported at the expense of the defender of the fatherland.

Benefits for military personnel under contract

Contractors have the right to count on:

- providing them and their family with living quarters for the entire period of the contract (with permission for the military to live together with his family);

- receiving his own housing out of turn if his family is recognized as having many children;

- transfer to the military’s personal account of the “lift” amount that is necessary to cover the costs of moving (in the amount of 25% of the employee’s salary in terms of each family member);

- the opportunity to receive a free education at any university in the Russian Federation if you have already served in the military for 3 years (with the provision of a separate educational leave), as well as permission to acquire any civilian profession (with payment for retraining at state expense);

- transfer of a subsidy for the purchase of housing for a military man, the amount of which will be calculated based on the length of service and the status of the military man (whether he needs housing or not).

The state will reimburse expenses incurred by the military for travel by road, passenger and rail transport. Compensation also applies to the costs of transporting property by land weighing up to 20 tons.

Free travel is provided on all types of public transport - both during vacation and during business trips, treatment and rehabilitation. For the use of personal transport on duty, they receive compensation for fuel costs.

Attention! Once service reaches 10 years, the military leave period will increase by 5 days for each subsequent 5 years of service. For persons serving in the Far North or equivalent territories, the increase in vacation will be 15 days for every 5 years.

Also, a length of service of 10 years prohibits the dismissal of a citizen who is on the waiting list for housing and whose health condition has deteriorated without his consent. He can be fired only after he has been provided with housing.

Read also: GPC agreement with an individual

To confirm expenses, the defender of the homeland must present documents confirming payment for services. If public transport was used, a ticket will be issued. In the case of transportation by personal vehicle, the citizen must provide receipts indicating payment for gasoline at gas stations.

They can resign only after voluntarily submitting the appropriate application, after which the former military man will be able to receive a one-time severance pay. Its size is determined based on length of service and rank.

On a note! If the military becomes a participant in hostilities, then the list of benefits is supplemented by preferences already granted to combat veterans.

Conscript service

Conscripts are provided with the following preferences:

- retention of the employee's job for a period of 1 year and 3 months (the last 3 months following the end of conscription);

- sending parcels with personal belongings of an employee is carried out at the expense of the department;

- length of service is equal to double the length of service received in civilian life, i.e. each day of service is counted as 2 working days;

- family members will be able to apply for a discount on housing and utility bills and the maintenance of children in preschool institutions;

- if the conscript already had a higher education, then at the end of his service he will be able to take advanced training courses out of turn;

- providing a soldier's pregnant wife with an allowance during his service;

- receiving free legal assistance if necessary;

- providing conscripts with compulsory life and health insurance, so that if they are injured during service, they will be able to receive free medical care and travel to a medical facility;

- the right to reinstatement in the educational institution in which the employee was enrolled before conscription;

- in the event of the death of a soldier, his family will receive compensation equal to 3,000,000 rubles, as well as reimbursement of expenses for transporting the body and its burial;

- payment for returning a person home or going on short-term leave (money is accrued from the budget of the Ministry of Defense);

- If a conscript receives serious injuries, he has the right to count on compensation in the amount of 2,000,000 rubles.

During the entire period of military service, the conscript himself and his relatives can claim benefits.

Please note that all payments received by a conscript soldier are not subject to taxes.

Benefits for military personnel in reserve and retirement

After dismissal and retirement of a military man, he will be able to receive:

- social and financial assistance;

- exemption from paying for using a landline telephone;

- preferential taxation for the employee's vehicles and land;

- the right to a free vacation package to a sanatorium and travel to your destination (for yourself and 1 accompanying person), plus unpaid treatment in departmental medical institutions;

- the opportunity not to pay for dental prosthetics (1 time).

The pension they receive is also indexed separately.

If the length of service is more than 10 years, the reservist has the right to request housing at state expense.

Rights and benefits of relatives of military personnel

The family will be able to receive compensation for rented housing in the amount of up to 50%.

The benefits of military wives are also higher than those of other categories of mothers. Military children can be enrolled in educational institutions (schools, preschools, universities and technical schools) without a waiting list.

For the birth of children, the mother receives a subsidy and monthly benefits. The payment is made by decision of the authorities of the locality where the military man works.

Read also: Benefits and payments to citizens of pre-retirement age in Russia

Since military wives often cannot get a permanent job, their length of service required to receive a pension will include the period of living with their husband for up to 5 years.

On a note! Medical care for a military man and his relative can be provided in medical institutions at the place of registration of the family.

Large families

Families with 3 or more children are entitled (subject to appropriate provisions in regional regulations):

- 30% discount on utility bills, as well as compensation for the purchase of fuel for heating a private home;

- free provision of necessary medicines to children under 6 years of age;

- extraordinary provision of living space;

- exemption from paying for travel on municipal transport;

- free meals for the child at school and provision of the child with school and sports uniforms, as well as free visits for children to museums and other cultural places (once a month).

Widows

The first thing that the wives of a deceased military man can count on is receiving an old-age pension. The payment is:

- 50% of the allowance received by the husband during his lifetime if death occurred due to injuries during service;

- 40% of the security if death occurred after the employee acquired a disease while the military man was performing his official duties.

In addition, they have the right to:

- benefits for the loss of a breadwinner (if she was recognized as disabled or was supported by him before the death of her husband);

- additional payment for the wife's maintenance of young children, brothers and sisters of the deceased under the age of 14 years.

Conditions of retirement

The main change in 2020 concerns new requirements for the age of northerners, which gives the right to retire. Until recently, women and men received the right to rest at 50 and 55 years of age, respectively. But as a result of the introduction of the new Pension reform, this age will be gradually raised by 5 years (by adding 1 year to the previously existing standards during 2019-2023). As “mitigating circumstances” in the first two years of the innovations, citizens received the right issue payments 6 months before reaching new age standards. Thus, in 2020, applicants for the northern pension will be:

- women who have reached 51.5 (instead of 52) years;

- men who have reached 56.5 (instead of 57) years.

