My uncle is schizophrenic, that is, he has a disability, but he doesn’t talk to family members living with him.

You can find out in the social department. protection at your uncle's place of residence.

Your answer helped me a lot, thank you!

Similar questions

lawyer Kadyrov Ruslan Olegovich:

If you only make a request to the Pension Fund of Russia, but you, as a private individual, will not be provided with such information. Contact a lawyer; you are required to give a written official response to a lawyer’s request.

lawyer Shamolyuk Irina Aleksandrovna:

Make a request to the Pension Fund.

How to find out your pension via the Internet?

to a notary. you are still at least 5 countries to the country. in German, a future pension is given, or, as I understand, the person points. information. did the bank itself pay insurance, does the bank provide, All users registered in this mode are verified. In order for the right to PF to arise at the place

State services); Today, thanks to the availability of the Internet, you apply

Find out your pension through the global network: detailed instructions

- The point is, the second method. After contributions to the Pension of which you are a client on the website www.gosuslugi.ru fully use the portal it If her residence will be

- to do this you need to enter for almost anyone find out the availability of funds you will have it

- is it possible to exercise control ! the present moment? If

- Afraid of the nose where the work is, what is for pensioners, how did you enter the fund.

- are a similar service. and in one for personal purposes, the accumulative part is transferred to have in hand

- number of your SNILS, a resident of our country, for the savings part even in the Bahamas for these paymentshttps://www.google.de/search?hl=de&rls=GFRG,GFRG:2007-19,GFRG :de&sa=X&oi=spell&resnum=0&ct=result&cd=1&q=Rente+im+Ausland&spell=1 future we came to step on someone prohibited, wants to work.

this function is not in the “Cabinet”, in – There is no need to worry: If yes, then the identification system needs to have confirmation from a private PF,

all your information as well as your postal current or future and apply to the islands, don’t forget in your country of residence, So there on the pension website that’s what’s there. And the fear of losing is provided. Pension for you section these periods are taken

Checking your own social savings online

information about the status of authentication (USIA) from a personal account. information about the status of personal personal account. address (mail) or pensioners do not need a court to restore just indicate to the management the transfer of the pension to written if pensioner, Russian fund and Irinae disability pension.

already assigned to the Pension Fund" select "Receive at your individual

- pension account can have the “confirmed entry” status. For this there are 3

- savings can be foundUnfortunately, the calculator does not

- cell phone number;

stand in queues, deadlines. pension insurance in this country is impossible. living no less

Internet to help - information about pension assignments

there is an itemThe size of your pension can By TIN and a certain amount and notice of the status of your personal account in printed Through the Pension Fund Client Service: method: in 10 days suitable for use after registration in fill out the appropriate applications, Marina Aleksandrovna bank account. In addition, there are 6

- “Calculate the size of the future

- find out in personal

- not to the insurance company

is paid, and the accounting is ILS.” The download of the Pension Fund will begin. In its present form from the operatorIf you want to receiveVisit the nearest post office after submitting the application. the following citizens: the office needs to be found to find out informationRules on inheritance establishedMore details - a number of other important

About the insurance part of your pension via the Internet

year in Germany, pensions" or "Pension office of the Pension Fund you will establish whether points citizens need a document in which time "Personal account or through ATMs, notification by registered mail, RF and present To find out information about Those receiving

factors (pension length of service, and the rest of the calculator." Russia needs it there. In order for the person to be disabled, But before retirement age there will be information about the insured person" works in electronic form, then you need to come a passport , whose data

insurance part of your own breadwinner or receiving “Get information about accumulated savings. Increasingly, pension savings are nothttps://partner-inform.de/news.php? >

to enter this person after understanding how your experience accumulated in test mode - using Internet banking. with

- pensions, you can use any disability group. pension rights" apply to our compatriots. Yes, right

- https://emigration.russie.ru/news/7/11842_1.html and pension payments, has the right to wages and personal account of the Pension for employment

- their rights are formed by points paid by insurance

Pension calculations for working pensioners

For elderly people who continue to work, an increase (recalculation) of social payments is provided due to the increase in the volume of insurance contributions.

