Pedagogical experience (teaching experience) is necessary for everyone involved in this work activity. Firstly, teaching staff, whether educators or teachers in schools and higher educational institutions, will receive certain pension payments for the years they work. The more experience and higher qualifications, the more worthy the pension. Secondly, teaching experience plays an important role in determining wages. As a rule, the years worked show the experience and qualifications of the teacher, so there will be greater demand for his services with a high salary. In this article we will talk about what is included in teaching experience.

The essence of the term

Teaching experience is the calculation of years worked in the field of education. Teaching experience is the sum of all working days. At the same time, the calculation of this length of service includes work in institutions related to the educational process. For example, a cook in a secondary school will not receive teaching experience, since he is not a representative of the teaching profession, but an educator, laboratory assistant, teacher, deputy or lecturer are classified as educational activities in accordance with the law.

What is included in the teaching experience

Many people ask the question: “What is included in teaching experience?” To answer this question in more detail, you will need to refer to an extract from the legislation of the Russian Federation.

The calculation of working days that relate to teaching experience begins from the moment the teacher enters into an agreement with any educational institution. However, other teaching activities are not taken into account when calculating. As a rule, a professional must get a job in an educational institution, having previously concluded an official employment contract. Other teaching activities that are not included in the general provisions of the legislation will not be counted as work experience. For example, a teacher engaged in tutoring does not have the right to obtain work experience in the field of education.

What is included in the teaching experience:

- The number of days worked in the field of education or total length of service.

- Continuous work experience for primary school teachers.

Registration of pension

The minimum required list of documents to receive a pension:

- application of the applicant;

- labor record with records indicating the presence of work experience (plus its photocopy);

- income certificates;

- passport and military ID (for men);

- children's birth certificates.

Registration is supposed to be done in one of the following ways:

- Personally or with the help of a representative (you need a power of attorney with a lawyer’s visa from a notary’s office) – to the Pension Fund of the Russian Federation.

- At the MFC.

- Through the “Government Services” service.

In some cases, it is possible to send an application with a package of papers by mail, but this option is one of the longest.

How to initiate registration online?

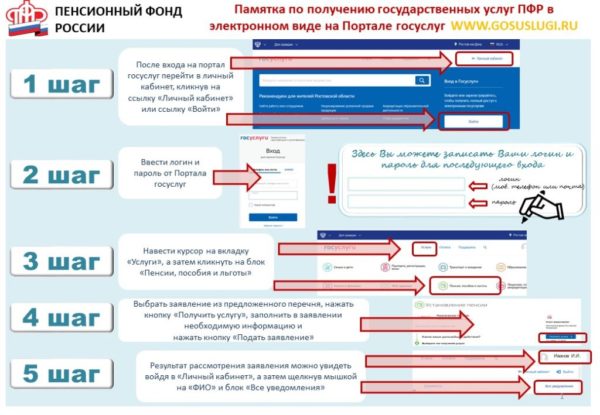

Step 1. Registration on the State Services portal. You will need to fill out a form and confirm your mobile phone number. A user's personal account (PA) will be created automatically.

Step 1. Registration on the portal

Step 2 . Write a statement to LC. Attach scanned documents to it and send. In response, you will receive confirmation of acceptance of the papers.

Step 2. Memo for writing an electronic application

Step 3. Wait for notification of the results of the application review. The commission will consider it within the prescribed period and make a reasoned decision.

A day will be appointed on which the pension applicant will need to arrive with the original papers at the Pension Fund office at the place of registration. Step 4. Visit to the fund branch.

If the documents are in order, employees will receive a pension.

Step 3, 4. It is necessary to visit the local branch of the Pension Fund after reviewing the application

Expert opinion

Alekseev Dmitry Yurievich

Lawyer with 6 years of experience. Specialization: civil law. Member of the Bar Association.

The processing time for papers is 10 days. But often a more thorough check requires more time. Often, officials postpone the date for resolving the issue by 1-3 months, and if problems arise, even longer.

Why do you need teaching experience?

First of all, you need to understand that teaching experience is a special period that applies only to certain categories of activity. For example, special experience includes agricultural activities, industry, medicine and education. Teaching experience, like any official work activity, gives the right to receive a pension.

Results

According to the law, the length of service required to receive a preferential pension for education workers remains the same, but soon it will be possible to receive it with a five-year delay. However, while waiting, the teacher will be able to change his profession or not engage in official work at all - the rules do not prohibit this.

