- Increased indexation of pensions

- Benefits and guarantees for people of pre-retirement age

- Transition period to raise the retirement age

- Who doesn't change their retirement age?

- What changes are provided for pensioners

- Increasing pensions for rural pensioners

- Retirement age for northerners

- Assignment of pensions to doctors, teachers and artists

- Retirement age for civil servants

- Assignment of social pension

- New grounds for early retirement

- Payment of pension savings

In accordance with Federal Law No. 350-FZ of October 3, 2018, Russia begins a gradual increase in the generally established age, which gives the right to receive an old-age insurance pension and a state security pension. The changes will occur in stages over a long transition period of 10 years, ending in 2028. As a result, the retirement age will be raised by 5 years and set at 60 years for women and 65 years for men. In 2020, the retirement age for women was 55 years, and the retirement age for men was 60 years.

Increased indexation of pensions

Starting from 2020, the law provides for increased indexation of insurance pensions at a rate that is faster than the forecast growth of inflation. Old-age insurance pensions for non-working pensioners will increase on average by 1 thousand rubles per month, or 12 thousand rubles per year.

From January 1, 2020, the indexation of insurance pensions is 6.6%, which is higher than the forecast inflation rate for 2020. The size of the fixed payment after indexation will increase to 5,686.25 rubles per month, the cost of the pension coefficient will increase to 93 rubles. As a result of indexation, the old-age insurance pension increases on average in Russia by 1 thousand rubles, and its average annual amount is 16.5 thousand rubles.

The increase in pension for each pensioner is individual, depending on the size of the pension received. In order to find out how much the pension will increase from January 1, 2020, you need to multiply the amount of the pension received by 0.066 (6.6%).

Example The disability insurance pension of a non-working pensioner is 10,137 rubles. After indexation from January 1, the pension will increase by 669 rubles and amount to 10,806 rubles. Another example: The old-age insurance pension of a non-working pensioner is 16,437 rubles. After indexation from January 1, the pension will increase by 1,085 rubles and amount to 17,522 rubles.

Benefits and guarantees for people of pre-retirement age

For citizens of pre-retirement age, benefits and social support measures previously provided upon reaching retirement age are retained: free medicines and preferential travel on transport, a discount on the payment of major repairs and other housing and communal services, exemption from property and land taxes, and others.

Starting from 2020, new benefits related to annual medical examinations and additional job guarantees are also being introduced for pre-retirees. Employers are subject to administrative and criminal liability for dismissing workers of pre-retirement age or refusing to hire them due to age. The employer is also obliged to annually provide employees of pre-retirement age with two days of free medical examination while maintaining their wages.

The right to most pre-retirement benefits begins 5 years before the new retirement age, taking into account the transition period. From 2019 onwards, women born in 1968 and older and men born in 1963 and older are entitled to benefits.

The five-year period is also relevant when, when assigning a pension, both the achievement of a certain age and the development of special experience are taken into account. This primarily applies to workers in dangerous and difficult professions according to lists No. 1, No. 2, etc., which allow early retirement. The onset of pre-retirement age and the right to benefits in such cases arises 5 years before the age of early retirement, subject to one of the conditions: development of the required preferential length of service, if the person has already stopped working in the relevant specialty, or the fact of working in the relevant specialty.

For example , drivers of public urban transport, if they have the necessary special experience (15 or 20 years depending on gender), retire at 50 years old (women) or 55 years old (men). This means that the pre-retirement age limits will be set for female drivers starting at 45 years old, and for male drivers starting at 50 years old.

The pre-retirement age of doctors, teachers and other workers, whose right to a pension arises not from certain years, but when developing special experience, occurs simultaneously with its acquisition. Thus , a school teacher who will have completed the required teaching experience in March 2020 will be considered pre-retirement from that moment.

For those whose retirement age has not changed since 2020, they also have the right to pre-retirement benefits 5 years before retirement. For example , for mothers with many children and five children, it occurs starting at the age of 45, that is, 5 years before their usual retirement age (50 years). When determining the status of a pre-retirement person in such cases, two factors are taken into account. Firstly, the basis that gives the right to early assignment of a pension - it can be the required number of children, disability, experience in hazardous work, etc. And secondly, the age at which a pension is assigned, from which the five-year period for providing benefits is counted.

The exception to which the 5-year rule does not apply is tax benefits. They are provided upon reaching the previous retirement age limits. For most Russians, this is 55 or 60 years old, depending on gender, and in the case of people retiring early, earlier than this age. For example, for northerners, who under the previous legislation retire 5 years earlier than everyone else, the pre-retirement age for receiving tax benefits is 50 years for women and 55 years for men.

Confirmation of pre-retirement status

The Russian Pension Fund has launched an information service through which information is provided about Russians who have reached pre-retirement age. This data is used by authorities, departments and employers to provide appropriate benefits to citizens. For example, employment centers, which since 2020 provide pre-retirement workers with increased unemployment benefits and are engaged in professional retraining and advanced training programs for pre-retirement workers.

PFR data is transmitted electronically through SMEV channels, through the Unified State Social Security Information System (USISSO) and electronic interaction with employers. A certificate confirming a person’s status as a pre-retirement pensioner is also provided through a personal account on the Pension Fund website and in the territorial offices of the Pension Fund.

A new pension reform is being prepared in Russia. How about Mavrodi? Wouldn't want to retire without money?

Plot: Pension reform

Pensions will be frozen for another year. The Pension Fund's draft budget has been submitted to the State Duma. Who is entitled to a second pension, find out urgentlyMore 201 news

The next pension reform will be launched in Russia. The Ministry of Finance has prepared a “guaranteed pension product” for the population. The bill has been developed and sent for approval to the Ministry of Labor. What kind of innovation is this and most importantly, how can we not be left without money in retirement?

