Among other NPFs, the rating of Lukoil Garant deserves special attention. At the end of December 2020, all legal processes relating to the renaming of the largest Non-State Pension Fund in Russia, which united three leaders at once: Lukoil Garant, RGS and Elektroenergetiki, were completed. The new merged fund is now called Otkritie NPF.

What place in the ranking is now Lukoil Garant or, in a new way, Otkrytie? Let's evaluate some indicators:

- The number of insured persons of the Otkritie pension fund is 7,418,535 people and provides it with 2nd place in the ranking;

- In terms of the level of pension savings, which in 2020 amounted to 486,260,049 rubles, it is in 2nd place (in first place is Sberbank);

- According to the results of the rating agency's assessment, it is in the top five most reliable companies.

General characteristics of Lukoil-Garant

The non-state pension fund Lukoil-Garant (hereinafter referred to as NPF LG) was formed in 1994. NPF LG is a fund that has always been a leader in managing pension savings in the country.

Let us highlight the basic characteristics of the fund in the form of the following table:

| Indicator name | results |

| Number of clients | 3.3 million |

| Number of persons receiving payments from NPFs | 70,000 people |

| Hotline number | 8 800 200 5 999 |

| Main office address | Moscow, st. Gilyarovsky, house 39, building 3 |

| Asset volume | 100 billion rubles |

| Assessment by the rating agency "Expert RA" | A++ |

| Cumulative return | 134% |

| Number of branches | 75 cities |

| Official site | www.lukoil-garant.ru |

Disclosure of key indicators

The stability and reliability of the fund can be assessed by basic economic indicators, among which the most important are the volume of pension savings, the level of profitability and the number of insured persons.

Reference! In terms of compulsory pension insurance, Lukoil-Garant is among the top five funds, occupying 10.85% of the market.

Table 2. Number of participants and insured persons of the fund in 2005–2017. Source: lukoil-garant.ru/cbr.ru

| Year | Number of clients according to OPS, thousand people. |

| 2005 | 458 |

| 2006 | 504 |

| 2007 | 594 |

| 2008 | 845 |

| 2009 | 1 135 |

| 2010 | 1 603 |

| 2011 | 2 013 |

| 2012 | 2 424 |

| 2013 | 2 895 |

| 2014 | 2 714 |

| 2015 | 3 280 |

| 2016 | 3 571 |

| as of 09/30/2017 | 3 704 |

According to the latest report of the Central Bank, at the end of the 3rd quarter of 2017, the number of insured persons amounted to 3,507,809 people.

Chart 1. Growth dynamics of participants and insured persons of the fund in 2005–2017. Source: lukoil-garant.ru/cbr.ru

The volume of pension savings under compulsory pension insurance and reserves under non-public pension insurance has steadily increased.

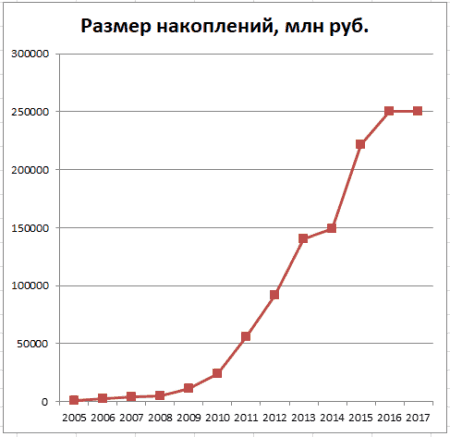

Table 3. The amount of pension savings of the fund in 2005–2017. Source: lukoil-garant.ru/cbr.ru

| Year | Amount of savings, million rubles. |

| 2005 | 795 |

| 2006 | 2 437 |

| 2007 | 4 274 |

| 2008 | 5 118 |

| 2009 | 11 203 |

| 2010 | 24 225 |

| 2011 | 55 855 |

| 2012 | 91 838 |

| 2013 | 139 967 |

| 2014 | 149 289 |

| 2015 | 221 598 |

| 2016 | 250 569 |

| as of 09/30/2017* | 250 198 |

*The volume of savings for 2020 is indicated without taking into account ROPS

Graph 2. Dynamics of increase in savings in 2005–2017 Source: lukoil-garant.ru/cbr.ru

Reference! In terms of savings volume, Lukoil-Garant ranks 4th, behind only NPF Sberbank, Gazfond Pension Savings Fund, and NPF Future.

