General information about the pension deposit of Rosselkhozbank

The bank was formed in 2000 to provide assistance to the agricultural sector and agricultural territories of Russia.

Since then, it has been included in the list of systemically important financial institutions in the country. Deposits at Rosselkhozbank are presented for pensioners with a special line of programs with high rates and loyal processing conditions. In order to register a pension deposit at Rosselkhozbank in 2020, you will have to present to the manager at the branch a certificate or a special document from the Pension Fund on the assignment of an insurance pension. In some cases, it is allowed to open a deposit if there is a document on lifelong maintenance payments (relevant for judges).

You can conclude a deposit agreement without certificates and certificates. Now deposits in Rosselkhozbank have become more accessible to citizens who have reached retirement age. You can get by only with a passport even if there are less than 2 months left before the age limit.

It is important to remember an important fact that at Rosselkhozbank, deposits for pensioners today participate in the RF CER. This means that all savings of individuals, including deposits for pensioners, in the amount of up to 1.4 million rubles, including interest, are reliably protected and guaranteed for payment by the government.

Pensioners at Rosselkhozbank have access to an extensive range of banking products: relatively cheap loans, various plastic cards, deposits for individuals.

This may be a pensioner’s ID or other official paper from the Pension Fund of the Russian Federation, indicating the assignment or establishment of an insurance pension to a citizen.

Pensioners who have confirmed their status can open a special deposit.

In some situations, it is possible to open a pension deposit upon presentation by the client of a documented court decision assigning him a lifelong maintenance, paid monthly. Now you don’t have to present a pensioner’s ID, limiting yourself to providing a certificate from the Pension Fund.

A depositor who has already reached retirement age may not be provided with any paper at all certifying the regular accrual of a pension. As you know, men in the Russian Federation receive pensioner status at the age of 60, and women at the age of 55. It is not significant for the bank if the client still has a maximum of two months left before reaching these age marks.

Rosselkhozbank offers elderly people an interesting product - issuing a pension card, which allows them to regularly receive interest income accrued on the account balance. This is an interesting opportunity to earn additional income for an ordinary Russian pensioner.

What does a pensioner need to open a deposit?

To open a pension deposit you need to provide the following documents:

- passport,

- pensioner's ID,

- a document from the Pension Fund of the Russian Federation on the establishment and/or assignment of an insurance pension or a document on the assignment of monthly lifelong maintenance from the courts included in the judicial system of the Russian Federation.

No additional documents are needed:

- upon reaching retirement age;

- in case there are 2 months left before old-age pension;

- when choosing another deposit from the Rosselkhozbank line.

These deposits are opened at the bank's office.

Rosselkhozbank - what are the deposits for pensioners today?

In 2020, clients are offered a choice between 10 different investment options. At the same time, 2 types of deposits were created and prepared specifically for pensioners, which is confirmed by both their name and opening conditions. Potential investors will have to choose between:

- Pension income;

- Pension plus.

Both of these options have a lot of similar features, but some important nuances and provisions make them unique. Therefore, in order to choose one of the offers, you should familiarize yourself in advance with the interest rate, withdrawal procedure and existing restrictions. At the same time, it is necessary to focus on your own desires and needs and ensure that the decision made is fully consistent with the existing goals.

Rosselkhozbank, Deposits of individuals 2019

The “Profitable” deposit is one of the most profitable programs of Rosselkhozbank. Maximum rates: up to 8.00% per annum in rubles, up to 4.00% per annum in dollars, and up to 1.10% per annum in euros.

All deposits of Rosselkhozbank are insured by the state for an amount of up to 1.4 million rubles. In this case, the Federal Law will reliably protect the savings of depositors. Deposit rates, when compared with 2018, have increased slightly (especially in foreign currency).

The interest rate on the deposit will depend on the following factors: the placement period (the longer the deposit term, the higher the rate is assigned), the deposit amount (the larger the amount, the higher the rate), the opening method (opening a deposit through remote channels is encouraged by increased rates), from method of withdrawal of interest (if interest is paid at the end of the term, the rate is higher).