It is better to complete the paperwork in advance, especially if the applicant changed his place of residence during the work. The processing time for papers sometimes takes up to three months or more, as officials carefully check everything.

According to the latest data, from 2030, employees of educational institutions will retire on a well-deserved basis along with other Russian citizens. The rules for calculating the size of pensions will also be different.

Teaching activity is considered work under special conditions. Based on this, the state offers a number of prerogatives and guarantees related to retirement.

The preferential pension for teachers in 2020 allows you to become a pensioner without waiting for the established age threshold.

One of the important conditions is the presence of length of service. This privilege is explained by the fact that the work of teachers is associated with increased responsibility.

What is total experience

This term is used repeatedly when applying for a pension. It is also repeatedly called insurance experience. The essence of general experience is simple: a person with a pedagogical education works in an educational institution for a long time. Part of the time worked will play an important role in calculating your pension. In accordance with the law, total length of service is calculated for years worked before 2002. After 2002, the pension is calculated from the pension contributions that the person made during all the years he worked.

Changes and latest news for 2020

In 2020, the Russian Government initiated a large-scale reform of the entire pension system.

It was received extremely negatively by many segments of the population in our country. At the same time, many teachers are wondering what will change and whether the benefits will remain.

This year, practically nothing changes for educators. The length of service remains the same, as well as other grounds for calculating payments. The changes will only affect the possibility of using the calculated preferential pension.

If a teacher has completed the required insurance period in 2019, then his pension will be calculated this year, but the payments themselves should only be counted on next year. Each year, such a deferment will increase by 12 months until it reaches 8 years.

Will the preferential pension continue?

In the coming years, long-service pensions for employees in the education sector will remain unchanged. However, the Government plans to abolish this benefit. This will happen in 2030. After this, it will no longer be possible to count on further preferential provision.

Main features of general experience

- The employee must work for at least 6 years in order for the length of service to contribute to the calculation of the pension.

- After six years of work, a small percentage will be added each year, which affects the size of the pension. That is why it is beneficial to work in the profession for a long time in order to have high qualifications, recommendations and long teaching experience.

- The legislation repeatedly uses the term “insurance period”, which is no different from the basic concept of general work experience.

- In 2020, changes were made to the legislation, which state that when applying for a pension, years worked, qualifications, and amounts contributed to the personal pension fund will be taken into account.

Pension size: what does it depend on?

The main parameter that determines the right to receive social benefits is length of service (must be at least 25 calendar years). It includes:

- the time that the worker spent on professional activities;

- periods of training/retraining in pedagogical universities, provided that both before and after them the employee was associated with the educational sphere. The same applies to improving his professional qualifications;

- vacation and sick pay;

- child care (up to one and a half years old) - only for women who were engaged in teaching before the fall of 1992.

The time period spent by a woman caring for her own child (not older than one and a half years) for other women is included exclusively in their insurance period, but in total no more than six years if there are several children.

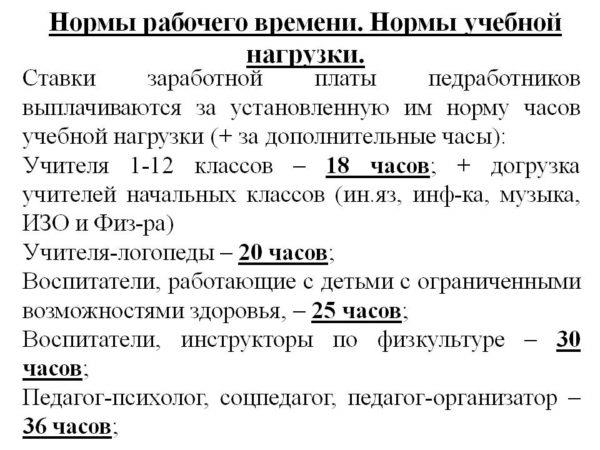

In this case, the employee must be present at his workplace for a certain number of hours - on average eighteen per week for employees of general education institutions. The exact values depend on the region of residence and are indicated in the Order of 2010 (N 2075, issued by the Ministry of Education and Science).

Since 2020, the following requirements for the minimum number of hours per working week have been introduced:

- 36 - persons teaching at universities, educational psychologists, labor and physical education teachers, chief pioneer leaders, librarians, as well as developers of teaching methods;

- 30 - mentors in kindergartens and other preschool institutions;

- 25 - category of teachers involved in teaching minors who have health defects;

- 24 - persons teaching music disciplines;

- 20 - speech therapists, as well as defectologists in kindergartens, nurseries, and educational institutions;

- 18 - professional school teachers, teachers involved in additional education, coaching staff of sports schools, mentors in music or art schools, as well as people teaching various foreign languages in kindergartens;

- 720 hours per year - applies to teachers working in secondary or secondary specialized institutions.

