Average payout

Contributions for persons who were employed in mining are paid by the employer every month. The mining company sends funds to the pension fund where the employee has entered into an insurance contract. The amount of payment for such persons is indexed annually. This is necessary due to increasing amounts of employer contributions.

A list with all professions for which early payment of a pension can be issued is contained in PSM of the RSFSR No. 481. The list has not undergone changes since the law came into force.

Formula and example of calculating a pension for a miner in Russia

The payment is calculated according to the following formula:

- SPst – type of benefit;

- IPC – accrued points;

- SPK – pension point value

- WMP – fixed payment.

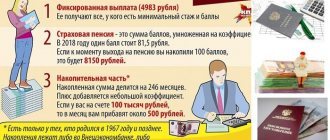

The cost of a pension point in 2020 is 87.24 rubles. It is by this amount that all points earned by the pensioner will be multiplied.

The fixed payment amount in 2020 is 5334.19 rubles. Next year the amount will be indexed, and the percentage of the increase will depend on the economic situation in the country.

Knowing the initial data, you can calculate the size of the pension payment. As an example, let's take a man who worked in hazardous enterprises for 20 years, served in the army and worked in other fields for about 5 years. Over the course of his life, his contributions have accumulated 138 pension points. Then the size of the final pension will be:

The total amount may be increased due to additional tariffs and factors:

- duration of work;

- average salary;

- the amount of funds transferred as insurance premiums.

If the bonus is based on the number of years of service on which the person has earned seniority, the bonus will be increased by 55%. And for each year that a person continues to work after the potentially acceptable retirement age, 1% is added to the payment.

The size of the pension payment for miners will not be affected by periods of sick leave and leave taken to care for a child.

Pension recalculation

Receiving additional payment is possible only after submitting a corresponding application to the Pension Fund of the Russian Federation. The department must be selected depending on the place of temporary registration or permanent registration.

A package of additional documents must be attached to the application:

- military ID;

- family composition certificate;

- salary certificate from the accounting department;

- confirmation of the required work experience.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

The pensioner will be given several ways to receive a pension to choose from, from which he can choose whichever one is most suitable for the citizen.

The law allows you to submit documents through a third party. But in this case, a notarized power of attorney must be attached to the papers.

The preferential system operates in such a way that when a pensioner returns to official work, he will stop receiving payments until he leaves the company. To re-issue the payment, you will need to collect a complete set of documentation again.

Possible additional payments and benefits for miners

Miners have the opportunity to obtain additional benefits. Citizens who were employed in hazardous and difficult types of production will be able to receive:

- free medical care;

- free dentures;

- discounted travel on public transport.

Not only the workers themselves, but also their children can count on benefits. The child is entitled to free breakfast at school and enrollment in educational institutions on a first-come, first-served basis.

The legislation clearly defines the categories of citizens who have the right to receive a pension under special conditions. To do this, you need to be a beneficiary, which includes miners.

As a main benefit, citizens receive a reduced age limit for retirement. The amount of payment will be determined for each miner individually depending on the number of accumulated pension points.

Useful video

We invite you to watch a video about the specifics of assigning pensions to miners in Ukraine:

Since 2020, Russia has been implementing a pension reform that affects all categories of citizens planning to retire. Even before this, miners were granted the right to early retirement.

Mining of mineral resources by above-ground and underground methods is associated with an increased risk to life and health. Work in hazardous conditions was compensated by social security benefits and pensions as well. The same status was retained by the mining profession within the meaning of the new pension reform.

Calculation of preferential length of service for early retirement

- pulp and paper production;

- production of medicines, medical and biological preparations and materials;

- certain types of work in healthcare institutions (for example, the work of radiologists, as well as doctors constantly employed in X-ray and angiography rooms, etc.);

- printing production;

- transport (certain types of work);

- work with radioactive substances, sources of ionizing radiation, beryllium and rare earth elements;

- general professions (for example, divers and other workers engaged in work under water, including in conditions of high atmospheric pressure, at least 275 hours per year (25 hours per month); gas cutters engaged in work inside tanks, tanks, tanks and compartments

- ships, etc.);

- nuclear energy and industry.

This is important to know: Pension for a warrant officer with 20 years of service

When do miners retire?

Early retirement is regulated in the Russian Federation by the provisions of Federal Law-400 dated December 28, 2013, Decree of the Russian Government No. 665 and other regulatory documents. Employees of the mining industry, which include miners, are guaranteed early retirement.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

This measure of state support provides for the end of working life for men at 50 years old, for women at 45, which is 15 years earlier than the generally established period.

But early retirement is not guaranteed for all workers involved in the mining industry. A complete list of industries, positions and specialties falling under the preferential category is contained in Resolution No. 665.

Insurance experience

The insurance period is the periods of your working activity during which the employer paid contributions to the Pension Fund. It is necessary to determine the right to an insurance pension and its amount.

Every year, the requirements for the duration of the insurance period that must be had to assign an insurance pension are increasing.

| Year of retirement | Minimum insurance period |

| 2015 | 6 |

| 2016 | 7 |

| 2017 | 8 |

| 2018 | 9 |

| 2019 | 10 |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2023 | 14 |

| 2024 | 15 |

What requirements must a retired miner meet?

The miner's retirement date is determined by his length of service and the value of the IPC (individual pension coefficient).

