Activities for social support of family citizens who have adopted or given birth to a second child provide for the possibility of obtaining an MSK certificate. To improve the standard of living of this category of citizens, in recent years it has been allowed to withdraw 25 thousand from maternity capital for the personal needs of the family.

Is it possible to receive part of maternity capital at present, and is it possible to receive 25 thousand from maternity capital in 2020? The answer to these questions can be found in the presented material.

Who is entitled to

The payment is made using the same targeted approach as for the first-born child born after January 1, 2020. Financial assistance is provided in the following cases:

- NEW! if the average per capita family income for the second quarter is below 2 subsistence levels in the region;

- if the baby is not yet one and a half years old;

- assistance from maternity capital is issued only for the second child.

Parents - mother or father - can apply for a subsidy. Important - it is issued only until the child reaches one and a half years old.

This type of social assistance does not apply to the first or third children.

For the first-born, parents can apply for a payment, which is designed for those born after January 1, 2020. For the third child, an EDV allowance is issued, which is issued for up to three years.

Latest changes and news of maternity capital – 2020

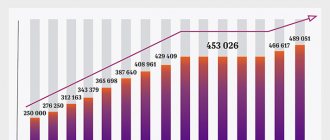

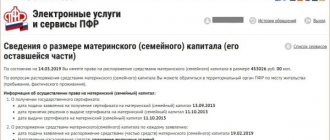

The latest news is that maternity capital indexation will not be carried out until 2020! How much is maternity capital in 2017? The exact amount is 453,026 rubles. Over the 10 years of the program, the amount of state aid has almost doubled - from 250,000 rubles.

Matkapital was put into effect by Federal Law of December 29, 2006 No. 256-FZ. It was initially assumed that government support for families would end at the end of 2020. Until what year will the “maternity capital” program be valid? At the moment, it has been extended until the end of 2020.

How much can you receive monthly?

The specific amount of payments is determined regionally, depending on the cost of living established by local authorities. The minimum cost of living, which was established for the second quarter of the year preceding the date of application to the Pension Fund with the corresponding application, is taken into account.

A nuance - due to the fact that the validity of maternity capital was extended until December 31, 2021, the President of the Russian Federation announced the approximate average amount of the benefit:

- in 2020 - 10,500 rubles;

- in 2020 - 10,800 rubles;

- in 2020 - 11,400 rubles.

Benefits are paid from the Pension Fund budget. Please note that the amount of monthly assistance may vary significantly depending on the region. The remainder of the maternity capital amount can be used for other purposes provided for by law.

Read: Maternity capital in 2020: amount, changes, until what year it is valid

Living wage table for calculating monthly payments from MK for the period 2020

| Region | Quarter year | Per capita | For able-bodied | For pensioners | For children | Document |

| Adygea Republic | 2nd 2018 | 8966 | 9563 | 7353 | 9104 | 02.08.2018 №143 |

| Altai Republic | 2nd 2018 | 9429 | 9820 | 7903 | 9679 | 10.08.2018 №252 |

| Altai region | 2nd 2018 | 9490 | 9906 | 8152 | 9811 | 31.10.2018 №401 |

| Amur region | 2nd 2018 | 11361 | 12026 | 9194 | 11909 | 01.10.2018 №233 |

| Arhangelsk region | 2nd 2018 | 11998 | 13009 | 9959 | 11866 | 07/24/2018 No. 330-pp |

| Astrakhan region | 2nd 2018 | 9612 | 10101 | 7754 | 10434 | 07/26/2018 No. 299-P |

| Bashkortostan Republic | 2nd 2018 | 9014 | 9552 | 7315 | 9182 | 05.09.2018 №424 |

| Belgorod region | 2nd 2018 | 8376 | 8995 | 6951 | 8291 | 08/20/2018 No. 299-pp |

| Bryansk region | 2nd 2018 | 10056 | 10763 | 8309 | 10029 | 07/16/2018 No. 343-p |

| Buryatia Republic | 2nd 2018 | 10497 | 10904 | 8297 | 10993 | 26.07.2018 №410 |

| Vladimir region | 2nd 2018 | 9777 | 10625 | 8189 | 9911 | 30.07.2018 №567 |

| Volgograd region | 2nd 2018 | 9318 | 9973 | 7556 | 9569 | 08/27/2018 No. 372-p |

