- Increased indexation of pensions

- Benefits and guarantees for people of pre-retirement age

- Transition period to raise the retirement age

- Who doesn't change their retirement age?

- What changes are provided for pensioners

- Increasing pensions for rural pensioners

- Retirement age for northerners

- Assignment of pensions to doctors, teachers and artists

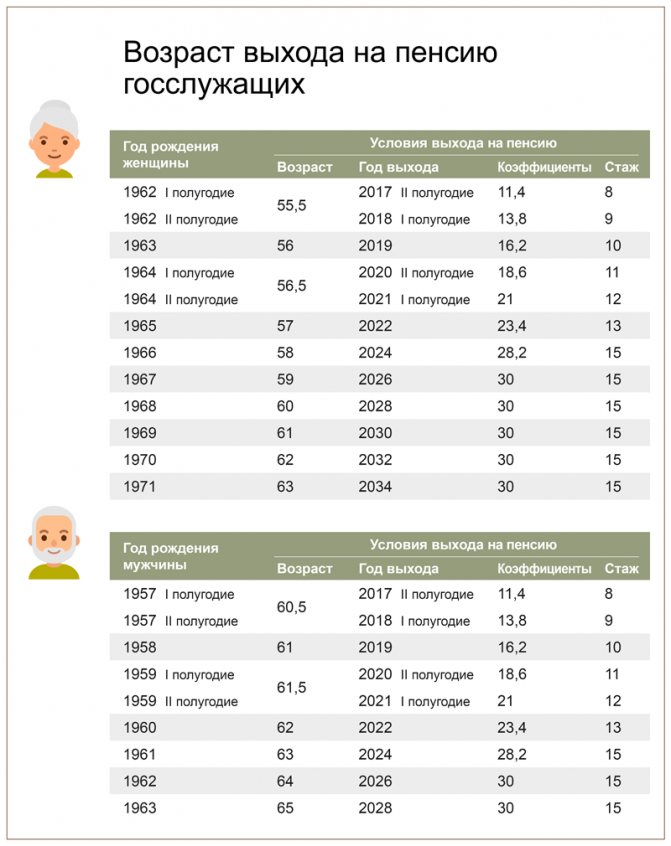

- Retirement age for civil servants

- Assignment of social pension

- New grounds for early retirement

- Payment of pension savings

In accordance with Federal Law No. 350-FZ of October 3, 2018, Russia begins a gradual increase in the generally established age, which gives the right to receive an old-age insurance pension and a state security pension. The changes will occur in stages over a long transition period of 10 years, ending in 2028. As a result, the retirement age will be raised by 5 years and set at 60 years for women and 65 years for men. In 2020, the retirement age for women was 55 years, and the retirement age for men was 60 years.

Increased indexation of pensions

Starting from 2020, the law provides for increased indexation of insurance pensions at a rate that is faster than the forecast growth of inflation. Old-age insurance pensions for non-working pensioners will increase on average by 1 thousand rubles per month, or 12 thousand rubles per year.

From January 1, 2020, the indexation of insurance pensions is 6.6%, which is higher than the forecast inflation rate for 2020. The size of the fixed payment after indexation will increase to 5,686.25 rubles per month, the cost of the pension coefficient will increase to 93 rubles. As a result of indexation, the old-age insurance pension increases on average in Russia by 1 thousand rubles, and its average annual amount is 16.5 thousand rubles.

The increase in pension for each pensioner is individual, depending on the size of the pension received. In order to find out how much the pension will increase from January 1, 2020, you need to multiply the amount of the pension received by 0.066 (6.6%).

Example The disability insurance pension of a non-working pensioner is 10,137 rubles. After indexation from January 1, the pension will increase by 669 rubles and amount to 10,806 rubles. Another example: The old-age insurance pension of a non-working pensioner is 16,437 rubles. After indexation from January 1, the pension will increase by 1,085 rubles and amount to 17,522 rubles.

Forecasts for the future

The average version of the Rosstat forecast indicates that by 2036, despite the ongoing reform, the share of pensioners could increase to 30.1%. At the same time, people's life expectancy is increasing.

