Many people are interested in the difference between a mixed pension and pension accruals based on mixed service for retired military personnel.

Mixed pension: military and civilian

To understand the intricacies of pension accruals, it is necessary to carefully study Article 13 “Conditions determining the right to a pension for length of service” of Law number 4468-1, adopted on 02/12/1993 “On pension provision for persons who served in military service...” as amended by 3.07.2016.

Legislative act

The following persons have the legal right to receive a long-service pension:

- military personnel specified in Article No. 1 of the current law, who at the time of dismissal have length of service in military service, the state fire service, who are serving in the internal affairs department or bodies that control the circulation of drugs and psychotropic drugs, who served in the penal system or Federal troops of the National Guard of the Russian Federation are 20 years old and older.

- military personnel, designated in Article No. 1 of the current legislation, who were released from service upon reaching the maximum permissible age limit for being in service due to deteriorating health conditions or due to situations of an organizational or staffing nature; military personnel who were already 45 years old upon discharge; employees with a cumulative work experience of 25 full years, with at least 12 years and 6 months of military service; working in organizations to combat the spread of drugs or potent drugs that have a negative impact on the psyche; working in the Federal National Guard of the Russian Federation, in the service of the internal affairs department and the criminal legal system.

Excerpt from Article 13 of the Law of the Russian Federation No. 4468-1

If at least one of the above conditions is not met, then you cannot count on receiving a mixed type of pension from any law enforcement agency, be it the Ministry of Internal Affairs, the Ministry of Defense of the Russian Federation, the FSB or other services.

When registering the right to receive a long-service pension, the length of service includes:

- seniority;

- insurance experience accrued and justified in the prescribed manner for the recalculation and assignment of labor pensions by the law “On Labor Pensions in the Russian Federation”;

- insurance experience confirmed by the federal law “On Insurance Pensions”.

Based on the above, we can conclude that there are 2 possibilities for assigning a military pension for long service.

- A military pension for length of service, if at the time of dismissal from service the serviceman had 20 years or more of service.

- Military pension for length of service for military personnel whose length of service is less than 20 years, but not less than 12 years and 6 months in calendar terms.

When calculating a pension, the serviceman's length of service is taken into account

In this case, a military pension for mixed service is determined subject to the following points:

- at the time of dismissal, the serviceman must be at least 45 years old;

- the total work experience must consist of a full 25 calendar years;

- out of 25 years of this total work experience, there must be at least 12 years and 6 months. for military service.

In what cases is mixed experience calculated?

If during his life a person managed to serve in military service for at least 13 years, and was also officially employed as a civilian specialist for at least 6 years, he is entitled to a mixed pension - military and civilian. They can be accrued in the following cases:

- The citizen was in military service in the Ministry of Defense, but was transferred ahead of time to the reserve due to reduction, due to a discrepancy between his health status and the position, when he reached the maximum age limit.

- The citizen did not serve in the army, but in one of the many Russian law enforcement agencies - these are the MFD, the state security service, the penitentiary service, etc.

- The total length of service in all law enforcement agencies was at least 13 years.

In this case, they talk about mixed pension experience, and a special calculation system is applied to the pensioner.

This is important to know: Calculation of a civil servant’s pension based on length of service: example

Conditions for granting a pension

Pension accruals based on mixed length of service can be assigned to those citizens who have at least 20 years of experience. Reasons for this may include the following circumstances when resigning:

- poor health;

- reaching a certain age limit;

- disbandment of the unit;

- reduction of structure.

There must be valid reasons for leaving the service

If at least one of the listed conditions is not met, then the serviceman will not have the right to receive a mixed pension from the security forces.

Before 2002, a different method was used to calculate mixed work experience, the size of which was influenced by the following periods:

- completing training at a university;

- residence of a military family in areas where there are problems with employment.

However, at this time, the above-mentioned periods are not taken into account when calculating a mixed pension.

