The Far North occupies a vast territory of Russia. Although the climatic conditions there are far from ideal for humans, millions of the country’s residents work and live in these areas permanently. This leads to additional stress on health, and working conditions for many professions in such regions become very difficult. In an effort to somewhat compensate a person for difficult living conditions, the state provides benefits and privileges for those who choose to work in the northern territories. They also apply to the length of service required to assign a pension. The concept of “northern experience” has even been introduced by law.

Northern experience for retirement

Northern experience is the total time that a person worked in the Far North and the territories that were equated to it. It is considered a special type of length of service and is taken into account when assigning a pension.

Reference! Whether a particular region or even a settlement is a territory of the Far North or equivalent to them or not is determined not only by geographical characteristics. To simplify and unambiguously answer questions, the Government of the Russian Federation issues Resolutions that list specific regions in which work makes it possible to “earn” a preferential pension.

Having northern experience is the basis for receiving the following preferences:

- the opportunity to retire earlier;

- increased amount of payments determined individually for each person;

- various benefits (for example, for the provision of housing).

Important! Only official work time is taken into account. A person must ensure that all relations with the employer are documented. Otherwise, after working for many years in difficult climatic conditions, a person may not receive the right to the required benefits. If an employer avoids drawing up an employment contract, you can contact the labor inspectorate for help.

What is included in the northern experience

Northern experience includes the time that a person officially worked at various enterprises in the Far North (and in equivalent areas). Some categories of citizens have the right to expect that periods of military service, study, as well as rest, travel, etc. will also be included in the northern period of service.

Reference! In the past, there was a different procedure for accounting for northern experience, but at present it is not applied and is not relevant.

Northern retirement experience for men and women

Millions of men and women work in the northern regions of the country. To obtain the right to retire early, citizens must simultaneously fulfill several conditions:

- score the required number of points – 30;

- obtain the necessary experience, including work in the north and any other areas;

- have northern experience - 15 years;

- reach the age established for early retirement.

To fully use the benefits for their intended purpose, men and women must have 15 years of northern experience. This norm is the same for both sexes. But if a woman has given birth to 2 or more children, then the requirements for northern experience will be reduced to 12 years.

For a long time, early retirement was set at 50 for women and 55 for men. But raising the retirement age also affects all those who work in the Far North. By 2023, it will be 55 years for women and 60 years for men.

The retirement age for “northerners” is being raised gradually – by 1 year each year. Moreover, in 2020 and 2020, they, like everyone else, have the right to receive a pension six months earlier than the deadline established by the new legislation. In 2020, women with full northern experience can count on receiving payments from the Pension Fund at 50.5 years, and men at 55.5 years. In 2020, for northern men, the retirement age will be 56.5 years, and for women – 51.5.

Retirement table by northern length of service

What will not be included in the northern retirement experience for men and women

The northern length of service does not include all periods of time that are counted in the normal period of employment. In particular, the following periods are not added to the period of work in the Far North:

- the time when the citizen did not officially work, even if he was registered with the employment service;

- period of training in various educational organizations (from vocational schools to universities);

- service in the ranks of the Armed Forces (with the exception of certain cases, for example, for career military personnel);

- leave to care for children up to 1.5-3 years old.

When working part-time, this period will be counted toward the length of service only if the person ended up working full-time. Although care leave is not included in the calculation, women have the right to include pre- and post-natal leave, paid on the basis of certificates of incapacity.

The size of the pension supplement for northerners in 2020: indexation and latest changes

Reading time: 11 minutes(s) According to the current legislation of our country, residents of the Far North and equivalent regions have the right to count on receiving benefits when establishing a pension. This is due to the fact that living conditions in such an area are officially considered difficult. In this article we will talk about what the northern pension is and what it will be in 2020.

What you need to know

Residents of the Far North and officially equivalent regions have access to a grace period for retirement, while the basic part of the insurance pension is subject to increase. Residents of other cities with northern experience have similar rights.

A year of work in places equated to the Far North corresponds to nine months of experience directly in the North. After 6 years and 7 months of work in a given area, each subsequent year of work brings the retirement date closer by 4 months.

Since the beginning of 2020, the labor pension has been transformed into an insurance pension, and the fixed basic amount has been changed to a fixed payment to the insurance pension. At the same time, the conditions and procedure for early establishment of insurance coverage and increase in insurance payments for northerners remains unchanged.

Legislation

Currently in Russia there are three main laws regulating the establishment and payment of pensions to northerners:

- Federal Law No. 166 “On State Pension Security” (for citizens receiving state support);

- Federal Law No. 173 “On Labor Pensions” (since January 2020, it is valid only in part of the provisions governing the procedure for calculating and paying pensions that were assigned before the end of 2014);

- Federal Law No. 400 “On Insurance Pensions” (for citizens retiring after January 2020).

Will there be changes to the northern pension in 2020: latest news

Like the pensions of all citizens of the Russian Federation, “northern” security is subject to annual indexation as planned - insurance payments are increased on February 1, and social security increases on April 1.

Next year it was planned to index pension payments according to actual inflation (7%), which will be carried out on January 1, 2020. As last year, the increase in insurance coverage will affect only non-working pensioners.

According to data provided by the Pension Fund, from April 1, 2020, social pensions will increase by 4.3%.

How many years do you need for northern experience: what time do you retire in the North?

Minimum

Today, to qualify for a “northern” pension, you must have at least 15 years of experience.

Retirement age in the north

Certain categories of the population have the right to retire earlier than the generally established age. Article 32 of Federal Law No. 400 states that a citizen has the right to count on early registration of pension benefits if he has worked in the North for a sufficient number of years.

The legislation provides for the establishment of old-age insurance payments with a reduction in the retirement age in proportion to the length of service in the Northern regions. In other words, for each full year of northern experience, the age at which a citizen can retire is reduced by 4 months.

Important: For citizens who worked in areas officially equated to the Far North, one calendar year of work is equivalent to 9 months of work experience in the North.

Northern retirement experience for men

To receive insurance payments at the age of 55, men must have 15 years of experience in the Far North or 20 years in areas equivalent to it. In this case, the duration of the total insurance period must be at least 25 years.

For clarity, let us present a table that demonstrates the dependence of the age of assignment of an old-age pension on the length of insurance coverage in the Far North regions:

| Duration of northern experience, years | Age of assignment of old-age insurance pension, years/months |

| 7,5 | 57/8 |

| 8 | 57/4 |

| 9 | 57/0 |

| 10 | 56/8 |

| 11 | 56/4 |

| 12 | 56/0 |

| 13 | 55/8 |

| 14 | 55/4 |

| 15 or more | 55/0 |

To retire at the age of 50, a man must permanently reside in these areas and have at least 25 years of experience as a reindeer herder, fisherman or commercial hunter.

Northern retirement experience for women

A northern pension for women with two children can be assigned at the age of 50, provided that the total insurance period is at least 20 years, and 12 years of them were devoted to work in the Far North (17 years for areas equated to it).

The retirement dates for women are shown in more detail in the following table:

| Duration of northern experience, years | Age of assignment of old-age insurance pension, years/months |

| 7,5 | 52/8 |

| 8 | 52/4 |

| 9 | 52/0 |

| 10 | 51/8 |

| 11 | 51/4 |

| 12 | 51/0 |

| 13 | 50/8 |

| 14 | 50/4 |

| 15 or more | 50/0 |

If she has 20 years of work experience as a reindeer herder, fisherman or commercial hunter, a woman can retire at the age of 45. A prerequisite for obtaining such a pension is permanent residence in the area.

Conditions for receiving a northern pension

Like all citizens of the Russian Federation, northerners have the right to apply for both insurance and social benefits. However, in comparison with residents of other regions, citizens living in the Northern regions can receive certain benefits when assigning both types of pensions.

In addition, persons who have worked in a given area for a certain number of years can also take advantage of “northern” benefits, regardless of their place of residence at the time the pension was established.

A video on this topic can be found here:

How to calculate

According to Russian legislation, years of work in the Far North count one to one in northern experience, and a year of experience in areas officially equivalent to it is counted as 9 months of work in the Far North.

It should be noted that periods of actual unemployment spent in a given area are not included in the northern length of service. In this case, part-time employment due to the enterprise operating on a part-time basis is counted according to the time actually worked. In case of part-time work, the time worked is counted towards the northern length of service only on the condition that the combination of several positions provided the employee with full employment.

After 7.5 years of work in the North, one year of work activity reduces the retirement period by 4 months.

If, due to some circumstances, a citizen was unable to earn a sufficient amount of work experience or pension points, then he does not have the right to receive an insurance pension. However, such categories of the population are entitled to social benefits, which, like insurance, are established upon reaching retirement age. However, in some cases, social benefits may be assigned earlier than this period.

Paragraph 4 of Article 11 of Federal Law No. 166 states that representatives of small peoples of the North who permanently reside in a given area can retire much earlier - at 50 for women and at 55 for men.

According to Government Decree No. 1049 of October 1, 2015, the small peoples of the North include:

- Itelmens;

- Nenets;

- Aleuts;

- Chukchi;

- Evenks and others.

For other citizens who do not belong to these nations, social benefits in old age are established on an equal basis with everyone else in the country - at 65 years old for men and at 60 years old for women.

Size and calculation procedure

For all categories of citizens of the country, the state insurance pension is established in accordance with Article 15 of Federal Law No. 400. In this case, the amount of payment is determined as follows:

SP = FV + IPC x SIPC,

Where:

SP – insurance pension;

FV – fixed payment;

IPC – accumulated number of pension points;

SIPC is the cost of the individual pension coefficient on the day the pension was established.

It should be noted that the SIPC is indexed annually and for 2020 is 93 rubles.

The size of the fixed payment is also subject to annual indexation and from January 2020 will be 5334 rubles 19 kopecks , however, for citizens with northern experience, Article 17 provides for an increased fixed payment: 2843 rubles 13 kopecks with 15 years of service in the Far North, 1705 rubles 88 kopecks for pensioners who have worked for 20 years in areas equated to the Far North.

Social benefits for old age are established for residents of the North in the same way as for other citizens of our country. After indexation in April 2020, the payment will be 5,686 rubles 25 kopecks. Moreover, if recipients of social benefits permanently reside in the North, then the amount of payments also increases due to the corresponding regional coefficients.

The principle by which the northern pension is calculated is described in detail here:

What are the regional coefficients for the northern pension?

Citizens permanently residing in the regions of the North receive increased pension payments. The pension increases due to regional coefficients, which are established by the Government of the Russian Federation for each region separately. Currently, the spread of regional northern pension coefficients ranges from 1.2 to 2.0. Moreover, the more severe the climatic conditions, the higher the indicator.

It should be noted that this increase in benefits can be applied both to the social pension and to the insurance payment. In this case, the fact of permanent residence should be confirmed annually by regularly submitting the necessary documents to the Pension Fund authorities.

Residents of the North with an insurance experience of 15 years in the Far North (20 years in equivalent areas) and a total experience of 20/25 years are given a choice - they can receive an increased insurance pension due to:

- establishing an increased fixed payment;

- increasing the fixed payment using the regional coefficient.

The regional coefficients of the northern pension can be found by downloading the following document: https://yadi.sk/i/mRNPYNkY3QkbGy.

Online calculator

On the Internet you can find many programs that allow you to calculate online the size of the future pension for northerners. One of these services can be found on the official website of the Russian Pension Fund at the link https://www.pfrf.ru/eservices/calc.

To obtain up-to-date information, you just need to enter the data requested by the system and click the “Calculate” button.

It is necessary to understand that the result of such a calculation will be approximate, since no program is yet able to take into account all the features of the work activity of a particular citizen. Thus, for citizens over 80 years of age, disabled people of group I and citizens permanently residing in the Northern regions, the insurance pension will be paid in an increased amount due to an increase in the fixed payment or the use of the so-called “northern” coefficients.

What kind of work is there in the Far North and similar areas?

Business trip

According to current legislation, employees on a business trip are subject to the work and rest hours of the organizations to which they are sent. Based on this, work performed during a business trip to the North is included in the calculation of northern experience as work in the regions of the Far North. If these citizens have 15 years of work in a given area, an increased amount of pension payments is established, regardless of place of residence.

For example, if an employee was sent from an area equated to the regions of the Far North on a business trip directly to the Far North for a period of at least 1 full working day, this period should be taken into account in the special length of service as work in the Far North and in the future the work should be taken into account as a person who has “ mixed" work experience to establish an increased basic part of the pension.

It should be noted that special work experience includes periods of business travel to conferences, meetings, exchange of experience and other similar events if the employee was sent on business trips by the employer to perform relevant job duties.

Periods of business trips for military service, training camps, seminars, training, advanced training courses, sports competitions, celebrations, competitions and other events that do not involve the actual performance of work are not counted towards special length of service. Also, periods of work in the regions of the Far North are not taken into account for employees who have a traveling nature of work without a business trip: railway transport workers, emergency medical services, drivers, pilots and sea crews.

Shift method

The specificity of the Far North leaves its mark on the necessary professions. For the most part, these regions have a developed mining industry, so the most popular specialties include bulldozer operators, drivers, welders, builders, mechanics, crane operators, drillers, geologists, and so on.

When working on a rotational basis in the North, it is necessary to take into account that the northern experience is credited to the employee based on the time actually worked.

Review of popular professions for work in the North: top 7

In the northern regions of our country, the construction, oil and gas, logging and railway industries are especially developed. It is in the North that the vast majority of gold and diamond mining companies are located. In this regard, the most popular professions in the regions of the Far North today are:

- geologist: responsibilities: exploration of the Earth's interior;

- salary: from 70 to 150 thousand rubles.

- responsibilities: seismic exploration, based on the study of the propagation of elastic waves in the earth's crust caused by an impact or explosion;

- responsibilities: drawing up a drilling schedule, forecasting results, coordinating work, analyzing data, carrying out calculations for casing wells, and so on;

- responsibilities: organization and coordination of work on labor protection, control and maintenance of documentation, organization of work to create safe working conditions, work to prevent and eliminate accidents, control over the completeness and timeliness of providing workers with personal protective equipment, etc.;

The above professions are management-level specialists, but representatives of blue-collar professions are no less in demand at oil-producing industry enterprises:

- drivers of drilling rigs/truck cranes/bulldozers/excavators (110-120 thousand rubles);

- drillers (115-125 thousand rubles);

- repairmen (50-90 thousand rubles).

In the field of construction in the North, what is most needed is:

- masons (50-100 thousand rubles);

- concrete workers (60-100 thousand rubles);

- installers (80-120 thousand rubles);

- argon welders (80-130 thousand rubles);

- electric and gas welders (80-130 thousand rubles);

- finishers (60-120 thousand rubles);

- slingers (50-90 thousand rubles).

Since the development of new deposits is impossible without the creation of roads, the professions of proper specialists are especially popular: operators of loaders/rollers/asphalt pavers and other road equipment (70-100 thousand rubles). Also in the North, good drivers with category E and D certificates, as well as ADR (50-150 thousand rubles) are always in demand.

Contrary to popular belief, “female” specialties are also in demand in the regions of the Far North, because shift workers live at the fields in villages that also need to be serviced. In this regard, maids, cooks and commandants are often required to work in the North (50-80 thousand rubles).

As for the work schedule, each individual organization has its own. The most commonly used schedules are 15/15, 30/30/ and 45/45 days. However, sometimes you can find longer shifts - 2-6 months of work.

To get a job in the North, you need not only desire , but also excellent health . The thing is that in order to get a job on a rotational basis, it is necessary to obtain an appropriate medical certificate about the possibility of working and living in conditions of high humidity, sudden changes in pressure and a small amount of sunlight. Another important requirement is the availability of sufficient education and experience in the sought-after field of activity, while the specialist must periodically “confirm” his knowledge and skills by regularly taking advanced training courses.

Where can you earn the most in the North?

The highest paid professions in the regions of the Far North are most often associated with mining, exploration and development of new deposits, laying communications, construction and a number of other complex jobs that require high professional qualifications from the employee.

More detailed information about work in the North can be found in the following video:

Which job can you retire from quickly?

Working as a reindeer herder, commercial hunter or fisherman in the Far North allows men to retire at age 50 (with 25 years of experience), and for women at age 45 (with 20 years of experience).

What is the pension for military personnel from the Far North?

A second pension from the Pension Fund may be assigned to military pensioners if the following conditions are simultaneously met:

- reaching the generally established retirement age (60 years for men and 55 years for women),

- the presence of a minimum insurance period that is not taken into account when assigning pensions through the law enforcement agencies (11 years as of 2020);

- the presence of a minimum amount of IPC/points (16.4 points as of 2020);

- the presence of an established pension for disability or long service through the relevant law enforcement agency.

A distinctive feature of military pensioners who continue to work in the regions of the Far North is the possibility of early retirement in old age (55 years for men and 50 years for women).

What benefits are provided for northern pensioners?

Today, northern pensioners are entitled to the following types of benefits:

- regional coefficients (used to increase pensions and salaries);

- percentage bonuses (set to the salary after six months of work in the Far North or a year of work in regions equivalent to it);

- pension benefits (right to early retirement, larger payments);

- housing subsidies (benefits for moving to regions of Russia with a more favorable climate);

- additional paid leave (24 days for the Far North and 16 days for regions equivalent to it);

- compensation for transportation costs (twice a year to the holiday destination and back).

It should be emphasized that for residents of the Far North and residents of regions equated to it, the benefits are the same, the only difference is in the volume provided (for example, residents of the Far North have longer additional leave, and the regional coefficient is higher).

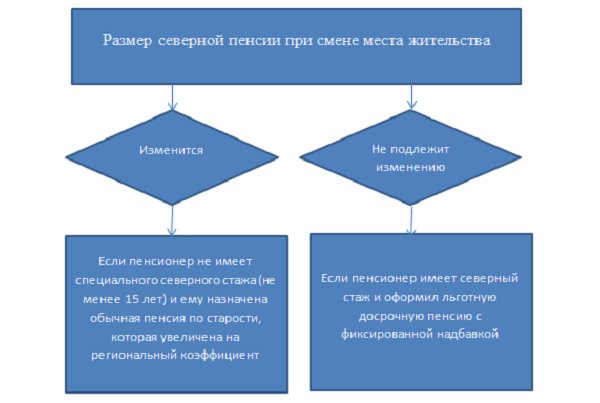

Will the pension remain the same or will it decrease when moving from the North to the middle zone?

In accordance with the current legislation of the Russian Federation, when a citizen moves to another region, the amount of his northern pension is subject to recalculation . Moreover, depending on the new place of residence, the pension can be changed in any direction. In this case, the size of the fixed payment is subject to revision, determined taking into account the regional coefficient - it is established only for the period during which the pensioner lives in the northern region. Moreover, each northern region has its own coefficient, so the amount of pensions in different regions can vary significantly.

If a pensioner moves to a region with a normal climate, then the fixed payment to his state security will be recalculated without taking into account the regional coefficient, which means the pension will become lower.

Thus, when moving to another region, the northern pension is not saved, since the fixed payment to it is paid in an increased amount only during the period of permanent residence of the citizen in the given area.

Northern allowances when moving

If a citizen who has received a northern pension decides to leave the boundaries of permanent residence within the North or regions equivalent to it, and changes his place of residence to a region with a normal climate - the amount of the fixed payment, taking into account the increase for full length of service in the North or upon reaching the age of 80 years, will remain unchanged. In this case, the regional coefficient will no longer be used.

Regions of the Far North and equivalent areas: list and map

You can get acquainted with the current list of regions of the Far North and areas equated to it by following the link https://yadi.sk/i/mRNPYNkY3QkbGy.

Indexation and increase in pensions for northerners in 2020: how much will it increase?

Like the pensions of other citizens, the “northern” security is subject to mandatory annual indexation - insurance payments increase in February, and the amount of social security increases in April.

In 2020, the insurance pension of non-working pensioners will be indexed ahead of schedule, and from January 2020 will increase by 7%.

As for social pensions, from April 1, 2020 they will increase by 4.3%.

How to apply and receive: instructions

Where can I get a certificate of northern experience?

You can request a certificate of northern work experience directly from the employer. To do this, you should contact the company’s personnel service with a corresponding request from the Pension Fund, write an application addressed to the manager and attach copies of your general passport and work book to the document.

If the organization no longer exists at the right time, it is recommended to contact the archive at the place of registration of the enterprise - this will take a little more time, but will allow you to obtain reliable information about the work activities of a particular citizen.

Where to go and what to do to get it?

A citizen has the right to apply for the establishment of pension payments immediately after acquiring the right to them. To do this, you must submit the appropriate application and documentation to the territorial office of the Pension Fund of Russia in any convenient way (in person, by mail or via the Internet).

What documents are needed?

The main documents required to submit an application for a pension to the Pension Fund are:

- general civil passport of the Russian Federation;

- work book and other documents confirming work experience;

- SNILS;

- certificate of average salary for any 5 years of work before 2002.

If necessary, the Pension Fund specialist may require the provision of additional documents, so in each individual case the list of required papers should be clarified on an individual basis.

The procedure for assigning and paying insurance pensions

The Russian Pension Fund is given 10 working days to consider the application and make a decision on establishing state support. If the application is approved, payment will be assigned from the first day of the month of application. In this case, both types of security will be paid monthly and are established indefinitely on an application basis. The only exception is the social pension - it is established without application for those persons who were previously recipients of disability benefits and are not entitled to receive an old-age insurance pension.

How to properly apply for a pension is described in detail here:

Thus, northerners have quite a lot of privileges, but some of them are preserved only if they permanently reside in the North. That is why, when moving to another region of the country, you should be prepared for the fact that the amount of pension payments may change significantly.

Did this article help you? We would be grateful for your rating:

0 0

How to calculate northern experience

The standard is to consider northern experience separately. Every 1 year worked by a person in the Far North is counted as 1 year of insurance experience, and 1 year worked in equivalent areas is counted as 9 months special. length of service

For shift workers, their length of service includes not only the period of work itself, but also the time spent working, as well as the rest period between shifts.

If a person served in the Armed Forces until 1992 in units in the Far North, and then remained to work in such a region, then he is included in the special class. length of service and time of military service.

Important! As a standard, all calculations are made based on entries in the work book. If it is not clear from them where the person worked, then additional documents will be required. Particular attention should be paid to this point for employees of various branches with central offices of companies in other regions of the Russian Federation.

If the northern experience is more than 7.5, but less than 15 years, then the retirement age for a person is reduced by 4 months for every 1 year of northern experience.

Pensions in the Far North: what areas are we talking about?

The Far North is the part of Russian territory that is located north of the Arctic Circle. Regions are considered polar if they are not connected by transport routes to the “mainland”, or this connection stops when the seasons change.

The following cities and regions are partially or entirely equated to the Polar Regions:

- Arkhangelsk;

- Amur;

- Sakhalin;

- Irkutsk;

- Tyumen;

- Tomsk;

- Transbaikalia;

- Permian;

- Krasnoyarsk;

- Primorsk;

- Khabarovsk.

Republics:

- Altai;

- Karelia;

- Buryatia;

- Komi;

- Tyva.

In the Russian Federation, 27 regions are located in the polar territory or in areas equivalent to it, localized in the region of 60 degrees north latitude.

How to apply for a northern pension

The procedures for applying for a regular and northern pension are virtually no different. General regulations apply to them.

The procedure for applying for a pension includes 3 steps:

- Preparation of a package of documents. It may vary depending on the individual's situation.

- Checking the availability of all necessary papers and rights. This is an optional step, but it is better to check everything yourself in advance.

- Submitting an application for a pension and receiving a decision on it. The originals of all necessary documents are submitted along with the application.

What documents are needed

When contacting the Pension Fund, a person must confirm all the circumstances to establish it and determine the amount of payments. The package of documents may vary significantly depending on the situation of a particular person.

The general list of required papers includes:

- passport;

- work book and other documents confirming work activity;

- salary certificate for 5 consecutive years until 01/01/2002;

- certificate of change of full name or other data.

Other papers may be required to confirm pension rights. A person may not have some documents from the general list.

Important! If there are people who are disabled in the family of the future pensioner, then all the documents for them must also be submitted.

Where to submit documents

You can apply for registration at the territorial offices of the Pension Fund or MFC. The first option is convenient if you need to get advice right away, and the second allows you to reduce the time for submitting documents, and MFCs also work according to a convenient schedule.

For the convenience of citizens, it is also possible to submit an application through the State Services portal . But the original documents will still have to be submitted to the Pension Fund or MFC. You can also send it by mail or send it through a representative. In the latter case, the representative will also need a properly executed power of attorney.

What is the deadline for making a decision?

The standard period for making a decision on an application for a pension is 10 working days . But in practice it may increase if the package of documents is incomplete. It is recommended to seek advice from the Pension Fund several months in advance.

How many years do you need to work for a preferential pension?

A citizen will be able to receive early insurance coverage for a certain duration of work at a compressor station. By law, it is 15 calendar years. The total amount of preferential insurance coverage cannot exceed the amount of 3 standard minimum pension payments, i.e. RUR 26,178 Calculation of the northern length of service for a preferential pension is carried out according to the formula:

- 1 calendar year of work is equal to 9 months of work in the Arctic, i.e. In order for the official period of employment to be 15 calendar years, a citizen must work for 135 months.

The average amount of pensions for specialists who worked in the Far North is 40–50 percent higher than the amount of standard funded payments. The minimum amount of insurance coverage for former RKS employees in 2020 was 9,200 rubles. For citizens permanently residing in the territories of the Far North, increasing coefficients (1.5–2) will be applied. The magnitude of the multiplier depends on the location.

- MTS tariffs without monthly fee for pensioners

- Classic massage - a description of the technique and techniques of general, medical or wellness

- How to paint the walls in an apartment with your own hands

For men on a general basis

Specialists will be able to become early retirees after 55 years of age. Features of calculating preferential length of service for men:

| Basis for the benefit | Minimum length of service to reduce the retirement age | Northern experience | Insurance experience | Early retirement age |

| Work in CS areas | 7.5 years | 15 | 25 | 55 |

| Work in territories equated to CS | 20 |

Women

To receive an early pension, this category of specialists will have to work for at least 20 years. Table with features of calculating preferential length of service for women:

| Basis for the benefit | Minimum length of service to reduce the retirement age | Northern experience | Insurance experience | Early retirement age |

| Work in CS areas | 7.5 years | 15 | 20 | 45 |

| Work in territories equated to CS | 20 | 50 | ||

| Birth of 2 or more children | 17 |

Permanently residing in the RKS and equivalent territories

The law allows native northerners to retire 10 years early. Reindeer herders, hunters, and fishermen will be able to take advantage of the benefit. To receive early retirement benefits, the total duration of work must be at least 25 years. When you change your place of residence, the benefit ceases to apply and the amount of payments is reduced. The indigenous peoples of the North include:

- Evenks, Evens, Nanais, Ulchis;

- Udege, Negidal, Orok, Oroch;

- Khanty, Vepsians, Mansi, Sami;

- Nenets, Enets, Nganasans, Selkups;

- Shors, Dolgans, Tuvans-Todzhas, Telengits;

- Soyots, Kumandins, Teleuts, Tubalars;

- Chelkans, Tofalars, Chulyms;

- Chukchi, Koryaks, Nivkhs, Itelmens, Eskimos, Yukaghirs;

- Kets, Chuvans, Aleuts, Kereks, Kamchadals, Tazy.

