Retirement age

Retirement in the country depends on the following factors:

- seniority;

- job title;

- gender identity.

As in the Russian Federation, women pensioners in Kazakhstan retire earlier than men.

In accordance with the Law “On Retirement Age”, citizens with a certain length of service are entitled to receive benefits. The higher it is, the more substantial the payout.

In order to receive a pension based on length of service, a person undertakes to work for a certain amount of time. The minimum for men and women will vary. Women must work for the state for 20 years. It is possible for men to receive a well-deserved retirement only after 25 years of continuous service.

Today, the retirement age for women is 58 years, for men – 63 years.

Plan to raise the retirement age in Kazakhstan

Until 2027, it is planned to gradually increase the retirement age for women. Starting in 2020, the release schedule will gradually shift and increase by 6 months.

In 2027, women will also retire at 63.

You can find out about the retirement age and pension amount in the CIS countries on our website.

Return to contents

Everything about funded pensions in Kazakhstan

With the introduction of the savings system, each employer is obliged to transfer contributions to an individual PF account. The amounts can be viewed in your personal account on the UAPF. The following persons may apply for payments from this fund:

- who have reached retirement age;

- having sufficient funds for an annuity in the amount of the minimum pension;

- those who received disability of groups 1 and 2 indefinitely;

- those who moved outside the Republic of Kazakhstan for permanent residence.

Before 2020, a citizen himself could set the frequency of receiving amounts; after that, only monthly. To calculate the amount of payments, there are special formulas and a minimum (54% of the minimum wage). If the collected amount in an individual account does not exceed 12 minimum pensions, then it can be received at a time.

Payments are made until all savings are fully used and there are guarantees from the state for safety, taking into account the level of inflation. The remaining amount in the event of death is inherited by law.

If the accumulated amount allows you to buy a pension annuity, then it is transferred to the insurance company and payments are received. An annual indexation of 5% is provided, which is not included in the Pension Fund. If there are insufficient funds, you can deposit them in any way and then enter into an agreement with the insurance company. The Pension Fund must check it and only then transfer the required amounts.

If there are enough funds, then those who exceed the annuity leave it in the UAPF and receive benefits from there. The contract with the insurance company is concluded for a certain period or for life. After the time expires, payments stop. In case of death before the end of the established period, the heir receives the amount.

Interesting from BBQcash: the insurance company can pay a certain percentage of the amount one time.

The payment schedule is established in the contract.

Voluntary pension

This is a type of funded pension, but voluntary. It is received by citizens who have made additional contributions to the UAPF or another fund from their own funds. The concluded agreement determines the frequency and duration of payments.

Early retirement

Early retirement is relevant for the following categories of citizens of the Republic:

- Kazakhstanis who were born in the period from 08.29.49 to 07.05.63, who have lived in environmental risk zones for at least 5 years and whose health has been compromised due to testing at the Semipalatinsk test site.

- Males whose age by 01/01/98 was 50 years old and whose work experience was 25 years.

- Females whose age by 01/01/98 was 45 years old and whose work experience was 20 years.

A mother of many children can also retire early. By the age of 53, a mother with many children needs to have time to give birth or take care of more than 5 children and raise them until the age of eight.

Pension system of the Republic of Kazakhstan

Return to contents

Calculation of work experience

When assigning an old-age pension, the following types of activities are taken into account:

- Service in the Ministry of Internal Affairs.

- Military service.

- Business activities.

- Caring for a disabled parent.

- Caring for a disabled child.

- A non-working mother caring for her small child.

- Caring for any other disabled relative of group 1, as well as groups 2 and 3.

- Caring for any unrelated person who has received a disability pension.

The period of joint life of spouses serving in the Ministry of Internal Affairs and living in areas where there was no possibility of their employment is also taken into account. The same applies to all military personnel, except conscripts. Length of service is also taken into account.

And studying at the institute is also taken into account.

Average pension in the Commonwealth countries and Georgia

Return to contents

Preferential calculation of length of service

To apply for an old-age pension when calculating preferential length of service, the following is taken into account:

- military service for the period of hostilities;

- participation in the Second World War;

- work in infectious diseases institutions;

- participation in mining events;

- service in the police or military in the regions adjacent to the Semipalatinsk test site;

- work on water transport.

Return to contents

Social payments

Social benefits from the State Social Insurance Fund increase every year.

