From January 1, 2020, the pension reform (PR) will continue in Russia, implying a gradual increase in the retirement age every 5 years during 2019-2028. The law provides for the possibility of taking a well-deserved retirement ahead of schedule if women have a work experience of 37 years and 42 years for men. What subtleties do you need to know to arrange early retirement in 2020?

Note! If you have any questions, you can chat for free with our lawyer at the bottom of the screen or call the HOTLINE. Free call for all of Russia.

Harmful experience for retirement

Harmful work experience is taken into account by pension fund employees to determine the amount of monthly pension payments, bonuses and benefits for pensioners, and also allows a person working in harmful and dangerous industries to retire early.

Statistics show that more than 40 percent of Russian residents work in harmful and dangerous industries, performing work that threatens not only loss of health, but in some cases even life.

Despite this, people go to work in dangerous fields of activity, because in addition to early retirement, they are attracted by significant additional pension payments in the amount of 2 to 9 percent of basic accruals.

In Russia, this type of experience is regulated by the following legislative acts:

- Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

- Law “On Labor Pensions...” dated December 17, 2001 No. 173-FZ.

- Lists No. 1 and No. 2, which include a list of professions with hazardous conditions, working in which people can receive early retirement and additional payments.

- Decree of the Government of the Russian Federation “On lists...” dated July 16, 2014 No. 665.

In addition to the above documents, there are also additional lists of activities in specific professional industries, which also provide the opportunity to retire early.

Assignment and registration of a preferential pension based on harmfulness

To apply for a preferential pension, you must submit an application to the fund yourself, since despite all the harmfulness of your work activity, no one will automatically do this for you. It is required to submit an application on a general basis with the required documents.

We count ourselves

In order to calculate the preferential pension, a special formula is used. This formula is not complicated and this calculation can be performed independently, on your own.

SPst = IPK × SPK + FV

Where in the formula:

- SPst – the prescribed amount of old-age pension;

- IPC – individual coefficients (according to profession);

- SPK – the sum of the coefficient at the time of early retirement;

- FV – fixed payment;

Using this formula, you can roughly calculate the amount of your pension payment.

List of documents

The list of documents is also standard and is not particularly difficult to collect:

- Statement.

- Passport.

- Documents certifying permission to receive a preferential pension.

- Military ID is required for men.

Registration procedure

If you have the documents from the list, you need to go through the process of applying for an early pension.

Here are several options for you on how to do this:

- This is to send your package of documents by mail.

- Register on the fund’s website and do everything through your personal account.

- Hand over the documents to the PF inspector.

What is harmful experience?

This concept is actively used in the pension funds of the Russian Federation in order to provide the future pensioner with a decent pension for the fact that he has worked for many years in dangerous or harmful conditions that threaten his health, as well as to allow him to retire early.

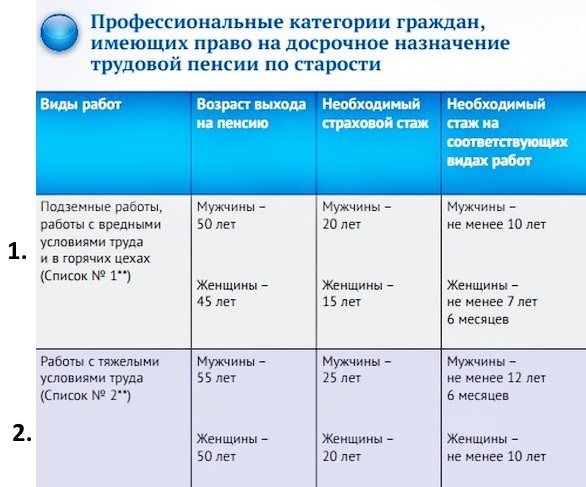

Males have the right to early retirement and additional payments if they have worked in those industries indicated in the first list for 10 years or more, and their total work experience is at least 20 years.

Female persons who have worked in industries included in the first list can retire early if their special work experience is 7.5 years and their total work experience is 15 years. In addition, it is worth noting that early retirement due to harmful work experience is permitted for males no earlier than 50 years of age, and for females no earlier than 45 years of age.

The second list, which is also given below, allows early retirement for male persons who have reached the age of 55 years if they have worked in the relevant position for 12.5 years, and their total experience is 25 years.

Female persons can retire early if they have worked in an industry included in the second list for 10 years, and their total experience is at least 20 years. In addition, the age of a woman who decides to take early retirement must be at least 50 years old.

Who can receive and in what amount

So, what category of persons can count on the fact that the duration of their activity will fall under the concept of preferential?

This category may include persons who have the following social status and have carried out the following types of activities:

- women who are mothers of more than five children, and their age must be more than 8 years;

- parents (one of them) raising a disabled child, read more about how to register a disability for a child here;

- guardians of disabled children who raised him until he was 8 years old;

- persons with dwarfism;

- women who raised children (at least two) in the Far North or territories that are equivalent to it, from 12 and 17 years old, respectively;

- citizens who have become disabled as a result of participation in or consequences of hostilities;

- persons who carried out their labor activities in the Far North or territories that are equivalent to such a region;

- citizens whose permanent place of residence is the Far North (if their activities are related to reindeer herding or they worked as fishermen or hunters).

The legislation also defines the following types of professions, the holders of which can count on preferential calculation of length of service:

- doctors and medical staff institutions;

- teaching staff;

- employees of hot shops of various industries;

- workers whose activities involved exposure to particularly hazardous conditions for health (excessive concentrations of harmful chemicals or radioactive substances);

- women who worked as machinists;

- females who worked in sewing shops with increased workload;

- transport drivers (freight and passenger);

- persons whose occupation was related to ensuring security at railway stations;

- employees of organizations and enterprises that are associated with the search for minerals, in particular coal;

- pilots and sailors;

- employees of correctional institutions and colonies;

- firefighters;

- persons who were engaged in the extraction and processing of fish.

Harmful work experience – 1st and 2nd list

It was said above that there are 2 lists that list areas of activity.

By working in them for a certain time, a person deserves the right to receive a pension for harmful work experience, as well as the opportunity to retire earlier than employees in other industries. The first list was compiled and approved back in 1991 by a resolution of the USSR Cabinet of Ministers; over time, types of activities were added to it, it was changed and supplemented. Today, there are two lists that people working in pension funds rely on when determining the amount of pension accruals and the possibility of early retirement.

Listed #1

lists all types of activities that are associated with particularly harmful and difficult working conditions. It lists those types of activities that are carried out in workshops (“hot”), underground, etc., which can seriously threaten not only the health of the person working in them, but also lead to his death.

On the list No. 2

a list of jobs and professions is listed, most of which, although they do not pose a danger to human health, also deserve retirement earlier than others.

Both lists contain types of activities with hazardous working conditions, which are carried out in such areas as:

- “hot” shops (this could be metallurgy, mechanical engineering, etc.);

- mines;

- printing;

- healthcare sector;

- logging;

- Russian Railways employees;

- nuclear industry;

- firefighters;

- geology;

- chemical industry;

- rescuers;

- mines;

- fleet;

- textile industry (mainly for women);

- paper production.

In addition to the two lists, there are also smaller lists covering professions in individual economic sectors. They are also regulated by law.

Preferential retirement in 2020 in the Russian Federation - latest news

Are beneficiaries affected by the innovations? In 2020, changes took place in Russia aimed at reforming the system of social and pension security for the population. Some of them involve increasing the age when the right to a pension arises.

They were perceived ambiguously by society, since the insurance pension is a kind of compensation for lost ability to work. Increasing the retirement age significantly delays the right to receive these payments.

Reference! The new pension reform will affect not only citizens who have the right to count on a regular insurance pension, but also beneficiaries, except for employees of hazardous industries. However, the changes will affect them to a lesser extent.

For employees who have the right to receive an insurance pension based on length of service (medics and teachers), a gradual deferment in the right to dispose of the accrued pension is provided. Thus, those of them who received payments in 2020 will be able to receive them only in 2020. The deferment period will change every year.

For workers in the north, the retirement age will increase. At the end of the reform, it will be 55 years and 60 years, depending on gender. In 2020, “northerners” have the right to retire at 50.5 years and 55.5 years, respectively.