Until 2010, when asked how many pensioners over 80 lived in the country, the authorities answered that their number did not exceed 2 million people. By 2012, the figure had grown to 4 million and continues to grow, but not at such a fast pace. Over the past decade, the proportion of older people over 80 (relative to the number of people in the entire country) has increased from 2 to 3%.

Other Rosstat indicators, for example, how many non-working pensioners are in the Russian Federation, do not change so quickly. The number of working pensioners has remained practically at the same level for many years. Rosstat provides statistics on the share of working pensioners from their total number:

- 2016 – 23.1%;

- 2014 – 22.3%;

- 2011 – 23%.

Benefits and guarantees for people of pre-retirement age

For citizens of pre-retirement age, benefits and social support measures previously provided upon reaching retirement age are retained: free medicines and preferential travel on transport, a discount on the payment of major repairs and other housing and communal services, exemption from property and land taxes, and others.

Starting from 2020, new benefits related to annual medical examinations and additional job guarantees are also being introduced for pre-retirees. Employers are subject to administrative and criminal liability for dismissing workers of pre-retirement age or refusing to hire them due to age. The employer is also obliged to annually provide employees of pre-retirement age with two days of free medical examination while maintaining their wages.

The right to most pre-retirement benefits begins 5 years before the new retirement age, taking into account the transition period. From 2019 onwards, women born in 1968 and older and men born in 1963 and older are entitled to benefits.

The five-year period is also relevant when, when assigning a pension, both the achievement of a certain age and the development of special experience are taken into account. This primarily applies to workers in dangerous and difficult professions according to lists No. 1, No. 2, etc., which allow early retirement. The onset of pre-retirement age and the right to benefits in such cases arises 5 years before the age of early retirement, subject to one of the conditions: development of the required preferential length of service, if the person has already stopped working in the relevant specialty, or the fact of working in the relevant specialty.

For example , drivers of public urban transport, if they have the necessary special experience (15 or 20 years depending on gender), retire at 50 years old (women) or 55 years old (men). This means that the pre-retirement age limits will be set for female drivers starting at 45 years old, and for male drivers starting at 50 years old.

The pre-retirement age of doctors, teachers and other workers, whose right to a pension arises not from certain years, but when developing special experience, occurs simultaneously with its acquisition. Thus , a school teacher who will have completed the required teaching experience in March 2020 will be considered pre-retirement from that moment.

For those whose retirement age has not changed since 2020, they also have the right to pre-retirement benefits 5 years before retirement. For example , for mothers with many children and five children, it occurs starting at the age of 45, that is, 5 years before their usual retirement age (50 years). When determining the status of a pre-retirement person in such cases, two factors are taken into account. Firstly, the basis that gives the right to early assignment of a pension - it can be the required number of children, disability, experience in hazardous work, etc. And secondly, the age at which a pension is assigned, from which the five-year period for providing benefits is counted.

The exception to which the 5-year rule does not apply is tax benefits. They are provided upon reaching the previous retirement age limits. For most Russians, this is 55 or 60 years old, depending on gender, and in the case of people retiring early, earlier than this age. For example, for northerners, who under the previous legislation retire 5 years earlier than everyone else, the pre-retirement age for receiving tax benefits is 50 years for women and 55 years for men.

Confirmation of pre-retirement status

The Russian Pension Fund has launched an information service through which information is provided about Russians who have reached pre-retirement age. This data is used by authorities, departments and employers to provide appropriate benefits to citizens. For example, employment centers, which since 2020 provide pre-retirement workers with increased unemployment benefits and are engaged in professional retraining and advanced training programs for pre-retirement workers.

PFR data is transmitted electronically through SMEV channels, through the Unified State Social Security Information System (USISSO) and electronic interaction with employers. A certificate confirming a person’s status as a pre-retirement pensioner is also provided through a personal account on the Pension Fund website and in the territorial offices of the Pension Fund.