Video material about social payments in Kazakhstan:

Survivor's pension

Family members have the right to receive social benefits in the event of the loss of a breadwinner.

The pension is assigned:

- Persons under 18 years of age (children, brothers and sisters - if they do not have parents);

- Persons over 18 years of age if they have a disability that appeared before they turned 18;

- Persons studying full-time at any secondary or higher educational institution (up to 23 years old);

- Relatives of the deceased who are raising his child/children (up to 3 years old);

- Guardians (per child for each lost parent).

The survivor's pension is calculated from the number of disabled citizens living in the family:

| Number of disabled family members | Amount (tenge) |

| 1 | 21 035 |

| 2 | 36 444 |

| 3 | 45 250 |

| 4 | 47 940 |

| 5 | 49 652 |

| 6 or more | 51 609 |

The amounts depend on the subsistence level (subsistence level). For family members of military personnel, the amount of payments increases by 0.25 monthly wages for each member.

Disability pension 1st group

Disabled children (from 16 to 18 years old), disabled since childhood, disabled people with general illness receive a benefit in the amount of 1.78 monthly wages. Military personnel, special services workers:

- 1.78 PM – for disability received outside of working hours;

- 2.74 PM - for disability received in the performance of official duties.

Conscripts - 2.11 PM. In addition, disabled people of group 1 have the right to receive a Special State Benefit:

- 1.49 MCI – disabled people with general illness, disabled children (16-18 years old);

- 0.96 MCI – disabled children (under 16 years old).

The amount directly depends on the PM coefficient, which increases every year.

Types of pension payments

The main types of pension contributions are presented in the table.

| Type of pension | Description |

| Basic | All Kazakh pensioners receive it, regardless of their length of service and deductions. The size of the basic pension today is 15.2 thousand tenge/30 calendar days. |

| Solidarity pension in Kazakhstan | Paid to those Kazakhs and representatives of other nationalities whose work experience before 1998 was 6 months. |

| Cumulative | This is a new type of pension, which Kazakhstanis began to receive in 2014. Payments of savings occur either once or every year or month. In the first case, the maximum amount should not exceed 249 MCI. |

Return to contents

News about pension increases

The rise is carried out in 3 smooth steps:

- As of July 1, 2020, the labor pension increased by 11% (of which 9% in January), the basic pension by 13% (of which 7% in January);

- The second stage begins on January 1, 2020, with the plan to increase the basic pension to 16%;

- The next step will come into force on July 1, 2018. It will directly affect the basic pension payment. The payment amount will be based on the years worked before 1998. and mandatory pension contributions.

It is planned to gradually increase the percentage of mandatory pension contributions - which will directly affect pensions. The employer will be required to pay 5%. These contributions cannot be withdrawn from the fund; they will be paid along with the pension (as opposed to the 10% mandatory contributions). The size of pensions and benefits in Kazakhstan will be doubled, watch the video for more details:

How pension payments are calculated

The size of pensions in Kazakhstan is gradually increasing. A recalculation of the amount awaits those who receive a basic pension.

Increasing labor pensions in Kazakhstan

You can find out the approximate size of the minimum pension calculated using the new formula using an online calculator.

Read on our website: average pension in European countries.

Return to contents

Calculation of basic pension

Today, the size of basic pension payments is 50% of the monthly minimum. After the increase, its percentage will vary from 53 to 100% of the PM.

Social benefits will be accrued on the basis of work experience that was developed before 01/01/98. Also, the calculation will take into account the period of receipt of pension contributions to the funded part of the PS after 1998.

With ten years of work experience, the pension in Kazakhstan will be 54% of the monthly salary. For every 12 months over ten years of experience, 2% will be added.

The basic pension is calculated based on the total length of service.

Return to contents

Calculation of joint pension

The calculation of the joint pension is carried out on the basis of 2 indicators: length of service and average monthly income.

Amount of joint pension in Kazakhstan

You can calculate the second indicator for 36 months of work by dividing the total income for all 3 years by 36.

The size of the joint pension is calculated at 59% of the average monthly profit of a citizen of the Republic of Kazakhstan for any 36 months from 01/01/95.

In accordance with the new calculation of pensions in Kazakhstan, every 12 months. length of service, pension payments will be recalculated and increased by 1%. You should know how much it will be in the end: the average pension in the Republic will be 74%.

