Increase in pensions for pensioners of the Ministry of Internal Affairs

Disabled people who have the right to receive a pension can count on an increase in the amount of their pension. The size of the increase is directly related to the disability group that was assigned to the citizen who served in the Ministry of Internal Affairs. In addition, the cause of the disability is taken into account.

At the legislative level, the main reasons for assigning a disability group are highlighted:

- Getting a general illness

- Acquiring a work injury

- Sustaining a war injury

There is a main rule according to which pension benefits for disabled people are increased. This is a legislative norm, according to which disability cannot be assigned to a citizen as a result of his committing actions of an illegal nature.

Employees of the Ministry of Internal Affairs who participated in the Second World War and became disabled also have the legal right to increase the interest rate for calculating pensions for employees of the Ministry of Internal Affairs.

Indexation of the Ministry of Internal Affairs pension in 2020

The legislation on the salary of employees of the Ministry of Internal Affairs provides for a mandatory annual increase in their benefits by the inflation factor. Until 2020, there was a moratorium on increases for several years, so they were not carried out, and the purchasing power of employees, accordingly, fell.

In 2020, the coveted increase took place on October 1, and for pensioners it occurred in two directions at once. Firstly, the provision increased due to an increase in the salaries of existing employees, and secondly, due to an increase in the so-called reduction factor (the percentage of salary taken to calculate the pension).

Reference! Although the reduction factor has increased, it has not reached the level previously provided for in the law. Thus, the legislator envisaged its gradual increase from 54% in 2012 by at least 2% annually. But since 2020, such indexation has been regularly suspended by special laws. This moratorium has been extended into 2020. Therefore, the size of the increase turned out to be lower than established by law, which caused a negative reaction from some of the police pensioners.

How much did the pension increase?

So, let’s consider the percentage increase in both indicators that affect the size of the increase in the amount of support for former police officers from the state:

- The salary of current employees of the Ministry of Internal Affairs, in accordance with the consumer price growth rate (inflation), will increase by 4.3% from October 1, 2020. Consequently, the same increase was expected for pensioners of this department. To calculate the already increased content, it is necessary to multiply the previously obtained amount by 1.043. So, if the security before October 1 was received in the amount of 14,000 rubles, then after this date its amount will be 14,000 * 1.043 = 14,602 rubles.

- Reduction factor . Since pension benefits for former employees of the Ministry of Internal Affairs, including some allowances, are calculated in proportion to salary, its size directly depends on the latter. At the same time, to calculate the payments due, not 100% of the allowance is taken, but only some part of it. This is called the “reduction factor”. As of 2020, it was equal to 72.23% of the allowance. But from October 1, this coefficient was increased, and now the pension amount is calculated from 73.68% of allowance. The indicated difference of 1.45% made it possible to provide about 2%, so actively promised by the authorities (and the president, in particular), to the previously received content.

Let us try to clearly demonstrate the level of growth of Ministry of Internal Affairs pensions of 6.3% announced by the government.

For example, previously a former police officer received 10,000 rubles, which was 72.23% of the salary of an active police officer (meaning equal to 13,845 rubles). An increase in content by 4.3% ensured a salary of 14,440 rubles. Those. now the pensioner will receive 14,440 * 4.3% = 10,639 rubles. Thus, it can be seen that the increase was 10,000 / 10,639 = 1.0639 or 6.3%.

The required level of growth was made possible thanks to the funds reserved for these purposes in the 2020 budget. However, it was not planned to increase the reduction coefficient until the beginning of 2020.

Attention! According to experts, the average pension amount for former police officers after the October indexation was about 17,000 rubles.

Special allowances for pensioners of the Ministry of Internal Affairs

The percentage of the bonus that will be paid from the amount of the calculated pension to employees of the Ministry of Internal Affairs is directly related to the following factors:

- Recipient's age

- His marital status

- Recipient status

Citizens who receive cash payments for long service are entitled to the following additional allowances:

- Pensioners of the Ministry of Internal Affairs who participated in the Great Patriotic War are provided with a bonus - its amount is 32%. If the pensioner has reached the age of 80, the size of the supplement doubles and reaches 64%.

- Pensioners who have Group 1 disability and whose age has reached 80 will receive an increase. Its size is 100%.

- If a pensioner does not work, but has disabled relatives on his shoulders (that is, he supports them), he is awarded an appropriate allowance. Its size is: - In the case of 1 dependent - 32%; — In the case of two dependents – 64%; — If a pensioner is supported by three or more dependents, then the amount of the supplement is 100%. If these family members receive pension benefits, the bonus will not apply.

