Article 23

Veterinary specialists with higher or secondary specialized education working in state veterinary institutions serving rural areas are provided with free utilities, as well as emergency residential premises in accordance with current legislation. Veterinarians and veterinary paramedics of the state veterinary service are given a bonus for continuous work experience in the amount of: from one to 5 years - 10 percent, from 5 to 10 years - 20 percent, from 10 to 15 years - 30 percent, over 15 years - 40 percent from the basic official salary.

Regulatory framework

The list of benefits and other measures of state support for rural teachers is determined by the relevant legislative acts. The main document is Federal Law No. 273 “On Education”. This document regulates the provision of utility benefits and monetary payments of a compensatory nature (Article No. 47). In accordance with the norms, these support measures for teachers are provided at the expense of the budget of the subject of the federation in which the specialist is employed. Previously, support measures for rural teachers were determined by the norms of Federal Law No. 3266, according to which the volume and type of benefits did not depend on the level of the educational institution and its municipal affiliation. In the current version of the Federal Law, administrative measures take into account the territorial affiliation of the educational institution, the age of the teacher and other aspects. Thus, rural teachers are provided with additional benefits that are not available to their colleagues working in cities.

Benefits for women working in rural areas

Recently, women often start working just a few months after giving birth. The Labor Code of the Russian Federation gives such mothers the right to additional breaks to feed the child. The employer is obliged to provide such breaks at least every three hours, lasting at least 30 minutes each. If a woman has two or more children under one and a half years old, then each additional break should last at least one hour. 1 answer. Moscow Viewed 86 times. Asked 2013-06-06 11:55:44 +0400 in the topic “Labor Law” How many acres of land are needed to build a store in the countryside of the Rostov region? — How many acres of land are needed to build a store in the countryside of the Rostov region. Further

Features of providing housing and communal services benefits

Despite the simplicity of the registration procedure, it should be taken into account that there is a difference between the list of compensated services for teachers living in a private house and teachers living in an apartment.

In the first case, the employee can count on reimbursement of the cost of consumed electricity and heat. In the absence of a centralized heating system, benefits are provided through the purchase of fuel - solid or gaseous. Residents of rural apartment buildings, along with basic resources, are compensated for such housing and communal services as: major repairs, removal of solid waste, etc. The amount of compensation for other utilities, excluding electricity and heat, is calculated using a formula and depends on additional factors, including the income of teachers, the presence of special titles and rights to additional benefits. In general, rural teachers can receive a discount of up to 60% of the cost. In addition to the above factors, the size of the benefit may be influenced by the region of residence of the employee (pensioner), since the local administration has the right to establish its own rules.

In some cases, rural teachers may be provided with 100 percent reimbursement of costs through housing and communal services. Such benefits are provided for pensioners of the education system who have retired due to length of service. In the case under consideration, the amount of compensation and the right to receive it do not depend on the decisions of local officials, the type of housing owned by the pensioner and other factors mentioned above. In general, benefits are provided regardless of length of service and the presence of additional statuses.

Conclusion

The state provides teachers who choose rural educational institutions as their main place of work with an expanded list of benefits compared to colleagues employed in urban schools. You can add to the list of additional privileges:

- the right to provide own or rented housing;

- compensation for housing and communal services and transport benefits;

- the possibility of refinancing old mortgage loans;

- the right to receive a subsidized housing loan, etc.

Young rural teachers are paid allowances. For teachers employed in urban educational institutions, other benefits are relevant.

What benefits are available to doctors and healthcare workers in 2019-2019?

- Decent working conditions in the workplace.

- Regular professional retraining and improvement of qualifications at the expense of the employer.

- Regular salary increases based on certification results.

- Professional activity risk insurance.

Download to view and print

- When he belongs to any of the categories entitled to general benefits.

- Place of work: government agency.

- The amount of earnings relative to the subsistence level in a given area is not higher than a certain level.

- Employment in a medical institution for at least 0.75 times the wage rate.