Duration of employment

Persons employed at underground and surface coal mining enterprises need at least 25 years of experience for early retirement, provided they work a full shift. This period is necessary for those who work in the field of mining, equip and maintain mine structures and communications, and participate in rescue operations.

Leading specialists, miners, machinists, and miners need to work 5 years less, that is, 20 years.

The value of the coefficient changes annually - it increases. In 2019, the IPC was 16.2.

Important! Women at the age of 45 who have worked for 15 years, half of them in a hazardous area, as well as men aged 50 with a total experience of 20 years, half of them in hazardous production, can count on an early miner's pension. 1 year is added to the length of service in case of a work-related injury.

Miners receive credit for their time spent studying and serving in the army.

What is included in the northern experience

The calculation of the time of employment in the North, taken into account for early retirement, is carried out in calendar terms. It includes only the duration of constantly performed throughout the entire shift with the payment of insurance contributions to the Pension Fund (clause 4 of the Rules, approved by Decree of the Government of the Russian Federation of July 11, 2002 No. 516, clause 3 of Decree of the Government of the Russian Federation of July 16, 2014 No. 665).

Before calculating the northern work experience , you need to determine what other periods are included in it. For the purposes of providing a preferential pension, in addition to the time spent performing official duties, the following is counted:

- sick leave time;

- all types of paid leave (except for child care);

- the duration of paid forced absence due to illegal dismissal or transfer;

- the probationary period, regardless of whether the employee has completed it.

IMPORTANT!

If a citizen is employed part-time for an incomplete week, but full shifts, the calculation of preferential length of service is based on the proportion of time actually worked.

When working on a rotational basis, the following are included in the northern length of service (clause 8 of the Decree of the Government of the Russian Federation of July 11, 2002 No. 516):

- duration of performance of official functions;

- breaks between shifts;

- duration of travel to the work area and back to the region of residence;

- inter-shift rest.

At present, the question of including periods of business trips to areas not related to the North in the preferential length of service remains unspecified. Although the Pension Fund of the Russian Federation quite often refuses to count this time into the northern length of service for pensions, judges take the side of citizens (appeal ruling of the Judicial Collegium for Civil Cases of the Krasnoyarsk Regional Court dated August 1, 2012; resolution of the Federal Antimonopoly Service of the West Siberian District dated October 22, 2012 No. F04 -4383/12 in case No. A75-365/2012; decision of the Khabarovsk Territory AS dated July 5, 2013 in case No. A73-4743/2013).

IMPORTANT!

Until October 6, 1992, periods of parental leave were counted toward the length of service in the North for the purpose of early retirement. The time of maternity leave after the specified date is not subject to inclusion in the northern length of service for a pension (Law of the Russian Federation of September 25, 1992 No. 3543-1).

The following are not included in the preferential length of service:

- periods of exclusion from the workplace due to alcohol intoxication, failure to undergo labor safety instructions or medical examinations;

- time of suspension from work due to a medical report;

- time of military service, including in the northern regions.

Design rules

Applying for a pension begins with writing and submitting the appropriate application. Supporting documents are attached to it.

- Passport or other identification document;

- Employment history;

- SNILS;

- Military ID (for men);

- Additional documents confirming promotion, family composition, employment contract, etc.

The application is submitted to the Pension Fund branch or the nearest MFC. It can be sent by mail or registered through the State Services portal or the Pension Fund of Russia personal account. 2 weeks are allotted for consideration of the application. Based on the result, the future pensioner receives a notification. If one of the required applications is missed, he has 3 months to correct it.

Miner's pension amount

The amount a miner who has worked for 20 years will receive depends on his length of service, the value of the IPC and the region of residence.

The formula for calculating the amount receivable is as follows:

P – monthly payment amount;

A – the number of accumulated pension points;

B – the cost of the individual coefficient (in 2020 it is equal to 81.49 rubles);

B – the amount of the fixed payment according to the law.

Additional payments for overtime

We are talking about workers who worked at the mine in excess of the mandatory minimum for pensions. That is, more than 25 or 20 years (leading specialists and equivalent). Such employees can count on a monthly additional payment. It is paid from the contributions that the company paid to the Pension Fund.

What determines the amount of increase (EDV) to a miner’s pension?

The amount of the monthly increase depends on the size of the salary, the average salary in Russia and the amount of insurance premiums. The duration of work in hazardous conditions also matters.

The rate of bonus for length of service (exceeding the mandatory length of service) in 2020 was 55%. Each “extra” year adds 1% to it. The maximum surcharge for overtime is 75%.

Are there plans to increase pensions for miners in 2020?

At the end of 2020, there was no talk of increasing pensions for miners. However, it will be recounted in 2020. The revision of the salary of retired miners is associated with changes in the minimum wage, the cost of living and an increase in insurance premiums that mining enterprises pay to the budget.

If you disagree with the accrued amount, an application is submitted to the Pension Fund for recalculation. The Pension Fund Management raises the documents and verifies the correctness of the accruals, taking into account the facts specified in the application.

What is a miner's pension in Russia? You can learn about the procedure for registration, calculation and accrual of these payments in this article. We also recommend reading information about pensions for Chernobyl victims .

At what age do miners in Russia retire?

Employment in underground and open-pit mining is one of the types of activities that are included in the lists of work with harmful and dangerous working conditions by the current legislation of the Russian Federation. This fact guarantees employees of this type of employment access to pension benefits on preferential terms.

In accordance with Federal Law No. 400 , Government Decree No. 665 and other regulatory legal acts of the Russian Federation, pensions are assigned to miners until they reach the generally established retirement age. Payments are based on the duration of work under difficult conditions.

The provisions of Article 30 of Federal Law No. 400 establish that preferential insurance benefits are assigned to persons upon reaching 45 and 50 years of age for women and men, respectively.

Conditions of appointment

According to the provisions of these legal acts, a miner's pension in Russia can be accrued:

1. With full-time employment in underground and open-pit mining (coal, ore mining, etc.), regardless of age, provided that you have:

- no less than 25 years of work experience;

- individual pension coefficients. This figure is increasing every year; for the current year it is 13.8.

For workers in leading professions (miners, machinists, etc.), the indicator of duration of work, in accordance with the law, can be reduced to 20 years;

2. Upon reaching 45 and 50 years of age (for women and men, respectively) and if the person has been employed in jobs with hazardous working conditions for at least 10 and 7.5 years, as well as 20 and 15 years (for men and women, respectively ) general insurance experience.

Pension system for miners

Some workers in hazardous enterprises have the opportunity to reduce their retirement age. The right is assigned only to citizens employed in hazardous work, working a full shift.

The system applies to persons who have an insurance record of more than 25 years and have worked for a certain time in open-pit and underground mining operations related to the extraction of coal, shale, ores and other minerals. The minimum period of labor activity is reduced to 20 years if a person works as a miner, miner or driver of some working units.

Early retirement is an opportunity that appears for men at the age of 50, and for women at the age of 45. To do this, you must be employed in difficult and dangerous work for at least 10 (men) and 7.5 years (women). The total work experience must be between 20 and 15 years, respectively.

Persons who are employed in open-pit mining operations at a depth of more than 150 meters can receive a pension without taking into account age. Professions related to work on the surface of such quarries will not be able to receive such a benefit.

The system allows employees of hazardous enterprises to receive additional social security. This clause of Federal Law No. 84 is regulated. In accordance with the law, miners who have been employed full-time at the workplace for 20-25 years (the exact period depends on the profession) receive an addition to their pension payments. The amount of payment is determined for each miner individually.

How to apply for a miner's pension?

In order to apply for an insurance benefit on preferential terms, a citizen interested in payments must:

- collect all necessary documents;

- draw up an application for a pension in the established form;

- submit all information to the local Pension Fund structures (at the place of registration or actual residence);

- choose a method of receiving funds.

Pensions for miners can be arranged both by future pensioners personally and by their proxies. To do this, you need to draw up and notarize a power of attorney.

Documentation

To calculate cash payments before the established retirement age, you must collect the following information:

- identification;

- work book;

- insurance certificate (SNILS);

- certificates confirming additional periods of official employment of a person (archival information, order of appointment to work, agreement between employee and employer, etc.);

- documents indicating the special nature of work activity (if this fact is not indicated in the work book);

- military ID;

- a correctly executed power of attorney (in cases where the rights and interests of the future pensioner are represented by another person);

- a certificate of family composition and the presence of dependents, as well as other documents that confirm additional circumstances.

The application form for the assignment of a pension benefit can be found on the official Internet page of the Pension Fund.

Where to submit?

The application along with the documents is submitted to the local divisions of the Pension Fund of the Russian Federation. Also, for this procedure, a citizen can use the services:

- local structures of the Multifunctional Center (MFC);

- legal representative;

- Russian Post;

- electronic services of the official pages of the Pension Fund and State Services.

It is worth saying that via the Internet a citizen can fill out an application for a pension and set a date and time for receiving the documentation. You can read about online registration with the Pension Fund here .

Deadlines

Pension Fund divisions consider the specified notification within 2 working weeks from the date of submission of all necessary documents. If the information was not provided in full, the citizen can take advantage of additional time to resolve this problem.

This period should not exceed 3 months. Benefits are accrued from the date of submission of the application, but not before the right to receive an insurance pension ahead of schedule arises.

What is the miners' pension?

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

The size of the pension benefit for this category of the population is influenced by many factors, including the length of the insurance period and periods of employment in jobs with hazardous working conditions, the number of pension points, etc.

Calculation

What is the pension for miners in Russia? The calculation formula for old-age insurance benefits is determined by the provisions of Article 15 of Federal Law No. 400. Thus, this law states that the amount of accruals is determined as follows:

A=B*C+D, where: A is the amount of payments for compulsory pension insurance; B — the number of pension points earned; C is the cost of one individual coefficient at the time of granting the benefit. For the current year, the price of this indicator is 81.49 rubles; D is a fixed payment determined at the legislative level.

The minimum pension of a miner in Russia must correspond to the minimum subsistence level established in a particular subject of the Federation. The indicated figure for the Russian Federation as a whole is 8,726 rubles (according to Federal Law No. 362).

Fringe benefits

In addition to early retirement, miners can also qualify for additional preferential accruals. In accordance with Federal Law No. 84, this category of the population has the right to a monthly supplement to the basic amount of pension provision, subject to employment in underground and open-pit mining for at least 25 years, or 20 years of activity in leading professions.

This bonus is paid from contributions to the Pension Fund of the Russian Federation, which are made by organizations in the coal industry.