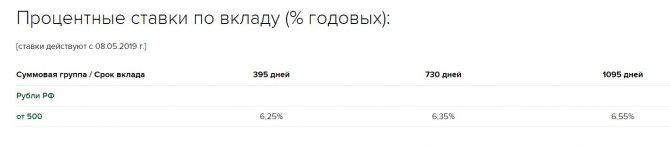

Deposit percentage

The “Pension Plus” deposit in RosselkhozBank in 2020 brings a good income to citizens who trust and open an account. Calculating interest today is not difficult with the built-in calculator on the bank’s website. You just need to click on the yellow “Calculate return on deposits” button.

To find out what percentage you can get, select the currency (ruble) in the calculator. Next, indicate the amount you would like to invest. Then enter the due date. Move the slider to the right for the desired number of months.

395 days is approximately a little over 13 months, and 750 is about 24. Scroll down the page to see all the offers for the various programs. Find the product you need from the list. The table will indicate the rate, the possible maximum amount for storage, when interest is paid, as well as income at the end of the contract.

For example, for 100 thousand rubles. for a period of 395 days or 13 months you can get 7622 rubles 41 kopecks.

Other contributions

In addition to targeted deposits for pensioners, older people in 2021 can take advantage of other deposits for individuals. Rosselkhozbank has many programs implemented on favorable terms.

- The “Profitable” deposit provides a rate of up to 5.6% per year even when opened for an amount of 3,000 rubles or more. You can place funds online through a mobile application or your personal account on the organization’s website. Profit, at the request of the client, can be transferred to his account monthly, or capitalized. When opening a deposit of 50,000 rubles or more, the client is issued a card with a favorable tariff plan.

- The “Reliable Future” deposit is one of the most profitable. The interest rate ranges from 5.8 to 6.2%. The minimum contribution should not be less than 50,000 rubles. There are no restrictions on the maximum amount. The contract period is from 180 to 395 days.

- The “investment” deposit is made for a period of 395 to 730 days. The minimum contribution is 50,000 rubles or 1,000 dollars. The program does not provide for any expenditure or replenishment of funds. Otherwise, the agreement with the bank will be terminated, and the profit will be calculated at a minimum rate of 0.01%. The interest rate is 6.4%.

- The “Save for a Dream” deposit is placed at 4.75%. The minimum amount for opening a deposit is 3,000 rubles. The contract period is up to 730 days, depending on the client’s wishes. Interest is capitalized every month.

Results

Rosselkhozbank has programs on various conditions, among which you can find something suitable. An elderly person can use both a deposit for pensioners and a deposit for individuals. After studying the conditions, you will be able to choose the program that is more profitable or more suitable.

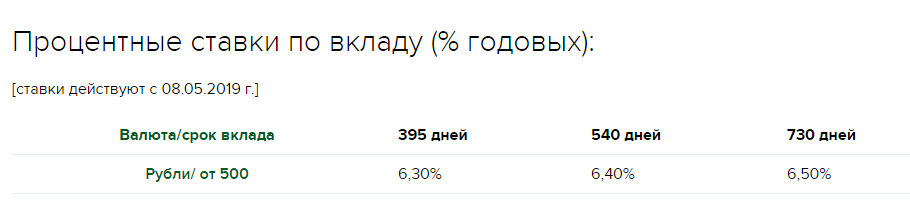

Pension income

Moving on to the study of current deposits, the first step is to consider in detail “Pension income”. For this type of investment, the financial institution offers:

- profit of 7.1% per annum;

- 3 types of agreement terms – 395, 540, 730 days;

- a minimum amount of 500 rubles;

- monthly payments;

- the client has the right to choose an account for receiving interest between a transfer using the details specified by him and crediting to a savings account;

- the maximum amount of savings does not exceed 2 million;

- replenishment is allowed, withdrawals are not allowed;

- in case of early closure, charges are made at the rate of 0.01% per annum;

- automatic renewal of the contract, unless the owner of the money has stated otherwise, occurs without changing the conditions.