Return to contents

Minimum and average size

In accordance with the law on pension provision, an indirect minimum of joint pension payments was determined. It's called the "minimum wage". This is the lower guaranteed limit for Kazakhstanis who have the required work experience.

The minimum pension today is 38,636 tenge. Considering that pensions in Kazakhstan are now calculated according to a new scheme, after summing up all the coefficients, the average pension amount is 85 thousand tenge. The maximum pension after indexation is 117 thousand tenge.

Moreover, according to the new calculation of pensions, both basic and joint payments will be taken into account.

For those Kazakhstanis who are already on a well-deserved retirement, in 2020, in accordance with the new procedure for calculating pensions, the increase in the basic benefit will be made automatically. No special certificates are required to be submitted to the state pension payment center.

Return to contents

WE CALCULATE YOUR PENSION

1 287

How to calculate your future pension? If at the time of retirement a person does not have enough work experience, then what will be the amount? What will determine the size of the basic pension, and who will receive the additional 5 percent? At the numerous requests of our readers, we asked the deputy head of the department for control and social protection of the population, Manshuk Lepesova, to answer these and other questions regarding pension provision.

— Tell us, what is a pension in Kazakhstan? — A pension is a set of pension payments from an authorized organization, the Unified Accumulative Pension Fund, or a voluntary accumulative pension fund. The calculation of pensions, their size and payment procedure is regulated by the Law of the Republic of Kazakhstan No. 105 of June 21, 2013 “On pension provision in the Republic of Kazakhstan”. All citizens of the Republic of Kazakhstan, as well as foreigners and stateless persons permanently residing in the territory of Kazakhstan, have the right to pension provision. Kazakhstan has a mixed pension system, which consists of a solidary (labor) pension system, a funded system and a basic pension. On June 18, 2014, No. 841, the Decree of the President of the Republic of Kazakhstan “On the Concept of further modernization of the pension system of the Republic of Kazakhstan until 2030” was signed. The concept was developed in pursuance of the instructions of the Head of State, voiced in an address to the people of Kazakhstan on pension reform issues dated June 7, 2013. The main goal of the Concept is to ensure adequate pension payments. The concept provides for the development of a three-tier pension system, which will include:

1) A basic pension provided by the state and aimed at reducing poverty and stimulating citizen participation in the pension system. Currently, the basic pension is assigned in the same amount to all citizens who have reached retirement age, regardless of length of service and salary. In contrast to the current procedure for assigning a basic pension, it is planned to assign a basic pension depending on the length of participation in the system and when citizens reach the generally established retirement age. Thus, according to these changes, from July 1, 2017, the basic pension will be assigned only when citizens reach the generally established retirement age and depending on the length of participation in the pension system. If citizens have less than 10 years of experience in the system, they will be provided with a social pension equal to 50% of the subsistence minimum; for each year over 10 years, its size will increase by 2%, and with 35 or more years of experience, it will be equal to the subsistence minimum. . This will solve the problem of three generations of participants in the pension system. The first generation includes established retirees who receive a minimum pension, have a long work history, but did not provide information on income due to their absence at the time of retirement, as well as due to legislative restrictions. From July 1, 2017, this category of pensioners will undergo a one-time recalculation of the basic pension, taking into account the length of participation in both the joint and funded pension systems. The second generation is people who reach retirement age before 2043 and have an incomplete record of participation in both the joint and funded pension systems. They will be assigned a basic pension depending on: 1) their work experience accumulated as of January 1, 1998; 2) the period of payment of pension contributions to the funded pension system after 1998. The third generation is people who will retire after 2043 and receive a basic pension depending on the amount of savings. A basic pension will be assigned in the event that their pension amounts received from other components of the pension system are lower than the established socially acceptable level of pensions.

2) The second component of the pension system will be a pension from the new conditional savings system, which is formed from 5 percent contributions by employers in favor of their employees. For each participant in the system, an individual pension account is opened in the UAPF, on which the amount of transferred contributions or pension savings is recorded. They are conditional and are not the property of the system participant. The pension amount is determined as pension savings divided by the life expectancy ratio. A pension is assigned when citizens reach the generally established retirement age and have at least 5 years of experience in the system. It is paid for life and is not inherited.