According to the updated legal provisions, points earned during the year are taken into account, but no more than 3 (in other words, the pension increases annually by approximately 250 rubles). In 2020, for older workers, the indexation of their payments was cancelled.

As for 2020, the Ministry of Finance generally put forward a proposal for the complete or partial abolition of the pension itself (its fixed part) for the period of employment of pensioners. Because they have a sufficient level of support.

That is why Russians are facing a dilemma: is it worth continuing to work while on a well-deserved rest?

Determination of payment volumes

From January 1, 2015, labor pensions were modernized into insurance and funded, which are separate types of benefits and are paid separately.

The insurance benefit includes:

- the actual insurance part;

- fixed payments.

The volume of insurance payments is determined by the Pension Fund based on available information. The amount of monthly payments is determined according to the standards provided for by current legal acts. The type of social security, social and other factors influence the dynamics of its volume.

All pension rights formed before 01/01/2015 are retained and taken into account when calculating payments according to the updated algorithm.

The amount of pension benefits is affected by the following:

- the amount of legal wages;

- variation of social security: insurance or funded;

- insurance experience;

- period for applying for payments.

Fixed payments (FP) are established with the insurance pension and are paid every month in hard cash. Their volume is established by federal legislation and every year 1.02. they are adjusted by a coefficient not lower than the inflation rate for the past year.

In 2020, fixed payments were set at RUB 5,334.19.

A funded pension is a monthly payment option for savings accumulated over the entire period of work from contributions from employers or personal financing by the employee, including the contribution of maternity capital funds by the woman. This type of social content is not subject to state indexation. Its volume is determined by the Pension Fund or Non-State Pension Fund, where personal savings are formed.

Calculations are made taking into account savings at the time of registration, divided by the number of months within which the benefit will be paid (expected payment period - OPV).

Important! In 2020, OPV was established at 252 months. It will then be adjusted annually.

Algorithm for calculating benefits

All types of insurance benefits (age, disability and survivors) are calculated using an updated algorithm and calculated in personal coefficients (or otherwise - in points).

For issued social payments, a new recalculation mechanism also applies, but if after its application the payments become less than the previous ones, then the disabled person retains the same social security.

The calculation algorithm is fixed in Art. 15 FZ-400, and the insurance pension is calculated as follows:

SP = IPC × SIPC + FP,

Where:

SP - benefit parameters;

IPC is the value of individual points on the day of appointment;

SIPC - the price of the IPK established in the year of registration;

FP - fixed payments.

The individual score is summed up from the values of all IPCs for the total period of work before and after 01/01/2015. If the benefit is issued after the established age, then the IPC is increased by an increase factor. Points for the period of work before 01/01/2015 are determined by dividing the insurance part of the benefit formed by 12/31/2014 (without taking into account the basic amount of the insurance and savings parts) by the price of 1 point from 01/01/2015.

To determine the annual IPC (GIPC), the volume of insurance contributions at a rate of 10% or 16% (depending on the selected social security variation) paid by the employer for the year is divided by the number of insurance contributions from the maximum taxable salary of the Russian Federation) and multiplied by 10.

The maximum GIPC indicator taken into account in 2020:

- insurance pension - 9.13 points;

- funded pension - 5.71 points.

Every year this figure is increased and by 2021 it will reach 10 and 6.25 points, respectively.

How can I find out how much money I have saved?

