In Russian legislation there is a separate category of citizens who have the right to a suspended pension - these are veterans. In order to take care of them, the Russian Federation adopted Law (in 1995) No. 5-FZ “On Veterans”. Pensions for combatants are established in a different amount and procedure than for ordinary, ordinary citizens.

Download for viewing and printing:

Federal Law of January 12, 1995 N 5-FZ (as amended on December 19, 2016) “On Veterans”

Who are the combatants?

Combat veterans (VVD) include everyone who is listed in Article 3 of Federal Law No. 5-FZ “On Veterans”. These are four categories of persons:

- Military personnel and employees of government agencies who performed official duties in other countries during hostilities (the full list of countries is indicated in the annex to the law).

- Military personnel involved in demining the territories of the USSR and other countries in 1945-1951 and in trawling domestic and international waters in 1945-1957.

- Military personnel who took part in battles in Afghanistan, including pilots, drivers and government employees who worked in this country from December 1979 to December 1989.

- Military personnel sent to perform special tasks in Syria from September 30, 2015 (subject to completion of the period specified in the contract).

At what stage of consideration is the proposed bill?

No decision has been made on the bill yet

. There has not yet been a single reading in the State Duma, so it is too early to talk about its fate.

On the bill, conclusions of the relevant committee (State Duma Committee on Labor, Social Policy and Veterans Affairs), the Legal Department were prepared, and the conclusion of the Government was also received.

The Cabinet of Ministers did not support such a proposal, noting that the adoption of such a decision would put UBI in an advantageous position over other recipients of the EDV (including WWII veterans, war invalids, etc.). In addition, the Government referred to the lack of funding for the proposed expenses (the drafter of the bill noted that 41.3 billion rubles would be required annually).

Consideration of the bill was planned back in June 2020, but was later postponed to November. But he was not there in November either - the hearings were postponed indefinitely. Therefore, it is worth being patient and continuing to monitor the fate of the bill.

This is important to know: Survivor's pension for a military pensioner

Changes for 2020

Since February 2020, the amount of insurance pensions for combat veterans has been increased; more about this is below, in the section on the amount of payments.

In August 2020, changes were made to the list of participants in hostilities, which took effect from 01/01/2020. The VBD now includes military personnel and militias who took part in the counter-terrorist operation in Dagestan in August-September 1999. They will be entitled to all the benefits and payments that other persons mentioned in the law “On Veterans” have.

Supplement to departmental pension

According to current legislation, the departmental pension of military veterans is subject to an increase of 32%. In this case, it means processing increased civil payments. This is relevant for individuals with mixed work experience, the minimum length of which is 25 years. The amount of payments will depend on the minimum amount of social pension, taking into account a thirty-two percent premium. In addition, funds are subject to mandatory indexation, carried out once a year. If a veteran is entitled to several bonuses at the same time, he must choose the most profitable one. Thus, it is impossible to simultaneously assign a pension for long service and disability.

Types of veterans' pensions

The legislation provides for three types of payments for UBI. And the size of the pension depends on what kind of pension is assigned to military veterans.

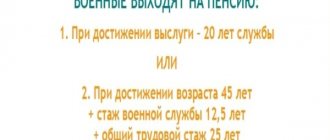

Long service pension

Veterans are entitled to one of three options for such payment:

- military - to receive it, a veteran must have at least 20 years of military service and be over 45 years old;

- military insurance - total experience over 25 years, of which at least half is military service. Age - from 45 years;

- insurance - assigned to people who have worked their entire career in civilian life, and received the status of a participant in combat operations when they performed regular official duties in a zone of military conflicts. The assignment of an insurance pension occurs at the same age as for civilians: in 2020 it is 60.5 years for men and 55.5 for women. In the future, the retirement age will increase annually by 6 months and by 2024 will reach 65 years for men and 60 years for women.

Monthly cash payment (MAP)

This is a government payment from the Pension Fund of Russia, it is established in accordance with Article 23.1 of Law No. 5-FZ. It applies to all combatants. Its size is specified in the law and is regularly indexed (in 2020 the amount was increased by 3%). Part of the due amount of the monthly cash payment is allowed to be used to finance a set of social services (travel to the place of treatment, sanatorium treatment, dental services, etc.). To do this, every year the veteran writes a statement, either agreeing or refusing a set of social services.

Military disability pension

Relies on military personnel who lost their health during the performance of official duties, or no later than 3 months after dismissal from service. If disability occurs due to a wound, concussion, injury or illness received during service, the pension is awarded later than the established 3 months.

The decision to assign a payment is made by the Russian Pension Fund on the basis of a document from the military medical commission that recognized the former serviceman as disabled. The period for payment of military pension is limited. It ends if the disability is removed at the next military medical commission or if the “regular” retirement age comes.

It is calculated based on the monthly allowance of the military personnel. Accordingly, the longer the service period, the higher the assigned disability pension.

Pension payments to veterans of Chechnya

Military personnel participating in military operations on the territory of Chechnya also have the right to receive a military pension and daily allowance.

Upon receipt of disabled status, payments increase by:

- 3138 rubles for 1st disability group.

- 2241 rubles for disability group 2.

- 1794 rubles for disability group 3.

The monthly allowance for veterans, in this case, is 2,781 rubles. In addition, a social package of 1,053 rubles is provided. It includes payment for medicines, travel and sanatorium treatment. The total amount of pension payments will depend not only on the required allowances, but also on the length of service and the amount of military pay.

Pension amounts

The amount of payment to a specific combatant is established based on his individual conditions and parameters.