Calculation of the Ministry of Internal Affairs pension for disability

Citizens who received disability status during the period of service or during the three-month period following dismissal can apply for this type of pension. Disability occurring later than this period must be caused by the following reasons:

- Injury received during years of service

- Injured during service

- A disease that a citizen received while serving in the Ministry of Internal Affairs

- Concussion received during service in the Ministry of Internal Affairs

The amount of the pension is directly related to the disability group - it will be established by a medical and social examination, which will draw up a conclusion on this issue. There are a number of citizens who may qualify for additional allowances:

- Persons of retirement age who have reached 80 years of age

- Citizens who are dependent on disabled family members

- Citizens who participated in the Second World War and receive a pension from the Ministry of Internal Affairs

The procedure for registering pension payments by an employee of the Ministry of Internal Affairs

The assignment of pensions to military personnel takes place through the Ministry of Internal Affairs and has a number of features provided for in Section VI of Law No. 4468-1. The applicant must apply sequentially:

- to the personnel department of the unit - a list of required documentation will be determined there;

- to the military registration and enlistment office - for registration at the place of residence;

- to the pension department of the Ministry of Internal Affairs.

A period of 10 calendar days is given for consideration of applications. Appointment for a long-service pension is carried out from the date of dismissal, but not earlier. For other grounds, the following deadlines are established:

- when disability is established - from the time of recognition as disabled;

- upon death/destruction of the breadwinner - from the date of death, but not earlier, when the monetary allowance/pension was paid, with the exception of later dates in case of loss of income by the parents/spouse - from the date of application.

Pensioners, former police officers, for registration of an insurance (old-age) pension will need to apply to the Pension Fund of Russia, branches of the Pension Fund of the Russian Federation in their region, according to the general rules that apply to all Russians, civilian recipients of social security. The Ministry of Internal Affairs pension is paid in 2020, as it was: at the place of residence/stay through post offices (at home if desired) or through territorial branches of Sberbank of the Russian Federation.

What documents are required

To apply for a pension for a former police officer, you need the following documents and certificates:

- an application supplied by the personnel department, or you can download the form from the official portal of the Ministry of Internal Affairs;

- payslip (per period) provided by the department's accounting department;

- monetary certificate (stub) from the accounting department;

- right to benefits (if any);

- In addition, you will need to sign consent to the processing of personal information.

To determine the old-age pension, the social security applicant submits the following list of documentation to the Pension Fund:

- statement;

- identity card - passport;

- documents confirming work experience (work book);

- SNILS;

- confirmation of the presence of dependents and family members with the applicant;

- documents on conferring titles and awards (if available).

Formula for calculating a police officer's pension

When calculating the amount of pension for employees of the Ministry of Internal Affairs, the following will be taken into account:

- Cool qualification

- Salary by position

- Military rank

- Length of work experience

- Long service bonus

Allowed allowances and salary will be summed up. Then the resulting amount is multiplied by a percentage of the existing monetary allowance.

Let's look at the calculation of a pension using a specific example under the following conditions:

- A citizen whose length of service in the Ministry of Internal Affairs is 22 years

- The salary according to rank is 8,500 rubles

- The bonus percentage is 30%, which totals 6,300 rubles

According to the Constitution of the Russian Federation, employees of the Ministry of Internal Affairs are classified as military personnel. They are entitled to a pension in accordance with the calculated standards for military pension payments. In 2017, the same rules and bases for calculating pensions apply as in previous years.

In 2018, pension changes will be affected in terms of indexation and receiving the “13th payment”.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Pension for MFD employees in 2020 according to length of service

Employees of the Ministry of Internal Affairs are treated as military personnel on a par with those serving in the army and the FSB. The Ministry of Internal Affairs pension in 2020 is formed on the same basic principles for the formation of payments as for the previous year 2017. The following parameters are used to calculate the amount:

- employee experience, including mixed work experience;

- job title;

- rank;

- allowances during service;

- salary;

- qualification.

What pension is due to employees of the Ministry of Internal Affairs?

The calculation process is regulated by the following laws:

- For years of service. Federal Law No. 400 and Federal Law No. 424 stipulate payments due to citizens. They consist of a basic (insurance) and funded part. The insurance payment is formed from points accumulated during service, and the cumulative payment is valid for citizens born in 1967 and later.

- Survivor's pension. Paid to family members in the event of the death of the breadwinner while performing his official functions.

- Disability pension. Assigned to citizens who were injured while serving in the authorities or in case of deterioration of health after 3 months after dismissal. The amount of pension accruals depends on the assigned disability group.

In addition, persons with dependents, WWII participants and persons who have reached the age of 80 can count on additional allowances.