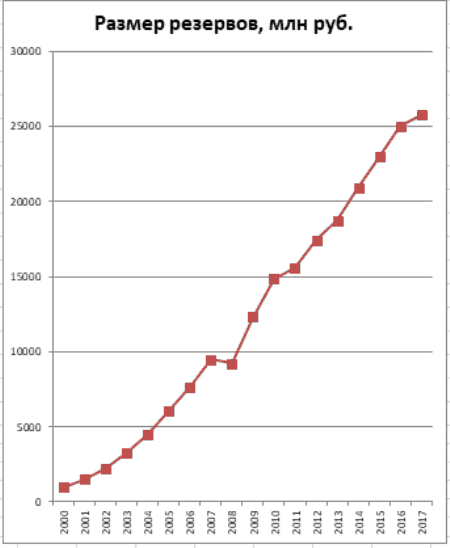

In terms of non-state pension provision, the size of reserves is an order of magnitude lower, but also tends to grow rapidly.

Table 4. The size of the fund’s pension reserves in 2005–2017. Source: lukoil-garant.ru/cbr.ru

| Year | Amount of reserves, million rubles. |

| 2000 | 991 |

| 2001 | 1 486 |

| 2002 | 2 242 |

| 2003 | 3 274 |

| 2004 | 4 510 |

| 2005 | 6 069 |

| 2006 | 7 649 |

| 2007 | 9 470 |

| 2008 | 9 245 |

| 2009 | 12 341 |

| 2010 | 14 840 |

| 2011 | 15 600 |

| 2012 | 17 444 |

| 2013 | 18 763 |

| 2014 | 20 913 |

| 2015 | 22 980 |

| 2016 | 25 042 |

| as of 09/30/2017 | 25 782 |

Reference! In terms of reserves, Lukoil Garant ranks 7th in the unified rating of NPFs and covers a 2.03% share in the NPO market.

Chart 3. Dynamics of growth of reserves in 2005–2017 Source: lukoil-garant.ru/cbr.ru

At the end of the 3rd quarter of 2020, 58 thousand pensioners participating in the fund received a non-state pension.

The fund directs client funds in trust management in accordance with current legislation No. 75-FZ “On Non-State Pension Funds” to the management company for investment in various income-generating projects.

As of 2020, the managers are:

- LLC Management Company "Kapital"

- LLC UK "Navigator"

- LLC "Management Consulting"

In addition, the funds are sent to the depository.

A sound investment policy allows the fund to provide stable returns. In total, the accumulated return on pension savings at the beginning of 2020 amounted to 175.10%.

Table 5. Return on investment of funds from mandatory pension insurance and non-public pension funds in 2014–2017. Source: npfsberbanka.ru, cbr.ru

| Year | Profitability, % | |

| OPS | NPC | |

| 2014 | 8,95 | 11,58 |

| 2015 | 8,96 | 8,9 |

| 2016 | 10,58 | 15 |

| as of 09/30/2017 | -2,41 | -10,78 |

Reference! According to the regulator, Lukoil-Garant ended 9 months of 2017 with a profitability indicator of -2.41%.

The picture with the profitability of pension reserves is no better. According to this indicator, Lukoil-Garant ranks, as of September 31, 2017, 66th in the ranking (-10.78%) among 68 non-state funds.

However, profitability is an indicator influenced by various factors, and the professionalism and many years of experience of the fund will allow us to find ways to bring it to a positive level.

One of these steps was the termination of the contract in March 2018 between the fund and LLC Management Company AK BARS CAPITAL, one of the management companies acting as an insurer for compulsory pension insurance.