| Vologda Region | 2nd 2018 | 10995 | 11905 | 9103 | 10940 | 20.08.2018 №730 |

| Voronezh region | 2nd 2018 | 8686 | 9390 | 7239 | 8657 | 30.07.2018 №640 |

| Dagestan Republic | 2nd 2018 | 9301 | 9552 | 7345 | 9488 | 07.09.2018 №122 |

| Jewish Autonomous Region | 2nd 2018 | 12864,47 | 13582,72 | 10377,82 | 13593,51 | 10.07.2018 №77 |

| Transbaikal region | 2nd 2018 | 11249,27 | 11713,99 | 8886,99 | 11801,16 | 16.08.2018 №325 |

| Ivanovo region | 2nd 2018 | 10149 | 11003 | 8458 | 10214 | 07/24/2018 No. 77-ug |

| Ingushetia Republic | 2nd 2018 | 9512 | 9685 | 7372 | 9661 | 25.07.2018 №119 |

| Irkutsk region | 2nd 2018 | 10452 | 11067 | 8405 | 10730 | 07/27/2018 No. 546-pp |

| Kabardino-Balkarian Republic | 2nd 2018 | 11007 | 11383 | 8559 | 11978 | 12/17/2018 No. 241-PP |

| Kaliningrad region | 2nd 2018 | 11125 | 11894 | 9088 | 10926 | 09.08.2018 №481 |

| Kalmykia Republic | 2nd 2018 | 9056 | 9455 | 7264 | 9227 | 07.08.2018 №242 |

| Kaluga region | 2nd 2018 | 10374 | 11158 | 8580 | 10292 | 28.08.2018 №510 |

| Kamchatka Krai | 2nd 2018 | 19381 | 10295 | 15325 | 20797 | 07/24/2018 No. 308-P |

| Karachay-Cherkess Republic | 2nd 2018 | 9335 | 9836 | 7528 | 9608 | 29.08.2018 №206 |

| Karelia Republic | 2nd 2018 | 13030 | 14186 | 10862 | 12330 | 09/06/2018 No. Expected |

| Kemerovo region | 2nd 2018 | 9397 | 9925 | 7550 | 9930 | 25.07.2018 №304 |

| Kirov region | 2nd 2018 | 9675 | 10314 | 7881 | 10008 | 08/30/2018 No. 415-P |

| Komi Republic | 2nd 2018 | 12668 | 13555 | 10321 | 12883 | 31.07.2018 №345 |

| Kostroma region | 2nd 2018 | 9922 | 10773 | 8273 | 9893 | 07/30/2018 No. 312-a |

| Krasnodar region | 2nd 2018 | 10365 | 11185 | 8559 | 10057 | 31.07.2018 №1084 |

| Krasnoyarsk region | 2nd 2018 | 11675 | 12327 | 9074 | 12365 | 07/17/2018 No. 418-p |

| Crimea Republic | 2nd 2018 | 9808 | 10479 | 8049 | 10488 | 06.08.2018 №380 |

| Kurgan region | 2nd 2018 | 9730 | 10361 | 8031 | 10347 | 24.07.2018 №230 |

| Kursk region | 2nd 2018 | 9196 | 9850 | 7604 | 9368 | 07/13/2018 No. 561-pa |

| Leningrad region | 2nd 2018 | 9852 | 10498 | 8603 | 9680 | 06.08.2018 №281 |

| Lipetsk region | 2nd 2018 | 8844 | 9516 | 7363 | 9100 | 13.07.2018 №438 |

| Magadan Region | 2nd 2018 | 17929 | 18846 | 14091 | 19336 | 07/24/2018 No. 130-p |

| Mari El Republic | 2nd 2018 | 9139 | 9716 | 7458 | 9545 | 30.07.2018 №326 |

| Mordovia Republic | 2nd 2018 | 8503 | 9132 | 6975 | 8924 | 24.07.2018 №396 |

| Moscow | 2nd 2018 | 16463 | 18781 | 11609 | 14329 | 09/19/2018 No. 1114-PP |

| Moscow region | 2nd 2018 | 12229 | 13528 | 9137 | 12057 | 28.09.2018 №677/34 |

| Murmansk region | 2nd 2018 | 14667 | 15270 | 12196 | 15158 | 08/15/2018 No. 384-PP |

| Nenets Autonomous Okrug | 2nd 2018 | 20609 | 21658 | 16794 | 21666 | 07/26/2018 No. 174-p |

| Nizhny Novgorod Region | 2nd 2018 | 9609 | 10309 | 7911 | 10092 | 20.08.2018 №582 |