The amount of this surcharge is calculated using the procedure established by current legislation. So, this amount is influenced by the following factors:

- average monthly earnings of a citizen;

- the size of the average salary in the Russian Federation for a certain period;

- average monthly amount of contributions to the Pension Fund, etc.

Useful video about miners' pensions

Do you want to know how early retirement is processed? You should watch the following video:

Miners are a category of workers belonging to the list of professions with hazardous working conditions.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

For this reason, the Government of the Russian Federation provides benefits for these employees.

In 2020, there will be no reduction in the list of benefits for former miners; on the contrary, it is planned to increase social support for this category of persons.

Early

The opportunity to retire earlier than other citizens of the Russian Federation is the main privilege of miners.

This is explained by the fact that their working conditions are considered harmful. Early retirement is regulated by Law No. 400-FZ of December 28, 2013.

The state guarantees early pensions for miners if they have a certain amount of work experience in the mine.

Law No. 173-FZ of December 17, 2001 states that early pension provision is provided to the following categories of citizens:

- have worked for 25 years in the coal industry on a full shift (this must be indicated in the work book);

- employees of the mine rescue service;

- quarry miners;

- persons who are engaged in the arrangement of communications and structures in mines;

- who have reached retirement age.

Citizens whose work activity consists directly in the extraction of mineral resources (shale, ore, uranium miners) and coal are entitled to a pension after twenty years of experience in such work.

20 years of work experience is sufficient for retirement for the following categories of workers:

- miners at the working face;

- miners;

- coal combine operators;

- miners who extract coal using jackhammers.

If you have not worked for 20 or 25 years as a miner, and the retirement age has arrived, then the existing length of service (for example, 10 years) is calculated on a preferential basis.

Official website of the authorities of the Municipal Municipality "Selenginsky District"

A certain category of workers engaged in underground and open-pit mining, along with early pension provision provided for in Lists No. 1 and No. 2, has the right to early assignment (under certain conditions) of an old-age labor pension in accordance with subclause. 11 paragraph 1 of the commented article, regardless of age.

These conditions are as follows. Citizens who are directly employed full-time in underground and open-pit mining, including personnel of mine rescue units, in the extraction of coal, shale, ore and other minerals, as well as in the construction of mines and mines, have the right to an old-age pension, regardless of age, if they have worked in the relevant jobs and professions for at least 25 years. The list of such jobs and professions was approved by Resolution of the Council of Ministers of the RSFSR dated September 13, 1991 N 481 <1>, which is applied on the territory of the Russian Federation in accordance with Decree of the Government of the Russian Federation dated July 18, 2002 N 537.

Workers of leading professions (“face miner”, “miner”, “jackhammer operator”, “mining machine operator”) are granted an old-age pension early in accordance with the specified subclause, regardless of age, if they worked in underground mining operations at least 20 years.

Work on the production of products from extracted minerals, carried out in underground conditions of mines and mines, does not give the right to early assignment of a labor pension, since they are not directly related to the extraction of mineral resources. For example, sea salt production can be organized in the underground conditions of a mine. Workers engaged in this production do not have the right to early pension provision.

The same applies to workers in drainage mines who are not engaged in mining; they are subject to clause. 11 clause 1 art. 27 does not apply.

Geological exploration organizations may employ drillers engaged in exploration and other geological work in underground conditions. The current legislation does not provide for early pension provision. Drillers have the right to use an early-assigned labor pension according to the list of professions and positions provided for in List No. 1 (Section I).

When considering the issue of early assignment of an old-age labor pension to workers provided for in the List dated September 13, 1991, one should keep in mind: in relation to those who are engaged in underground work in the extraction of ore and other minerals, documentary evidence is required that what they extract minerals contain in their composition (including in host rocks) silicon dioxide (10% or more) or that their extraction is associated with gas-dynamic phenomena, rock bursts. Silicon does not occur in nature in its pure form. It is found in rocks in the form of compounds: silicon compounds with oxygen (silicon dioxide, or free silica), silicon compounds with metals (silicides), salt-like compounds (silicates), etc. These do not include ores and other minerals in which contains silicides, silicates and other silicon compounds.

Clause 2 of the List dated September 13, 1991 provides for mine rescue units serving mines and mines that are dangerous due to gas-dynamic phenomena, rock bursts, as well as mines and mines that are super-category or belong to the third category for gas. An old-age labor pension (regardless of age) with 25 years of employment in the specified mine rescue units is assigned to respiratory workers and commanders of squads and platoons, their deputies (assistants).

The term “rock bursts” means the manifestation in various forms of abnormally high rock pressure in a mountain range, which can manifest itself at any time in the form of a rock burst. Rockbursts, according to the degree, strength and nature of their manifestation, are divided into rockbursts proper, rock-tectonic bursts, microbursts, tremors, and shootings. Manifestations such as tremors and shooting in massifs also refer to rock bursts.

All deposits are divided into non-hazardous, threatened and dangerous due to rock bursts. Threatened and dangerous deposits due to rock bursts are united by the general term “prone to rock bursts.”

Information on the characteristics of ores and other minerals, indicating the percentage of silicon dioxide they contain, is available in the technical documentation for the development of the deposit, as well as in current geological documentation. These documents contain a preliminary assessment of the presence of gas-dynamic phenomena and rock bursts.

For workers engaged in underground coal and shale mining, as well as in the construction of coal and shale mines, confirmation of these factors is not required.

Along with underground work for the extraction of minerals and the construction of mines and pits, the List of September 13, 1991 provides for open-pit mining work for the extraction (overburden) of coal, ore and other minerals in open-pit mines and quarries with a depth of 150 meters or more, except for work on the surface ( including dumps).

Of the persons employed in these jobs, an old-age pension, regardless of age, is assigned to truck drivers involved in the removal of rock mass, loader drivers, bulldozer drivers, drilling rig drivers and their assistants, and excavator drivers and their assistants.

Open pit mining is mining operations carried out in quarries and open pits.

A quarry is a mining opening in the earth's crust as a result of open-pit mining.

The cut is the same, but only in relation to coal and shale mining.

Stripping is the removal of rocks that cover and host minerals during open-pit mining. Stripping operations are used both during the construction of quarries and open-pit mines to create the primary front of mining operations, and during the operation period to maintain and develop this front.

A dump is a mound on the earth's surface of waste rock, substandard minerals or waste. There are internal dumps (within the contours of a quarry or open-pit mine) and external dumps (outside the quarries and open-pit mines).

As noted above, the right to early assignment of a labor pension is given by open-pit mining in quarries and sections with a depth of 150 meters or more. The depth of a quarry or cut is determined as half the sum of the depths along the high and low sides. The elevation of the high edge of the quarry (cut) is taken to be the highest elevation of the upper edge of the upper ledge, the mark along the low side is the mark of the upper edge of the entrance trench at the point where it adjoins the contour of the quarry, and the depth of the quarry (cut) along the high and low sides is determined as the difference between corresponding marks of the top of the side and the bottom of the quarry (cut).

The length of service in the relevant types of work includes the time of work from the moment the quarry (cut) reaches a depth of 150 meters. In this case, the marking of the location of the workplace in such sections and quarries does not play a role.

The List dated September 13, 1991 provides for drilling rig operators and their assistants, as well as excavator operators and their assistants; other drivers are listed in this List without their assistants. Can these assistants be granted an old-age pension early, regardless of age? In accordance with the clarification of the Ministry of Labor of Russia dated May 22, 1996 N 5 (clause 9), “assistant” is a derived name from any profession, in this case from the profession “machinist”. Workers whose professions are derived from the professions provided for in this List may enjoy the right to early assignment of an old-age labor pension, regardless of age.

A few words about truck drivers working in quarries and open-pit mines. They are assigned an old-age pension (regardless of age) if they are engaged in the removal of rock mass in the technological process of open-pit mining. Truck drivers performing work on the surface do not have the right to an old-age pension, regardless of age. They are provided in List No. 2 (subsection 1 section II).

For longwall miners, drifters, jackhammer drivers and mining machine operators, in accordance with the clarification of the Russian Ministry of Labor dated July 15, 1992 No. 1, periods of work as hole drillers, hydraulic monitor operators, and fasteners (engaged in fastening working faces during mining) are also counted in their special experience. minerals), drilling rig drivers, vibratory loading rig drivers, loading and hauling machine drivers, loading machine drivers and scraper winch drivers, provided they are constantly employed in the faces of mines and mines directly in the extraction of mineral resources and excavation of mine workings as part of integrated teams on works provided for in the tariff and qualification characteristics of the specified leading professions.

Does the length of service in the relevant types of work include the period of training in the professions specified in the list?

For workers engaged in underground work and who have not completed the necessary length of service to qualify for an old-age labor pension, but who have it for at least 10 years, an early old-age pension - regardless of age if they have at least 25 years of underground work experience - is awarded with credit for this length of service. for each full year of work as a longwall miner, drifter, jackhammer operator, mining machine operator - for one year and three months, as well as for each full year of underground work provided for in List No. 1 - for nine months.

This procedure for calculating length of service in the relevant types of work applies only to those workers who are engaged in underground work. For example, such a right does not apply to workers engaged in open-pit mining operations for the extraction (overburden) of coal, ore and other minerals, although these works give the right to early assignment of an old-age pension in accordance with subparagraph. 11 paragraph 1 of the commented article.

Thus, an indispensable condition for acquiring the right to a preferential procedure for calculating the length of service of miners is that workers have at least 10 years of experience, which should only be in underground work. Moreover, this experience can be developed only in the four leading professions or only in the professions provided for in the List of September 13, 1991.

Example No. 1.

The citizen worked as a miner for 12 years and 14 years in the profession of “fixer” in the extraction of minerals that do not contain silicon dioxide (10% or more) and in the absence of gas-dynamic phenomena, rock bursts (this profession is provided for in List No. 1). In this case, the citizen’s length of service in the relevant types of work will be 25 years 6 months, which is added up as follows: (12 x 1.3 = 15 years) + (14 x 0.9 = 10 years 6 months). Taking into account this length of service, he may be assigned an early retirement pension in old age, regardless of age, as an employee with 25 years of underground work experience.

Example No. 2.

The citizen has a total of 10 years of experience in underground work, provided for in subsection. 11 clause 1 art. 27 of Law No. 173-FZ. Of these, 8 years - in the profession of “mining machine operator” and 2 years - in the profession of “hole driller” in underground work for coal mining in a mine (the work is provided for in the List of September 13, 1991). In addition, the citizen worked for 5 years in the profession of “forklift driver” in open-pit mining (overburden) of coal and ore (the profession is indicated in the List) and 11 years in underground work according to List No. 1. The citizen’s special work experience will be 25 years: (8 x 1.3 = 10 years) + (11 x 0.9 = 8 years) + (2 + 5 = 7) = 25 years. This provides grounds for the early assignment of an old-age labor pension to him, regardless of age, according to the List of September 13, 1991.

Example No. 3.

The citizen has 14 years and 6 months of work in the profession of “hole driller” in underground coal mining operations in a mine (the profession is indicated in the List of September 13, 1991), which provides grounds for applying a preferential procedure for calculating length of service in the relevant types of work.

For another 14 years he worked in the profession of “fixer” in underground mining of minerals that do not contain silicon dioxide (10% or more) and in the absence of gas-dynamic phenomena, rock bursts (this profession is included in List No. 1). As a result, the citizen’s length of service in the relevant types of work will be 25 years: 14 years 6 months + (14 x 0.9 = 10 years 6 months). A citizen has grounds for early assignment of an old-age labor pension according to the List dated September 13, 1991. Office of the Pension Fund of the Russian Federation in the Selenga region

How old are they?

Many people are interested in information about what time miners retire.

- Citizens who work full time in open and underground mining areas, as well as mine rescuers and those who construct mines and shafts, regardless of age, can retire if they have 25 years of experience.

- Miners who work with jackhammers, mining face workers, and mining machine operators only need to work for 20 years to qualify for a pension.

- An accident is added to the length of service if it occurred at work. In this case, the employee’s age is reduced by 1 year (that is, 1 year is added to the length of service).

- When working underground, there is a reduction of ten years for men and seven and a half years for women.

Study and military service are also included in the preferential miner's length of service, which allows such citizens to become pensioners earlier.

Calculation of preferential length of service for early retirement

If a woman does not retire after 55 years of age, but continues to work, then for each subsequent year she can count on additional points and an increase in the fixed pension. How much underground work experience is needed? If a citizen worked in underground work for most of his work experience, then he has the right to count on accrual of a preferential part of his work experience.

A preferential supplement to pension provision is assigned to those who worked directly in the coal industry, on a full-time basis, in open or underground jobs in the mining of coal and shale, and also participated in the construction of mines. Federal Law, it is necessary to establish the sector of the economy or field of activity in which the person applying for early retirement worked.

- A list that includes the type of activity of a person who has the right to retire early.

- Compare the name of the profession in the work book with the one that is in one of the lists.

In general, the amount of pension accruals is made according to a special formula approved by Federal Law No. 400-FZ. To schedule early payments, a person must contact the local pension fund at his place of registration or the MFC. An application for such a pension must be submitted either by the applicant himself or his legal representative.

Has there been minimal changes?

In 2020, the minimum provision for miners depends on several factors, the main one of which is the cost of living in a particular region of the Russian Federation.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

The minimum pension in 2020 averages 17 thousand rubles, this amount varies depending on the region of residence of the pensioner, since the cost of living varies in different regions.

Is there a promotion planned?

Additional payment to the security is carried out through the Russian Pension Fund and is accrued along with the pension.

Payments to pensioners are financed by employers, who transfer funds to the Pension Fund every month for employees working in hazardous conditions.

There are no plans to increase miners' pensions in 2020, but recalculations will be made. The Russian Pension Fund will adjust the amount of additional payments, since the amount of contributions made to the Pension Fund has changed. The increase is made after the citizen submits an application for recalculation.

Benefits for miners in the healthcare sector

Important! Miners are subject to compulsory life and health insurance at the expense of federal appropriations for the corresponding year.

Miners have the right to an annual medical examination free of charge, and travel to the examination site is paid for (in both directions). In addition, they are entitled to free production, installation and repair of dentures. The only thing is that they cannot be made from expensive materials such as porcelain, ceramics, metal ceramics, and precious metals.

If a miner suffers a work-related injury or injury, treatment will be provided free of charge; in addition, the worker will be provided free of charge with prosthetics and orthopedic products necessary for rehabilitation. Occupational diseases are also subject to treatment at public expense.

Miners are provided with free trips to sanatoriums and resorts to improve their health after difficult and harmful work.

Additional payment to miners for pensions in 2020

When miners retire and payments are made, they are entitled to an additional payment accrued every month. Many people are interested in how the surcharge is calculated in Russia and its size.

The calculation of the amount of the surcharge is made by multiplying the values:

- average wages for the period July-September 2001;

- quotient from dividing the average monthly salary for 24 months of work in hazardous conditions (60 months of work in another position) and the average salary in the Russian Federation for the same period of time;

- private, obtained by dividing the average amount of contributions to the Russian Pension Fund and the total amount of money in the form of additional payments to pension provision;

- coefficient of average employee payments.

A revision of the formula according to which the pension supplement for miners is calculated is planned for November 2020.

Perhaps after this the surcharge will be increased.

Size

What additional payment to the miner's pension will be does not depend on the amount of security, but it is approved specifically for it.

Factors on which the size of pension benefits depends:

- duration of work in the coal mining industry;

- average monthly salary of a former miner;

- contributions transferred by the employer to the Russian Pension Fund.

In the case where the bonus is calculated based on the amount of security for length of service, its value in 2020 will be 55%. If a citizen works for one year in excess of the required length of service, then another percentage (56%) is added to the amount due to him.

Interest accrual above 55% continues until the value of 75%, calculated from the pension provision, is reached.

Parental leave and sick leave are excluded from the list of factors influencing additional payments.

The average monthly salary of an employee applying for a security supplement includes:

- bonuses;

- government cash rewards.

Design features

It is impossible to accrue additional payments to miners' pensions in 2020 by default.

To receive money, a citizen must write an application to the Pension Fund of the Russian Federation and attach a package of documentation to it:

- papers confirming the duration of work activity, according to which it is possible to receive a bonus;

- a document containing information about the average monthly salary for the last 24 months.

The interests of the pensioner can be represented by a representative, provided that a notarized power of attorney is issued in his name.

Privileges

If in the past a pensioner was a miner and he has papers that confirm this, then such a citizen has the right to benefits at the federal and regional level.

List of benefits at the federal level in 2020:

- medical care in state hospitals for a former miner will be free;

- prostheses made from inexpensive materials are installed free of charge;

- state pharmacies provide preferential distribution of medicines (but there are few such points left in the Russian Federation, so a limited number of pensioners can take advantage of this benefit).

Does a pension depend on the minimum wage? Find out here.

Regional benefits include free travel for pensioners on public transport.

If a citizen does not want to receive medicines for free, then he has the right to submit an application to the Pension Fund with a request to receive this amount in cash equivalent.

Preferential medical care includes:

- insurance;

- free diagnostics;

- free prosthetics and dental checks;

- free treatment for work-related injuries.

List of benefits for children of miners:

- free breakfasts at school twice a week;

- provision of new school uniforms free of charge;

- priority admission to educational institutions.

Miners are rewarded for their length of service or quality of work done - a lump sum payment is made once a year.

Former miners have the right to choose this or a pension supplement.

If injured or disabled, a miner has the right to receive financial assistance.

If a miner dies, his family members have the right to receive the following assistance:

- from an insurance company (500 thousand rubles);

- benefits in the amount of one million rubles from the government;

- free funeral of the deceased is provided.

Upon receipt of disability, a miner has the right to choose a specialty and study for free in order to subsequently work elsewhere.

After the official assignment of a disability group, the former miner becomes entitled to benefits for the disabled.

Who retires at 50? Find out here.

What is the pension of deputies? Read on.

What is special retirement experience?

Special length of service represents the number of full years during which the employee carried out his labor activity in a special industry. What industries can be called special?

These are those professions that involve working conditions with increased risks.

Let's look at some of these professions.

- Medical workers - some of the professions, for example, a worker in the infectious diseases department, are exposed to risks when working with viral and infectious diseases.

- The pedagogical work experience of a citizen is also special .

- Test pilots also belong to the category of workers who receive special experience for calculating benefits.

- Military personnel have the right to retire early, and they receive additional guarantees and benefits.

- Civil servants are a category of workers who are given the right to go on vacation earlier for their length of service.

- Hot work experience is assigned to those categories of professions that are associated with very harmful and difficult working conditions . We will look at them in more detail below.

What is special retirement experience? Some professions have a negative impact on a person’s health and emotional state; when working under such conditions, a person has the right to additional allowances and the possibility of early retirement.

At the same time, the state must ensure that the citizen receives an earned pension in accordance with established guarantees and benefits.

Hot

Employees who work in conditions that negatively affect their health are entitled to additional bonuses in accordance with their accrued length of service.

The list of professions that can provide long-term work experience is determined at the legislative level.

There are two main lists of such specialties.

Let's look at which categories are included in the first list.

- Most of the work is underground in nature, this can be work in coal mines, laying communications underground, and so on.

- Some types of work characterized by harmfulness and difficult working conditions. These include work in the production of electrical equipment, at enterprises producing ammunition, and at oil refining stations.

- A category of work that is directly related to high temperatures, which are used for melting metal, glass, production of ceramic products, and so on.

Employees from this list may leave a little earlier than the established general period of rest if such conditions are met

- Men are allowed to leave at the age of 50, but at the same time he must have 10 years of active service and 20 years of insurance;

- Women can apply at the age of 45 if she has 7.5 years of active service and 15 years of insurance coverage.

There is another special list that we will look at below.

- Work in mountainous areas.

- Work in hazardous conditions of light industry - this can be gas and oil production, participation in drug production processes, food industry, and other types of light industry.

- Categories of work related to transport.

- Other types of work.

If we talk about working conditions, then in the second list they are easier when compared with the first, but at the same time they are not normal.

Therefore, men can retire upon reaching the age of 55, if the harmful service is 12.5 years and the insurance period is 20 years. As for women, they have the right to retire at 50, if the harmful work experience is 10, and the insurance period is 20 years.

Infectious

Healthcare workers often deal with hazards and risks, for example, they have to deal with infectious diseases. Many questions have been raised about early retirement for health care workers given the increasingly private nature of the industry.

But at the same time, the Constitutional Court does not share this opinion, since regardless of whose ownership the enterprise is, an employee of a medical institution has the right, enshrined in law, that he can leave early.

Regulatory regulation of this issue is carried out through Federal Law No. 173. Here are the main points regarding the rules for calculating an employee’s length of service, as well as the assignment of benefits.

