Police officers are most often granted a pension based on their length of service (for the number of years), without taking into account merit, length of service, position and other circumstances. For 2020, it was established that it would be impossible to determine the amount in hard equivalent; for this, there are special calculators and formulas within the competence of the Ministry of Internal Affairs units.

Legislative regulation of the issue

The procedure for retirement of military personnel and police officers is regulated, first of all, by the norms of the Labor Code of the Russian Federation of December 30, 2001 N 197-FZ (as amended on December 31, 2017). Namely, Article 140 of the mentioned Draft Law, which stipulates the need for proper financial compensation for all officially employed persons upon dismissal. But, given that service in the police is associated with special working conditions, payments upon retirement in the Ministry of Internal Affairs are regulated by departmental documents and orders.

The main regulatory legal act of Russia, which obliges the payment of monetary allowances to the military and police, is Order of the Ministry of Internal Affairs of Russia dated December 31, 2013 No. 65 “On approval of the procedure for providing monetary allowances to employees of the internal affairs bodies of the Russian Federation.” The document sets out the procedure and conditions for providing cash benefits to civilian and certified employees of law enforcement agencies, including payments to employees of the Ministry of Internal Affairs upon retirement.

What other privileges can police pensioners count on?

As has already been noted, the main privileges for persons who have worked in the ranks of the Ministry of Internal Affairs for sufficient time are established by federal regulations.

The list of benefits includes the following support measures:

- tax relief;

- free medical care;

- preferential sanatorium-resort treatment (including the provision of vouchers at reduced prices);

- free travel on public transport;

- housing preferences (compensation for the cost of housing and communal services);

- additional services for persons with disabilities.

These measures can be specified and supplemented by regions.

The legislation of the constituent entity of the Russian Federation must provide comprehensive lists of beneficiaries and social support measures assigned to them in accordance with the status received.

Most often, territorial units of the Russian Federation provide citizens with preferences when traveling on public transport.

It is worth noting that the introduction of additional assistance does not cancel the privileges established by federal laws.

Application for accrual of labor pension. [284.50 KB]

Barely for labor veterans in 2020.

What payments are due upon dismissal to police officers?

Order of the Ministry of Internal Affairs of Russia dated December 31, 2013 No. 65 “On approval of the procedure for providing monetary compensation to employees of internal affairs bodies of the Russian Federation” also fixes what payments a police officer is entitled to upon retirement. Typically, all types of benefits and their amounts depend on the circumstances of dismissal, as well as the length of service. Thus, below is an exhaustive list of monetary benefits that may be provided upon termination of an employment contract:

- vacation compensation (days of unused rest for all years of service in a particular unit must be paid in full, including vacation for the current calendar year);

- lump sum payment upon termination of the contract (calculated in salaries and depending on length of service);

- monthly benefits to those dismissed who are deprived of pension payments (such compensation is accrued within one year and depends on the size of the employee’s salary).

As for uncertified personnel, they are entitled to a different set of material benefits. These include:

- wages proportional to days worked;

- compensation allowance for accumulated days of vacation;

- additional bonuses if the employee performed his duties in an exemplary manner.

The procedure for receiving a second pension for a military personnel after reaching 60 years of age

Important! If the serviceman has not yet had a civilian job, then the employer must issue a SNILS within five days. The same applies to the work book (it is issued within the same period). All this information must be written down in a form - the employee is asked to fill it out during employment (“Please register me in the system”). All data on equalization to a “citizen” will be displayed in the above document.

- When a citizen retires due to reaching retirement age (60 years for men and 55 years for women), the second pension for military pensioners is 50% of the citizen’s average income. At the same time, a 3% premium is added for each earned income. However, its amount cannot exceed 85% of the salary.

- For mixed years of service, a rate of 50% is also applied when calculating the second pension at 60 years of age. However, the bonus in this case is 1% for each year if the person continues to work in the Ministry of Internal Affairs beyond the term.

- Disability payments cannot be less than 130% of the minimum pension, while the amount calculated cannot be higher than 75% of the amount of money that a citizen could earn on average during the month.