| Novgorod region | 2nd 2018 | 10496 | 11386 | 8688 | 10495 | 07/19/2018 No. 194-rg |

| Novosibirsk region | 2nd 2018 | 10942 | 11615 | 8770 | 11358 | 27.07.2018 №154 |

| Omsk region | 2nd 2018 | 9250 | 9767 | 7411 | 9641 | 08/22/2018 No. 240-p |

| Orenburg region | 2nd 2018 | 8816 | 9357 | 7232 | 9259 | 08/27/2018 No. 552-p |

| Oryol Region | 2nd 2018 | 9625 | 10304 | 7969 | 9741 | 01.08.2018 №322 |

| Penza region | 2nd 2018 | 8349 | 9587 | 7437 | 9398 | 08/15/2018 No. 422-pP |

| Perm region | 2nd 2018 | 10098 | 10804 | 8279 | 10289 | 07/25/2018 No. 422-p |

| Primorsky Krai | 2nd 2018 | 12457 | 13117 | 9988 | 13689 | 08/03/2018 No. 364-pa |

| Pskov region | 2nd 2018 | 10651 | 11620 | 8865 | 10635 | 27.08.2018 №285 |

| Russian Federation | 2nd 2018 | 10444 | 11280 | 8583 | 10390 | 08/24/2018 No. 550n |

| Rostov region | 2nd 2018 | 9816 | 10412 | 7941 | 10413 | 09.08.2018 №503 |

| Ryazan Oblast | 2nd 2018 | 9691 | 10464 | 8017 | 9767 | 31.07.2018 №217 |

| Samara Region | 2nd 2018 | 10144 | 11111 | 8005 | 10181 | 01.08.2018 №439 |

| Saint Petersburg | 2nd 2018 | 11007,60 | 12063,80 | 8944,30 | 10741,70 | 28.08.2018 №690 |

| Saratov region | 2nd 2018 | 8707 | 9354 | 7176 | 9022 | 06.08.2018 No. 435-P |

| Sakha (Yakutia) Republic | 2nd 2018 | 16463 | 17457 | 13226 | 16906 | 22.08.2018 №249 |

| Sakhalin region | 2nd 2018 | 13591 | 14261 | 10738 | 14536 | 06.08.2018 №386 |

| Sverdlovsk region | 2nd 2018 | 10672 | 11376 | 8785 | 11133 | 08/10/2018 No. 500-PP |

| Sevastopol | 2nd 2018 | 10099 | 10782 | 8267 | 10766 | 09.08.2018 No. 507-PP |

| North Ossetia-Alania Republic | 2nd 2018 | 9181 | 9635 | 7540 | 9520 | 21.08.2018 №287 |

| Smolensk region | 2nd 2018 | 10409 | 11169 | 8588 | 10353 | 30.07.2018 №504 |

| Stavropol region | 2nd 2018 | 8793 | 9324 | 7118 | 9154 | 07/26/2018 No. 293-p |

| Tambov Region | 2nd 2018 | 8693 | 9408 | 7254 | 8710 | 20.07.2018 №732 |

| Tatarstan Republic | 2nd 2018 | 8800 | 9356 | 7177 | 8896 | 26.07.2018 №604 |

| Tver region | 2nd 2018 | 10190,65 | 10955,27 | 8429,45 | 10710,64 | 08/07/2018 No. 238-pp |

| Tomsk region | 2nd 2018 | 11104 | 11674 | 8854 | 11573 | 02.08.2018 No. 216-r |

| Tula region | 2nd 2018 | 9797 | 10486 | 8374 | 9776 | 06.08.2018 №304 |

| Tyva Republic | 2nd 2018 | 10102 | 10408 | 7968 | 10655 | 22.08.2018 №417 |

| Tyumen region | 2nd 2018 | 10789 | 11342 | RF | 11100 | 07/27/2018 No. 293-p |

| Udmurt republic | 2nd 2018 | 9150 | 9675 | 7423 | 9302 | 29.08.2018 №359 |

| Ulyanovsk region | 2nd 2018 | 9682 | 10370 | 7937 | 9992 | 08/30/2018 No. 401-P |

| Khabarovsk region | 2nd 2018 | 13313 | 14134 | 10744 | 14051 | 15.08.2018 №60 |

| Khakassia Republic | 2nd 2018 | 9803 | 10326 | 7874 | 10361 | 13.08.2018 №428 |