The bill “On a guaranteed pension product” involves four main elements: a voluntary procedure for citizens to join the savings system; guaranteeing the safety of funds by the state; registration of savings accounts by the central administrator, as well as tax benefits for businesses and tax deductions for citizens. A guaranteed pension product is not the first innovation of the Ministry of Finance. Before this, people were presented with a guaranteed pension plan. He assumed that Russian citizens could independently transfer money to non-state pension funds. How much to transfer is everyone’s business, but 6% of the project, which, however, never came to fruition, was supposed to be exempt from personal income tax, writes Tsargrad.

The guaranteed pension plan caused a negative reaction from the population (at that time they were talking about automatic connection) and the expert community. And now the Ministry of Finance has finalized the bill and, just in case, renamed it. However, experts are still not very happy. And the main dissatisfaction is, of course, that the GPP (plan or product, it doesn’t matter) is intended to replace the IPC (individual pension capital), which was frozen by the government in 2014.

Remember, there was such a Mavrodi,” recalls economist Mikhail Delyagin. – Unfortunately, he passed away, but he had MMM, then he had MMM - 2005, then MMM - 2011 (they painted on all the asphalts) and even MMM - 2012. The same thing here. Our savings contributions were frozen, in fact, our money was stolen from us, after which they say: “Guys, about the money that we froze, but in fact stole, please forget about it and bring us more money - we We’ll do something interesting with them.” This is Mavrodi’s approach. I think if Mavrodi had lived to this day, he would have become Deputy Minister of Finance or Minister of Finance without any problems.

That is, people had already trusted the state once and agreed to become part of the IPK system, and then the officials sat, thought and decided: “This was not a very good idea, let’s forget about all this and start from scratch - here’s the GPP.” . By the way, we are not promised a return on investment when participating in the GPP. But what's the point then? Why not just open a bank account and top it up every month?

“It is completely pointless to entrust this money to the state,” continues Mikhail Delyagin. – And most people see that, firstly, if you just stupidly put money on deposit in a state bank, then by the time you retire you will receive more money than the money that is invested in various kinds of savings schemes, even state ones . And it will be your money, and not the money of some gentleman who, perhaps, will unfasten something from your master’s shoulder.”

The point here is not even a matter of the master’s desire or unwillingness. It may happen that in principle there will be nothing to “unfasten”. We are invited to save money for old age under the supervision of the state in NPFs - non-state pension funds. These NPFs invest our savings. And the savings system works as long as stock markets rise. But it is likely that they will soon stop growing.

Many experts say that the market is “overheated,” but few understand what this means. The main indices - the S&P 500 and NASDAQ - have been trading at maximum values for months now, breaking through the ceiling every now and then. This is despite the fact that the world's largest economy, the United States, is now in a recession. And this dissonance suggests that something is wrong in the market, something is broken. And soon there will be, if not a collapse in the quotations of major companies, then a very significant drop. “What do we have to do with this?” – the attentive reader will ask. And despite the fact that non-state pension funds, in which we are asked to put money for a future pension, will begin to go bankrupt en masse. Then the IPC, and GLP-1, and GLP-2 will go to waste. And, of course, it is surprising that, despite these obvious things, such a reform is being proposed to us. And here the question arises: is a new pension reform necessary at all? Of course it is needed. But it should not bring something new, innovative into our lives, but cancel all previous reforms that the authorities have managed to come up with over the past quarter century.

It is necessary to restore a normal pension system - the Soviet pension system - economist Mikhail Delyagin is sure, - it is necessary to liquidate the Pension Fund as a center of theft (this was shown by the Accounts Chamber). This is an absolutely meaningless bureaucratic superstructure. But practice has shown that the most effective and beneficial system for society is the solidary distribution system, and everything else is carrots that are shown to people in order to rob them.

That is, the state must guarantee a pension to the population, and everything higher - please save it yourself without locking up funds for many years and without non-state pension funds, which can go bankrupt at any time. How to save? Better not in rubles. The average inflation rate for 15 years is 8%, and banks offer to place deposits at a maximum of 4%. That is, our ruble deductions will simply be eaten up by inflation. It is still better to save money in foreign currency - dollars (debatable, given the unrest in the USA), euros or Swiss francs. Or another option - gold coins. This is if the future pensioner is far from portfolio investing. And if you study this issue, the options may be more interesting. But in any case, it is better to save for retirement yourself. At least for those who have something to save.

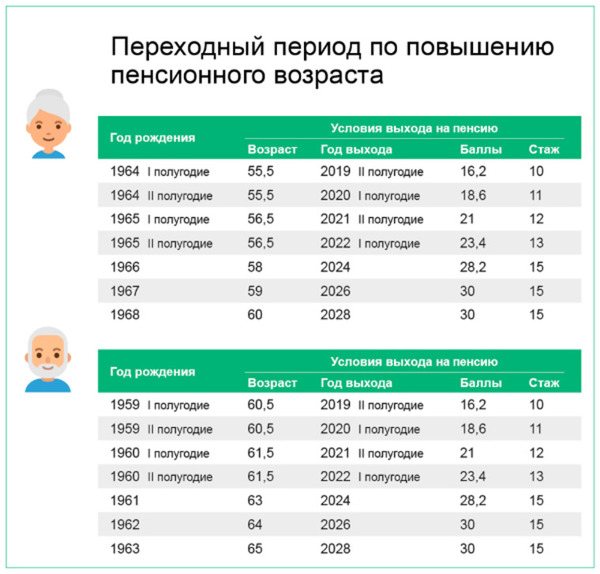

Transition period to raise the retirement age

To gradually increase the retirement age, a long transition period of 10 years is provided (from 2020 to 2028). Adaptation to the new parameters of the retirement age in the first few years of the transition period is also ensured by a special benefit - the assignment of a pension six months earlier than the new retirement age. It is provided for those who were supposed to retire in 2020 and 2020 under the previous legislation. For old-age insurance pensions on a general basis, these are women born in 1964–1965 and men born in 1959–1960. Thanks to the benefit, pensions on new grounds will be assigned as early as 2020: to women aged 55.5 years and men aged 60.5 years; in 2020: women aged 56.5 years and men aged 61.5 years.

