The non-state pension fund "Diamond Autumn" was created in 1995, the owner of the main stake is the diamond mining company ALROSA. In the winter of 2020, it was transformed into a joint-stock company, and in the fall the organization began to participate in the system of rights of insured persons (DIA).

22 enterprises from various fields of activity took part in Diamond Autumn. The Fund's services are used by 4,500 people, including employees of financial organizations, scientists, doctors and teachers working in the field of diamond mining and agriculture.

Information about the Diamond Autumn Foundation

Diamond Autumn NPF year. The name comes from the main shareholder of the non-state pension fund of the ALROSA enterprise. In 2020, the fund was reorganized into a joint-stock company, and then the organization took part in the system of guaranteeing the rights of insured citizens. The Foundation is engaged in carrying out activities on NGOs and OPS.

The fund's investors include more than 20 enterprises operating in various fields and forms of ownership.

More than 45 thousand employees work under a corporate pension form, among them there are diamond miners, bank employees, scientists, municipal employees, doctors and teachers, and agricultural workers.

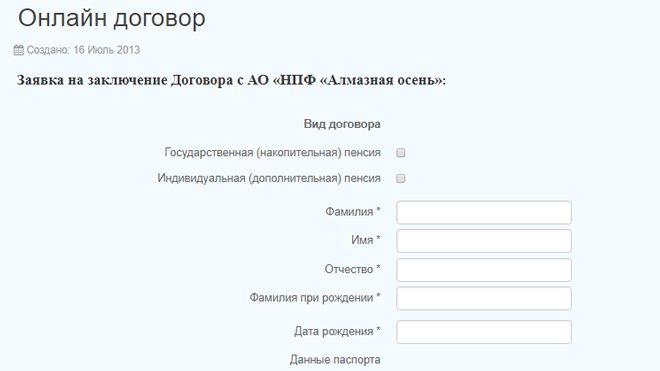

Procedure for registration and termination of an agreement with the fund

In order to conclude an agreement with the fund, you should go to the NPF Diamond Autumn official website and contact specialists. Citizens can connect to a personal plan and create pension capital in additional accounts. After the agreement is concluded, additional payments to pension accruals begin to be made.

List of documents

In order to register a pension with the fund, citizens will need to collect certain documents. The application is written in free form, but it must include personal information and account details for transfers. List of documents:

- statement;

- application for transfer from the Pension Fund to the Non-State Pension Fund;

- certificate 3-NDFL;

- NPF certificate;

- payment details;

- certificate 2-NDFL;

- copy of TIN;

- copy of the passport;

- certificate of funds transfer;

- pension agreement.

Reliability and profitability rating

To understand whether it is worth investing in the company in question, you need to take into account the level of profitability. This indicator is formed due to the accumulation of contributions. Over six months, this organization reached a level of 6.7%. This figure is higher than inflation calculated for the specified time period, amounting to 2.3%.

In addition, the income level of the so-called silent people is exceeded, which was 6.42%. In total, the financial increase is 16%, taking into account contributions made by insured persons and depositors.

It is also required to assess the reliability of the company in question. In particular, the Expert RA agency indicated that the NPF was assigned an AA rating. This indicator is the highest, while the predicted rating is stable. Taken together, these data indicate the stability of the company in question.

To join the ranks of clients of this fund you will need:

- contact the NPF branch;

- use the capabilities of the official website.

The citizen gets the opportunity to make a choice regarding which program will be used to plan savings. This concerns the placement of funds in additional value accounts.

Information on the fund

Detailed statistics

After a person executed an agreement, he received the opportunity to use additional funds in relation to payments associated with retirement. To become a participant in the program, you will need to collect a certain list of documentation . The application is formed in any form, and information of personal significance is specified in it.

You will need to provide information about your deduction number.

Citizens collect the following papers:

- application in a free format;

- application to the pension fund for the transfer of funds to Almaznaya Osen JSC;

- certificates issued in form 3-NDFL;

- accounts for making payments;

- TIN;

- an act by which the identity of a citizen is verified;

- pension transfer agreement.

A citizen who is a member of the fund makes contributions depending on his financial capabilities. The company offers a flexible schedule for depositing funds to replenish the account to form the cumulative part of payments.

To terminate relations with the fund, you will need to issue instructions regarding the withdrawal of funds from your accounts. Money can be placed in a bank account or in another non-state pension fund.

Payment of fees

There are several different ways to claim contribution deductions. All this depends on the situation of the citizen.

The payment of contributions is directly dependent on the financial capabilities of the citizen who is creating pension savings. A flexible replenishment schedule is very beneficial for customers.

If a citizen is going to terminate the contract with NPF Almaz, then he should write instructions on withdrawing funds from the account. Funds can be transferred to another NPF or capital transferred to a bank account.

The application must indicate information about the NPF or bank details for transferring contributions. You can return the money within three months from the date of application. In this case, the investor will have to suffer losses:

- partial profit from the deposit;

- withholding tax 13 transfer costs are paid by the depositor.

Advantages and disadvantages

The strengths of the Diamond Autumn Fund are:

- receipt of a larger amount of money by citizens after investment operations; it is also possible to independently determine the amount of investments and periods;

- the possibility of receiving a pension from the fund;

- insurance against pension reduction;

- preferential tax rate;

- control over funds;

- effective investment;

- transfer of pension savings by inheritance;

- transfer funds to any account.

The fund also has a number of disadvantages:

- problems with the economic situation;

- inability to withdraw funds when starting investment projects;

- savings can only be in one selected currency;

- payment of commission to the fund.

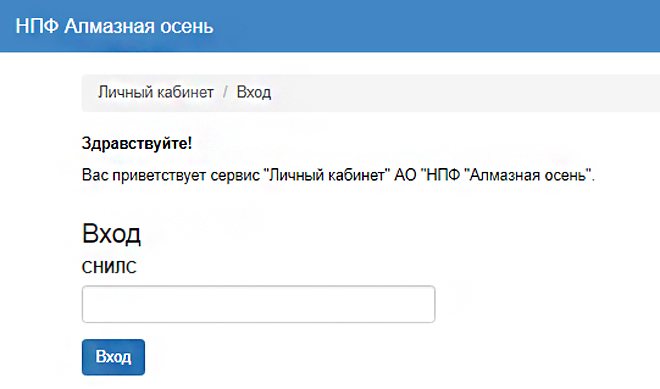

Personal account of NPF Diamond Autumn

In order to get to your personal account, you need to enter the official website of JSC NPF Almaznaya Osen in the search engine. It will help you quickly find information about the status of your accounts.

Personal account features

The personal account is available to participants of the fund’s insurance program, where you can view the availability of funds and their increase, transactions and transfers, and receive news from the Diamond Autumn Non-State Pension Fund.

Registration and login to your personal account

All information for logging into your personal account will be provided by fund employees when completing an agreement and application; you can also register from the official website.

To enter you will need:

- SNILS number;

- phone number.

A message with a one-time code will be sent to the subscriber number to access your personal account.

Vyacheslav Khmyrov: “The main indicator of any fund is payments”

In May 2020, one of the oldest non-state pension funds in Russia, JSC NPF Almaznaya Osen, celebrates its 25th anniversary. We talk about this and the current work of the fund with the General Director of JSC NPF Almaznaya Osen, Vyacheslav Khmyrov.

Vyacheslav Viktorovich, how did it all begin 25 years ago?

In short, a clean slate and the need for a new pension system, an alternative to state provision. We all remember the “mid-nineties” - pensions were not paid, and their size did not reach the subsistence level. The solution was proposed by the largest enterprises, which began to create their own corporate pension programs for their employees. Among them is the diamond mining company ALROSA, our main founder and main investor.

Then, a quarter of a century ago, we started our work in a cramped room with one computer. The pension was paid in cash directly in the office, and communication with pensioners was carried out exclusively through Russian Post. Today, in the age of information technology, communication with the client is carried out by pressing one key. And then letters to the fund’s participants were written by hand and were the “front” of our work for many days.

The mid-nineties was also the heyday of financial pyramids. Was there any mistrust in the fund?

Naturally. Old-timers of the fund still remember what kind of negativity they encountered during presentations of the fund’s services in ALROSA workers’ collectives. Moreover, “MMM” was the mildest epithet addressed to us... The mistrust disappeared with the start of the first payments. As soon as the fund began to actually fulfill its obligations, client queues appeared in our office. Years later, 22 thousand people are already receiving a non-state pension from JSC NPF Almaznuyu Osen. Among them there are even “dynasties” - pensioners of the fund are not only parents, but also their children. I believe that the history of our fund is a visual aid to the history of the formation of the non-state pension fund industry as a whole.

In your opinion, what are the main achievements of the fund over the past 25 years?

A quarter of a century ago we were a narrowly corporate ALROSA fund, and today we are the largest non-state pension fund in the Far East. Then we were on the periphery of the market, and today we are among the leaders. The fund is among the TOP 10 NPFs in Russia in terms of pension reserves (as of 01/01/2020 - 30.4 billion rubles), and for three years in a row (2016-2018) we did not fall below fifth place in the ranking of all NPFs in terms of profitability of pension savings. That is, we managed to achieve not just high, but consistently high performance indicators. Since 2020, the fund has been participating in the Council of the National Association of Non-State Pension Funds (NAPF).

Over the years, we have managed to create a decent map of our pension products for every taste and color: corporate pension programs, individual pension plans, pension savings management. Today you can become a recipient of three pensions from JSC NPF “Almaznaya Osen” at once, plus a pension from the state. This does not require large investments.

But our main achievement is the continuity of pension payments. Over 25 years, we have already paid out more than 16 billion rubles. And every ruble of this amount reached each recipient in a timely manner. Without this indicator, all the other “goodies” of the funds (brand, electronic services, ease of service, etc.) are just a bright showcase.

Speaking of payments. What pension size can the fund's clients expect?