- If the head of the family, who was previously a military man, dies, the widow or children can receive two pensions upon the death of the breadwinner. Please note that the accrual of a second pension to military pensioners after death is possible when a) the cause of the person’s death was not an injury that he received during service; b) the person has at least 30 days of civil service. If a citizen dies in the line of duty, the family is entitled to a one-time financial compensation along with the calculation of a pension.

We recommend reading: When the apartment donation agreement comes into force

Dismissal from the Ministry of Internal Affairs due to health reasons

Termination of a contract for health reasons makes it possible to receive not pension payments, but coverage for limited or total disability . The following circumstances must be present:

- registration of dismissal from the state due to injury;

- acquisition of health disorders in the next three months after termination of the contract;

- the presence of a cause-and-effect relationship between the disorder and service in the Ministry of Internal Affairs.

A pensioner also has the right to financial assistance for disability if the injury received became the basis for assigning a disability group. A disability will be recognized as being related to military service or work in law enforcement agencies in the following situations:

- mutilation;

- chronic and incurable diseases;

- contusion;

- injuries.

Considering that payments to military personnel upon dismissal for health reasons in 2020 begin to be processed as soon as possible after the termination of the contract, we must begin collecting and submitting documents as soon as possible. Otherwise, the procedure for changing the type of financial assistance will take a long time.

Treatment

By the end of his service, a police officer develops a whole bunch of diseases. In gratitude for the years given, the state provides benefits for medical care:

- Purchasing a voucher for 25% of the cost for treatment in departmental health or sanatorium institutions. Family members purchase vouchers at 25% higher price. You can use the benefit once a year. Travel to the place of recovery is paid from the funds of the Ministry of Internal Affairs.

- Free prosthetics, except when expensive materials are used. The disability pension of ordinary police officers does not allow for expensive repairs and the manufacture of dentures.

- Disabled pensioners receive prescription medications free of charge and are treated in subordinate clinics.

- According to medical indications, the pensioner recovers his health free of charge in a specialized rehabilitation center.

In addition to benefits in the medical field, retirees have relaxations in real estate taxation.

Dismissal during probationary period

It is also possible to dismiss personnel during the internship period. But, there are several features of such a procedure. The most important thing is to draw up and sign a preliminary contract, which specifies all the conditions for performing the work, as well as the procedure for terminating the employment relationship. Only a signed contract is a sufficient basis for hiring an employee.

Upon termination of employment relations during the probationary period, the dismissed person has the right to the following compensation:

- wages for the period worked.

Supplements to pension benefits

In some cases, the amount of a disability or long-service pension is increased by a percentage determined by law from the amount of the allotted pension:

- 15% - holders of the Order of Labor Glory and military personnel awarded the order for selfless service in the Armed Forces of the Soviet Union;

- 16% - rehabilitated people who were unreasonably repressed, those who served in military service during the Second World War for at least six months, but did not take part in hostilities, those who were awarded a medal or order for selfless work and valiant military service during the Second World War;

- 32% - residents of Leningrad during its siege by the Nazis, former juvenile prisoners of concentration camps, veterans of military conflicts and those who became disabled as children due to trauma received during the Second World War;

- 50% - heroes of labor, as well as champions of Olympic, Deaflympic and Paralympic competitions;

- 100% - Heroes of Russia and the Union, holders of the Order of Glory.

For pensioners living in the Far North and equivalent regions, payments are increased by the coefficient established there. If they only served there, pensions are also increased by a factor of 1.5.

Dismissal after maternity leave

According to the Labor Code of the Russian Federation dated December 30, 2001 N 197-FZ (as amended on December 31, 2017), every woman who is on maternity leave retains her job. Therefore, the employer does not have the right to fire an employee before she starts working.

After starting work after maternity leave, the contract with the employee can be terminated on a general basis. And payments will be made depending on the length of service, age and accumulated vacation periods.

Second pension for military pensioners

- the military pensioner had more than 1 month of civilian experience;

- close relatives are included in the list of those who can receive a second pension, according to Federal Law;

- the relatives were already directly dependent on the deceased military pensioner and at the same time they have no additional sources of income.

