Pensioners who live in our country, unfortunately, do not always receive a pension that is enough to live on. From the point of view of the law, such a pension is defined as an amount of funds that is below the subsistence level. So that pensioners could somehow make ends meet, a special additional payment to the pension was invented. What is it and how to get it, we will look further in our article.

FSD is a pension supplement that is due to pensioners included in the category of the country's poor population

What is FSD for retirement?

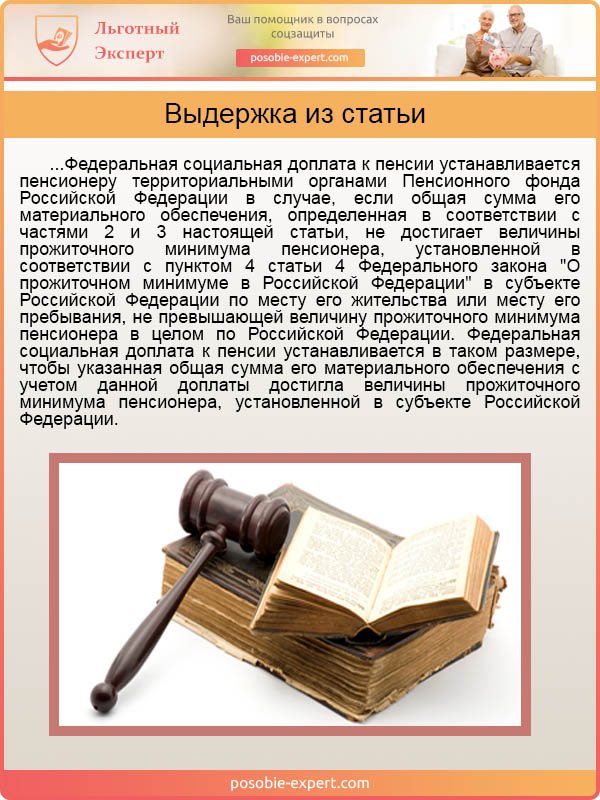

So, FSD stands for Federal Social Surcharge. The establishment of this additional payment is made to pensioners who have stopped working due to the onset of a specific age threshold, illness or other reasons. However, it is very important that one condition be met: the pensioner must receive a state payment (pension), the amount of which does not correspond to the minimum cost of living that is relevant for a particular subject of our country.

Federal Law 178 Article 12.1. Social supplements to pensions

It turns out that if a pensioner receives the minimum possible pension, then the state must pay him an additional certain amount of funds, which will allow him to receive the very minimum living wage that one person needs to survive in our country.

Of course, quite often the subsistence level is not enough for a decent existence, but these funds can at least allow a pensioner to survive.

The purpose of this benefit is to support citizens who are disabled, aimed at providing them with the opportunity to survive

How is the amount of the Federal social supplement to pension determined?

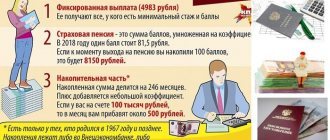

To determine the amount of the Federal social supplement added to the pension of citizens living in our country, the following monetary payments are taken into account, which, according to the legislation of our country and its individual regions, are established for pensioners:

- the amount of the pension itself;

- the size of all additional sources of material support of a social nature;

- monthly payment of funds (in particular the price of a set of social services);

- other measures of legally established social support that have a monetary value (for example, payment for telephone communications of a pensioner, payment for utilities and housing, payment for the use of all types of transport), excluding those measures of social support that are provided to pensioners at a time.

If a pensioner already receives a large pension and other social benefits, then most likely he is either not entitled to a pension supplement or is entitled to a very small one.

Taking into account the amounts of these payments will inversely affect the amount of the surcharge. So, if all of the listed accruals have a maximum amount, then the Federal social supplement will decrease, and vice versa, if the pensioner received really small amounts before its appointment, then it will be large in order to compensate for the lack of funds at least to the minimum level, that is living wage.

If the amount of all accrued material support for a pensioner is the minimum subsistence level, but the basic pension is less than this amount, the citizen is no longer entitled to a payment, since in this case he will not be officially considered poor.

Please note: the amount of the cost of living in each individual region of the Russian Federation will vary, therefore, if, for example, you have studied only the average amount of this payment in the country, you may later be surprised when you receive the wrong amount of funds, therefore, it is better to clarify the exact amount of the surcharge in advance.

The cost of living is calculated for each region separately

16.04.2017

All non-working pensioners in the Kemerovo region, whose total amount of material support does not reach the pensioner’s subsistence level established in the region (PMP), are assigned a federal social supplement to their pension up to the value of the PMP in the region of residence.

The cost of living for pensioners in the Kemerovo region for 2020 is set at 8,208.00 rubles. (KO Law of September 28, 2016 No. 66-OZ). When calculating the total amount of material support for a non-working pensioner, the amounts of the following cash payments are taken into account:

- All types of pensions , including through law enforcement agencies.

- All types of monthly cash payments (MAP), (disabled people, veterans, family members of victims (deceased veterans, Chernobyl survivors, as well as categories equivalent to them), including a set of social services (NSS) (travel in suburban transport and to the place of treatment, medicinal provision, sanatorium-resort treatment, even if received in kind).

- In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account. Information on the cash equivalents of social support measures provided to pensioners comes from the social protection authorities.

FSD is a “floating” allowance that does not have a fixed monetary amount

Example of FSD calculation:

Ivanov I.I. does not work, is a recipient of a disability insurance pension of group 3, as well as a recipient of a monthly cash payment (hereinafter - MDV) for the category of disabled people of group 3. As of 01/01/2017, the size of his pension was 5,500 rubles, the size of his daily allowance was 1,919.30 rubles. In addition, the regional law granted him the right to free travel on all types of public passenger transport, the monetary equivalent of which is 268 rubles. The total amount of payments to Ivanov I.I. to determine the right to FSD for January 2017 is: 5500 + 1919.30 + 268 = 7687.30 rubles.

Thus, the FSD was established for I. I. Ivanov for January 2020 in the amount of 520.70 rubles. (8208 – 7687.30 = 520.70 rub.)

Taking into account the indexation of insurance pensions and single daily income by 5.4% from 02/01/2017, the amount of Ivanov I.I.’s pension from 02/01/2017 was 5,797 rubles.

The amount of EDV from 02/01/2017 is 2022.94 rubles.

The monetary equivalent of travel on public passenger transport remained the same – 268 rubles.

The total amount of payments to Ivanov I.I. to determine the right to FSD for February 2020 is: 5797 + 2022.94 + 268 = 8087.94 rubles.

FSD for February 2020 will be 120.06 rubles. (8208 – 8087.94 = 120.06 rubles).

Thus , in the event of an increase in the size of the pension, EDV (due to recalculation, indexation, etc.), a new calculation of the amount of the FSD is made each time (the size of the FSD decreases).

If the pensioner's total income exceeds the PMP amount, the federal social supplement is not paid.

Phone number for inquiries: (8 384 43) 5-05-74, (8-384 44) 2-15-64

Office Address: Mariinsk, Lenin St. 39 A, room. 1

Address of the department in the Chebulinsky district: Verkh-Chebula village, Sovetskaya st., . 62

How are the social allowances in question assigned and paid?

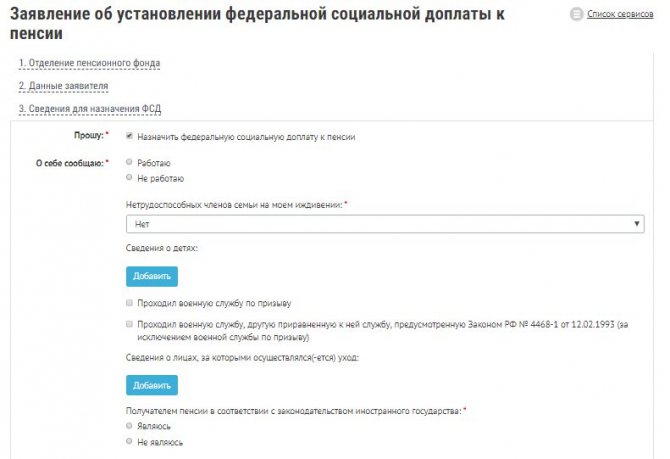

Receiving an allowance, like all other social payments in our country, is of an application nature. In other words, funds will be credited to you only if you appear at the relevant government authorities with a statement indicating a request to receive a payment.

Only on the condition that you declare your desire to receive funds in the form of FSD, then you will be able to obtain them, otherwise no one will forcibly pay them to you

At the same time, as you remember, only non-working pensioners have the right to submit an application, since working people are considered able-bodied.