To obtain it, a number of conditions must be met:

- total experience of at least 25 years;

- service experience in the Ministry of Internal Affairs of at least 12 years and 5 months;

- age from 45 years;

- dismissal due to deterioration of health during the performance of official duties, reaching retirement age, or taking measures to reduce the number of employees in the Ministry of Internal Affairs.

If at least one of the above conditions is not met, then the former employee of the Ministry of Internal Affairs will receive a pension on a general basis when he reaches the age of 60.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

Government Decree No. 941 provides for one-time payments. They are calculated in the following cases:

- upon completion of 20 years of service, the employee is entitled to a one-time payment of 7 salaries;

- with less than 20 years of experience – 2 salaries;

- 1 salary is provided as an incentive for receiving a state award or honorary title.

In addition, preferential rates in the form of surcharges can be used by:

- disabled people of group 1 – 100% increase;

- citizens who have reached the age of 80 – 100%;

- disabled citizens of retirement age with one dependent – 32%, with two – 64%, more than two – 100%;

- WWII participants - 32%; when they reach 80 years of age, the premium increases to 64%.

to contents

Types of pension

It is no coincidence that employees of the Ministry of Internal Affairs have the right to receive a preferential pension, because a rather complex function is entrusted to their shoulders. They perform dangerous work, protecting the peace of ordinary citizens of the state. The activities they carry out can directly threaten their health and life, and their working hours are usually irregular.

Preferential pensions for former employees of internal affairs bodies are of several types and are classified depending on the characteristics:

- by length of service;

- on disability;

- due to the absence of a breadwinner in the family.

IMPORTANT! Even if an employee has every right to receive one of the above pensions, but was unable to provide a complete list of required documents, he will most likely be denied a pension.

A person cannot submit several applications to receive two or three types of pensions at the same time. Only one pension from these three types will be assigned.

Additional payments to employees of the Ministry of Internal Affairs in the amount of 2,500 rubles

By Decree of the President of the Russian Federation of May 7, 2012 No. 604, persons who are or have previously served in internal affairs bodies are entitled to a pension supplement in the amount of 2,500 rubles .

Every preferential pensioner has the right to receive it; the specified payment began to be accrued from February 1, 2020 .

Accrual of employees of the Ministry of Internal Affairs according to length of service

To determine the size of the long-service pension, both insurance payments and savings contributions are taken into account. Based on these components, a future preferential pension is obtained. In addition, the length of service, the amount of salary received, the position held by the employee, as well as whether he received additional payments for the entire period of work in the authorities are taken into account.

REFERENCE. In order to receive a long-service pension, you must work for at least 20 years in bodies subordinate to the Ministry of Internal Affairs. Moreover, the longer the length of service, the greater will be the future increase in the preferential payment.

Insurance pension

It is quite common for former police officers to continue working after retirement in positions unrelated to law enforcement agencies. And when they reach the age that is the generally accepted limit for old-age pension, subject to certain conditions, they can take advantage of such a right as receiving an old-age insurance pension. At the same time, the previously assigned preferential pension for a former employee of the Ministry of Internal Affairs can be preserved. This right is established by Federal Law No. 4468-1 of February 12, 1993 “On pension provision for persons who served in military service in internal affairs bodies...” (as amended and supplemented).

If a person is assigned two pensions - for old age and as a former employee of the Ministry of Internal Affairs, while he continues to work, the indexation of pension fund payments is temporarily suspended for the period of his work. Thus, an employee of the Ministry of Internal Affairs can receive an old-age pension upon reaching 60 years old if he is a man, or 55 years old if he is a woman. The IPC indicator must be greater than or equal to 13.8 points , and in order to obtain insurance experience, you must work for at least 9 years.

According to the legislation, the IPC for military pensioners in terms of receiving an old-age pension increases annually by 2–3 units , and by 2025 it will reach 30 points . The required insurance period is also increasing every year in connection with the pension reform, and by 2024 it should reach a duration of 15 years.

Pension for the loss of a breadwinner who was an employee of the Ministry of Internal Affairs

For families that are left without a breadwinner who worked in the internal affairs bodies, the state is obliged to pay benefits in the form of special pensions. Survivor pensions are awarded if an employee dies while performing work assignments or if he is declared missing.

The list of relatives entitled to receive this type of pension is limited to the following:

- spouse;

- minor children up to 18 years of age, and in the case of studying at a university - up to 23 years of age;

- relatives-guardians of the employee’s children;

- elderly retired parents of a deceased or missing employee.

Features of calculating preferential pensions for employees of the Ministry of Internal Affairs

Pension fund authorities assign pensions only on the basis of a submitted application.