| Khanty-Mansiysk Autonomous Okrug Yugra | 2nd 2018 | 14457 | 15551 | 11805 | 14427 | 07/27/2018 No. 225-p |

| Chelyabinsk region | 2nd 2018 | 9689 | 10344 | 7979 | 10147 | 24.07.2018 №163 |

| Chechen Republic | 2nd 2018 | 10197 | 10548 | 8372 | 10154 | 07.08.2018 №166 |

| Chuvash Republic | 2nd 2018 | 8741 | 9248 | 7101 | 8930 | 08.08.2018 №300 |

| Chukotka Autonomous Okrug | 2nd 2018 | 21737 | 22273 | 16654 | 22730 | 24.07.2018 №248 |

| Yamalo-Nenets Autonomous Okrug | 2nd 2018 | 16168 | 16849 | 12700 | 16175 | 06.08.2018 No. 811-P |

| Yaroslavl region | 2nd 2018 | 9744 | 10650 | 7876 | 9929 | 20.07.2018 №190 |

What documents need to be collected

List of required documents:

- Application for payment.

- Birth certificate.

- Applicant's passport.

- Bank account information.

- Certificate of income of each family member for the 12 months preceding the month of application.

Additionally you may need:

- Documents confirming the death of a woman, declaring her deceased, deprivation of her parental rights, cancellation of adoption.

- Documents confirming divorce.

How to get a subsidy for a second child if the firstborn has died

If the mother lost her first child even during childbirth, then the second child after birth will be recognized as the second.

The family has the right to claim:

- for payments due for the second child;

- maternal capital.

To receive benefits, you will need to provide documents confirming the birth and death of your first child. If his birth document was not received in a timely manner, then the law allows him to contact the registry office later.

According to the law, a birth certificate is issued for children who have not lived for 2 weeks. But if the baby died in the womb and was not born, then such a document is not issued.

FAQ

Is it possible to return certificate funds that were sent to the Pension Fund for the funded part of the pension?

Yes, you can. If capital funds were sent to form a pension and there was a need to use them for other needs, in this case, it is necessary to write a statement of refusal to dispose of capital and send it to the Pension Fund of the Russian Federation, but no later than retirement age.

How to use maternity capital for retirement?

In order to transfer funds to the mother’s pension savings, the owner of the document needs to write a corresponding statement of consent to the Pension Fund of the Russian Federation. This can be done 3 years after the birth of a child in the family.

Is it possible to pay for the education of the first child with capital?

It's possible. The law allows capital to be spent on the education of any child in the family. However, this can be done no earlier than the child in whose name the certificate is issued turns 3 years old.

If my husband has a son from his first marriage who lives in our family, do I have the right to a payment if I give birth to a second one?

No, It is Immpossible. Due to the fact that your husband’s son is your stepson, this means that you are not entitled to MK. In your case, you need to give birth to another common child in order to receive support from the state.

How to get maternity capital if we live in another country, while we and our children have Russian citizenship. Can we apply for a maternity certificate?

Yes, by law you have the right to receive this benefit and payments for it, and it does not matter where you live. However, your child must have the status of a citizen of the Russian Federation. Thus, due to the fact that your children are citizens of the Russian Federation, you have the absolute right to receive a certificate.

If an application by order of the MK has already been submitted, is it possible to change the purpose of the funds?

Yes, according to the law, you have the right to change the decision on the direction of MK funds. To do this, you need to contact the branch of the Pension Fund of the Russian Federation with an application. However, it is necessary to do this no later than the decision on the first application is made.

Is it possible to buy a car with maternity capital?

The authors of the bill introduced some restrictions on the possibility of using Maternity Capital 2020 to purchase a vehicle. Not every family can take advantage of this right. Primarily, only families with many children, or families raising a disabled child, as well as adoptive parents can count on a car. In this case, purchasing a car is considered appropriate.

It should be taken into account that the law allows you to spend Maternity Capital 2017 exclusively on a car of a domestic manufacturer. The vehicle cannot be sold during the first 3 years after purchase. In case of purchasing a car on credit, the program allows large families to repay the loan/credit using the funds from the mother’s certificate.

Whether the State Duma will support the bill is still in question. However, experts predict the development of this area, due to the fact that the ability to use maternity capital for a car may in the future provide support to the domestic auto industry. Moreover, this innovation will not affect the budget. According to surveys, the possibility of purchasing a vehicle using MK money is promising for most families.