The assignment of payments will be made starting from the first day of the month that followed the previous 30-day calendar period within which the pensioner applied for the accrual of the specified payment.

Please note: the only situation in which the Federal social supplement is assigned without a declaration relates to children. At the same time, these children will also be pensioners, only in this case their pension will be assigned not due to reaching a certain age, but for the following reasons:

- due to children having disabilities;

- due to the fact that children who have not reached the age of majority, that is, the age of 18, have lost their breadwinner.

Not only older citizens can be called pensioners, but also persons who, for example, receive a disability pension

From time to time, citizens have the question of how to register disability for a pensioner in order to receive all the required benefits. In a special article we will examine this issue in detail.

Thus, pensioners applying for this payment can be not only old men and women, but also people of much younger age. Moreover, regardless of which category you belong to, the Federal social supplement will be established for you for the same period as the main pension, in accordance with the letter of the law.

An application for the establishment of a federal social supplement to a pension can be submitted through the Pension Fund website

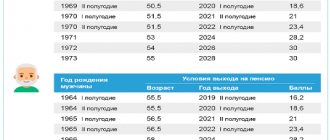

So, for example, pensioners who retired due to the fact that they have reached a certain age (in our country this age threshold is now 60 years for women and 65 years for men) will receive this additional payment as long as their pension is valid, that is, until the end, essentially, of his life.

The same persons who have lost their breadwinner and receive a pension due to being a minor will receive this additional payment until they turn 18 years old, since, according to the law, at this age they will already have reached working capacity and will be able to support themselves.

The payment of the bonus we are interested in will occur differently in some cases.

There are many nuances that have a direct impact on the payment of the Federal social supplement

Table 1. Nuances affecting the procedure for paying the Federal social pension supplement

| Category of persons | How does pension payment work? |

| This category of persons receives a pension directly from the territorial body of the Pension Fund of the Russian Federation. | The funds are transferred by the organization to the pensioner’s personal account simultaneously with the payment of the pension. |

| Other categories of surcharge recipients | The funds are transferred separately to the personal account of the person who is a pensioner, which was indicated in the application for the addition of the Federal social supplement to the pension. |

SET OF SOCIAL SERVICES (NSS)

It is part of the monthly cash payment, and you do not need to write a separate application to receive it.

The range of social services includes:

• provision of necessary medications according to doctor’s prescriptions - 863.75 rubles; • provision, if there are medical indications, of a voucher for sanatorium-resort treatment - 133.61 rubles; • free travel on suburban railway transport, as well as on intercity transport to the place of treatment and back - 124.05 rubles.

When providing social services, citizens with disability group I and disabled children have the right to receive, under the same conditions, a second voucher for sanatorium treatment and free travel on suburban railway transport, as well as on intercity transport to the place of treatment and back for person accompanying them.

In order to refuse to receive a set of social services in kind and receive cash, you must submit an application for refusal to receive social services or one social service to the territorial body of the Pension Fund of the Russian Federation before October 1.

From February 1, 2020, the cost of NSU is 1121.41 rubles per month.

It is enough to submit an application for refusal of benefits in kind once, after which there is no need to confirm your decision annually.

The submitted application for refusal will be valid until the citizen decides to resume receiving benefits.

In what cases is the payment of the Federal social supplement suspended?

Payment of FSD towards pension may be suspended. Unfortunately, there are many different reasons for this. Let's look at them further in the table.

Table 2. Reasons for suspending the payment of the Federal social pension supplement

| Cause | Description |

| Suspension or termination of payment of the relevant pension | As you might understand, there can be many reasons why pension payments are suspended or terminated. For example, the retirement of a pensioner who received a survivor's payment from a minor age, that is, his becoming an able-bodied citizen, causes the termination of pension payments, and, as a consequence, the termination of accrual of the Federal pension supplement. |

| For the period of work or other activity | Provided that the pensioner has taken up work or any other activity in which he receives payment and is subject to compulsory pension insurance by law, the pensioner also cannot receive the required additional payment. |

| The total amount of social supplements is equal to the subsistence minimum | Provided that all the money accrued to the pensioner, which he is entitled to receive from the state, in total has reached the minimum amount that is needed in order to live in a particular region, then the payment of the Federal social supplement is cancelled. |

If a pensioner suddenly goes back to work, for the duration of his entire work activity he no longer has the right to receive the required additional payment.