In order to receive a preferential pension, employees of internal affairs bodies must fulfill a number of certain conditions:

- has a specialized experience of at least 20 years;

- have officially worked for 25 years or more - total work experience;

- reach the age of 45 years.

The amount of pension payments directly depends on the total length of service in the authorities, as well as on the total length of service. Additionally, the amount of payments may be influenced by such factors as whether the future pensioner has dependents or the status of a disabled person acquired while performing work activities. Also, the size of the pension is affected by the regional coefficient established for the area in which the person worked.

Disability pension of the Ministry of Internal Affairs

This type of pension payment can be assigned to a citizen who acquired a disability group while performing service. Applicants also include employees who have been seriously injured while performing a job assignment or have suffered shell shock.

Disability can be assigned within the first three months after being injured , even if health problems did not arise immediately. If, for example, on the 45th day after performing official duties a person felt unwell and went to a medical center, where he was confirmed to have acquired the status of a disabled person, he can also count on a special pension.

Mixed pension for former employees of the Ministry of Internal Affairs

This type of pension can be assigned to those employees of internal affairs bodies who have not served the required period of 20 or more years in service.

A mixed pension is assigned to a former employee of the Ministry of Internal Affairs if:

- the person has a total working experience of 25 years;

- worked in positions in the Ministry of Internal Affairs for at least 12.5 years;

- reached the age of 45 years;

- resigns due to deteriorating health.

If at least one of the above points does not apply to the person, then you can only retire on a general basis upon reaching the age of 60 years (except for the point about the age of 45 years and older).

Calculation of length of service for granting benefits

So how to calculate? When calculating the length of service of a citizen who has retired, the time spent studying at universities in the country and periods of work in various law enforcement agencies of the Russian Federation are taken into account.

The calculation of the long-service pension begins when the employee has worked for 20 years in the authorities. If an employee has reached the service age required for length of service, but has not exceeded the working threshold of 20 years, then such an employee is entitled to a pension in the following cases:

- reaching 45 years of age or having a disease that prevents the employee from performing his job functions;

- total experience of 25 years or more, of which 12 years and 5 months. must serve in the bodies of the Ministry or military service with the assignment of a military rank.

If during the period of service you were injured or acquired a disease, then length of service does not affect the receipt of a disability pension.

Long service payments are calculated at 50% of the corresponding cash payments for 20 years of service. For each subsequent year worked, the employee is assigned 3% of the corresponding amounts, but not more than 85% (what is the minimum and maximum pension for employees of the Ministry of Internal Affairs?).

The long-service pension, taking into account work experience, is calculated at 50% for 25 years of total work experience , and for each subsequent year - 1%.

Basic provisions

Benefits for former security forces are calculated not from the treasury of the Pension Fund of Russia, but from the resources of the federal budget. The relevant department directly deals with issues of providing for former personnel.

Important! The main condition for initiating payment processing is length of service. The higher this value, the larger payments the pensioner will receive.

Possible situations when a law enforcement officer has the right to complete work and receive financial assistance:

- achieving the required length of service specified by law. As a general rule, a person must have at least 20 years of specialized experience. If the entry into work at the Ministry of Internal Affairs was made in the work book at least 12.5 years before the end of service, but the total duration of work has reached the 25-year mark, you can also apply for a pension;

- exceeding the age limit for service in law enforcement agencies. It is important to take into account that separate age thresholds have been established for different categories. For example, a colonel general is required to end his career by his 65th birthday, colonels - before his 55th birthday, and for lower ranks the maximum is 50 years old. The minimum age for retirement is 45 years old;

- receiving injuries or mutilations during the performance of direct official duties. In such cases, the right to a pension due to disability arises.

The calculation of the amount due is made taking into account the amount of salary, the increase for a special rank through the Ministry of Internal Affairs or Justice, work experience and acquired qualifications.

The specific result is determined by summing up all types of salaries and multiplying the resulting result (DD - salary) by a reducing factor. The PC was last revised in 2020. Since then, the ratio has been set at 72.23%.

What will be included in special training?

The fixed deduction rules provide coverage of the following periods:

- tenure in the current position;

- suspension of official activities;

- work in structural divisions of internal affairs;

- filling government positions;

- probationary period during employment;

- education;

- business trips;

- military service.

How to calculate?

- monthly earnings (salary);

- the amount of time worked in the structure of the Ministry of Internal Affairs (experience);

- assigned title;

- long service bonus;

- reduction factor as a percentage.

All this data must be substituted into the formula below -

- R – salary according to law and salary for rank.

- B – basic pension amount, deducted using the formula (salary*%)/100.

A good example

- B = (26500*30)/100 = 7950 rub.

- Longevity factor = 50% + 3% + 3% = 56%.