3) The third component will be pensions from the current funded pension system. They are formed from 10 percent mandatory contributions from the employees themselves. At the same time, the amount of pension payments received will depend on the participation and regular deductions of citizens’ contributions, as well as on the level of profitability of pension savings. For persons employed in hazardous working conditions, from January 1, 2014, in addition to the mandatory pension contributions of employees, mandatory professional pension contributions (OPPV) in the amount of 5% of the wage fund were introduced. Moreover, employers deduct OPPV only for those types of production that are classified as hazardous, and only to those persons who are employed in them. The list of types of hazardous industries and the list of professions of workers employed in them is approved by the Government of the Republic of Kazakhstan and will be periodically revised taking into account changes in working conditions. In addition to all this, joint pension payments are maintained for both established pensioners and citizens with at least 6 months of work experience as of January 1, 1998. The assignment and payment of solidarity pensions will be carried out in accordance with current legislation, along with basic, conditionally funded and funded pensions. — At what age can a person count on a pension? — Currently, men retire at 63 years old, women at 58 years old. Women who have given birth to five or more children can count on retirement at age 53. From 01/01/2018, the age of women will increase by 6 months annually for ten years, and from 01/01/2027, pension payments will be made to women upon reaching 63 years of age. Currently, men receive a full pension from the solidarity system if they have 25 years of work experience, and women - at least 20 years before January 1, 1998. — How is the old-age pension calculated (calculated) in Kazakhstan? — Pensions are calculated in full from the Center at the rate of 60% of average monthly income. To calculate income for calculating a pension, you need to divide the total amount of income for any 3 years (36 months) of work in a row, regardless of breaks in work since January 1, 1995, by thirty-six. Income for calculating pension payments from the Center cannot exceed the 41st monthly calculation index, the amount of which is currently 1,852 tenge. (41 x 1,852 = 75,932 tenge). Income for calculating the pension amount has been accepted since 1995, tenge in Kazakhstan since November 1993. The amount of average monthly income for the period from January 1, 1998 is established according to the income from which mandatory pension contributions were made to savings pension funds in the manner determined by the central executive body in the field of social protection of the population. The amount of pension payments for each full year worked before January 1, 1998, in excess of the required length of service, increases by 1 percent, but not more than 75% of the income taken into account for calculating the pension. The maximum amount of pension payments cannot exceed 75% of 41 times the monthly calculation index (56,949 tenge). — Please give an example of calculating a pension. — Let’s say a man was born on July 1, 1951, upon reaching 63 years old, applied for an old-age pension, works, total work experience as of January 1, 1998 is 28 years, average monthly income for the period from 2011 to 2013 is 87,000 tenge. To calculate the income of 87,000 tenge, we take into account the limitation of the 41st monthly calculation indicator and get 75,932 tenge (41 x 1,852 = 75,932). We multiply by 63% of the average monthly income for 25 years (this is added to 60% by 3% for each year of excess work experience). As a result, the man will receive a pension in the amount of 47,838 tenge, to which the basic pension will be added. — What is the size of the basic, minimum and maximum pension in Kazakhstan in 2014? — According to the Law “On the Republican Budget for 2014-2016”, from April 1, 2014, the following pension amounts have been established in Kazakhstan: . basic pension - 10,450 tenge; . minimum pension - 21,736 tenge; . maximum pension - 56,949 tenge. — Who is paid the minimum pension? — The minimum pension is assigned if there is sufficient length of service, but there is no or insufficient income to calculate the pension. — Let’s say a person has reached retirement age, he has some work experience, but before retirement he didn’t work anywhere for five years. Or, on the contrary, a person has some experience, but there was a long break in work and only a year or two before retirement he got a job. How is the old age pension calculated in this case? What will determine the size of the pension in this case? Give an example. — The size of the pension depends on length of service and salary. The amount of the old-age pension in the absence of the required work experience is calculated as a share of the full pension in proportion to the existing work experience as of January 1, 1998. For example: a woman has 10 years of work experience as of January 1, 1998, no income, pension amount is 10,868 tenge, that is, 21,736 x 120: 240 = 10,868 tenge (21,736 tenge is the amount of the minimum pension, 10 years - 120 months , 20 years = 240 months). A woman with the same length of service, but with an average monthly income of 70 thousand tenge, has a pension of 21,000 tenge, that is, 42,000 x 120: 240 = 21,000 tenge (42,000 = 60% of 70,000 tenge, full pension). — Who gets a pension on preferential terms in Kazakhstan? — The following are entitled to a preferential pension in Kazakhstan: . women who have reached the age of 53, who have given birth (adopted) five or more children and raised them up to the age of eight; . citizens who lived in zones of extreme and maximum radiation risk during the period from August 29, 1949 to July 5, 1963 for at least 5 years are entitled to pension payments: - men - upon reaching 50 years of age with a total work experience of at least 25 years as of 01/01/1998; - women - upon reaching 45 years of age with a total experience of at least 20 years as of 01/01/1998. — What is included in the length of service for calculating an old-age pension? — When calculating the length of service for assigning a pension from the Center, the following are taken into account: . work under employment contracts, paid by individuals and legal entities; . military service; . service in law enforcement agencies; . public service; . entrepreneurial activity; . the time a non-working mother cares for young children, but no more than until each child reaches the age of 3 years, within 12 years in total; . training in higher and secondary specialized educational institutions, in colleges, schools and courses for personnel training, advanced training and retraining, in graduate school, doctoral studies and clinical residency, as well as in full-time higher and secondary religious educational institutions on the territory of the Republic of Kazakhstan and beyond it outside, etc.