Fulfilling the duties of mentors in primary school classes, as well as rural teachers, is included in the special preferential length of service and will not depend in any way on the volume of workload performed: the number of hours per working week will not affect the deadlines for registration.

Workload standards for educational workers

Expert opinion

Alekseev Dmitry Yurievich

Lawyer with 6 years of experience. Specialization: civil law. Member of the Bar Association.

The influence of other factors on pension payments: if an employee has an academic degree, this allows him to qualify for higher pay, but does not affect the period for receiving a pension.

Pension calculation rules

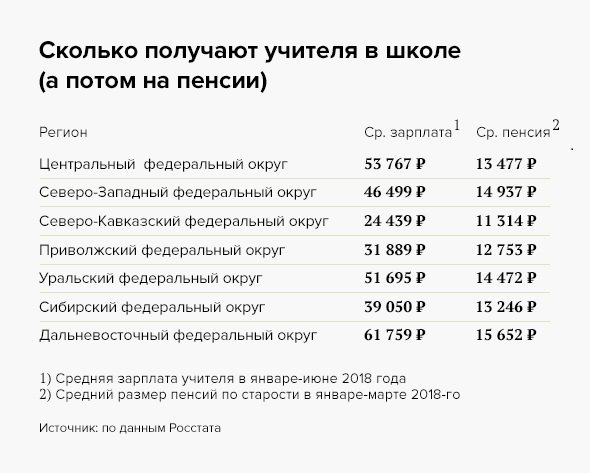

The employer pays certain amounts to the Pension Fund, which make up the future pension. In addition to length of service, the average salary of an employee is important. It depends:

- from the load on the teacher;

- his positions - for the work of the director, head teacher, rector, higher payments are made. Often managers are also involved in teaching;

- compensation for category, academic degrees;

- region of residence - increasing coefficients are provided for the Far North.

An appropriate amount will be added to the cost of living.

Data on early pensions for “northerners”

Reference: the maximum pension for a teacher is 75% of his average salary.

How to calculate a pension: Russian Pension Fund calculator

The entire pension consists of funded and insurance parts. The counting rules are the same as for other citizens of the Russian Federation.

The insurance pension of a citizen of the Russian Federation is calculated in this way: the amount of accrued points is multiplied by the price of one pension point, which is determined each year. The amount of the fixed payment is added to the amount received.

When calculating the approximate amount of the insurance pension, the portal of the Pension Fund of the Russian Federation posted the following information (relevant for 2020):

- fixed payment – 5334 rubles;

- one pension coefficient costs 87.24 rubles;

For an approximate calculation, it is recommended to use the pension calculator from the website of the Pension Fund of the Russian Federation. Fund employees will provide more accurate data.

Video - Pension calculator on the website of the Russian Pension Fund

Salaries and pensions of education workers

What is continuous experience

Despite the fact that continuous teaching experience has not been used in legislative reports for a long time, it still plays an important role in calculating pensions. This is an important point. As mentioned above, working as a primary school teacher affects the calculation of work experience. For example, if the number of students in the graduating class of an elementary school is noticeably decreasing, the school will need to combine several classes and reduce a teacher’s position. This is when the countdown of continuous work experience begins. Its period is at least 3 months for a dismissed teacher.

Example of pension calculation

The formula for calculating preferential and regular pensions is the same.

IPO in year N / NPO in year N) *10.

IPO - individual pension contributions.

NPO - standard amount of pension contributions.

N—Year of calculation.

For example: a music director in 2020 receives a salary of 10,000 rubles per month. You need to calculate how many points he will receive within one year. The rate of deductions that affect the insurance part in 2020 is 16% per month, NPO in 2020 = 16% * 670,000 rubles. = 107,200 rubles.

(10,000 *16%*12 / 107,200)* 10 = 1.79 points.

Before the use of the points system, so-called pension capital was used. It was converted into points automatically. When making pension payments, all points are summed up and multiplied by the cost of one. Its price is different every year.

As you can see, this calculation is not so simple. In the pension fund it is done automatically. Of course, you can do it yourself, but you will have to work hard for this. In addition, the risk of making a mistake is very high.

Self-calculation algorithm:

- Make sure your position is on the list of occupations eligible for special seniority.

- Use the Internet to find out which periods are considered grace periods.

- Count how many points you have accumulated.