Note ! Women military personnel on maternity leave can count on this period being added to their total length of service.

If the conditions approved by Law of the Russian Federation No. 4468-1 are not met, then the former military personnel can only receive an insurance type of pension, which can be assigned on general terms. This means that the serviceman will not be able to count on financial assistance from the Ministry of Defense.

If at least one of the specified conditions is not met, the citizen has the right only to an insurance type of pension

Time taken into account when calculating length of service

The following periods are included in a serviceman’s work experience:

- service in law enforcement agencies;

- service in the armed forces;

- periods of illegal detention of persons brought to criminal liability;

- time spent resolving controversial situations that arose due to illegal dismissal;

- the period of time required for reserve officers for training related to the definition of service (but not more than 5 years, with 1 year equal to 6 months of service).

Excerpt from Article 13 of the Law of the Russian Federation No. 4468-1

Military pension calculator

Go to calculations

Who can receive a mixed pension?

The category of persons entitled to a mixed type pension includes the following citizens (classified as military personnel):

- serving in the armed forces;

- employees of the Ministry of Defense;

- police officers;

- employees of the state fire service and the Ministry of Emergency Situations of the Russian Federation;

- employees of anti-drug agencies.

Excerpt from Article 1 of the Law of the Russian Federation No. 4468-1

In addition to a mixed type pension, other content may be assigned in situations where the reasons specified in the legislation occur:

- disability;

- loss of a breadwinner.

If you achieve the required government experience. provision for military personnel is accrued without considering age restrictions.

In some situations, the family of a serviceman may receive the second half of pension contributions instead.

A citizen has the right to receive another pension, for example, for disability

How is a mixed pension assigned to military personnel in Russia?

If at least one of the conditions for assigning the type of pension in question is violated, there is no right to receive financial support from the Ministry of Defense. For example, when an officer retires before reaching 45 years of age or if he does not have 20 years of service, he will receive a regular pension.

- Bodies of Internal Affairs (OVD);

- penal institutions;

- armed forces, Ministry of Defense;

- state fire service;

- institutions that control the circulation of psychotropic and narcotic substances.

Disability pension

A disability pension can be awarded to military personnel in situations where the existing injury is documented and classified in the following categories:

- diseases;

- contusions;

- injuries;

- injury caused by loss of ability to work while performing the duties of a military personnel;

- loss of ability to work occurred no later than 3 months from the date on which the dismissal act was signed.

The amount of the supplement is determined by the severity of the injury, as well as the disability group. It can reach the following values:

- 1st disability group - 300% of the pension;

- Group 2 - 200%;

- Group 3 - 150%.

Excerpt from Article 16 of the Law of the Russian Federation No. 4468-1

The legislative framework

The legislative framework of the Russian Federation contains acts that regulate the assignment of mixed pensions to employees of the Ministry of Internal Affairs.

Pension provision is regulated by the following legal acts:

- Federal Law No. 4468 of February 12, 1993

- Resolution of the Council of Ministers - Government of the Russian Federation No. 941 of September 22, 1993

- Federal Law No. 166 of December 15, 2001

- Federal laws No. 247, 173, 283

- Resolution No. 1237

- Regulatory acts of other types

According to the legislation, of all the people working in the structure of the Ministry of Internal Affairs, two large groups can be distinguished:

- civil servants - do not have a position or military rank;

- employees of the Ministry of Internal Affairs - a military man with the position and rank of a police officer.

This is important to know: Additional payment for rural experience for pension: what professions

Those working in civilian positions have the right to retire in the general manner, that is, they do not have any benefits. For them, the retirement age does not decrease: for women it is 55 years, and for men – 60.

Citizens who are employees of the Ministry of Internal Affairs can apply for the following types of pensions:

- for disability, when during the course of service injuries were received or certain diseases occurred due to which the employee was recognized by a medical examination as disabled;

- for the loss of a breadwinner: if an employee of the Ministry of Internal Affairs died during an official operation, then the pension will be paid to members of his family;

- by length of service, if the employee of the Ministry of Internal Affairs has a long period of service in this structure (the required terms are established by law);

- according to mixed experience.