Deposits for individuals of Rosselkhozbank 2019: interest and conditions

Interest rates on deposits at Rosselkhozbank differ not only from the term and amount, but also from the method of opening deposits. When making a deposit online, the profitability may be greater than when opening a similar deposit in the office. This should be taken into account.

To make it easier for you to choose a suitable deposit at Rosselkhozbank, we have collected them on one page.

Rosselkhozbank today offers a wide range of products intended not only for villagers. For example, today Rosselkhozbank offers clients a range of individual deposits in rubles and foreign currencies on the most diverse and favorable terms at a fairly attractive interest rate.

There are Rosselkhozbank deposits for those who do not have too much money, and for those who have large sums and are ready to receive the maximum interest. There are special deposits for pensioners.

How to register pension deposits at Rosselkhozbank in 2019

To take advantage of profitable deposit services, you should show the branch manager your pensioner ID and, of course, your passport. The “Pension Plus” deposit of Rosselkhozbank in 2020 or “Pension Income” can be concluded in favor of a third party. At the same time, his presence in the department is optional; the main thing for a pensioner is to know the name of the person in whose name such a “gift” is issued.

There are several options available to clients for making a deposit with RSHB:

- At a bank branch.

- Through ATMs.

- Remotely, through the Internet banking service.

The last two methods significantly save time, but are available to existing clients who have managed to open a card, current account or use a loan at the institution.

New clients must contact any office of RSHB JSC with a general civil passport, sign an application for opening a deposit account, and then top it up.

How can a pensioner choose a deposit?

In order for a pensioner to choose the most comfortable and profitable deposit account, you need to go to the official website of Rosselkhozbank and see what offers the bank is putting forward today. It is necessary to carefully review what conditions each deposit account will have and choose a deposit that is convenient, but also profitable with a higher interest rate.

On the website in the deposits section there is a special profitability calculator that helps calculate the benefits of investing funds under a particular program, which is what a pensioner should use. And if a person is a bank client, then it is worth taking a closer look at offers with the possibility of remote opening in order to receive an increased rate.

You need to choose a program wisely; there is no need to rush. You can also consult with a specialist at a bank branch, and he will tell you which offer is more suitable for a person, taking into account his wishes and capabilities.

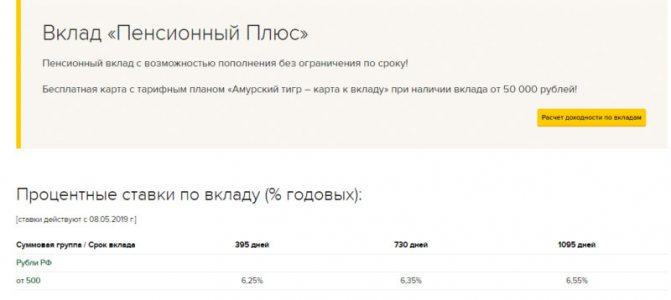

Pension plus

The deposit from the Russian Agricultural Bank is currently a profitable pension investment. The demand for a deposit is based on charges and the requirements for opening an account. Among the main conditions are:

- The deposit is opened upon presentation of an official ID or a special certificate from the Pension Fund regarding the transfer to the pension account.

- The general age for women is 55 years or more, and for men 60 years or older. An age group with a two-month period before the onset of these years is allowed.

- The deposit can be opened for a relative if he is a minor.

- The minimum investment is 500 rubles.

- Profitable capitalization of the process is carried out once a month.

- There is a replenishment from one ruble.

- The permissible maximum amount is 10 million rubles.

- Expenses can be made while maintaining the established rate and fully maintaining the pre-designated balance; it does not decrease.

- The amount of the balance that does not decrease is 500 rubles.

- If early termination is necessary, charges correspond to the rate of the “Demand” account.

- The deposit is subject to prolongation. It is carried out for the same time and on the same rules under which the deposit was opened.

The second type of deposits in Rosselkhozbank with interest in 207 for pensioners involves slightly different conditions. According to the main provisions of the agreement concluded between the financial institution and the depositor:

- The minimum amount on the account is 500 rubles;

- when opening a deposit with interest for 395 days, the rate will be 6.8%;

- when concluding an agreement for 730 days – 7%;

- profit is credited monthly to the deposit itself (capitalization);

- Deposits and withdrawals are allowed, provided the account is maintained within the permitted limits;

- the maximum permissible amount is 10 million;

- in case of early closure, interest is paid at the “demand deposit” rate, which is 0.01% per annum;

- The contract extension occurs automatically, preserving the current terms and conditions.

