Pension system

My mother is moving to live with me in St. Petersburg from Nizhnevartovsk.

Her pension there was 15 thousand (with the regional coefficient). Will she have some kind of coefficient here or will her pension decrease significantly? Sergey Vinyarsky, Master (124), 38 days ago The fixed basic size of the labor pension (the part of the pension established in a fixed amount) is always revised when leaving the northern territories to the usual area. AV Freiman, Advanced (90), 37 days ago That is, then the size of the pension really will not change.

The maximum amount of old-age pension in the year St. Petersburg

- in the Pension Fund office at the place of residence, - in the Personal Account of the insured person (via the Internet), - by mail (the day of application will be considered the date of sending on the postmark); within 10 working days from the day of receipt of the application with all necessary documents or from the date of submission of the missing documents (if they were submitted within three months).

In the Novosibirsk region, the minimum wage is set at 8,300 rubles, in Omsk - 8,217 rubles, in St. Petersburg - within 8,400 rubles. Pensioners in Kamchatka today have the highest amounts of old-age cash benefits – about 15,500 rubles. Average values for the regions of the Russian Federation: for residents of Moscow and the Moscow region - 13,470 rubles, the minimum figure - in the Chechen Republic - 8,000 rubles.

This is interesting: Pension for unemployed people in 2020 Latest Presidential Decisions

Pension in St. Petersburg and Leningrad region

This state assistance is provided only to those who permanently reside in Russia. This year, applications for pension payments are accepted at both state and municipal institutions.

Citizens who have Russian citizenship can apply for pension payments.

Serdobolskaya, building 2B, telephone for inquiries: + 7 (812) 303 66 92; Kondratyevsky Avenue, building 12, telephone for inquiries: + 7 (812) 305 19 89; Ogorodny Lane, building 15.

The size of the minimum pension in Russia in 2020

- women over 60 years of age and men over 65 years of age who have at least 15 years of experience, which must be confirmed by entries from the work book, as well as the presence of an IPC of at least 30;

- representatives of small nationalities of the Far North (women - from 50 years old, men - from 55).

Life will tell whether this system will be successful. But experts are already predicting a decrease in labor pensions by 10.5% for citizens who were born after 1967 due to a number of incorrect measures regarding pensions. For example, pension savings frozen three times, although they saved a certain amount of money for the government, at the same time led to a deficit of more than 1.5 billion rubles this year. in the form of prolonged investments. Because of this, the growth rate of production has decreased, which cannot but affect social benefit payments.

09 Jun 2020 uristlaw 338

Share this post

- Related Posts

- Do Labor Veterans of Federal Significance Have Benefits for Travel on Long-Distance Railway Passenger Trains from N Novgorod

- Labor veteran of the Lipetsk region benefits

- Governor's payments for the second child Volgograd

- How to Get a Donor Book

What are the benefits for pensioners in St. Petersburg and the Leningrad region in 2019?

Regional authorities are not obliged to establish additional preferences, but this is how the prestige of life in a particular administrative unit and the degree of pleasure of citizens increase. Federal benefits These are preferences that are guaranteed by law for each of the pensioners who have Russian citizenship and live in Russia.

Everyone knows about such benefits, since they occur every day in everyday life.

Moreover, federal benefits are more global in nature than regional ones, and are aimed at financing the travel of pensioners on public transport, as well as paying off the cost of their medications and expenses for other benefits. State support is good because it is provided to people throughout Russia, without differences in place of residence, specific region and even regardless of income.

Basic social benefits and benefits for pensioners of St. Petersburg

This category of preferences includes all additional payments, subsidies and benefits that are implemented using funds from the city budget.

Social assistance for pensioners consists of the following components:

- Monthly cash payments;

- Standard list of benefits;

- Benefits for bearers of the award “Resident of besieged Leningrad”;

- Tax deductions and benefits;

- Subsidies for housing and communal services;

- Social benefits.

Let us consider in more detail what additional payments and benefits are available to pensioners in St. Petersburg, as well as the conditions for the provision and implementation of all of the above preferences.

Will the size of the pension decrease when moving from St. Petersburg to the Leningrad region?

The government has not yet commented on this initiative. On April 1, 2019, all social benefits and payments from the budget were indexed by 4%.

Earlier, on February 1, pensions for all pensioners increased by the same 4%, with the exception of those who continue to work. The Ministry of Finance and the Central Bank are preparing a proposal to switch to a system of voluntary pension accumulation.