Transition period to raise the retirement age

To gradually increase the retirement age, a long transition period of 10 years is provided (from 2020 to 2028). Adaptation to the new parameters of the retirement age in the first few years of the transition period is also ensured by a special benefit - the assignment of a pension six months earlier than the new retirement age. It is provided for those who were supposed to retire in 2020 and 2020 under the previous legislation. For old-age insurance pensions on a general basis, these are women born in 1964–1965 and men born in 1959–1960. Thanks to the benefit, pensions on new grounds will be assigned as early as 2020: to women aged 55.5 years and men aged 60.5 years; in 2020: women aged 56.5 years and men aged 61.5 years.

Throughout the transition period, the requirements for length of service and pension coefficients necessary for the assignment of an old-age insurance pension continue to apply. Thus, in 2020, retirement requires at least 11 years of service and 18.6 pension coefficient.

The increase in the retirement age does not apply to disability pensions - they are retained in full and are assigned to people who have lost their ability to work, regardless of age when the disability group is established.

Following the transition period, starting from 2028 and beyond, women will retire at 60 years old, men at 65 years old.

How much does a pensioner earn in Germany?

The pension of a German pensioner is calculated depending on marital status, health status, and insurance contributions depend on the amount of salary. Payments are calculated according to the same principle as in Russia. This became clear during a conference between the Pension Fund of Russia (Novgorod) and employees of the Federal Office for Pension Insurance of Miners, Railwaymen and Sailors of Germany, which took place in August 2020.

In Germany, the retirement age is 65 for those born before 1947, 67 for those born in 1964 and subsequent years. In the current transition period, women and men retire at the age of 65–67, respectively.

There is reason to rejoice: in 2020, German pensioners will experience not just a pension adjustment, but an adjustment plus 2%

Every second old-age benefit in Germany is less than 900 euros (RUB 63,774) after deductions for long-term health care and insurance. From July 1, 2020, payments to German pensioners were increased by 3.18–3.91%.

In February 2020, Germany introduced an initiative to introduce a basic pension that would be higher than the minimum. Now the minimum wage - 514 euros (36,422 rubles) - is paid even to those who have not worked at all during their lives. A basic benefit of 961 euros (68,101 rubles) will be awarded to people who have worked for at least 35 years at the minimum wage.

Who doesn't change their retirement age?

The majority of citizens who have the right to receive an early pension remain at the same retirement age. These include, in particular:

- Persons to whom a pension is assigned earlier than the generally established retirement age due to work in difficult, dangerous and harmful working conditions, for which employers pay additional insurance contributions to the pension at special rates. Namely, persons employed:

● in underground work, work with hazardous working conditions and in hot shops - men and women;

● in difficult working conditions, as locomotive crew workers and workers directly organizing transportation and ensuring traffic safety on railway transport and the subway, as well as truck drivers in the technological process in mines, open-pit mines, mines or ore quarries - men and women;

● in the textile industry, in work with increased intensity and severity – women;

● in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, search, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work - men and women;

● as crew members on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships permanently operating in the port water area, service and auxiliary and traveling ships, commuter and intracity vessels), as well as in work on the extraction and processing of fish and seafood , receiving finished products at the fishery - men and women;

● in underground and open-pit mining, including personnel of mine rescue units, in the extraction of coal, shale, ore and other minerals and in the construction of mines and mines - men and women;

● in the flight crew of civil aviation, in the work of controlling the flights of civil aviation aircraft, as well as in the engineering and technical staff in the work of servicing civil aviation aircraft - men and women;

● at work with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment - men and women;

● women as tractor drivers in agriculture and other sectors of the economy, as well as drivers of construction, road and loading and unloading machines;

● as workers, foremen in logging and timber rafting, including maintenance of machinery and equipment - men and women;

● as drivers of buses, trolleybuses, trams on regular city passenger routes - men and women;

● as rescuers in professional emergency rescue services and units – men and women.

- Persons to whom a pension is assigned earlier than the generally established retirement age for social reasons and health reasons:

● a woman who has given birth to five or more children and raised them until they are 8 years old;

● a woman who has given birth to two or more children, with the necessary insurance coverage and work experience in the Far North or equivalent areas;

● one of the parents of a disabled person since childhood, who raised him until he was 8 years old – men and women;

● guardian of a disabled person since childhood, who raised him until he was 8 years old – men and women;

● disabled due to war injury – men and women;

● visually impaired, having the first disability group - men and women;

● a citizen with pituitary dwarfism (Lilliputian) and a disproportionate dwarf – men and women;

● fisherman, reindeer herder or commercial hunter permanently residing in the Far North or equivalent areas - men and women.