- The pension amount taking into account the reduction factor = (19292*72.23)/100 = 13934.61 rubles.

How is recalculation done?

The size of the pension depends on the total payments accrued during the period of service. If the size of these payments increases, recalculation becomes possible and rational. But due to the difficult economic situation in the country and the decrease in contributions to the budget revenues, the Government is discussing the possible abolition of indexation, various payments and allowances.

Last year, indexation was not carried out in full. At the beginning of 2020, a reform to increase the length of service for the possibility of retirement was considered and is still in progress. The deadline for completing this reform was set until October of this year.

- February 1 on the inflation rate;

- April 1 at the discretion of the Pension Fund of the Russian Federation.

Thus, in 2018, pension contributions are expected to increase in proportion to inflation rates.

How to count?

We provide a convenient calculator especially for retired employees of the Ministry of Internal Affairs of the Russian Federation. The pension of police officers is calculated differently than that of ordinary citizens. So, in order not to get confused in these complex operations, we offer our own calculator for calculations. Below there will be a description in full detail of how to use it.

It is worth understanding that laws do not stand still, and perhaps we made a little mistake somewhere. This calculator should be used to roughly estimate the size of your future pension - the calculator will definitely not go wrong with this.

Attention! Dear reader, if you notice any inaccuracy, have a question or addition, feel free to write a comment. We will help as much as we can. Let us not refuse gratitude either. Thank you!

In the meantime, let's look at all the mechanics of use.

Formula

Here we have already written about the features of pensions for employees of the Ministry of Internal Affairs - CLICK.

Formula used when calculating for the current year:

RPO = 1/2 × (OD + OSZ + NVL) × 72.23%

where RPO is the amount of the pension, OD is the official salary, OSZ is the salary for a special rank, NVL is the award for long service. About the coefficients 1/ and 72.23 will be a little lower; they also change in the calculator. The expression OD+OSZ+NVL is also called “cash allowance.”

For simplicity, the calculation in our calculator is divided into 2 phases:

- Calculation of monetary allowance.

- Calculation, directly, of the pension amount.

The pension itself is calculated based on the first point, so just fill out all the fields one by one, and the result will appear at the very bottom of the form. Below is more detail on each point on how to calculate the pension of an employee of the Ministry of Internal Affairs of the Russian Federation, in case you get confused.

Calculation of monetary allowance

Salary by position

The main thing here is to indicate your latest salary for the position of a police officer. The list already contains positions held, if you don’t remember, you can choose an approximate salary that suits you. There is also an item “Indicate your salary yourself.” By selecting it, a field will appear below for manually entering your exact salary.

Promotion for flight crew class

Pilots' salaries are slightly higher. This list provides possible adjustments for increases. If you haven’t flown, feel free to skip it.

Salary by rank

The pension of police officers also depends on their rank. Similar to the first point - titles are also presented.

Establishing a bonus for length of service in the Ministry of Internal Affairs - all points are in place. All that remains is to count.

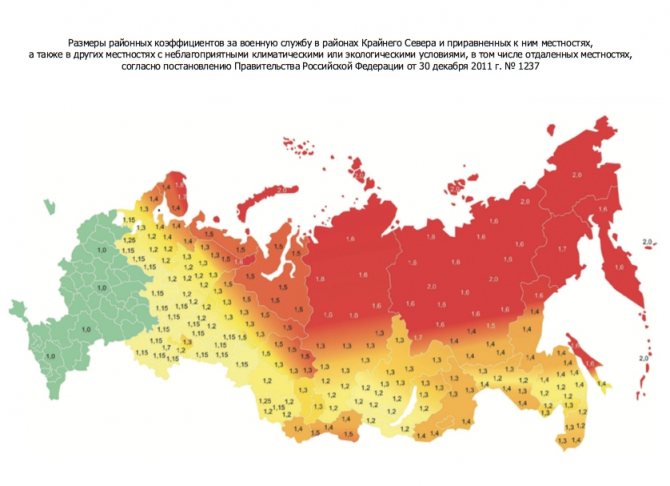

Regional coefficient

Depending on the place of service, it affects the amount of allowance. Feel free to search for your region on the Internet. If it is very difficult, we will specifically insert your region into the table.

Pension calculation

Here we have 2 main influencing coefficients - dependence on length of service and a reduction coefficient.

Seniority

To calculate your pension you must have:

- From 20 years of pure experience.

- or 25 years of mixed experience.

For this, the coefficient of 50% begins to work (the same ½ in the formula). At the same time, for each year of service over 20 years, 3% is added, and for mixed service, for each year over 25% - 1%. All this is reflected in the list. The maximum percentage is 85.