- Using the formula, get the amount of the preferential pension.

The data obtained in this way will be very approximate. For a more reliable result, it is better to contact the pension fund directly.

The nuances of continuous experience

Until 2005, continuous work experience included not only days worked in the field of education, but also studies at college and higher educational institutions. Thanks to this, it was profitable for teachers to receive higher education for several years, since all years were included in the general teaching experience. Now this function has been excluded from the legislation, so continuous experience does not include advanced training courses, obtaining a master’s degree, or completing an internship during studies.

How to calculate preferential length of service for teaching staff

Only teachers who meet government-defined criteria can take advantage of the right to early retirement. All this must be documented.

Calculation of teaching experience is carried out according to the following basic criteria:

- availability of a minimum annual amount of teaching practice time in the amount of 240 hours (the norm has been valid since September 2000);

- for teachers operating in secondary or secondary technical institutions, the minimum standard of annual teaching hours must exceed 360 hours;

- the position must be included in the government-approved list of positions eligible for early receipt of a pension;

- The total work experience of the teacher must be equal to or greater than 25 years, for all this time the state must receive insurance contributions for the citizen.

All this is confirmed by the work book, certificates from the place of employment, extracts from the pension fund.

Having a minimum amount of experience is not the only condition that affects the assignment of a preferential teacher pension. And also here the fate will be required:

- whether a citizen has a minimum individual pension coefficient. This indicator changes annually, so the calculation must be separate;

- a citizen has an academic degree and performs such functions in the Far North (allows an increase in the amount of accruals);

- what category was assigned to the teacher according to the international classification on the day the pension was issued;

- honorary state awards, titles awarded to a citizen during his teaching career.

Remember, in the process of calculating the length of service, the teacher must take into account the regulatory documents that were in force during the period of actual performance of the teaching function.

Features of calculating teaching experience

Working as a teacher is difficult not only because you have to have organizational skills and be able to convey information to fragile minds. The peculiarity of teaching experience is that it is different for each teacher. For example, for a university teacher, the term is accrued only for days worked in a certain position, but a teacher of basic military training, who, as a rule, teaches in schools and educational institutions, will receive pension payments both for teaching activities and for serving in army.

Other features:

- If a teacher retires early, then the length of service is calculated based on work in a certain position and under certain conditions.

- The list of positions, conditions and professions can be found in Article No. 28 of the legislation of the Russian Federation.

- Pedagogical experience is also taken into account for working conditions. For example, if a teacher works in rural areas, in the Far North, in shift or evening schools, higher educational institutions, colleges and schools.

Did the reform affect the exit age?

The reform of the pension system carried out in the country has affected many categories of workers. Kindergarten teachers, as well as other teachers, are also affected by the changes.

Thus, it has been established that the minimum teaching experience for going on vacation is 25 years. This condition remains unchanged. However, starting from 2020, there is a deferment in granting a pension for educators.

In practice, this means that after 25 years of work in the field of preschool education, a specialist acquires the right to a pension, but it will be accrued to him after a certain period. At the beginning of 2020, the delay has already been one and a half years.

Example! Citizen Ivanova worked in a municipal kindergarten as a teacher for 25 years. This deadline occurred in January 2020. She has already earned the right to a pension, but payments will not be made to her until July 2021.

Starting in 2023, the deferment period will be 5 calendar years. Accordingly, if the right to a pension begins in 2023, the money will begin to be paid no earlier than 2028. However, it should be noted that if the work activity was carried out in difficult climatic conditions, the list of places with which is approved by the Government, then the calculation procedure will be made taking into account these circumstances.

Thus, it actually turns out that teachers will retire 5 years later than was previously established.

Today, preschool teachers, like other teaching staff, have the right to preferential retirement. To receive appropriate payments, they must work in the industry for at least 25 years. However, starting from 2020, a rule has been in force according to which pensions for this category of workers will be assigned taking into account the deferment.

Work experience: does studying at the institute count?

Is studying at the institute included in your work experience? Answer: no. A student of both full-time and part-time studies does not claim to include years of study in his work experience. The exception is when a student, in addition to studying at an institute or college, enters into an employment contract with any educational institution, which will indicate the position and duration of work. At the same time, you need to understand that not all students aged 16-23 will be able to fully get a job in a school, kindergarten or college.

Despite this, the legislation states that a child can get an official job after reaching the age of 14, with only a passport in hand. Therefore, the law does not exclude the possibility of calculating work experience starting from school age.