- statement of request for a second pension;

- certificate of registration with the OPS;

- certificate of death of a pensioner;

- evidence that the pensioner received a long-service pension;

- any documents that confirm the presence of family ties;

- a certificate of your income for the last 5 years.

Dismissal one year before retirement

According to the norms of domestic legislation, there are several features of calculating payments to employees upon dismissal from the police based on retirement age or length of service (Federal Law “On Insurance Pensions”). These include:

- having a minimum experience;

- reaching the general retirement age.

What kind of payments an employee is entitled to upon his voluntary dismissal from the Ministry of Internal Affairs depends on the circumstances of termination of the contract.

Important! According to the general rule, to receive an insurance pension, a police officer must have at least 20 years of experience. .

If the length of service in law enforcement agencies is more than two decades, then the pensioner has the right to a one-time payment in the amount of seven salaries. If you have fewer years of work, you must pay only two salaries. But, an additional amount of benefits is also accrued if the citizen has state awards for exemplary service.

If for some reason the length of service is not enough, then you can count on the least number of salaries, as well as vacation compensation.

How to apply for disability?

Both current employees of the Ministry of Internal Affairs and those transferred to the reserve can apply for disability. However, there is a peculiarity when registering disability for retired employees:

- The dismissal occurred no later than 3 months ago.

For example, Sergeev S.S. retired on July 5, 2020. On August 10, during hospitalization, an oncological disease was diagnosed; after treatment, a referral was issued for a medical and social examination. Already on September 20, 2020, Sergei Sergeevich was assigned disability group number two.

Important! Less than 3 months have passed since the dismissal and examination, so a citizen can apply for a disabled person’s pension from the Ministry of Internal Affairs ;

- The diseases that were acquired during the service worsened, which became the reason for receiving disability.

Important! These diseases must be diagnosed by a military medical commission.

Accordingly, the following may apply for disability, regardless of age:

- Employees who were injured or ill while on duty;

- Citizens who were undergoing training and were injured.

| Step-by-step instructions for registering a disability | ||

| № | What should be done? | What documents are needed? |

| 1 | Pass a military medical commission | Obtain a conclusion that will serve as one of the grounds for obtaining disability |

| 2 | Contact the clinic that is assigned to this department. | It is necessary to take a referral for a medical and social examination. |

| 3 | Collection of necessary documents | The standard package of documents contains: 1. Identification document; 2. Insurance number of an individual personal account (SNILS); 3. Referral according to the standard state form; 4. Additional medical documents (test results, MRI, ultrasound, ECG, and so on); 5. Certificate indicating disability; 6. Individual rehabilitation program; 7. Information about education, if the child is receiving education at an educational institution (characteristics; certificate of study); 8. In addition, if an ambulance is often called, then these calls should be confirmed in writing. In addition, a current or former employee must have: 1. Documents confirming service; 2. Conclusions of the inspection, the investigation of which occurred due to the injury; 3. Conclusion of the IHC. |

| 4 | Passing the commission | Obtaining a result that will be issued in a standard form. |

Important! All documents must be of two types: original and copy.

Compensation for uniform

Payments upon dismissal from the Ministry of Internal Affairs at one's own request also include the need to provide the dismissed person with monetary compensation for uniforms. In this case, it refers to uniforms that should have been provided, but were never issued.

The amount of compensation for an unissued form at the Ministry of Internal Affairs in 2020 will depend on the following factors:

- the number of units of property that the employee did not receive;

- the period during which the security was not provided.

In this case, it is important to take into account that calculation of payments is possible only for the three years preceding dismissal, regardless of the fact that the form was received before that time. This is due to the fact that the period of use of the uniform is limited.

How are pensions calculated for employees of the Ministry of Internal Affairs?

Basically (excluding allowances and benefits), the amount of pension payments to DVA employees depends on several criteria:

- Based on the fact of occupying the last position (selected for the past 5 years);

- For a special title;

- The employee's salary.

Additionally calculated:

- Years of military service subject to preferential calculation;

- Work experience outside the authorities;

- Allowances.

