What is maternity capital?

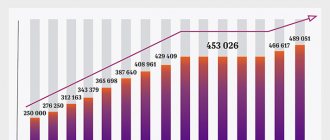

Maternity capital is a form of one-time government support to the population. Families in which a second and subsequent child has been born (or adopted) since 2007 are awarded a special cash certificate.

Young parents can spend maternity capital funds on certain needs that do not contradict the law. The certificate is issued both in paper and electronic form.

Not everyone knows that if at the birth of their second child parents did not take advantage of their right to maternity capital, they can do so at the birth of their third and subsequent children.

Buying a share in an apartment using maternity capital

There are only 2 cases when purchasing a share in an apartment with maternity capital is possible:

- A share in an apartment is a separate room (or several), which is an isolated residential unit. The remaining shares in this case are registered in the name of other citizens. For this reason, it will not be possible to purchase a share in one-room apartments.

- If the family already owns some share of the living space, and upon redemption, the housing completely becomes the property of the applicant.

It is recommended to first obtain legal and real estate advice before spending maternity capital on the purchase of an apartment.

Algorithm of actions:

- Sign an agreement to purchase a share of living space.

- Register the transaction in Rosreestr.

- Send a request to the Pension Fund to spend the subsidy.

- Upon completion of the verification, the Pension Fund transfers the money to the seller’s account.

Deadlines for registration of maternity capital

Parents can manage funds from the maternity capital account, namely write a corresponding statement, at any time after the child’s third birthday. In the case of adoption - after three years have passed from the date of adoption. A child left without parental care can apply for disposal of maternal capital after reaching the age of majority.

Articles on the topic (click to view)

- Conditions for using maternity capital to repay a mortgage in 2020.

- Federal Law 256 on maternity capital and Federal Law on large families

- Federal law on the use of maternity capital: rules for use in 2020

- Federal Law on the protection of family, motherhood and childhood

- Requirements for housing purchased with maternity capital

- Deadlines for registration and receipt of maternity capital

- Article 157 of the Criminal Code of the Russian Federation and maternity capital

In some cases, the application can be submitted immediately after issuing the certificate itself or at the same time. To obtain accurate information on this issue, you can contact the Pension Fund.

Before 2020, the application was considered within 30 days. But since 2018, the review period has been reduced to 15 days. For the most part, this is a merit of automation - now the Pension Fund independently requests all the necessary information from other departments via electronic channels.

General deadlines for issuing and disposing of a certificate

So, let's summarize. Maternity capital can be used only for the purposes provided for by law. The timing of document execution is not limited by time frame. However, the right to receive it appears once in the period between 2006 and 2022, after the birth of the second, third or subsequent child.

The period for consideration of an application for the disposal of funds, regardless of the purpose, is one calendar month. The time frame for transferring funds to a current account is 10 days.

The government annually reviews bills regarding maternity capital. The terms of its payments are reduced, and the intended purpose is expanded.

Useful video:

Promdevelop editorial team: we provide useful articles for our beloved readers

In 2020, the procedure for monthly payments from maternity capital came into force as a support for low-income families and a solution to the demographic problem in the country.

- Who is entitled to payment from maternity capital?

- Deadlines for calculating payments from maternity capital

- How to calculate average per capita family income

- The process of assigning a monthly payment to the Pension Fund and the bank

- What documents are needed for registration?

- Living wage by region of the Russian Federation to determine the right to benefits

How to register maternity capital?

To receive help from the state, you must first obtain a certificate. To do this, an application for its issuance is written at a branch of the Pension Fund, in a multifunctional center or on the government services website. You can also use your personal account on the official website of the Pension Fund for these purposes.

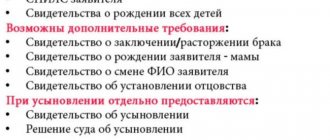

Along with the application, you must provide the following documents:

- Birth certificates of children or court decision on adoption.

- Applicant's passport.

- SNILS of the applicant.

- In the event of the mother's death, the father must provide a supporting certificate.

If you submit an application through the government services website, you need to be prepared that you will receive an invitation to the Pension Fund to check the original documents. Once a decision has been made, responsible employees contact the applicant and invite them to receive a certificate. You can also print the certificate from your personal account.

How long does it take from the birth of a child to receiving funds?