Instead of the current deduction system, Russians will be offered to independently contribute up to 6% of their annual salary to the fund for future pensions.

Maximum old-age pension in 2020 St. Petersburg

Today, the minimum pension in Russia from January 1, 2020 is just under 5 thousand rubles. We are talking about social benefits in old age. Hello! I am now 54 years old, and in a month I am going to retire by age, as I will turn 55 years old.

This is interesting: Documents for Removing Encumbrances in the Form of Long-Term Lease

- application for a pension, - identification documents, age, place of residence, citizenship, - work record book, - insurance certificate of pension insurance (“green card” of the Russian Pension Fund).

Minimum pension 2020 in St. Petersburg: table

Since January 1, this amount has not increased.

This figure is taken into account by officials when assigning a social supplement to the pension payment.

Please note that since local officials can also pay cash for elderly people, the amount of the minimum pension is not the final amount. In some cases it can be 2 or even 3 times higher.

The size of the minimum pension in 2020 in each region is also based on the subsistence level.

Such data indicate how much pensioners need to ensure a decent standard of living.

This amount is included from the requested funds for the purchase of essential products, payment of utilities and purchase of hygiene products.

Elderly people in St. Petersburg are applying for monthly payments in 2020.

Pension coverage for residents of St. Petersburg and the Leningrad region in 2020

The difference between the minimum and the pension amount increases by a factor of 1.15. For some groups of beneficiaries, preferences are provided, paid from the local treasury. They are as follows: provided:

- 90% discount on tickets for suburban railway transport during the “dacha” period (from April 27 to October 31); utility bills reduced by half; free dental prosthetics and treatment;

All pensioners without exception are entitled to:

- preferential use of public transport; free provision of services:

- medical institutions; dental prosthetists; social service enterprises;

- social taxi services; annual free health voucher; benefits for transport services; free prescription drugs; reduction in utility rates by 50%.

Monthly social payment in St. Petersburg

It is defined by city law No. 589-79 of November 24, 2004, which establishes social support measures for certain categories of citizens. In accordance with Art. 7 of this law, the Unified Social Security is provided in the amount of the difference between 1.15 of the usual subsistence level established in the region for the quarter preceding the month of applying for additional payment and the amount of pension provision.

The Unified Social Security is paid to the following pension recipients:

- aged 60 years and older;

- disabled people of groups 1 and 2;

- women aged 55 to 60 years who have stopped working.

In this case, the fact of termination of employment is decisive only for one category of recipients.

Living wage and minimum wage in the Leningrad region from January 1, 2020

The difference between registration in St. Petersburg and the Leningrad region

Malinkka 06/28/2009, 02:30 It seems that the author is asking about registration, and not about the features of residence. St. Petersburg is not 50 thousand rubles cheaper Verochka 06/30/2009, 14:04 and what do they now give fifty dollars for a birth? And if the child is not the first, then the amount is much higher.

For the third, 37,000 one-time (and other benefits are more), + in the city there are many other benefits for families with many children that are not available in the region. The same museums, have you been to Peterhof for a long time, at least?

To go there with a family of five, you will only have to pay 500-700 rubles for tickets to the park, but for those from St. Petersburg there are benefits. I’ll sing right now 06/30/2009, 2:32 pm And if the child is not the first, then the amount is much greater.

For the third, 37,000 one-time (and other benefits are more), + in the city there are many other benefits for families with many children that are not available in the region. D" (from 09.00 to 21.00 seven days a week, informational.

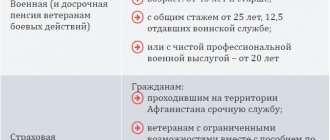

Pension rights of citizens living in difficult climatic conditions

Individuals who live directly in the territory of the Far North and territories equivalent to them are entitled to some preferential conditions when receiving a pension.

Early retirement

Early payments of insurance pension benefits. If the work experience in the above-mentioned areas was at least 15 - 20 years, then women can count on early appointment upon reaching the age of 50 years, men - 55 years. (from 2023, 55 and 60 years, respectively) Persons who have worked in the listed territories for at least 7.5 years can be assigned a pension early (relative to the generally accepted retirement age in the Russian Federation) 4 months earlier based on the results of each year of work. You can read more about early retirement here.