Benefits for residents of rural areas

In every rural administration there is an announcement about how many cubic meters are allocated for repairing a barn or stable, 10 cubic meters for stove heating (every year), 200 cubic meters for building a house (once) this is in the Vologda region. But it’s easier for people to buy two cars of already sawn wood. wait for the timber to be diverted in order to look for a team to cut it down and take it away. For building a house, of course, you will find a team to harvest the timber. Electricity in the countryside is cheaper than the city, 2.68 kW/h. Teachers and doctors who come after college are given an allowance of a million rubles, but then they have to work for 3 years . State compensation is a system that provides compensation for harm caused by damage or violation of rights. Such activity must be directly related to causing harm to an individual or legal entity during the exercise of power by authorized persons.

Please note => Transport tax benefit for the Republic of Karelia

Rural specialists are entitled to a payment to pay for housing and utilities

For those who have retired, the payment continues provided that they retired immediately upon completion of work in a specialist position, filled it for at least 12 full months immediately before dismissal, and worked in rural areas for at least 10 years. Another condition is that retired specialists must continue to live in rural areas.

- professionals and retirees living alone;

- families of two people, if both are old-age pensioners;

- families in which a specialist or pensioner lives together with a dependent minor child; disabled; a family member under the age of 23 studying full-time (with the exception of additional education).

Rural specialist benefits for utilities

Medical workers have the right to retire early if they work: Indicators Experience In the city 30 In rural areas 25 Age restrictions are not taken into account. Working conditions are also taken into account. Based on this, 3 methods for calculating length of service have been adopted:

- professionals and retirees living alone;

- families of two people, if both are old-age pensioners;

- families in which a specialist or pensioner lives together with a dependent minor child; disabled; a family member under the age of 23 studying full-time (with the exception of additional education).

General and private benefits

Every teacher, regardless of where the educational institution is located, has the right to a number of additional motivating bonuses to the basic salary for the position. Additional funds are accrued along with the monthly salary. The so-called salary benefits include the following types of additional payments accrued for:

- classroom management;

- work on correction programs;

- home schooling;

- checking notebooks;

- harmful when working with chemicals and other substances;

- purchase of teaching aids, etc.

The size and availability of some benefits depend on the region of employment of the teacher; the administration of the locality has the right to independently regulate their list within the framework of current legislation. The above list is fixed at the federal level and is mandatory to provide. As for rural teachers, in this case the following targeted benefits are available:

- one-time cash benefit. Provided upon the teacher’s move to a rural area and employment in one of the educational institutions. The purpose of the payment is financial support for a specialist and increasing the literacy level of rural school-age children;

- salary supplements. As part of the benefit program, teachers working in rural areas are entitled to an appropriate additional payment. The calculation of the premium amount is carried out according to a coefficient greater than that applied in other cases. The amount of additional payment is subject to increase depending on the experience accumulated by the teacher while working in a rural educational institution;

- additional bonus. Another incentive payment due to a teacher who has worked for three years or more;

- transport benefits. Teachers have the right to free travel on commuter routes. Some regions offer full or partial reimbursement.

These privileges are reserved for rural teachers by federal legislation; additional benefits may be provided at the regional level.

Benefits for rural pensioners

Also, citizens of retirement age from 60 to 99 years have the right to undergo a free medical examination once every 3 years. This applies to old-age pensioners who do not belong to any other preferential categories of persons. And disabled people, residents of besieged Leningrad and disabled people of the Second World War have the right to stay in a dispensary every year at any age. Many public sector employees receive a certain package of benefits when carrying out their work activities - we are talking about cultural workers, teachers, social workers, medical employees of state and municipal clinics. For those who work not in cities, but in rural areas, the list of benefits is expanding. In this regard, the question arises - what benefits are granted to rural pensioners, and whether the previous benefits are retained after retirement.

The size of the allowance for labor in rural areas

Due to the absence of a unified federal law that would define the rules and features of the calculation of the material accruals in question in the case of official employment in rural areas, the amount of the required payment differs in each individual organization and field of activity.

At the same time, you need to remember that the established charges can be expressed in a fixed amount or as a percentage of the available salary amount.

Practice shows that in most cases the amount of the bonus under consideration in the presence of official labor activity in rural areas is set at the level:

- 25% of the salary for a specific field of activity;

- 30% - within the scope of Resolution of the Supreme Court of the RSFSR No. 298/3-1.

Important: according to regional legislation and local company documents, payment amounts may vary up or down.

Benefits for social workers in rural areas in 2019

- Providing special equipment and clothing for carrying out their work activities. If management cannot independently provide tools and clothing for work, then the employee’s personal expenses are compensated by monetary payments.