Natalia URAZGALIEVA

Payments to military and police

The increase in pensions in the country will also affect former military personnel and employees of the Ministry of Internal Affairs.

Before the pension reform, benefits for former military personnel were paid from the age of 45. This is also the case today. Pensions in Kazakhstan for military and former employees of the Ministry of Internal Affairs will be calculated in accordance with:

- length of service;

- disability;

- having mixed experience.

The amount of benefits for this category of citizens is gradually increasing from 2020.

Providing military housing in Kazakhstan

In 2020, the year worked will be assessed separately. This is due to the introduction of the GPC - the annual pension coefficient.

In addition to the basic benefit, former military and police officers can count on additional funds. The amount of the pension supplement is indicated in the tablet.

| Category | Supplement amount |

| WWII participants under 80 years of age | 31% |

| WWII participants over 80 years old | 41% |

| Disabled people over 80 years old | 100% |

| Non-working persons of retirement age with dependents | 33–100% |

The total indexation volume in 2020 was 7–8%.

Return to contents

Pension calculation, minimum and average amount

For those citizens who apply for payments, the pension consists of three parts:

basic + labor (or solidarity) + funded

Starting from 2020, the minimum basic payment amounted to 16,037 tenge. It is entirely determined by the length of service and the living wage established by the state.

With less than 10 years of experience, the basic part of the pension will be 54% of the subsistence level. Each year worked after the required length of service gives an increase of 1%. After working for more than 33 years, basic payments will be 100% of the subsistence level.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The minimum solidarity payment in Kazakhstan from 2020 will be 36,108 tenge. The average size of all payments will be 101,000 tenge.

Indexation of other payments

In accordance with the law of the Republic of Kazakhstan “On social benefits for disability, loss of a breadwinner and age in the Republic of Kazakhstan”, benefits for the loss of a breadwinner in the country are assigned and paid to disabled members of his family.

First of all, this concerns children with disabilities of groups 1, 2 and 3.

Survivor's benefits are provided for the entire period during which a family member of an untimely deceased person is considered incapacitated.

A person applying for benefits must present a photocopy of any document that confirms a family relationship with the deceased:

- Marriage certificates.

- Document establishing paternity (maternity).

- Identity cards.

More detailed information can be obtained by contacting the state pension payment center. It will also be possible to clarify whether payments will increase in the near future.

Another point where you can get reliable information is the Department of Control and Social Protection of the Population. You must apply strictly at your place of stay.

Return to contents

How to transfer a pension from Kazakhstan to Russia

Moving for permanent residence to another country automatically gives the right to stop payments from the Kazakhstan Fund. Upon arrival in Russia, the pensioner should contact the local Pension Fund for new registration.

To submit documents you need citizenship, or at least a residence permit!

The Pension Fund of the Russian Federation calculates pensions in accordance with the norms of Russian Legislation. To register, you must provide a passport and work book, after which a request is sent for an early place of residence to receive an existing pension file. After receiving it, a new pension is issued.

Possibility of benefit transfer

A person who wants to move to Russia or any other country has the right to withdraw his pension savings. The main criterion is the correct registration of permanent residence.

Today, a pension agreement is being developed between the member countries of the Eurasian Union. In accordance with it, the transfer of a monthly pension payment is possible when changing citizenship within the union. Return to contents

Agreement between the CIS countries

The issue of pensions for migrants from one country to another is regulated by the Agreement, which was signed in 1992.

The following principles of this agreement are highlighted:

- funds are paid in accordance with the legislation of the country in which the pensioners live;

- the costs of payments fall on the shoulders of the home state;

- benefits are assigned only at the place of residence.

Work experience includes all years of work recorded in the territory of any of the CIS countries that signed the agreement.

Labor migration and social security of citizens in the EAEU

Return to contents

How to transfer benefits

In order to transfer your savings to the territory of the Russian state, you will need to prepare a list of certificates in advance. The next steps are as follows:

- It is legal to cross the border of the Russian Federation.

- Register with the territorial Federal Migration Service.

- Apply for a residence permit.

- Notify the Pension Fund of the Republic of Kazakhstan about the change of place of residence.

- Withdraw from the pension register in your home country.

- Send a list of documents related to work experience to the Russian pension fund.

Transfer of benefits to migrants is carried out only after employees of the special commission have examined the pension file of the applicant and confirmed the accuracy of all documents provided.

Payments are transferred to the card of one of the Russian banks. But money can also be transferred to a pensioner by mail. The procedure is provided for by Russian law.

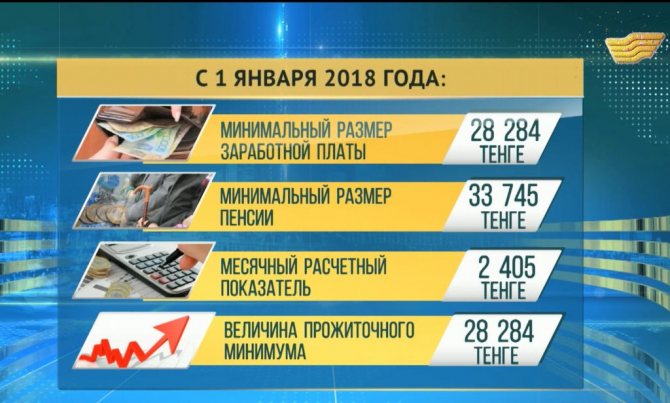

Changes in the minimum subsistence level in Kazakhstan

Return to contents

Registration of benefits

The following documents are required to apply for a pension:

- residence permit;

- identification document;

- work book, which records the work experience;

- a certificate from the Pension Fund of the Republic of Kazakhstan confirming that the migrant does not receive any payments;

- certificate from the place of residence in the Russian Federation;

- a document fixing the amount of contributions from the insurance fund.

If a migrant or refugee needs a pension, then a certificate confirming his status will need to be attached to the main list of documents.

Read on our website: receiving a pension with a residence permit in Russia.

In accordance with the Agreement adopted in 1992, legalization of certificates for submission to the Russian pension fund is not necessary.

Return to contents

What amount is paid

Recalculation of payments is carried out on the conditions presented in the table.

| Type of benefit | Conditions |

| Due to old age. | The applicant must be over 58 years of age. Work experience – from 15 years. The pension coefficient must be 30 points. |

| Due to disability. | To carry out the recalculation, the applicant will need to go through the MSEC again. Disability is confirmed on the territory of the Russian Federation. |

| For the loss of a breadwinner. | The first step is to confirm the death of the breadwinner. Then all documents proving the fact of relationship are presented. |

| According to length of service. | It is necessary to provide proof of work in hazardous work. |

Regardless of the grounds, the pension includes insurance and fixed payment.

Return to contents

Moving

On the territory of Russia there is an agreement on guaranteeing the rights of citizens of the CIS countries in the field of pension accrual.

Citizens of Kazakhstan working under an employment contract in Russia apply for SNILS. This is necessary to take into account the length of service when applying for a pension, to receive benefits in your state or in the Russian Federation.

Migrants are paid a pension according to the laws of the state where they live. When calculating, all length of service earned in the CIS is taken into account. Moving to permanent residence and obtaining Russian citizenship will entail the termination of payments in Kazakhstan. It is necessary to complete the transfer: they receive a pension file and submit all the required documents to the Pension Fund of the Russian Federation.

Staying on the territory of Russia with a temporary residence permit allows you to receive a Kazakhstani pension on a bank card and withdraw it in the Russian Federation.