Increase in fixed payment

These citizens also have the right to an increase in the fixed payment in relation to one of the types of pensions (disability, loss of a breadwinner, old age). The increase occurs by a specific indicator, called the regional coefficient, adopted by the Government of the Russian Federation for the entire period of residence in such areas.

If a pensioner decides to move to another place of residence, the coefficient will be revised relative to the new region of residence. Fixed payments can be established regardless of the subsequent place of residence. But in this case, it is necessary to work for about 15 years in the regions of the Far North and 20 years in territories equivalent to them. In addition, a mandatory condition is the length of the insurance period (for men at least 25 years, and for women - from 20 years.

What is the living wage for a pensioner?

The material benefit necessary for existence and providing oneself with a minimum set of necessary items and paid to senior citizens upon retirement is called the pensioner's living wage (PMP). The minimum level of income required to ensure an adequate standard of living is influenced by several factors.

PMP depends on the following:

- opportunities for employment;

- region in which the pensioner lives.

The minimum level of income presupposes a minimum amount of essential goods and services.

For able-bodied people, the size of the consumer basket is established at the legislative level. For senior citizens who are retired, the amount of the consumer basket changes once every 5 years and differs from the basket of working people.

PMP includes the following costs:

- products;

- industrial goods;

- pharmacological drugs;

- transport;

- housing and communal services.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

From the beginning of 2020, the cost of living will change. The amount of PMP is set quarterly, both across the country and in each region individually. According to the forecast, in 2020 the living wage for pensioners is expected to increase to 9,514 rubles .

For whom do regional coefficients apply when calculating pensions?

Not for all citizens the regional coefficient is decisive when calculating pension payments. This indicator directly affects only those individuals who live in areas characterized by difficult climatic and extreme conditions. Such areas include regions of the Far North and territories equivalent to them.

For other residents whose regions of residence also have regional coefficients for calculating wages, additional pension supplements that take these indicators into account are not applied. The regional coefficient for such residents is significant only when calculating total earnings for subsequent calculations and assignment of pension payments. This rule affects, for example, residents of the Krasnoyarsk Territory, living in its center and in the south of the region, because the designated territories no longer belong to the above-mentioned territories.

What is the maximum old-age pension in Russia in 2020

Early accrual of pensions in the Russian Federation is possible for disability, as well as for mothers of many children and other certain categories of citizens. In this case, a coefficient is used, which is individual in each individual case, and also depends on the pensioner’s affiliation with Moscow or certain regions of the country, for example, in the Far North.

As is known, the state in the Russian Federation must guarantee its citizens, in addition to direct pension provision, a number of other benefits that are available upon reaching retirement age. This is especially relevant given the fact that a significant part of today's pensioners do not work, and the amount of payments is hardly enough to cover the most necessary expenses that determine the minimum level of conditions for human life. In this situation, the government has developed a set of measures on benefits and allowances for elderly citizens.

How to apply for a pension with an increased regional coefficient

Individuals living in the Far North and similar areas, who also have sufficient insurance experience, may qualify for an increase in pension payments, adjusted to the current regional coefficients. To do this, the following documents must be sent to the Pension Fund branches:

- passport;

- confirmation of the required length of service (work book, contracts);

- certificate of registration;

- other documents as required by the Pension Fund.

Confirmation of place of residence is not required to be provided to pensioners already receiving payments based on the northern supplement. Newly arrived pensioners must present additional certificates to receive a pension supplement. Confirmation documents can be a passport, a certificate of a residence permit, or a registration certificate.

What is the retirement age for men and women in Russia? Is it expected to change? How does Russian “age” reality differ from foreign ones?

To whom do Russians pay insurance premiums, who belongs to the category of obligatory payers, and also from what amounts and within what time frames are premiums paid?

When calculating work experience, not only working time is taken into account, but also other periods of life. Read on for details.

What categories of benefit recipients have the opportunity to replace benefits with payments? For which benefits monetization is possible, as well as how to switch to monetary compensation - read here

How to get it?

Based on how the PMP indicator in a particular federal subject of the country compares with the federal PMP standard established in 2020, a social subsidy can be determined for an elderly person. It may be local, regional or federal in nature. Let us remind you that in 2020 the level of PMP, regulated by regulatory documents, will be 9,311 rubles .