How to confirm northern pension experience

Usually, data from the work book is used to confirm northern work experience. But if a person worked in a division of a Moscow or other company, then the entry in it may be made incorrectly. Because of this, you will have to request certificates indicating specific periods of work on a rotational basis.

If a person needs to confirm a period of service in the Armed Forces for length of service, then he will need a military ID. All other facts are also confirmed by relevant certificates and extracts.

Read more: Confirmation of work experience for pension

In what cases is early retirement possible according to northern seniority?

With permanent residence in the northern regions and experience in the fishing, reindeer herding or commercial sectors, representatives of indigenous peoples have the opportunity to retire even earlier by 5 years . This right applies to both men and women. At the same time, men must have at least 25 years of total experience, and women must have at least 20 years.

Read more: Early retirement

Relocation pension

When moving from any northern city to warmer climes, there is a change in the calculation of the pension for a former employee of the Far North. The amount of payments will now be related to the new place of residence of the future elderly person. However, the length of service remains unchanged. That is, after moving, only the northern coefficient is not taken into account, but the amount of payments taking into account legal norms in force at the new address is taken into account.

When moving, the algorithm of actions will be as follows:

- The pensioner contacts the Pension Fund department to draw up an application for transfer of pension to a new address;

- Employees make a request at the previous place of residence to obtain the pensioner’s personal file. The case is received on the same day by e-mail to the PRF, and the paper form arrives after 3 days;

- If you have the original personal file, Pension Fund specialists register the pensioner with further assignment of pension payments within 2 days;

- An elderly person is required to provide documentation to the Pension Fund office, namely: passport, certificate of new registration; power of attorney. After which the fund employee checks the correctness of the assignment of pension payments.

We also recommend watching an interesting video on the topic of pensions when moving from the Far North.

Citizens working in populated areas of the North have the opportunity not only to retire earlier, but can also increase their pension contributions based on their length of service. Consequently, work in the north is profitable, but at the same time dangerous and harmful. Therefore, study all the nuances of registering pensions for northerners so that no additional questions arise when they retire.

Will the size of the pension for northern service remain the same when moving to another city?

Quite often, people, upon retirement, decide to move to another city or town with a more comfortable climate. At the same time, they retain the right to a previously assigned pension. But after registering in a new place of residence, the assigned amount of payments will be recalculated .

During recalculation, the accumulated points and length of service will remain the same, but the regional coefficient will change. It will be installed depending on the new region of residence. In some areas it may be completely zero. In fact, if you move, the size of your pension will be significantly reduced. The difference in payments can reach 60%.

Northern experience provides the opportunity to retire earlier than established by the general rules. But we must take into account that it is necessary to accumulate a certain number of years of such experience and fulfill a number of other conditions in order to be able to take advantage of the benefits.

Is the northern pension preserved when changing place of residence?

As we already reported above, the northern pension includes three components:

- fixed;

- insurance;

- regional coefficient.

The pension of residents of the KS and equivalent territories includes all three types of payments.

When people move to another region, the northern regional coefficient will not be calculated, since it is relevant exclusively for the local population of the northern regions of the country. The amount of pension supplements will be tied to the pensioner’s place of residence and will be reduced or increased by the regional coefficient at the place of residence. For more information about the connection between the coefficient and place of residence, see the video “ New rules for calculating the northern allowance.”

Social protection of older people and those who have worked for a long time in special climatic conditions is very important. As we see, workers in the North can count on early retirement for their work and a good bonus in the form of an insurance pension and a regional coefficient. All this motivates people to work and live in the North, regardless of climatic conditions.