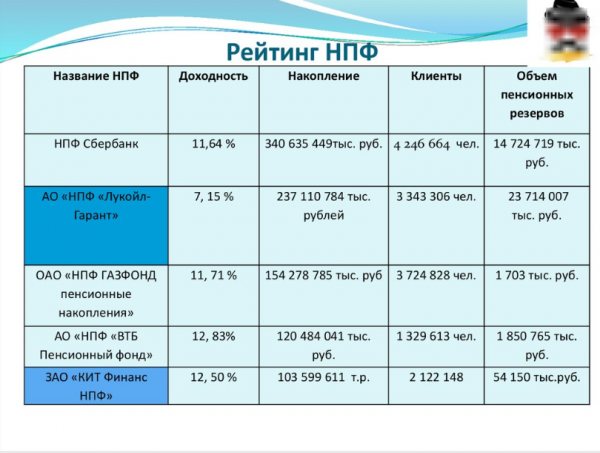

The best funds of 2019-2020 in terms of reliability and profitability

Non-state pension funds are firms engaged in profitable investments of citizens' money in various projects. The income of its clients depends on how wisely the fund manages its investments.

The advantages of storing pension savings in such an organization are as follows:

- You can influence your own pension. A citizen can independently decide how many contributions he will make to the fund.

- You can receive pension payments from different organizations. Diversification of sources of passive income has a positive effect on material well-being. Storing savings even in one NPF allows you to receive 2 pensions (from the state and from the NPF). In addition, you can participate in several funds at once.

- The state regulates the activities of funds. All NPFs must follow state laws, have permits to engage in their own activities, and provide reports to the state. This is one of the reliability factors that reduces the risks of transferring savings to a non-state fund.

- Tax benefits . Moreover, they are provided not only to citizens, but also to employers who make contributions. Money contributed to the fund is not taken into account when taxing the fund participant and the employer.

- Transparent activities . Fund participants can at any time receive data on their own accounts and find out how many contributions have been made and what income has been accrued.

The main disadvantages of participating in a non-state pension fund are:

- Low level of income from investments. The percentage of capital increase in NPFs is usually very small (about 10 percent per year).

- It is impossible to receive your money before the due date. It is possible to receive savings from a non-state fund only in exceptional situations (death, obtaining the status of “disabled person”, serious illness, emigration). In other situations, it is impossible to receive your own money ahead of schedule.

- Lack of influence of NPF clients on where their money will be invested. Non-state pension funds invest participants’ money wherever they want. For ordinary citizens, such a drawback is not significant, but an experienced investor could perhaps manage his money much more profitably.

- Profit is taxed. By making contributions to a non-state pension fund, a citizen receives tax benefits. However, when you receive money from the fund, you must pay capital tax.

NPF rating by reliability

The “European” NPF is one of the most famous. It is popular among citizens due to its good profitability. This company has more than a million clients who have entrusted it with their own savings.

The NPF provides for European standards of service. Thus, citizens can create a personal account on the fund’s website and also monitor cash flows. You can transfer money to another NPF in case of bankruptcy.

An increased interest rate has been determined for citizens who invest their savings in Surgutneftegaz. The company pays pensions on time, has been on the market for more than 20 years, and has a positive reputation among Russians.

According to the statistics and rating of NPF of Russia 2020 in terms of reliability and profitability, you can determine how fully and timely the company fulfills its obligations to insured citizens.

According to the Central Bank in 2020, the rating of NPFs in terms of reliability looks like this:

- "Sberbank". Many Russians prefer to transfer their own savings to the official fund of Sberbank. The main stimulating factor here is that savings are under state protection. Compulsory insurance allows you to increase your savings through periodic contributions. There are special programs for people who plan to continue working even in old age. There are corporate programs aimed at increasing business efficiency.

- "VTB".

- "GAZFOND".

- NEFTEGARANT.

- "Atomgarant".

- "Alliance".

- "Diamond Autumn"

- "Surgutneftegaz".

- "Renaissance of pensions."

- "Society".

- Lukoil Garant (Otkritie).

- NPF Electric Power Industry.

By volume of savings

The first places in the ranking in terms of savings volume are occupied by those organizations that store the most pension savings of citizens. As of 2020, the ranking of companies by amount of savings is as follows:

Rating of NPFs by pension savings

- "Sberbank".