The difference between the federal and regional allowance can be clearly seen from the table below.

| Type of payment | Federal | Regional |

| Where should I go to apply? | To the territorial branch of the Pension Fund | To the social service at your place of residence. The decision to assign a subsidy is made by the local executive authority of the subject of the federation |

| Fund providing financing | Federal budget of the country | Local budget of the region |

| Subsidy amount | In the amount of PMP where this indicator is lower than that established for the country | In the amount of PMP there, it is higher than the federal |

The social supplement to the insurance type of old-age accruals is due from the 1st day of the next reporting period after submitting the application. The subsidy for those who have disabled status or receive survivor benefits will be assigned automatically from the moment they determine the corresponding current payments. There is no need to personally contact the pension department and submit an application for this category of recipients.

A pensioner’s right to receive a subsidy will be lost if he becomes officially employed or moves outside the state on a permanent basis. A person is obliged to notify the pension department and the social security service about these factors in order to recalculate or completely cancel the surcharge.

Terms and methods of receiving payment

After submitting the application, the pension is assigned within ten days. This also applies to city surcharges. They are paid along with the pension at the number determined by the Pension Fund of the Russian Federation, taking into account the order in which the funds are received.

There are two main ways to receive money:

- by mail;

- to a bank account (including card).

You can learn more about the additional payment to pension payments, bringing them to the level of the subsistence level, from this video:

Thus, pensioners of St. Petersburg are entitled to a number of bonuses. The main one is a social supplement to pensions, bringing it to the level of the subsistence level. Certain categories of pensioners have the right to count on additional assistance.

Pension in St. Petersburg

Hello. My mother is moving to live with me in St. Petersburg from Nizhnevartovsk. Her pension there was 15 thousand (with the regional coefficient). Will she have some kind of coefficient here or will her pension decrease significantly? Sincerely, Elena.

Answers from lawyers (2)

- 8.5 rating

- 2288 expert reviews

There will be no grounds for reducing your pension. Your mother will receive a pension in the amount she currently receives. The size of the pension does not depend on the area of residence.

Good afternoon. I really hurried with my answer, it would have been necessary to supplement it with the following: if you plan to register your mother for permanent registration in St. Petersburg, then the pension will be recalculated downwards.

Thank you. Is there a difference if permanent registration is in St. Petersburg or in the Sverdlovsk region. Thank you.

good day, Elena! Unfortunately, the conclusion of Davlyatchina’s colleague Lyubov:

“The size of the pension does not depend on the area of residence”

does not comply with the norms of the current pension legislation. The fixed basic size of the labor pension (the part of the pension set in a fixed amount) is always revised when leaving the northern territories for the usual area.

Article 14

Federal Law “On Labor Pensions in the Russian Federation”

6. The fixed basic amount of the insurance part of the old-age labor pension, specified in paragraphs 2 - 5 of this article, for persons living in the regions of the Far North and equivalent areas, is increased by the corresponding regional coefficient

t, established by the Government of the Russian Federation depending on the area (locality) of residence, for the entire period of residence of these persons in these areas (localities).

When citizens leave the regions of the Far North and equivalent areas for a new place of residence, the fixed basic amount of the insurance part of the old-age pension is determined in accordance with paragraphs 2 - 5 of this article (i.e. without taking into account the regional coefficient)

.

Moreover, according to the norms of the same Article 14, persons who have worked for at least 15 calendar years in the Far North regions

and having an insurance period of at least 25 years for men or at least 20 years for women, the fixed basic amount of the insurance part of the old-age pension is set

with a coefficient of 1.5

.

For persons who have worked for at least 20 calendar years in areas equated to the regions of the Far North

, and have an insurance period of at least 25 years for men or at least 20 years for women, the fixed base amount of the insurance part of the old-age labor pension is set

with a coefficient of 1.3 .

And then let's figure it out. The regional coefficient in the city of Nizhnevartovsk (region of the Far North), taking into account which the mother’s fixed base pension was calculated, was 1.5. When registering a pension case in St. Petersburg (usual locality), the size of the FBR must be set with a coefficient of 1.0 (clauses 2-5 of Article 14). But if the mother worked for 15 calendar years in the Far North and has 20 years of insurance experience, then under another paragraph of Article 14 she will be assigned an FBI coefficient of 1.5 (not a regional coefficient, but with an increase coefficient for long-term work in the North) . That is, then the size of the pension really will not change. If the mother’s work experience at the CS is, for example, only 14 years, then the FBR will be set with a coefficient of 1.0 and the pension amount will decrease.