Calculation of a mixed type pension and subtleties of legislation

In a situation where a retired military man continues to perform his work duties, the amount of financial support offered to him is indexed every year.

Note ! “Civilian” years of service cannot influence the size of pension payments.

Maintenance at the national level can be assigned only when military personnel reach the required age (for women after 50, for men after 60 years). If military personnel do not have a minimum civilian length of service equal to 10 years (in 2019), then they can only count on accruing a military pension.

To receive a mixed pension, you must have at least 10 years of civil service

To calculate the minimum payments of a mixed type pension, the following indications are taken into account:

- the amount of military pension;

- seniority;

- the amount of cash payments for more than 25 years of service;

- length of service of mixed type.

On a general basis, a mixed pension cannot be accrued to military personnel until they reach 45 years of age.

The following reasons influence the size of the pension:

- total length of service;

- salary;

- additional accruals for special positions, merits and titles.

The size of the pension is affected by length of service, amount of earnings, etc.

Military personnel who are on leave due to reaching retirement age, but who do not interrupt their work duties in civilian institutions, make mandatory contributions to state funds at the same level as other citizens.

Legislative nuances when calculating a mixed pension

- If a citizen who has been assigned a pension continues to perform a labor function, then the amount of the proposed material support is subject to annual indexation;

- Civilian length of service does not affect the amount of payment;

- National maintenance is assigned to military personnel only after they reach the specified age threshold (after 55 and 60 years for women and men, respectively);

- Military personnel who do not have the minimum established civilian length of service of 6 years can apply for only one type of pension - military;

- The 2020 pension reform also affected the maintenance of military personnel;

- When determining the minimum content for a mixed pension, the following indicators are taken into account:

- Amount of military pension;

- Length of service;

- The amount of monetary allowance for length of service exceeding the 25-year limit;

- Duration of mixed experience;

- As a general rule, a mixed pension can be assigned to military personnel upon reaching the age of 45;

- The following factors influence the amount of pension contributions:

- Salary;

- Total length of service;

- Allowances for special merits, titles, positions;

- Military personnel who are retired due to reaching retirement age, but continue to work at “civilian” enterprises, pay mandatory contributions to extra-budgetary funds on an equal basis with other citizens.

Experience while serving in the army

The following periods are counted towards continuous length of service, in addition to work as an employee or employee:

- time of service in the bodies of the State Security Committee under the Council of Ministers of the USSR, the Armed Forces of the USSR and the Ministry of Internal Affairs of the USSR, in partisan detachments or people's militia, if the interval between release from official duties and the date of entry to work or enrollment in a university or secondary specialized educational institution (and for preparatory courses), for courses, for graduate school or college, requalification should not exceed a period of 3 months.

- if female military personnel are dismissed from the Armed Forces of the USSR or bodies of the State Security Committee of the USSR due to pregnancy or in connection with the birth of a child, the period of service, as well as the time during which they were accrued maternity benefits, are counted towards continuous length of service, provided entering the workplace or school when the child turns 1 year and 6 months old.

- The period of work activity or work practice in paid work and positions while studying at universities or colleges, while in graduate school or clinical residency does not depend on the length of breaks required for training.

- the period of training in technical, vocational schools, nautical schools, factory schools, etc., if the interval between the day of completion of school or college and the date of entry to work was not more than 3 months;

- period of forced absence after illegal dismissal, if the employee is reinstated at work, etc.

Some other periods are also included in the length of service

Pension registration procedure

Even now, the procedure for registering a pension is not so perfect that everything goes smoothly. Any military personnel involved in applying for a pension must follow a given algorithm of actions. This need is due to the fact that Pension Fund employees must check all information about military and civilian experience. Sometimes it is necessary to collect documents indicating that a citizen works in an institution. A positive factor is that all information is archived, which means it is unlikely to be lost. However, this only works if the employee was officially employed.

