The human right to independently choose a profession and type of activity is enshrined in the Constitution of the Russian Federation and is called the principle of freedom of labor. Every citizen can enter into labor relations to realize their potential without any discrimination. An employer, when selecting new personnel, should in no case allow any discrimination, including when hiring a pensioner. Otherwise, citizens who have been discriminated against in the world of work have the right to apply to the relevant authorities for the restoration of the violated right, compensation for material damage and compensation for moral damage (Article 3 of the Labor Code of the Russian Federation).

Cumulative pension for citizens born in 1953-1967

Persons in this age group can form pension savings. These funds were formed from insurance transfers from employers made in the period 2002-2004. Previously, until 2014, the insurance premium for Russians younger than 1967 was distributed in fixed proportions:

- 6% – joint and several part (not reflected in the individual account of the insured);

- 10% – insurance part (on an individual account);

- 6% – funded part.

The funded component (6 percent) is not used to pay current pensioners; it is invested and can be transferred to legal successors. The following can receive the funded part of the pension at a time:

- Persons born in 1967 and younger when they are assigned an early insurance pension upon reaching age (old age).

- Citizens in whose favor in 2002-2004. insurance premiums have been paid for the funded part of pension deposits. Since 2005, deductions have ceased due to legislative changes. This condition applies to citizens born in 1953-1966. (male) and born 1957-1966 (female).

- Russians who participated in the state co-financing program when forming a pension. The program was open for entry during the period 01.10.2008–31.12.2014. Citizens who paid the first installment before January 31, 2015 are considered participants.

- Persons who have allocated maternity capital to form a future pension (only for women).

What payments are due?

If a Russian has savings in a pension fund, state or non-state, they can be obtained in several ways. According to Law No. 360-FZ of November 30, 2011, 3 types of payments are provided:

- unlimited (performed every month throughout the life of the pensioner);

- urgent (during the period established by the pensioner themselves);

- one-time (one-time payment).

After the death of a pensioner, his heirs can claim the funded pension of the deceased. Important: a lump sum payment is established under conditions strictly defined by legal norms. Pensioners, real and potential, born before 1967, unlike the younger generation, were deprived of the right to choose the type of pension formation.

- How personality traits influence the risk of developing dementia

- Signs of cerebral vasoconstriction after 50 years

- 50 percent discount on fines

In 2002-2005 their employers paid contributions to the funded component of the pension in accordance with the established mandatory procedure. In this category, such savings that have been accumulated for a short time are insignificant, and with a value of less than 5 percent, citizens born in 1953-1967 can receive savings provision in lump sum payments (based on Article 4 of Law No. 360-FZ of November 30, 2011).

Amount of pension savings

It is necessary to clarify the size of possible payments depending on the place of their formation. If the funds were transferred to the management of any non-state pension fund (abbreviated as NPF), then the pensioner should apply for receipt to a specific NPF.

If contributions were made to the Russian Pension Fund, this authority pays the funds. With this option, the MFC also considers the request for payment. If a pensioner does not know where the funds are located, this can be clarified at the territorial branch of the Pension Fund, through the State Services portal or the MFC.

Regional benefits for pensioners in Moscow and the Moscow region in 2020

The authorities of Moscow and the Moscow region, as measures of social support for people of retirement age living in the capital and region, have primarily provided for an increase in benefits and compensation payments, which are paid taking into account the living wages for pensioners and social standards established in the regions. The comparative table presents the main benefits and compensation payments for such persons:

| Type of benefit | Moscow | Moscow region | Conditions of receipt |

| Free travel on public transport | You can also take advantage of the benefit when traveling on commuter trains running from Moscow to the region and back. | With the exception of taxis, including minibuses | |

| Free dental prosthetics | The benefit is provided for non-working pensioners. The service includes a consultation with a doctor, treatment of simple enamel damage, repair of a prosthesis, and prosthetics with products of “budget” designs. | With the exception of products made of precious metals and metal ceramics. | |

| Free trips to sanatoriums. | The voucher is issued once a year, for a period of 18 days of sanatorium service, at the social security authorities at the place of registration of the pensioner. Also, travel to the sanatorium is paid for at the expense of the regional budget. | Availability of medical indications. | |

In Moscow, the city authorities pay for single pensioners telephone calls, as well as some utilities, such as garbage collection.

Owners of a Moskvich social card can count on discounts both in municipal institutions and private commercial enterprises, for example, pharmacies, shops, and catering establishments.

How to receive lump sum payments

The accumulated funds can be received one-time or no more than once every 5 years. Payments are available subject to the following conditions:

- The insured person born in 1967 and later did not refuse the opportunity to form a funded pension, and the employer made contributions.

- The pensioner continued to independently pay insurance premiums for the funded portion of his income.

Conditions of receipt

Based on Art. 4 of Law No. 360-FZ, the following insured persons can apply for security:

- receiving pensions for old age (age, including those assigned early), disability, and loss of a breadwinner;

- those receiving a social pension provided due to insufficient insurance coverage or pension points;

- who have accumulated contributions of 5 percent or less of the amount of the old-age insurance pension component.

- 5 bones that people break most often

- 6 body products that are cheaper to buy at fixed prices

- Honey face mask

Exemption from property tax

Tax benefits that retirees can enjoy will next year also become benefits for citizens of pre-retirement age (Putin’s initiative was approved by the State Duma).

This right appears for men 60 years of age and women 55 years of age who are owners of living space. What will happen to the benefits of labor veterans in the light of pension reform?

They are exempt from the following:

- From property tax accrued to an individual. You can avoid paying only for one apartment or room, 1 house or some part of the house, 1 garage or 1 car space, 1 building for household purposes (building area up to 50 square meters).