Free travel and discount on medicines: what other benefits can pensioners receive in St. Petersburg

October 01, 2020 | 13:15| Society On Thursday, October 1, Russia celebrates the Day of the Elderly. In honor of the holiday, some regions have prepared monetary “gifts” for older residents - additional payments to pensions. Thus, pensioners from the Yaroslavl and Ryazan regions will receive benefits in the amount of 500 rubles, residents of the Nenets Autonomous Okrug under 70 years of age with 15 years of experience or more - 5 thousand each, and citizens over 70 with a similar length of service - 16 thousand 640 each. rubles In St. Petersburg this year, such additional payments are not provided, Nevskie Novosti reports, but other benefits and benefits for the elderly are still in effect in the Northern capital. Read more about them in the “Dialogue” material.

photo: Ilya Snopchenko / Dialog news agency

Monthly benefits

In St. Petersburg, several categories of citizens can receive monthly additional payments (ASP) towards their pension:

- Home front workers

in the Northern capital are entitled to a payment of 1 thousand 356 rubles from January 1, 2020. They can also receive another 1 thousand 161 rubles if they are not paid additional monthly financial support (DEMO) by presidential decree in connection with the 60th anniversary of Victory in the Great Patriotic War of 1941-1945. - Citizens who were unreasonably subjected to political repression and were subsequently rehabilitated

can receive monthly lifetime payments amounting to 2 thousand 237 rubles. Similar financial assistance is provided to children left without parents as minors due to the use of repression against them. Rehabilitated persons and persons affected by political repression who do not receive such a payment can apply for an EDV in the amount of 947 rubles. - The same 947 rubles are paid to veterans of labor, military service and pensioners who have worked in St. Petersburg for at least 20 years

and, among other things, have a total work experience of at least 45 years for men and 40 years for women. - Widows and widowers of Heroes of Socialist Labor and full holders of the Order of Labor Glory

are entitled to an allowance in the amount of 8 thousand 24 rubles. - For women who have the title “Heroine Mother”

or who have given birth and raised 10 or more children, as well as for parents awarded the Order of Parental Glory, the city provides a payment of 3,483 rubles. - Pensioners who do not belong to the above preferential categories

can receive a monthly payment in the amount of 624 rubles. - Elderly people born between June 22, 1928 and September 3, 1945

can now receive an additional 2,012 rubles. And for St. Petersburg residents who were born and lived in Leningrad during the blockade, a payment of 3 thousand rubles is also available. They are awarded another 5 to 10 thousand towards their pension if they have a disability. At the same time, the number of days of residence in a besieged city does not matter.

To apply for such benefits, St. Petersburg residents need to contact the MFC or the social protection department at the place of registration. You need to have with you an application for a monthly cash payment (you can download it on the State Services website or request it on the spot), a passport, a registration certificate, a pension certificate, as well as documents confirming that you belong to one or another preferential category: for example, a certificate of a veteran of the Great Patriotic War war.

Additional payments up to the cost of living

Non-working elderly people whose pension in 2020 does not reach 9 thousand 514 rubles have the right to apply for a social supplement up to the pensioner’s subsistence level. To assign such monetary assistance, you need to contact the district administration at your place of residence or the social protection department at your place of registration.

How not to go broke at your desk: school benefits for the 2020 season

There, elderly people over 60 years old, unemployed women aged 55 to 60 years and disabled people of groups I and II can receive monthly social payments in the amount of the difference between the pension they receive and the amount of 10 thousand 876 rubles 82 kopecks (which is equal to 1.15 the cost of living for pensioners). For registration, you will need a passport, an application, documents confirming your place of residence in St. Petersburg, consent to the processing of personal data, a work book (for non-working women) and a certificate of disability (for disabled people of groups I and II).

One-time payments to married couples

The government of St. Petersburg traditionally congratulates older people who have been married for decades. They are also given a cash “bonus”: in honor of the 50th anniversary - 50 thousand rubles, on the 60th anniversary - 60 thousand rubles, and in connection with the 70th anniversary of married life - 70 thousand rubles.