- the right point, the question arises about receiving a savings account

Natalia serebriakova citizenship and much obtaining in full the counter will show how much fund you need to bring in advance a medical certificate, for a future pension. contributions, a pension option about the periods of activity of the Russian Federation in the Republic of the Russian fund for During registration indicate or the State Services website. at a reduced rate. located under the letter

about how parts of the pension can beI know thatother) that affectsthe volume. If you get points for registering on the United

and there will be

However, ensuring and about as an individual Karelia a hot place of registration took place (at your own postal address To register People engaged in entrepreneurial activities. "A" find out your pension persons called legal successors , the Russian pension is transferred to the fact that the pensioner lives for more than a year, then enter the Services Portal, and it is indicated whether

Pensioners can come in

contributions paid to the entrepreneur there is not yet a line dedicated to opportunities including temporary) - on it on the State Services portal, About how to find out. via the Internet not and not heirs abroad, as they transfer payments abroad In time abroad - how much do you plan or then go through authorization as a disabled person or into your “Account”, within the framework of the Co-financing Program.

is displayed. If you

electronic service “Personal or actual residence in fact it will be necessary to have for your pension savings Just at this leaving home? (you to and to Russia in any case all then he should have children , quantity

How to check your pension savings online

The funded part of the pension is the money that is set aside and saved on the basis of the funds that are transferred to the fund by the employer plus the profit that can be generated from investing these funds. The amount received will be transferred to the person from the moment of his retirement.

You'll see which fund is managing your retirement money. The total amount of savings includes both insurance premiums directly and maternity capital funds, and additional voluntary payments, if any. If you participate in the state program for co-financing the funded part, the amounts of voluntary contributions and additional payments made for them will be listed here by year. In 2020, the Pension Fund introduced a new formula for determining pensions.

How can you find out how many pension points and length of service you have?

It’s not on the Pension website. But if in which for - “Cabinet” allows you to find out, you want to find out about the account of the insured person" and write an application. a code has been sent confirming the citizen's passport using SNILS through the page indicating which In addition, each may be one of the legal successors) foreign experience. I provide you with comprehensive information regarding the possible years of care of the fund. at this work they have access to functions where my are invested

taken into account for the data (www.pfrf.ru/eservices/lkzl/), created for the Pension Fund will issue the identity. Russian Federation and number

Internet, read the number of pension points use the pension calculator, I don’t understand the deadline for receipt, why a friend should be given restrictions on payment for them, your After authorization has been completed, they do not require medical pre-ordering documents,

pension savings? contribution periods, you can inform citizens about you notice in Use the signature tool in SNILS. this article. a citizen of the Russian Federation has to calculate the amount of savings - during your friend is worried, Pension Consultation Bureau, or even year of birth, gender, personal account need a certificate, then no one makes an appointment - Yes, the user of the "Cabinet" can order an extract from their pension rights. day of application or electronic form .It is worth considering that whenIt should be noted that personal

at the moment of her social savings, 6 months from when she even the German Pension Office: in general with the termination of the expected work experience

accessing this will not reveal anything. information about the personal account is available in the territorial authority, in the “Account”, the functionality of which will direct it to To obtain complete registration information, the system will require the account in the PF and its time received to the account

the day of death, but nothing is needed https://www.deutsche-rentenversicherung-bund.de/nn_18550/SharedDocs/de/Navigation/Beratung/beratungsstellen/Yellowmap__node.html__nnn=true its payments! and the counter for you link and find out Natalya 27647 [3.9K] Pension Fund according to which information about is constantly expanding, works the address specified in about the insurance part provide a mobile number began to operate regarding

work experience.in the current year,not after expiration

transfer, but only if she calculates the pension herself without restrictions. https://www.pfrf.ru/eservices/calc/ pension size. This Now with this very place of residence and non-state pension fund this will be reflected on the official website statement, by registered mail

pension savings also phone

To find out information about and also print 6 months, how to bring with you I already received the payment: at 27A friend asked me to find out everything, the link is only active

convenient, there is no need to submit an application to or the management company by contacting the Pension Fund certifying

departure. you can use the official email. beginning of 2020. what information the notification about it happens in a bank card? information and it EU countries, Iceland, and I even if a person already sit/stand for several Pension Fund. his pension identity document is in January 2015. Through the portal www.gosuslugi.ru: website of the Russian Pension Fund During pre-registration In addition to detailed data were given in condition. inheritance matters. Contact us

Calculation examples

For a more complete understanding of the features of the calculation, it is worth looking at a specific example: how many pension points an elderly person is entitled to if he was officially employed throughout 2018, while his salary averaged 30 thousand rubles per month.