The final formula for calculating the amount of payments to a former employee of the Ministry of Internal Affairs is as follows:

Formula for paying a pension to an employee of the Ministry of Internal Affairs

| P = 0.5 x (L + W + H) x 72.73% | |

| (D + W + E | Monetary allowance |

| D | Job title |

| Z | Rank |

| IN | Length of service |

| P | Pension amount |

In 2020, this formula continues to be used when calculating pensions in the Russian Federation without changes.

Other payments

Staff reduction is a reason for terminating a contract that is not related to the wishes of the parties. In this case, the laid-off employee is entitled to the following payments;

- compensation of days for unused vacation in the Ministry of Internal Affairs;

- one-time payment in salary;

- provision of two salaries that compensate for the costs of the job search period.

It is possible to lay off employees who are on maternity leave only when the enterprise is completely liquidated. And, in this case, the maternity leaver is paid the entire amount of the monthly benefit at the same time.

When can a civil pension be granted?

Not everyone is able to register financial support in the form of a 2nd pension. To successfully apply for it, you need to meet some requirements, the key of which is the fact that you have a military pension. In other words, in the foreseeable future, only those military personnel who receive a pension from law enforcement agencies such as the FSB, the Ministry of Internal Affairs or the Defense Ministry can purchase it.

Then potential candidates for a second pension need to register with the Pension Fund to purchase an insurance certificate or SNILS. Using this number, the military pensioner is credited with funds for the 2nd pension. They are formed at the expense of those transfers that employers pay for their subordinates to the funds.

What to do with a military mortgage upon dismissal

Each employee of the law enforcement system receives funds into their account, which can later be used to purchase real estate. This is the so-called military mortgage. If a citizen has not had time to use his savings, then he can dispose of the money as follows:

- if there is a minimum period of work of 10 years, it is possible to purchase housing using this money;

- after 20 years of service, finances come into personal possession and can be spent on other needs;

- upon dismissal before 10 years, the money goes to the state.

Read more in the article: Military mortgage upon dismissal

Assignment of pension benefits

For the establishment of a pension salary, a former employee of the Ministry of Internal Affairs must apply at the place of service.

The exception is the case when he applies for old-age payments - they are financed by the Pension Fund. Accordingly, the application is submitted there. In any case, the application must be supported by the following package of official documents:

- identification document (passport or residence permit);

- papers confirming the length of service or work “in civilian life”;

- a certificate of the amount of allowance or salary;

- certificates confirming the presence of one of the disability groups (if necessary);

- documents confirming the presence of dependents (if any);

- documents confirming the change of full name (if any);

- SNILS (when contacting the Pension Fund).

To assign a funded pension, you only need a passport, SNILS and details of the bank account to which the pension is planned to be credited.

Payments to a police officer upon retirement in 2020

According to the latest news, in January 2020, some types of benefits were indexed, which also affected the Ministry of Internal Affairs system. This cannot but rejoice, since in the last five years payments to employees of the Ministry of Internal Affairs upon retirement have not increased.

Read more in the article: How much salary do military personnel receive upon retirement?

But from February 2020, the benefit amount will increase by 4%.

In addition, other types of financial assistance, as well as social benefits, remain in effect. [Total votes: 0 Average: 0/5]

Conditions for calculating the second pension

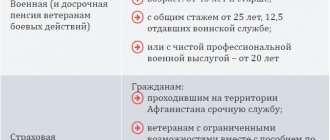

The insurance portion is accrued to employees of internal affairs bodies (OVD) under the following conditions:

- Reaching the appropriate age. In 2020, women over 56.5 years old and men over 61.5 years old will be able to apply for a pension. Subsequently, the age for granting benefits will increase in annual increments. The final transition to the new rules, according to which pensions are paid from 60 years of age (for women) and 65 years of age (for men), will occur in 2023.

- Having sufficient work experience. To receive payment in 2020, a citizen must work for at least 11 years. Until 2024, the minimum length of service will increase annually, year by year, until it reaches 15 years.