Throughout the transition period, the requirements for length of service and pension coefficients necessary for the assignment of an old-age insurance pension continue to apply. Thus, in 2020, retirement requires at least 11 years of service and 18.6 pension coefficient.

The increase in the retirement age does not apply to disability pensions - they are retained in full and are assigned to people who have lost their ability to work, regardless of age when the disability group is established.

Following the transition period, starting from 2028 and beyond, women will retire at 60 years old, men at 65 years old.

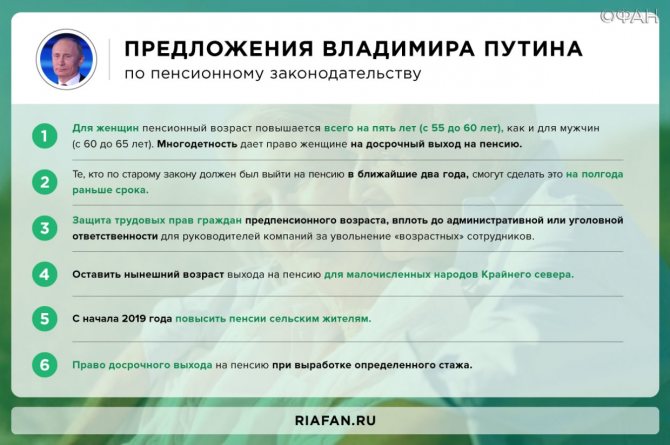

Summary of the bill

The essence of the legislative project is to raise the age of retirement in old age. No other significant changes are envisaged in the reform. The main ideas were described in the version of the bill, which the State Duma adopted in the first reading. However, then the bill was edited, most of the changes were made by the President of Russia. The full list of adjustments was published on September 24, 2018. 09/26/2018 The State Duma approved Vladimir Putin’s amendments in the 2nd reading. Other adjustments did not find support.

From January 1, 2019, the retirement age will begin to increase. The legislative draft approved by the State Duma defines a new age limit - 60/65 years. The retirement age will gradually increase to maximum values until 2028.

The increase in the retirement age will first affect males who were born in 1959; females who were born in 1964. According to the bill, they will retire at 60.5 and 55.5 years, respectively.

Who doesn't change their retirement age?

The majority of citizens who have the right to receive an early pension remain at the same retirement age. These include, in particular:

- Persons to whom a pension is assigned earlier than the generally established retirement age due to work in difficult, dangerous and harmful working conditions, for which employers pay additional insurance contributions to the pension at special rates. Namely, persons employed:

● in underground work, work with hazardous working conditions and in hot shops - men and women;

● in difficult working conditions, as locomotive crew workers and workers directly organizing transportation and ensuring traffic safety on railway transport and the subway, as well as truck drivers in the technological process in mines, open-pit mines, mines or ore quarries - men and women;

● in the textile industry, in work with increased intensity and severity – women;

● in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, search, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work - men and women;

● as crew members on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships permanently operating in the port water area, service and auxiliary and traveling ships, commuter and intracity vessels), as well as in work on the extraction and processing of fish and seafood , receiving finished products at the fishery - men and women;

● in underground and open-pit mining, including personnel of mine rescue units, in the extraction of coal, shale, ore and other minerals and in the construction of mines and mines - men and women;

● in the flight crew of civil aviation, in the work of controlling the flights of civil aviation aircraft, as well as in the engineering and technical staff in the work of servicing civil aviation aircraft - men and women;

● at work with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment - men and women;

● women as tractor drivers in agriculture and other sectors of the economy, as well as drivers of construction, road and loading and unloading machines;

● as workers, foremen in logging and timber rafting, including maintenance of machinery and equipment - men and women;

● as drivers of buses, trolleybuses, trams on regular city passenger routes - men and women;

● as rescuers in professional emergency rescue services and units – men and women.

- Persons to whom a pension is assigned earlier than the generally established retirement age for social reasons and health reasons:

● a woman who has given birth to five or more children and raised them until they are 8 years old;

● a woman who has given birth to two or more children, with the necessary insurance coverage and work experience in the Far North or equivalent areas;

● one of the parents of a disabled person since childhood, who raised him until he was 8 years old – men and women;

● guardian of a disabled person since childhood, who raised him until he was 8 years old – men and women;

● disabled due to war injury – men and women;

● visually impaired, having the first disability group - men and women;

● a citizen with pituitary dwarfism (Lilliputian) and a disproportionate dwarf – men and women;

● fisherman, reindeer herder or commercial hunter permanently residing in the Far North or equivalent areas - men and women.

- Persons to whom a pension is assigned earlier than the generally established retirement age in connection with radiation or man-made disasters, including the disaster at the Chernobyl nuclear power plant, the disaster at the Mayak chemical enterprise, accidents at the Mayak production association and discharges of radioactive waste into the Techa River, as well as in connection with radiation exposure due to nuclear tests at the Semipalatinsk test site - men and women.

- Persons to whom a pension is assigned earlier than the generally established retirement age in connection with work in the flight test crew, as well as in connection with flight tests and research of experimental and serial equipment: aviation, aerospace, aeronautics and paratroops - men and women.

A complete list of citizens for whom the retirement age does not change

Under what scheme will the retirement age be raised?