List of professions

It was noted above that the first list

includes particularly dangerous areas of activity, such as:

- Railway workers.

- Mine workers.

- Workers in “hot” shops.

- Workers engaged in geological excavations.

- Mining works.

- Energy workers.

- Underground construction work.

- Mining.

- Mine workers.

- Metallurgy (black shops).

- Services involved in the repair of equipment in hazardous industries.

- Workers of coke, pitch coke, coke-chemical and thermo-anthracite industries.

- Workers in chemical industries.

The full list can be found in Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10.

To the second list

includes people engaged in activities such as:

- Parachutists.

- Psychologists.

- Theater, ballet or circus artists.

- School directors.

- Teachers.

- Defectologists.

- Pilots.

- Speech therapists.

- Pharmaceutical factory workers.

- Doctors.

- Food and light industry workers.

- Transport workers (air, sea, urban and railway).

- Workers in such sectors of the economy as communications.

- Workers working in glass production.

- Geologists.

- Workers of agrochemical services for agriculture.

Both lists have the right to “preferential” retirement.

But the first list will be exactly the list of professions that are called “harmful”. Read more about what preferential seniority is here. Employers must also draw up lists listing the jobs and workers employed in them that will be subject to harmful work experience. These documents are submitted to local pension funds every 5 years.

Before submitting such lists, the employer must conduct a special assessment of working conditions (special assessment of working conditions) at the production, company, institution or organization, conducted by a third-party organization.

Features of determining membership in the preferential category of medical workers and teachers

Let's look at some of the most in-demand professions that can also count their length of service as preferential - medical and teaching workers.

In relation to medical workers, there are the following features and provisions related to the calculation of preferential length of service:

- Medical workers (employees of healthcare institutions) whose professional activities involve contact with particularly dangerous substances (radioactive) with a power of more than 10 microcuries are entitled to preferential calculation of length of service. This category includes persons who worked in X-ray rooms and other separate departments in which they could be exposed to radioactive physical substances;

- medical workers who had contact with radioactive substances, but received exposure to less than 10 microcuries, may also be entitled to preferential calculation of length of service (such circumstances are separately indicated in the law on calculation of length of service);

- Those medical workers belong to the preferential category. institutions that had direct contact with patients with infectious diseases, psychiatric diseases, tuberculosis (especially in severe forms). This category may apply to people who worked in hospitals specializing in the treatment of such diseases, as well as in institutions where such patients could be located (correctional institutions, orphanages, etc.);

- Both doctors and paramedical and junior medical personnel who worked in chemical therapy departments, burns and purulent departments can apply for earlier retirement.

As for teaching staff, to be able to retire it will be necessary to work in an educational institution (exclusively for children - school, kindergarten, etc.) for 25 years.

It is worth noting that when you go on parental leave, such length of service ceases to count until you return to work. Also, for employees of educational institutions there are the following features prescribed in the law on the accrual of preferential length of service:

- the period of activity carried out before September 1, 2000 is considered a preferential period without taking into account the fulfillment of the norm expressed in hours;

- activities carried out after September 1, 2000 are calculated as preferential length of service only if the required hours are met;

- Regardless of the workload completed, teachers of certain types of institutions, including gymnasiums, cadet corps, lyceums, and rural schools, have the right to count their length of service as preferential.

How is it calculated?

Before calculating the length of service that ensures a person’s right to retire early, you need to determine:

- Periods of activity

by a citizen at work where there were dangerous and harmful factors. - Also, in accordance with Part 1 of Art. 30 of Law 400-FZ, it is necessary to establish the sector of the economy or field of activity

in which the person applying for early retirement worked. - A list that includes the type of activity

of a person who has the right to retire early. - the name of the profession

in the work book with the one that is in one of the lists.

In general, the amount of pension accruals is made according to a special formula approved by Federal Law No. 400-FZ. To schedule early payments, a person must contact the local pension fund at his place of registration or the MFC.

