Against the backdrop of the ongoing economic crisis, the Ukrainian leadership was forced to radically reconsider pension reform. Today, pensions in Ukraine continue to be one of the lowest in Europe.

Holy Dormition Lavra in Ukraine

Find out whether you need a visa to enter Ukraine on our website.

Return to contents

At what age do Ukrainians acquire pensioner status: current situation

The procedure for recognizing the right to a pension is regulated by the law “On Compulsory State Insurance”. It regulates when and with what length of work experience a Ukrainian can count on a pension subsidy.

This year, changes to this law are possible for those who have already become pensioners and are just about to become one. Today there are two conditions for retirement:

- the onset of 60 years;

- availability of insurance experience in the required amount.

If a person wants the Pension Fund to begin paying a pension immediately after reaching the age of 60, he must apply for its registration no later than 90 days from the date of reaching this age.

New bills, updates related to retirement age

Today, a bill is being developed that should change the retirement age of beautiful women. It was proposed by deputies of the Servant of the People party, who doubted the fairness of the retirement age set at 60 in 2011.

If the law is passed, the female part of the population will be able to go on vacation at the age of 55, but only if the candidate for subsidies for pensioners does not work. Officially employed women of this age will not receive the right to a pension.

If we talk about the male half of the population, it is planned that in 2028 only 1/2 of them will retire at the age of 60. Others will be forced to work until they are 63-65 years old, as they will not have enough experience. According to forecasts of the Ministry of Social Policy, the number of such elderly people (who do not receive a pension at 60) will only grow.

Important!

There are two distinctions between pension payments:

- According to the age.

- For years of service.

The first type of pension is assigned to men aged 65 and women aged 60. The second is based on length of service in the list of certain professions.

Nuances of determining payment parameters until 2019

Until 2020, when calculating benefits, a formula was used that took into account more than 20 legislative acts. Its use was inconvenient and required changes.

From 12/01/2018, the cost of living increased to 1,497 UAH, 63.13 USD or 4,016.15 RUB (by 62 UAH, 2.61 USD, 166.33 RUB). From 07/01/2018 the minimum amount of pension payments was increased by the same amount (62 UAH, up to 1435 UAH, 60.52 USD or 3,850.19 RUB). Their increase in 2020 according to the State Budget Law was 9% (same as in 2019).

Should we expect stricter requirements for retirement age?

Since the “gaps” in the budget of the Pension Fund of Ukraine have increased, and the pension reform has not been able to reduce them, there is a high probability that the IMF will put forward new demands on us in terms of setting the boundaries of the retirement age. It is expected to rise to 65 years.

This year, the government increased the pension fund deficit to 157 billion hryvnia. The purpose of the event is to carry out indexation of pensions, regulated by law. For comparison, we note that in 2020 the deficit increased to UAH 139 billion.

As soon as representatives of the World Bank were aware of the size of the pension fund deficit (12.2019), they stated that raising the retirement age limit and a new reform in the field of pensions for Ukrainians are inevitable.

So far, the changes have affected women, for whom, on April 1, 2020, the retirement age was raised by 180 days, which amounted to 59.5 years. A wave of increases in insurance coverage standards is expected in November.

Pension system reform and its impact

Innovative reform of the pension system:

- eliminated actual discrimination against working pensioners;

- introduced the concept of “insurance period”;

- made the payment calculation algorithm universal and introduced a mechanism for automatic annual recalculation;

- eliminated special categories of payments (for deputies, judges, civil servants, etc.);

- raised the retirement age.

In the future, the reform should lead to the formation of a three-level provision with the introduction of funded (general and voluntary) insurance.

What types of internship are there?

Ukrainians have heard the expressions “insurance” and “labor” experience more than once. Let's look at how they differ below.

Insurance experience means the number of years during which a Ukrainian/Ukrainian made contributions to the Pension Fund. The length of service includes the years that people spent working (worked officially).

Many people are interested in how the requirements will change. Even more questions swirl in the mind of the average Ukrainian regarding the implementation of the pension reform. The length of service on which the retirement date depends is divided into 4 categories:

- Labor (general). The pension fund calculates it based on entries in the work book. Used for more retirees.

- Insurance. It is calculated according to PF data, which records the number of years and months during which a person made a compulsory insurance contribution in the amount established by the law “On Compulsory Pension Insurance” (Article 24).

- Preferential. The experience that residents of Ukraine have working at enterprises in dangerous/harmful conditions. The list of such enterprises has been compiled by the Cabinet of Ministers.

- Special. Experience, which gives Ukrainians the right to retire earlier. It is calculated by summing up the number of years and months spent on labor of a certain composition.

Note!

Work experience (general) is a concept in which it is permissible to include other types of experience (preferential, special), which provide benefits for the onset of legal grounds for retirement.

Until January 2004, a Ukrainian’s earned work experience was equal to insurance coverage. After this date, only the period for which the employer paid taxes to the Pension Fund for the employee (insurance period) began to be taken into account. The amount of time a person actually worked was not taken into account.

01/01/2020 – date of establishment of new rules for establishing pensions:

- 60 years;

- 63;

- 65.

The specific age of retirement depends on the length of the insurance period.

An idea of the coefficients included in the calculation

The duration of the period worked at state enterprises is determined using a special coefficient designated for the total length of service. This value is calculated using the formula: Ks = Sg x 0.0135, where Sg is the years worked by the pensioner.

Before 2000, in order to determine the pension length, it was enough to provide a work book and other papers certifying employment; after July 1 of this period, the data is provided by the personal account of the PFU.

To determine another coefficient that is important for accounting for monthly earnings, use the formula: Kzm = Zm: Zs, where:

- Kzm – monthly earnings coefficient

- Zm – payment for one month’s work

- Zs – average salary recorded in the same month throughout Ukraine

Calculators are allowed to exclude lower rates at the time of sampling earnings; this period should not exceed 10%. The remainder of the time worked after eliminating months with a small salary will be included in the main pension calculation; it must be separately designated - H.

For the main formula, you will need to find out the value of the overall coefficient of total earnings. You need to collect the monthly coefficients, add them up, and divide the resulting figure by “H”.

It should be noted that there was a lot of debate among legislators whether or not to include wages earned before 1.07. 2000. The President, by his decision, ended the disagreements and the money received before this period will be included in the calculation.

Pensioners who receive security without taking these funds into account have the right to apply to the Pension Fund for recalculation.

How old should a Ukrainian be to retire?

We all already understand that the length of the insurance period is the main parameter in determining the date of retirement. So far this fact has not changed since 2004. It’s not so important how many years you worked in an organization or a company, the main thing is how long the management paid taxes to the Pension Fund for you. For some, the insurance experience accumulated over a lifetime will allow them to retire immediately, while others will feel the lack of it. Although there are options for purchasing insurance experience.

Our country also provides a social pension for people. You can read more about this type of pension in our material: Social pension: cash assistance if there is not enough experience.

How to use the formula

A study of the basic principle of calculating age pensions in Ukraine shows that economists have brought it to the population with maximum accessibility.

Calculation of pensions in Ukraine

The main formula includes the following parameters: P = Sz x Kz x Ks, where:

- P – pension amount

- Sz – the value of average Ukrainian earnings, selected from the last three years before applying for appointment

- Kz – remuneration of labor expressed as a coefficient

- Ks – length of service in the form of a coefficient

To make the calculation yourself or using a calculator, you need actual numbers to substitute them into the formula, then multiply the three main indicators.

At what age do women and men retire in Ukraine?

The retirement age for women as of 2020 is 59.5 years, for men - 60. If the insurance period is not enough, there are some nuances.

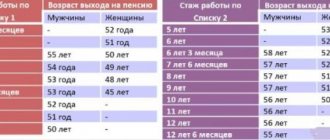

Below are the age limits for retirement and the amount of insurance coverage required for this (the parameters apply to men and women):

Example:

in 2023 the man will turn 60 years old. In order for the Pension Fund to assign him a legal pension and begin payments, he must have 30 years of insurance experience (SS). But the man has only 27. This means that he will be able to retire at age 63, where 20-30 years of service is acceptable.

As we can see, in 2028, the SS amount will be 35 years minimum in order to become a pensioner at 60. Those who have not accumulated this amount will receive a pension at 63 or 65 years old, if insurance contributions reach 25-35 years / up to 25 years, respectively.

Framework for retirement age standards for citizens of other countries

For example, in other countries people retire at this age (men/women):

- Canada – 65/65;

- Germany – 65/60;

- France – 67/67;

- USA – 65/60;

- Japan – 65/60;

- Russia – 60/55;

- Kazakhstan – 63/58;

- Poland – 65/60;

- Belarus – 60/55.