- Persons to whom a pension is assigned earlier than the generally established retirement age in connection with radiation or man-made disasters, including the disaster at the Chernobyl nuclear power plant, the disaster at the Mayak chemical enterprise, accidents at the Mayak production association and discharges of radioactive waste into the Techa River, as well as in connection with radiation exposure due to nuclear tests at the Semipalatinsk test site - men and women.

- Persons to whom a pension is assigned earlier than the generally established retirement age in connection with work in the flight test crew, as well as in connection with flight tests and research of experimental and serial equipment: aviation, aerospace, aeronautics and paratroops - men and women.

A complete list of citizens for whom the retirement age does not change

What changes are provided for pensioners

Raising the retirement age does not affect current pensioners. Everyone who has already been assigned any type of pension before 2020 will continue to receive due payments in accordance with the acquired rights and benefits. Increasing the retirement age will make it possible, starting from 2020, to ensure higher growth in pensions for non-working pensioners due to indexation exceeding the level of inflation (in accordance with the Decree of the President of Russia “On national goals and strategic objectives of the development of the Russian Federation for the period until 2024” dated May 7, 2020 ).

How will the pension reform affect

In 2020, only half of the usual number will become old-age pensioners. In total, pensions (before the reform) were assigned to more than 1.5 million per year. In 2020, it is planned that only 1 million new pensioners will appear. Every year their number increased by approximately 700 thousand people. This occurs due to natural population decline. That is, annually it is about 700-800 thousand among older people. It can be assumed that the results for 2019 will be as follows: from the assigned 1 million new pensions, 700 thousand natural losses can be deducted. Therefore, the increase will be about 300 thousand instead of the usual 700 thousand. But this is only the first year of the reform. It is planned that in the future the growth rate of the number of pensioners will decrease noticeably.

However, Rosstat provides not entirely optimistic figures. Until 2019, the share of pensioners among the total population increased by 0.5% annually. The measures taken, according to the published forecast, make it possible to reduce this figure to only 0.2-0.3%. Thus, the number of elderly people will continue to increase. The ongoing reform only allows us to reduce the rate of this growth in order to ensure economic stability for all age categories of our society.

Increasing pensions for rural pensioners

Since 2020, village residents have the right to an increased fixed payment to the old-age or disability insurance pension. The right to a 25 percent increase in the fixed payment is granted subject to three conditions: having at least 30 years of experience in agriculture, living in a rural area and the absence of paid work.

The increase in the pension of rural pensioners from January 1, 2020 is 1.3 thousand rubles per month, for recipients of disability pensions with the third group - 667 rubles per month, from January 1, 2020 - 1.4 thousand rubles per month , for recipients of disability pensions with the third group - 705 rubles per month.

In this case, the pensioner has the right at any time to submit additional documents necessary for recalculation.

When calculating the length of service that gives rural pensioners the right to an increased fixed payment, work on collective farms, state farms and other agricultural enterprises and organizations is taken into account, subject to employment in animal husbandry, crop production and fish farming. For example, as agronomists, tractor drivers, veterinarians, beekeepers, etc. - in total there are more than 500 professions.

Work that was performed before 1992 on Russian collective farms, machine and tractor stations, inter-collective farm enterprises, state farms, peasant farms, and agricultural artels is included in the rural experience, regardless of the name of the profession, specialty or position held.

Forecasts and reality about the number of pensioners

According to the latest data from the Pension Fund, in 2020 the total number of pensioners in Russia reaches 46.2 million people . Of these, the majority receive an old-age insurance pension, and another part receive a social pension. The rest are recipients of pensions for disability, loss of a breadwinner and victims of disasters.

Earlier, the former head of the Pension Fund Anton Drozdov stated that due to changes in the retirement age, the number of pensioners in 2020 would decrease by 800,000 people. Let us remind you: today citizens aged 55.5 and 60.5 years will be able to retire.