Fund rating

In order to assess the overall rating of NPF LG, you need to analyze the main characteristics of the fund, which will be discussed below:

- High reliability - despite the crisis of 2008 and 2014, the fund was able to maintain high reliability indicators after assessment by the rating agencies Expert RA and NRA (national rating agency).

- Positive customer reviews – you will rarely find negative reviews about the work of this company on the Internet, since NPF carefully prepares its staff for high-quality work with potential clients.

- NPF LG is among the 10 best NPFs in the country.

The volume of pension reserves is 18 million rubles.

- Stable level of profitability - for every 1000 rubles of savings, NPF LG provides double income - up to 2000 rubles. For more detailed profitability indicators, read the next section of this material.

NPF Lukoil-Garant - profitability rating and customer reviews

Reading time: 4 minutes(s) NPF Lukoil-Garant

Information about the fund

Status in 2020: Reorganized (merger with another NPF)

NPF Lukoil-Garant: reorganization and merger

In 2020, as a result of the reorganization, the NPF RGS and NPF Elektroenergetiki funds were merged with Lukoil-Garant.

And then it was renamed NPF Otkritie. Founded in 1994, the non-state pension fund Lukoil-Garant currently has the reputation of one of the most financially powerful non-state pension funds with the highest level of reliability. Despite the numerous crises that have occurred during this time, the fund has not violated a single obligation to its clients. By the way, the total assets of this fund are around 100 billion rubles. About 75% of the investment structure of this fund is taken up by ruble deposits, the remaining funds are distributed for the purchase of bonds and securities.

Full name of the organization: Lukoil-Garant JSC NPF

Data for 2013: According to the rating agency Expert NPF Lukoil-Garant has a rating: A++, and according to the NRA: AAA - the highest possible indicators of the RF Pension Fund. The Transneft pension fund has exactly the same rating; here you can read more about it.

Reliability rating in 2017

Expert RA: rating withdrawn National Rating Agency (NRA): AAA

Rating agency RAEX (Expert RA) confirmed the reliability rating of NPF LUKOIL-GARANT (OJSC) at level A++ (exceptionally high (highest) level of reliability) and withdrew it due to expiration and the fund’s refusal to update the rating.

The National Rating Agency confirmed the reliability rating of OJSC NPF LUKOIL-GARANT at the AAA level with a stable outlook. The rating was first assigned to the Fund on May 29, 2015 at the “AAA” level with a stable outlook.

Among the services provided by the fund are the following:

- Non-state pension

- Mandatory pension insurance

- Pension programs for corporate clients

- Additional pension insurance

Statistics of NPF Lukoil-Garant

Statistics on NPO (non-state pension provision) as of July 1, 2013

- Volume of pension reserves: 18,000 million rubles

- Total number of participants: 399,214 people

- Number of participants receiving pension: 66,687 people

- Amount of pension payments: 731,225 thousand rubles

Statistics on compulsory pension insurance (compulsory pension insurance) as of July 1, 2013

- Return on savings: 7.57%

- Number of insured participants: 2,300,903 people

- Volume of savings: 116,306,329 thousand rubles

Under the leadership of the Lukoil-Garant fund, every 1,000 rubles of savings under pension programs increased to 2,058 rubles in the period 2005-2012. For comparison, NPF Raiffeisen was able to reach only 1,575 rubles in a slightly shorter period, as you can see on this page, where its profitability statistics are posted.