- Compensation for travel on public transport is provided. If a social worker is forced to use intercity or city routes during the working day, they are paid in advance to pay for travel. The list does not include travel by taxi or minibus.

- Additionally, compensation is paid for mobile communications.

- Employees are entitled to a free annual medical examination. The same examination is carried out when applying for a proposed social sector position.

- Social workers have the right to receive benefits to pay for utilities in existing housing - an apartment or a private house.

- A social worker's leave ranges from 28 to 56 days. Based on the law, well-deserved annual rest cannot be less than 4 weeks, but most social workers receive a long period of 45 days, which is necessarily prescribed in the employment contract. Social workers undergoing training to improve their skills receive 45 days of leave. Teachers can expect an inflated vacation period of 56 days, which is only available during the summer.

- Social workers receive the right to free advanced training every 5 years.

- Employees can register a minor child in a preschool or school without queuing.

- In rural areas, social workers are provided with housing in accordance with living space standards for each family member.

Please note => Are there any Polars in Surgut 2019

Social workers in rural areas have the right to enjoy all legally established benefits, which not every worker knows about. Further, the issues of providing subsidies, their registration and the necessary documents for this will be discussed in detail.

What privileges are provided to rural residents?

The life and development of any settlement requires specialists from various fields of activity.

The following can count on government assistance:

- teachers (teachers, kindergarten teachers);

- social workers;

- cultural workers;

- doctors and employees of various medical organizations.

Many benefits apply to specialists who have retired.

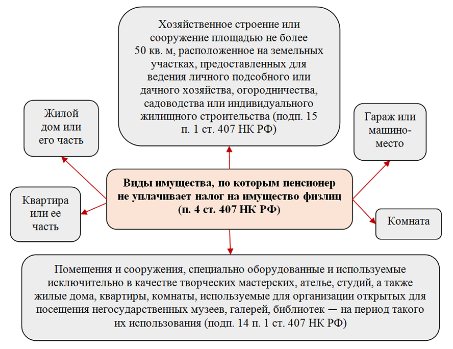

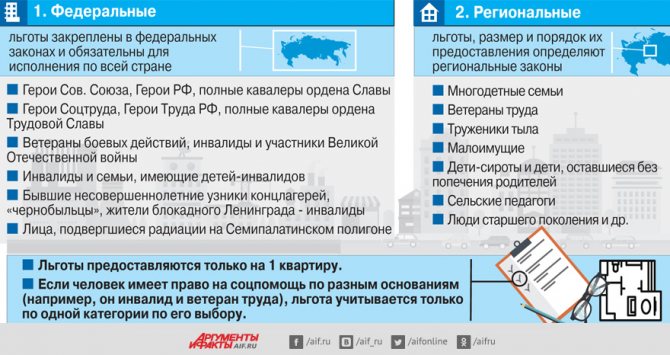

Tax privileges

The tax legislation of the Russian Federation provides for a relaxation in the payment of mandatory fees for various categories of the population.

Rural pensioners are completely exempt from property tax if the following conditions are met:

- real estate is used for purposes not related to profit;

- ownership of the property belongs to a person of retirement age;

- the cost of the object does not exceed the amount specified by law.

Article 407 of the Tax Code of the Russian Federation (clause 4) stipulates that the benefit can only be used in relation to one object. For example, two private houses and three plots of land are registered in the name of a pensioner. In this case, the full amount of tax will be charged on one house and two plots.

Nuances of paragraph 4 of Art. 407 Tax Code of the Russian Federation

The scope of transport and land taxation is regulated by federal and regional regulations.

Article 358 of the Tax Code of the Russian Federation exempts owners of the following equipment from fees:

- cars with low-power engines (up to 100 horsepower);

- machines intended for use by persons with disabilities;

- stolen vehicles;

- tractors, combines and other machines intended for agricultural work;

- specialized equipment (for example, milk tankers or veterinary care vehicles).

The category of beneficiaries and the amount of transport tax are established by the authorities of Russian constituent entities. The amount of the discount for rural residents in different regions may vary significantly.

Important! Federal legislation provides exemption from paying land tax to owners of plots whose size does not exceed six acres (600 sq. m.). Regional benefits allow you to further reduce the area of the plot for calculating the tax base.

Article 407 of the Tax Code of the Russian Federation “Tax benefits”

Read also: Compensation for kindergarten

Article 358 of the Tax Code of the Russian Federation “Object of taxation”

Withholding personal income tax

The list of income that is exempt from personal income tax is defined in Article 217 of the Tax Code of the Russian Federation.

The state does not collect a percentage of the following payments into the federal budget:

- insurance and funded pension;

- social supplements to old age benefits;

- financial assistance and compensation for the purchase of medicines provided by the former employer (if the amount does not exceed 4,000 rubles);

- subsidies issued for the development of farms.

Tax privileges apply to employer reimbursement of funds spent on sanatorium and resort treatment.

Article 217 of the Tax Code of the Russian Federation “Income not subject to taxation (exempt from taxation)”

Pension allowances

The state provides a pension supplement for certain categories of rural residents (Article 17, Federal Law No. 400-FZ of December 28, 2013).

An additional payment of 25% of the fixed part of the insurance pension is assigned if the following conditions are met;

- work experience in the agricultural sector for at least 30 years;

- permanent residence in rural areas.

The benefit does not apply to working pensioners. The bonus is available to citizens only after completion of their working career.

The list of industries in which work is included in the preferential “rural” experience for receiving payments is approved by Decree of the Government of the Russian Federation (N 1440 of November 29, 2018).

Pension increases are available to representatives of the following professions:

- head (director) of a peasant farm;

- agronomist;

- livestock specialist (livestock breeder);

- veterinarian;

- machine operator;

- master of plant growing;

- mechanic for repairing agricultural machinery.

Public sector employees (for example, doctors or teachers) cannot qualify for additional payments.

Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”

Decree of the Government of the Russian Federation of November 29, 2018 N 1440 “On approval of the list of works, industries, professions, positions, specialties, in accordance with which an increase in the amount of a fixed payment to the old-age insurance pension and to the disability insurance pension is established in accordance with Part 14 of Article 17 The Federal Law “On Insurance Pensions”, and the Rules for calculating periods of work (activity), which gives the right to establish an increase in the fixed payment to the old-age insurance pension and to the disability insurance pension in accordance with Part 14 of Article 17 of the Federal Law “On Insurance Pensions”

Payment of utility services

The right to receive discounts and subsidies for housing and communal services is granted to various categories of rural residents. At the same time, part of the payments is made at the expense of the regional budget. Therefore, the amount of compensation is determined by the authorities of the constituent entity of the Russian Federation.

Utility privileges apply to payment for:

- electricity;

- gas;

- water supply;

- heating (including materials and their delivery).

A special category of beneficiaries includes medical and teaching workers. For example, teachers are given a discount from 60 to 100 percent of the accrued amount.

Who can receive benefits for housing and communal services?

Doctors and nursing staff receive utility benefits in the form of subsidies if the following requirements are met:

- work in a government agency;

- employment of at least 0.75 rates;

- income relative to the subsistence level is not higher than the level determined in the region.

On a note! Utility benefits are retained for employees of public sector sectors after retirement. A 100% subsidy for housing and communal services is provided to cultural workers.

Social support

The state guarantees rural residents additional social protection measures.

For example, pensioners receive subsidies for gasification. Read also: Program “Accessible Environment”

The list of benefits includes:

- provision of housing, which after a certain period becomes the property of the specialist;

- discounts on travel on some types of transport;

- provision of free medicines;

- vouchers to the sanatorium.

In difficult life situations, every citizen can count on help. Targeted support is provided in cash or in kind (for example, clothing or food).

Labor benefits

The state provides privileges for working villagers.

The benefits provided by law are reflected in the text of the employment contract. Village residents can use:

- free retraining when working conditions change;

- payments in the amount of one minimum wage during forced unemployment.

For working women, the working week is officially reduced to 36 hours. In this case, wages are calculated as for normal working hours. The reduction in working hours is set automatically. If an employer violates a woman’s interests, she may be subject to administrative liability.

The duration of the main leave provided to rural workers is 28 calendar days (Article 115, Labor Code of the Russian Federation). Pensioners who continue to work are entitled to additional rest time of up to 14 calendar days.

Working women have the right to an additional day off once a month at their own expense (without pay).