[ads_middle_center2]

Women born in 1963–1968 and men born in 1958–1963 will retire according to a special principle. The retirement age for women born in the following years will be:

- 1963 – at 55 years old;

- 1964 – at 55.5 years old;

- 1965 – at 56.5 years old;

- 1966 – at 58 years old;

- 1967 – at 59 years old;

- 1968 and younger - at 60 years old.

The retirement age for men in the following years of birth will be:

- 1958 – at 60 years old;

- 1959 – at 60.5 years old;

- 1960 – at 61.5 years old;

- 1961 – at 663 years old;

- 1962 – at 64 years old;

- 1963 and younger - at 65 years old.

You can retire early (before reaching 60/65 years for women/men) if you have worked 37/42 years of service, if you are over 55/60 years old, and a maximum of two years younger than the general retirement age. The following were excluded from the years counted toward length of service: conscript service and maternity leave. That is, only work time and sick leave are included. Many people whose active labor activity occurred in the 90s, when they often worked without official employment and were paid in envelopes, also became permanent victims. It is also unclear what modern freelancers who pay income tax but are, in fact, unemployed should do.

Mothers of many children can retire if there are three children - at 57, four - at 56, five or more - at 50. Workers of the Far North, doctors, teachers and artists who previously retired “on special training”, in principle, retire at the same age as before, but must first live longer (you don’t even have to work or work not in your specialty) with a shift over the years:

- if the special internship expires in 2019, another six months;

- in 2020 – one and a half;

- in 2021 – three years;

- in 2022 – four years;

- 2023 and beyond – five years.

This applies to all those leaving their seniority. The pension periods for leaving work due to age in case of insufficient work experience have also undergone changes - up to 65/70 years. For this category of persons, the scheme by year of birth will be as follows for women:

- before 1958 – at 60 years old;

- 1959 – at 60.5 years old;

- 1960 – at 61.5 years old;

- 1961 – at 63 years old;

- 1962 – at 64 years old;

- 1962 – at 65 years old.

And for men:

- before 1953 - at 65 years old;

- in 1954 - at 65.5 years old;

- 1955 – at 66.5 years old;

- 1956 – at 68 years old;

- 1957 – at 69 years old;

- 1958 - at 70 years old.

What changes are provided for pensioners

Raising the retirement age does not affect current pensioners. Everyone who has already been assigned any type of pension before 2020 will continue to receive due payments in accordance with the acquired rights and benefits. Increasing the retirement age will make it possible, starting from 2020, to ensure higher growth in pensions for non-working pensioners due to indexation exceeding the level of inflation (in accordance with the Decree of the President of Russia “On national goals and strategic objectives of the development of the Russian Federation for the period until 2024” dated May 7, 2020 ).

Increasing pensions for rural pensioners

Since 2020, village residents have the right to an increased fixed payment to the old-age or disability insurance pension. The right to a 25 percent increase in the fixed payment is granted subject to three conditions: having at least 30 years of experience in agriculture, living in a rural area and the absence of paid work.

The increase in the pension of rural pensioners from January 1, 2020 is 1.3 thousand rubles per month, for recipients of disability pensions with the third group - 667 rubles per month, from January 1, 2020 - 1.4 thousand rubles per month , for recipients of disability pensions with the third group - 705 rubles per month.

In this case, the pensioner has the right at any time to submit additional documents necessary for recalculation.

When calculating the length of service that gives rural pensioners the right to an increased fixed payment, work on collective farms, state farms and other agricultural enterprises and organizations is taken into account, subject to employment in animal husbandry, crop production and fish farming. For example, as agronomists, tractor drivers, veterinarians, beekeepers, etc. - in total there are more than 500 professions.

Work that was performed before 1992 on Russian collective farms, machine and tractor stations, inter-collective farm enterprises, state farms, peasant farms, and agricultural artels is included in the rural experience, regardless of the name of the profession, specialty or position held.

Retirement age for northerners

Residents of the Far North and equivalent areas have the right to early retirement 5 years earlier than the generally established retirement age. Northerners retain this right in the future. At the same time, the age of early retirement for residents of the North is gradually increasing by 5 years: from 50 to 55 years for women and from 55 to 60 years for men.

The minimum required northern length of service for early assignment of a pension does not change and remains 15 calendar years in the Far North and 20 calendar years in equivalent areas. The requirements for insurance experience similarly do not change and are 20 years for women and 25 years for men.

The transition period to raise the retirement age of northerners will last, like everyone else, for 10 years – from 2020 to 2028. At the first stage, the age increase will affect women born in 1969 and men born in 1964. At the same time, northerners, who, according to the old legislation, should have been assigned a pension in 2019–2020, also have the right to a benefit for retirement six months earlier than the new retirement age.

For example, a man born in 1965 (July), with 30 years of work experience in the north and 35 years of insurance experience, will retire in January 2022 at the age of 56.5 years.

As a result of the transition period, in 2028, northern women born in 1973 will retire at the age of 55, and northern men born in 1968 will retire at the age of 60.

At the same time, the transition period for raising the retirement age also applies in cases where the northern length of service has not been fully worked out and the age for granting a pension is reduced for each year worked in the northern region.

Example A woman born in 1970 (March), with 11 years of experience in the north and 18 years of insurance experience, according to the old legislation, was supposed to retire in July 2021 at the age of 51 years and 4 months. Considering that in 2021 the retirement age will be raised by three years, a woman will be able to retire in July 2024 upon reaching 54 years and 4 months.

Some northerners, however, will not have to adapt to the new retirement age, since it will not be increased for them. The changes will not affect the small indigenous peoples of the North, who, depending on their gender, retire at 50 or 55 years old, as well as northern women who raised two or more children - if they have the necessary northern and insurance experience, they are entitled to a pension starting at the age of 50.