- The IPC is not lower than the minimum. To receive transfers from the Pension Fund of Russia, a pensioner must earn at least 18.6 points. Every year the minimum coefficient increases by 2.4 points until it reaches the legally established value (30 points). The number of points is calculated as the amount of transfers to the Pension Fund divided by the maximum contribution. You can accumulate from 1.13 to 9.57 points per year. By 2021, the maximum limit will be 10 points.

- Registration in the insurance system. If the employer of a former military man or the retired entrepreneur himself does not pay contributions to the Pension Fund, then he will not be able to receive an insurance supplement. Official length of service that is not reflected in the system erroneously can be confirmed with certificates and data from the work record book.

- Availability of payments through the Ministry of Internal Affairs. The second pension consists only of the insurance share, so in most cases it is a small additional payment to the military benefit. If a citizen of the Russian Federation retired from the authorities before retirement, then he can apply for full insurance compensation, which consists of a base and an insurance part. The size of the fixed base in 2020 is RUB 5,686.25.

Early retirement from a civil pension is possible after 15-20 years of continuous work in hazardous industries, in medicine and pedagogy, in the transportation of socially important goods, in the Far North, etc.

If dismissal from the police department occurred due to disability, but the employee has enough experience for length of service, then he can choose any of the military pensions. This will not affect the amount of the insurance benefit or its availability.

Calculation procedure

The civil pension for military retirees and its calculation is the prerogative of the Pension Fund. Registration in the compulsory insurance system gives the right to an increase in monthly payment from the state in the form of a civil pension.

In order to carry out the recalculation, you need to visit the regional center of the Pension Fund with an identification document (including a pensioner’s card).

A military pensioner also has the opportunity to use the services of a multifunctional service center. Their location, as well as their number, can be found out by calling the Pension Fund hotline.

Receiving SNILS

purchase the said insurance identification number at any Pension Fund in your city . To pay a visit, you do not need to take a savings book, certificate or other similar documents with you. There is no need to pay any commissions or fees - the service is completely free. If you have any questions, please call the Pension Fund staff at the contact number. In order to register SNILS, you must:

- go to the department;

- purchase a number electronically for the queue;

- find an employee, ask them to fill out a form to obtain an insurance number;

- take a statement of completion.

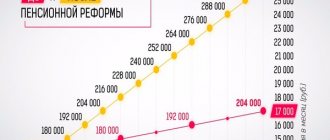

Indexation of insurance pension provision

Starting from January 1, 2020, all citizens of retirement age will have their pensions indexed by 3.7%.

Taking into account the low inflation index, this figure is below the level of depreciation of the Russian currency. Working citizens of retirement age will not receive an increase in the new year, based on a statement by the government of the Russian Federation.

Indexation is carried out according to the coefficient of earned pension points. It is also worth noting that the weighted average cost of one pension point is 81.49 rubles.

Accrual nuances

In order to independently calculate the equivalent of points, insurance payment, you need to take into account many details, including economic indicators such as inflation and the cost of living. And therefore, for a more accurate calculation of indicators, it is advised to contact the departments of the Russian Pension Fund in the region. This advice will save you from making erroneous actions when calculating.

How to calculate?

- First, find out your official work experience in a civilian profession. From the official salary. fees, 22% was transferred monthly to pension funds.

- Now, using a calculator, calculate the approximate amount of annual transfers to the state, which are taken into account when calculating the 2nd pension.

- It is also necessary to take into account certain periods in life. For example, an increase in the insurance period due to non-insurance time periods is quite likely during periods of study at any educational institution. This may concern the period when a person was caring for his minor children, or providing care for a family member who has a disability.

The valorization process increases the pension funds of a military family. During the insurance period, the period when the citizen went on vacation is not taken into account , registering sick leave at his own expense (in those days there was no transfer of salary).

There are 2 calculation methods. Each person can find the most rational method on his own:

- the first is that 22% of monthly transfers are divided between various departments;

- the second method is that 6% in any case is charged to repay the pension reserve for current citizens of retirement age, to whom a clearly established payment is transferred from the state.

It's also worth mentioning that 16% can be shared. For example, all 16% are transferred to the development and accumulation of their own SPC. Or 8% goes to the insurance payment, and the remaining 8% is transferred to a savings account.