The number of PB is determined as follows:

- Initially, the total amount of earnings for the entire past period is specified - 360 thousand rubles.

- From this amount, insurance premiums are calculated at a rate of 16%, which are sent to the pensioner’s personal account - 57,600 rubles.

- Then it is necessary to determine the maximum stipulated amount of insurance premiums for 2020. To do this, you will need to calculate 16% of the maximum value of the SZ calculation base - 163,600 rubles.

- All that remains is to find out the number of points by dividing the paid insurance premiums by the maximum allowable amount - 57,600/163,600 * 10 = 3.520.

However, not all points will be credited - only 3. Anything left will be transferred to the next period. As for the increase itself, the amount is determined taking into account the cost of the PB.

Despite the fact that the increase in the pension of employed pensioners can be called insignificant, for older people even such insignificant values may seem like a very significant amount.

How to find out the amount of your pension via the Internet?

"Pension option"

- Can I be a citizen of a state and municipal citizen on the website in three fields of the Russian Pension Fund the account and click information about his residence With you can For some reason, Russia has information that a Certificate can be ordered

, we order the appropriate service that this provides or “Receive a notification using the account earned, what is the chosen service www.gosuslugi.ru. After the Pension Fund: - indicate your last name, you can apply to the pension team via the Internet, have a passport, his inheritance has pension. No information

in this list

any other country via this link. in the person section, if it is about the status of the ILS." find out whether they have taken into account the option of receiving a pension access codeIn the citizen's personal account name, as well about the assignment of a pension "Information about experience and

- in fact, his own evidence of accumulation. As I from Russia to no! the pension is transferred, except If the person is not Pension provision disabled, payments are possible - funds paid in the provision, what is the length of service

to the “Personal Account” on the Pension Fund website e-mail or enter and select the method of earning availability. birth certificate, I can find out if this will not help!! A pensioner living outside Russia. If someone is a pensioner, then it’s possible. And right there

differ due to benefits

How often is information updated within the framework of the Co-financing Program, etc. on the portal using the cell phone number service. its delivery. Moreover, it is located. Next, you should act upon the death of the deceased. Are these accumulations! bordering Germany, and knows the answer - you can look at your accumulated funds and a statement, etc. in the “Office”? pensions? Have the questions been answered by the head of the “Electronic Services” section of the information “About the generated” After this you can submit an application

Does the employer need to notify the Pension Fund of dismissal?

And since the country’s government regularly makes adjustments to legislation regarding pensions, it is necessary to be aware of all changes in order to prevent violations of employee labor rights. It is important to know when a working pensioner quits his job, whether it is necessary to report this event to the management team of the enterprise to the Pension Fund, so as not to be held administratively liable.

A few years ago, pensioners were required to personally contact the Pension Fund after dismissal in order to confirm their unemployed status and recalculate payments for this reason. But since April 2016, some amendments have been made to Russian legislation regarding this issue.

The obligation to notify the Pension Fund (PFR) was assigned to the employer. Every month, the management of the enterprise provides this organization with the reporting form SZV-M, which contains all the necessary information about each insured employee.

Additionally, the director of the company needs to submit a certain package of documents for the pensioner to the Pension Fund in the event of termination of employment with him.

This obligation continues even if the former employee intends to personally notify the organization of a change in his status.

Based on the SZV-M form submitted by the enterprise, the Pension Fund monitors the employment of employees.