Thus, if a pensioner encounters circumstances that deprive him of the right to receive this bonus, he must inform the Pension Fund of our country about this, and immediately. This applies to all cases of employment, training, employment and other situations that would entail changes associated with this additional payment.

Provided that the recipient of the Federal social bonus does not bring any notice to the Pension Fund directly in the month of employment or does not verbally declare that appropriate temporary or permanent changes have occurred in his life, the territorial body of the Pension Fund will be forced to take all possible measures aimed at compensation amounts of the Federal social allowance.

Only those amounts that were paid to the pensioner excessively and through his fault in the framework of legal proceedings, if required, will be reimbursed.

A bill on compensation for unpaid pensions has been submitted to the State Duma

A bill has been submitted to the State Duma obliging the Pension Fund of Russia (PFR) to pay pensioners penalties for under-accrued pensions. This initiative was made by deputies of the “A Just Russia” faction, led by its leader Sergei Mironov, TASS reports with reference to a document posted in the electronic database of the lower house of parliament.

“Pension fund employees often make mistakes when calculating length of service and calculating pensions. Because of this, people receive less money than they should. In our opinion, in such cases, the Pension Fund should pay fair compensation to pensioners - interest on the amount of unaccrued funds,” his press service reports Mironov’s words.

It is assumed that the amount of such interest will be calculated based on the key rate of the Bank of Russia in force in the relevant periods. However, it will not be possible to reduce it. “Thus, these shortfalls will not only be paid, but will also be indexed through the implementation of the above mechanism,” note the authors of the document.

From the explanatory note to the bill it follows that its adoption will not require additional expenditures from the federal budget, but the Pension Fund’s spending will still increase.

The head of A Just Russia, Sergei Mironov, recalled a recent audit of the Pension Fund by the Accounts Chamber, which revealed that the fund underpaid pensioners by a total of 2.2 billion rubles.

“For this reason, it is necessary to create a system so that fund employees take a responsible approach to calculating seniority and assigning pensions, so that any such mistake leads to financial losses for the fund, and then to severe punishment of the person responsible,” TASS quotes Mironov.

Last month, the Accounts Chamber discovered errors in the pension calculation system. The department spoke about this in a report based on the results of an audit of the work of the Pension Fund from 2020 to 2020.

It turned out that one person could open two or more accounts or assign one SNILS to several citizens, as a result of which the system determined the size of the pension on only one basis. This led to the fact that the size of the actual payment decreased. A simple change of first or last name could also lead to an understatement of the pension.

The pension fund did not indicate on the personal accounts the last name, first name and patronymic of the owner, which he had at birth, because of which, again, one person could have double accounts. Thus, over three years, the Pension Fund of Russia merged about 90 thousand accounts, as a result of which many were not accrued additional payments.

Another error was discovered in the system, but this time not in favor of the fund. In some cases, the Pension Fund continued to accrue payments after the death of pensioners, since the information reached the fund with a delay. Relatives of the deceased could gain access to this money, as a result of which overpayments amounted to more than 377 million rubles in only two territorial bodies of the Pension Fund of Russia.

First Deputy Chairman of the Social Committee of the Federation Council Valery Ryazansky previously told the NSN portal about how to restore your pension rights in the event of an error when calculating pensions.

To solve the above problems, the senator advised to go to the Pension Fund to draw up a corresponding application.

“If at the first attempt, in [the pensioner’s] opinion, his claims were not taken into account and his pension experience was interpreted inaccurately, then we can double-check it again, even going so far as to contact State Duma deputies and members of the Federation Council,” Ryazansky said.

He also emphasized that not a single letter is left unattended, and if the presence of an error is confirmed, the recalculation is in any case made in favor of the applicant.

“The state, even if it makes a mistake in favor of the recipient, retains these payments,” the senator explained, adding that the errors discovered by the Accounts Chamber are ordinary operational shortcomings, and this is an absolutely acceptable situation.

Amounts of living wages for pensioners by region of the country

Of course, in order to have an idea of how much extra money you will be paid, you need to roughly understand what the cost of living is for a particular region of our country. As we have already said, the amounts for each subject, although slightly, vary, and as a result, the amounts of additional payments will also differ slightly. Let's look at the table that shows the minimum cost of living for the regions of our country.