Reduction factor

Another constant value established by law for government employees. The reduction factor is gradually decreasing, now it is 72.23%, and in 2035 it will completely disappear. This coefficient is indicated for edits for early exit. If you don't know, don't touch it.

That’s all, below in the column “Final amount of pension” the approximate value of the pension of employees of the Ministry of Internal Affairs will be calculated. Take it for comparison. That's all, use our online pension calculator. Any questions - ask below.

Benefits for pensioners of the Ministry of Internal Affairs

Special benefits provided for by Federal Law No. 247-FZ dated July 19, 2011 for pensioners who served in the Ministry of Internal Affairs provide for the possibility of them receiving: a one-time benefit for employees with over 20 years of experience in the amount of 7 monthly salaries; a one-time benefit for employees with less than 20 years of experience in the amount of 2 monthly salaries.

If an employee received a state award or honorary title during his service, the benefit increases by 1 salary.

Citizens dismissed without the right to a pension and with at least 20 years of experience receive benefits every month for 1 year. The amount of the benefit is determined by the salary indicator by rank. How to calculate long service pension? 1. 20 years of service

To find out how to calculate the Ministry of Internal Affairs pension, a citizen should determine his work experience. The amount of the service pension depends on the status of the recipient.

Thus, the legislator establishes that persons entitled to receive a pension from the Ministry of Internal Affairs, with 20 years of service, receive a pension in the amount of 50% of the amount of their salary.

If the employee has more than 20 years of service, the pension will be calculated at the rate of 3% of the amount of allowance for each year of service. At the same time, the maximum pension for a person with more than 20 years of service is 85% of the citizen’s allowance. 2. Length of service from 25 years

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

If the employee’s work experience is 25 calendar years, then he receives 50% of the allowance. The pension of persons with such experience is calculated according to the rule established by Art. 14 of the Law of the Russian Federation of February 12, 1993 No. 4468-I.

In this case, accrual is made at the rate of 1% of the amount of allowance for each year of service. The size of the pension is not limited by law, but the law contains a clause according to which a work experience of 25 years must include at least 12 years and 6 months spent by a citizen in military service in certain government bodies. 3.

Minimum cash payout

The long service pension cannot be less than 100% of the pensions established in Federal Law No. 166-FZ dated December 15, 2001. At the same time, the authorities calculating the size of the pension should take into account the regular indexation of its size. 4. Increase in pension amount

Disabled people eligible to receive a pension can expect its amount to be increased. The increase in the amount depends on the disability group assigned to the citizen who served in the Ministry of Internal Affairs. In addition, the reason why the citizen became disabled is taken into account.

Among the main reasons for assigning a disability group, the law indicates: receipt of a military injury; getting a general illness; acquisition of a work injury.

The main rule for increasing a pension for a disabled person is the rule according to which disability should not be assigned to a person as a result of his committing unlawful acts.

Employees of the Ministry of Internal Affairs who were participants in the Second World War and recognized as disabled can also count on an increase in the interest rate for calculating pensions. 5. Special allowances

The percentage of the supplement paid from the amount of the calculated amount of pension transfers depends on the status of the recipient, his age and marital status.

Thus, persons receiving payments for long service are entitled to the following additional allowances: Citizens with pensioner status and group 1 disability who have reached the age of 80 years are awarded a 100% allowance. Pensioners who do not have a place of employment and who support disabled relatives are awarded a supplement in the amount of: 32% - for one dependent; 64% - for two; 100% - for 3 or more (if these family members receive a pension, the supplement does not apply). Pensioners who participated in the Great Patriotic War are given a bonus of 32%, but if they have reached 80 years of age, the bonus increases to 64%. Disability pension

This pension is received by persons who become disabled during the period of service or within 3 months from the date of dismissal. If disability occurs later, it must be caused by: injury during service; shell shock while working in the Ministry of Internal Affairs; injury during service; a disease acquired during service in the Ministry of Internal Affairs.

The amount of pension payments depends on the disability group, which is determined in accordance with the conclusion of a medical and social examination. Additional allowances can be received by: persons with dependent family members; pensioners over 80 years of age; WWII participants receiving a pension from the Ministry of Internal Affairs. Survivor benefits

Such a pension is accrued in the event of the death of the breadwinner to the families of employees of the Ministry of Internal Affairs who died/died during the period of service or no later than 3 months from the date of dismissal. It is also possible to pay a pension if the breadwinner died later than the specified period, if the cause of death was an injury or illness received during the period of service. Pension calculation formula

When calculating the pension amount, the following is taken into account: Salary by position. Length of work experience. Rank. Great qualifications. Long service bonus.