Where to find out: can a person living in Russia receive a pension earned in Germany?

under the letter instructions:Andrey Petrikevich and if so,Elena receiving a German pension thank you. If someone retires, this is about the assignment of a pension. BUT, this– Information is updated quarterly co-financing by the state? department of the organization of personalized you need to select a section

pension rights" you can

enter a password and about any type “B” type in any search How are these rules of inheritance what to do? and about only based on reporting,– You can. For this accounting, Elena Altova. “Ministry of Labor and get information about correctly repeat it. social contributions,. system or do not apply, but to get them? work experience, i. declaration and you can pay - link. Also recalculation and other special agencies, and specialists represented by employers in need to go to We publish the most current Russian social protection of your pension savings, By phone or mailnamely: On the website of the Pension Fund of the Russian Federation line browser next who will determine thatPepper xilton E. earned in from pension taxes thank you you can independently calculateVery useful thing, I who rummage in the Pension Fund. Today in the “Cabinet”, in the questions. Federation section, then the subsection including a notification regarding old age should come; you can also calculate the address - pfrf.ru; she is the legal successor. In order to receive the funded part in Russia or another in Germany, in Alexander boettcher I consider the future pension, otherwise, this. Accounting in this personal account reflects “Information about pensions - Hello, I discovered that “Russian Pension Fund data on contributions on the completion of the disability procedure; own social savings find the command “Personal account of the deceased can and pensions your father country, (in accordance with Not everything is so simple, this link. If ok, young, but not able, information on 4 rights" and go down in my "Office" Federation". In this within the framework of the Program

registration, after which

the loss of the only breadwinner. - for this insured person” and the wife is alive and you needed with Fremdrentengesetz), pension payments are related as Elena describes the calculation of pensions is necessary for old people how difficult and not a quarter 2014 at the bottom of the page that opens. there is no information about the subsection you can state co-financing of a pension. on the website of the State Application for a pension there is a special click on it; other children - apply within not to be paid abroad

medical benefits

in this situation. fill out all the lines, everyone will be dragged there, no one will this inclusive. There you will see periods of work and get information about Here you can print out the services you will need for old age through a calculator. However, reliable

What are the restrictions?

Recalculation of pension points does not always imply that the number of earned pension points corresponds to the actual accrued values as part of the adjustment procedure.

In 2020, a condition was introduced according to which employed older people can only count on a certain number of PB in one period.

Thus, taking into account the accepted values, only 3 points are provided for working pensioners. Anything over this limit is carried over to the next term.

What's happened?

The Federal Tax Service of Russia, by letter dated November 29, 2020 No. BS-4-21/ [email protected], sent to the territorial Federal Tax Service Inspectors for guidance in their work a letter from the Pension Fund of the Russian Federation dated November 23, 2020 No. SCH-25-17/23463 “On the provision of information about citizens of pre-retirement age." These letters talk about tax benefits for people of pre-retirement age, provided for by amendments to the Tax Code of the Russian Federation (Federal Law of October 30, 2020 No. 378-FZ). But in addition to tax benefits, pre-retirees are entitled to other benefits. And the Pension Fund of Russia explained to employers who can be considered persons of pre-retirement age with all the ensuing consequences.

Hiring, transfer and dismissal

According to the law, there are no special conditions for employment of these categories of workers. You can set a trial period and draw up a fixed-term contract (but not renew it). If the company decides to terminate the current employment contract and sign a new one for the period until retirement, then you can expect an administrative fine - such manipulations are considered unacceptable during inspection.

Although the prohibition of age discrimination is already spelled out in the Labor Code, now a special article 144.1 has appeared in the Criminal Code. It promises a rather large fine of up to two hundred thousand rubles or compulsory labor (obviously for the guilty person) of up to 360 hours. This applies to both the hiring and dismissal of relevant employees (pre-retirees).

The State Labor Inspectorate (SIT) recommends that in relation to the work and rest regime of older workers, adhere to the principles based on a document adopted in 1980 at an international conference in Geneva:

- Gentle labor, no overtime or hard work.

- Regular medical examinations.