How is the pension calculated?

According to the standards, there are several indicators on the basis of which a combat veteran’s pension is calculated: length of service, military rank, the amount of insurance contributions (if the VBD worked in civilian life), the number of dependents, the presence of disability. The average pension for combat veterans in Russia in 2020 in the Russian Federation is 25,000 rubles.

Amount of disability payment for former military personnel: from 40% to 85% of the salary for the corresponding rank, at least 150% of the social pension (for disability groups 1 and 2 - at least 300% and 200%, respectively).

The procedure for receiving bonuses for veterans

The procedure for applying for a pension for a combat veteran is quite simple. What is needed for this:

- contact the military registration and enlistment office for registration, obtain certificates confirming the status of a military driver;

- visit the territorial branch of the Pension Fund of Russia and provide a list of documents approved by law.

If the pension has already been issued, but additional payments were not accrued for some reason, the procedure is somewhat simplified: it is enough to contact the Pension Fund with an application and documents confirming the status of UBI.

In order for supplements to be transferred to military pensioners, 30 days before the date of retirement, you must bring the following documents to the Pension Fund of the Russian Federation:

- application according to the established form. You can take it in person from the Pension Fund or download it from the official website;

- copies of passport and photographs size 3x4;

- work book;

- certificates and awards for participation in military operations;

- veteran's certificate;

- papers confirming the presence of disability.

Pension Fund employees are given 10 days to review applications, after which they are required to notify the citizen in writing of the decision made. If there are comments on the submitted documents, additional time is allocated to eliminate them.

Additional payments and allowances

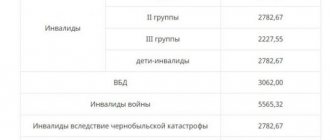

The main additional payment that is due to each participant in hostilities is a monthly cash payment. From 02/01/2020, the EDV was increased by 3%, and it reached the following level:

- participants in combat operations - 3062 rubles;

- combat veterans - disabled - 5565 rubles 32 kopecks;

- veterans of the Great Patriotic War - 4173 rubles 97 kopecks.

1,100 rubles of this amount is the cost of a set of social services that are received in kind. Then the size of the cash payment will decrease.

Veterans receiving military pensions are entitled to the following allowances:

- if you have more than 20 years of service - a payment of 50% of the monthly amount paid + 3% for each year of service over 20 years;

- if you have mixed experience over 25 years - payment of 50% of the usual salary + 1% for each year of work (no matter military or civilian) over 25 years;

- an allowance of 100% of the calculated indicator for “military” disabled people who have reached the age of 80 years. This bonus affects the pension of veterans of the Great Patriotic War - its size is larger than that of others.

And there are a number of additional payments for this category of citizens:

- additional payment to military disabled people of group 1 (300% of the basic calculation indicator established in Law No. 5-FZ); 2 groups (200%); 3 groups (100%);

- additional payment for length of service (at age 45 and experience over 25 years);

- additional payment in the presence of disabled family members of a combatant: 32% - for one, 64% - for two, 100% - for three or more;

- additional payment if you have a military rank - 32% of the established pension amount.

Some constituent entities of the Russian Federation establish additional payments for participants in combat operations in certain regions. Pensions for Afghans, participants in the Chechen conflict and others are being increased. For this information, you should contact the regional branch of the Pension Fund.

Pension payments to Afghanistan veterans

Participants in military operations in Afghanistan have the right to receive a military pension, and one length of service is equivalent to three years. In addition to the basic payment, an additional 32% of the minimum social pension will be provided as unified tax. Afghanistan veterans can receive additional payment in cash or in kind. The size of the first will be 3696.40 rubles. If the recipient of the funds refuses the money, he will be provided with medicines for this amount, and treatment in a sanatorium and medical institutions will be paid for. Among Afghan veterans, disabled people occupy a special place.

Read more: How to obtain a labor veteran’s certificate in Moscow

Pension payments for them are subject to increase:

- For disabled people of group 1 – three times.

- For disabled people of group 2 – twice.

If, after retiring from military service, an Afghan veteran decides to continue working in a civilian job and reaches retirement age, he will be able to obtain insurance benefits. Their national average is 9 thousand rubles, the total amount of pensions of former Afghans is 20 thousand rubles.

Benefits for combatants

In addition to cash payments, veterans are also entitled to in-kind benefits:

- tax (deduction for personal income tax of 500 rubles, exemption from property tax, and in some regions, from transport tax);

- provision of housing - if a combatant in need of improved housing conditions registered before 2005, then he is entitled to a cash certificate for the purchase of an apartment or a plot of land for individual housing construction;

- vouchers for sanatorium treatment, benefits for prosthetics, free medical care in military hospitals;

- the right to install a home telephone without waiting in line;

- provision of leave at any required time, an additional 35 days of annual leave (15 days are paid, the veteran has the right not to use the rest);

- free provision of funeral services in the event of a person’s death;

- discount on housing and communal services.

EDV

Those who participated in the Great Patriotic War have the right to receive an additional cash payment every month. Citizens of besieged Leningrad and the family of this person, who received an award during his lifetime, can count on a monthly payment.

The monthly payment amount consists of:

- Concentration camp slave – 4,795 rubles 17 kopecks.

- Disabled citizen of the Great Patriotic War - 4,795 rubles 17 kopecks.

- Participant of the Great Patriotic War - 3,596 rubles 37 kopecks.

- Members of local wars - 2,638 rubles 27 kopecks.

In 2020, the latest news says that indexation this year is 5.4%.