Dismissal of a pensioner is the final termination of the work activity of a person who receives pension payments. Currently, most of those who have reached retirement age continue to work. And in this regard, very often employers have a question: how to legally dismiss a pensioner due to the necessary rotation of personnel? In turn, employees approaching retirement age are worried about whether it is possible to fire an old-age pensioner. We will answer these and other questions in the article.

Age is not a reason to quit

A person who has reached a certain age has the right to stop working and retire.

But the legislation of the Russian Federation also does not prohibit such elderly people from working. Especially if they are full of strength and can fully cope with their work responsibilities. Despite the fact that due to the pension reform of 2020, the retirement age has been increased (for men - 65 years, for women - 60), it did not become a reason for dismissal. And if the manager nevertheless forced an older employee to terminate the employment relationship without justified reasons, this will be regarded as age discrimination. In such cases, employers are in for big trouble. How to fire a pensioner without violating his rights and legislation?

Statement

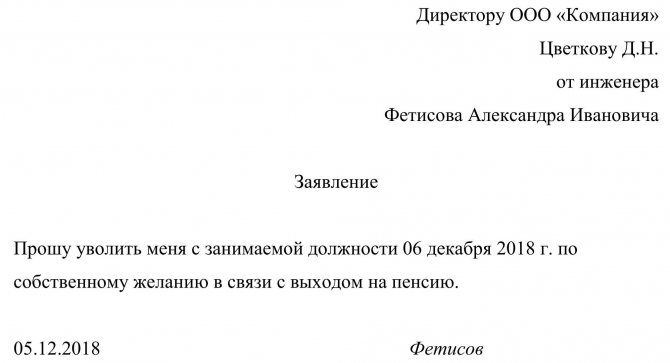

An application for resignation of an employee at his own request does not have a unified form. Typically, each company has its own recommended sample for filling out this document.

The application must reflect the following points:

- In the “header” of the document in the upper left corner the name of the employing company and the full name of the head of the company, as well as the applicant’s data, are written down.

- The name of the document “Application” is written in the center.

- The main part contains a request for voluntary dismissal, indicating the reason for dismissal.

- The date and signature of the employee with a transcript are placed.

Sample document: application for dismissal of a pensioner at his own request can be downloaded here.

The pensioner should pay special attention to the wording of the petition part of the application. If he simply writes here “Please resign at his own request” without reference to the retirement age, he will have to work for two weeks. Of course, if the employer does not agree to let him go from work without the work required by law.

But if the pensioner refers in the application to his desire to retire (“I ask you to dismiss at your own request in connection with retirement under paragraph 3 of Article 80 of the Labor Code of the Russian Federation”), then the employer will be obliged to dismiss the pensioner on the very day on which he pointed out. The pensioner does not have to submit such an application within the prescribed period (at least two weeks in advance). For example, if a pensioner writes a statement on May 22, then it is on this day that the employer must terminate the contract with him.

The legislative framework

All situations related to employment and termination of an employment contract are regulated by the Labor Code and adopted regulations:

- Federal Law No. 400 dated December 28, 2013 “On insurance pensions”;

- Federal Law of December 17, 2001 No. 173 “On labor pensions in the Russian Federation”;

- Art. 77, 78, 80, 81 Labor Code of the Russian Federation.

Fixed-term contracts, which are regulated by Art. 59 Labor Code of the Russian Federation. According to the law, the period for concluding such an agreement is limited to 5 years. It is convenient for the employer, as it allows the working relationship to end on time and does not require payment of severance pay. But a fixed-term contract can only be concluded with the consent of the candidate.

Does an employee have the right, when retiring, not to work for 2 weeks?

If an employee, upon reaching retirement age, wishes to continue working, the management of the enterprise has no right to prevent this. Labor activities are carried out under the same conditions. Article 3 of the Labor Code of the Russian Federation prohibits an employer from dismissing a citizen because he has reached retirement age . There is also no automatic termination of the contract.

At his own request, a pensioner has the right to resign at any time, having previously notified the employer about this within the period specified by law (Article 80 of the Labor Code of the Russian Federation).

The standard period of information (working out) is usually 14 days, but in some cases it can be increased or shortened (3 days - for a fixed-term contract, seasonal employment, 1 month - for managers, coaches). In special circumstances, it is permissible to resign without complying with the specified notice periods.

Article 80 of the Labor Code of the Russian Federation allows you to leave without working out if situations arise when carrying out work activities becomes impossible. Retirement is considered one of these circumstances.

That is, a citizen has the right to retire without working or by reducing it, notifying the employer about this. Dismissal is made on the day specified by the pensioner in the application. The employer has no right to retain the employee and prevent the termination of the contract.

Rights of a working pensioner

According to the Labor Code, working pensioners have the same rights as other workers. And in some cases they even have advantages:

- a WWII veteran, if he works, can choose a convenient time for vacation;

- an elderly employee can take additional unpaid leave of up to 14 days;

- exempt from paying property tax;

- have preferences when issuing vouchers to holiday homes or sanatoriums;

- upon dismissal due to retirement, they have the right not to work the required two weeks.

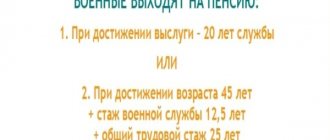

What do employees of the Ministry of Internal Affairs have to do?

A one-time benefit upon retirement from the army or internal affairs bodies, including the police, depends on length of service, distinction and health status:

- if the service life exceeds 20 years - 7 salaries of special monetary support;

- with a service life of less than 20 years - 2 salaries of special monetary support;

- in the presence of government awards of Russia or the Soviet Union - 1 salary of special monetary support;

- if a military serviceman or an employee of the Ministry of Internal Affairs is injured in service, then upon retirement he is entitled to an additional benefit of up to 2 million rubles;

- when disability is established, the funds due to the pensioner are indexed taking into account a coefficient established depending on the disability group and the cause of injury;

- compensation for personal property.

If at the time of dismissal the serviceman has not received clothing for the current year, then he is entitled to monetary compensation based on the submitted report and a certificate from the clothing service.

Dismissal of a pensioner at his own request

The easiest way to fire a pensioner is if he writes a statement of his own free will.

The legislation does not establish a time period between obtaining the right to receive a pension and the voluntary dismissal of a working pensioner. The employee can write an application immediately after receiving the right to pension payments or remain working as long as he considers possible.

The dismissal process in this case is no different from other employees, with one exception. We have already written about it above: if an employee receiving an old-age pension quits for this reason for the first time, he may not work the required two weeks.

First of all, a statement must be drawn up, which indicates:

- FULL NAME. employer;

- personal data and position of the resigning person;

- the text of the statement itself;

- date and signature.

Sample application for voluntary resignation

After the manager has received the application, he can proceed to issue the order. It is drawn up according to the T-8 form approved by the State Statistics Committee.

The order states:

- name of the organization, OKPO code, order number, date of issue;

- the date of termination of the employment contract and the number under which it is listed in the internal archives of the organization;

- FULL NAME. the retiring pensioner and his position, personnel number;

- grounds for termination of an employment contract. To avoid an offense, this line indicates that the basis was the employee’s own desire to resign due to retirement;

- the employer’s position, his signature with a transcript and the signature with a transcript of the employee, confirming that he is familiar with the document.

After issuing the order, the manager must give the resigning employee a full payment, including mandatory payments and additional ones.

At the same time, a work book is drawn up, in which the date, reasons for dismissal, order number and date of issue are entered.

After completing all the necessary papers, they are handed over to the former employee. Who, in turn, must sign the journal for recording the movement of internal documents, confirming their receipt.

For financially responsible persons, everything is a little more complicated. The resignation letter must be submitted two weeks before the expected date of completion of work. An inventory must also be carried out and the accountable property must be transferred to the successor or employer.

When terminating an employment contract at his own request, the employer must pay:

- wages for actual time worked;

- compensation for unused vacation this year;

- additional payments at the discretion of the employer.

Other reasons for dismissal of a pensioner

Reaching retirement age is not a reason to fire a worker. However, such an employee can be dismissed under Article 83 of the Labor Code of the Russian Federation, which describes the reasons for termination of an employment contract due to circumstances beyond the control of the parties.

Information

Of course, a pensioner is unlikely to be drafted into the army, but the basis for dismissal: recognition of an employee as incapable of working for medical reasons (clause 5 of Article 83 of the Labor Code of the Russian Federation), occurs quite often, and is quite applicable for pensioners.

You can also terminate your employment relationship with an employee of retirement age for all the reasons described in Article 81 of the Labor Code of the Russian Federation. Age is not a barrier to dismissal if the following conditions are met:

- the company ceases its business activities;

- the employee himself does not correspond to the position he occupies.

InformationThis should be evidenced by the certification conclusion.

- he violated the internal routine;

- committed an illegal act at his workplace;

- other grounds prescribed in Art. 81 Labor Code of the Russian Federation.

Attention

If the worker is at fault, then the termination of the relationship must be properly formalized. If there is even the slightest mistake, the fired person will be able to be reinstated in the workplace through the court.

The procedure for terminating the contract is as follows:

- an internal investigation must be carried out;

- if a crime is committed at the workplace, the employee’s guilt must be proven;

- written explanations must be taken from the perpetrator;

- if necessary, remove him from performing labor functions;

- issue a dismissal order. In it, indicate the basis, according to the article of the Labor Code of the Russian Federation;

- The dismissed pensioner must be familiarized with the order. If he does not agree, he must still sign for acquaintance, but also indicate “disagree”;

- on the day of dismissal, pay the dismissed person in full;

- give him his work book and issue all the necessary documents. The work certificate is given against signature on receipt in the accounting journal.

Attention

You can challenge dismissal “under the article” in court.

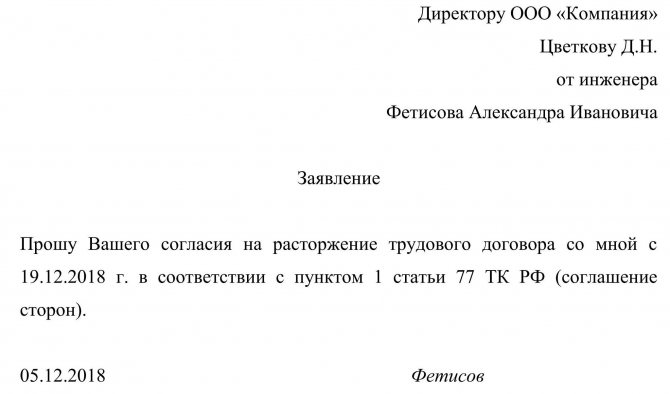

Dismissal of a pensioner by agreement of the parties

In this case, termination of the employment contract occurs at the initiative of both parties. The procedure is completed in the same way as when leaving at your own request. But with one exception. In this case, withdrawal of the application is practically impossible. Withdrawal of the application and return to work must also occur by mutual agreement.

Sometimes a manager offers a working pensioner to switch to an easier job that corresponds to the health status of the subordinate. The transfer must be carried out only with the consent of the employee.

Sample letter of resignation by agreement of the parties

Dismissal of a pensioner due to insufficient qualifications

This is not an easy option and quite labor-intensive. The Labor Code allows the termination of a working relationship due to an employee’s inadequacy for the position held based on the results of the certification (clause 3 of Article 81). To take advantage of this opportunity to terminate a contract with an employee, you must:

- conduct recertification for compliance with the qualifications of the position held;

- receive a negative conclusion about the pensioner’s qualifications based on the results of certification;

- establish the absence of a vacancy for transfer or receive an employee’s refusal to transfer to another position.

A written refusal of the pensioner to transfer to another vacancy, if any, is required in this case.

Select month and date

When is it better to quit - at the beginning, in the middle or at the end of the month? If you have the opportunity to choose the latter option, you will receive the salary due to you, and starting from the 1st day of the next month you will already be considered a non-working citizen. If you leave your job at the beginning or in the middle of the month, you will not be able to take advantage of this opportunity - this month will be counted as your working month.

Another good option is to quit in January. Recalculation of insurance pensions begins on January 1 of the next year, which means that starting from the New Year you will be credited with an already indexed pension. Moreover, if you wish to return to work in February, the non-retroactive indexation will not be reversed.

Dismissal of a pensioner due to staff reduction

This option is financially expensive. An employee who has reached retirement age can be dismissed due to a reduction in the number of employees. The presence of pension rights does not provide any benefits to the employee, and the termination of the working relationship takes place in the general manner:

- Order to reduce staff.

- Two months notice about job reduction.

- Offering available vacancies when available.

- Written consent to transfer to another position or written refusal to transfer.

- Order of dismissal.

In this case, the employer must comply with certain rules:

- the pensioner must be notified of the layoff at least two months in advance;

- issue an official order;

- make payments and issue all documents on the due date.

But since the procedure for dismissing a pensioner due to staff reduction is no different from dismissing other employees for this reason, the employer must first offer the pensioner another vacancy existing in the company. If the elderly person agrees to switch to it, then the transfer process is carried out. And only in case of refusal the employment contract is terminated.

Also, on the last working day, a full settlement with the employee must be made and all documents must be issued.

What payments are due?

A retiring retiree is entitled to the same benefits as any other employee in a similar situation. In addition to salary, a citizen who decides to retire has the right to expect to receive compensation for unused vacation. If the company's management dismisses an employee due to staff reduction, he is entitled to severance pay, the amount of which must correspond to his average monthly salary.

In accordance with the current legislation of the Russian Federation, a citizen who decides to retire has the right to claim:

- salary for the current pay period;

- payment for unused vacation;

- compensation 13 bonuses - paid by those institutions whose employment contracts provide for material incentives for employees at the end of the year;

- severance pay.

Salary for the current pay period

The final payment upon termination of the employment relationship with a pensioner must be made within a strictly established time frame in accordance with the legislation of the Russian Federation. As a rule, it is carried out on the last day of work. If the worker was not present at his place on the date of dismissal, but his position was retained, payments upon retirement by age must be made no later than the day following the request for final payment indicated by this citizen.

Scheme of monthly income payments upon dismissal:

| Balance of unpaid wages | Days worked per month. Salary x Total number of days per month. | Prices x Products manufactured in the last month. | Bonus approved for payment by the manager |

Russian employers use unified form No. 61 to document the calculation of salary and other compensation upon dismissal. After deducting all due payments, the calculation of wages upon retirement will be calculated according to the following formula: Z (OST) = OKL / RD x OD - D, where:

- OKL – monthly salary of the worker;

- RD – the number of working days in the month for which the salary balance is calculated;

- D – debts of the employee to the employer;

- Z (OST) – salary (balance);

- OD – the number of unpaid days worked (including the day of dismissal).

Cash compensation for unused vacation

If a retiring pensioner has unused vacation days left, they are calculated using the following formula: BUT = GG x 28 + 28/12 x M – O, where:

- BUT – compensation for unused vacation;

- GG – the number of complete years worked in the organization;

- M – the number of months in partial years of work in the company;

- O – the number of compensated vacation days at the time of dismissal.

If a pensioner has worked at the enterprise for a full 11 months from the date of registration of the employment contract, it is considered that he has worked for a full year. If the length of service does not exceed an eleven-month period, a simplified formula is used to calculate the number of vacation days: BUT = 28/12 x M - O. If the resigning pensioner worked in the organization from 5.5 to a full 11 months, and the termination of the employment contract is due to:

- liquidation of the company;

- reduction of staff;

- temporary suspension of work or reorganization;

- conscription of an employee for military service;

- professional incompetence;

the BUT indicator will be calculated using the formula: BUT = 28 – O.

Compensation for unused vacation will be calculated using the following formula: VNO = NO x SZ, where:

- VNO - payment of compensation for unused vacation;

- SZ – average daily salary;

- BUT – unused vacation.

Average daily earnings are calculated using the formula SZ = V/OD, where V are all payments that are taken into account in the billing period (1 year or less, starting from the date of conclusion of the employment contract until the day of leave or dismissal), and OD is the number of hours worked. days. To obtain the OD indicator, the following formula is used: OD = M x 29.3 + ODNM / KDNM x 29.3, where:

- M – number of full months worked;

- ODNM – the number of days of labor activity in partial months of the billing period;

- KDNM – the number of calendar days in partial months. work.

13th prize

Payment of 13 salaries after dismissal is a separate procedure. Only the employee whose work contract contains a bonus clause has the right to apply for this type of compensation. The presence of a contractual condition is relevant if:

- the results of labor activity were satisfactory, and during the billing period the company made a profit;

- According to the contract, a pensioner who resigns at his own request does not lose the right to receive a bonus.

In exceptional cases, claims for financial incentives in the form of 13 salaries are not satisfied, for example, when workers are laid off due to unprofitable production. The right to bonuses, as a rule, is stipulated by a number of documents - any of them gives the worker the opportunity to claim this type of compensation:

- collective contract;

- wage regulations;

- bonus act;

- personal employment contract.

The bonus is paid immediately before retirement along with other compensation. If the employer provides quarterly and/or annual financial incentives, the legislation of the Russian Federation obliges the employer to pay even those employees who quit earlier, since they were related to the organization’s profit for the specified time period.

- The benefits of swimming in the pool for your figure. What are the benefits of swimming in the pool?

- Homemade feijoa compote

- What does scabies look like?

The bonus amount is calculated according to the following rules (for the specified period):

- the total percentage of incentives is calculated;

- the employee’s total income is calculated;

- if the billing period (quarter or year) was not fully worked out, only the number of full months is taken into account;

- the percentage of payments should be multiplied by the worker’s current income - this is how the amount of incentives is obtained;

- from the bonus received, 13% personal income tax (hereinafter referred to as personal income tax) is deducted and paid to the federal budget.