Each of our products has its own accumulation conditions and, accordingly, a different output result. I can only give some examples at the end of 2020. Within the framework of corporate programs, using ALROSA as an example, the average lifetime payment of a non-state pension was 5,907 rubles/month, and under parity conditions - 31,459 rubles/month. Don’t be confused by the last amount, it was formed through joint (parity) investments of the employee and the employer, in which the employee himself chooses how to receive the accumulated amount - for life or close his pension account for a certain period (at least 5 years).

As for payments of pension savings, the amounts are slightly more modest: at the end of last year, the average size of the funded pension of our insured persons was 1,304 rubles/month, urgent payments - 1,682 rubles/month, one-time payments - 186,985 rubles. The amounts could be higher, but due to the freezing of the funded part, this is the ceiling. The average bill of insured persons of NPF Almaznaya Osen JSC is one of the highest on the market and amounts to 168,396 rubles (as of 01/01/2020).

Today, pension funds are going through difficult times. In addition to the freezing of pension savings, there was an increase in the retirement age, a general negative attitude toward non-state pension funds due to losses from the recent reorganization of the largest banks... Does this affect your fund?

In fact, raising the retirement age has passed us by. For funded pensions and non-state pension agreements concluded before 2020, the age remained the same.

As for the “negativity,” we are indeed faced with it today, but this does not affect the work and plans of the foundation. While other, larger funds today are working to retain their client base, our fund continues to show growth, even in the face of “general negativity.” At the end of 2020, we have an increase in clients: +0.8% for compulsory pension insurance, +3.1% for individual pension plans for individuals and +91% for corporate pension programs.

Why, in your opinion, do the services and products of JSC NPF “Almaznaya Osen” remain in demand?

Because people always have a pressing question: how and what to live on in retirement. Over the years of pension reform, the financial literacy of citizens has increased significantly. And when choosing a fund where to store their pension savings, they have long been turning to rankings of fund returns that are publicly available. For the last 3 years we have been consistently at the top of these rankings. And future retirees see this.

But at the same time, JSC NPF Almaznaya Osen is not one of the largest and most recognizable funds.

If we evaluate the effectiveness of the fund by the size of the client base and brand awareness, then the most effective fund is the Pension Fund of the Russian Federation.

What makes Almaznaya Osen NPF JSC stand out from other NPFs?

It is very difficult to stand out because all funds offer identical products. But unlike most large funds, we do not engage in aggressive marketing or work with agents. Our advertising is the real results of our work and maximum transparency. Back in 2020, we were one of the first to begin to disclose in detail on our website information on profitability and our investment portfolios, including information on issuers.

And also NPF “Diamond Autumn” is the easternmost NPF. When our colleagues from other NPFs are still preparing for the New Year, we are already in the New Year. We are always several hours ahead.

The 25th anniversary of JSC “NPF “Diamond Autumn” coincided with a difficult epidemiological situation in the country and in the world. In what mode does the fund operate today, and what consequences, in your opinion, can this situation have for the financial market?

During the period of non-working days declared by the President of the Russian Federation, the fund switched to a limited mode of operation - we try to interact with our clients remotely, and we strongly recommend that pensioners not leave their homes and use electronic services on the fund’s website. Today, the Personal Account on our website includes the entire range of pension services and full-fledged work on remote interaction has been established. For us, this is a kind of serious test of working in conditions of developed information technology.

Regarding the consequences for the financial market where the funds of NPF clients are placed, I can only say one thing: NPF “Diamond Autumn” is ready for any market decline, so our clients should not have any concerns. Over a quarter of a century, the fund has seen a lot, and the behavior of the Russian financial market can no longer take us by surprise.

What words do the employees and clients of the NPF “Diamond Autumn” deserve on the occasion of the 25th anniversary of the fund?

The team of NPF “Diamond Autumn” includes not just professionals, but also like-minded people. Our team is small, only 70 people, but with it you can take on any cities and fortresses. We even have employees who have had only one entry in their work books over the past 25 years – NPF “Diamond Autumn”. I wish the entire staff of the foundation new professional achievements, and most importantly, that prosperity and peace reign in their families. When an employee is doing well at home, he does not need any motivation at work.

And on behalf of myself and my colleagues, I wish our pensioners good health! And so that they never feel lonely, deprived of the attention of loved ones. Among our pensioners there are veterans of the Great Patriotic War. A low bow to them for the Victory and for a peaceful sky. Exactly 75 years ago they fought for us, and today we work for them.

other materials No. 2 (42) April-June 2020 Issue 2. JSC NPF “Diamond Autumn”

Zargaryan Ivan Viktorovich Editor-in-Chief

No. 2 (42) April-June 2020 Issue 2. JSC NPF “Diamond Autumn”

Contact Information

Head office: 678170, Republic of Sakha (Yakutia), Mirny, Komsomolskaya str., 16

Reception: (411-36) 3-27-58

Opening hours: daily, except weekends, from 8.30 to 18.00 (lunch from 12.30 to 14.00)

The last Saturday of the month is working, from 10.00 to 15.00

Official website: https://npfao.ru

Personal account: https://lk.npfao.ru

Hotline number

Press center

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 2

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 3

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 4

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 5

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 6

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 7

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

Page 8

To register on the site as a Legal Entity, please fill out a file with information about the company and send it to the email address

Download company information file template

npfao.ru