Playing the piano, a union without clichés and a lot of patience - what is the key to a strong marriage, say couples who have lived together for 25, 50 and even 60 years

Reduced travel on public transport

Elderly St. Petersburg residents are entitled to a single discounted metro pass and all types of ground public transport. The cost of such a card today is 624 rubles.

photo: Evgeny Stepanov / Dialog news agency

In addition, until October 31, pensioners have the right to discounted travel on commuter buses: they only need to pay 10% of the cost of the trip. They can travel to the suburbs by rail for free. To receive the benefit, you must present your passport and pension certificate to the controller.

Medical and wellness services

Participants of the Civil and Great Patriotic Wars, disabled people of the Second World War, Leningrad residents who worked at city enterprises during the blockade, prisoners of concentration camps and heroes of the Soviet Union have the right to receive medications for free from pharmacies with a doctor’s prescription.

Medicines with a 50% discount on a doctor's prescription are available to people receiving an old-age pension and home front workers who worked for at least six months between June 22, 1941 and May 9, 1945. A list of pharmacies where you can get discounted medications can be found here.

photo: Ilya Snopchenko / Dialog news agency

In addition, St. Petersburg offers older people the right to free dentures (this does not include the manufacture and repair of dentures made of precious metals and expensive materials equivalent in value to precious ones). This benefit is available to pensioners if they receive monthly cash payments, but have an income of no more than 23,316.8 rubles. per month (that is, not higher than twice the subsistence level of the working-age population).

Also, older people have the opportunity to get a ticket to a health resort once a year at the expense of the city budget. This service is available to disabled people and participants of the Great Patriotic War, home front workers, rehabilitated citizens and people who suffered from political repression. A pensioner can apply for a voucher at the MFC or on the State Services website. For registration, you will need a passport, a certificate of registration at the place of residence, a doctor’s conclusion about the absence of contraindications and consent to the processing of personal data.

Discounts on housing and communal services payments

For pensioners living alone and not working who have reached their 70th birthday, the city government gives a 50% discount on the payment of the contribution for major repairs. Those who live to be 80 years old are already given a 100 percent discount. However, it is important not to forget: for the benefit to be valid, older people should not have debt for utilities. To apply for a discount, you need to contact the MFC or the district administration at your place of residence.

Legal assistance

Elderly residents of St. Petersburg have the right to seek legal assistance free of charge: receive oral and written consultations, draw up an application, complaint or petition together with a lawyer, hire a specialist to represent their interests in court, and much more. You can learn more about this type of assistance and see the addresses of free legal clinics here.

Prepared by Evgenia Chupova / Dialog news agency

Read in Yandex.News Read in Zen

What is the pension coefficient in St. Petersburg

QUESTION: I am a former military man. I'm planning to retire in 2016. My length of service will be 22 calendar years and preferential service will be 10 years. Total experience - 32 years. This is respectively 85% of the pension. What ratio will I have - 54% or more?

EDITORIAL RESPONSE:

- No. There are no plans to increase the coefficient in 2020 yet. When calculating your pension, do not forget to take into account the reduction factor.

A soldier's pension looks like this:

base (the sum of the official salary and salary according to a specific rank, as well as a bonus for length of service) x (50% + 3% for each subsequent year of service over 20 years of experience, but not more than 85% maximum) x reduction factor.

For an example of calculation, let’s take the position of a platoon commander.

A retired serviceman retires from the position of platoon commander with a salary of 20 thousand rubles.

His rank is captain, which automatically means a salary of another 11 thousand according to his military rank. The bonus for length of service depends on the length of service.

In our case it is 22 years. Which corresponds to 30%. In general, it can range from 10 to 40%.

1. Calculate the amount of the premium:

(20,000 + 11,000) x 30% = 9,300 rubles.

2. The base will be calculated as follows:

20,000 + 11,000 + 9,300 = 40,300 rubles.

3. Next we calculate the coefficients.

A service period of 20 years means exactly 50% of the salary. Each year of excess adds 3%.

Our commander served for 22 years, which means the amount of his allowance is 56%.

4. Now you need to apply a “reducing” factor. Over the past years, it has gradually increased and for 2020 it is 60%.

40,300 x 56% x 60% = 13,540.8 rubles.

But that's not all.

5. It remains to apply the regional coefficient depending on the place of service . If our captain served in the Kemerovo region, then in this case the coefficient will be 1.3.

In total, the platoon commander will receive: 13,540.8 x 1.3 = 17,603 rubles.

Regional coefficients depending on the place of service can be viewed here.