Initially, you need to decide which institution to contact to issue pension accruals. But there is practically no choice due to the fact that all the data goes to the Pension Fund, which considers each application separately, while the structural unit determines the registration of the worker.

You need to contact the Pension Fund to apply for a pension.

Note ! In the absence of permanent registration at the place of residence or location, a person can bring the collected documents to the institution that directly works with the territorial entity. For military personnel, the application procedure must be carried out by a separate resolution and have an accelerated registration of pension payments - this means that it is possible to apply to absolutely any division of the Pension Fund.

In addition to the standard application, when applying for a pension, a person must present the following set of documents:

- A passport is the main document confirming the identity of a citizen, containing information about his age and place of registration.

- Certificate of pension insurance to confirm that the citizen has a personal account.

You will have to provide a package of documents

It is also necessary to take care of documentary evidence of experience. To do this, you need to take a specific template from your workplace indicating the salary amount and period of work. More complete information can be obtained from the entry in the work book, which is why it is so important to create this document before the start of work and monitor the accuracy of the information entered into it.

Note ! A selection of salary information for 5 years should be done after consultation with Pension Fund employees.

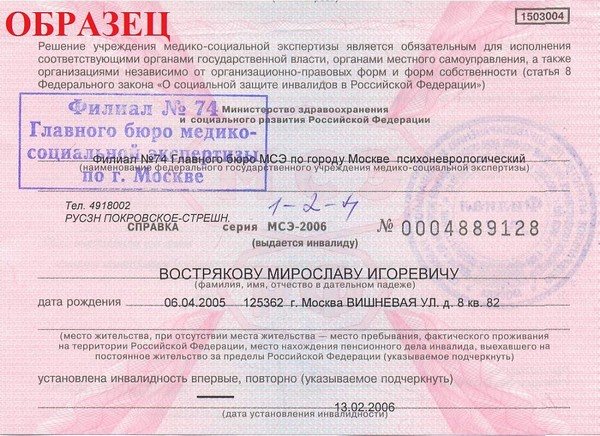

Additional documents are worth having if there are specific features of the application. Thus, disability pension contributions for military personnel can be issued if there is a medical certificate confirming the assignment of a disability group. Changes in personal information must also be documented. To receive payments directly, you will need to decide on the type of receipt. You can create a bank account, debit card, etc.

If a citizen has a disability, it is necessary to provide a certificate about this

Note ! Determining on your own how much your pension will be calculated is not easy. It is best to contact the Pension Fund for this. The calculation rules are established by law; in each case, length of service is taken into account. The basic amount is ½ cash payments for 25 years, to which various coefficients are added.

Registration procedure

To avoid problems in receiving a mixed pension, you must follow the procedure for its registration.

The future pensioner must know in advance which authority to contact and what documents will be required.

Where to contact

All necessary documents must be submitted to a place that depends on the location of the person who is serving in military service:

- if there is no place of registration at the place of stay and residence, and at the same time the person has also traveled abroad, it is allowed to apply directly to the Pension Fund;

- in the absence of a place of registration at the place of residence for any specific reason, the person has the full right to apply to the Pension Fund at the place of his immediate residence;

- If there is no place of registration at the place of stay and residence for any specific reason, a person can apply to the Pension Fund of the Russian Federation in the region where he is actually present.

To implement the above procedure, the former military man must follow the guidelines of the Pension Fund of the Russian Federation and the Ministry of Labor of February 27, 2002 No. 17/19. In accordance with this agreement, a Russian citizen can apply for a pension immediately after becoming entitled to it at any convenient time. There are no time restrictions in this case. An important point is collecting the necessary package of documents. If one of the documents is missing, the citizen may be refused.