The salary and bonus amounts must be summed up. After this, the amount is multiplied by a percentage of the monetary allowance. If necessary, a regional coefficient is added to the result.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

The calculation of the Ministry of Internal Affairs pension differs from how pension benefits are calculated for other citizens. Therefore, a special program has been developed that helps to find out the future pension of a police officer.

Calculation of monetary allowance

At the legislative level, not only the calculation of monetary allowances for employees of the Ministry of Internal Affairs is determined, but also the conditions for assigning payments and the procedure for registering pensions.

The criteria that are taken into account when calculating preferential pensions for former employees of the Ministry of Internal Affairs are the following:

- the amount of salary received;

- length of service and total work experience;

- position held by the employee;

- availability of additional payments.

If you know all the numbers for calculating future pension payments, you can use the formula to independently calculate the amount of future benefits. Also presented below is a simple calculator that will help you make calculations automatically, spending no more than one minute on it.

Can civil and service pensions be paid simultaneously?

Payments of two pensions at once are possible if a person has acquired the right to receive them and has also completed all the necessary actions to register them.

Thus, upon reaching the threshold required to obtain special experience, an employee of the Ministry of Internal Affairs can continue his work activity. The law provides for the opportunity to continue working outside the service after retirement in order to obtain length of service for the appointment of a second payment - an old-age pension.

To do this, the following conditions must be met:

- reach retirement age;

- obtain 10 years of work experience, excluding professional experience;

- accumulate the number of individual pension coefficients (IPC) in the amount of 16.2.

When a citizen retires to an old-age pension, he also has the right to claim benefits if the amount of the assigned old-age pension is less than the established minimum in the region of his residence. In this case, the pension fund provides him with an additional payment up to the subsistence level.

Seniority

To receive a preferential pension, you must have 20 or more years of pure work experience in the authorities or more than 25 years of mixed experience.

If a person has a minimum special length of service, then the formula will use a coefficient of 50% when calculating the amount of pension payments. For each year of service over 20 years, 3% is added to this coefficient (for mixed service over 25 years, 1% is added each year). The maximum ratio that an employee can achieve is set at 85% .

Allowances and increases

Didn't find the answer to your question? I can help you

Ruslan Krymov

Lawyer at PensiyaPortal.ru

The legislation provides for pension supplements for the presence of such circumstances as:

the pensioner has dependents (for one person a third of the DD is paid, for two people - two thirds, and for three or more people - 100%);

disability of the 1st and 2nd groups (additional payment of 85% of the DD);

80 years of age of a pensioner - two thirds of the DD;

if a pensioner is a participant in the Second World War, he receives a bonus of 32%, and if he is 80 years old - 64%.

In addition, there are bonuses for length of service.

Salary by position

The calculation takes into account the average salary established for the position you held before retirement. If you calculate your pension using a calculator yourself, you can choose any position from the list proposed by the system, the salary of which will approximately correspond to the income you receive.

Promotion for flight crew class

The legislation stipulates that if an employee of the Ministry of Internal Affairs is also a pilot, he has the right to receive an increased pension relative to the generally accepted amounts of payments to employees of internal bodies.

Regional coefficient

Each region of the country has its own coefficient for calculating pensions, which directly affects its final size. You can find the coefficient for your region in the illustration below.

Reduction factor

This coefficient has a constant value and is established by the state. For example, in 2020 it had a value of 72.23%. The value has not changed over the past two years and slightly changed its value upward only in 2020 to 73.68%. According to experts, this indicator should be abolished by 2035, which will significantly improve the situation with the amount of pension payments.

20 years of service or more

A period of service of 20 years entitles an internal affairs employee to receive a pension in the amount of 50% of the salary he receives at the workplace. Moreover, for each year worked in service, this coefficient is supposed to increase by 3%, until the figure reaches a maximum value of 85%.

25 years of service or more

For those persons who have a mixed length of service in the Ministry of Internal Affairs, the main condition for receiving a pension is 25 years of work experience, 12.5 years of which were spent in service in the bodies. Every year over 25 years adds another 1% to the 50% coefficient.

Peculiarities of assigning pension payments in the Ministry of Internal Affairs system

The retirement of a police officer is subject to certain conditions.

These include;

- having 20 years of service;

- total output for at least 25 years;

- reaching the age category of 45 years;

- long service in the law enforcement department.

If a citizen is fired from the structure in question, then the reason that was taken into account when terminating the employment relationship is taken into account. For example, if the reason was a reduction in staffing levels, then the policeman is awarded a pension.

Factors influencing the amount of pension payments to employees of the Ministry of Internal Affairs

When talking about how to calculate the Ministry of Internal Affairs pension in 2020, it is worth considering certain provisions.