It should be remembered that when contacting the Pension Fund of Russia in order to receive payments for harmful work experience, you must have with you a package of documents (original and copy of passport, work book and other documentation that can confirm activity in hazardous production or industry, military ID if available ). In order to reduce the time required for assigning such pensions, the Pension Fund of Russia bodies begin to check in advance the documents of those people who are going to retire and create a model of the pension file.

How does the calculation work?

The procedure for calculating preferential length of service is determined by the following provisions (we will give only some of them):

- The length of service for citizens whose work involves exposure to harmful conditions should be 20 years for men and 15 years for women. At the same time with this condition, it is necessary that a man has worked in such production for at least 10 years, and a woman for at least 7 years;

- When calculating preferential length of service, the calculation coefficient is important, which is calculated depending on the years of experience. For example, an experience of 25 years is equivalent to a coefficient of 0.55. The more years worked, the greater this coefficient will be (its maximum value can be 0.75);

- Each year of work under harmful or special conditions can be withdrawn in addition to one more, due before the pension is calculated, if the length of service under harmful conditions is more than 5 years for men and more than 3 years and 9 months for women.

The process of calculating preferential length of service itself is quite complicated for people who have never encountered such situations: the presence of a large number of inconsistent coefficients, special conditions that must be observed - all this significantly complicates attempts to independently calculate. In such cases, we recommend that you first seek advice from the local branch of the pension fund, where they will help you accurately calculate your length of service.

What is not included in harmful experience?

When preparing to retire, many people who have worked a sufficient amount of time in hazardous areas of activity begin to think about what may not be included in this length of service, for example, sick leave or vacation, as well as maternity leave and parental leave.

A detailed answer to an exciting question can be obtained by reading in detail Art. 121 of the Labor Code of the Russian Federation and Decree of the Government of the Russian Federation No. 516 of July 11, 2002.

Having studied the above legislative acts, we can come to the conclusion that the insurance period, which gives the right to early retirement, includes periods such as temporary inability to work while receiving state social security benefits.

This length of service does not include periods of unpaid leave (administrative or “at your own expense”), or educational leave. It also does not include the probationary period, downtime (due to the fault of the employer or the fault of the employee), the time during which the employee was not allowed to work due to such circumstances as:

- any type of intoxication;

- a medical report identifying the reasons for inadmissibility to perform work;

- failed knowledge test in the field of labor protection.

In addition to the above, there are other reasons why an employee may not be allowed to carry out activities. These periods are also not counted towards the length of service of this type.

By what rules is preferential service considered?

To obtain the right to early retirement, a person must work the number of years that he is entitled to by law. At the same time, his age at this moment does not matter.

Calculation rules:

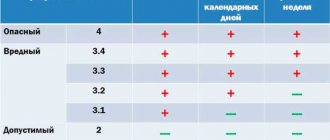

- Determine which preferential category a particular profession belongs to.

- Correlate the type of activity with the size of the increasing coefficient. Depending on working conditions, one calendar year can be equal to 1 year 3 months of experience, 1 year 6 months, 1 year 9 months, two years.

- According to the entries in the work book, calculate the period during which work was carried out on preferential terms.

- Based on all calculations, preferential length of service is calculated.

The fact of carrying out labor activity must be documented in the labor document. If there is no entry in the book, you can contact the human resources department of the institution for a certificate.

IMPORTANT! In some cases, if it is impossible to document the fact that a person works in an organization (for example, during the liquidation of a company), the testimony of two or more witnesses is accepted. But the very nature of the activity is not confirmed by witnesses.

What are the periods of service?

To receive benefits in the pension sector, the following periods are taken into account:

- annual basic and paid vacations;

- sick leave and periods of temporary disability, including sick leave for pregnancy and childbirth;

- time for advanced training, retraining in accordance with the student agreement;

- if a pregnant woman is transferred from a hazardous occupation to a job without unfavorable conditions, then the period of work in the new place is also considered preferential;

- if a pregnant woman is indicated to be transferred to a safe place, and management is not able to immediately provide her with new working conditions, then the waiting period is also included in the length of service;

- The probationary period during employment is counted into the grace period, regardless of whether the candidate passed it or not.