- From land tax, if the land plot is owned up to 6 acres. If the plot is larger, the benefit still remains. The citizen will have to pay extra for the “extra acres” of property. For example, if a summer cottage plot is 20 acres, then 6 acres is a benefit, and for 14 you will have to pay.

In the current conditions, when there is a transition to calculating taxes based on the cadastral value of property (and this necessarily leads to an increase in the final tax figure), the value of benefits increases significantly.

Making a one-time payment from a funded pension

To receive the accumulated money, you must submit an application to the NPF or Pension Fund. Through the Pension Fund of the Russian Federation, a one-time benefit to pensioners born in 1957 is issued upon an application submitted:

- to the territorial branch of the Pension Fund or MFC at the place of residence - upon a personal visit to the pensioner;

- via the Internet on the website of the Pension Fund of Russia or in the system on the State Services portal - electronically, by registering there and opening a personal user account;

- by registered mail.

How to make an application

If the funds are in accounts with the Pension Fund, the application is submitted there in the form approved by Order of the Ministry of Labor No. 11n dated 07/03/2012. To receive savings from a non-state pension fund, the application is drawn up in the form of Appendix 1 of Order of the Ministry of Labor No. 12n dated 07/03/2012. The document must contain:

- name of the authority;

- individual data about the insured applicant;

- SNILS of a pensioner;

- savings account number (filled out by a fund specialist);

- information about already assigned pension benefits;

- method of receiving payments;

- date of registration;

- pensioner's signature.

What documents are required

Decree of the Government of the Russian Federation No. 1047 of December 21, 2009 approved the documentation required to be submitted for processing funded payments (originals or notarized):

- the statement itself;

- passport;

- confirmation of the right to receive a pension, insurance or social;

- certificate of assignment of disability (incapacity for work), loss of a breadwinner;

- documents for the representative (passport, power of attorney), if the application is not submitted by the pensioner himself.

It is legally permitted to submit copies of documents certified by a notary instead of originals. Important: when sending an application by mail, only copies are sent, original documents are not included. When accepting documents, the fund specialist issues the applicant a corresponding receipt, notifying that the pensioner’s application has been registered and accepted for consideration.

Mandatory share in the inheritance mass

Currently, pre-retirees can receive an inheritance even if they are not mentioned in the will document. But provided that they appear to be close relatives of the deceased person or simply lived with him and were dependent on him.

A new legislative draft has been introduced to Parliament, allowing pre-retirees to receive a mandatory share in the inheritance. That is, the age of the obligatory heir does not change, despite the introduction of pension reform.

Definitely, the most valuable benefit that pensioners would like to see would be the lifting of the moratorium on the indexation of pensions of working pensioners. Alas, such a legislative project was not submitted to the State Duma. And according to the official statements of some officials, we can conclude that there are no plans to introduce them.

Receipt times

The decision is made within a month from the date of receipt of the application. Payments to pensioners born in 1953-1967 are assigned from the date of application, but not earlier than the date when the basis arose. The payment is transferred one-time within 2 months upon acceptance of a positive result. The pensioner himself can choose the method that is convenient for him to receive money:

- at the post office;

- in the bank;

- through a delivery company.

When considering the application, the pensioner may be refused. Grounds for refusal:

- the applicant has not reached retirement age and is not entitled to pension benefits;

- savings amount to more than 5 percent of the insurance part of the pension;

- the applicant receives the funded part according to the schedule;

- the citizen already received a one-time payment less than five years ago.

Benefits announced for 2020 by local authorities for pensioners in the Rostov region

The authorities of the Rostov region promised to maintain existing benefits for pensioners for 2020. So the list of regional privileges includes:

- free dental care;

- 50% of payment from the regional fuel budget for pensioners living in houses without gas heating;

- free use of public transport, including trains;

- free vouchers to sanatoriums for medical reasons.

In addition, for pensioners who have worked in the public sector for at least 10 years in rural areas of the region, 100% compensation for utility bills and 50% payment for sanatorium and resort holidays are provided.

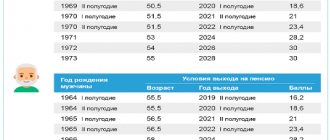

Retirement schedule (scenario relaxed by Putin)

Let us recall the president's proposal:

Women

| Date of Birth | Year of retirement | Retirement age | How many years has the retirement age increased? |

| 1964, January 1 - June 30 | 2019, July 1 - December 31 | 55,5 | +0,5 |

| 1964, July 1 - December 31 | 2020, January 1 - June 30 | 55,5 | +0,5 |

| 1965, January 1 - June 30 | 2021, July 1 - December 31 | 56,5 | +1,5 |

| 1965, July 1 - December 31 | 2022, January 1 - June 30 | 56,5 | +1,5 |

| 1966 | 2024 | 58 | +3 |

| 1967 | 2026 | 59 | +4 |

| 1968 | 2028 | 60 | +5 |

The table published on the Pension Fund website looks like this:

Men

| Year of birth | Year of retirement | Retirement age | How many years has the retirement age increased? |

| 1959, January 1 - June 30 | 2019, July 1 - December 31 | 60,5 | +0,5 |

| 1959, July 1 - December 31 | 2020, January 1 - June 30 | 60,5 | +0,5 |

| 1960, January 1 - June 30 | 2021, July 1 - December 31 | 61,5 | +1,5 |

| 1960, July 1 - December 31 | 2022, January 1 - June 30 | 61,5 | +1,5 |

| 1961 | 2024 | 63 | +3 |

| 1962 | 2026 | 64 | +4 |

| 1963 | 2028 | 65 | +5 |

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Pension Fund table: