Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/02/2020

Reading time: 3 min

6

4569

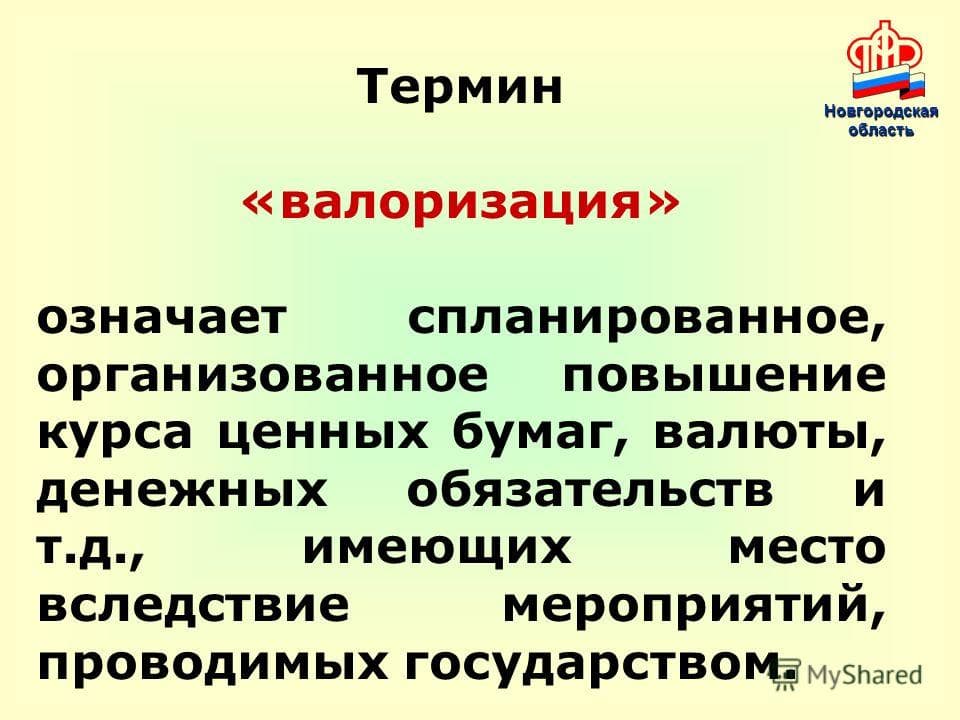

Pension legislation remains quite confusing and incomprehensible for many citizens: changes regularly appear in the procedure for calculating pension savings, which introduces additional confusion. One of the innovations, the essence of which remains unclear to many citizens, is valorization. What kind of increase is this, who is entitled to it, and what is the calculation procedure?

- What is valorization and who does it apply to?

- Calculation procedure

- How to apply

- Conclusion

Defining the valorization process for pensioners

The valorization process begins with the recalculation of citizens' pension savings by at least 10% , plus 1% for each year of service until 1991. Working citizens with experience before 2002 who have not reached retirement age participate in the valorization process, but there will be an increase in pension not that noticeable.

Valorization of pensions

Non-working pensioners whose pensions and social benefits are less than the minimum established in the country will receive additional payments. The pension amount is calculated individually and depends on the region, age and length of service. Valorization amounts are multiplied by indexation coefficients, which depend on the time the pension was assigned.

Valorization of pensions

In the past, a citizen's pension depended on contributions earned over the past few years and work experience. If the salary was low before retirement, the citizen received funds taking into account the last five working years, when the salary was higher.

Valorization affects everyone who was officially employed before the start of the pension reform. The program is based on the official employment of each citizen - the longer a citizen worked, the higher the coefficient and the higher the increase.

Valorization of pensions: we help you figure it out

Pensioners were especially looking forward to the coming of the New Year, because from January 1 their pensions increased as a result of valorization. Of course, I wanted to find out faster - by how much? Not everyone was happy with the increase, and, naturally, questions began to pour in both to the branch of the Pension Fund and to the editorial office of the newspaper. Elena Mikhailovna Korneeva, deputy manager of the State Branch of the Pension Fund of the Russian Federation for the Smolensk region, answered readers’ questions on the hotline. — How can you check for yourself whether the valorization is calculated correctly? V.N. Gorodicheva, Ozerny settlement.

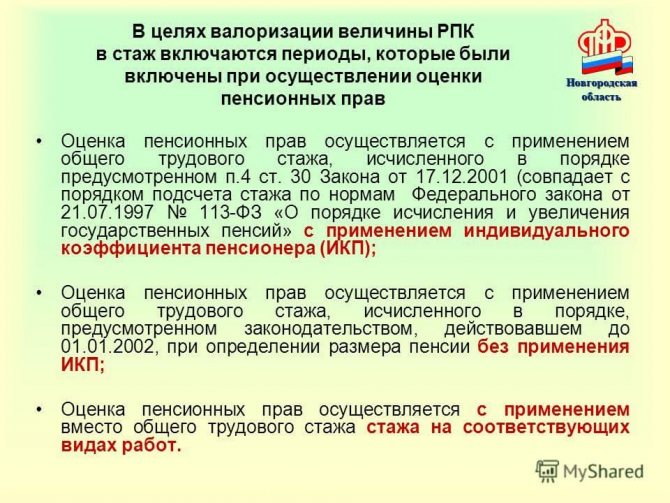

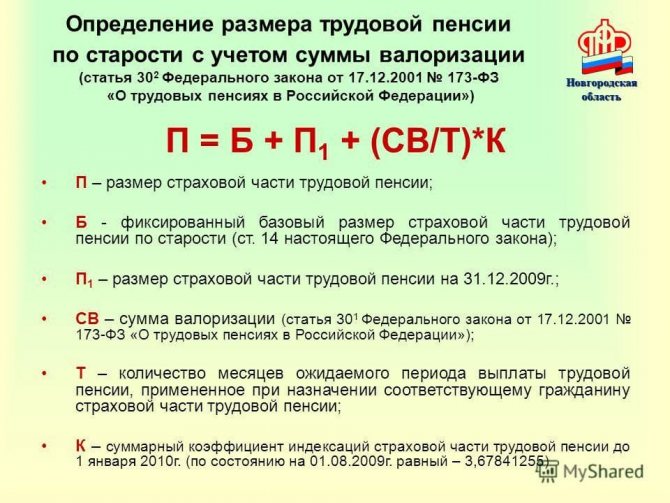

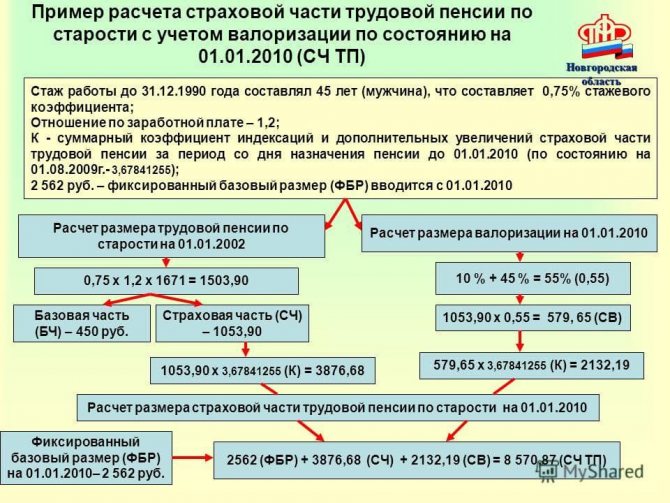

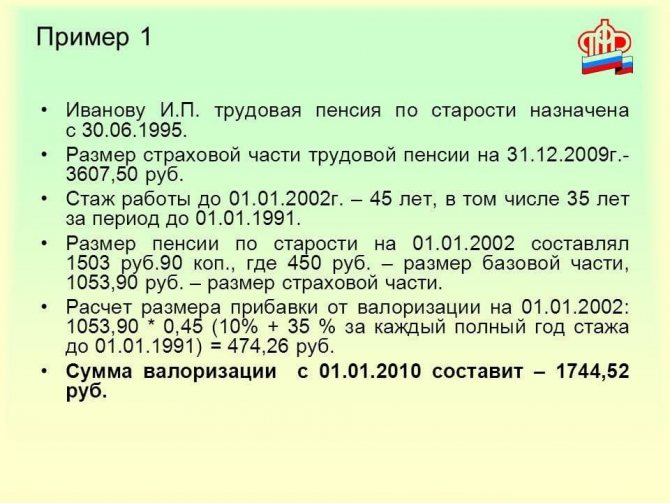

— From January 1, 2010, the size of the insurance parts of citizens’ labor pensions was increased through an increase (valorization) of the estimated pension capital (hereinafter referred to as the PKC). During the recalculation, only that part of the RIC was subject to increase, which was determined taking into account the length of service and earnings before 01/01/2002. The other part of the RIC, formed taking into account the amounts of insurance premiums accrued by the employer for periods of work after 2002, was not subject to increase. To determine the amount of increase in the pension when it is valorized, it is necessary to multiply the amount of the insurance part of the pension (excluding insurance contributions) by the number of percent for each full year of work until 01/01/1991 and, in addition, by 10 percent for the length of service until 01/01/2002. For example, as of December 31, 2009, the amount of the old-age labor pension was 5,600 rubles. 50 kopecks (2562 rubles - the base part and 3038 rubles 50 kopecks - the insurance part, including the share of accrued insurance premiums 58 rubles 25 kopecks). At the same time, the length of work experience until January 1, 1991 was 25 full years. The calculation is made in the following order: the insurance part excluding the share of accrued insurance premiums is 2980 rubles. 25 kopecks (3038 rub. 50 kopecks - 58 rubles. 25 kopecks) x 35% (25% for experience before 01/01/1991 and 10% for experience before 01/01/2002). As a result, the increase in the insurance part of the pension is equal to 1043 rubles. 09 kopecks, and the total pension amounted to 6,643 rubles. 59 kopecks

— How is the length of service coefficient calculated when calculating a pension? What was the average monthly salary in the country in 2001? How to calculate your valorization yourself? E.S. Gridin, Safonovsky district.

— The size of the increase in pension as a result of its valorization from January 1, 2010 is individual for each pensioner and depends on the initial size of the insurance part of the pension, namely, on the length of service coefficient and the value of the earnings ratio. The length of service coefficient is 55 percent for the work experience required by law (for women - 20 years, for men - 25 years) and increases by 1 percent for each full year of total work experience in excess of the required one, but not higher than 20 percent. The value of the earnings ratio when calculating pensions is taken into account in an amount not exceeding 1.2 (with the exception of certain categories of citizens - northerners). In addition, when determining the value of the RPC, the average monthly salary in the country for the 3rd quarter of 2001 in the amount of 1,671 rubles is taken into account. Based on the size of the pension capital, the size of the insurance part of the pension is then calculated as of January 1, 2002, which increases taking into account all indices after this date until December 31, 2009. The percentage of valorization is calculated from the insurance part of the pension received in this way.

— I worked in the North from 1974 to 1996. Why, during valorization, was my experience counted one year after another? Before 1998 there was 1 year in 1.5 years. ON THE. Gordeeva and other northerners, Roslavl.

— When recalculating pensions during valorization from January 1, 2010, periods of work activity (including work in the North) are included in the total length of service in the same order (i.e., calendar - 1 year for 1 year), in which were taken into account in the specified length of service when establishing (recalculating) the labor pension according to the norms of the Federal Law of December 17, 2001.

No. 173-FZ “On labor pensions in the Russian Federation”. At the same time, from January 1, 2010, at the choice of the insured person, it is possible to carry out valorization taking into account the preferential calculation of the northern length of service, as was the case before 1998. But then the amount of the pension must be calculated according to the old standards, and this is beneficial to a few pensioners. In your case, it is more profitable to receive a pension in the established version. — The size of my pension from January 1, 2010 is 3,800 rubles. I also receive compensation for benefits of 850 rubles. Why am I not entitled to a pension supplement of up to 4,330 rubles? G.M.

Stepanova, Smolensk. — From January 1, 2010, in accordance with Federal Law No. 213-FZ of July 24, 2009, the establishment of so-called social supplements to pensions is provided. Non-working pensioners living in the territory of the Russian Federation whose total amount of material support is less than the subsistence minimum established for pensioners in the region (region) have the right to them. For 2010 in the Smolensk region, this value is set at 4,330 rubles. When calculating the total amount of material support, not only the pension is taken into account, but also: additional material (social) support; monthly cash payments (including the cost of a set of social services); all social support measures established by regional legislation, provided in monetary terms; the monetary equivalent of the following social support measures provided in kind: payment for the use of a home telephone, payment for housing and utilities, payment for travel on all types of passenger transport (urban, suburban and intercity). When calculating your financial support, in addition to your pension, cash payments established by regional legislation were taken into account. Thus, the total amount of your material support was 4,650 rubles (3,800 rubles + 850 rubles) and exceeded the subsistence level. In this connection, there are no grounds for establishing a social supplement to your pension.

— Help me figure out why the size of my pension decreased in February 2010? IN AND. Pylikova, Demidov.

- The size of your pension has not decreased - in January and February of this year you were paid the same amount of pension. Since it is below the subsistence level, you are provided with a social supplement to your pension. As I said above, only non-working pensioners living in Russia, whose total amount of material support is less than the minimum subsistence level established for pensioners in the region, have the right to establish social supplements to their pensions. In our region for 2010, this value is set at 4,330 rubles. When calculating your total financial support, in addition to your pension, cash payments established by regional legislation were taken into account. According to information provided by the Smolensk Regional Department of Social Development, you, as a labor veteran, have been provided with social support measures at the regional level in the form of a monthly cash payment (MCA) and compensation for housing and communal services. In 2009, the monthly cash payment to labor veterans was 337 rubles. 16 kopecks From January 1, 2010, it is increased by 10% and amounts to 370 rubles. 88 kop. Since the establishment of the federal social supplement and the formation of delivery documents for payment for January 2010 were carried out in December, before the resolution was adopted to increase the regional EDV, in order to calculate your financial support, the social protection authorities transmitted information about the amount of EDV you received in the amount 337 rub. 16 kopecks and compensation for housing and communal services in the amount of 226 rubles. 47 kopecks Taking this into account, the total amount of income was equal to 4,160 rubles. 73 kopecks. (pension 3597 rubles. 10 kopecks + daily allowance 337 rubles. 16 kopecks + compensation for housing and communal services - 226 rubles. 47 kopecks) and up to the subsistence level for January 2010, you are provided with a federal social supplement to your pension in the amount of 169 rubles. 27 kopecks In February 2010, taking into account the indexation of the EDV as a labor veteran, the total amount of your material support increased by 33 rubles. 72 kopecks, and, accordingly, the amount of the social supplement to the pension decreased by the specified amount and is equal to 135 rubles. 55 kopecks (4,330 rubles - (pension 3,597 rubles. 10 kopecks + EDV 370 rubles. 88 kopecks + compensation for housing and communal services - 226 rubles. 47 kopecks). Thus, the total amount of payments established for you in January and February 2010 ., equal to the subsistence level - 4,330 rubles. Subsequently, the amount of the surcharge will be determined as the difference between 4,330 rubles and the total income that will be calculated monthly. For example, with an increase in the size of the pension or monthly cash payment, the amount of the surcharge will decrease, or its the payment will be terminated if the total income exceeds the subsistence minimum. For your information, we inform you that the subsistence minimum for assigning a federal social supplement is established by regional law and will be revised (increased) annually. As reflected above, for 2010 it is equal to 4,330 rubles.

— Why is northern experience not taken into account during valorization as a year and a half (from 1971 to 1994)? G.V. Akimova, Roslavl.

— When calculating the size of the labor pension, the total length of service calculated in calendar order (including the period of work in the North) is taken into account, i.e. according to actual duration. The length of work experience for valorization is calculated in the same manner. Since your total length of service before 1991 was 21 full years, the calculated pension capital, calculated taking into account length of service and earnings before January 1, 2002, was increased by 31 percent. As a result, the pension increase from January 1, 2010 amounted to 1,247 rubles. 48 kopecks At the same time, from January 1, 2010, Federal Law No. 173-FZ dated December 17, 2010 “On Labor Pensions in the Russian Federation” (as amended on July 24, 2009) stipulates that, at the request of the pensioner, valorization can be carried out with calculation work experience in the North on a preferential basis (1 year for 1.5) according to the previous legislation. But at the same time, the calculation of the amount of the insurance part of the pension must also be done according to the old procedure, and also a restriction must be applied in an amount not exceeding 3 times the minimum pension, the amount of which as of December 31, 2001 was 555 rubles. 96 kopecks This procedure for calculating the amount of pension is beneficial to some pensioners with very low pensions. For you, this option for calculating the size of your retirement pension is unprofitable, since the total amount of the pension will be much lower than what is paid now. When calculating the amount of the insurance part of your labor pension, an increased earnings ratio of 1.4 was applied (instead of the maximum possible - 1.2). The fixed basic amount of the insurance part of the pension is also paid to you in an increased amount (until January 1, 2010 - the basic part).

- I am a war veteran, a prisoner. V.V. Putin promised to add 2 thousand rubles to the pension from January 1, 2010. And I also want to know: I gave birth to nine children, am I entitled to any rewards for this? P.I. Kozlova, Smolensk district.

— The media provided data on the average size of the increase by age category. The increase was carried out according to documents on length of service and earnings before January 1, 2002, available in the pension file of each individual pensioner. Since your work experience before January 1, 1991 was 33 full years, the estimated pension capital (insurance part of the pension) was increased by 43 percent (10 percent for the total work experience before January 1, 2002 and 33 percent for each worked year before January 1, 1991). As a result, the size of your insurance portion of your pension increased by 1,821 rubles from January 1, 2010. 44 kopecks Additionally, we inform you that the norms of the current pension legislation provide for the right to early pension provision for those who have given birth to five or more children, namely from the age of 50. You have exercised this right. As for awards, the Pension Fund does not determine the right to them.

The topic will be continued in the next issue.

Why was there a need for valorization?

After the pension reform, the contributions of persons who became pensioners before 2002 and those who received pensions later were practically equal and did not cause problems. Over time, the gap has become much larger: people who have taken out a pension these days, in addition to accumulated contributions, receive insurance premiums. The employer is required to transfer these contributions to the citizen’s account.

Valorization of pensions

The length of service was the same, but citizens who retired in 2002 or later received more than citizens who worked before 1991 because in the past, pensions were calculated using a special indicator based on data on the average salary throughout the country.

While it is not necessary to provide paperwork for every year of work, it may increase your pension contributions.

In order for pension calculations to be carried out fairly, it was decided to index the pension contributions of persons who worked before 2002 , even if they have not yet reached retirement age. Those who do not have documents on employment between 1991 and 2001 must prove the presence of at least some work experience before 2002.

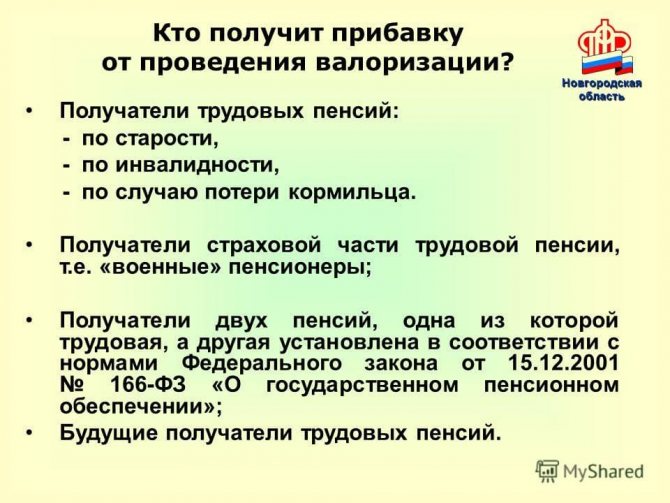

Who will receive an increase from valorization

The average amount of pension increase for older citizens is 1,100 rubles, for younger ones – 700 rubles, depending on length of service.

How can I confirm my work activity before 2002?

To confirm the length of service before 2002, several methods are used:

- Work book entries.

- Papers from the archive.

- Witness's testimonies.

It is possible to establish length of service during a trial with the provision of the above documents and information not accepted by the department. Pension Fund.

Additional documents may include:

- labor agreements;

- excerpts from official papers;

- certificates from organizations in which the citizen worked;

- salary receipts;

- papers confirming payment of taxes;

- documents on contributions to the trade union.

In the absence of submitted documents without the possibility of restoration, an additional payment will be calculated based on the testimony of witnesses who collaborated with the applicant during work. For different values of length of service, a smaller number of length of service is established in the indicators.

The reason for the lack of supporting documentation also plays an important role: if the circumstance is a natural disaster, then this will allow obtaining permission to testify, on the basis of which an additional payment will be assigned. In case of negligence or intentional damage, the period will be confirmed by no more than 50% of the length of service . To contact the Pension Fund branch, you should prepare the entire package of documents in advance.

Differences between valorization, indexation and recalculation

All three concepts mean an increase in the amount of pension payments, but the conditions, regulation and method of receipt are very different.

Valorization

The size of the increase in pension depends on the length of service earned before 1991. The point of valorization is to equalize the pensions of people who worked in the USSR. Affects citizens employed before the start of the pension reform in 2002. The process occurs automatically; citizen participation is not required.

Recalculation of pensions taking into account valorization

Indexing

Indexation is carried out automatically for pensioners to increase purchasing power during inflation. Indexation depends on price increases ; the government independently determines the coefficient. Pensions of federal civil servants and astronauts are indexed as monetary remuneration increases.

Recalculation

If circumstances affecting pension payments change, recalculation occurs. If the pension authority has all the documents confirming the citizen’s rights to a pension, the recalculation will occur automatically . According to Article No. 142 of the Federal Law, recalculation occurs on August 1. Additional paperwork is required if:

- the pensioner has reached 80 years of age;

- a higher disability group has been established;

- the number of dependents has increased;

- The pension authority mistakenly did not take into account the pensioner’s length of service.

Basic rules and valorization rights

The main rule of valorization is automatic recalculation based on the citizen’s official work experience before 2002 The pension authority has information on the amount of pension contributions as of January 1, 2020.

Rules for valorization of pensions

If a citizen worked unofficially, but can confirm this with other documents, he must send them to the pension authority for review.

Citizens officially employed in the Far North receive an increased valorization coefficient. It ranges from 1.4 to 1.9%, varies from region to region and leads to higher pension payments.

The benefits of longevity that open up opportunities in 2020

To receive a lifetime supplement, it is absolutely not necessary to work in the Far North. An identical principle is used to calculate those who worked on an official basis in regions that are equated to the Far North. Such workers are entitled to a 30% bonus if their output represents 20 years in total.

The “northern” surcharge remains with the pensioner even if, after completing his working career, he decides to move to another region. To be eligible to receive such a privilege, you must have a total work experience, which for women is 20 years and for men – 25.

Some areas have their own bonuses for a number of pensioners. There is no exact information here, since each region has its own requirements and nuances, because similar incentives are not even offered throughout the state. As an example, consultants cite St. Petersburg. Here, length of service is taken into account, subject to 20 years of official experience.

Basic terms of valorization

Calculating valorization is not difficult if you understand the basic terms:

- The work experience coefficient means the period of official employment until 2002. If the work experience is 25 years, the coefficient is 0.55. For 1 year, 1% is accrued, but not more than 75%. Interest rates are reduced if the work experience is less than 25 years.

- Conversion - recalculation of length of service into cash equivalent for citizens working before 2002.

- Pension rights - data on wages and insurance accruals that determine the insurance part of payments.

- Estimated capital is the amount of pension contributions for 2002. All officially employed citizens who have received a pension certificate have an estimated capital. When a citizen begins to receive a pension, the capital becomes the insurance part of the payments.

Calculation of pensions taking into account valorization

How to calculate the amount of pension payments

The Pension Fund will independently calculate the amount of your pension upon reaching retirement age. It’s easy to find out this amount; just count two main numbers:

- how many years worked before 1991;

- how many years worked from 1991 to 2002?

To calculate valorization, there is a formula : the percentage of valorization (in the example it was 30%) multiplied by the amount of accumulated capital. Valorization will affect only those citizens whose pensions were accrued before 2002. The rest receive contributions in accordance with the new pension program.

Calculation of pension valorization

To begin with, take the average salary for 5 years, including the months when no work was carried out. This amount is divided by the average salary in the country and multiplied by the length of service. For all years of activity before 2002, a percentage is added. With work experience of 25 years or more, the coefficient increases.

According to the new program, the main part of the pension is calculated from the federal budget and is the insurance part. Previously, pension increases depended on the level of inflation and rising prices on the market. Since 2010, the amount of contributions depends on the income of the Pension Fund and the average salary in the country.

For example, if the length of service exceeds 25 years for a year, the basic part of the pension increases by 6%, after two years - by 12%. Citizens decide for themselves whether they want to retire later or not.

Converting pension capital into points

In connection with the adoption of Federal Law No. 400-FZ “On Insurance Pensions”, pension rights and insurance contributions until January 1, 2020 were transferred to individual pension coefficients (IPK), in other words, points. The IPC is essentially the same pension capital that was used in the calculation before the 2020 reform, but calculated using points.

To convert pension capital into points, the following steps were taken:

- The amount of the insurance pension (P) was calculated as of December 31, 2014 (excluding its base part);

- The resulting size P was divided by the cost of 1 point, established as of 01/01/2015 - 64.10 rubles.

- As a result, the IPC value is obtained - the number of points accumulated over the years of work.

The process of switching to a point system when assigning pensions was automatic ; filing an application with the Pension Fund was not required. The number of points earned can be viewed in your personal account on the Public Services portal or on the Pension Fund website.

1 199

Conditions for undergoing valorization

No applications are required; the pension authority carries out all calculations automatically . Documents are needed only if some data has been lost or entered incorrectly; you can deliver the papers at any time.

If any documents are missing, the employer is required to provide copies. If the company no longer exists or it is impossible to contact them, the documents are located in the local archive. Such an archive should be in the city where the work took place. Very small cities and towns transfer documentation to the regional archive.

If the pension authority requires additional documents, they will send a written notice asking you to deliver the papers. If a citizen believes that providing additional documents will affect pension contributions, he needs to come to the Pension Fund and write an application.

An example of calculating a pension taking into account valorization

List of documents that may be needed during valorization:

- passport and copies of pages with information (registration, marriage information);

- amounts of wage payments with dates;

- insurance experience, officially confirmed by documents;

- average salary in Russia after 2002;

- date of retirement.

Insurance accruals for old age, loss of a breadwinner and disability, calculated taking into account the valorization coefficient, can be changed if:

- the citizen was able to prove earnings that were not taken into account in the initial calculation of pension payments;

- if the option for calculating deductions selected automatically differs from that chosen by the citizen.

A citizen can apply for recalculation to the pension authority after the grounds for recalculation arise. Changes in payments are indicated in letters from the Pension Fund of the Russian Federation, or you can go to the Pension Fund and get information at any time.

How to apply

According to the current regulations, valorization has an undeclared nature and occurs automatically based on information available in the Pension Fund.

It is believed that the Pension Fund itself has the necessary information to carry out valorization. A citizen will need to take part in valorization only if he wants to declare an additional period of unaccounted Soviet labor experience. This mainly applies to those persons who have worked for more than 45 years (for men) and more than 40 years (for women). The fact is that this particular length of service was considered the maximum in the USSR, and many did not consider it necessary to confirm their work experience beyond the specified period.

If an employee has periods of unofficial work experience, but has the necessary evidence, then he can contact the Pension Fund to clarify the scope of pension rights and to adjust the amount of payments. Such evidence may include certificates of employment, copies of orders, employment contracts, payslips and archival documents.

Valorization is carried out exclusively from federal budget funds. Employers do not have to compensate her.