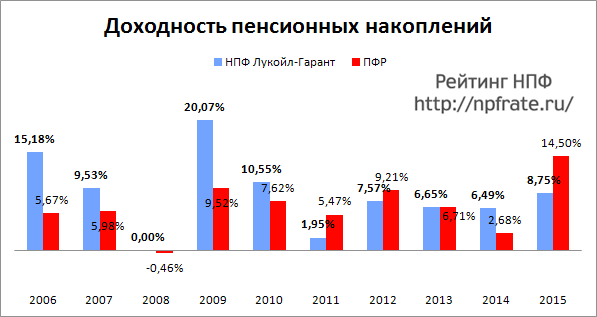

Profitability and reliability

From 2005 to 2010, NPF Lukoil-Garant showed an unprecedented level of profitability, which amounted to 87%. For comparison, for the state-owned management company Vnesheconombank, this figure is two times lower. In the same year as this fund, NPF Sotsium was founded, which was unable to achieve significant indicators in the pension services market. This is confirmation that age and length of work are not a decisive factor.

Data on the profitability of NPF Lukoil-Garant until 2012

Data on the profitability of Lukoil-Garant JSC NPF as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Profitability of NPF Lukoil-Garant for 2014-2015 and previous years

The fund has not currently provided a profitability rating for 2016-2017.

How to join?

In order to join the pension program of the Lukoil-Garant fund, the procedure is as follows: - contact the Pension Fund or the MFC and write an application for choosing NPF Lukoil-Garant - take your passport and insurance certificate (SNILS) and contact the office of the NPF itself to conclude an agreement

You can find out more at the office. fund website

Has the license been revoked?

As of the beginning of 2017, NPF Lukoil-Garant’s license has NOT been revoked; the organization continues its work. The foundation received a license with an unlimited period of validity in 2006.

Information about the license on the website of the Central Bank of the Russian Federation

You can find out the latest information about non-state pension funds with valid licenses on the official website of the Central Bank of the Russian Federation at this link.

Official website and contacts

On the official website of NPF Lukoil-Garant, located at https://www.lukoil-garant.ru, in addition to all the necessary information, there are such convenient services as a pension calculator for your case (calculated based on work experience and other parameters) and personal client account of this fund.

Personal account: find out your savings

If you are already a client of the fund, then the entrance to your personal account of NPF Lukoil-Garant is located at the web address https://lk.lukoil-garant.ru/

Address

The main office of the company is located at: 129110, Moscow, st. Gilyarovskogo, 39, building 3

NPF Lukoil-Garant on the Yandex map:

The Lukoil-Garant pension fund has branches in 60+ regions and more than 74 cities of the Russian Federation.

Hotline number

24/7 support service for the Lukoil-Garant Foundation is available by phone 8

Partner banks

NPF Lukoil-Garant has a number of partner banks, by contacting which you can get advice and enter into an agreement with the fund on the transfer of the funded part of your pension. According to information from the official website, the list of partner banks is as follows:

- Alfa Bank

- Bank "Financial Corporation Otkritie"

- OJSC "GUTA-BANK"

- Stavropolpromstroybank

- Credit Europe Bank

- "Opening Insurance"

- Ural Bank for Reconstruction and Development

- Bank "Petrocommerce

- Tatfondbank

- Khanty-Mansiysk Bank

- National Bank "Trust"

- Promsvyazbank

- CB "Renaissance Credit"

- Uniastrum Bank

- AlfaStrakhovanie Group

Customer Reviews

On this page you can find reviews from clients of NPF Lukoil-Garant. If you are a former or current client of this fund and would like to share your opinion about its work, leave your feedback (no matter whether positive or negative) in the comments. Also, if you know of a case of fraud on the part of an employee of this fund, be sure to write about it!

Office addresses

For your convenience, we provide a list of addresses of offices of NPF Lukoil-Garant in different cities of Russia: Moscow Address: Russia, Moscow, Gilyarovskogo street, 39с3 (Metro Prospekt Mira, Rizhskaya) Telephone: +7 495 411‑55-37, 8 800 200‑59 -99 Opening hours: Mon-Thu 9:30–17:00; Fri 9:30–16:00

According to information for 2017, in the following cities, offices previously located at the indicated addresses are currently CLOSED :

- Izhevsk - st. Vostochnaya, 8a

- Tula-Lenina Avenue, 40 (1st floor)

- Nizhny Novgorod - Belinskogo, 9/1 (5th floor)

- Samara - Dachnaya, 2 k2, office 407 (4th floor)

- Irkutsk - Podgornaya, 66

- Chelyabinsk - Lenina prospect, 52a, 21, 22 office

- Saratov - Upper Market, 10 (5th floor)

- Stavropol - Kulakova Avenue, 8zh (1st floor)

- Yaroslavl - Lenina Avenue, 61a; Ushinsky, 38 / Pushkin, 2; Svobody, 71a

- Ekaterinburg - Radishcheva, 33 (3rd floor)

- Volgograd - Socialist, 17

To obtain advice and conclude contracts, you can contact partner banks, the list of which is indicated in the article.

Did this article help you? We would be grateful for your rating:

0 0

NPF profitability

The profitability level of NPF Lukoil-Garant is as follows:

- 2012 – 7,5%

- 2013 – 6,6%

- 2014 – 6,5%

- 2015 – 8,7%

- 2016 – early 2020 no data available.

More detailed information on profitability over the past few years is provided in this table:

Reliability

When choosing a company that will determine your well-being in retirement, you need to focus, first of all, on the reliability rating of the NPF Lukoil Garant. This is an assessment of the financial institution’s ability to pay you the funded portion of your pension at any given time. This assessment is carried out by a competent rating agency.

In May 2020, the NPF was assigned the “AAA” status in terms of reliability rating, which transferred it to the category of super stable financial ones - this is the highest rating according to the reliability criterion. For the first time, Lukoil-Garant received such an assessment in 2020.

Also, since 2020, he has been a participant in a program that guarantees the fulfillment of the rights of the insured person.

When choosing where to transfer the funded part of your pension, also focus on the information posted on the organization’s official website. If you can't find statistics about the company's payouts, guarantees, and status, think twice. On the official website of NPF Otkritie, all information is freely available.

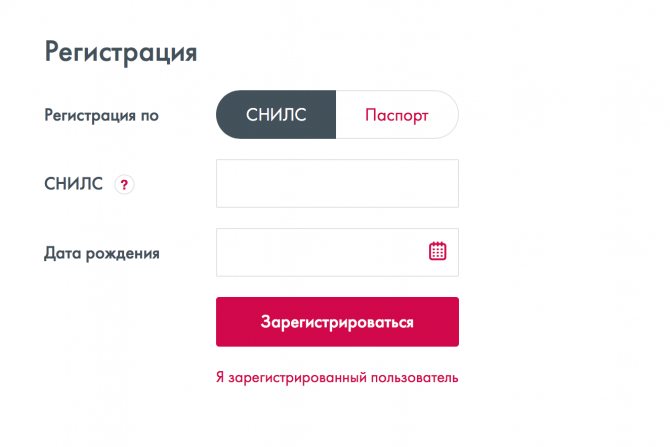

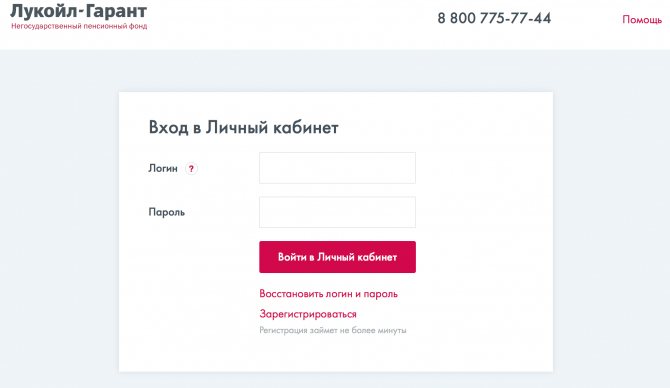

How to access your personal account?

Citizens who have signed an agreement with NPF LG have the right to register in the “ Personal Account ” tab on the website: lk.lukoil-garant.ru.

To register on the site, you need to complete the following steps:

- Click on the link: https://lk.lukoil-garant.ru/?mode4=CheckForm.