Number of working and non-working pensioners in the Russian Federation

The increase in the number of non-working pensioners greatly increases the tax burden on working people. This factor undermines the well-being of existing pensioners, and an obvious indicator of this is that the pension fund budget is weakening. As a result, there is no possibility of indexation of pension benefits and it is expected to lag behind the inflation rate.

During 2020, the number of pensioners in Russia increased by more than 600,000 people.

The figure significantly exceeded the 2014 data. This is explained by the fact that from January 1, 2020, pensioners of the Republic of Crimea and a city with federal status, Sevastopol, joined Russia’s pension funds.

The number of recipients of the insurance part of pension payments under the new law during 2020 increased by almost 500,000 people and at the beginning of 2020 amounted to more than 42.7 million people. In 2020, an increase of more than half a million pensioners is expected.

In 2020, the number of pensioners grew to almost 43 million people. Thus, their share amounted to a third of the Russian population.

As of January 1, 2020, the number of working pensioners is 9.3 million people . They make up 21.4 percent of their total number. In the same period in 2020, the figure was 9.6 million.

Thus, the percentage of non-working pensioners in Russia (including disabled people and those receiving survivor benefits) is slightly less than 80 percent. This is evidenced by official data, but how things really stand is known only to the pensioners themselves and their employers involved in the shadow sector.

For example, after a moratorium was imposed on the indexation of pensions for working pensioners, almost half of them ceased to be officially employed. For comparison: as of 2016, the number of working pensioners was 15.2 million people, and a year later, in 2017, it was 9.8 million.

Number of pensioners in some regions in 2020:

- Most pensioners live in the capital - 2,669,966;

- Moscow region - 1,878,776;

- Krasnodar region - 1 469166;

- Novosibirsk - 800 100;

- Rostov-on-Don - 1,100,000;

- Kazan - 1,106,900.

These figures do not include the number of military retirees, since their retirement is carried out by the military department. The category of military pensioners of the Ministry of Defense includes military personnel who have 20 or more years of experience in the Armed Forces, disabled people from military service and those who receive a military pension for the loss of a breadwinner.

The number of military pensioners in 2020 exceeded the regular composition of the modern Armed Forces. It is difficult to talk about the exact ratio of retirees and active military personnel, because there is a constant movement of personnel in the army: conscription, retirement, and the annual arrival of new personnel from military schools.

According to today's statistics, the supply of fresh personnel is stable or more than in previous years. But those who apply for pension benefits are approximately 1.5 times less than military pensioners. The growth in the number of pensioners in the army is much lower than in the civilian world, but, nevertheless, it is present.

According to forecasts, by 2030 the growth in the number of military pensioners should stabilize and stop at 700,000 people, which should account for 1/3 of the active military in the Armed Forces.

It is planned that stabilization will be facilitated by the increased attention of the state to increasing the amount of pay for military personnel, which will attract more young people to the ranks of the Russian army, the Ministry of Internal Affairs, the Ministry of Emergency Situations and other law enforcement agencies.

As for the situation with the population of retirement age, by 2020 the labor market is expected to suffer from the fact that the birth rate fell sharply in the 90s, that is, a decrease in the number of working-age population in Russia by 10%. It is also predicted that the number of 80-year-old citizens will double and a significant increase in pensioners born in 1960–1965.

Dynamics of the number of pensioners from 2012 to the present

| Year | Total number of pensioners, million people. | Receiving old-age insurance pensions, million people. | Receiving social pensions, million people |

| 2012 | 40.2 | 32.9 | 2.8 |

| 2013 | 42.8 | 33.4 | 2.9 |

| 2014 | 43.3 | 33.9 | 2.9 |

| 2015 | 43.8 | 34.4 | 3 |

| 2016 | 45.2 | 35.5 | 3.1 |

| 2017 | 45.7 | 36 | 3.1 |

| 2018 | 46.1 | 36.3 | 3.1 |

| 2019 | 46.5 | 36.7 | 3.2 |

| 2020 | 46.2 | 36.3 | 3.2 |

Detailed number of pensioners in Russia in 2015-2016.