Since we have 12 million citizens receiving pensions for every 10 million working people, a budget deficit is created in the Pension Fund. This leads to the government’s decision to take measures to reduce the number of Ukrainians living off the state pension.

Many European countries and the United States plan to move the retirement age to 70 years in the coming decades. Governments are taking various measures to ensure that older people remain able to work longer and are provided with jobs. For example, the Japanese government awards pension benefits based on retirement age—the later, the greater the amount.

Ukrainians decide for themselves when to retire, based on their personal life circumstances. Minimum parameters are established at the legislative level.

Having reached pension age, citizens can apply to the Pension Fund for registration at any time. There are no special time limits established by law.

Do not forget about the dependence of the pension amount on the minimum wage in the country. She cannot be below her level. The higher the minimum salary, the higher the pensions.

Preferential pensions

People belonging to the preferential category should also be aware of the changes introduced:

- For participants in combat operations

(UBC), the age of retirement has been reduced by the Law “On Compulsory Insurance”. Thus, men can officially become pensioners at 55 years old, having 25 years of service, women - at 50 years old, having 20 years of SS. This is regulated in the Final Provision of the above law. To register, Afghans must provide documents of combatants. - For disabled people,

their own rules apply in accordance with the Law “On Pensions” (Article No. 25). Persons who become disabled as a result of an occupational disease/injury at work have the right to retire early even if they do not have the required length of service. Disabled people of groups 1, 2, 3 of general diseases must have the required level of experience. For example, a 56-year-old person with a disability of 2 or 3 groups must have at least 14 years of experience. - Teachers

in Ukraine are required to have 30 years of experience, which they must have in order to receive a pension. Otherwise, it is necessary to work up to the required level of experience. Employees in the healthcare and education sectors can use a long-service pension if they have reached the age of 55 and have a special work experience of at least 27.5 years (requirements for the period from April 1, 2019 to March 31, 2020). Innovations are being introduced gradually so as not to displease people. - The law regulating the provision of pensions to citizens (Article No. 14) determines the standards for miners

. In accordance with it, persons who have worked for 25 years in open-pit and underground mines can retire, regardless of age. For workers in leading specialties, 20 years of experience is enough. The main condition is full-time employment in these jobs. This includes all professions related to the extraction of minerals (ore, shale, coal), the construction of mines, shafts, etc. Men who have less than 10 years of experience in this field, and women less than 7 years, can hope to lower the retirement age. - for military personnel

in 2020. Persons over 65 years of age, with a working experience of 35 years for men, 30 years for women, are expected to increase their pension by 15-40%.

The main conditions for receiving a preferential pension are:

- the amount of work experience falling under the preferential category;

- the age of a citizen applying for preferential conditions for retirement;

- availability of evidence that working conditions are harmful/potentially dangerous (workplace certification is carried out).

Thus, the following persons receive the right to receive preferential pension benefits from the state:

- the female part of the population who has reached 45 years of age has at least ½ of 15 years of work experience in the mine;

- women 55 years of age and older who raised a disabled child, or 5 or more children;

- The male half of the population who has reached 50 years of age has a working experience of ½ of 20 years minimum.

The norms for vacation time for such categories of the population as the visually impaired, dwarfs, citizens who participated in state conflicts of a military nature, or worked in hazardous enterprises did not undergo changes. For all others, standard legal norms apply.

Registration of an old-age pension

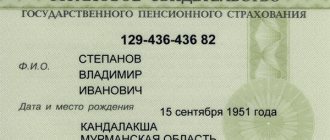

As the law states, a Ukrainian who has sufficient insurance experience and has reached a certain age can become a pensioner. Registration of a pension is possible after submitting the following set of documents:

- passport;

- document on social state insurance/identification code;

- completed application;

- work book;

- diplomas/other documents confirming that a person completed his studies in the period before January 1, 2004;

- paper confirming the place of official registration (address);

- Bank account number;

- certificate from work about the amount of salary for the last 5 years;

- military ID;

- certificates confirming marriage, birth of children.

It is necessary to bring original documents and photocopies to the Pension Fund. There are a lot of free services on the Internet today that allow you to calculate the amount of your future pension using an online calculator.

Carefully study the legislative framework (laws, additional provisions, updates) as you approach retirement age. By being properly informed, a lot of disappointment can be avoided.