Raising the retirement age for residents of the Far North

Due to the difficult conditions not only of living, but also of work, residents of the northern regions have the right to retire earlier than citizens of other regions. The pension reform, which came into force in January 2020, involves raising the retirement age limit for both northern men and women.

A gradual increase in the retirement age of northerners will be carried out from 50 to 55 years for the fair sex and from 55 to 60 years for the male part of the population. The minimum length of service for northern early appointment is 15 years in the Far North and 20 years in equivalent regions.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

In 2020, the requirement for insurance experience will not change: 20 years for women and 25 years for men. The transitional stage of raising the age limit for residents of the North will last from 2020 to 2028 (10 years). The first participants in the new system were women born in 1969. and men born in 1964

Assignment of pensions to doctors, teachers and artists

For employees who are granted a pension not upon reaching retirement age, but after acquiring the required length of service (special length of service), the right to early retirement is retained. Such workers include teachers, doctors, ballet dancers, circus gymnasts, opera singers and some others. The minimum required specialized experience for granting a pension does not increase and, depending on the specific profession, as before, ranges from 25 to 30 years.

At the same time, starting from 2020, the retirement of workers in the listed professions is determined taking into account the transition period to raise the retirement age. In accordance with it, the assignment of pensions to doctors, teachers and artists is gradually postponed from the moment of development of special experience. At the same time, they can continue working after acquiring the necessary length of service or stop working.

Example To retire, rural health workers require 25 years of service in health care institutions, regardless of age and gender. If a rural doctor completes the required length of service in September 2021, his pension will be assigned in accordance with the generally established transition period for raising the retirement age - after 3 years, in September 2024.

Pension reforms in the Russian Federation. Background

Since 2005, due to the PFR budget deficit, the funded part of the pension for all citizens born before 1967 was abolished, and these funds were used to finance the insurance part of the pension.

The state again began to take steps to increase the amount of funds in the pension savings system only in 2008. Then the size of the funded part of the pension for citizens born in 1967 was increased from 4% to 6%.

In 2010, the division into basic, insurance and funded parts was eliminated, and the pension began to consist only of insurance and funded. In July 2012, the first payments of the funded part of the pension began, when citizens who paid 2 percent insurance contributions to the funded system in the period from 2002 to 2004 reached retirement age.

In 2013, another reform of the pension system was announced. Within its framework, a three-tier pension system was created. It included insurance and savings parts; it also became possible to join the corporate pension insurance system. The funded pension became voluntary: Russian citizens could choose a management company or non-state pension fund to form it, otherwise the incoming funds had to be transferred to the insurance part. In addition, the labor pension, calculated according to the insurance system, received a system of coefficients for its calculation, which was made up of work experience, retirement age and salary level.

As of 2013, the client base of private management companies and non-state pension funds reached 25 million people, the amount of funds under their management amounted to almost 1 trillion rubles, and the total volume of pension savings exceeded 2.5 trillion rubles. (taking into account the money in VEB accounts, where the money of the so-called “silent people” is stored - citizens who have not chosen a non-state pension fund or a management company for their savings).

In September 2013, during the preparation of the state budget, it was announced that in 2014 the transfer of funds to the funded part of pensions would be frozen, and all money would go to the insurance part of the Pension Fund. The pension freeze was subsequently extended into 2020, and discussions were held about the possible abolition of the funded component. On April 23, 2015, Russian Prime Minister Dmitry Medvedev announced that the funded part of the pension will be preserved. On October 7, the head of the Pension Fund, Anton Drozdov, announced that a decision had been made to freeze pension savings for 2020.

Freezing transfers of the funded portion of pensions was also undertaken by other countries around the world. For example, in 2011, Hungary abandoned the funded system; in 2010-2011. no payments were made to the funded second pillar of the Estonian pension system; in Slovakia, the amount of funded payments was reduced from 9% to 4%.

In addition to freezing the funded part of pensions, other options for balancing the budget of the Pension Fund of the Russian Federation were discussed. In particular, in 2010-2011. An active discussion began about raising the retirement age. On April 16, 2020, Vladimir Putin said that, in his opinion, Russia is currently not ready for a sharp increase in the retirement age, but this is possible in the future “with an open and active dialogue with society,” and should not affect people of pre-retirement age. Other options for reducing the Pension Fund deficit include reducing indexation and pension payments to officials or working pensioners, in particular, those with large labor incomes.

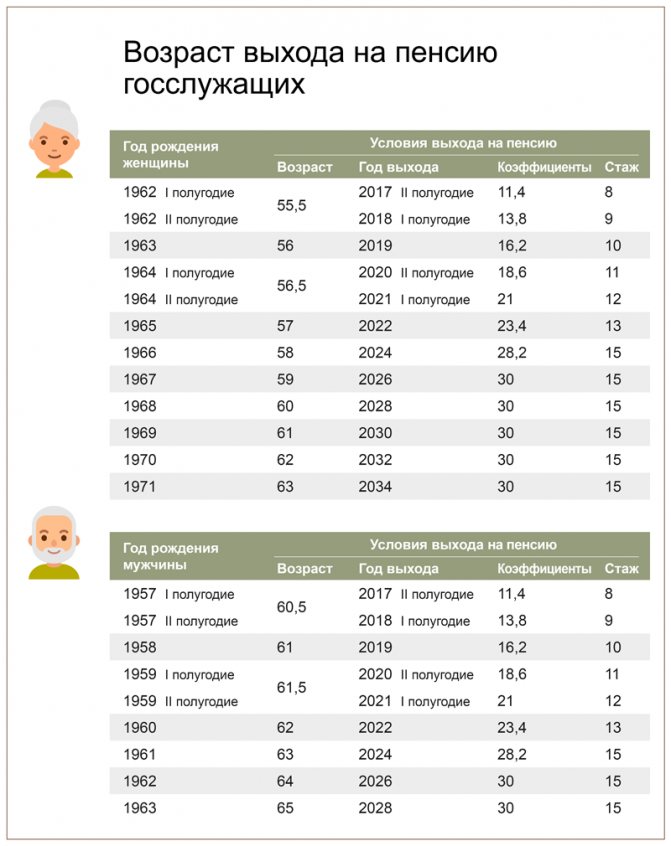

Retirement age for civil servants

For state civil servants at all levels of government (federal, regional and municipal), the transition to new retirement age values occurs in stages. Until 2021, the age increase is six months a year, then the rate is synchronized with the general rate of increase in the retirement age in the country and begins to increase year by year. Male civil servants will retire at 65 by 2028, and female civil servants will retire at 63 starting in 2034.