How to cash out maternity capital

Today, a large number of family certificates have appeared, incl. on the Internet. It should be borne in mind that actions aimed at attempting to “cash out” maternity capital 2020 are subject to criminal liability. Such companies are under strict government control.

However, in 2020 and 2020, there was a legal procedure for receiving funds in cash from MK. In 2020, you could cash out 20 rubles, in 2020 – 25,000 rubles.

10 years later, since the start of the family support program, the question of the possibility of withdrawing cash from the maternal certificate still arises.

According to the law, money from maternity capital is transferred only through a non-cash transaction by the Pension Fund of the Russian Federation, at the request of the certificate holder.

A person holding a family certificate, agreeing to participate in any “cash out” procedures, goes against the legislation of the Russian Federation and can be recognized by a court decision as an accomplice to a crime aimed at misuse of budget funds.

Improving living conditions through maternity capital

The current federal law in 2020 allows the use of a certificate for improving housing conditions for several intended uses at once, depending on the family’s need to increase housing space or reconstruct existing property. Each of these areas differs in implementation features, terms, conditions, etc.

In 2020, under the family support program, there are two ways to improve your living conditions:

- Increase the available area (reconstruction of an emergency condition). Repairs, including major ones, are not paid for, since repairs do not imply an expansion of at least one standard living space standard.

- Purchase new residential property. This method gives certificate holders the right to choose and involves several options for purchasing a home:

- Payment of the entrance fee for housing savings cooperatives. This method is defined as more economical in terms of payment volumes than a mortgage, but this is not always feasible due to the lack of proposals for this type of construction.

- Payment for participation in shared construction.

- Payment of a mortgage transaction. The certificate can be used to pay the down payment or the balance of the debt on a bank loan.

- Purchasing a home under a sales contract.

Conditions for receiving maternity capital 2020 to improve housing conditions

There is a list of conditions for the targeted use of state support, which are supported by the legislation of the Russian Federation and are not subject to challenge in court:

- One-time payment from maternity capital in 2020. State support in the form of financial payments can be spent only for one purpose specified in the application to the Pension Fund of the Russian Federation. If violations are detected, the transfer of funds will be blocked or the certificate holder will be required to return them (if there was fraud)

- Many unscrupulous residents of the country are using fraudulent methods to simultaneously obtain money from the budget and register another home in their name (buying apartments from close relatives, etc.). In both cases, these actions entail criminal penalties.

- Repayment of a loan/mortgage with maternal capital is possible after the child turns 3 years old and until he reaches 23 years old. Maternity capital does not repay fines and sanctions for any type of loan.

Maternity capital indexation 2017

The family certificate is intended primarily to support motherhood and is aimed at improving the standard of living in large families. Due to the fact that inflation is rising, the income of citizens is decreasing, and as a result, the standard of living in the family is deteriorating. In order to prevent the depreciation of money, the Russian government provided for its indexation. Indexation of the subsidy occurs automatically, so citizens do not need to take any formal action regarding the indexation of coefficients.

Below are statistics on the growth of odds from 2008 to 2016:

- 2008: the coefficient increased by 10.5%, the payment amount was 276,250 rubles.

- Year 09: K- 13%, amount - 312,162 rubles.

- Year 10: K 10%, — RUB 343,378.

- Year 11: K 6.5%, – RUB 365,698.

- Year 12: 6%, – RUB 387,640.

- Year 13: 5.5%, – RUB 408,960.

- 14 year: 5%, – 429,408 rub.

- 15 year: 5.5%, – 453,026 rubles.

- In 16 and 17 indexation stopped. The amount remains the same.

How is the amount of capital received indexed?

Upon receipt of the certificate, the document is marked with an amount corresponding to the amount of payment for a certain year. The date of issue of the document does not affect indexing. However, if the certificate says 2011, when the amount of capital was 365,698 rubles, and the parents decided to use it only in 2020, when the amount of capital amounted to 453,026 rubles, then this amount will be payable directly.

How to use maternity capital up to 3 years

MK is a program of social support for motherhood and family. You can receive the document immediately after the birth of a child in the family.

According to the law, the certificate holder has the right to use the money for its intended purpose after the birth/adoption of a child, 3 years later. To receive a payment, you need to write an application and submit the necessary documents to the local Pension Fund.

If 3 years have not passed since the receipt of the certificate, the state allows the money to be sent for its intended purpose related to the repayment of mortgages and housing loans.