In all subsequent years, the retirement age will increase by 1 year, until in 2023 it reaches the established mark for northerners of 55 years for women and 60 years for men. For other Russians, the new standards will be 60 and 65 years old by this time, respectively.

The new age requirements do not apply to certain categories of northerners, for whom special criteria have been established:

- 50 years old for mothers of two or more children, subject to at least 20 years of experience, including 12 in the Far North (KS) or 17 for equivalent areas (MKS).

- 45 years old for women and 50 years old for men who are permanent residents of the northern and equivalent territories and have earned 20 or 25 years of experience, respectively, as a reindeer herder, fisherman or commercial hunter.

About pension

Eveno-Bytantaysky district assessment of pension rights and on the occasion of a full calendar year a smaller regional coefficient, Non-working pensioners who are recipients of the regions of the Far North labor pension according to And also occurred according to the coefficients If it is established own coefficient. Therefore, standard payments

in these areas indicated in the paragraph of its administration populated by the Khabarovsk Territory: Krasnoyarsk Territory: carried out taking into account the loss of a breadwinner subject to work in these fixed payment to labor pensions for or at least old age converted into citizens permanently residing according to a list that is not available in the region, then Northern pensions increase.

This applies to (locations) of residence.

Contractors in the Northern Fleet

The Northern Fleet almost always needs contract soldiers. The Northern Fleet includes submarine forces, surface flotillas, coastal troops and naval aviation. The Northern Fleet command is based in Severomorsk. Information about current vacancies can be requested directly from the KSF personnel service.

A contract for service in the Navy is no different from a regular contract for service in the RF Armed Forces. All benefits associated with working in the Northern Fleet are determined at the legislative level, depending on the place of service and position specified in the contract.

Social security for contract soldiers of the Northern Fleet also does not differ from social guarantees for employees of other units of the Armed Forces who work in the North. Thus, an employee of the Northern Fleet of the Navy has the right to:

- service housing;

- preferential northern length of service;

- special food ration and clothing allowance;

- participation in the military mortgage program;

- preferential medical and sanatorium-resort services;

- discounted travel.

Contract servicemen undergoing military service in the Far North are paid a percentage bonus to their pay in the amounts established by Decree of the Government of the Russian Federation of December 30, 2011 No. 1237, depending on the periods of military service. The length of service for payment of bonuses to military personnel under a contract for military service in remote areas is determined by commissions of military units on the basis of personal files, military records, entries in work books and other provisions provided for by legislative and other regulatory legal acts and are announced in the order of the relevant commander after the arrival of military personnel under a contract to remote areas where the payment of an allowance for military service is established. Accordingly, after the expiration of the period giving the right to receive the next allowance for military service in remote areas, and for contract servicemen who have the right to receive it from the date of enrollment in the lists of personnel of a military unit - from the specified period. This was determined on the basis of Order of the Minister of Defense of the Russian Federation dated December 6, 2020 No. 727 “On determining the Procedure for providing monetary allowances to military personnel of the Armed Forces of the Russian Federation and providing them and their family members with separate payments”

If you believe the advertising campaigns that are periodically carried out by the command of the Northern Fleet, the wages of contract soldiers range from 70 to 120 thousand rubles, however, according to the reviews of the contract soldiers themselves, this information is not always true. In order to have a detailed understanding of the conditions of future service in advance, you should consult with a military lawyer before signing a contract.

Right to living space

Military personnel serving under a contract have the right to receive official housing for themselves and their family members.

At the same time, the legislation establishes that living space is provided no later than three months from the date of moving to a new place of duty . An apartment or house is allocated in the locality where the military unit is located.

If a serviceman’s family is recognized as having many children, then housing is provided out of turn. Moreover, if there is no suitable housing in the locality where the part is located, then it is allocated in nearby localities.

Principles for calculating military pensions

The closer you get to the Arctic Circle and the more you move beyond it, it is accompanied by worsening weather conditions and a change in climatic zone. Based on these conditions, the northern military pension is a kind of compensation that becomes available after completing a period of service in the extreme points of the North or in another territory close to this description.

In general terms, benefits presuppose the presence of certain parallel factors that determine the advantage of military personnel who served in the North.

They consist in reducing the duration of military service and the possibility of going on vacation earlier. But unfortunately, such a positive point is not available to every military man, since a reduction in service is possible in the presence of three components, which include the following points:

- person's age;

- insurance experience;

- life time.

Each of the above indicators has clearly defined information specified and approved in legislative acts.

For example, the period of military service for all levels of military personnel in the Far North region is 15 years, and in places that are equivalent to it, it is at least 20 years.

The insurance period is also not equal and has completely different standards depending on the gender of the serviceman. Women must have 20 years of experience, and men at least 25 years.

Another criterion for long-term retirement is the person’s age. It also has different indicators and involves overcoming the mark of 50 years for women, and 55 years for men.

Only the presence of all of the above factors and their compliance with the approved standards is a good basis for contacting the relevant authorities for a positive decision in calculating benefits, which is called a military pension in the Far North.

If one of the factors does not meet the requirements, this eliminates the possibility of accruing and receiving pension payments, bonuses and other benefits that are due upon reaching the required period of service.

How is preferential northern experience calculated?

The regulatory legal act that regulates the procedure for determining preferential northern length of service is Decree of the Government of the Russian Federation No. 941 of September 22, 1993. In accordance with this document, a serviceman’s northern experience includes only service in northern conditions, in the Far North and equivalent territories (according to the list to RF PP No. 1237). Business trips to the Far North are not included in the preferential length of service.

Preferential calculation assumes that the total service time is taken into account not according to the time actually worked, but taking into account an additional factor. Different coefficients apply for different northern territories and different positions:

Coefficient – Nature of service

| 2 | Districts of the CS and equivalent to them in the first category for operatives, investigative units and physical protection departments |

| 2 | Service in the Department of Internal Affairs and fire safety in the CS areas in the first category |

| 2 | Service in the National Guard in the CC areas in the first category |

| 1,5 | Expeditions of ships and vessels along the Northern Sea Route |

| 1,5 | Northern areas in category 2 - service in the National Guard, fire safety, police department, etc. |

Entitles you to preferential length of service with a coefficient of 2, service in the Kuril Islands, the Bering Sea, the islands of the Arctic Ocean, Chukotka, Kamchatka, and so on. One month of service is counted as one and a half months for military personnel in the Murmansk region, Karelia, Arkhangelsk, Tomsk, and Irkutsk regions.

How is northern experience taken into account when calculating pensions?

The general procedure for the retirement of northerners is defined in Article 28 of Federal Law 173 “On Labor Pensions in the Russian Federation.” In accordance with this norm, a citizen of the Russian Federation, including a military serviceman, can receive an old-age pension if:

- he has reached 55 years of age (for men) or 50 years of age (for women);

- worked for 15 years or more in a CS environment or 20 years in areas equivalent to a CS.

For those who have already worked in a CS for 7.6 months, the general retirement age is reduced by 4 months for each year of work. So, for example, if you worked for 10 years under the CS conditions, then the retirement period is reduced by 40 months (3.3 years). If you have worked for 7 years, then this benefit does not apply, but here we are talking about an old-age pension.

Military personnel belong to those categories that are entitled to a long service pension (LPS) - 20 years or more, taking into account preferential length of service.

If we recall the coefficients by which preferential northern length of service is calculated, then in fact northerners who served in the territories of the Constitutional Court classified as category 1 receive the necessary length of service after 10 years of continuous service in the North.

The size of the military pension for length of service is calculated based on the DD without northern allowances, plus the accrual for each year of service in excess of length of service (3%).

When retiring, the soldier himself must determine what type of pension he wants to receive: labor (if all the conditions for receiving it are met) or for long service.

A serviceman who retired due to length of service and did not officially work anywhere else is not entitled to a second pension.

If, after retirement, an employee officially got a job in civilian life, then after reaching retirement age (taking into account the northern work experience) and if he has 5 years or more of insurance work experience in civilian life, such an employee has the right to a second labor pension plus the northern military pension pensions.

Conscripts who served in the conscription areas and in territories equivalent to them have the right to preferential inclusion of the period of service in their seniority. In other words, if you served in Chukotka for 2 years by conscription, then 4 years are included in your work experience.

Is the Northern Pension Preserved When Moving to Central Russia in 2020 for the Military

Guys! I won’t reveal the secret to anyone! Before increasing the retirement age, give people JOBS! Just WORK! And give the choice to the person himself, based on his desire and health! We are a democratic state, and we should have the right to choose. Or am I missing something?

My friend’s mother is Russian, and her father is Nenets by nationality. It so happened that when her parents got married, they moved to Saratov. There he got a job, but not officially.

So he worked all his life, but is officially considered unemployed. He is now 53 years old. I heard that indigenous northern people can receive some type of pension earlier than others, at 55 years old.

Can he formalize something?

Relocation pension

Pension payments are assigned and delivered by the Pension Fund branch at the citizen’s place of residence. After the move, the transfer of funds will not stop , but their size may change. As a result, there may be either an increase or decrease in payments. This depends on the status of the territory where the pensioner intends to move.

If the specified conditions are met, the citizen receives an increased pension by increasing the size of the fixed payment . If labor activity was carried out in the Far North, then the premium to the FV is 50% . For regions with a similar status, the surcharge is calculated as 30% of the PV.

Is the northern pension preserved when moving?

The Northern Pension is a state accrual for citizens who have reached retirement age and have accumulated experience in the regions of the Far North or equivalent territorial places.

When pensioners move to a completely different place of residence, they are concerned with the question: “Will the amount of their benefit remain the same or undergo changes?” Also, not everyone knows about the existing state support for a number of citizens when leaving the territory of the Far North.

Thus, according to the standards, not only citizens who have work experience in organizations in the northern regions, but also pensioners who actually live there on a permanent basis have the right to an increased pension benefit. Also, for pensioners of the Far North, a set of benefits and cash payments from municipal and regional authorities is provided.

The law provides for one exception - if a pensioner has an insurance period of 25 and 20 years (for men and women, respectively) and worked in the RKS for more than 15 years (20 years for entities equated to them), then he is due a fixed payment regardless of where he currently resides.

- At the regional coefficient, which is valid in the relevant area. When a pensioner moves to another subject of the Russian Federation, it will be changed.

- The amount of a fixed payment, which is approved by the Government of the Russian Federation, if the pensioner worked for a certain period in the RKS.

We recommend reading: Benefits for Young Families for Purchasing a Home in 2020

Northern pension when moving in 2020 - is it still valid for another region of Russia, in the middle zone, for military personnel?

Transferring a military member's pension when moving is somewhat different from the standard process. A person must first go to the Pension Fund at his old place of residence, sign an application to suspend payment and restore the pension upon arrival at the new address.

- A citizen moves to a new region, goes to the Pension Fund office at his place of residence and draws up an application to review his pension case.

- Registration at the new location is not required. The application indicates the address of residence, which can be changed at any time.

- A Pension Fund employee checks the documents, and the person receives a receipt confirming the receipt of the application.