- "GAZFOND".

- "Opening".

- "FUTURE".

- "VTB Pension Fund".

- "SAFMAR".

- "NEFTEGARANT".

- "Confidence". This fund was opened 18 years ago. It was founded by companies involved in the economic life of Nizhny Novgorod, as well as large banking organizations. NPF takes part in a co-financing program, which allows you to significantly increase pension savings.

- "Big".

- "Society".

By number of insured

NPF rating by number of participants

If we compare organizations by the number of participants, the rating will look like this:

- "Sberbank".

- "Opening".

- "GAZFOND".

- "FUTURE".

- "SAFMAR".

- "VTB Pension Fund".

- "Confidence".

- "NEFTEGARANT".

- "Big".

- "Society".

Liquidation of NPF Strategy and its reasons

The main reason for the liquidation of the license of Perm Strategy NPF was the constant violation of the law regarding the timely provision of information about the company’s activities.

During the audit, it was found that various manipulations with securities occurred during trading, the value of assets was inflated, and inspectors and investors were misled. This fact aroused the keen interest of law enforcement agencies.

Subsequently, the DIA on the official website, according to the latest news of the NPF Strategy, was recognized as an insolvent organization and declared bankrupt.

Creditors are demanding damages in the amount of more than 5 billion rubles. The market value of the organization's fixed assets is more than 500 million rubles. During the forced liquidation of the fund, it was determined that the value of the organization’s property was insufficient to pay money to creditors, and as a result it was declared insolvent.

Some time ago it was reported that the Perm Arbitration Court fully satisfied the application for the liquidation of the Strategy fund of the NPF Perm. The latest news is on the website of the provisional administration. After the liquidation of the license, the head of Pyotr Pyankov, NPF Strategy in Perm, was arrested.

A criminal case was opened against him for fraud on an especially large scale, which was committed by a group of people. Then the citizen was released, he was under house arrest.

The former head of the company was accused of embezzling other people's funds in the amount of more than 200 million rubles, selling illegal property and providing false information to the tax authorities.

NPF Strategy Perm, the latest news today reports that a criminal case has been opened again, because previously unclear circumstances have been discovered. The investigation into the case has been ongoing for two years.

Profitability rating - list of funds

Profitability characterizes the amount by which the NPF has increased its existing savings. It is impossible to determine the percentage of savings in advance, however, reliable organizations usually inform them about the volume of planned income or demonstrate the profit of previous years when drawing up agreements with citizens.

After reading the NPF profitability rating for 2020, you can transfer your savings to a company that has earned the highest amounts for its clients.

NPF rating by profitability

Profitability table of non-state pension funds:

| Fund name | Profitability since the beginning of the year, % |

| "GAZFOND" | 9.13 |

| "Consent-OPS" | 6.82 |

| "First Industrial Alliance" | 6.81 |

| "Diamond Autumn" | 6.8 |

| "VTB Pension Fund" | 6.8 |

| "UMMC-Perspective" | 6.63 |

| "NEFTEGARANT" | 6.43 |

| "Sberbank" | 6.35 |

| "Surgutneftegaz" | 6.26 |

| "Agreement" | 6.04 |

| "Defense-Industrial Fund named after Livanov" | 5.82 |

| "Stroykompleks" | 5.75 |

| "Khanty-Mansiysk Fund" | 5.72 |

| "Vladimir" | 5.46 |

| "Transneft" | 5.16 |

| "AQUILON" | 5.1 |

| "National" | 4.94 |

| "Rostvertol" | 4.7 |

| "Hephaestus" | 4.5 |

| "Atomfond" | 4.29 |

| "Federation" | 4.19 |

| "Confidence" | 4.1 |

| "Volga-Capital" | 3.97 |

| "Society" | 3.86 |

| "Alliance" | 3.75 |

| "Rostec" | 3.03 |

| "PROFESSIONAL" | 2.94 |

| "Big" | 2.62 |

| "Magnet" | 2.16 |

| "SAFMAR" | 1.16 |

All ratings in Russia are developed taking into account information published by organizations. According to the NPF data, the previous year turned out to be very favorable for these organizations. The total amount of savings increased by 3.11 percent, reaching 3.3 trillion rubles.