Maternity capital and house construction

Let's consider issues regarding the use of maternity capital funds for building a house.

The subsidy cannot be used to purchase land. In this case, the Pension Fund, by law, must refuse this.

An exception is the purchase of land at the same time as a house present on it, which meets the conditions for living in it. Then the state will transfer the amount to purchase the house, and the land will remain an addition to it.

Citizens who own a family certificate should contact the Pension Fund to receive payment of maternity benefits.

After consideration, the Pension Fund of the Russian Federation will transfer half the amount of capital, in the presence of a certificate for the MK, a passport of the certificate holder, a spouse’s passport, a marriage or divorce certificate, in the presence of title papers for the land plot, documents confirming ownership, as well as in the provision of permission to construction and account details where to transfer money.

After six months, the owner of the certificate can receive the remaining part if there is a lease agreement, a certificate of registration of rights and other papers confirming the right to own a plot of land.

Is it possible to use maternity capital to buy a dacha or garden plot for construction?

To receive a subsidy from the state, the Pension Fund will request a document giving the right to build a residential building.

According to the law, it is prohibited to use the following land plots for the construction of a house:

- Dacha non-profit partnership - land for growing agricultural crops and building a dacha house.

- Garden non-profit partnership - intended for the construction of outbuildings and a garden house or the cultivation of agricultural crops.

A building permit is not issued for these types of land.

Thus, it is impossible to buy a plot of land plot or land plot with family capital.

It is allowed to build a house on plots with the following types of use:

- Individual housing construction—intended for the construction of a residential building.

- Personal subsidiary plot - intended for agriculture and construction of a residential building.

Mortgage for maternity capital

It is not prohibited by law to use certificate money to pay for mortgage loans. Moreover, it is possible to obtain a loan even before the birth of the second child in the family. In this case, the spouse can act as a co-borrower or guarantor for the loan.

It is strictly prohibited to repay fines, commissions, penalties and other sanctions on loans.

Most existing banking programs provide their clients with the opportunity to receive a targeted loan using certificate funds. In this case, it is possible to repay both interest and principal or make a down payment.

Repaying a mortgage with maternity capital

If a housing loan in the family has already been issued, before the birth of the second (third) child, the parents have the opportunity to use part of the maternity benefit money for early repayment of the existing loan.

If you purchase ready-made housing, the borrower must register ownership of the apartment. At the same time, on the certificate of ownership, the Russian Register puts a mark that the apartment is pledged. You must obtain a certificate of debt from the bank.

Next, a set of documents is collected and sent to the Pension Fund for review. If the application is approved by the Pension Fund, the money will be transferred to the bank using the details provided.

After repaying the full loan amount and signing the necessary documents with the bank, the apartment will be released from encumbrance, after which the property owner will be able to register it as the property of other family members.

Down payment on mortgage using mat capital

Previously, it was permissible to use MK for a down payment on a mortgage only after the third anniversary of the birth/adoption of a child. Then it became possible to transfer money into the down payment on mortgage transactions before 3 years.

Documents for obtaining a mortgage

Documents for obtaining a loan that are provided to the bank:

- bank application form;

- the borrower’s passport and copies of all its pages;

- copy of TIN;

- copy of SNILS;

- marriage/divorce certificates;

- child birth document;

- a copy of the military ID for men;

- a copy of the work book;

- certificate of income;

- copies of existing loan agreements;

- bank statements.

Each bank has individual requirements for borrowers, so this list can be supplemented with other documents.

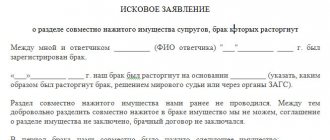

How is maternity capital divided during divorce?

According to the laws of the Family Code, joint property and monetary payments are subject to division of property between spouses, except for payments of state benefits.

Maternity capital is considered a state benefit and is not subject to division during a divorce. In the event of a divorce, the maternity certificate remains with the person in whose name it was originally issued. The document can be issued in both the name of the mother and the name of the father in certain cases.

Rights to maternity benefit do not cease or change upon divorce. Even if the family marriage has ceased to have legal force, the certificate holder continues to have grounds to use maternity capital.

In the case where housing was purchased with maternity benefits, after a divorce, its owners will be the mother and child.

In some situations, a woman may lose the right to a maternal certificate, and the father of children, on the contrary, may acquire such a basis. Eg:

- a woman acted illegally towards her child;

- mother died;

- the woman was deprived of parental rights.