| 2015 | 2016 | |

| Number of pensioners registered with the Pension Fund | 41456000 | 42 729 00 |

| Including: | ||

| By old age | 34422000 | 35555000 |

| Disabilities | 2317000 | 2267000 |

| Survivor loss | 1331000 | 1395000 |

| Victims of radiation disasters | 312000 | 332000 |

| Civil servants | 66000 | 71000 |

| Social | 3007000 | 3108000 |

| Working pensioners | 14917000 | 15259000 |

| Including: | ||

| By old age | 13872000 | 14199000 |

| Disabled people | 773000 | 759000 |

| Survivor loss | 17000 | 23000 |

| Victims of radiation disasters | 118000 | 127000 |

| Civil servants | 20000 | 22000 |

| Social | 116000 | 128000 |

Retirement age for northerners

Residents of the Far North and equivalent areas have the right to early retirement 5 years earlier than the generally established retirement age. Northerners retain this right in the future. At the same time, the age of early retirement for residents of the North is gradually increasing by 5 years: from 50 to 55 years for women and from 55 to 60 years for men.

The minimum required northern length of service for early assignment of a pension does not change and remains 15 calendar years in the Far North and 20 calendar years in equivalent areas. The requirements for insurance experience similarly do not change and are 20 years for women and 25 years for men.

The transition period to raise the retirement age of northerners will last, like everyone else, for 10 years – from 2020 to 2028. At the first stage, the age increase will affect women born in 1969 and men born in 1964. At the same time, northerners, who, according to the old legislation, should have been assigned a pension in 2019–2020, also have the right to a benefit for retirement six months earlier than the new retirement age.

For example, a man born in 1965 (July), with 30 years of work experience in the north and 35 years of insurance experience, will retire in January 2022 at the age of 56.5 years.

As a result of the transition period, in 2028, northern women born in 1973 will retire at the age of 55, and northern men born in 1968 will retire at the age of 60.

At the same time, the transition period for raising the retirement age also applies in cases where the northern length of service has not been fully worked out and the age for granting a pension is reduced for each year worked in the northern region.

Example A woman born in 1970 (March), with 11 years of experience in the north and 18 years of insurance experience, according to the old legislation, was supposed to retire in July 2021 at the age of 51 years and 4 months. Considering that in 2021 the retirement age will be raised by three years, a woman will be able to retire in July 2024 upon reaching 54 years and 4 months.

Some northerners, however, will not have to adapt to the new retirement age, since it will not be increased for them. The changes will not affect the small indigenous peoples of the North, who, depending on their gender, retire at 50 or 55 years old, as well as northern women who raised two or more children - if they have the necessary northern and insurance experience, they are entitled to a pension starting at the age of 50.

Assignment of pensions to doctors, teachers and artists

For employees who are granted a pension not upon reaching retirement age, but after acquiring the required length of service (special length of service), the right to early retirement is retained. Such workers include teachers, doctors, ballet dancers, circus gymnasts, opera singers and some others. The minimum required specialized experience for granting a pension does not increase and, depending on the specific profession, as before, ranges from 25 to 30 years.

At the same time, starting from 2020, the retirement of workers in the listed professions is determined taking into account the transition period to raise the retirement age. In accordance with it, the assignment of pensions to doctors, teachers and artists is gradually postponed from the moment of development of special experience. At the same time, they can continue working after acquiring the necessary length of service or stop working.

Example To retire, rural health workers require 25 years of service in health care institutions, regardless of age and gender. If a rural doctor completes the required length of service in September 2021, his pension will be assigned in accordance with the generally established transition period for raising the retirement age - after 3 years, in September 2024.

Retirement age for civil servants

For state civil servants at all levels of government (federal, regional and municipal), the transition to new retirement age values occurs in stages. Until 2021, the age increase is six months a year, then the rate is synchronized with the general rate of increase in the retirement age in the country and begins to increase year by year. Male civil servants will retire at 65 by 2028, and female civil servants will retire at 63 starting in 2034.