Article 115 of the Labor Code of the Russian Federation “Duration of annual basic paid leave”

For teachers

The amount of benefits for employees in the educational sector depends on the capabilities of regional authorities.

Teachers are provided with the following privileges:

- reduction of the working week to 18 hours;

- increased annual leave time (up to 56 days);

- official employment in several organizations;

- early registration of pension payments regardless of age (15 years of continuous teaching experience, 25 years of total work time).

The wages of teaching staff cannot be lower than the average wage in the region. After moving to rural areas, young specialists are entitled to one-time subsidies (in the amount of several salaries) for their organization.

After ten years of work in a rural school, a teacher has the right to take leave for a period of 1 year. At the same time, the teacher retains his workplace. In addition, 50% of the salary is accrued every month.

For doctors

Healthcare employees can count on federal and regional benefits.

The list of privileges, in addition to subsidies for housing and communal services, includes:

- allowances in accordance with medical specialty and category;

- preferential calculation of length of service;

- free treatment at the place of work;

- obtaining ownership rights to service housing after 10 years;

- advanced training at the expense of the employer once every three years.

Important! To attract specialists to rural hospitals, the state developed the “Zemsky Doctor” program. Program participants are allocated an amount of 1 million rubles to purchase housing in the locality at the location of the medical organization.

Implementation of the Zemsky Doctor program

Prosecutor's Office of the Orenburg region

It has been established that the Law of the Russian Federation “On Veterinary Medicine” as amended before January 1, 2005, provided for the right of specialists of the state veterinary service working and living in rural areas, as well as pensioners of this service, to free provision of utilities. From January 1, 2005, for this category of citizens, this benefit was canceled and social support measures were provided in accordance with Russian legislation and the legislation of the constituent entities of the Russian Federation. It was noted that when replacing benefits in kind with monetary compensation, the previously achieved level of social protection of citizens must be preserved. The Belyaevsky District Prosecutor's Office based on the results of consideration of appeals from employees of the State Budgetary Institution "Belyaevsky District Veterinary Department" filed claims in court, demanding from the employer? district veterinary department and founder? The Ministry of Agriculture, Food and Processing Industry of the region reimbursed 11 veterinarians for the costs of housing and communal services.

Cash compensation

In terms of motivating and compensation payments provided for by law for teachers, it is necessary to note:

- reimbursement of costs through housing and communal services. Funds are paid in a set amount (regulated by the local administration) based on calculations as a percentage of the accrued amount. To receive benefits, you must register your status and provide the required documents at the local government office;

- reimbursement of rental expenses. For rural teachers who do not have their own housing and live in rented space, the state provides reimbursement of part of the expenses. Funds are paid upon presentation of a receipt confirming the relevant expenses;

- covering part of the costs of paying bills for basic resources and repairs. As part of the benefit, money is paid for fuel consumed, including when using autonomous systems, hot water supply, electricity, etc.

Compensation payments for resources are made based on consumption rates, meter readings, etc. Some benefits and payments are provided only to rural teachers who have reached retirement age and have accumulated more than 10 years of departmental (continuous) experience.

Compensation for utilities for medical workers

- At least once every six months, provide social protection with payment receipts for water supply, gasification, heating and electricity, as well as if charcoal was purchased

- Avoid debt on utility bills;

- In the event of a change in the type of activity, for example, quitting the hospital, immediately notify the USZN.

- With various types of radiation, namely laser, ultrasound, radioactive, which are harmful to health

- With medications containing chemicals

- During irregular working hours and heavy workloads

- In regions with harsh climatic conditions, for example the Far North, Chukotka, Kamchatka

- In rescue services

18 Jan 2020 marketur 123

Share this post

- Related Posts

- How to legally avoid paying bank loans video

- How to recover after expulsion to another university

- For the Third Child 103800 How You Can Get

- Benefit according to the USN for ur basic foreign technologist

How to apply

The assignment of benefits is carried out by federal and regional government agencies. The registration procedure depends on the type of privilege that the village residents are entitled to.

There are several ways to apply for preferences:

- personally to the social protection authority or to the nearest branch of the MFC;

- via Russian Post (by registered mail with notification);

- online on the official Gosuslugi portal.

Read also: Child subsidies in 2020

Exemption from mandatory fees is handled by the tax inspectorate at the place of residence of the benefit recipient (or at the location of the property).