For medical industry workers, the right to benefits is determined in such a way that early retirement is possible:

- for men upon reaching the age of 55 years, if the medical experience is 12.5 years, and the insurance period is 25 years;

- for women upon reaching 50 years of age, with 10 years of medical experience and 20 years of insurance experience.

The most alternative option for calculating benefits will be determined individually for you; for this you need to contact the fund at your place of residence.

Estonian

Estonia and Russia have been continuing mutually beneficial cooperation in the field of pensions for some time now. Special options for calculating benefits have been developed for the Russian military. It is worth noting that in Estonia this category of people retires somewhat earlier.

What is the cooperation between the two states? A serviceman who lived and worked in one of these states and then decided to change his place of residence has the right to receive benefits at his place of residence.

But there is a very important condition here. In order to secure this right by law, it is necessary to obtain at least 12 months of work experience at the place of new residence.

How is deputy work taken into account when calculating benefits?

For deputies who have retired, they have the right to additional benefits and additional payments. To assign such additional payments, you must independently contact the pension authority and write a corresponding application.

Some categories of such citizens receive and reserve the right to lifelong security, monthly additional payments, raises, and so on.

Forest

If a citizen works at an existing logging enterprise, then he has the right to early retirement in the following cases:

- for men upon reaching the age of 55 , if the forestry experience is 12.5, and the insurance period is 25 years;

- for women, the age for early care will be 50 years , while forestry and insurance experience should be at the level of 10 and 20 years, respectively.

The accrual and calculation of pensions is regulated by Federal Law No. 400.

Payments to diesel locomotive drivers with incomplete wheel experience

Railway workers have some benefits when applying for a pension and entering a well-deserved retirement. Early care is provided for them, five years earlier than the established period, that is, upon reaching the age of 55, under certain conditions, a pension benefit can be issued.

What these conditions are, we will consider further. If a railway employee has worked for more than 12.5 years and his total insurance experience is 25 years, then he may have such a right.

But at the same time, it is worth considering all the lists of professions that are included in the list of those who can be equated to railway workers.

If the diesel locomotive driver had incomplete wheel experience, then the term of service is proportionally reduced by a year for every 2.3 and 2 years for men and women, respectively.

Proslavery

Workers in the construction field, as well as those involved in the reconstruction and restoration of buildings and structures, are supposed to go on vacation a little earlier than the period established by the general procedure.

In this case, the calculation of output and the amount of pension occurs on an individual basis. In order to obtain such a right, you must contact the Pension Fund authorities at your place of residence with all the necessary documents.

For early retirement, the period of well-deserved rest is determined by the age for men and women of 60 and 55 years, respectively. In this case, the slave production should be 12.5 and 10 years, respectively.

If the length of service is not fully completed, then for every 2.6 and 2 years the age of care is reduced by a year.

Rural

Benefits are provided for medical workers when working in rural areas. Thus, a special procedure for calculating length of service and calculating benefits is provided for them.

For example, if a nurse worked in a village for 1 year, then her output will be 1 year and 3 months. These benefits apply to doctors and junior medical staff who worked in rural areas.

Field

If a citizen works in the geological field, then he also has the right to early retirement. The conditions for this are:

- for men this is possible at the age of 55, if the field and insurance experience is 12.5 and 25 years, respectively;

- for women the age is 50 years if the output is 10 and 20 years.

The category of field work includes expeditions, exploration, work in geological parties, and so on.

Charges to miners

Special conditions are provided for miners for early retirement. At the same time, miners belong to the category of workers who earn underground experience. For retirement in Russia, it is 10 and 7.5 years less than the established period for men and women.

As for work experience, it must be at least 25 years. Moreover, if an employee was injured at an enterprise and was on sick leave, then this period is included in the length of service. At the same time, the period of care is reduced by a year.

Length of service for masons

For some categories of masons, the possibility of retiring earlier than the established period has been established. At the same time, the minimum development in this profession is 6 years and 3 months, the maximum is 12.5 years.

As for the insurance output, it should be at the level of 25 years. This applies to men who have reached the age of 55 years. For women, the conditions are slightly different. Namely, you can retire at the age of 50, if the mason’s output has reached 10, and the insurance coverage is at the level of 20 years.

For firefighters

Rescuers of the Ministry of Emergency Situations and firefighters can retire earlier in the following cases:

- the employee has completed a certain length of service, which is determined depending on the profession;

- he turned 50;

- the total output in this service is at least 25 years.

A certain output is at the level of 15 and 25 years. The first is provided for those who worked in difficult working conditions that are dangerous to health.

Read about how to retire with mixed service for military personnel and emergency workers of the Ministry of Emergency Situations here.

For tractor drivers

For tractor drivers, a reduction in the retirement age is possible only for the category of women who have worked in this position for 15 years; upon retirement, a woman must be 50 years old.

Insurance experience of 20 years is required.

For FSIN employees

Employees working in correctional organizations and colonies have benefits and other benefits upon retirement. It is worth saying that working in the Federal Penitentiary Service is equivalent to military service.

Such categories of workers can receive a pension for long service , for disability, and in the event of his death, relatives can apply for a survivor's pension. The retirement period is 45 years, the service life is 12.5 and 25 years, respectively, in the positions of the Federal Penitentiary Service and insurance.