Package of documents

The basis for the appointment of a mixed pension will be an application written by a citizen of the Russian Federation, which is submitted to the relevant branch of the Pension Fund. In addition to the application, the following documents will also be required:

- A document that confirms a citizen’s identity, citizenship, age and place of residence.

- SNILS.

- A document that confirms the presence of the necessary length of service - certificates of salary and work received, work record book, etc.

- Until January 1, 2002, you needed a certificate of average earnings, certificates issued by the employer about earnings for the last 5 years. In the case when a person worked from 2000 to 2001, he is not required to provide documents on income for 5 years.

- Documents that confirm the fact of changing the patronymic, surname, and first name.

- A certificate of the established form, issued by the law enforcement agency and reflecting the entire period of service, performing some work and conducting activities that are required by the position (all this is taken into account when calculating the amount of benefits).

- A document that indicates the method of delivering a pension to a citizen - to the account of Sberbank, another financial institution or through a post office.

If one of the above items is missing from the documents, then in accordance with the current legislation (clause 3, article No. 19 of Federal Law No. 173-F3), the person must be given another 3 months to complete the documents.

However, it is necessary to remember an important nuance: if more than twelve months have passed since the right to receive a mixed pension became available, you will need to simultaneously submit an application for recalculation at the same time as the required package of documents. However, in the case of the right to receive a pension after the citizen has officially worked for twelve months. The basis for this is Federal Law.

If a serviceman's pension is received by his relatives

People who have certified a blood relationship with a recipient of a mixed type of pension can apply for the second part of the payment for themselves if the following situations are associated with the serviceman:

- died as a result of an injury incurred in the performance of official duties;

- if the civil service period is less than 1 month.

The following persons are considered relatives entitled to receive the second half of the pension:

- children of a military personnel;

- spouse;

- disabled adults;

- guardians of young children of military personnel;

- other dependents.

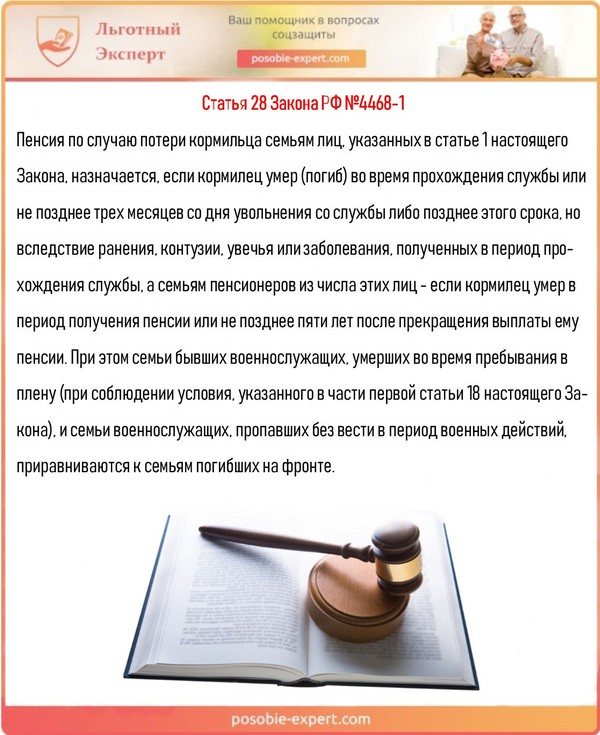

Article 28 of the Law of the Russian Federation No. 4468-1

If the widow (widower) of a serviceman remarries, then (he) she is deprived of the right to payment under the rules of succession.

Calculation of civil and mixed pensions

The calculation of a mixed type pension is carried out according to a special method established by law. When calculating, the main criteria are taken into account - the serviceman’s experience and length of service. Based on their size, the main payment amount is calculated. In the future, special coefficients will be applied to it.

However, even when entering a well-deserved retirement based on mixed length of service, it is possible to increase the amount of benefits. If the employee continues to work, then each subsequent year he is entitled to a 1% bonus. Recalculation is carried out annually on August 1.

Note ! The minimum amount of a civil and mixed pension is half of the registered allowance for 25 years. The calculation takes into account the salaries received during the service, the amounts of which depend on the serviceman’s position and length of service.

When calculating the pension, payments received are taken into account

The calculation is made according to the following scheme:

- an accurate calculation of length of service is made, Pension Fund employees decide whether the applicant is entitled to receive a military pension;

- the total period of work is determined upon retirement of a mixed type;

- the entire amount of payments is calculated;

- the total amount of benefits is determined;

- Pension accruals are paid to the military personnel at the place of residence or in the locality from which he left for mixed service.

Note ! Both civil and military pensions are associated with the employee’s retirement. At the same time, former military personnel have some benefits in matters relating to the calculation of pensions. They can count on an additional pension and receive it not only individually, but also together with their families.

The main criterion for calculating such benefits is the employee’s length of service. In situations where it is not enough, the employee can retire on a mixed length of service, when his entire length of service earned in the service and in civilian work is taken into account.

The main criterion for determining a mixed pension is the employee’s length of service

Pension for mixed military service

- What is mixed experience

- Registration procedure

- How is it calculated

The total amount of accruals for military personnel, including military and work experience, is called a mixed service pension. This type of social benefits is accrued to military personnel in cases where, when they reach the age of leaving service, their military service turns out to be less than 20 years.

According to the current legislation in the country, the category of military personnel includes citizens who served or worked in parts of the Armed Forces, as well as in the Ministry of Emergency Situations, the FSB, foreign intelligence, the criminal correctional system and other paramilitary units of the Russian Federation. The concept of “soldier” is explained in detail in Federal Law No. 76.

The calculation of the pension does not depend on age. The determining factor is the length of military service, defined as 20 years. Calculating the length of service of military personnel has its own special procedure.

- age for men is 60 years, and for women – 55;

- insurance experience in civilian work for at least 6 years;

- If you choose work with difficult conditions or in a difficult climate, then additional payments are due.

This is important to know: What length of service determines the right to an old-age pension?

The transition from a military pension to a civilian one is documented. If any data changes, you must notify the Pension Fund of the Russian Federation by writing a corresponding statement.

Determination of pension provision using a mixed method

Pension, like military, mixed-type content is based on the salary of a military personnel.

Example: if the salary of a private is 5 thousand rubles, for a lieutenant general it will be 25 thousand rubles.

The final amount is influenced by completely different coefficients for special cases. For example, for serving in difficult conditions, etc.

Example: Major Petrov applied for a mixed type pension. He worked at the military school from 10/04/89 to 08/17/95. In addition, this serviceman has military service of 14 years and 9 months. Therefore, Petrov cannot apply for military support due to the fact that this length of service is insufficient.

This soldier served in civilian life for 10 years, 10 months and 13 days. Combined with military experience, this amounted to 25 years, 6 months and 14 days. According to these indicators, the applicant will be able to receive a mixed type of benefit only after his 45th birthday.

A mixed pension can only be received after 45 years of age

To calculate the size you need to have the following data:

| Data | Example size |

| Salary for the required military specialist | 24 thousand rubles. |

| Salary for the position from which the person left | 16 thousand rubles. |

Main principle of calculation:

(24000+16000) + (24000+16000)/2 = 40 thousand rubles.

Thus, Petrov’s monthly accruals will look like this:

40,000 rub.* 50%=20,000 rub.

Payment transfer methods

Any pensioner can independently choose to transfer monthly transfers. Legal transfer methods:

- post offices;

- to a bank card;

- through a special courier service.

You can choose the most convenient way to receive your pension

The transfer method must be indicated when submitting the application. In addition, legislation allows you to change the method of transferring funds. To do this, you need to submit an application to the Pension Fund branch, the current file of the pensioner. Changing the transfer method takes place within a month after submitting the application.