In a word, the main positive difference of this type is the ability to withdraw money, and the negative difference is lower interest rates.

Pensioners are an interesting category of citizens who can afford to work and receive a pension. This arrangement helps you live in abundance, help your children and grandchildren, and also make small savings. Why not put these savings at interest? As you know, money must work.

RSHB thinks about people of retirement age and invites them to use the “Pension Plus” or “Pension Income” program. It is easy to open one of the deposits at any bank branch by presenting a pension certificate or a certificate from the Pension Fund. The retirement age by law is 55 for women and 60 for men, with the exception of certain categories of citizens. You can also open a deposit for a minor child.

A deposit can only be opened at bank offices, subject to the condition of replenishing the deposit with a minimum amount.

Calculation of profitability on pension deposits of Rosselkhozbank

Before opening one or another deposit with Rosselkhozbank, you need to understand what kind of profit it can bring in the end. Citizens of the Russian Federation, including pensioners, can obtain this information at a bank branch or make all the necessary calculations online on the website. To do this, just use a deposit calculator.

Be careful, the accuracy of the calculation depends on the relevance of the data. Therefore, check in advance all the necessary indicators: deposit term, interest rate, availability of capitalization and other conditions.

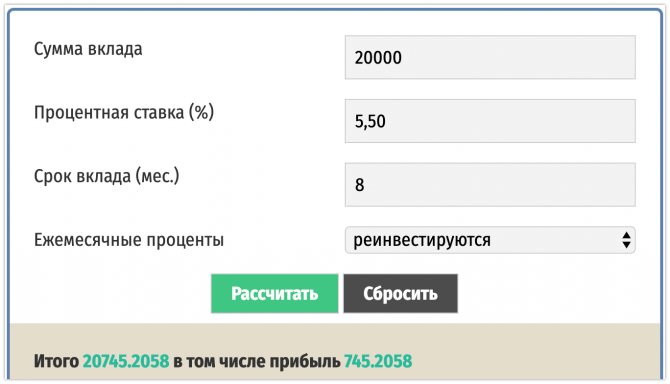

Example. The pensioner decided to open a bank deposit “Income Pension” at Rosselkhozbank. Opening date 01/10/2020. The contract period is 270 days (8 months). Interest is calculated monthly. Interest rate – 5.50%, fixed. Deposits and partial withdrawals are prohibited. The contribution amount is 20,000 rubles. The frequency of payments is once a month. According to the terms of the agreement, there is no capitalization.

Based on the data specified in our example, the return on the deposit will be 745 rubles 20 kopecks for 270 days.

Additional opportunities for older investors

At RSHB JSC, pensioners can take advantage of additional tools for using deposits:

- Open a power of attorney in the name of a third party

As mentioned above, even during registration you can request to make a deposit for a relative or child, but the pensioner has this right for the entire duration of the deposit. The document can be drawn up either at the RSHB branch or at a notary.

- Leave a testamentary disposition

The agreement is concluded for the branch of the bank in favor of one or more individuals. This will allow a person to pass on the contribution to inheritance. The signed document does not limit the pensioner’s right to manage his money in the account. If desired, a testamentary disposition can easily be canceled or supplemented with several more accounts opened in the department.

Calculator

Every confident Internet user has the opportunity to make preliminary calculations before opening a deposit. To do this, you need to visit the official website of the financial institution, find the section with the desired deposit category and enter data such as the investment amount and term into the calculator form. After this, the system automatically calculates the profit. Based on such calculations, the user can clearly see what interest and after what time the amount planned to be deposited into the account will bring.

What deposits can pensioners open at Rosselkhozbank

Rosselkhozbank offers a wide range of deposit programs for the population. A pensioner has the opportunity to open any of the bank deposits on a general basis. Two deposits have special conditions: “Pension income” and “Pension plus”. The deposits are similar.