IMPORTANT! The main condition for obtaining a preferential pension is the fact that during the period of service tax contributions were made to the Pension Fund of the Russian Federation.

What periods are not taken into account?

The calculation does not include the following time periods:

- when an employee was removed from duty due to intoxication;

- when the employee has not undergone training and certification in labor protection;

- if the person has not passed a mandatory medical examination;

- if, after passing a medical examination, the employee was not allowed to work for medical reasons;

- when a person did not perform labor activity at the request of authorities and officials;

- hours of downtime (due to the fault of management or the employee himself).

IMPORTANT! Preferential length of service includes forced paid absenteeism in case of illegal dismissal, as well as in case of transfer to another job and subsequent reinstatement in the same place.

General rules for calculating preferential length of service

Calculation rules for all categories of beneficiaries:

- the employee performed his work full time, or at a reduced rate, if this is in accordance with the employment contract;

- citizens applying for a pension must be registered in the pension insurance system;

- Shift service, which allows you to receive early retirement, includes work at the site, rest time between shifts, travel time from the collection point to the place of production and back;

- If an employee has reached the retirement age limit and has not yet accumulated the benefit period, then he has the opportunity to complete the missing number of years.

IMPORTANT! If the professional activity was carried out part-time, but full-time, due to a decrease in production, then the actual time worked is included in the length of service.

Is vacation included in harmful service?

This question often worries people who are planning to retire early.

In paragraph 5 of the Government of the Russian Federation Resolution No. 516 of July 11, 2002, a detailed description is devoted to this issue. After reading it, we can conclude that this length of service includes the time of annual paid leave - both basic and additional, which are often provided to people engaged in hazardous activities in order to improve their health. Harmful work experience allows a person who has worked a certain number of years in a hazardous or hazardous industry to retire early and receive benefits. But when applying for such professions, a person must soberly assess the situation and calculate his resources, since working in hazardous industries can seriously undermine one’s health.

Who is entitled to a pension and what is included in the seniority

Preferential benefits (at an earlier age) are granted to those Russian citizens who meet the following criteria:

- have reached the legal age (it is different for these two lists);

- have behind them the necessary period of work under harmful or difficult conditions (depending on the grounds for retirement);

- have earned insurance experience of the appropriate duration (in total with other non-preferential types of work);

- their insurance contributions generated an IPC (number of points) of at least 30.

In order to correctly count the periods providing the benefit in question, you need to familiarize yourself with the norms of Law 400-FZ and the lists approved by the Cabinet of Ministers of the USSR. List 1 includes such types of work as mining, ore mining, metallurgical, chemical, etc. The second includes professions and positions occupied, including in the same industries, but which are not affected by harmful factors.

In addition to the above categories of citizens, railway workers who are part of locomotive crews and those responsible for organizing transportation are entitled to a preferential pension based on their seniority.

What benefits and allowances exist for long service?

The main and only benefit for holders of active service is the right to early retirement. At the same time, another advantage can be indirectly identified.

If there are harmful or other abnormal factors affecting the employee at a particular workplace, employers are required to pay higher insurance premiums. They, accordingly, form a larger size of the IPC, which directly affects the amount of future government provision.

Thus, in terms of retirement for those workers who are employed in jobs with harmful or difficult conditions, nothing has changed as a result of the pension reform. They still retain the preferential age for the appointment of state support, subject to compliance with other mandatory requirements.

How to apply for a pension if you had a long period of service

The procedure for registering security is essentially no different from the usual one. The applicant must contact the territorial branch of the Pension Fund in advance, who will advise and, if necessary, help collect a package of documents.

Confirmation of the presence of preferential periods of work can be contracts, orders for the organization (for example, on temporary transfer to another job), a work book, certificates from archival authorities and from enterprises, etc.

The procedure will be difficult only if the Pension Fund refuses to recognize the existence of a grace period. In this case, it is recommended to contact the labor inspectorate, which will explain to the citizen his rights, and if he is right, will act as an expert in court.

After this, the citizen must apply to the court to certify the legal fact of working under harmful or difficult conditions. If there is a positive court decision, the Pension Fund is obliged to award a pension (subject to other conditions).