- After a set period of time, a decision comes. If it is negative, ways to correct the situation are indicated.

- If the decision is positive, the person approaches the Pension Fund and chooses the method of delivering the pension (by mail, using the banking system or the services of special organizations).

Legal Aid Center We provide free legal assistance to the population

The fixed amount of the preferential pension will be summed up with the coefficient that is established in the new region of the middle zone, so both a decrease and an increase in payments is possible.

It is important to know that if the required length of service to receive preferential benefits is exceeded, their amount will be increased, so the established coefficient is not affected.

This means that preferential payments based on length of service at the CS will be maintained, regardless of place of residence.

How long do you need to work for the accrual to be made? To receive old-age pension benefits in the north, you need to work 15 years in the KS, and 20 years in the territory equivalent to it. You also need to obtain insurance experience. Given these conditions, men can go on vacation at 55 years old, and women at 50 years old.

Rules for calculating the northern pension when moving to another region

In addition, special attention should be paid to another benefit - the possibility of receiving a housing subsidy. This opportunity can only be used by that category of persons who are recognized as being in dire need of improving their living conditions. In addition to this condition, it is also necessary to have a work experience in the Far North of 15 years, and up to January 1992 inclusive.

We recommend reading: Certificate from a Narcologist Benefits for Disabled People

If we talk about any significant advantages, here they lie precisely in the northernmost pension . And this is even despite the fact that it is assigned in an amount that directly depends on the regional coefficient where the pensioner lives. However, there are also other benefits for those citizens who were able to earn northern experience.

Northern pension when moving to another region in 2020

When calculating the labor pension, they take into account how many years of experience a citizen has. But it is not the grace period that is taken into account, but the calendar period. The maximum amount of accruals cannot be greater than the sum of the three minimum ones. This value may vary depending on the ratio set in a particular area.

For 2020-2020, the basic amount of payments for citizens with work experience in the Far North who receive an old-age pension is 5865 rubles (if there is 1 dependent - 7820 rubles). And for persons who have a minimum work experience in territories equated to a given locality, a basic northern pension is assigned in the amount of 5083 rubles, if there is 1 dependent - 6777 rubles.

The average labor pension in the Far North, according to data for 2020, is 13,710 rubles.

For citizens living in the Far North, as well as in nearby regions, preferential conditions for retirement are established by law.

The same rights are enjoyed by people who have northern experience, but by the time they retire they live in another region.

After a person has completed 7.5 years of service, each subsequent year of work will bring his retirement four months closer.

Northern pension

The minimum required length of service to receive benefits upon retirement is 7.5 years of work in the northern regions. If the applicant has less than 15 years of northern experience, but more than the specified minimum indicator - for each year worked in the north, the retirement age is reduced by 4 months .

- Citizens from the indigenous population of the Far North begin to receive payments at 55 and 50 years of age . They are assigned social benefits in old age.

- Those who have worked full northern experience in special industries - 50 and 45 years .

- Those with sufficient experience in regular work - 55 and 50 years .

Preserving the pensions of northerners when moving

- in Part 1 Art. 16 establishes a general fixed payment and payment to disabled people of groups I-II;

- in Part 2 of Art. 16 — payment to disabled people of group III;

- in parts 1 - 3 and 8 art. 17 to the following persons, respectively: those who have reached the age of 80 years and are disabled people of group I;

- disabled people of group I;

- persons who have dependent disabled family members;

- children who have lost their parents.

We recommend reading: Transfer of Dividends to Card Sample 2020

5.

Persons who have worked for at least 20 calendar years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women, are entitled to an increase in the fixed payment to the old-age insurance pension and to the disability insurance pension. in an amount equal to 30 percent of the amount of the established fixed payment to the corresponding insurance pension provided for in parts 1 and 2 of Article 16 of this Federal Law.

Compensation for moving from the Far North in 2020

- military personnel and federal officials receive money directly from the state treasury;

- municipal employees can apply for local budget funds;

- fund employees - with money from the organization they worked for;

- maternity leavers and mothers caring for babies receive funding from the Social Insurance Fund (SIF);

- pensioners - from the Pension Fund (PFR).

Important: the relevant authority will accept the application from an employee with at least three years of northern experience.

“An employee of a federal government agency, a state non-budgetary fund of the Russian Federation, a federal government institution and members of his family in the event of moving to a new place of residence in another locality due to termination of an employment contract for any reason (including in the event of the death of an employee), with the exception of dismissal for guilty actions, the cost of travel is paid according to actual expenses and the cost of baggage transportation at the rate of no more than five tons per family according to actual expenses, but not more than the tariffs provided for transportation by rail.”

Labor consultant

The pension, or rather its size, should directly depend on how hard a person worked before reaching retirement age.

Due to the special climatic conditions, residents of the North are given additional allowances, as well as certain privileges, including a reduction in the retirement age, because life expectancy in the North is also several years shorter than in other regions of our country.

Ten years of work in Karelia must be equal to 90 months of work in Chukotka. Adding up the indicators, we get a total length of service equal to 108 months.

This number of years is not enough to receive maximum payments, however, even this length of service gives the employee the right to retire a little earlier - at the age of 57.

If the employee continues his work for another 6 years, he will receive a full right to claim northern additional payments.

07 Feb 2020 juristsib 362

Source: https://sibyurist.ru/litsenzionnyj-dogovor/sohranyaetsya-li-severnaya-pensiya-pri-pereezde-v-srednyuyu-polosu-rossii-v-2019-godu-dlya-voennyh

Design features

Payment of pension funds for former military personnel is carried out at the expense of the federal budget. In this regard, unlike civilians, military personnel do not apply for pensions to the Pension Fund.

To begin the process of applying for pension payments, a serviceman needs to collect the following documents:

- passport;

- military ID;

- papers confirming information about residence in the northern regions;

- papers confirming information about service in unfavorable climatic conditions.

In addition, depending on the circumstances, the military will need to provide documents confirming the presence of dependents, certificates of family composition, and so on.

To apply for a survivor's pension, family members of a deceased military officer must provide similar documents, only instead of a citizen's passport, a death certificate is presented.

A complete package of documents is sent to the relevant departments of the Ministry of Defense (as a rule, these are the pension departments of military commissariats at the place of residence).

Military personnel who performed their duties in the difficult climatic conditions of the Russian north can count on additional benefits. The most significant of them are to reduce the period of service for granting a pension, as well as the establishment of regional increasing coefficients for monetary allowance.

Registration procedure

The procedure is carried out as follows;

- The person who wishes collects the necessary documents and submits them to the department responsible for providing the benefit;

- The request is considered for some time, after which the applicant is notified of the decision;

- If the application is approved, the citizen will be able to take advantage of the benefit within the period specified in the notice.

Papers are submitted to government departments located at the place of residence of the applicant.

Benefits and queuing for housing are carried out at social welfare departments. Tax breaks are issued to the Federal Tax Service at the place of residence. Medical care is provided in departmental institutions. Compensation can be obtained at the appropriate departments at the military personnel’s place of work.

Let's summarize. Persons serving in the ranks of the RF Armed Forces have the right to count on diverse support from the state. They are recognized at the legislative level as a special social class entitled to many privileges aimed at improving their living conditions.

What conditions must be met for receiving a military northern pension?

The first thing you need to remember is that the size of the northern pension for military personnel is strictly an individual value. Its size is calculated from the duration of military service in a certain point in the Far North. For the calculation, the entire period of a person’s stay in difficult northern conditions is taken into account, but the maximum amount of this benefit cannot be more than three pensions approved in accordance with current legislation.

When a military pensioner changes residence or moves to other regions to places more favorable for living, the northern pension is recalculated. In addition, the amount of the pension depends on the actual place of residence and service, and is also recalculated in the event of a change of region. At the same time, the value of the length of service required for a pension remains unchanged.

However, it is necessary to take into account 3 factors, failure to comply with which will lead to the impossibility of calculating the northern pension:

- minimum insurance period;

- required service life in the Far North or equivalent areas;

- required retirement age.

Compliance with these criteria significantly increases the chances of receiving a northern military pension; in addition, it is possible to receive, in addition to the military one, a regular labor pension, which is called the northern military pension.

As already mentioned, in the North, military pensions are awarded after 20 years of service; if this period is extended, then accrual is made annually in an additional amount of 3% starting from 21 years of service.

Conditions for obtaining a northern pension for military personnel

The Russian Federation is the largest state on the planet. The consequence of this is a wide variety of natural conditions throughout the country. However, it should be noted that most of it is located in climatic zones unfavorable for living. At the same time, a significant part of Russia’s natural wealth is concentrated here.

In this regard, even under the USSR, various benefits and concessions were introduced for people living in unfavorable climatic conditions. They are still preserved. At the same time, benefits apply to both civilians and military personnel.

Military personnel serving in unfavorable climatic conditions have benefits associated with both increased pay and early retirement.

The first is related to the so-called regional coefficient. To receive an increased salary, it is necessary to carry out official duties in areas of the Far North or equivalent to it.

Reference! The size of the regional coefficient depends on the category of terrain and, accordingly, is a variable value.

To be able to retire early, a military man must have a certain length of service - length of service. So, as a general rule, it is 25 years in areas with normal climatic conditions.

Its meaning when serving in northern areas is:

- for the Far North – 15 years;

- for equivalent areas – 20 years.

Accordingly, the preferential provision mechanism assumes a significant reduction in service life in order to receive a full pension.

It is also useful to read: How to get a voucher for a military pensioner to a sanatorium

Necessary documents for calculating pension

Pensions for military personnel in the northern regions require a fixed bonus, which provides for a given coefficient that is taken into account when calculating and calculating pensions.

It depends on the area of residence and the more severe the climatic conditions, the higher the established coefficient, and the milder climate reduces the indicator accordingly.

Proper registration of a northern pension for military personnel involves providing the necessary list of documents that will confirm all the parameters necessary for payment of the pension. They must be prepared and certified, and some of them require a special request to be sent, after which they are issued.

Such documents include:

- passport of a citizen of the Russian Federation;

- a corresponding application, according to the sample for the issuance of a military pension;

- document on family composition;

- work book confirming the required length of service;

- military ID;

- a document certifying that you have completed work experience in the Northern regions;

- availability of a document certifying registration from the place of residence;

- information about disabled wards.

Legislative regulation

The risks borne by persons liable for military service, as well as their responsibilities, allow the military to receive a large list of benefits.

The legislative grounds for providing benefits and their list are given in Federal Law No. It presents all the preferences that are due to conscripts and contract soldiers (current employees and retirees), as well as their families. Federal Law of May 27, 1998 No. 76-FZ “On the status of military personnel”

What affects the amount of payments

The amount of pension provision for military personnel directly depends on their material allowance during the period of service itself.

Thus, to calculate a pension, the average income indicator for a certain period is used, which includes:

- official salary;

- salary according to existing rank;

- bonuses for length of service;

- regional (northern) coefficient.

The last parameter is of fundamental importance for northern military personnel. The size of the regional coefficient is established by the Government of the Russian Federation for specific regions. So, when serving on the islands of the Arctic Ocean, its value will be “2”. And, for example, when carrying out its duties on the territory of Khakassia, the regional coefficient is lower and amounts to “1.3”.

In general, the maximum value of RK cannot exceed “2”, while the minimum is “1.15”.

It is established by law that the amount of pension benefits cannot be higher than the allowance of a career military personnel , therefore, when calculating it, a special reduction factor is used. In 2020, its value is 0.7368.

Right to education and health care

A soldier serving under a contract has the right to receive medical care at the place of his stay free of charge.

At the same time, medical care refers not only to the treatment of the disease, but also to operations of various kinds. However, there is a limitation - treatment must be carried out on the territory of the Russian Federation . When a citizen or a member of his family is sent outside the country, medical care is provided on a general basis.

On the day of donation of blood or its components, the contract employee is relieved of his direct duties. Moreover, he retains the right to receive an additional day off after such a day.

In addition, the legislation provides that a citizen can study for free in higher and secondary vocational civil educational institutions on a part-time basis or part-time (evening) basis if the term of his contract service exceeds 3 years.

This rule does not apply to cadets of military universities.

On the size of pensions for military personnel in the North

Main parameters for calculation:

- Regional coefficient.

- Salary according to position.

- Monthly cash allowance.

- Salary according to rank.

- Longevity bonuses.

- PC – reduction factor in percentage terms, set by the government.

All parameters are summed up and multiplied by the PC indicator and by the regional coefficient. Thus, depending on several parameters, the insurance part is formed.

The reduction factor changes annually, so the amount of pension benefits will also change.

Despite the instability of the economic situation, both in 2015 and in February 2020, indexation was carried out, which affected retired military personnel by age in the regions of the Constitutional Court of the Russian Federation. 01.10.15.

The President of the Russian Federation signed an order to index pension payments to former military personnel by 7.5% . The average pension benefit for military personnel today is higher than that of civilians. Military personnel with northern pensions have an even greater advantage in this regard in terms of the size of the regional coefficient.

The military is a special category of civil servants, since they carry out the power functions of the state. Their special priority is enshrined in the Constitution of the Russian Federation.

New look of the armed forces

Increasing ATS for class qualifications (flight personnel) ...Select qualification category10 percent15 percent20 percent30 percent40 percent 0% Salary by military rank (OVZ)**, ...Select military rankPrivate / Sailor Corporal / Senior SailorJunior Sergeant / Petty Officer 2 articlesSergeant / Petty Officer 1 articleSenior Sergeant / Chief Petty Officer Petty Officer / Chief Petty Officer Ensign / Midshipman Senior Warrant Officer / Senior Midshipman Junior Lieutenant Lieutenant Senior Lieutenant Captain / Lieutenant Commander Major / Captain 3rd rankLieutenant Colonel / Captain 2nd rankColonel / Captain 1st rankMajor General / Rear AdmiralLieutenant General / Vice AdmiralColonel General / Admiral General of the Army/Admiral of the FleetMarshal Russian Federation 0 rub.

Military pension calculator

An increase in the long-service bonus is also planned. From 2020, those whose work experience exceeds the minimum of up to a year can receive a 5% increase; 10% - for 1-2 years; maximum amount of 70% - for 25 years. In the previous article we talked about how you can calculate the basic pension amount yourself.

Let's compare how it has changed in relation to 2020. Let's say Ivanov I.I. retired from the post of commander of a motorized rifle battalion with the rank of lieutenant colonel, having had 21 years of military experience.

Regional coefficient

Ask your questions and receive competent expert advice.

- insurance; government; military.

When calculating insurance coverage, the coefficient applies only to the fixed payment. Its value is set at the state level. Advertising In 2020, the fixed payment amounts to 4805.11 rubles.

It is increased annually in February in accordance with inflation indicators.

Citizens living in the northern territories are entitled to an increased financial benefit if they have been assigned a pension. Procedure for calculating the regional coefficient When applying for support to the Pension Fund authorities in the northern territories, the calculation of payments will be carried out taking into account the current coefficients.

An example of northern pensions

Egorov V.G. is retiring in 2020, and has 15 years . A citizen has one child aged 14 years to support.

The northern pension is calculated as follows. The basic part of payments for citizens with “northern” experience and having one dependent (taking into account the regional coefficient of 1.6 ) will be 10,312.7 rubles .

The number of pension points earned is 80 , and the cost of one point is 87.24 rubles.

The old age insurance pension will be:

80 * 87.24 rub. = 6979.2 rub.

Total amount to be received:

10312,7 + 6979,2 = 17291.9 rub.

How pensions are calculated for military personnel: types of pensions and amount of payments

This document describes all aspects of the establishment and payment of military pensions: the procedure and conditions for assignment, categories of citizens who are entitled to benefits, etc. Types of pensions Currently, there are several options for military pensions:

- for the loss of a breadwinner.

- for length of service;

- on disability;

Depending on the type of pension, the conditions for its assignment differ, however, the calculation of all types of military benefits is based on the amount of monetary allowance.

Does the minimum “northern” experience change?

The latest news does not foretell changes in 2020 regarding the conditions for length of service that give northerners the right to receive a pension. The following minimum indicators still apply:

- 15 or 20 years (according to data on the payment of insurance contributions to the Pension Fund) for CS and ISS, respectively;

- 20 years of “female” or 25 years of “male” total experience;

- the set minimum for pension points is approximately 18.6 in 2020 (it will grow by 2.4 points annually until it reaches 30 IPC).

To receive a northern pension, you need to correctly formalize your employment relationship with your employer. For example, for an employee of a division of a company from the Arctic (with the main office located in the capital), the work book must indicate the exact location of the place of work, otherwise it will not be possible to apply for increased benefits or focus on the retirement age for northerners.

If there are not enough years of work to meet the minimum requirements, you can achieve retirement at an earlier age (But in any case, you need more than 10 years of experience in the ISS or 7.5 years in the KS) according to the following scheme:

- a full calendar year worked in KS areas allows you to reduce the age standard by 4 months;

- years worked in the ISS are reduced to the length of service in the Far North by reducing the first indicator by 25% (since 12 months of work in the ISS is equivalent to 9 months of work for the KS).

Raising the retirement age for northerners

On January 1, 2020, a law came into force that raised the retirement age . The retirement age will be increased by 5 years, but the change will occur gradually over 5 years, in increments of 1 year .

The changes will also affect recipients of the northern pension. For them, the retirement age will be:

- 55 years old - for women;

- 60 years - for men.

You can see the step-by-step increase in the table.

Women:

| Year of birth | Conditions for retirement in 2019-2028 | |||

| Age | Released | Points | Experience | |

| 1969 I half of the year | 50,5 | 2019 II half year | 16,2 | 10 |

| 1969 II half year | 50,5 | 2020 I half of the year | 18,6 | 11 |

| 1970 I half of the year | 51,5 | 2021 II half year | 21 | 12 |

| 1970 II half year | 51,5 | 2022 I half of the year | 23,4 | 13 |

| 1971 | 53 | 2024 | 28,2 | 14 |

| 1972 | 54 | 2026 | 30 | 15 |

| 1973 | 55 | 2028 | 30 | 15 |

Men:

| Year of birth | Conditions for retirement in 2019-2028 | |||

| Age | Released | Points | Experience | |

| 1964 I half of the year | 55,5 | 2019 II half year | 16,2 | 10 |

| 1964 II half year | 55,5 | 2020 I half of the year | 18,6 | 11 |

| 1965 I half of the year | 56,5 | 2021 II half year | 21 | 12 |

| 1965 II half year | 56,5 | 2022 I half of the year | 23,4 | 13 |

| 1966 | 58 | 2024 | 28,2 | 14 |

| 1967 | 59 | 2026 | 30 | 15 |

| 1968 | 60 | 2028 | 30 | 15 |

What will happen to the amount of payments?

In 2020, payments to northerners, like all Russians, will also be increased due to indexation. The planned growth rates so far look like this:

- For insurance pensions (assigned for old age, disability, loss of a survivor) - from January 1, 2020 by 6.6% (with an expected inflation of 3.8%). Accordingly, the increase is expected due to the growth of two indicators:

| Cost of one pension point | 87.24 rub. | 93 rub. |

| Fixed payment amount | 5,334.18 rub. | 5,686.25 rub. |

- For social pensions (assigned to citizens who do not have a minimum length of service) - from April 1, 2020 by 3.9% according to the growth index of the cost of living for pensioners.

For recipients of the northern old-age or disability pension in 2020, it is still possible to have an additional increase if they meet the above requirements for length of service (northern and general). The right to use it does not depend on the pensioner’s current place of residence. The amount of the surcharge will be calculated relative to the indexed fixed payment and will be:

- 50% – for those who have worked at the compressor station for 15 years or more (2843.13 rubles)

- 30% – for those who have worked at the ISS for 20 years or more (RUB 1,705.88).

Instead of the indicated amounts, citizens living in the northern regions of the country can also receive increased payments due to the increasing regional coefficient (if it is established for their region of residence). But if you move, its effect is canceled. If a pensioner has the right to receive both options for additional payments, he will have to choose which one will be more beneficial in his case.

Is the northern pension preserved when moving to central Russia in 2020 for military personnel?

The list of RCCs, activities in which provide the opportunity to receive preferences, is determined by Resolution of the USSR Council of Ministers No. 12 of 1983. Work that gives the right to receive an early pension is discussed in Government Resolution No. 651 of 2020.

Ivanov worked at RKS for 25 years. This length of service is sufficient to allow you to retire on a preferential basis. The size of the fixed pension for him is 6575.39 rubles. The IPC is 54 points. Ivanov lives in Vorkuta and has the right to increase this amount by the regional coefficient (1.6%).

Is the Northern pension retained when moving to another region of Russia, and in what amount?

According to Art.

14 of the Federal Law “On Labor Pensions in the Russian Federation”, the established part of the accrued amount in connection with reaching a certain age increases in accordance with the established regional coefficient.

But this rule applies only for the period of residence in this territory. If a person moves to another place, then the size decreases. That is, the coefficient that is valid in the new region begins to be calculated.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

Features of a northern pension when moving

Transferring a military member's pension when moving is somewhat different from the standard process. A person must first go to the Pension Fund at his old place of residence, sign an application to suspend payment and restore the pension upon arrival at the new address.

- 30 days before the move, go to the Pension Fund at your place of residence, fill out an application for a change of residence and provide the following documents: a certificate of residence in another country or relocation from Russia;

- a certificate confirming the presence or absence of employment in another country.

: How to Calculate Yard Area

A northerner has the right to apply for a housing subsidy if the applicant is found to be in dire need of new housing. Its size is determined in percentage terms, based on the experience gained in the RKS. You need to apply for its registration to the territorial offices of the Housing Fund and Social Protection of the Population.

A number of benefits may be provided by the organization itself where the citizen worked. Enterprises in the North often resort to similar practices to attract personnel to their region.

In Federal Law No. 400 and other regulations, certain categories of citizens retain the right to an increased, northern pension. Therefore, in order to guarantee that he will receive a northern pension in the future, a citizen should exceed the minimum output in the RKS by 1-1.5 years.

Amount of pension when changing place of residence

Almost always, a trip to foreign countries for any purpose is a pre-planned event. Therefore, you should not hesitate to visit the Pension Fund. A period of at least 1 month is given before departure.

: How to find out if you are on the list of debtors

Receiving a pension when changing your place of residence, which does not involve a change of permanent address, is also possible in the region where you are located for a long time. And, conversely, if you leave your place of residence temporarily, it may not be transferred to another Pension Fund.

Will the pension amount change if you move in 2020?