Deposit with replenishment function and no partial withdrawals. It is possible to make a deposit in rubles.

Deposit characteristics:

- The minimum for opening a deposit is 500 rubles, the maximum is 2 million.

- There are 3 deposit terms: 395, 540 and 730 days.

- Contributions to the deposit can be made during its entire validity period.

- The minimum contribution amount is 1 ruble.

- The extension of the deposit occurs automatically, under the same conditions that will apply during the extension at the bank.

- Interest is paid every month or at the end of the deposit period at the request of the client. Interest can be capitalized by adding it to the total amount of money invested, or transferred to a separate account.

- If you wish to terminate the contract early, interest is paid according to the rules of the “On Demand” deposit in ruble currency.

- The deposit can be opened in the name of a minor.

Conditions of the “Pension Income” deposit

This type of deposit is partially similar to “Pension income”. The minimum amount, replenishment conditions, auto-renewal, early termination, the ability to open a deposit in the name of a child under the same conditions as the Pension Income program.

The maximum deposit amount is 10 million rubles. Interest is added monthly to the deposit amount. “Pension plus” can be issued for 395, 730 and 1095 days. Partial withdrawals are possible provided the minimum balance is maintained. Otherwise, interest on the deposit is lost.

Conditions of the “Pension Plus” deposit

Opening an account will not cause any difficulties, since the main actions that the future investor has to perform do not contain anything special and almost completely coincide with what needs to be done when drawing up similar agreements in other banks. But there is still one important difference today.

Otherwise, nothing unusual or unexpected will happen. With the package collected, you will have to visit the nearest branch and write an application for opening. After that, all you have to do is deposit the initial amount and wait to receive a profit. The percentage you can claim was indicated above.

It is important to note that it is necessary to read the agreement being concluded very carefully, since the procedure and quality of receiving banking services depends on it. Don’t be shy to ask questions and clarify unclear nuances, because the job of managers is precisely to help clients.

Types of individual programs for pensioners today

In addition to general loan and deposit products, the banking institution offers pensioners individual investment programs.

“Income pension”: main advantages

By opening a deposit account under this program, the investor can receive a good monthly increase in his pension. The rate depends on the contract period.

| Period for signing the contract, days | With monthly accrual, % per annum | When accrued at the end of the term, % per annum |

| 91 | 5,05 | 5,1 |

| 180 | 5,2 | 5,3 |

| 270 | 5,3 | 5,5 |

| 395 | 5,5 | 5,75 |

| 455 | 5,5 | 5,75 |

| 540 | 5,55 | 5,85 |

| 730 | 5,6 | 5,95 |

| 910 | 5,6 | 5,95 |

| 1095 | 5,65% | 6,15% |

| 1460 | 5,70% | 6,40% |

At the depositor's request, bank interest can be accrued monthly or at the end of the period. In the second case, the return on the deposit is higher.

Under this program, additional account replenishment and withdrawal of part of the invested funds are not provided. In case of early termination of the agreement, the bank will recalculate deposit payments at 0.01%.

Each client chooses the deposit period independently - from 91 to 1460 days.

Preferential conditions allow pensioners to open a deposit if they have 500 rubles. Foreign currency investments are not provided for under this program.

To obtain maximum income, it is recommended to invest an amount significantly exceeding the minimum, for a longer period and without monthly withdrawal of bank charges.

“Income pension” - interest is accrued monthly.

"Pension Plus": features of the deposit

This is the most profitable deposit program. Its main advantage is the possibility of monthly replenishment of the savings account. In this case, the investor, if necessary, can withdraw part of the invested funds without losing interest.

But after partial withdrawal, at least 500 rubles should remain on the deposit. If this requirement is violated, the banking institution has the right to recalculate charges at 0.01%.

The program includes interest capitalization. If the pensioner does not withdraw funds throughout the entire period, he will receive additional income at the end of the period. In this case, bank interest is calculated monthly, and the next month the same rate applies.