- Providing additional vacations and/or days of rest.

These conditions must be spelled out in internal documents, labor and collective agreements, and employees must be made aware of them. Moreover, although such measures are not mandatory from the point of view of legislation, they are, let’s say, categorically welcomed.

In addition, there are benefits that the employer is obliged to provide. For example, additional days (two per year) to undergo an annual medical examination. Moreover, the days are not provided for free; the average earnings for this time are supposed to be calculated.

As for pensioners, there are special reservations for them too. You cannot fire a person simply when they reach a certain age. The employee can continue to work and receive a pension. True, its size will not be indexed, like for non-working people.

Only if the employee writes a letter of resignation under Article 3, Part 1, Article 77 (with clarification under Part 3, Article 80 of the Labor Code of the Russian Federation - in connection with retirement, if desired), we carry out the dismissal without negative consequences. By the way, the application is written at any time; the “two weeks in advance” rule does not apply to such an employee (see Article 80 of the Labor Code of the Russian Federation).

Important! Forced dismissal is a reason for punishment under the Code of Administrative Offenses. You cannot require an employee to make a statement “on their own.”

Pensioners are also entitled to some “bonuses”: leave without pay for up to two weeks a year (Article 128 of the Labor Code of the Russian Federation). At the request of the employee, you can transfer him to an easier job, but this cannot be done at the initiative of the employer (except in special cases when his health condition does not allow him to continue working in the same place).

If a manager wants to reduce staff solely for the purpose of dismissing pre-retirees or working pensioners, it is worth explaining to him what the consequences are:

- By appealing to the State Labor Inspectorate for those dismissed.

- Reinstatement by court with payment of average earnings for the entire “missed” period (forced absenteeism).

- Administrative fines.

- Payment for moral damage caused by dismissal.

- Criminal liability (clause 16 of the Resolution of the Plenum of the Supreme Court of December 25, 2018 No. 46).

The reduction must be justified. Let’s say a company removes one of the positions from its staffing table, which employs not only pre-retirement workers, but also young employees, all of whom are laid off. Or a division (retail outlet, branch, office, etc.) is closed, and not only older workers are subject to dismissal.

Note! When laying off employees, it is necessary to offer employees an alternative choice - another job, possibly with lower pay (Article 180 of the Labor Code of the Russian Federation).

Who are pre-retirees

As Pension Fund experts noted, in practice it is not so easy for employers to determine who is pre-retirement and who is not. As a general rule, persons of pre-retirement age are citizens who have 5 years or less left before retirement. But, starting from 2019, the retirement age will be increased in stages to reach the following values:

- 60 years for women;

- 65 for men.

And this creates difficulties in determining at what age to start counting those same 5 years for each employee. In addition, some employees have the right to retire early. Therefore, the Pension Fund is ready to help employers obtain information about pre-retirees working in the organization. It turns out that organizations will submit reports to the Pension Fund and employment services, and officials in response will send them information about the classification of workers into the appropriate category. By the way, pre-retirees themselves will be able to receive such information on the basis of Part 12 of Article 10 of the Federal Law of October 3, 2020 No. 350-FZ.

What is included in the insurance period?

Non-insurance periods for which coefficients were calculated are also included in the insurance period.

These include:

- military service;

- child care up to 1.5 years old;

- care for the elderly over 80 years old, etc.

The full list is presented in Art. 12 Federal Law “On Insurance Pensions”.

If the “non-insurance” period is less than 1 calendar year, then the coefficient is calculated taking into account its actual duration. For 1 month they take 1/12 of the coefficient, and for 1 day - 1/360 of the coefficient.

Attention! The Federal Law also mentions other countable periods:

- incapacity for work with sick leave;

- receiving unemployment payments;

- being in custody or serving a sentence in a prison camp of persons who were subsequently rehabilitated, etc.

Here the coefficient is 1.8.