In addition, for all federal civil servants, starting from 2017, the requirements for the minimum length of service in civil or municipal service, which allows them to receive a state pension for long service, are being increased. Each year, the specified length of service increases by six months (from 15 years in 2020) until it reaches 20 years in 2026.

Taking into account all the changes, the insurance pension for civil servants is assigned in 2020 upon reaching 56.5 years (for women) and 61.5 years (for men). A long-service pension is awarded after 17 years of civil service experience.

Assignment of social pension

Changes in the pension system that come into force in 2020 do not affect the social pension for disability and loss of a survivor, which are assigned regardless of the generally established retirement age. As in the case of an insurance pension, in relation to state pensions, the right of people who have lost their ability to work due to disability to apply for a pension, regardless of age, is fully preserved.

The age at which the right to a social old-age pension arises is increased by 5 years in accordance with a phased transition period. By 2028, men will receive a social old-age pension upon reaching 70 years of age, and women upon reaching 65 years of age.

What is an old-age pension and what types are there?

Pension is financial support for older people, allocated from the state budget. Its size can be determined individually depending on certain factors - citizen status, region of residence and work, working conditions, wages and length of service.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The legislation of the Russian Federation defines two types of old-age pensions in 2019 - insurance, funded and social payments. The first is provided to people with disabilities or work-related injuries.

New grounds for early retirement

Early assignment of pension for long service

A new basis is provided for citizens with extensive experience. Women with at least 37 years of experience and men with at least 42 years of experience will be able to retire two years earlier than the generally established retirement age, but not earlier than 55 years for women and 60 years for men.

Early granting of pensions to women with three and four children

Women with many children with three and four children receive the right to early retirement. If a woman has three children, she will be able to retire three years earlier than the new retirement age, taking into account transitional provisions. If a woman has four children, she is four years earlier than the new retirement age, taking into account transitional provisions.

At the same time, for early retirement, women with many children need to develop a total of 15 years of insurance experience.

Early assignment of pensions to unemployed citizens

For citizens of pre-retirement age, it remains possible to retire earlier than the established retirement age in the absence of employment opportunities. In such cases, the pension is set two years earlier than the new retirement age, taking into account the transition period.

In addition, for citizens of pre-retirement age, from January 1, 2019, the maximum amount of unemployment benefits will increase from 4,900 rubles to 11,280 rubles. The period of such payment is set at one year.

Payment of pension savings

The changes to pension legislation that have entered into force do not change the rules for assigning and paying pension savings. The retirement age giving the right to receive them remains the same – at 55 years for women and 60 years for men. This applies to all types of pension payments, including funded pensions, fixed-term and lump-sum payments. As before, pension savings are assigned subject to the minimum required pension coefficients and length of service: in 2020 this is 18.6 coefficients and 11 years, respectively.

Working pensioners will again be left without indexation

Back in 2020, the government canceled the indexation of pensions for working pensioners, suggesting that this category of the population does not experience serious losses from rising inflation, since it can compensate for the lack of income through wages.

Instead of indexation, working pensioners will receive a recalculation of payments after August 1 by 244.47 rubles. This is the sum of three pension points, the cost of which is 81.49 rubles. Since workers’ pensions remain “frozen” at the level of 2020 values, their average size by the end of next year will be about 14 thousand rubles.

The social pension will be increased, but it will still remain low

This type of pension is assigned to unemployed citizens who do not have enough length of service or points to qualify for an insurance pension. Social benefits will be indexed by only 2.4%, to 9,215 rubles, which is only 600 rubles more than the living wage of a pensioner. The increase will take place on April 1.

Villagers and military will receive increases

Pensioners who have lived and worked in rural areas (about 950 thousand people) for at least 30 years will receive a pension increase of 2.4 thousand rubles next year.

And pensions of retired military personnel will increase by more than 6% from October 1. As a result, the average military pension in Russia will be 26.2 thousand rubles.

You can get a pension at 55 and 60 years old

But only to participants of the savings system or non-state funds. To activate pension payments from a non-state source, you only need an agreement with a non-state pension fund. At the same time, savings under Mandatory Pension Insurance (savings system) are still frozen, but are indexed annually.