Under this program, pensioners are offered only 3 periods for signing an agreement: for 395, 730 or 1095 days. The longer the period, the higher the annual percentage: 5.35, 5.4 and 5.5%, respectively.

Deposit amount - from 500 rubles. up to 10 million rubles

The Pension Plus deposit allows you to withdraw part of your funds without losing interest.

“Pension income”: conditions and advantages for pensioners

Only Russian citizens who have a pensioner’s certificate can use this product of Rosselkhozbank.

Terms of the deposit agreement:

- currency - only Russian ruble;

- the minimum deposit amount is 500 rubles;

- maximum amount - 2 million rubles;

- the period for concluding the agreement is for 395, 540 or 730 days;

- rate - 5.5% (395 days), 5.55% (540 days), 5.6% (730 days);

- capitalization of interest - at the request of the investor;

- the ability to replenish the deposit account throughout the entire period;

- no partial withdrawal.

This program provides automatic extension of the deposit. If the client does not plan to renew the contract, he must notify the financial company 30 days before the end of the period, but not later.

If the pensioner wishes to terminate the contract early, the rate will drop to 0.01%. This is the only drawback of the program.

“Pension income” with a minimum contribution amount of 500 rubles.

Deposit "Pension Plus" Rosselkhozbank: conditions

RSBH has developed special conditions that attract many investors:

- Currency – Russian ruble.

- The down payment can be from 500 rubles inclusive.

- It is possible to top up your deposit from 1 ruble. This can be done at any time, regardless of the amount and period.

- The deposit can be opened for 395 and 730 days.

- Accordingly, the annual percentage will be 6.8 or 7%.

- The maximum amount subject to annual calculation is 10 million rubles.

- Income is accrued monthly.

- There is capitalization.

- Payment of % at the request of the client.

- Possibility to withdraw money from the account up to a minimum threshold of 500 rubles.

- There is auto-renewal. The deposit is extended under the same conditions.

- In case of early termination of the contract (withdrawal), the bank recalculates income at a reduced rate on demand.

- There is no rate increase.

- There is insurance on the deposit.

Interest rates from Rosselkhozbank for pensioners in 2020

The interest rate depends entirely on the amount of the deposit and the term of the agreement.

Calculation of interest on pension foreign currency deposits

Interest rates on foreign currency deposits are significantly lower, for example:

- "Profitable". The minimum amount is 50 dollars or euros, the rate is up to 1.45% ($), up to 0.01% (€).

- “Investment” - from 1000 USD, rate - up to 1.6%.

- “Replenishable” - from 50 dollars or euros, up to 1% ($), up to 0.01% (€).

- “Save for a dream” - from 100 dollars (euros), up to 1.05% ($), up to 0.01% (€).

- “Comfortable” - from 150 dollars (euros), up to 0.9% ($), up to 0.01% (€).

- "Cumulative". The annual rate for dollar deposits is 1%.

The easiest way to calculate the possible profit on invested funds is to use a special deposit calculator offered on the official website of Rosselkhozbank.

Deposit calculator

To calculate the return on a deposit, you need to select a deposit program, currency on the calculator, enter the amount and term. The interest rate will be set automatically.

Calculation examples:

| Deposit program | Amount, thousand rubles | Period, months | Bid, % | Profit, rub. |

| "Pension Plus" | 150 | 12 | 6,66 | 10 807 |

| 300 | 24 | 7,09 | 42 487 | |

| 500 | 36 | 7,58 | 113 596 | |

| "Pension income" | 100 | 12 | 6,68 | 7 205 |

| 250 | 18 | 6,86 | 25 335 | |

| 400 | 24 | 7,11 | 56 651 |

By substituting different deposit programs, amounts and transaction terms into the online calculator, each investor can choose the optimal deposit option for himself.

Deposit return calculator provided by calcus.ru

About Rosselkhozbank

Rosselkhozbank was created to finance rural residents and stimulate agricultural development. The bank today offers a wide range of services for villagers, lends to farmers, and issues money for infrastructure projects in the village.

But today Rosselkhozbank also has a wide range of products intended not only for villagers. For example, Rosselkhozbank offers clients a range of deposits from individuals on the most diverse and favorable terms at a fairly attractive interest rate.