- Provide the following information:

- FULL NAME;

- Date of Birth;

- SNILS;

- passport details;

- contact number;

- Email.

- Indicate the code that was sent to the client’s phone or email.

- To get advice, you can click the “ Help ” button, where the most common list of problem situations is recorded.

Let's highlight the main advantages of registration:

- control over the increase in pension savings;

- Allowed to ask questions online;

- clarification of the size of the funded share of the pension;

- you can order an extract;

- presence of a function – pension calculator.

Personal account of NPF Lukoil

To ensure transparency of all manipulations with pension savings and the convenience of insured persons, the Fund provides all information of interest to users through an online account. Only clients of the company can register in it by indicating their date of birth and SNILS number (or passport details). After this, you will receive a confirmation and password by email.

Authorization in a personal account for individuals is carried out through a password and login - most often this is the SNILS number without spaces or hyphens. If the user has lost his password data, he can request a new one through the recovery service. Entering incorrect data during authorization five times will block access to your account for 24 hours.

When registering, it is advisable to indicate your phone number, which should be recorded in the Foundation’s database. After a confirmation mobile message, the user will be assigned an extended profile. In this case, the client will have access to the following additional services of his personal account:

- draw up an individual pension agreement;

- fill out an application for a funded pension;

- request copies of your agreements and fund licenses, statements of the status of open accounts, certificates in form 2-NDFL and the amount of accrued non-state pension

- change or confirm personal data.

If difficulties or questions arise, the user contacts customer service through his personal account.

How to terminate an agreement with Lukoil-Garant?

To terminate the contract with NPF LG, you need to do the following:

- Choose another company in which the insured person’s savings will be stored. A citizen has the right to choose another NPF or return the funds to the Pension Fund.

- Submit an application to the Pension Fund. The maximum period for transfer is until 31.12. current year. The form should indicate the NPF or Pension Fund to which the accumulated funds are transferred.

- Personal or electronic application to the new NPF, if the citizen does not plan to leave funds in VEB, which is under the control of the Pension Fund. You need to have your passport and SNILS with you.

- Receive notification of the transfer of a funded pension to a new fund.

When terminating an agreement with NPF LG, a citizen is not obliged to notify the fund about the decision made, since the document can be liquidated unilaterally!

Upon termination of the contractual relationship, the client may incur certain losses, for example the following:

- Profit from the invested funds will be received for an incomplete reporting period, so it is recommended to transfer savings no more than once every five years .

- When transferring funds to the Pension Fund, 13% of the amount of pension income received will be withdrawn from the client’s account.

- The costs of transferring capital to another fund are borne by the applicant.

How to receive the funded part of your pension

If a person has reached retirement age (including early), he can apply for payment of accumulated funds and receive them:

- lump sum in the form of one amount;

- in the form of fixed amounts monthly for a limited period, but not less than 10 years;

- as a monthly pension until the death of the insured person;

- in the form of payment to the legal successors of the unspent savings of the deceased.

When submitting an application before reaching retirement age in the event of being assigned a disability group or in the event of the loss of a breadwinner, receiving the funded part of the pension is possible only in a lump sum payment.

There are several ways to apply for payment:

- when contacting a non-state pension fund in person;

- through your personal account with an extended profile;

- by mail to the following address - 300013, Tula region, Tula, st. Radishcheva, 8.

Please note that requests and documentation are sent to the specified address and not to the head office in Moscow. The application is filled out in the prescribed form, in accordance with paragraphs 4, 5 of Art. 36.28 of the Law of 05/07/1998 N 75-FZ; clause 16 of Rules No. 884n. In this case, you must provide the following documents:

- passport;

- SNILS;

- certificate of marriage or its dissolution or change of surname, if any;

- bank account details for pension transfer;

- pension certificate, if available.

If the client plans to start receiving a non-state pension (the grounds are similar to receiving a state pension), then the insured person needs to contact the fund. The following copies of documents are attached to the written application:

- passport;

- pensioner's ID;

- for other reasons - a certificate from the ITU, a certificate from the Pension Fund.