Payments upon dismissal of a pensioner due to staff reduction

When dismissal due to staff reduction, the calculation includes:

- wage;

- compensation for unused vacation;

- a benefit in the amount of average monthly earnings (paid in the first and second months after the layoff, can be paid in certain cases for up to six months).

If the organization has other additional payments upon dismissal of a working pensioner, they are also added to the total amount.

Compensation upon dismissal in certain cases may be in the amount of 2 weeks' earnings. This applies to the following cases:

- if the work was seasonal;

- if the employee refuses to transfer to another organization by agreement between employers.

There are some small peculiarities when paying compensation for the dismissal of pensioners due to staff reduction in the Far North and equivalent territories. According to Article 318 of the Labor Code of the Russian Federation, dismissed employees are entitled to compensation in the amount of salary for the period of employment, but not more than six months.

Payments and compensations

If a pensioner resigns of his own free will, by agreement of the parties, or upon retirement, the employer must pay him:

- wages for the time actually worked in the month in which the employment relationship is terminated;

- compensation for unused vacation, if any in the current working year;

- additional benefits at the discretion of the employer.

If a pensioner resigns due to staff reduction or liquidation of an enterprise, then the employer pays him:

- wages for actual time worked;

- compensation for unused vacation, if any;

- benefits for the first two months after dismissal, for the third - if necessary;

- Additional benefits are paid at the discretion of the employer. The law does not provide for this.

- if the pensioner carried out his labor functions in the regions of the Far North or in areas with a similar status, then the benefit is paid for a period of up to six months.

There are times when the benefit amount may be reduced:

- work of a pensioner in seasonal work;

- refusal to transfer him to permanent work at another enterprise, by agreement between employers.

Can a pensioner be fired for health reasons?

Dismissal for health reasons of a pensioner is possible only with a medical certificate. And in order to send a person for a medical examination, he must work in positions or jobs, the list of which is included in the Order of the Ministry of Health and Social Development dated April 12, 2011 No. 302n.

Passing medical examinations at the direction of the employer is the employee’s responsibility (Article 214 of the Labor Code of the Russian Federation). If there are health problems, which is often at retirement age, the medical commission can issue the following types of conclusions:

- establish the pensioner’s total incapacity for work;

- recognize the employee as needing lighter work for a period of less than 4 months;

- recognize an employee as needing lighter work for a period of more than 4 months.

If the medical commission recognizes the employee as completely disabled, then the reason for separation from the employee will be the grounds specified in paragraph 5 of part 1 of Article 83 of the Labor Code of the Russian Federation.

How can you fire a pensioner if the medical board recognizes him as needing easier work? In this case, if the employee needs a permanent transfer or transfer to another job for a period of more than 4 months (if the pensioner himself refuses such a transfer), then dismissal will be made under clause 8 of part 1 of Article 77 of the Labor Code of the Russian Federation. This can only be done if there are no suitable vacancies or, as already mentioned, if the transfer is refused. Before issuing a dismissal order, you should draw up a notice of termination of the contract due to the lack of vacancies corresponding to the state of health, and obtain the employee’s signature. In this case, the pensioner receives a compensation payment in the amount of two weeks’ average earnings (see Article 178 of the Labor Code of the Russian Federation).

Is it possible to fire a pensioner without his consent?

Many workers, upon reaching a certain age, and most often even a year before retirement, begin to get nervous, fearing that they will lose their job along with the onset of the retirement period. Can an employee be fired because of his age?

The law clearly states that refusal to provide a job on the basis of age is recognized as discrimination. An employee cannot be fired on the grounds that he has retired. Meanwhile, it’s no secret that this practice is still widely used. Employers are often interested in the influx of young personnel; moreover, new employees allow them to save on their wages, at least in the area of payment of amounts based on length of service.

An employer can part with an employee only on the grounds specified in Article 81 of the Labor Code of the Russian Federation and no other arguments are considered justified. Of course, if the employer plans to terminate the relationship, then he can systematically bring the person to submit an application of his own free will. However, such coercion can be challenged in court, and then the employer will not only need to reinstate the dismissed person in his position, but also pay him compensation for temporary downtime, and possibly pay for the moral damage caused. The material losses of the organization do not end there, because along with the recognition of illegal dismissal, it is ordered to pay legal costs, and administrative punishment may also be applied.