The Russian pension system is represented by two types of pension payments: state and non-state pension payments.

To receive a state pension you must meet the following requirements:

- length of service included in the insurance period;

- contributions to the pension fund for the period of official employment;

- retirement age requirements.

Non-state pension provision has its own characteristics, which we will consider in more detail.

Non-state pension agreement - what is it, with whom is it concluded?

The main condition for participation in the non-state pension system is the conclusion of an appropriate agreement with the selected fund. Its parties are:

- Non-state pension fund operating on the basis of an obtained license;

- The depositor making payments;

- A person who has already been paid or will be paid a non-state pension.

According to the law, investors can be both individuals and legal entities. In the first case, citizens personally pay contributions and at the same time are parties to the agreement. In the second case, contributions are paid by organizations in favor of employees.

Depositor's rights

Before concluding an agreement with a non-state pension fund, you need to know the rights and obligations of the investor.

On the first day of the visit, the applicant has the right to receive the following information:

- Availability of a license.

Typically a license is issued for a period of five years. After this period, it must be extended.

- Organization reliability rating.

The rating is compiled based on the opinions of competent rating agencies. For a reliable result, the company’s performance indicators and its financial results are studied. An example of such agencies: Interfax, Expert RA.

- Names of the founders.

- The name of pension programs with a well-thought-out investment mechanism.

An NPF organized in the Russian Federation does not have the right to offer one single program. The client must choose from a variety of products. Each scheme provides analysis and specific calculations. An NPF employee is required to make a calculation of how much finance the client will receive when choosing a particular program.

Payment procedure and amount of non-state pension provision

The amount of payments that will be accrued to a citizen in the future depends on the following factors:

Specific features of a particular non-state pension fund;- Pension program described in the contract;

- The amount of contributions at the time the client enters retirement age.

It should be noted that the size of the non-state pension can be increased in connection with the receipt of income from investing funds at the end of the calendar year.

After establishing pension payments, the fund sends a notification to the applicant about the assignment of a pension, indicating the accrued amount and the period during which the funds will be paid.

There are several ways for a participant in the system under consideration to receive a pension: to a bank account, to a card or by postal transfer. At the same time, the pensioner chooses the method of delivery of funds independently.

Which is better: NPF or GPF? What are their pros and cons and how to get a larger pension

Which is better, a state pension fund or a private one? What are the pros and cons of each type? What to look for when choosing and what nuances exist here. Doctor of Economic Sciences Andrei Kalganov answered these questions on 5-tv.ru.

What are NPFs and how do they work?

“The non-state pension fund (NPF) is a private financial company that accepts pension contributions from citizens and manages the received financial resources in order to try to increase them and thus not only preserve, but also increase pension savings,” the economist said.

According to him, previously citizens could send the funded part of their pension contributions to the NPF. This option has now been temporarily blocked, but you can still direct your own savings and save for retirement that way.

Why was it necessary to create non-state pension funds, what are their pros and cons?

Initially, it was assumed that NPFs would be able to manage citizens’ money more efficiently than government agencies. As a result, Russians would be able to receive higher pensions than when interacting with the state pension fund (SPF). However, this did not happen.

“Unfortunately, it turned out that the NPF’s efficiency in using these funds turned out to be low. It was more or less high in the mid-2000s - they showed relatively good efficiency, many of them. But since then, unfortunately, the situation has gotten worse, and some non-state pension funds give quite a decent return on the funds placed, while some do not or even end up in the red,” the expert said.

Kalganov emphasizes that corporate non-state pension funds remain the most effective now - they are created by large corporations only for their employees. In other similar financial organizations, things are not so good.

“In principle, you can even lose part of your savings in a non-state pension fund,” the specialist warns.

Pros and cons of GPF

The main advantage of the GPF is that it provides a guarantee of the safety of money. The main disadvantage is that it does not manage citizens’ funds very effectively compared to some non-state pension funds, so the increase in pension capital will be less. Another disadvantage of the State Pension Fund is the confusing system for calculating pensions.

“Understanding this scheme of pension points with all sorts of different coefficients is a very difficult task even for a person with a higher economic education,” the economist complains.

What to choose: GPF or NPF?

When asked what to do, the expert advises comparing different non-state pension funds, focusing on the most stable and profitable ones. It should be borne in mind that on average they do not provide very high returns. How the NPF will pay the money depends on the terms of the concluded agreement. For example, a non-state pension fund can begin paying a pension to a man at the age of 50.

“There may be different payment schemes. There may be a one-time return of savings after reaching a certain age. There may be a monthly payment. There may be different schemes. Another difference is that the savings that you accumulate in a non-state pension fund can be inherited. What you accumulate in the State Pension Fund is not inherited,” the expert added.

From the economist's words, we can conclude that the best way to get a large pension is to rely on yourself. To receive substantial benefits in old age, you need to work officially, have a long work history and a high official salary.

It doesn't hurt to have your own financial airbag. So, you can start saving part of the income (10%) from each salary, and invest this money in stocks or bonds. The former are considered risky assets, the latter – conservative. To achieve a balance between stability and profitability, it is best to invest in both. Experts say the longer you wait until retirement, the more risk you can take. Failures will be compensated by higher returns from successful investments.

Earlier, 5-tv.ru wrote how the size of the pension will change from August 1. The adjustment of payments will affect several categories of pensioners.

Conditions for assigning an early pension to a non-state pension fund

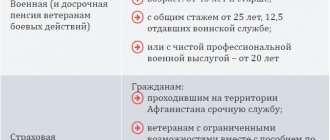

Non-state pension provision is assigned to:

- upon occurrence of the grounds specified in the contract;

- if there is a written application for the right to payment of benefits.

The assignment of a pension is possible from the date of application, but not earlier than the legal grounds for these actions. Payments are made in rubles, by transferring funds to the recipient's individual account, in accordance with the specified details or bank card number.

Reviews

Elena Sergeevna

I wanted to take my deposit into the NPF ahead of schedule. However, I had to pay a penalty and receive a minimum of interest. Therefore, I recommend reading the terms of the agreement with the fund as carefully as possible.

Vitaly Petrovich

When concluding a contract, find out in advance about the age at which payments begin. Then there will be certainty in the future. In any case, the text of the agreement must be read thoroughly on all points.

How to sign up for an individual plan

First you need to choose a reliable fund. Currently, some banks organize exceptionally reliable supplementary pension funds. One of such funds is NPF Sberbank. This is an open pension fund. It offers its clients various individual and corporate programs. The bulk of depositors' funds are invested in the banking sector, more than 10% in fuel and energy companies, and the remaining funds are distributed among promising companies that are leaders in the Russian economy.

To sign up for an individual plan, just go to the nearest Sberbank office with a passport or other identification document. Next, the bank employee will explain the sequence of further actions. After agreeing on an individual plan, an agreement is concluded, which will indicate the amount, payment schedule, return on investment, the possibility of early withdrawal of funds and some other points.

How to choose a non-state pension fund?

It is important to choose the right NPF so as not to lose your savings and increase them. Here's what you need to pay attention to:

- year of creation of the structure;

- profitability parameters over the past few years;

- number of service offices in the city.

It is not recommended to constantly transfer money from one fund to another in an attempt to obtain maximum returns.

It is much more profitable to work with one structure that seems the most reliable. If there are suspicions that the NPF may cease to exist, you can transfer the money to another structure, including the Pension Fund.

Advantages of non-state pension insurance entities

In previous times, when pension savings were managed monopolistically through a state fund, the share of insurance payments was 22 percent of the income received by the insured person.

Moreover, the distribution included the transfer of the savings portion to the account in the amount of 16%, and only 6% went to the insurance account.

From now on, the insurance part of the pension can be as much as 22%, which opens up more prospects in terms of increasing the size of pension payments. This opportunity is provided by non-state funds. And this is one of their main advantages.

As for profitability, it is also much higher than the indicators of the state structure, and the minimum profitability threshold is usually 10% or higher. For example, the leader of the NPF rating according to the Bank of Russia as of April 2020 provides a return of 13.10%.

The high degree of investment profitability is largely due to the fact that non-state pension funds have no restrictions in the choice of investment fund instruments. Likewise, they have greater freedom to choose management companies, and the number of such companies is also not limited. In this way, the principles of risk diversification are observed, which contributes to the reliability and safety of citizens’ pension insurance savings.

An undeniable advantage of deposits in non-state pension funds is the existence of an agreement. In its terms, the insured person can indicate the names of the legal heirs to whom the entire amount of the funded and insurance parts of the pension will be paid in the event of his death.

The list of risks when collaborating with these structures includes the possibility of license revocation, bankruptcy due to incorrect capital management and other non-market risks.

However, the maximum that a depositor can lose is some interest. If such risks occur, government agencies create a temporary board, and all clients of the fund that has ceased to operate within three months receive their money and can transfer it to another institution.

How can you move from one NFP to another?

Selecting pension programs

The choice of pension scheme is determined depending on the needs of the investor. Thus, at Sberbank NPF, each client independently decides how he wants to live in retirement. This determines the amount of additional contributions and the frequency of transfers (monthly, quarterly).

Payment options in the event of an insured event:

- Urgent pension.

It is understood that when choosing this scheme, all pension savings will be paid in the shortest period, for example, 5 years. Accordingly, contributions exceed the state pension, which “stretches” for as long as 20 years.

- One-time payment.

The system assumes that the pensioner will receive all the accumulated capital in a lump sum at the time of retirement. The choice of option is useful only for those whose savings in the NPF are less than 5 percent of the total insured amount.

- Lifetime pension.

It is calculated on average survival time, based on statistical data.

Advantages of the state pension system

For many decades, this structure has been developed so that all people of retirement age could have a guaranteed retirement income. Moreover, often no one ever asked the future pensioners themselves about their priorities in matters of pension provision.

Since the beginning of the third millennium, the reform of this outdated system has led to the fact that since 2012 the algorithm for redistributing insurance premiums on the personal SNILS number has been changed. If previously the policyholder paid 22% of his salary for each of his employees, now the insured person himself can do this, which makes it possible to secure a pension even for unemployed citizens.

The pension fund of the state structure definitely benefits in terms of the stability of its work. All its actions are regulated at the government level, which serves as a guarantee of stable and reliable service to citizens.

However, for such stability, insured persons have to pay in some sense. More precisely, they have to sacrifice part of the profitability of their pension savings. Despite all the stability and guarantees of reliability, the main pension fund cannot demonstrate a high degree of profitability. This is due to restrictions in the choice of investment instruments. The Pension Fund is entitled to only a small part of them:

- Federal loan bonds;

- Municipal bonds;

- Shares of leading Russian state corporations;

- Equity securities.

All these instruments can be controlled at the state level, which eliminates market risks. This means that the investor can be sure that his money will not disappear without a trace from the state fund, and pension payments will be guaranteed. In addition, the management of investment funds of the state fund is carried out by a limited number of management companies, and the main share of capital falls on a state entity - the State Development Corporation "VEB.RF" (until 2018, it was called "Vnesheconombank"), which largely ensures the safety of funds.

In addition, this structure is in solidarity with the state economic policy, and the state itself bears subsidiary liability to the insured persons for all actions of the central pension fund of the Russian Federation.

But no matter how attractive the advantages of the state pension structure are, its profitability leaves much to be desired. At the moment, the profitability of pension savings in the state pension fund is only 6.07% per annum. And this cannot in any way cover losses due to inflation in the long term.

But this, one of the few shortcomings, is successfully compensated by the fact that this 6.07% will be guaranteed to be credited, and the entire amount will be stably in the personal account. In this case, the insured person may not worry about the risk of bankruptcy of this subject of the pension insurance system or deprivation of its license.