In 2020, the answer to the question of what age police officers and other employees of the Ministry of Internal Affairs retire remains unchanged. The pension reform did not affect the circle of people whose well-deserved rest depends on the duration of their working activity.

Although over the past few years there has been active debate about possible innovations in the field of pensions for law enforcement officers. This in turn leads to the dissemination of a large amount of false information. After all, the proposed bills are at the discussion stage, and it is too early to judge the final introduction of changes.

Legislation

Police pensions are assigned and calculated in accordance with the following regulatory and legislative acts:

- Law No. 342-FZ of November 30, 2011 (on payments for mixed length of service);

- Law No. 4468-1-FZ of February 12, 1993 (as amended on December 20, 2020, effective January 1, 2020);

- Government Decree No. 941 of September 22, 1993;

- Federal Law No. 400 dated December 28, 2013;

- Law No. 247-FZ of July 19, 2011.

Long service pension

a) persons who have 20 years or more of service on the day of dismissal from service;

b) persons dismissed from service upon reaching the age limit for being in service, for health reasons or in connection with organizational and staffing measures and who have reached the age of 45 on the day of dismissal, having a total work experience of 25 calendar years or more, of which at least 12 years and six months of service.

(All conditions specified in paragraph “b” must be met on the day of dismissal. Work experience after dismissal from service is not taken into account)

a) persons with 20 years of service or more: for 20 years of service - 50 percent of the corresponding amounts of salary; for each year of service over 20 years - 3 percent of the monetary allowance, but in total no more than 85 percent of these amounts;

b) for persons with a total work experience of 25 calendar years or more, of which at least 12 years and six months are service, for a total work experience of 25 years - 50 percent of the corresponding amounts of monetary compensation; for each year of service over 25 years - 1 percent of the monetary allowance.

This is important to know: The period of incapacity for work on sick leave: how long does it last and for what is the minimum period of sick leave?

The procedure for calculating length of service is determined by Resolution of the Council of Ministers - Government of the Russian Federation dated September 22, 1993 No. 941, which defines the periods of service, training and work included in length of service for the purpose of assigning a pension for long service, incl. and in preferential terms.

In addition, from January 1, 2012, pensions are calculated from 54% of the corresponding amounts of monetary allowance (from 01/01/2013 - 56%; from 10/01/2013 - 58.05%; from 01/01/2014 - 60.05%, from 10/01/2014 – 62.12%, from 10/01/2015 – 66.78%, from 02/01/2016 – 69.45%, from 02/01/2017 – 72.23%, from 10/01/2019 – 73.68%). The further calculation procedure remained unchanged.

Calculation of pension for length of service.

How much experience is needed?

In the Russian Federation, women retire at 55, men at 60. Before this age, payments may be assigned:

- employees of hazardous industries;

- teachers;

- health workers;

- police officers;

- military.

In order to retire, an employee of the Ministry of Internal Affairs must have at least 20 years of service in the relevant structures.

If he reaches the maximum service age (45 years), but does not have twenty years of service, then in order to receive a pension the following conditions must be met:

- there must be medical conditions that do not allow him to perform his duties (the policeman is dismissed for health reasons);

- mixed experience, that is, with 25 years of experience, at least twelve and a half years of service in law enforcement agencies (must be awarded a rank, passed certification).

Payments for mixed length of service were legalized in 2011 thanks to Federal Law No. 342. If the length of service in law enforcement agencies is less than twelve and a half years, then benefits are paid.

The period of study at a university is included in these twelve and a half years if a title was awarded during study.

Disability benefits are paid when an illness is acquired or an injury occurs during service. The purpose of such payments does not depend on length of service.

Main characteristics of a pension

Procedure for retirement of employees of the Ministry of Internal Affairs

Employees of the Ministry of Internal Affairs have a number of benefits upon retirement, since their activities are directly related to risks to life, irregular work schedules and other factors.

The retirement procedure largely depends on what type of pension is assigned to the former employee of the Ministry of Internal Affairs. Pensions are currently being allocated:

- by length of service;

- by disability group;

- for the loss of a breadwinner.

Conditions for applying for a pension:

- employee experience - 25 years;

- direct labor activity in authorities - 12.5 years;

When you retire, you should send the following papers to the Pension Fund branch (hereinafter referred to as the Pension Fund):

- application;

- calculation based on the length of service of the period worked;

- monetary certificate;

- a document confirming the application of preferential conditions;

- consent to the processing of personal information.

When forming a pension related to disability, it is necessary to additionally provide a certificate from a medical expert commission, which identifies one of three groups.

When forming pension contributions to the relatives of the deceased, you must additionally submit to the Pension Fund: a document confirming the fact of death of an employee of the Ministry of Internal Affairs; decision of the judicial authorities to declare a close relative missing; an extract from the order to exclude the deceased from the Ministry of Internal Affairs; documents on relationship with a former employee of the Ministry of Internal Affairs; an investigation document related to identifying the cause of death; conclusion of the military medical commission (briefly MMC).

Drawing up a report on retirement

When applying for a pension, an employee of the Ministry must submit a report addressed to the head of the Ministry of Internal Affairs. The report is drawn up on a specially prepared form, which states the fact of receiving an imminent pension. In the form, the employee of the Ministry of Internal Affairs indicates personal information, including: full name; phone number; assigned title; actual and legal address of residence.

In addition, the main part of the form should indicate: the basis for dismissal; type of future pension; information about cash payments; information about a previously assigned pension (if available); general information about family and children. At the end of the application you must indicate the date and sign.

Pension supplements for employees of the Ministry of Internal Affairs

Preferential bonuses for former employees of the Ministry will be paid from the amount of calculated pension data, which depend on the age of the Ministry of Internal Affairs employee, his status and marital status.

What benefits do combatants have? Learn more about the amounts of allowances.

For example, employees of the Ministry of Internal Affairs who have received a long-service pension can receive such allowances as:

- participants in combat operations are entitled to an increase in pensions by 32%, upon reaching the 80-year age threshold - 64%;

- 1st disability group when turning 80 years old – 100% increase;

- for one disabled citizen - 32%, for two - 64%; more than three - 100%.

If a dependent receives a pension on his own, then the supplements are canceled!

Second pension for employees of the Ministry of Internal Affairs

According to Federal Law No. 156, former employees of the Ministry of Internal Affairs can apply for an old-age pension, except for the one assigned based on length of service.

To apply for an additional pension you need:

- take into account the insurance period - from 5 years, which was not taken into account when forming the basic pension;

- age – 60 years;

- availability of a previously assigned pension.

To apply for a second pension, you must provide the following documents to the Pension Fund:

- passport details;

- insurance certificate (SNILS);

- employment history;

- certificate of pension payments - it contains basic information about the recipient of pension contributions, for example, the date of formation of the pension, the number of years worked, and so on.

- income certificate.

Bills regulating the procedure for calculating pension payments to former employees of the Ministry of Internal Affairs:

- Federal Law-247 dated July 19, 2011;

- Resolution No. 878 of November 3, 2011;

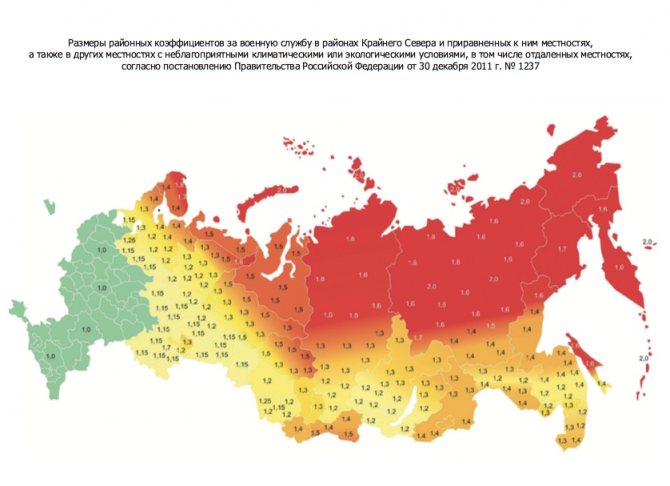

- Resolution No. 1237 of December 30, 2011;

- Order of the Ministry of Defense No. 288, Ministry of Internal Affairs of the Russian Federation No. 627, Ministry of Emergency Situations of the Russian Federation No. 386, FSB of the Russian Federation No. 369, Federal Customs Service of the Russian Federation No. 855 dated July 12, 2007.

Types of support for employees of the Ministry of Internal Affairs

According to Federal Law No. 4468-1, police officers are entitled to three types of pensions:

- for loss of a breadwinner;

- disability;

- length of service

The same law contains the rules according to which payments to police officers are calculated.

By length of service

Law No. 4468-1 (Article 13) contains a list of circumstances that give a police officer the right to receive benefits for his length of service.

The appointment is made in the following cases:

- existing length of service;

- being 45 years old, having the required total work experience and duration of service in the structures of the Ministry of Internal Affairs.

In the second case, the reasons why the employee was dismissed from the authorities are taken into account:

- age;

- reorganization, elimination of positions, changes in the number of staff, its composition, structure;

- disease.

The length of service required to enter a well-deserved retirement includes the period of study at a university and time of work in the following law enforcement agencies of the Russian Federation:

- Armed forces;

- Federal Penitentiary Service;

- Russian Guard;

- State Fire Service;

- Federal service that controls drug trafficking.

Government Decree of the Russian Federation No. 941 of September 22, 1993 will help you correctly calculate length of service.

For disability

The calculation of the amount of payments is made differently if the police officer was injured, as a result of which he became disabled. In this case, the amount of payments will depend on the disability group. Such payments can be assigned to employees within 3 months after dismissal.

To calculate payments from the Ministry of Internal Affairs, disability, if it occurs later than 3 months after dismissal, must be received during service due to:

- mutilation;

- contusions;

- injuries;

- diseases.

Persons who are entitled to receive disability benefits:

- 80-year-old pensioners;

- if they have dependent disabled close relatives;

- WWII participants receiving support from the Ministry of Internal Affairs.

In case of loss of a breadwinner

Similar payments are provided to the family of a police officer killed in service.

After death or within 3 months after dismissal, family members have the right to apply for support for the loss of a breadwinner.

Sometimes the appointment of such payments is possible upon dismissal from the structure of the Ministry of Internal Affairs due to injury, wounds or illness received during service.

Obtaining such security is possible in the event of death or destruction after a 3-month period after dismissal. In this case, the cause of death must be an injury or illness received during service.

Legal regulation

In the Russian Federation (hereinafter referred to as the RF) there are several by-laws with the help of which the calculation of pensions for employees of the Ministry of Internal Affairs is determined and regulated. Benefits and privileges for military personnel are stipulated by Federal Law No. 247-FZ of July 19, 2011 “On social guarantees for employees of internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation.”

The largest and smallest amount of benefits, types of benefits and allowances are determined by the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, drug control agencies and psychotropic substances, institutions and bodies of the penal system, troops of the National Guard of the Russian Federation, and their families.”

The procedure for calculating wages for employees of the Ministry of Internal Affairs is established by the Federal Law of November 7, 2011 “On the monetary allowance of military personnel and the provision of individual payments to them.” This document determines the minimum and maximum salaries of police officers according to military ranks and positions, and also establishes a specific amount of allowances depending on the length of service in the internal affairs bodies.

- 15 diseases that can be identified by your feet

- How to register at the dacha

- EDV 5,000 rubles for pensioners in 2020

Conditions for appointing an insurance company

Former police officers try to return to work after dismissal (retirement) even while receiving payments. Thanks to this, they have the right to receive an insurance pension, since the new employer transfers funds to the Pension Fund of Russia (PFR).

In accordance with Article 8 of Federal Law No. 400, insurance coverage is provided with the preservation of payments from the Ministry of Internal Affairs, if the conditions are met:

- age (women - 55, men - 60 years);

- the minimum IPC in 2020 is 13.8 points;

- The duration of the insurance period is from nine years.

The IPC (individual pension coefficient) indicator increases every year by 2.4 points.

The insurance pension assumes a certain amount of work experience, which will increase annually by 1 year until it reaches fifteen years in 2024.

Increasing pension benefits for police officers

When calculating police payments in 2020, indexation must be taken into account. This procedure is implemented every year. This applies to the entire population of the country, including retired police officers.

The calculation of the pension of an employee of the Ministry of Internal Affairs indicates the dependence of the amount on the type of social benefit.

It could be:

- payment related to length of service (the increase will occur from October 2020, the salary will increase by 4.3%, in addition, pension accruals will be indexed by 2%);

- benefits assigned to employees who have received disabled status (increased from April 2020);

- for non-working pensioners, the insurance component of the benefit has been increased by 6% since the beginning of the year.

For a working police officer, 2020 does not provide for an increase in the amount of payments.

Additional payments to employees of the Ministry of Internal Affairs in the amount of 2,500 rubles

In order to implement Decree of the President of the Russian Federation No. 604 of 2012 “On further improvement of military service in Russia,” citizens serving in the Ministry of Internal Affairs are assigned an allowance of 2,500 rubles .

This payment became effective in February 2020. The right to receive it is given to persons who have retired through the Ministry of Internal Affairs.

How to calculate a police officer's pension (formula)

The amount of payments to police officers for length of service is regulated by Article 14 of Federal Law No. 4468-1.

When calculating the amount of security, the following are taken into account:

- length of service (allowance);

- length of service (service or mixed);

- rank;

- official salary;

- cool classification.

The salary for the position is summed up with allowances, after which the resulting amount is multiplied by a percentage of the salary.

Are the widows of the liquidators of the Chernobyl accident entitled to a pension? What to do if the pension did not arrive on the Sberbank card? Find out here.

The formula by which the pension of a police officer is calculated in 2020:

RPO = 1/2 × (OD + OSZ + NVL) × 72.23%

- OD+OSZ+NVL is DD (monetary allowance);

- NVL - bonus for years of service;

- OSZ - salary in accordance with rank;

- OD - official salary;

- RPO - pension;

- 72.23% - coefficient (reducing for 2020).

According to Article 15 of Federal Law No. 400-FZ, the calculation of old-age payments to a police officer is made according to the formula:

SP=IPK x SPK

- SP - old-age insurance pension;

- SPK - the cost of 1 PC on the date of payment;

- IPC - individual pension coefficient (PC).

Calculation examples

Calculation of payments using the example of a specific pensioner:

- length of service in the Ministry of Internal Affairs - 22 years;

- salary for the position - 12,600 rubles;

- salary according to rank - 8550 rubles;

- surcharge - 30% (RUB 6,345).

12600+8550+6345=27495 rubles, this amount must be multiplied by the percentage of DD (27495 x 54% x 56%), resulting in 8314.49 rubles. A coefficient applicable in a particular area may be added to this amount.

On the Internet you can find an online security calculator for police officers, so it is not necessary to calculate the amount of payments manually.

Calculation of pensions of the Ministry of Internal Affairs

On the territory of the Russian Federation, much attention is paid to pension payments for citizens. Especially when it comes to civil servants, law enforcement officers and military personnel. The calculation of pensions for representatives of the Ministry of Internal Affairs and the FSB is not similar to that used when calculating pension payments for ordinary employees. To simplify calculations, use special programs in the form of a calculator.

Changes have been made to the online calculator for calculating pensions:

- From February 2020, the reduction factor is equal to 72.23% of the employee’s salary. By 2020, this value remained the same.

- Since January 2020, the salary amount for position and military rank has been increased by 1.04 times.

Decor

The assignment of benefits to police officers is within the competence of the Pension Departments of the Ministry of Internal Affairs.

Documents for this are submitted to the personnel department at the place of duty 3 months before the planned day of dismissal.

If the amount of experience is sufficient for registration of security, but if the citizen is under 45 years of age, he has the right to apply to the military commission in order to issue him a certificate on his state of health.

Such a commission confirms disability or declares a person unfit to serve in the structures of the Ministry of Internal Affairs.

Documentation

To assign collateral you will need to submit the following documents:

- conclusion of the IHC;

- monetary certificate;

- information about length of service;

- private bussiness;

- if available, an extract from the ITU;

- certificates of benefits (if any);

- statement.

In the case of existing dependents, this fact is certified by a certificate of family composition. After checking the pension file, security is assigned and paid through the bank.

Retiring at 45 years old allows employees of the Ministry of Internal Affairs to earn insurance coverage. Because former police officers get jobs and employers transfer funds for them to the Pension Fund.

Registration of insurance coverage is carried out through the Pension Fund of the Russian Federation, which will require the submission of documents there:

- documents confirming work experience;

- information about existing dependents;

- registration;

- preferential certificates;

- certificates of change of personal data;

- statement.

There is no need to provide information about the time of service to the Ministry of Internal Affairs. Payments are assigned and calculated within ten days.

How is recalculation done?

The size of the pension depends on the total payments accrued during the period of service. If the size of these payments increases, recalculation becomes possible and rational. But due to the difficult economic situation in the country and the decrease in contributions to the budget revenues, the Government is discussing the possible abolition of indexation, various payments and allowances.

Last year, indexation was not carried out in full. At the beginning of 2020, a reform to increase the length of service for the possibility of retirement was considered and is still in progress. The deadline for completing this reform was set until October of this year.

- February 1 on the inflation rate;

- April 1 at the discretion of the Pension Fund of the Russian Federation.

Thus, in 2018, pension contributions are expected to increase in proportion to inflation rates.

Additional payments

Supplements (quantity, amount) depend on:

- retired police officer status;

- family situation;

- age;

- amount of payments.

Types of allowances used when assigning benefits based on length of service:

- with a total work experience of more than 20 years - 50% of the standard pension (another 3% is added for each subsequent year, the maximum additional payment is 85%);

- WWII participants - in the amount of 32%;

- after a person reaches 80 years of age, the premium will be 64%;

- 80-year-old disabled people of group 1 - 100%;

- disability as a result of illness - 75%, due to injury in the line of duty - 85%;

- if there are dependents, 32% is added to the payments for each (if there are more than 3 dependents, then the premium is 100%);

- in the event of the death of a policeman, if this did not occur during hostilities, the family is paid 30% of his salary (loss of a breadwinner).

The supplement for dependents does not apply if these family members themselves receive a pension.

Peculiarities of assigning pension payments in the Ministry of Internal Affairs system

The retirement of a police officer is subject to certain conditions.

These include;

- having 20 years of service;

- total output for at least 25 years;

- reaching the age category of 45 years;

- long service in the law enforcement department.

If a citizen is fired from the structure in question, then the reason that was taken into account when terminating the employment relationship is taken into account. For example, if the reason was a reduction in staffing levels, then the policeman is awarded a pension.

Factors influencing the amount of pension payments to employees of the Ministry of Internal Affairs

When talking about how to calculate the Ministry of Internal Affairs pension in 2020, it is worth considering certain provisions.

The list includes:

- length of service in the system;

- total output.

In addition, calculating a pension involves taking into account whether the citizen has dependents and whether he received the status of a disabled person while performing his job duties. The amount of the pension is affected by the coefficient established in the area where the policeman worked. If the listed criteria are met, then payments increase.

Privileges

The final amount of security is summed up taking into account benefits, which are:

- medical;

- transport;

- tax;

- basic.

Any pensioner has the right to receive benefits, but their number and size are directly dependent on the department paying the benefits.

List of main benefits:

- obtaining housing (if a pensioner does not have an apartment, then he has the right to get one);

- exemption from certain regional taxes;

- for treatment, medicines, medical care;

- travel

There are benefits provided to close relatives of retired police officers. There are no benefits for utility bills for pensioners of the Ministry of Internal Affairs.

To apply for benefits you will need to submit the following documents:

- personal passport;

- a document confirming pensioner status;

- TIN;

- documents on ownership of land, real estate, vehicles.

After the required papers are submitted to the tax service and its employees recalculate, taxes will no longer be charged to the pensioner.

List of special benefits in accordance with Law No. 247-FZ of July 19, 2011:

- 2 cash salaries, paid in the form of a one-time allowance for police officers with less than 20 years of experience;

- 7 cash salaries in the form of a one-time benefit for pensioners with 20 or more years of service in the Ministry of Internal Affairs.

If a pensioner received a rank or was awarded during his service in the police, then the amount of the one-time benefit increases by 1 salary.

Police officers dismissed without the right to receive a pension with 20 or more years of experience receive benefits every month for one year, the amount of which depends on their salary by rank.

Medical

Former police officers are entitled to medical benefits:

- medical care is provided free of charge only in medical institutions belonging to the Ministry of Internal Affairs (in other cases you will have to pay for treatment);

- receiving a free trip to a sanatorium affiliated with the Ministry of Internal Affairs once a year;

- purchasing vouchers for close relatives for 50% of the cost;

- priority in the provision of additional social services.

The preferential program does not apply to everyone equally. You can find out exactly what a particular pensioner is entitled to claim from the specialists who prescribe payments.

How to count?

We provide a convenient calculator especially for retired employees of the Ministry of Internal Affairs of the Russian Federation. The pension of police officers is calculated differently than that of ordinary citizens. So, in order not to get confused in these complex operations, we offer our own calculator for calculations. Below there will be a description in full detail of how to use it.

It is worth understanding that laws do not stand still, and perhaps we made a little mistake somewhere. This calculator should be used to roughly estimate the size of your future pension - the calculator will definitely not go wrong with this.

Attention! Dear reader, if you notice any inaccuracy, have a question or addition, feel free to write a comment. We will help as much as we can. Let us not refuse gratitude either. Thank you!

In the meantime, let's look at all the mechanics of use.

Formula

Here we have already written about the features of pensions for employees of the Ministry of Internal Affairs - CLICK.

Formula used when calculating for the current year:

RPO = 1/2 × (OD + OSZ + NVL) × 72.23%

where RPO is the amount of the pension, OD is the official salary, OSZ is the salary for a special rank, NVL is the award for long service. About the coefficients 1/ and 72.23 will be a little lower; they also change in the calculator. The expression OD+OSZ+NVL is also called “cash allowance.”

For simplicity, the calculation in our calculator is divided into 2 phases:

- Calculation of monetary allowance.

- Calculation, directly, of the pension amount.

The pension itself is calculated based on the first point, so just fill out all the fields one by one, and the result will appear at the very bottom of the form. Below is more detail on each point on how to calculate the pension of an employee of the Ministry of Internal Affairs of the Russian Federation, in case you get confused.

Calculation of monetary allowance

Salary by position

The main thing here is to indicate your latest salary for the position of a police officer. The list already contains positions held, if you don’t remember, you can choose an approximate salary that suits you. There is also an item “Indicate your salary yourself.” By selecting it, a field will appear below for manually entering your exact salary.

Promotion for flight crew class

Pilots' salaries are slightly higher. This list provides possible adjustments for increases. If you haven’t flown, feel free to skip it.

Salary by rank

The pension of police officers also depends on their rank. Similar to the first point - titles are also presented.

Establishing a bonus for length of service in the Ministry of Internal Affairs - all points are in place. All that remains is to count.

Regional coefficient

Depending on the place of service, it affects the amount of allowance. Feel free to search for your region on the Internet. If it is very difficult, we will specifically insert your region into the table.

Pension calculation

Here we have 2 main influencing coefficients - dependence on length of service and a reduction coefficient.

Seniority

To calculate your pension you must have:

- From 20 years of pure experience.

- or 25 years of mixed experience.

For this, the coefficient of 50% begins to work (the same ½ in the formula). At the same time, for each year of service over 20 years, 3% is added, and for mixed service, for each year over 25% - 1%. All this is reflected in the list. The maximum percentage is 85.

Reduction factor

Another constant value established by law for government employees. The reduction factor is gradually decreasing, now it is 72.23%, and in 2035 it will completely disappear. This coefficient is indicated for edits for early exit. If you don't know, don't touch it.

That’s all, below in the column “Final amount of pension” the approximate value of the pension of employees of the Ministry of Internal Affairs will be calculated. Take it for comparison. That's all, use our online pension calculator. Any questions - ask below.

Benefits for pensioners of the Ministry of Internal Affairs

Special benefits provided for by Federal Law No. 247-FZ dated July 19, 2011 for pensioners who served in the Ministry of Internal Affairs provide for the possibility of them receiving: a one-time benefit for employees with over 20 years of experience in the amount of 7 monthly salaries; a one-time benefit for employees with less than 20 years of experience in the amount of 2 monthly salaries.

If an employee received a state award or honorary title during his service, the benefit increases by 1 salary.

Citizens dismissed without the right to a pension and with at least 20 years of experience receive benefits every month for 1 year. The amount of the benefit is determined by the salary indicator by rank. How to calculate long service pension? 1. 20 years of service

To find out how to calculate the Ministry of Internal Affairs pension, a citizen should determine his work experience. The amount of the service pension depends on the status of the recipient.

Thus, the legislator establishes that persons entitled to receive a pension from the Ministry of Internal Affairs, with 20 years of service, receive a pension in the amount of 50% of the amount of their salary.

If the employee has more than 20 years of service, the pension will be calculated at the rate of 3% of the amount of allowance for each year of service. At the same time, the maximum pension for a person with more than 20 years of service is 85% of the citizen’s allowance. 2. Length of service from 25 years

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

If the employee’s work experience is 25 calendar years, then he receives 50% of the allowance. The pension of persons with such experience is calculated according to the rule established by Art. 14 of the Law of the Russian Federation of February 12, 1993 No. 4468-I.

In this case, accrual is made at the rate of 1% of the amount of allowance for each year of service. The size of the pension is not limited by law, but the law contains a clause according to which a work experience of 25 years must include at least 12 years and 6 months spent by a citizen in military service in certain government bodies. 3.

Minimum cash payout

The long service pension cannot be less than 100% of the pensions established in Federal Law No. 166-FZ dated December 15, 2001. At the same time, the authorities calculating the size of the pension should take into account the regular indexation of its size. 4. Increase in pension amount

Disabled people eligible to receive a pension can expect its amount to be increased. The increase in the amount depends on the disability group assigned to the citizen who served in the Ministry of Internal Affairs. In addition, the reason why the citizen became disabled is taken into account.

Among the main reasons for assigning a disability group, the law indicates: receipt of a military injury; getting a general illness; acquisition of a work injury.

The main rule for increasing a pension for a disabled person is the rule according to which disability should not be assigned to a person as a result of his committing unlawful acts.

Employees of the Ministry of Internal Affairs who were participants in the Second World War and recognized as disabled can also count on an increase in the interest rate for calculating pensions. 5. Special allowances

The percentage of the supplement paid from the amount of the calculated amount of pension transfers depends on the status of the recipient, his age and marital status.

Thus, persons receiving payments for long service are entitled to the following additional allowances: Citizens with pensioner status and group 1 disability who have reached the age of 80 years are awarded a 100% allowance. Pensioners who do not have a place of employment and who support disabled relatives are awarded a supplement in the amount of: 32% - for one dependent; 64% - for two; 100% - for 3 or more (if these family members receive a pension, the supplement does not apply). Pensioners who participated in the Great Patriotic War are given a bonus of 32%, but if they have reached 80 years of age, the bonus increases to 64%. Disability pension

This pension is received by persons who become disabled during the period of service or within 3 months from the date of dismissal. If disability occurs later, it must be caused by: injury during service; shell shock while working in the Ministry of Internal Affairs; injury during service; a disease acquired during service in the Ministry of Internal Affairs.

The amount of pension payments depends on the disability group, which is determined in accordance with the conclusion of a medical and social examination. Additional allowances can be received by: persons with dependent family members; pensioners over 80 years of age; WWII participants receiving a pension from the Ministry of Internal Affairs. Survivor benefits

Such a pension is accrued in the event of the death of the breadwinner to the families of employees of the Ministry of Internal Affairs who died/died during the period of service or no later than 3 months from the date of dismissal. It is also possible to pay a pension if the breadwinner died later than the specified period, if the cause of death was an injury or illness received during the period of service. Pension calculation formula

When calculating the pension amount, the following is taken into account: Salary by position. Length of work experience. Rank. Great qualifications. Long service bonus.

The salary and bonus amounts must be summed up. After this, the amount is multiplied by a percentage of the monetary allowance. If necessary, a regional coefficient is added to the result.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

The calculation of the Ministry of Internal Affairs pension differs from how pension benefits are calculated for other citizens. Therefore, a special program has been developed that helps to find out the future pension of a police officer.

Can an employee's pension be deprived?

When answering the question whether a police officer can be deprived of payments, it should be borne in mind that this is possible if two conditions are simultaneously met:

- if he committed a crime (especially serious, serious);

- was deprived of his special rank by the court.

Will there be indexation of pensions for Afghans in 2020? When will pensions for working pensioners be cancelled? Find out here.

What is the pension for civil aviation pilots? Read on.

Example of calculating pension benefits for a police officer

To better understand payment calculation schemes, it is necessary to provide examples of calculation of pensions for military personnel of the Ministry of Internal Affairs of the Russian Federation.

The source data includes:

- according to the length of service of the Ministry of Internal Affairs, he has 24 years (in this case, the bonus will be 1.3 points).

After this, a formula is applied to calculate the allowance paid each month.

- D – amount of allowance;

- Od – salary amount for the position;

- Oz – salary for rank;

- B – length of service.

If the police officer has civilian experience

When a person has a civilian income, a different formula is used for calculation. For example, you can take 27 years of experience.

(0.5 * D) + (0.01 * (OVS – 25) * D) * 0.7368, where:

- D – amount of allowance;

- O – total experience.

Innovations in 2020 - 2020

Latest news from the Ministry of Internal Affairs of the Russian Federation regarding pensions for police officers:

- it is planned to increase the length of service first to 25 years (instead of 20 at present) and by 2025 - to 30 years, the corresponding document will come into force in 2020;

- indexation in 2020 and receiving the “thirteenth payment”;

- There will be no reduction in the number of benefits or monetary allowances in 2020.

Former employees of the Ministry of Internal Affairs still remain the most non-poor in the Russian Federation, compared to other pensioners.

The amount of support for police officers is approximately 1.7 times higher than usual for old age: the average pension for a major is 20 thousand rubles, for a colonel - 30 thousand rubles.

Latest news about indexing

Every year, a police officer’s pension in Russia is subject to indexation. The procedure for recalculation varies depending on the nature of the collateral.

| Type DD | Period, 2020 | % indexing | Note | |

| for long service | planned in October | 4,3 | Increase in allowance | |

| 2 | indexing | |||

| Due to disability | April | 2,4 | Together with other social benefits | |

| Insurance payments for pensioners | working | January | 7 | due to the increase in the cost of pension points |

| unemployed | planned in August | — | Depending on insurance premiums | |

Indexing is done automatically. To carry out recalculation, no additional applications need to be submitted.

Calculations based on the length of service of the Russian Guard

If a citizen has worked in the Russian Guard for 24 years, then for each year he adds 3%. In this case the calculation looks like this:

21970*0.03*4 = 2626.4 rubles.

The National Guard pension calculator in 2020 can only be found on unofficial resources.

The official website does not contain calculation programs.