When can maternity capital be used? Today the law does not stipulate the minimum period for the possibility of its use, but it does specify the maximum. Budget money must be disposed of before the second child reaches 18 years of age. The exception is the use of federal funds for training. In this case, the maximum age is 21 years.

When can you use maternity capital after the birth of a child? You can start collecting documents immediately after your children receive birth certificates and SNILS. This is possible the very next day after discharge from the hospital.

What should I do if I lose my certificate?

Unfortunately, situations where a certificate is lost are not that rare. People often lose a document or render it unusable. What to do if such an incident occurs? Of course, you shouldn’t worry, because in reality this is not as critical as it seems.

Any owner of a maternity capital certificate can receive a duplicate of it. To do this, you need to contact the local Pension Fund office with your passport and an application in which you need to indicate the reason for the damage or loss of the certificate. This can be done by the owner of the form himself, his representative or an authorized representative if he has a notarized power of attorney.

A duplicate can be issued immediately or sent by mail. It is important to ensure that the duplicate indicates the series and number of the certificate in exchange for which it was issued, and bears the seal of the Pension Fund of Russia.

Buying housing with capital on the secondary market

Trade in real estate on the secondary market is in high demand, since the cost of such living space is much lower than the price per square meter in houses under construction. The purchase of housing from the owner occurs only after drawing up and signing agreements with the owner of the residential property.

The family will need to obtain the owner’s consent in writing, since money when purchasing an apartment using maternity capital is credited to the owner’s account approximately 2-3 months from the date of registration of the transaction in the state register. Don’t forget to check the owner of the property from whom you are buying the property, perhaps he is wanted or has large debts to the bailiffs, which can lead to the cancellation of the transaction.

The bilateral agreement specifies the amount that the family pays from personal funds, and what part is covered by subsidies. Registration of property rights also requires that shares in the residential premises be allocated to all family members.

You can purchase secondary housing by following the instructions:

- Draw up a statement of the amount of maternity capital.

- Sign a bilateral agreement for the sale of housing with the owner of the property.

- Register the document in Rosreestr.

- Submit an application for disposal of financial support funds to the Pension Fund.

- Remove the encumbrance from your home by submitting an application to the MFC.

- Prepare an extract from the Unified State Register of Real Estate, which allows you to confirm the transfer of property into family ownership.

- Fulfill notarial obligations for shared registration of housing.

Important! When purchasing an apartment using maternity capital, be sure to order an extract from the Unified State Register of Real Estate on our official website. This will help eliminate cases of fraud.

What can you spend maternity capital on?

It is a mistake to believe that, having received a certificate, the owner can use it as his heart desires. It's not that simple. The law defines the purposes for which money can be spent:

- Improving living conditions.

Most often, certificate holders spend money on a down payment on a mortgage, partial payment of interest, or on building a house. Maternity capital funds can also be used for housing reconstruction. When buying a home for cash (without taking out a loan), part of the debt can be repaid with a certificate.

The second most popular option for using maternity capital is to pay for the education of any of the children. You can manage money in this way only when the second (third or subsequent) child turns 3 years old. An exception is preschool education - it can be paid for even immediately after the birth of the child.

As for higher education, the child’s age at the start of education should not exceed 25 years. Maternity capital funds can only be spent on studying in Russian educational institutions and those that must have an educational license.

Not everyone understands what exactly the concept of “spending maternal capital on a child’s education” means. Let's clarify. This includes:

- Payment for paid educational services.

- Payment for child care and maintenance in an institution.

- Payment for dormitory and utilities during the study period.

- The funded part of the mother's (or adoptive mother's) pension.

If you wish, you can dispose of maternity capital this way. This method is less popular, but still has a place. Mothers can use the entire amount of the certificate to form their pension, or some part of it. Before retirement, the parent has time to change her decision and send money for other purposes.

- Purchasing goods from a special list.

Families with disabled children can spend maternity capital on goods and services for their rehabilitation and social adaptation. A special list is established by the state and it will not be possible to spend money on items not from this list, no matter how vitally necessary it may be.

Tax deduction when purchasing an apartment with maternity capital

Before concluding a transaction, it is important to understand that the family will be able to obtain a tax deduction. The only condition is that the compensated 13% is calculated not from the entire value of the residential property, but from the amount remaining to be paid after deducting the capital. The maximum deduction amount when purchasing an apartment with maternity capital for real estate is the same as for purchasing real estate in the usual way.

It is more difficult to calculate the tax when purchasing an apartment with maternity capital on a mortgage:

- When allocating a subsidy to pay for the start-up payment, it is necessary to subtract its amount from the full cost. You can receive a tax refund for the remaining difference.

- When sending a subsidy to pay for the main part. It all depends on the amount sent by the bank to pay off the principal debt, as well as the amount of accrued interest.

If you want to apply for a property tax deduction, then before investing maternity capital in the purchase of an apartment, it is recommended to obtain legal advice.

Is it possible to cash out maternity capital?

Maternity capital funds can only be received by bank transfer. If you are the owner of a certificate and are offered a “legal” cash-out scheme, be aware that this is a scam, because... There are no legal schemes for cashing out maternity capital. And by agreeing to this, you automatically become an accomplice to the crime. This is considered a misuse of public funds.

If you are planning the birth of a second child and you have many questions regarding maternity capital, do not be lazy and consult with competent people.

For up-to-date information on collecting and submitting documents to obtain a certificate, see the following video.

This is important to know: Who is given maternity capital?

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

How and when is maternity capital issued?

An application for a certificate is submitted along with the necessary package of attached documentation to the Pension Fund. This can be done at absolutely any time from the moment the second or subsequent child appears in the family, whose year of birth is from 2007 and above.

Important! The main thing is that if there are 3rd, 4th and other children, the applicant has not previously exercised his right to issue family capital. Because this is only allowed once in a lifetime.

You can submit documents:

A response will be received within 1 month from the date of application. You are either given a certificate or refused to issue it with appropriate motivation.

Attention! In October 2020, it was decided to reduce this period by half, that is, to 15 days.

Deadlines for applying for funds in 2020-2020

But the period for disposing of maternal capital is somewhat different.

An application for disposition may be submitted no earlier than three years from the date of birth of the child. If the right to receive maternity capital arose in connection with the adoption of a child, then three years must pass from the date of adoption. If a child without parental care, who has the right to such a measure of state support, wants to dispose of maternity capital, then he needs to wait until he comes of age or reaches full legal capacity.

Attention! Exception:

- payment of a down payment or repayment of the principal debt and payment of interest on loans for the purchase or construction of residential premises;

- acquisition of goods and services intended for social adaptation and integration of disabled children into society;

- payment for paid educational services for the implementation of educational programs for preschool education and other related expenses;

- receiving monthly payments.

Here you can submit an application immediately after issuing the certificate itself or simultaneously with the application for its issuance, and/or due to the emergence of a real need for it.

After submitting the required package of documents, it will be carefully checked and the application will be approved only if the results of such a check are positive. This will take at least 1 month.

If there are a lot of documents or additional verification is required, the deadline is extended.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Reasons for refusal

If a package of documents raises any suspicions or doubts about their authenticity, the Pension Fund has the right to refuse to transfer funds. Even if the deal has already taken place.

Reasons for refusal may be:

- termination of the right to maternal capital;

- violations of the procedure for filing an application for the disposal of maternal capital;

- If the direction indicated in the application for the disposal of maternal capital is not provided for by law;

- If the amount specified in the application for the disposal of maternal capital exceeds its full volume;

- Restrictions on parental rights in relation to a child, in connection with whose birth the right to maternal capital arose;

- The selection of a child, in connection with whose birth the right to family capital arose;

- non-compliance of the organization with which the loan agreement for the purchase (construction) of residential premises was concluded with the requirements of current legislation;

- Recognition of the purchased residential premises as unfit for habitation or recognition of the apartment building in which the residential premises are located as unsafe and subject to demolition or reconstruction.

Such refusal must be submitted in written, motivated form. Naturally, you can appeal it through the court.

Advice! However, before doing this, consult with professional lawyers about the advisability of filing a claim.

To avoid such incidents, it is necessary to conduct legal due diligence of transactions at the initial stages. Then you can be sure that everything will go well and receive some guarantees.

Download for viewing and printing:

How to get maternity capital?

Initially, you need to draw up the child’s main document - a birth certificate, which will indicate the names of the mother and father. After this, it is necessary to enter information about the newborn (adopted) into the parents’ passports. After this, you need to submit documentation to the Pension Fund.

It is necessary to prepare a complete package of documentation in advance:

- passports of the father and mother, where the citizenship of the Russian Federation is indicated;

- extract from place of residence;

- birth certificates of all children (copies).

Documentation and receipt of financial support takes place at the local branch of the Pension Fund. For example, if a family from other regions lives in Moscow with temporary registration, then they can apply for a state subsidy at the local PFR unit associated with the area of residence.

You can also receive state support while living in a foreign country, if the family complies with the provisions of the current legislation of the Russian Federation. However, it is important to understand that you can manage money only within the state borders of the Russian Federation.

Doubling maternity capital when buying an apartment

not happening. However, in addition to state maternity capital, there are also local programs to support large families, operating at the level of almost every region of the Russian Federation. Parents can obtain additional certificates from local authorities for children born into the family after January 1, 2011. The amount and conditions for receiving regional support in each region are determined by local authorities.

The Pension Fund considers the application within 1 month and 5 days from the date of submission of the full package of documentation. If the decision is positive, the government agency issues a certificate to the applicant.

Deadline for cashing out maternity capital after the birth of a child

The law does not establish any exact terms for the use of maternity capital.

The age of the child is specified only when maternity capital funds are allocated for his education and is limited to 25 years on the date of commencement of education. The age of a disabled child for whose adaptation and social integration funds can be spent on maternity capital is not specified.

This is important to know: Allocation of shares to children after repayment of the mortgage with maternal capital

Also, up to 23 years of age, a child has an independent right to receive family capital funds if:

- both parents (adoptive parents) are no longer alive or have been declared dead;

- both parents are deprived of parental rights in relation to the child, in connection with whose birth the right to maternity capital arose;

- both parents committed a crime against their child;

- In relation to both parents, the adoption of a child was canceled, with the birth of which the family had the right to maternity capital.

A woman is deprived of her right if:

- her death or recognition of her death;

- deprivation of parental rights;

- cancellation of adoption;

- the presence of a court verdict on the commission of a deliberate criminal attack against the child’s person.

As for the possibility of redirecting funds to the mother’s pension savings base, such a right is not limited by time limits.

Terms of participation in the MSK program

The state program of financial assistance to family citizens in order to improve the demographic situation in the country is valid from 2007 to 2021 inclusive.

Attention! If the 2nd or subsequent child was born after December 31, 2021, then his family will no longer be able to take part in the program.

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

Subscribe to news

August 23, 2020 09:03

The PFR branch for the Republic of Adygea reminds residents of the region who are holders of a certificate for maternal (family) capital that in accordance with Federal Law No. 256-FZ “On additional measures of state support for families with children”, regulating the provision of maternal (family) capital to citizens ) capital, families in which the second, third or subsequent child was born or adopted from January 1, 2007 to December 31, 2020 have the right to MSC.

The presence of this norm has given rise to the widespread opinion that it is possible to use funds from maternity (family) capital only until December 31, 2020. In reality, this is not so: in a similar way, only the time is chronologically limited, before the expiration of which, in order for the right to MSC to arise, a second, third or subsequent child must be born or adopted, while receiving a state certificate for maternal (family) capital, as well as and you can submit an application for disposal of funds even after the end of 2020.

Regarding the use of MSC funds, the only chronological restriction is that if they are used to pay for a child’s education, the child’s age should not exceed 25 years.

Who can take advantage of state support funds and receive a certificate

Before figuring out when you can use mat capital after the birth of a child, you need to take into account the specifics of obtaining a certificate. This must be taken into account if the money is subsequently used to purchase housing. The law establishes the conditions for the use of funds.

The certificate can be issued in the name of:

- A woman who has given birth to or adopted a second or subsequent children. In this case, the child must have Russian citizenship.

- Men who are the father or sole adoptive parent. Maternity capital is issued to the father in a situation where his wife has died or been deprived of parental rights or freedom by a court decision.

- The children themselves after they reach adulthood. This is possible if minor citizens were transferred to the guardianship of the state as a result of the death of biological parents or deprivation of rights.

Particular care during the registration process must be shown to families in which only one spouse has Russian citizenship, or the mother, for some reason, cannot obtain a mortgage after childbirth for herself. This is due to the fact that it will be possible to buy an apartment using funds only if the mortgage agreement, purchase and sale agreement and ownership rights are issued in the name of the certificate holder. You need to remember that you cannot cash out maternity capital. This is a violation of current legislation and will be a reason for bringing violators to justice.

Video