The list includes:

- length of service in the system;

- total output.

In addition, calculating a pension involves taking into account whether the citizen has dependents and whether he received the status of a disabled person while performing his job duties. The amount of the pension is affected by the coefficient established in the area where the policeman worked. If the listed criteria are met, then payments increase.

The legislative framework

The calculation of the Ministry of Internal Affairs pension in 2020 is based on the following laws:

- Federal Law No. 247 of July 19, 2011 “On social guarantees for employees of internal affairs bodies”;

- RF PP dated November 3, 2011 N 878 “On establishing monthly salaries for employees of internal affairs bodies of the Russian Federation”;

- Decree of the Government of the Russian Federation of December 30, 2011 N 1237 “On the size of coefficients and percentage allowances and the procedure for their application for calculating the pay of military personnel”;

- Orders of the Minister of Defense of the Russian Federation No. 288, the Ministry of Internal Affairs of the Russian Federation No. 627, the Ministry of Emergency Situations of the Russian Federation No. 386, the FSB of the Russian Federation No. 369, the Federal Customs Service of the Russian Federation No. 855 dated July 12, 2007 “On measures to improve the work of determining the qualifications of state aviation flight personnel”;

- Law “On the federal budget for 2020 and for the planning period of 2020 and 2021” dated November 29, 2018 N 459-FZ.

Increasing pension benefits for police officers

When calculating police payments in 2020, indexation must be taken into account. This procedure is implemented every year. This applies to the entire population of the country, including retired police officers.

The calculation of the pension of an employee of the Ministry of Internal Affairs indicates the dependence of the amount on the type of social benefit.

It could be:

- payment related to length of service (the increase will occur from October 2020, the salary will increase by 4.3%, in addition, pension accruals will be indexed by 2%);

- benefits assigned to employees who have received disabled status (increased from April 2020);

- for non-working pensioners, the insurance component of the benefit has been increased by 6% since the beginning of the year.

For a working police officer, 2020 does not provide for an increase in the amount of payments.

Additional payments to employees of the Ministry of Internal Affairs in the amount of 2,500 rubles

In order to implement Decree of the President of the Russian Federation No. 604 of 2012 “On further improvement of military service in Russia,” citizens serving in the Ministry of Internal Affairs are assigned an allowance of 2,500 rubles .

This payment became effective in February 2020. The right to receive it is given to persons who have retired through the Ministry of Internal Affairs.

Instructions for use

In order to correctly calculate upcoming or future monetary compensation, it is important for a law enforcement officer to read the instructions for using this system.

Let's take a closer look at how to work correctly with this calculation program:

- The official salary is indicated in advance, which is provided to the employee monthly as a salary.

- Next, the increasing air traffic control coefficient is selected (it is used exclusively for flight personnel).

- After this, the bonus for the rank is indicated (you can select it or specify it yourself if the data does not match).

- The next step is to select the coefficient for the region, as well as the bonus for the total number of years of service of the citizen.

- Next, the length of service for your entire life and the percentage of payments are indicated (this value directly depends on the length of service available).

- A reduction factor must also be indicated (this value depends on a number of individual indicators).

After all fields have been filled in with reliable information, in the lowest item “Amount to be issued in rubles” the exact amount that a law enforcement officer or other law enforcement agency employee can currently claim will be displayed. The online pension calculator of the Ministry of Internal Affairs allows you to accurately determine the required amount of accruals.

Attention ! It is worth noting that to perform calculations it is not necessary to look for the official website of the system, since it is present on many Internet projects, including ours. It is only important to first check the program for relevance and compliance with the current year and the changes made to the legislation.

Example of calculating pension benefits for a police officer

To better understand payment calculation schemes, it is necessary to provide examples of calculation of pensions for military personnel of the Ministry of Internal Affairs of the Russian Federation.

The source data includes:

- according to the length of service of the Ministry of Internal Affairs, he has 24 years (in this case, the bonus will be 1.3 points).

After this, a formula is applied to calculate the allowance paid each month.

- D – amount of allowance;

- Od – salary amount for the position;

- Oz – salary for rank;

- B – length of service.

If the police officer has civilian experience

When a person has a civilian income, a different formula is used for calculation. For example, you can take 27 years of experience.

(0.5 * D) + (0.01 * (OVS – 25) * D) * 0.7368, where:

- D – amount of allowance;

- O – total experience.

Calculations based on the length of service of the Russian Guard

If a citizen has worked in the Russian Guard for 24 years, then for each year he adds 3%. In this case the calculation looks like this:

21970*0.03*4 = 2626.4 rubles.

The National Guard pension calculator in 2020 can only be found on unofficial resources.

The official website does not contain calculation programs.