In addition, for all federal civil servants, starting from 2017, the requirements for the minimum length of service in civil or municipal service, which allows them to receive a state pension for long service, are being increased. Each year, the specified length of service increases by six months (from 15 years in 2020) until it reaches 20 years in 2026.

Taking into account all the changes, the insurance pension for civil servants is assigned in 2020 upon reaching 56.5 years (for women) and 61.5 years (for men). A long-service pension is awarded after 17 years of civil service experience.

Couldn't prove the information? You're losing your pension!

As a new criterion for canceling the insurance part of the pension, the Ministry of Labor proposes to introduce unreliable information in the payment file. But now it often happens that it is simply impossible to verify such information, because many pensioners worked both in Soviet times and in the troubled nineties. There were no computers back then, employers were unorganized, and the administration of insurance premiums was not well established.

Therefore, often the only confirmation of work activity is an entry in the work book, and sometimes it happens that there is none. Therefore, it is strange to make the impossibility of verifying the data provided by the pensioner from the payment file as a reason for canceling a pension.

Currently, approximately every third pensioner does not have sufficient evidence of the data on the basis of which he was assigned a pension. And this, according to the rules of the Pension Fund:

number of years of insurance experience - to determine the right to retire now you need at least 10 years (by 2024 it will increase to 15 years);

the number of years of work experience before 2002 - to determine the length of service coefficient;

the average earnings of a citizen for any 60 months before 2002 - to determine pension rights before 2002.

It turns out that if a pensioner is unable to document his work experience or salary before 2002, he will be denied the insurance part of his pension. And this often happens, for example, if the employing organization no longer exists and the documents have not been transferred to the archive. Now in such cases even witness testimony is accepted, but after the amendments are approved by the Ministry of Labor, only documents will be quoted.

Assignment of social pension

Changes in the pension system that come into force in 2020 do not affect the social pension for disability and loss of a survivor, which are assigned regardless of the generally established retirement age. As in the case of an insurance pension, in relation to state pensions, the right of people who have lost their ability to work due to disability to apply for a pension, regardless of age, is fully preserved.

The age at which the right to a social old-age pension arises is increased by 5 years in accordance with a phased transition period. By 2028, men will receive a social old-age pension upon reaching 70 years of age, and women upon reaching 65 years of age.

The emergence of rumors

The first clue on this issue was the adopted bill on alimony for citizens of pre-retirement age from adult children. In fact, the bill itself was received very coolly by the media and ordinary citizens.

The majority believes that in this way the state is trying to relieve itself of responsibility for the future provision of a certain category of persons. The responsibility to support elderly parents will be assigned to the children. It was this moment that served as the catalyst.

According to some media outlets, this measure makes one think and draw conclusions that pensions will simply be abolished soon. Why did people come to such conclusions?

What did the Constitutional Court decide on pension reform? See here.

The main reason is that actions on the part of deputies increasingly resemble a process of ridding themselves of responsibility and obligations in relation to an unprotected segment of the population.

Will the pension be abolished in Russia and what do they want to replace it with? Answer in video:

The very fact that at the end of last year the government raised the retirement age by 5 years and guaranteed protection against job losses is alarming. What's really going on?

The age has risen, the desired retirement has been pushed back by 2-5 years (depending on the situation), but there is no protection as such. To tell the truth, if an employer wants to remove a pensioner from his job, he will find a way.

Not everyone is able to get a new job, nor is it possible for everyone to get permission to retire early. It turns out that the person is left without a livelihood. It was precisely for this case that the law on alimony was introduced.

Ultimately, the situations overlap and give rise to the news that the government is going to cancel pensions.

Fact or Fiction

Today, government officials are denying the news in every possible way, calling it an ordinary “fake.” However, it is simply impossible to give any guarantees. Just a year ago, Russian citizens could not even imagine that such significant changes would occur.

And given the tendency to create new bills, you can expect anything, up to the complete abolition of pensions and replacing them with so-called “benefits for the poor.” Information about this has also already appeared in the global space.

How can a pensioner avoid a tax audit? Find out by following the link.

Analysts put forward versions that pension payments will become obsolete in the next 20 years. Accordingly, citizens will independently save for their old age.

Reasons for canceling the pension. Photo propfr.ru

And special payments for the poor will be paid to those who have not been able to save enough money. Such statements only fuel the fears of ordinary citizens.

New grounds for early retirement

Early assignment of pension for long service

A new basis is provided for citizens with extensive experience. Women with at least 37 years of experience and men with at least 42 years of experience will be able to retire two years earlier than the generally established retirement age, but not earlier than 55 years for women and 60 years for men.

Early granting of pensions to women with three and four children

Women with many children with three and four children receive the right to early retirement. If a woman has three children, she will be able to retire three years earlier than the new retirement age, taking into account transitional provisions. If a woman has four children, she is four years earlier than the new retirement age, taking into account transitional provisions.

At the same time, for early retirement, women with many children need to develop a total of 15 years of insurance experience.

Early assignment of pensions to unemployed citizens

For citizens of pre-retirement age, it remains possible to retire earlier than the established retirement age in the absence of employment opportunities. In such cases, the pension is set two years earlier than the new retirement age, taking into account the transition period.

In addition, for citizens of pre-retirement age, from January 1, 2019, the maximum amount of unemployment benefits will increase from 4,900 rubles to 11,280 rubles. The period of such payment is set at one year.

First stage: how the retirement age has changed since 2020

Maximum pension limits will be set in 2028. Men born in 1963 and later will retire at age 65. Women born in 1968 and later - at 60 years old.

Read on RBC Pro

How to become a Speaker: advice from re:Store founder Evgeniy Butman How to manage talent in the era of “large-scale rebellion” - part I Bill Gates - about the madness of conspiracy theorists and the new Steve Jobs Strategy of Ivanushka the Fool: how a top manager can get out of a dead end in 9 steps

The age for assigning a social old-age pension, which is received by citizens who do not have the necessary work experience to receive an insurance pension, will be increased by five years - from 60 to 65 years for women and from 65 to 70 years for men.

The retirement age will gradually increase for workers who have the right to retire early.

- Citizens working in the Far North and equivalent areas will be able to retire at 60 and 55 years of age (for men and women, respectively). Now their retirement age is 55 and 50 years.

- The retirement age of teaching, medical and creative workers will be increased by five years, taking into account special length of service (the requirements for it do not change, it ranges from 25 to 30 years). That is, if a school teacher has completed 25 years of experience, which gives him the right to receive a pension in 2028, then due to the increase in the retirement age, his pension will be accrued only after five years, in 2033.

- Women who have worked for at least 37 years and men with at least 42 years of experience will be able to retire two years earlier than the established retirement age, but not earlier than 55 years for women and 60 years for men.

- Mothers with many children will be able to retire early if they have 15 years of insurance experience. If a woman has three children, the pension will be assigned at 57 years old, if four - at 56 years old. Women born in 1965–1966 will be the first to take advantage of the benefit. For women who have given birth and raised five or more children, the retirement age will not change and will remain 50 years.

For whom the retirement age will not change

Raising the retirement age will not affect everyone. The retirement age will not change for citizens employed in jobs with dangerous and harmful working conditions. We are talking, for example, about rescuers, workers in mines and hot shops, chemical plants, bus drivers, workers in the sea and river fleet, etc.

The retirement age will remain unchanged for women who have five or more children (see above), visually impaired people of the first group and military trauma, citizens injured in the Chernobyl accident, as well as for citizens who worked as flight test personnel directly involved in flight tests, etc. The conditions for retirement will remain the same for the indigenous peoples of the North.

How the authorities want to protect pre-retirement people

During the transition period of the reform, the pre-retirement age will be increased from two to five years before retirement. To protect the interests of pre-retirees, who, if they lose their jobs, risk being left without a pension or salary, the government has provided additional guarantees.

- Administrative and criminal liability is introduced for employers for dismissal or refusal to employ pre-retirees due to age. This measure was criticized by experts and businesses. Employers will begin to fire older employees even before they reach retirement age, and the HR service and lawyers will be keen to play it safe in advance and subject such an employee to comments and reprimands, warned the co-chairman of Business Russia, Andrei Nazarov.

- The government is developing a professional development program for citizens of pre-retirement age. According to the draft program, by the end of 2024, at least 450 thousand pre-retirees will undergo professional retraining free of charge (that is, 75 thousand annually). Retraining will take three months away from their main job; during retraining, pre-retirement workers will be paid a stipend in the amount of the regional minimum wage.

- If a pre-retirement pensioner cannot find a job, the maximum amount of unemployment benefit for him is increased to 11.28 thousand rubles, and the period of such payment is set at one year. For all other citizens, the maximum benefit amount will be 8 thousand rubles, the payment period will be from three to six months. Citizens recognized as unemployed will still be able to retire early in old age (two years before retirement age, as now).

“I created a pension fund for myself”: how to start a business before retirement Photo gallery

- Workers of pre-retirement age will be able to undergo a free medical examination for two days every year while maintaining their salary.

Benefits for pensioners

Federal benefits intended for current pensioners will continue to apply from age 55 for women and from age 60 for men during the transition period of pension reform. That is, until 2028, pension benefits will remain within the old limits of the retirement age. First of all, we are talking about taxes on real estate and land (the so-called tax on six hundred square meters), which pensioners do not pay. The decision to maintain regional benefits (they relate to housing and communal services, the purchase of medicines, payment for major repairs, and travel on public transport) was made by the authorities of the constituent entities of the Russian Federation.

From January 1, 2020, for village residents with at least 30 years of experience in agriculture, a 25 percent increase in the fixed payment of insurance pensions for non-working pensioners is introduced. According to the Ministry of Labor, about 950 thousand pensioners will receive this increase next year.

No benefit to the budget

Pension reform will give a negative financial result for the state, Vladimir Putin said. Initially, the government planned that it would be neutral for the budget system until 2024, that is, all the savings from raising the retirement age (reducing the cost of paying newly assigned pensions) would go to increase pensions for non-working pensioners. It was assumed that savings from raising the retirement age in 2019–2024 would exceed 3 trillion rubles. and all these funds will be used to increase the indexation of pensions.

But adjustments announced at the end of August reduced potential savings by RUB 500 billion. in six years. The main change that the president proposed was to increase the retirement age for women from 55 to 60 years, and not to 63 years, as the government proposed. Over the period from 2029 to 2035, the shortfall in income by the Russian Pension Fund compared to the initial government scenario will amount to 3.6 trillion rubles, noted Deputy Prime Minister Tatyana Golikova.

Photo: Vladimir Astapkovich / RIA Novosti

How will pensions grow?