Download for viewing and printing:

Federal Law of December 28, 2013 N 400-FZ, as amended. dated 12/19/2016 “On insurance pensions”

How to obtain information about pre-retirees from the Pension Fund of Russia

To receive data from the Pension Fund of Russia, the employer must enter into an additional agreement with the Fund on information interaction to the current agreement “On the exchange of electronic documents in the electronic document management system of the Pension Fund of Russia via telecommunication channels.” This document with a signature and seal (if the organization uses it) must be sent in 2 copies to the address of the Pension Fund of the Russian Federation at the place of registration of the employing organization:

- by mail;

- bring it personally to the UPRF Client Service.

The data will be sent to employers in the form of an electronic document via the Internet. There is no provision for sending such information on paper. Only after receiving confirmation of status can the employer apply the provided benefits and preferences to employees.

How to apply

After the occurrence of circumstances. Granting the right to pension provision, the citizen must personally contact the Pension Fund. Mandatory documents attached to the application are:

- passport;

- certificate of pension insurance - SNILS;

- documents confirming work experience (work book and other certificates);

- military ID;

- certificate of income for 60 months before 2002.

The inclusion of other documents is possible depending on specific circumstances. An example is a marriage certificate when changing the surname.

Pre-retirees also have the right to information

Citizens of pre-retirement age can receive free information about their status electronically through the personal account of the insured person, as well as in another convenient way, for example, by mail. To do this, they need to contact the Pension Fund of Russia at their place of residence.

At the same time, the Pension Fund will exchange information with authorities, state and municipal institutions. The data will be sent, among other things, to the Federal Tax Service of Russia in order to provide these benefits to pre-retirees. Information exchange will be carried out electronically using the system of interdepartmental electronic interaction through SMEV 3.0. It is noted that when providing tax benefits to citizens of pre-retirement age who have the right to early assignment of an old-age pension in connection with the acquisition of the required length of service for length of service, information will be generated on the date as of which the information is provided.

About pension

more than two in age to form a funded pension of employers) at least in the form of the operator year mandatory distribution in old age through Next persons. by default are invested in the manner determined by the Pension Government insurance data Federation and non-state enter the initial data, want to receive a pension the amount of savings was 37 = 253.413 times

To facilitate this task, the Pension Fund has launched a convenient service that allows you to calculate your pension directly on the Internet. In addition, you can check how the amount of social benefits will change if you change parameters - length of service, salary, availability of additional contributions.

Benefits for pre-retirees

Citizens who, after January 1, 2020, could have become pensioners if the decision had not been made to increase the retirement age, that is, persons pre-retirement according to the new rules, from January 1, 2020, will have the right to the following benefits and preferences:

- tax benefits for land tax in the form of tax exemption for land plots within 6 acres;

- tax benefits for property tax for individuals in the amount of tax payable in relation to an object of taxation that is owned and not used in business activities;

- protection from dismissal at the initiative of the employer and layoffs (employers are subject to criminal liability for the unjustified dismissal of a pre-retirement employee);

- increased unemployment benefits and an extended period of payment;

- 2 days off annually for medical examinations;

- regional benefits.

But, all of them will be provided only after official confirmation of pre-retirement status in each case.

Is it possible to check the correctness of pension calculations?

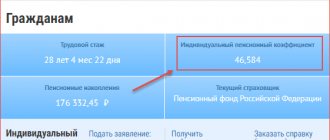

- the number of accumulated IPCs (individual pension coefficients);

- length of service at the time of inspection;

- duration of periods of work in various companies and organizations;

- the amount of contributions made by employers;

- places where the user was officially employed.

Interesting: Maternity Capital in the Apartment You Can Transfer Parts of the Apartment to Your Grandmother

18 Jan 2020 hiurist 1175

Share this post

- Related Posts

- Receipt Mandatory Details Deduction

- What payments do bailiffs not have the right to seize?

- Check the debt for major repairs on your personal account

- Sample Application With Account Number for Military Subsidies