A social supplement to pensions for non-working pensioners is only due if the pension of the persons sought is not equal to the minimum subsistence level, but is less than the required amount

Table 3. Living wages by regions of Russia

| The subject of the Russian Federation | The minimum cost of living in rubles |

| Belgorod region | 8 016 |

| Bryansk region | 8 441 |

| Vladimir region | 8 452 |

| Voronezh region | 8 620 |

| Ivanovo region | 8 460 |

| Kaluga region | 8 547 |

| Kostroma region | 8 549 |

| Kursk region | 8 600 |

| Lipetsk region | 8 620 |

| Oryol Region | 8 550 |

| Ryazan Oblast | 8 493 |

| Smolensk region | 8 674 |

| Tambov Region | 7 489 |

| Tver region | 8 726 |

| Tula region | 8 622 |

| Yaroslavl region | 8 163 |

| Moscow | 11 816 |

| Moscow region | 9 527 |

| Belgorod region | 8 016 |

| Republic of Karelia | 8 726 |

| Komi Republic | 10 192 |

| Arhangelsk region | 10 258 |

| Nenets Autonomous Okrug | 17 956 |

| Vologda Region | 8 726 |

| Kaliningrad region | 8 726 |

| Saint Petersburg | 8 726 |

| Leningrad region | 8 726 |

| Murmansk region | 12 523 |

| Novgorod region | 8 726 |

| Pskov region | 8 726 |

| The Republic of Dagestan | 8 680 |

| The Republic of Ingushetia | 8 726 |

| Kabardino-Balkarian Republic | 8 726 |

| Karachay-Cherkess Republic | 8 618 |

| Republic of North Ossetia-Alania | 8 064 |

| Chechen Republic | 8 719 |

| Stavropol region | 8 135 |

| Republic of Adygea | 8 138 |

| Republic of Kalmykia | 7 755 |

| Krasnodar region | 8 537 |

| Astrakhan region | 7 961 |

| Volgograd region | 8 535 |

| Rostov region | 8 488 |

| Republic of Crimea | 8 530 |

| Sevastopol | 8 722 |

| Republic of Bashkortostan | 8 320 |

| Mari El Republic | 8 036 |

| The Republic of Mordovia | 8 194 |

| Republic of Tatarstan | 8 232 |

| Udmurt republic | 8 502 |

| Chuvash Republic | 7 953 |

| Kirov region | 8 474 |

| Nizhny Novgorod Region | 8 100 |

| Orenburg region | 8 059 |

| Penza region | 7 861 |

| Perm region | 8 503 |

| Samara Region | 8 413 |

| Saratov region | 7 990 |

| Ulyanovsk region | 8 474 |

| Kurgan region | 8 630 |

| Sverdlovsk region | 8 726 |

| Tyumen region | 8 726 |

| Chelyabinsk region | 8 586 |

| Khanty-Mansi Autonomous Okrug-Yugra | 11 708 |

| Yamalo-Nenets Autonomous Okrug | 13 425 |

| Altai Republic | 8 594 |

| The Republic of Buryatia | 8 726 |

| Tyva Republic | 8 726 |

| The Republic of Khakassia | 8 543 |

| Altai region | 8 543 |

| Krasnoyarsk region | 8 726 |

| Irkutsk region | 8 723 |

| Kemerovo region | 8 347 |

| Novosibirsk region | 8 725 |

| Omsk region | 8 480 |

| Tomsk region | 8 561 |

| Transbaikal region | 8 726 |

| The Republic of Sakha (Yakutia) | 13 951 |

| Primorsky Krai | 9 151 |

| Khabarovsk region | 10 895 |

| Amur region | 8 726 |

| Kamchatka Krai | 16 543 |

| Magadan Region | 15 460 |

| Sakhalin region | 12 333 |

| Jewish Autonomous Region | 9 013 |

| Chukotka Autonomous Okrug | 19 000 |

| Baikonur | 8 726 |

State support is very important for pensioners

Let's sum it up

The federal social pension supplement is a kind of monetary support from the state to pensioners who are below the poverty line, that is, they receive money that is not enough to have at least a monthly subsistence minimum. This additional payment, in fact, serves to “hold out” the pension to the required subsistence level. Unfortunately, it is not used in every case, and this must be taken into account. And also remember that payment may be suspended at any time.