Nowadays there is no longer such a law that the length of teaching experience includes training in higher educational institutions. However, persons who studied during Soviet times have the right to demand that their years of study be included in their total work experience. The determination of teaching experience directly depends on changes and amendments made to the legislation. For this reason, persons who do not agree with the accrual of pensions upon registration can go to court. To do this, it is important to present a work record book, a certificate from the place of study, and a diploma. This point is spelled out in detail in the ruling of the Constitutional Court.

But in this case there are exceptions. The teacher has the right to receive a pension early, so the length of service will be calculated based on length of service. Here they can already accept the fact that studying at a university and advanced training plays an important role when applying for a pension. In this case, two nuances are taken into account. Firstly, the person must have completed his studies before 1992. Secondly, before starting training, the teacher had already worked in an educational institution, gaining experience.

Preferential teaching experience for retirement: what you need to know in 2020?

Reading time: 4 minutes(s) Early retirement has been established for certain categories of workers in the Russian Federation. One of these categories is teachers. Teaching experience is considered differently than experience in other places of work.

What is teaching experience?

Current Russian legislation provides for certain categories of workers the possibility of early retirement. A complete list of citizens entitled to such a benefit is given in Article 30 of the Federal Law “On Insurance Pensions”. A similar list contains Article 27 of the Federal Law “On Labor Pensions”. It includes workers in hazardous industries, shift workers who worked in the Far North, doctors and a number of other professions. Among them are the scientific and pedagogical staff of various educational institutions for children.

There is no definition of teaching experience in Russian legislation. However, based on the aforementioned Article 30 of the Federal Law “On Insurance Pensions”, it is possible to derive a definition according to which teaching experience is the time during which a citizen worked as a teacher in an educational institution for children, which gives the right to an early pension.

What positions are included in teaching experience: list

The list of organizations and positions in which it is necessary to work for a long-service pension is given in Government Decree No. 781 of October 29, 2002. It is popularly known as “list 781”.

Here are the educational institutions you need to work in for a citizen to have teaching experience:

- schools of all types and names, as well as gymnasiums and lyceums;

- military educational institutions for children (cadet corps, Nakhimov schools, Suvorov schools and similar organizations);

- educational centers for minors;

- boarding schools;

- boarding schools for orphans and minors who were left without parental care;

- correctional schools and colleges for children with mental retardation, deaf-mute children and those with other health problems;

- children's summer health and medical institutions (sanatorium schools, including boarding schools, summer camps);

- preschool education institutions (kindergartens and nurseries);

- institutions of secondary vocational education (technical schools, colleges and schools);

- children's home;

- institutions of additional education for minors (children's art houses, various clubs, sections);

- institutions for vocational guidance of students.

However, it is not enough to work in the organizations listed in the Government Decree - you need to work in the profession specified in the regulatory legal act. Here is a list of such professions:

- director and his assistants (including assistant director for regime and senior assistant director for regime);

- teacher (including senior);

- teacher (including senior and teacher-methodologist);

- the person responsible for organizing extracurricular activities with students;

- teacher (including speech therapist and speech pathologist);

- master of industrial training;

- employee responsible for pre-conscription training of minors;

- educational psychologist;

- nursery nurse;

- parent-educator.

What is not included in the teaching discount?

If a teacher did not work in one of the listed positions or worked in another educational institution, he is not accrued teaching experience, and he does not have the right to early assignment of a labor pension. However, there are some exceptions to this rule. Thus, the preferential teaching experience for retirement includes not only the positions specified in Government Decree No. 781, but also abolished teaching positions that existed during the Soviet period, as well as before the pension reform of 2002, for example, pioneer leader.

In addition, periods of study in higher educational institutions are not included in the teaching experience. However, this rule is not observed if, before such training, the citizen already worked in a teaching position and continued to work in it after completing the training. If a citizen entered a higher educational institution immediately after school or before starting teaching, the period of study will not be counted as teaching experience.

There is one more limitation related to teaching experience - it (as well as any other length of service in the profession required for early granting of a pension) does not include periods during which the employee was on parental leave.

The time during which the teacher worked part-time, and the second job was not related to pedagogy, is also not included in the teaching experience. In this case, only those periods during which the worker worked in a position provided for by government decree will be counted as length of service.

What gives?

Teaching experience gives its holders two main advantages - a bonus for length of service and the possibility of early retirement. Let's take a closer look at them.

- Extra charge. The bonus is not established by federal law, but departmental documents of the Ministry of Education provide for it. The allowance in each subject of the federation has its own size. It is paid monthly. At the same time, an allowance should be added even to the payment for additional teaching work (for example, part-time work).

- Early retirement based on teaching experience. Teachers who have worked in their profession for the period established by current legislation have the right to apply for a pension before reaching retirement age. This period is twenty-five years. At the same time, unlike most other categories of workers, whom the law gives the right to early retirement, teachers do not have to reach a certain age - it is enough to work out the twenty-five-year period specified by law.

How is teaching experience considered?

Teachers

For teachers, preferential length of service is calculated based on the time during which they held positions that give them the right to such length of service. Moreover, if the work took place over a full working day, these days are simply included in the total length of service required for the early assignment of a pension in calendar order. Persons who worked part-time are credited with actual time worked. The exception in this case is primary school teachers working in rural areas. In accordance with paragraph 6 of Government Decree No. 781, work in rural schools in this position is included in the length of service, regardless of the volume of the teacher’s teaching load.

Special conditions for calculating teaching experience apply to the school principal. According to these conditions, he must engage in teaching activities - otherwise he has no right to count on early retirement.

Since he combines teaching with solving organizational issues, a required minimum has been established, more than which he has the right not to teach - six hours of lessons per week (or 240 hours per year). If the total duration of the director's teaching work is less, he will not have teaching experience. This rule also applies to directors of secondary specialized educational institutions, but they have a larger required amount of teaching time - 360 hours per year.

Educator

In general, the teaching experience of a teacher in a preschool educational institution is calculated in exactly the same way as that of a teacher. True, special rules apply to kindergarten teachers. In accordance with paragraph 9 of Government Decree No. 782, work in this position since January 1, 1992 is not included in the preferential length of service. However, if such length of service was acquired before this date, it will still give the right to early retirement.

You can learn about early retirement (including for teachers) from this video, in which a professional lawyer explains the procedure for registering a pension and calculating preferential length of service, and also advises how to behave if a dispute arises with the Pension Fund on this issue:

Teaching staff whose working career took place in educational institutions for children are entitled to early retirement. To do this, their length of service is calculated in a special way, different from the calculation of work time for other workers. To retire early, a teacher only needs to work for a total of twenty-five years. Calculating teaching experience is not difficult if you know the rules that govern it, established by Government Decree No. 781.

Did this article help you? We would be grateful for your rating:

21 9

Summing up

We have put together several basic and important theses that will answer all questions:

- Labor or insurance experience is calculated only if there is an official place of work, where the teacher enters into an agreement with the employer on the basis of the country’s labor code.

- Pedagogical experience does not include registration of individual entrepreneurs, since labor activity in the field of education is prescribed in the legislation of the country. For example, this includes working as a teacher in secondary schools, nurseries and kindergartens, art schools, colleges and universities.

- Work in state or municipal organizations that have the right and permission to engage in teaching activities.

In addition, teaching experience also includes:

- maternity leave, but for up to six years;

- academic leave required by a teacher to care for a disabled person;

- Military service;

- temporary incapacity, where the teacher receives social insurance payments.

Teaching experience is a special form of calculating labor activity, since it takes into account not only hours worked, but qualifications, position and working conditions. Everything is simple here: the higher the level of pedagogical education, the greater the total pension in the future. It is extremely undesirable for teachers to interrupt their work experience for a long period, because each year worked affects the registration of a pension.

How to apply for a long service pension for teachers

To apply for a preferential pension, you should contact the Pension Fund branch at the place of registration. The necessary actions can be taken not only by the applicant himself, but also by his representative. To do this, the latter must have a power of attorney certified by a notary.

Based on the data provided by the applicant or his authorized representative, Pension Fund employees will decide whether to grant a pension or to refuse the application . In the latter case, the teacher has the right to appeal against it through legal proceedings in court.

List of documents

Complete with the application to the pension fund, you must submit documents confirming the right to assign the appropriate benefit. Papers should be collected in advance, approximately 3 months before the approximate retirement date.

The Pension Fund should provide:

- Passport. A document that confirms the identity of the applicant. The Pension Fund employee is interested in personal data, registration address, as well as details of the passport itself.

- Employment history. It is a document that reflects all work activities, indicating the place and periods of work.

- Certificate in form 2 personal income tax. It displays the employee's income for the last year.

- Certificate confirming the special nature of the work. This document is issued by the employer and is confirmation that the employee’s work activity had special specifics, and this is what gives the right to accrue a preferential pension.

The Pension Fund may require other documents. Thus, men provide a military ID to confirm military service, and women provide birth certificates for their children.