To annually increase the pensions of non-working pensioners by 1 thousand rubles, so that the average old-age pension reaches 20 thousand rubles. by 2024, it is still planned to spend about 3 trillion rubles. The presidential amendments to the pension reform established the parameters for indexing insurance pensions in 2019–2024, as well as the procedure for their increase from 2025.

- In 2020, the indexation of insurance pensions for non-working pensioners will be 7.05%, in 2020 - 6.6%, in 2021 - 6.3%, in 2022 - 5.9%, in 2023 - 5.6 %, in 2024 - 5.5%. The increases will take effect on January 1 of each year.

- From 2025, insurance pensions on February 1 will increase annually by the inflation of the previous year; their additional indexation from April 1 will be possible if the average monthly nominal salary for the previous year grew faster than inflation (for example, if nominal salaries increased by 6%, and consumer prices by 4%, then additional indexation in April will be 2%).

Reaction to pension reform

The government announced the increase in the retirement age on June 14, the day the World Cup began in Russia. First Deputy Prime Minister Anton Siluanov called this a “purely coincidence.” The reaction of citizens to the pension reform led to an increase in protest potential and disapproval of the activities of government institutions, and a decrease in indicators of social optimism, sociologists from the Levada Center pointed out.

Rallies and protests against pension reform were held in Russian cities, organized by supporters of opposition leader Alexei Navalny, the Communist Party of the Russian Federation, the Liberal Democratic Party of Russia, A Just Russia and trade unions.

IPC and the new pension formula

The next step in changing the Russian pension system will be the reform of the funded pension. Russians' pension savings have been frozen since 2014, and the moratorium on contributions to the funded part of pensions has been extended until 2021. The Ministry of Finance and the Central Bank have developed a new funded pension system - the concept of individual pension capital (IPC). The new pension model is designed to replace and modernize the frozen funded pension.

Initially, the Ministry of Finance and the Central Bank expected to launch the IPK system in 2019, but discussion of the concept was frozen until the formation of a new government after the 2020 presidential elections. In August, the Ministry of Finance published a notice about the beginning of the development of the draft law on IPC, from which it follows that the launch date of the savings system has been postponed to January 2020. Public discussion of the bill was supposed to end on August 22, but the document was never published. According to Anton Siluanov, the discussion of the IPC had to be postponed due to the reaction to raising the retirement age.

The IPC concept assumes that citizens will make contributions for future pensions from their salaries to non-state pension funds (NPFs). The amount of deductions will gradually increase from 0% in the first year of connection to the IPC and to 6% after five years, that is, by 1 percentage point. in year. Connecting citizens to the IPC will be based on Article 158 of the Civil Code of the Russian Federation “Form of transactions”, the third paragraph of which states that “silence is recognized as an expression of the will to complete a transaction in cases provided for by law or agreement of the parties,” RBC sources said.

The government intends to discuss the transformation of the pension formula from 2025, said Tatyana Golikova. As an alternative to the point formula, the rector of the Academy of Labor Alexander Safonov, financial ombudsman Yuri Voronin (in August he served as an adviser to the chairman of the Central Bank) and economist Evgeny Gontmakher proposed a formula for calculating pensions that takes into account earnings and length of service.

Payment of pension savings

The changes to pension legislation that have entered into force do not change the rules for assigning and paying pension savings. The retirement age giving the right to receive them remains the same – at 55 years for women and 60 years for men. This applies to all types of pension payments, including funded pensions, fixed-term and lump-sum payments. As before, pension savings are assigned subject to the minimum required pension coefficients and length of service: in 2020 this is 18.6 coefficients and 11 years, respectively.

How Putin softened the pension reform

On August 29, Vladimir Putin, during a televised address to Russians, voiced proposals for a serious softening of the pension reform bill.

For example, the retirement age for women is reduced to 60 years instead of 63, that is, it is gradually increased by five years, as for men. Thus, for women the retirement age is raised from 55 to 60 years, for men - from 60 to 65 years.

Pension benefits are being introduced for mothers of many children - women who give birth to three children will be able to retire three years earlier; those with four children are four years earlier. For mothers who have five or more children, the retirement age will remain the same as now - from 50 years old.

Those who, according to the old law, were supposed to retire in 2019-2020, will be able to do this six months earlier than they are supposed to under the new pension legislation.

The president also proposed reducing the length of service qualifying for early retirement by three years: now it is 37 years for women and 42 years for men.

From the current retirement age - 55 years for women and 60 years for men - all federal and most regional pension benefits will continue to be provided (for housing and communal services, public and suburban transport, taxation, etc.)

The concept of pre-retirement age has been expanded to five years, and administrative or criminal liability is introduced for violation of the labor rights of citizens of this age. Also, for people of pre-retirement age, unemployment benefits are more than doubled.

In addition, a number of pension benefits are provided that will affect various categories of citizens.

As political scientist Sergei Vvedensky to the Federal News Agency , the new version of the bill, developed taking into account the presidential amendments, significantly softens the reform, which, whatever one may say, is inevitable.

“The demographic situation in Russia is such that if nothing changes, we will soon have one working person for every pensioner. And this is impossible neither for the economy nor for society, especially considering the ambitious plans for large-scale modernization of the country,” the expert noted.

According to Vvedensky, the current demographic situation is not only distant echoes of the Great Patriotic War, in which the Soviet Union, according to the latest updated data, lost more than 40 million people, but also the consequences of the crisis of the 1990s.

“You know, I’m not a fan of throwing mud at the nineties, but I remember well that the birth rate really decreased then, and quite significantly. Many were simply afraid to give birth due to general instability and fear that they would not be able to feed even one child. Yes, then the situation improved, but the demographic - if not a hole, then, in any case, a gap - has remained since then,” the expert emphasized.