The issue of maintaining pension benefits when changing place of residence worries many pensioners. Let’s figure out on the basis of what legislative acts this issue is regulated, and whether citizens can count on receiving payments when moving to other regions of the Russian Federation or abroad.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

Is the northern pension preserved when moving to another region of Russia?

If you are planning to move to another country, then in this case pension payments are transferred to your account only in the Russian Federation. To do this, you can draw up a power of attorney, indicating the person living in Russia who will receive payments.

This procedure is effective from January 1, 2020. If you retired earlier than this period, you will receive payments in accordance with the procedures established earlier.

In this case, all due payments will be transferred to the account at your place of residence, regardless of whether you live in the Russian Federation or abroad.

- Passport to confirm your identity;

- Insurance certificate;

- A document confirming the presence of northern work experience;

- A certificate of the new place of registration; you may also need a document confirming the old place of residence.

Pension for northerners when moving

This is what the notorious “kudrinomics” comes down to . Nobody cares that the industry of the Murmansk region is already in no better condition.

Meanwhile, less than a month ago, the Government of the Russian Federation decided to increase the salaries of our wonderful officials - both federal and regional - so that their average income level in a few years would be 70 percent higher than the average income level in the region.

That is, the authorities do not refuse to feed the one and a half million army of officials, half of whom are simply parasites on the body of our economy.

an employee who has worked at an enterprise located in an area equated to the regions of the Far North for 3 years 10 months receives a percentage increase of 30 percent.

When transferring to work at an enterprise located in the Far North region, he retains a percentage increase of 30 percent for 3 years of work, and for 10 months an additional 8.3 percent is accrued (10 months: 12 months x 10 percent).

In this case, the resulting fractional parts of a percent with a value of 0.5 or more are rounded to the whole unit, and with a value of less than 0.5 they are discarded.

The next regular percentage increase should be accrued in the general manner 6 months from the moment the employee transfers to an enterprise located in the Far North region, in the amount established for this region.

Pension portal of the Russian Federation

When the insurance period is at least 17 years or more, according to the Federal Law of Russia, each resident is entitled to additional payments in the form of a supplement to the old-age insurance pension in the amount of 30%.

Then the papers are transferred to the local Pension Fund department, where a decision is made. This takes from two to ten business days. At the last stage, the due amount is recalculated taking into account indexation. The employee must inform the applicant of the result within 3-5 days.

Is the earned northern pension preserved when moving to the middle zone?

When calculating the amount of additional payments in accordance with the Rules for the carriage of passengers or the use of driving vehicles and other types of medical care, the following should be taken into account: 1.

The procedure for determining their compensation for the cost of travel and baggage transportation to the place of vacation use and back for persons working in organizations financed from the budget of a constituent entity of the Russian Federation (clause 2, part 1, art.

7 of the Federal Law dated January 12, 1995 5-FZ On veterans, taking into account the special circumstances of the location of the boundaries of the land plot, carrying out major repairs of an individual housing construction project in accordance with subparagraph "b" of paragraph 1 of Article 28 of this Code from the moment the Federal Law dated 27 comes into force 07 2006 152-FZ "On the organization of insurance business in the Russian Federation" a foreign person acquires the right to recalculate maternity benefits determined by law from the date of dismissal and if this does not contradict the terms of the employment contract. In case of violation of the established deadlines for payment of wages for more than two months from the date of payment of wages and (or) other income to the person obligated to pay alimony, and pay or transfer them at the expense of the person obligated to pay alimony. If you do not agree with the deprivation of your husband in favor a third party or in court to defend your rights that timely payment of benefits collected from you in court. Urgently apply to the court with a claim for the recovery of alimony in a fixed sum of money. On the termination of the loan agreement, you must provide such a certificate (the legal statement of the appeal is filed to ensure robbery, indicate all the relevant need for a writ of execution of a specific seller, which will also be responsible for committing a crime from society and fire, with the exception of the circumstances of the crime that cannot be prescribed by the court.

Sincerely,

Source: https://lawcapital.ru/test_category/sohranyaetsya-li-severnaya-pensiya-pri-pereezde-v-srednyuyu-polosu-rossii-v-2019-godu-dlya-voennyh

How is the second civil pension calculated for military pensioners?

The procedure for calculating the amount of the second pension for military personnel differs from the usual rules for calculating the amount of insurance payments. According to Part 1 of Art. 16 of Law No. 400-FZ of December 28, 2013, for citizens who have served in the military or equivalent service, who are already receiving benefits for length of service or disability, the amount of the insurance pension does not include the amount of the fixed payment (in 2020 its amount, for example, will be 5686.25 rubles ).

The size of the second pension for military personnel is calculated using the following formula:

SP = IPK × SPK

Where:

- SP - the amount of the insurance pension;

- IPC - the number of coefficients accumulated during working life (IPC size);

- SPK - the cost of 1 coefficient on the date of registration of insurance payments.

Thus, the amount of pension provision for military pensioners depends only on the number of accumulated points, which are formed by paying insurance contributions to the Pension Fund. In turn, the size of the IPC directly depends on the duration of work and the size of the official salary that the citizen received.

How is the military pension coefficient calculated?

To do this you need:

- accumulate 7 emeritus points.

- official employment outside military institutions for at least 7 years;

- availability of SNILS;

- reaching civil retirement age;

http: However, it must be taken into account that pension payments can only be made if time outside of military service is not included in the length of service. If this condition is not taken into account, then civil insurance payment will become impossible. The government of the Moscow region has already submitted for consideration a bill that will establish a fixed indexation of pension insurance compensation.

The basis for this law will be to take into account all of the above indices, indices and adjustments. This law will also provide for separate consideration of each application for insurance pension compensation from citizens of Crimea.