Deposits with Rosselkhozbank for pensioners can be safely considered a reliable investment. All 100% of the bank's voting shares belong to the Russian Federation.

Leading international rating agencies Fitch and Moody's assigned long-term credit ratings BB+ and Ba2 to Rosselkhozbank, respectively. The Russian rating agency ACRA (Analytical Credit Rating Agency) assigned JSC Rosselkhozbank a rating of AA (RU).

In addition, Rosselkhozbank deposits for pensioners, like all other deposits, are insured in accordance with the Federal Law “On Insurance of Individual Deposits in Banks of the Russian Federation” No. 177-FZ dated December 23, 2003. The total amount of compensation for deposits in the event of an insured event is today no more than 1.4 million rubles, including interest.

Contacts for information and consultations

For more information about the conditions and interest rates of deposits, please contact Rosselkhozbank employees.

Official website : www.rshb.ru

Phones:

8 (800) 100-0-100 (calls within Russia are free); +7 (495) 787-7-787; +7.

Postal address: 119034, Moscow, Gagarinsky lane, 3

The information is not a public offer. General license of the Bank of Russia No. 3349.

Source:

https://10bankov.net/deposits/rosselhozbank-novye-vklady.html

Using premium deposits

There are certain conditions for joining certain beneficial packages. Pensioners are given the opportunity to choose one or more programs. Here are the most basic of them:

- The average monthly balance on various user deposits ranges from 2,500 to 1 million rubles;

- The presence of an existing or repaid car loan, agricultural loan or consumer loan, the amount of which starts from 1 million rubles;

- Payroll in an amount exceeding 200 thousand rubles for the last three reporting months.

Clients using premium profitable service packages are able to open an account with an increased bonus. It is approximately 1-3% higher, but more precise coordination is carried out strictly individually.

Premium deposit rates for pensioners

Rosselkhozbank has developed comprehensive products with increased rates for wealthy clients. A distinctive feature of these RSHB deposits for pensioners is that they are opened only as part of the package. And this package is intended for citizens making deposits in excess of 1.5 million rubles. (50 thousand US dollars/50 thousand euros).

"Golden Premium"

It is aimed at citizens who plan to place funds on a deposit and, in the future, not make any transactions on it. The deposit is profitable: interest on it varies from 5.40 to 7.10% per annum. The rate does not depend on the deposit amount: it is tied to the duration of the agreement, which ranges from 91 to 1825 days. It is possible to place funds in Russian rubles, US dollars or European currency.

"Maximum savings Premium"

Unlike the previous product, this contribution can be considered as an investment. Here, the interest rate increases not only with an increase in the period of placement of funds, but also with an increase in the deposit amount. Other important terms:

- deposit currency – rubles;

- rate range – 5.10-5.65%;

- replenishment is provided, partial withdrawal is not;

- The size of the deposit is unlimited.

"Platinum Premium"

Unlike the previous product, partial withdrawals up to the minimum balance are possible here. However, there is a maximum contribution amount: it is equal to five times the initial contribution. A pensioner can open a ruble or foreign currency deposit.

"Profitable" deposit program

An excellent offer with an interest rate of up to 7.55% per annum in rubles, and up to 1.40% per annum in dollars. Options for replenishment and partial withdrawal are not provided for in the deposit agreement. Interest can be paid in the following ways: at the end of the term, monthly with a transfer to the account for withdrawal, monthly with a transfer to the deposit account (capitalization). The interest rate is influenced by the following factors: the amount (the larger the amount, the higher the rate) and the term of the deposit, the method of opening (if opened remotely, the rate is higher), the option of receiving accrued interest (the highest percentage is assigned for payment at the end of the term).

The “Profitable” deposit is allowed to be opened in favor of a third party. Automatic extension, depending on the term, is carried out from 2 to 11 times. If you invest more than 50 thousand rubles, a free “Amur Tiger - card for deposit” card will be issued as a gift.

Source:

https://vsebanki-rf.ru/rosselhozbank-vkladyi-fizicheskih-lits-2018-protsentyi/