Reviews

Most clients are satisfied with the work of NPF LG. There are several reasons for positive reviews:

- High level of trust – A++ (the highest trust from clients) – this fund receives positive feedback from clients.

- High and stable level of reliability and profitability.

- Availability of an agreement that specifies all the features of cooperation.

- A large number of branches throughout the country.

- Pension payments are made exactly on time, without delays.

But there are a number of disadvantages:

- lack of notification when transferring the funded part to the NPF LG;

- slow work of fund employees;

- failures when working in your personal account;

- lack of up-to-date information on the fund's work.

NPF LG is a stable, dynamically prosperous company. The NPF was able to withstand all the economic downturns that occurred in the country. Therefore, this fund can be trusted . To obtain reliable facts, study this material at any convenient time.

Lukoil-Garant NPF's license was revoked: was there a revocation?

Many websites and large agencies are guilty of poorly checking information. When portal employees learn about the error, they delete the articles. But it’s too late to do this; many users have read the information and consider it true.

This is probably how the rumor about the revocation of Lukoil-Garant’s license appeared. The possibility of ordering materials from competitors cannot be ruled out. The goal is to create panic among clients and damage the reputation so that people have doubts about the reliability of the institution.

Attention: there was no license revocation! This is nothing more than rumors and unverified materials from some sites. Therefore, you should not worry about the safety of your savings in the NPF.

Never take even the largest portals' word for it. Always verify information with official sources. You can call the fund personally and clarify the current state of affairs. The company will tell you that such data was fake and nothing more.

How to transfer funds to this NPF

In accordance with the law, citizens have the opportunity to change NPFs at their own discretion.

If a citizen is already a client of a fund, then in order to transfer funds to Otkritie, he needs to complete the following actions:

Enter into a contract

To be able to transfer funds, you must conclude a standard OPS agreement.

This can be done in two ways:

- directly at the office of a non-state pension fund or bank;

- through an agent.

Send an application to the Pension Fund

Before December 1 of the year in which the agreement was concluded, the citizen must submit a corresponding application to the state pension fund, attaching a copy of the agreement concluded with the NPF.

You can submit the relevant papers either directly to the branch of the state pension fund or electronically through the State Services portal.

A citizen has the right to conclude an agreement on the formation of a non-state pension at any time by contacting an agent or the NPF office.

Lukoil Garant Non-State Pension Fund License Revoked 2020

If the NPF in which your pension savings are located has its license revoked, you do not need to take special measures to return your pension savings. The Central Bank of Russia will do all the necessary actions for you. Starting from the date of cancellation of the license of your current insurer - NPF, the Pension Fund of the Russian Federation will become your new insurer in the compulsory pension insurance system. Information on the revocation of licenses from NPFs can be found on the website of the Central Bank of Russia.

In the event of termination of the fund's activities, all funds will be retained and transferred to the Pension Fund. Anyone who wants to entrust the management and preservation of their future pension to NPF Lukoil-Garant can do this in two ways:

Where did the non-state pension fund Lukoil Garant disappear to?

Competition in this case is quite justified, since both funds are equally successful in attracting new clients. Like NPF Sberbank, Lukoil-Garant does not enter into high-risk transactions and does not try to attract clients with the promise of exorbitant profits. Many believe that it is this conservative approach to financial matters that allows the fund to remain stable and reliable.

There are other points that anger investors. Clients like the relative stability of the profitability demonstrated by NPF Lukoil-Garant, although, judging by the reviews, no one would be against higher results:

Lukoil garant non-state pension fund revoked license 2020

To date, 29 non-state pension funds out of more than 100 previously operating have entered the system of guaranteeing the safety of pension savings. How many pension points can you be awarded for 2020? Maximum points for 2020

Expert RA, which is one of the most authoritative rating agencies, rated Lukoil-Garant at the A++ level in terms of reliability and profitability. By joining the Lukoil-Garant fund, investors can subsequently count on the following types of payments: