The legislative framework

Initially, it should be understood that military personnel are not included in the benefits provided to employees who have completed their service. Among the employees of the Ministry of Internal Affairs are police officers, the investigative committee and internal defense troops, as well as individual government formations.

Workers of these services have to ensure order in everyday life, the safety of society and individually of each citizen, catch criminals, catch migration criminals and protect public and private property.

The state allocates priority positions for providing social assistance to veterans of the Ministry of Internal Affairs.

Internal service positions, financial assistance and privileges are governed by multiple laws.

The main legislative projects are:

- Federal Law No. 247 of July 19, 2011. Determines what social guarantees are provided to employees serving in the Ministry of Internal Affairs;

- Federal Law No. 3 of February 7, 2011 . This legislative document clearly defines the rights and obligations of police officers;

- Federal Law No. 342 of November 30, 2011 . Determines issues that relate to the process of serving in internal affairs bodies;

- Law No. 4468-1 of February 12, 1993 . The issues that determine the provision of pension payments to persons who served in the internal affairs structure are spelled out here.

According to the last mentioned law, preferential benefits are provided to pensioners of the Ministry of Internal Affairs if they meet the following criteria:

- The duration of service in the structure of internal affairs bodies was twenty or more years, regardless of age category;

- The duration of service in the Ministry of Internal Affairs is twelve and a half years, the total length of service is twenty-five years, and the maximum age is forty-five years.

In any other cases, former employees of the Ministry of Internal Affairs are assigned a standard pension, the same as for ordinary citizens of the Russian Federation, and it is not possible to obtain privileges for the Ministry of Internal Affairs pension benefits, social guarantees and other advantages of the Ministry of Internal Affairs.

Regional benefits

Depending on the region, there are various additional benefits for pensioners of the Ministry of Internal Affairs. However, you must have permanent registration to receive them. It is worth noting that the amount of financial assistance depends on the capabilities of the regional budget. Thus, the capabilities of Moscow and St. Petersburg, as well as other large cities, are much greater than the capabilities of the budgets of small regions.

To receive these benefits, you must contact the department of benefits and social payments. Usually it is located in the district administration. Experts will tell you exactly what benefits apply in a particular region and how to apply for them correctly.

Video - Benefits for pensioners and employees of the Ministry of Internal Affairs

Benefits for pensioners of the Ministry of Internal Affairs in 2020

Today, the number of employees receiving benefits is becoming smaller. This trend is due to the tightening of candidate selection. However, the state is adjusting legislative projects, expanding the range of benefits in them.

Partial benefits for pensioners of the Ministry of Internal Affairs are provided at the expense of the state budget, and part of them are provided by the regional government. Today, preferential benefits are issued depending on what rank the employee had at the time of dismissal, length of service and length of service.

Pension payments are made based on length of service or disability that the worker received during his service.

If a person continues to work, then he has the opportunity to earn himself an additional insurance pension.

In addition to the above-mentioned benefits, those who have served in the internal affairs bodies are entitled to:

- Medical care without payment;

- Preferential pension;

- One-time cash benefit upon dismissal from the structure;

- Traveling in public transport without paying a fare (including intercity);

- Preferential promotion in resolving the issue of living space;

- Exemption from certain taxes;

- Compensation for sanatorium treatment and payment for travel to the sanatorium and back. This includes vouchers to holiday homes, vouchers to a sanatorium, etc.;

- Social benefits.

Housing benefits

What benefits are available

According to current legislation, the following benefits and payments are provided in 2020:

- A lump sum payment upon retirement.

- Tax benefits.

- Providing various medical services on a non-profit basis in municipal and departmental clinics.

- Benefits and compensation for relatives upon loss of a breadwinner.

- Visit to the sanatorium.

- Preferences when obtaining housing.

- Free travel on municipal transport.

Sanatorium-resort treatment for pensioners of the Ministry of Internal Affairs

One-time financial assistance to pensioners of the Ministry of Internal Affairs

Absolutely all pensioners completing their service receive a one-time financial payment.

Its dimension is regulated depending on the length of service in the Ministry of Internal Affairs:

- For a service period of up to twenty years - material compensation in the amount of two salaries;

- If the duration of service is more than twenty years - material compensation in the amount of seven citizens' salaries.

This material payment is made upon dismissal from the authorities and is called ODS.

In accordance with the latest amendments, all employees of the Russian Armed Forces who retire for a well-deserved pension due to health reasons or disability received during service, the employee is paid an additional two million rubles.

If a working Ministry of Internal Affairs does not take vacation, then he can count on reimbursement in cash.

In addition to the above one-time payments, an employee awarded a state award of the Russian Federation or the USSR is entitled to a cash payment in the amount of one salary for a pensioner.

Such payment is not provided if the person has disciplinary sanctions or other factors.

Lump sum benefit during retirement

Based on Federal Law No. 247, upon dismissal from service, all employees can receive a lump sum payment. The amount depends on rank, length of service and salary at the time of dismissal. So, it is possible to get:

- For less than 20 years of experience, the payment amount is 2 full salaries.

- When serving for more than 20 years, they are paid an amount equivalent to seven monthly salaries.

Important! If an employee has state insignia of the USSR or the Russian Federation, it is possible to receive one additional salary, regardless of length of service and other conditions upon dismissal.

Preferential pension of the Ministry of Internal Affairs

The main benefit for retired employees of the Ministry of Internal Affairs this year is the opportunity to retire early.

Taking this into account, former employees are assigned one of the following federal pensions:

- According to length of service;

- Upon receipt of a disability group received during service.

Social benefits for working Ministry of Internal Affairs are assigned when the following criteria are met:

- Have a service life of at least twenty years . In this case, the employee can officially retire, regardless of his age category;

- Have at least twenty-five years of work experience (of which at least 14 years in law enforcement agencies) . In this case, dismissal must occur for health reasons or due to layoffs.

In order to calculate pension payments for a former employee of the Ministry of Internal Affairs, they take the salary corresponding to the rank of the employee and the salary for his position, multiplied by a certain coefficient.

As of today, the coefficient is 71.23 percent, but it is constantly adjusted, depending on the economic situation and other factors.

In addition, the calculation takes into account the duration of service. If the length of service in the authorities is more than twenty years, then fifty percent is added, plus three percent for each year that exceeds twenty years of experience.

If the work experience is mixed, then the percentage addition will be only one percent.

Pensioners can count on these payments if the worker’s health deteriorates in the three-month period after official retirement. The amount of such payments to disabled people depends on the disability group.

The disability group is registered by a specialized medical commission, which issues a final conclusion.

Their dimensions are as follows:

- Loss of ability to work – eighty-five percent of salary;

- Severe pathology or disability – seventy-five percent of the salary;

- In case of loss of a breadwinner (outside of wartime) – thirty percent of the salary.

Benefits for the loss of a survivor

Sometimes it happens that while performing official duties after retirement, an employee of the Ministry of Internal Affairs dies. Then a number of preferences are assigned to the heirs of the first and second priority:

- Funeral at state expense (the list of services provided by the state in this case is specified in Federal Law No. 4202-1 ).

- Receiving insurance payment.

- Registration of pensions for dependents upon the death of an employee of the Ministry of Internal Affairs.

- Receipt of the remaining part of the funded pension.

- Compensation for part of utility bills.

- Reimbursement of part of the funds spent on heating payments.

- Treatment in boarding houses of the Ministry of Internal Affairs at a discount.

These benefits are issued at the social benefits department and at the Pension Fund. You will need to have a complete package of documents with you. In some cases, a certificate of income of the deceased will be required. It can be obtained through the Pension Fund or directly at the place of work of the deceased. Benefits for family members of a pensioner of the Ministry of Internal Affairs

What is expected for pensioners of the Ministry of Internal Affairs based on length of service?

For former employees of the Ministry of Internal Affairs, the state provides an addition to the state pension.

The size of the supplement to pension payments depends on the size of the state pension, age category, family and social status of the employee:

- Heroes of the USSR or the Russian Federation - 100% pension payment;

- For non-working employees who have completed their service in the Ministry of Internal Affairs and who are supported by family members who have lost the ability to work (only if they are not paid an insurance or social pension): - one family member - thirty-two percent;

- two disabled members of their families - sixty-four percent;

- three or more - 100% pension payment;

- Disabled people of the first group, for the provision of care for them - a 100% pension;

- Retired employees over eighty years of age receive a 100% pension for their care;

- Heroes of labor and social labor of the Russian Federation - fifty percent payment;

- Olympic, Paralympic and Deaflympic champions – fifty percent payments;

- Those who have the Order of Labor Glory of three degrees – fifteen percent payments;

- Those who have the Order “For Service to the Motherland in the USSR Armed Forces” receive fifteen percent payments.

Benefits for pensioners of the Ministry of Internal Affairs based on length of service

Tax benefits

Served employees of the Ministry of Internal Affairs may have the following benefits returned:

| Title of articles | Description |

| Article No. 217 of the Tax Code of the Russian Federation | Pension, compensation and one-time payments are not taxed; |

| Clause 10 of Article No. 407 of the Tax Code of the Russian Federation | A former employee is exempt from property taxes on one of his personal properties |

| Clause 7 of Article No. 64 of the Resolution of the RF Armed Forces No. 4202-1 | Compensation for land tax |

| Clause 7 of Article No. 64 of the Resolution of the RF Armed Forces No. 4202-1 | Compensation for property taxes on real estate that does not fall under the benefits described above |

| In Leningrad, Nizhny Novgorod, Krasnoyarsk, Chelyabinsk, Sverdlovsk regions | Exemption from transport tax is provided |

Medical service

A pensioner of the Ministry of Internal Affairs receives the right to free medical treatment in hospitals owned by law enforcement agencies, and the purchase of medicines and medical supplies at the expense of the state budget.

The list of preferential medicines is approved by the Russian Government in a strictly limited manner.

Social privileges for former employees of the Ministry of Internal Affairs

At the federal level, the status of an officially retired employee of the Ministry of Internal Affairs is not a basis for discounts on utility bills and the use of city and regional transport without paying for travel.

Regional authorities can introduce their own laws that will provide the right to free travel on public transport in a certain city.

Discounts on sanatoriums and health resort holidays for DVA pensioners

Each of the structural departments has assigned recreation centers and wellness (for health restoration) centers, in which employees and pensioners of the Ministry of Internal Affairs have the right to relax no more than once a year.

The state compensates for almost the entire trip, leaving only twenty-five percent of the total amount to the pensioner.

The total cost of the trip is:

- For twenty-one days in a sanatorium - twelve thousand rubles;

- At the rehabilitation center for eighteen days - nine thousand rubles.

In addition, the state compensates financial compensation for travel to and from the holiday destination.

Who are the benefits for?

Pensioners of this structure have the right to decent social security. Determining the amount of a pension with sufficient length of service takes into account the salary for the period of retirement. Supplements to pension payments are calculated taking into account:

- employee's age;

- the amount of payments during the period of service;

- employee rank;

- marital status of the employee.

Provided that if a pensioner has the title of Veteran of Labor, then he has the right to additional benefits that are provided by regional authorities:

- free travel on public transport, with the exception of shuttle buses and taxis;

- increased pension;

- 50% discount on utility bills.

In accordance with legislative norms, the following are entitled to receive special benefits:

- disabled people whose illness developed as a result of service;

- those who have reached the age of eighty;

- if there are dependents in the family, then the pensioner can receive a 32% bonus for each non-working family member, but payments cannot exceed the maximum threshold of 100%;

- if you have insignia of the Russian Federation or the USSR, the premium is 100%

IMPORTANT! Military personnel of army units do not belong to law enforcement agencies, but their pension provision is similar to that of employees of the Ministry of Internal Affairs.

Benefits for pensioners of the Ministry of Internal Affairs for housing

If it is impossible to move to decent housing at the time of service, the employee may be given an ESV, which stands for a one-time cash payment.

One-time financial support is provided to those citizens who were in line to improve their housing conditions.

The allocation of ERUs by the state occurs when:

- An employee lives in a one-room apartment with two or more families, regardless of family relationships;

- Non-compliance of the premises with housing standards;

- Accommodation of the beneficiary in a communal apartment or hostel;

- If one of the family of a pensioner of the Ministry of Internal Affairs has serious chronic diseases for which they cannot live together.

Housing benefits

Former employees of the Ministry of Internal Affairs have the right to receive housing from the municipality under a social rental agreement. There is also the possibility of assistance in repaying the mortgage, which consists of half being contributed by the state. Housing is provided free of charge today only if the pensioner is on the waiting list before March 1, 2003. After this period, it was not possible to receive housing for free from the state. Benefits for labor veterans

Here are the reasons for providing housing on a non-profit basis:

- His own home does not meet sanitary requirements.

- A pensioner of the Ministry of Internal Affairs lives in a dormitory or communal apartment.

- The apartment in which a pensioner lives is actually used by two or more families, regardless of their status and degree of relationship.

Documents for privatization

To privatize a municipal apartment, you must provide the documents specified in:

- Applicant's passport.

- Marriage and divorce certificate if available.

- Certificates from the archive in form No. 2, containing information about all places of registration of the applicant, in order to verify that he has not previously exercised the right to privatization.

- Permission for privatization.

- Help-explication and floor plan from BTI.

- Cadastral and technical passports.

- Extended extract from the house register.

- Extract from the Unified State Register.

- Extract from the Unified State Register in form No. 3 (it must be provided for all participants in the transaction).

- Certificate of absence of debts on utility bills from the housing department, management company or homeowners' association.

- Receipt for payment of state duty.

Documents for privatization of an apartment

After providing these documents, an inspection will be carried out. If there are no restrictions on registration of privatization, then a pensioner of the Ministry of Internal Affairs will soon be able to obtain this object for personal use.

How can pensioners of the Ministry of Internal Affairs receive benefits in Russia?

The algorithm for registering preferential benefits is regulated by the state legislative draft on pension provision for citizens who served in the Ministry of Internal Affairs. In addition, regional bills are also taken into account.

To receive pension payments, a person will need to contact the authorized bodies, following the following algorithm:

- Read all the rules for submitting documents and types of benefits;

- Find the nearest legislative body that deals with such issues;

- Collect the required documentation;

- Fill out the application and submit it with the papers;

- Receive payments.

The algorithm for obtaining preferential benefits is regulated by the state legislative draft

Where do they receive their pension?

To apply for a pension benefit and entitlement benefits, you need to contact the nearest Multifunctional Center.

In addition, you can write applications directly to those authorities that are responsible for certain types of benefits:

- Tax Service – available tax benefits;

- Management structure, or utilities – discounts on utility bills and housing and communal services;

- Personnel Department of the Ministry of Internal Affairs - issues of housing, treatment in hospitals and resorts;

- Social Protection Service - social benefits.

Treatment in departmental sanatoriums

Federal Law No. 4468-1 allows pensioners of the Ministry of Internal Affairs to receive compensation for spa treatment. However, this is only relevant when applying to a medical institution that is on the balance sheet of the Ministry of Internal Affairs. If the vacation takes place in a commercial boarding house, then there is no right to compensation. The benefit can only be used once a year. In this case, the citizen is obliged to write an application for the issuance of a voucher, after which the applicant is put on a waiting list. When the necessary voucher becomes available, the candidate is informed about it no later than 2 weeks before arrival.

Important! The maximum cost of a trip for 2020 can be 12 thousand rubles, and the services of rehabilitation centers should not exceed 9 thousand rubles. At the same time, pensioners of the Ministry of Internal Affairs themselves must pay only 25% of this amount. If the trip is carried out with relatives, then they pay 50% of the cost of the trip.

What is required to apply for benefits?

To receive the required benefits, a pensioner of the Ministry of Internal Affairs will need to collect the required documents. The following documents must be submitted to the MFC:

- Passport;

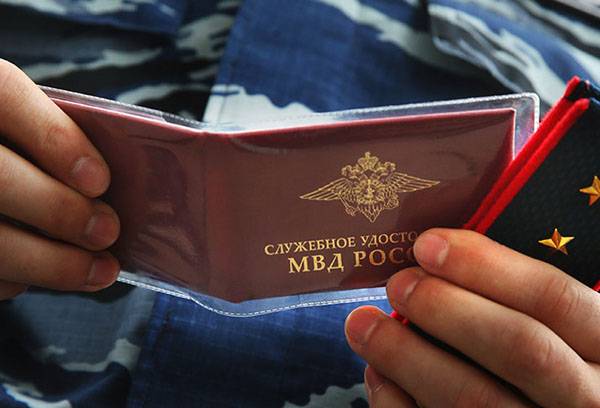

- Certificate of a pensioner of the Ministry of Internal Affairs;

- Military ID;

- Certificate of loss of ability to work;

- Documentation indicating poor financial situation;

- Documentation regarding the right to own property.

Providing documentation can occur as follows:

- By coming directly to the governing body;

- Registered letter (required with an inventory);

- Through the website of the structural department;

- Through a notarized representative.

Tax benefits

Pensioners of the Ministry of Internal Affairs have some tax breaks based on. Property tax benefits for pensioners

In particular, they have the right to the following:

- Pensions and various payments that are provided to improve living conditions are not taxed and do not form a tax base.

- There is no need to pay property tax, but this relief is only relevant for one property. The pensioner himself can choose what exactly he will not pay for. All other properties are subject to this tax.

- Possibility of receiving compensation for paying land tax.

- Transport tax benefit (not relevant in all regions and is regulated by internal regulations).

To receive property tax benefits, the applicant must provide the following documents to the Federal Tax Service office at the place of registration:

- Applicant's passport.

- SNILS.

- TIN.

- An extract from the Unified State Register, which will indicate the pensioner’s ownership.

Taxes from which pensioners are exempt

Social support for disabled people of group 2

Failure to comply with both conditions leads to the assignment of only a social disability pension. The disability insurance pension is paid to citizens upon reaching the age of 55 years (women) or 60 years (men). The third type of disability pension is state , it is received by disabled people of 2 groups of the following categories in the amounts:

- The right to free or discounted travel with a single travel ticket (cost 200 rubles) on any type of municipal transport (except for taxis), as well as suburban transport. From October 1 to May 15, disabled people of group 2 can get a 50% discount on trips on intercity public transport lines, and for the rest of the year one free round trip to the place of treatment.

- Education in higher and secondary vocational educational institutions is provided without competition, and all disabled students of group 2 receive a scholarship.

- Exemption from property tax.

- Exemption from payment of transport tax on a car with a capacity of up to 100 hp, granted to a disabled person by the social protection authority.

- When calculating the land tax rate, the price of the plot (according to the cadastre) is reduced by 10 thousand rubles.

- Tax deduction 3000 rub. monthly for disabled people of group 2, participants of the Second World War, 500 rubles. monthly for disabled people of group 2 and disabled children.

- 50% discount on notary assistance;

- Exemption from payment of state duty when filing a claim in court for an amount less than 1 million rubles.

- Assistance in obtaining legal assistance.

- Assistance in ensuring adequate care for a disabled person.

State assistance to family members

The category of family members of a retiree includes relatives living together with the pensioner (registered at his place of residence) or who are dependent.

For a close circle of people, one of the most attractive privileges continues to apply: sanatorium-resort treatment in health resorts of the Ministry of Internal Affairs with a voucher with a 50% discount. Travel in both directions is also reimbursed. The opportunity is provided once a year to one of the relatives specified in the law.

Along with the pensioner himself, his family is guaranteed supervision in departmental medical institutions . Financing is provided through compulsory health insurance. For outpatient medications, you will have to pay at retail price.

Sanatorium and medical benefits for employees of the Ministry of Internal Affairs, pensioners, and their relatives are provided according to the rules approved in December 2011 by Government Resolution No. 1232.

If a retired employee dies due to injury related to the performance of official duties or as a result of damage to health during service, his family members can count on government support. The list of benefits also includes those positions that are lost by ordinary retirees and current employees.

The family of a deceased pensioner can count on compensation:

- actual expenses incurred for housing and communal services, regardless of the type of housing stock;

- installation of home telephone and communication services;

- purchasing and delivering fuel to houses not equipped with central heating. Expenses are reimbursed within the limits of consumption standards established in the region;

- renovation of your own private home;

- hiring or renting housing with repair work.

Widows cannot count on tax breaks and additional payments. But they retain the right of ownership of departmental housing if it was received by a disabled pensioner during the period of service (Clause 3 of Article 5 of Federal Law 247). If the widowed spouse remarries, she loses the entire circle of preferences.

Features for persons with disabilities

The reform of law enforcement agencies, which has been actively underway since January 2012, has resulted in a reduction in benefits and the abolition of preferences. For now, disabled people from the Ministry of Internal Affairs are holding out. It is difficult to say what awaits retirees in the long term, but now their support from the state is more significant than for ordinary pensioners in uniform.

Free aftercare and sanatorium stay

Let's start with the fact that a disabled pensioner who has lost his health in the service can undergo free rehabilitation in sanatoriums .

The algorithm is as follows:

- The pensioner is undergoing inpatient treatment for the main disease in an institution of the Ministry of Internal Affairs. If the department does not have the necessary equipment and specialists, assistance is provided in state and municipal clinics;

- immediately after hospitalization, it is necessary to be examined at the place of treatment by a medical commission to determine the need for sanatorium-resort rehabilitation;

- then the medical institution sends a request for information about the patient’s need for further treatment to the Medical and Sanitary Unit of the internal affairs department of the subject. All necessary medical documentation for the disabled person is attached.

The allocated voucher with a personal appointment is sent by the medical unit to the department’s sanatorium, which provides specialized treatment.

The applicant for restoration is required to arrive for free rehabilitation by the specified date. If you are late, the tour will be extended at existing prices out of your own pocket. And only if there are free places.

In standard situations, pensioners with disabilities need to pay a quarter of the cost for a trip. The road is free.

Reimbursement for dental prosthetics and other “gifts” from medicine

A pensioner of the Ministry of Internal Affairs who has officially registered a loss of ability to work has the right to preferential provision of medicines and medical products. destination .

But only when it is confirmed by medical prescriptions from a departmental hospital.

A retiree has the opportunity to install or repair dentures, however, if he does not claim to use the latest generation materials.

Retired veteran of labor

The title is awarded in accordance with Federal Law No. 5 “On Veterans” and departmental circulars.

In fact, all benefits have been transferred to the competence of the regions .

It can be:

- reimbursement of 50% of utilities;

- preferential use of urban and suburban transport links;

- medical preferences: prosthetics, free prescription medications, etc.

Locally, an increasing premium to the veteran's pension .

How to get a pension supplement?

Pensioners of the Ministry of Internal Affairs are entitled to certain supplements to their basic pension payments. Their size depends on the age and status of the citizen.

- People over 80 years of age and disabled people receive a supplement corresponding to 100% of the monthly benefit.

- Former employees with dependent disabled family members receive 32% for each dependent, but in total no more than 100% of the pension.

- Heroes of the USSR and the Russian Federation - 100%.