Free legal consultation by phone:

8

NPFs or, in other words, non-state pension funds have the powers of joint-stock funds, but also have the right to engage in mandatory provision activities. After the state issued a decree introducing this category of organizations, they became popular among legal entities. Immediately after the adoption of the law, more than 350 non-state pension funds appeared in the country. The government decided to introduce a law to regulate such a large number of organizations and control this industry.

Basic Concepts

The following concepts are used in federal law:

- NGO agreement is an agreement between the fund and the investor, according to which the latter undertakes to make contributions to the NPF, and the organization undertakes to provide him with NGO.

- Compulsory pension insurance agreement (OPI) is an agreement between a NPF and a citizen, according to which the NPF undertakes to assign and pay him a pension when an insured event occurs.

- Depositor is an individual or legal entity who is a party to the NGO agreement and makes contributions to the NPF.

- The policyholder is an individual or legal entity that is obliged to make contributions to the pension provision of its employee.

- Participant is an individual who, in accordance with the agreement, is paid by the NGO. A participant can also be a depositor.

- The insured is an individual who has entered into an insurance policy agreement.

- Pension contribution is money paid by the investor to the participant in accordance with the terms of the agreement.

- A pension scheme is a set of rules under which contributions are paid and payments are made to an NGO.

- Redemption amount is money that is paid by the NPF to fund participants or transferred to another organization upon cancellation of the agreement.

- Pension reserves are money that is at the disposal of a non-state pension fund and is intended for the organization to fulfill its obligations to its participants.

- The investment portfolio of a management company is assets that are formed from pension savings provided to the management company for trust management by a non-state pension fund.

- An actuary is a person who meets the standards defined for persons involved in the actuarial assessment of the work of an enterprise.

- A one-time payment is an amount provided to insured citizens from savings.

Latest changes made to Federal Law 75

The latest changes to Law 75 on non-state pension funds were made on December 31, 2020, with the adoption of Federal Law No. 482.

According to the latest edition, changes were made to article number 25.1, clause 7 was added. Situations when funds do not have the right to disclose information or situations when funds can disclose only a limited amount of information are determined by the Government of the Russian Federation. In general cases, the public provision of information is determined by this Federal Law. The Russian Government also determines when a fund has the right to disclose or not disclose information about clients.

There have also been changes in Article 36.14. In the first paragraph of the article, the number 1 was added to the word “Manager”. Also, paragraph 2 was added to the article. According to the law, fund managers are required in certain situations to disclose or limit, or completely hide information about their own clients (shareholders). However, after adding paragraph 2, the Government of the Russian Federation has the right to consider individual cases and prohibit or provide access to information.

Basic provisions

The main provisions of the law concerning the activities of the fund are that it must follow the following principles in its work:

- Introducing participants to the rules of the organization.

- Maintaining records of information about each participant.

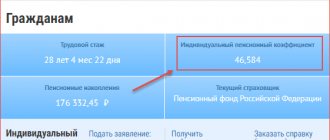

- Free provision to all participants of information about the status of their individual personal accounts (IPA) once every 12 months.

- Payment to the NGO according to the terms of the agreement.

- Compliance with the standards established by the Central Bank.

- Organization of a risk management system associated with work on NPO and OPS.

- Determining the price of assets that make up pension reserves according to the rules established by the Central Bank.

Prospects

The country is modernizing the current pension system, and the provisions relating to the activities of non-state funds are being revised. These organizations redistribute free resources to the needs of the economy, and not only pay additional funds to pensioners.

Prospects for the development of non-state pension funds are associated with the development of measures aimed at attracting individuals, as well as enterprise managers, to participate in the system of non-state provision of pensions.

This option suits citizens in that they can save money in small amounts, and the Non-State Pension Fund guarantees the safety of savings and their increase. The state undertakes to stimulate the development of funds and attract citizens to participate in the pension insurance system. Such organizations offer investors flexible schemes that are based on a contractual basis and legal mechanisms.

Guaranteed safety of funds

Conclusions:

- NPF is engaged in investing invested money, which allows the investor to increase the size of his funded pension.

- A fund operating on the basis of a license guarantees the fulfillment of all obligations stipulated in the agreement with the investor.

- The right to manage the funds of a deceased participant is given to any person named in the will.

- The activities of NPFs are controlled by the Bank of Russia.

- A citizen has the right to transfer a pension from one fund to another.

- The depositor receives information about the account status.

Legislative framework of the Russian Federation

not valid Edition from 07.05.1998

detailed information

| Name of document | FEDERAL LAW of 05/07/98 N 75-FZ “ON NON-STATE PENSION FUNDS” |

| Document type | law |

| Receiving authority | President of the Russian Federation, State Duma of the Russian Federation, Siberian Federation of the Russian Federation |

| Document Number | 75-FZ |

| Acceptance date | 13.05.1998 |

| Revision date | 07.05.1998 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | It does not work |

| Publication |

|

| Navigator | Notes |

The current version is FEDERAL LAW dated 05/07/98 N 75-FZ (as amended on 02/12/2001) “ON NON-STATE PENSION FUNDS”

FEDERAL LAW of 05/07/98 N 75-FZ “ON NON-STATE PENSION FUNDS”

May 7, 1998 N 75-FZ

Adopted by

the State Duma on April 8, 1998

Approved by

the Federation Council on April 22, 1998

Chapter I. General provisions Article 1. Relations regulated by this Federal Law

This Federal Law regulates the legal, economic and social relations arising during the creation, operation and liquidation of non-state pension funds, and also establishes the basic principles of state control over their activities.

Relations that arise during the creation, implementation of activities and liquidation of non-state pension funds in the system of non-state pension provision of the population are regulated by this Federal Law, other federal laws and other regulatory legal acts of the Russian Federation.

Article 2. Non-state pension funds

1. A non-state pension fund (hereinafter referred to as the fund) is a special organizational and legal form of a non-profit social security organization, the exclusive activity of which is non-state pension provision of fund participants on the basis of agreements on non-state pension provision of the population with fund investors in favor of fund participants.

The fund's activities for non-state pension provision of the population include the accumulation of pension contributions, placement of pension reserves, accounting for the fund's pension obligations and payment of non-state pensions to fund participants.

2. The funds operate and make payments of non-state pensions to fund participants regardless of the state pension provision of the population.

Article 3. Basic concepts used in this Federal Law

For the purposes of this Federal Law, the following basic concepts are used:

agreement on non-state pension provision (hereinafter referred to as the pension agreement) - an agreement between the fund and the fund contributor (hereinafter referred to as the investor) in favor of the fund participant (hereinafter referred to as the participant), by virtue of which the investor undertakes to transfer pension contributions to the fund within established periods and in certain amounts , and the fund undertakes, upon the onset of pension grounds, in accordance with the pension rules of the fund and the selected pension scheme, to pay the participant a non-state pension;

contributor - a legal or natural person who is a party to a pension agreement and transfers pension contributions in favor of the participants appointed by him;

participant - an individual who is a citizen of the Russian Federation, a foreign citizen or a stateless person, to whom, by virtue of the pension agreement concluded between the investor and the pension fund, payments of non-state pensions must be made or are being made. A participant can act as a contributor in his own favor;

pension contribution - funds contributed by the contributor to the benefit of the participant;

non-state pension - funds regularly paid to the participant in accordance with the terms of the pension agreement;

pension scheme - a set of conditions that determine the procedure for the formation of pension savings and payment of non-state pensions;

pension grounds - conditions (condition) for a participant to acquire the right to receive a non-state pension;

redemption amount - funds paid by the fund to the investor or participant or transferred to another fund upon termination of the pension agreement in accordance with the pension rules of the fund;

pension account - a form of analytical accounting that reflects the movement of the amounts of pension contributions of depositors and payments of non-state pensions to participants (joint pension account) or to a participant (registered pension account);

pension savings - the amount of pension contributions collected in favor of the participant, recorded in his pension account and determining the amount of the fund’s monetary obligations to the participant;

pension reserves - a set of funds owned by the fund and intended to ensure payments of non-state pensions;

pension rules of the fund (hereinafter referred to as the rules of the fund) - a document defining the procedure and conditions for the fund to fulfill its obligations for non-state pension provision, developed by the fund taking into account the requirements of this Federal Law, approved by the fund council and registered in the manner established by the state body in the field of pension provision, on which the Government of the Russian Federation is entrusted with control over the activities of the funds (hereinafter referred to as the state authorized body);

management company (hereinafter referred to as the manager) is a commercial organization in the form of a business company that has received the necessary permits (licenses) in the prescribed manner and manages the pension reserves of the fund (funds) on the basis of an agreement concluded with the fund (funds);

depositary is a professional participant in the securities market carrying out depository activities, which recognizes the provision of services for storing securities certificates and (or) recording and transferring rights to securities. Only a legal entity can be a depositary;

independent actuary (hereinafter - actuary) - a legal entity or individual entrepreneur registered in the manner prescribed by the legislation of the Russian Federation, having the appropriate permits (licenses) and carrying out actuarial assessment of the obligations assumed by the funds to investors and participants, the procedure for the formation of pension reserves, the accumulation of pension contributions and payments non-state pensions and redemption amounts, as well as actuarial assessment of the investment policies of funds and managers.

Chapter II. CREATION OF A FUND, ITS STATE REGISTRATION AND LICENSING OF ACTIVITIES Article 4. Creation of a fund

1. The creation of a fund is carried out in the manner prescribed by this Federal Law, other federal laws and other regulatory legal acts of the Russian Federation.

The founders (founder) of the fund can be legal entities and individuals.

2. The founders (founder) do not have rights to the property transferred to the foundation, which is the property of the foundation.

3. The Foundation is liable for its obligations with all its property.

4. The founders (founder), investors and participants, as well as the state are not liable for the obligations of the fund, just as the fund is not responsible for the obligations of its founders (founder), investors, participants and the state.

Article 5. State registration of the fund

The Fund acquires the rights of a legal entity from the date of state registration in accordance with the legislation of the Russian Federation.

The Fund receives the right to carry out activities related to non-state pension provision of the population from the date of receipt of permission (license) to carry out the specified activities.

Article 6. Constituent documents of the foundation

1. The constituent documents of the foundation are the charter and the constituent agreement. The foundation's charter is approved by its founders (founder). The procedure for creating a fund is determined by the constituent agreement concluded by its founders.

2. The foundation’s charter must contain:

full and abbreviated name of the fund, and the name must include the words “non-state pension fund”, information about its location;

regulations on the subject and goals of the fund’s activities;

information about the structure and competence of the fund’s management bodies, standards of representation in management bodies;

provisions on the procedure for appointing and dismissing officials, making decisions, publishing reports, monitoring the activities of the fund, reorganizing and liquidating the fund, distributing income from the placement of pension reserves, as well as the procedure for distributing property upon liquidation of the fund.

3. The foundation agreement must contain:

full and abbreviated name of the fund, information about its location;

regulations on the subject and goals of the fund’s activities;

information about the composition of the founders;

information on the amount of the total contribution of the founders when creating the fund;

information about the governing bodies of the fund and about the procedure for managing the activities of the fund;

a list of obligations of the founders of the fund to create the fund and ensure its activities, information about the conditions for the transfer of property by the founders to the fund and the participation of the founders in the formation of the total contribution;

provisions on the procedure for additional admission to the founders of the fund and withdrawal from the founders of the fund.

Article 7. Licensing of the fund’s activities

In order to protect the rights and interests of investors and participants, the activities of the fund are subject to mandatory licensing in the manner established by the legislation of the Russian Federation.

Chapter III. ACTIVITIES OF THE FUND Article 8. Functions of the fund

1. The Fund carries out its activities on the basis of this Federal Law, other federal laws and other regulatory legal acts of the Russian Federation, as well as the charter and rules of the Fund.

2. The Foundation, in accordance with the charter, performs the following functions:

develops conditions for non-state pension provision of participants;

concludes pension agreements;

accumulates pension contributions;

maintains pension accounts, informs investors and participants about the status of these accounts;

concludes contracts with the manager(s);

forms and places own funds, including pension reserves, independently or through a manager (managers);

maintains accounting records in accordance with the established procedure;

carries out actuarial calculations;

makes payments of non-state pensions;

exercises control over the timely and complete receipt of funds into the fund and the fulfillment of its obligations to participants;

provides information about its activities in the manner established by the state authorized body.

Article 9. Rules of the fund

1. The rules of the fund must contain:

a list of types of pension schemes used by the fund and their description;

provisions on the fund's responsibility to investors and participants and the conditions for the emergence and termination of the fund's obligations;

provisions on the procedure and conditions for making pension contributions to the fund;

provisions on the directions and procedure for placing pension reserves;

provisions on the procedure for maintaining pension accounts and informing investors and participants about their status;

list of pension grounds;

provisions on the procedure and conditions for the payment of non-state pensions;

provisions on the procedure for changing or terminating the pension agreement;

list of rights and obligations of investors, participants and the fund;

provisions on the procedure for forming pension reserves;

provisions on the procedure for calculating the redemption amount;

provisions on the procedure for providing investors and participants with information about the manager and the depositary with whom the fund has entered into agreements for the provision of services in accordance with the requirements of this Federal Law;

methodology for performing actuarial calculations of the fund's liabilities;

standards for determining the amount of payment for the services of the fund, manager and depository;

provisions on the procedure and conditions for making changes and additions to the rules of the fund.

2. Amendments and additions to the rules of the fund affecting the rights and obligations of investors and (or) participants are possible only with the consent of these persons or subject to their prior notification with the provision of investors and (or) participants with the right to withdraw from the fund with the receipt of the redemption amount or its transfer to another fund in case of disagreement of investors and (or) participants with the changes and additions made to the rules of the fund.

3. The rules of the fund may contain other provisions that do not contradict the legislation of the Russian Federation.

4. The rules of the fund cannot contradict this Federal Law, other federal laws and other regulatory legal acts of the Russian Federation. Pension agreements concluded by the fund cannot contradict the rules of the fund.

Article 10. Pension grounds

Pension grounds for the purposes of this Federal Law are:

the grounds provided for by the pension agreement and established at the time of its conclusion by the current legislation on pension provision in the Russian Federation;

other grounds established by federal laws.

Article 11. Requirements for pension schemes

Requirements for pension schemes used for non-state pension provision of the population in accordance with this Federal Law are determined by the Government of the Russian Federation.

Article 12. Pension agreement

1. The pension agreement must contain:

names of the parties;

information about the subject of the contract;

provisions on the rights and obligations of the parties;

provisions on the procedure and conditions for making pension contributions;

type of pension scheme;

pension grounds;

provisions on the procedure for payment of non-state pensions;

provisions on the liability of the parties for failure to fulfill their obligations;

duration and termination of the contract;

provisions on the procedure and conditions for changing and terminating the contract;

provisions on dispute resolution procedures;

details of the parties.

2. Pension agreement;

provisions on dispute resolution procedures;

details of the parties.

2. The pension agreement may provide for other provisions that do not contradict the legislation of the Russian Federation.

Article 13. Rights and obligations of investors and participants

1. The rights and obligations of investors and participants are determined by this Federal Law, other federal laws and other regulatory legal acts of the Russian Federation, the rules of the fund and the pension agreement.

2. Investors have the right:

require the fund to fulfill the fund’s obligations under the pension agreement in full;

represent your interests and the interests of its participants before the fund, appeal the actions of the fund in the manner established by the legislation of the Russian Federation;

require the fund to transfer redemption amounts to another fund in accordance with the rules of the fund and the pension agreement.

3. Participants have the right:

demand from the fund the fulfillment of the fund’s obligations for non-state pension provision in accordance with the terms of the pension agreement;

receive a non-state pension in accordance with this Federal Law, the terms of the pension agreement, the rules of the fund and the selected pension scheme when a pension basis arises;

require the fund to change the terms of non-state pension provision in accordance with the rules of the fund and the terms of the pension agreement;

demand from the fund payment or transfer to another fund of redemption amounts in accordance with the rules of the fund and the terms of the pension agreement;

receive information from the fund about the status of your personal pension account.

4. Investors are required to make contributions exclusively in cash in the manner and amount provided for by the rules of the fund and the pension agreement.

Investors and participants are required to inform the fund about changes that affect the fulfillment of their obligations to the fund.

5. Investors and participants may have other rights and obligations provided for by this Federal Law, other federal laws and other regulatory legal acts of the Russian Federation, fund rules and pension agreements.

Article 14. Responsibilities of the fund

1. The Foundation is obliged:

carry out its activities in accordance with this Federal Law;

familiarize investors and participants with the rules of the fund and all changes and additions made to them;

keep track of their obligations to investors and participants in the form of maintaining pension accounts and accounting for pension reserves, provide investors and participants with information on the status of joint and (or) registered pension accounts at least once a year;

pay participants non-state pensions in accordance with the terms of pension agreements;

transfer, on behalf of the investor or participant, the redemption amount to another fund in accordance with the terms of the pension agreement;

do not make unilateral decisions that violate the rights of investors or participants.

2. In order to protect the interests of participants, the Fund does not have the right to accept guarantees for the fulfillment of obligations by third parties, pledge pension reserves, act as a founder in organizations whose organizational and legal form implies full property liability of the founders (founder), or issue securities . Transactions made in violation of the requirements of this paragraph are considered void.

Article 15. Information constituting a commercial secret

The Foundation has no right to transfer information that constitutes a trade secret to third parties. This information includes information on the status of pension accounts and payments of non-state pensions made by the fund. The specified information can be transferred to third parties only at the request of investigative, judicial, tax authorities and the state authorized body in cases established by the legislation of the Russian Federation.

Chapter IV. OWN PROPERTY OF THE FUND Article 16. Own property of the foundation

The fund's own property is divided into property intended to support the fund's statutory activities and pension reserves.

Article 17. Property intended to support the statutory activities of the fund

Property intended to ensure the statutory activities of the fund is formed through:

total contribution of the founders (founder’s contribution);

target contributions of investors, part of the fund's income from the placement of pension reserves used to cover the fund's costs in accordance with the rules of the fund;

income of the fund from the use of property intended to ensure the statutory activities of the fund;

charitable contributions and other legal income.

Article 18. Pension reserves

1. To ensure its solvency for obligations to participants, the fund forms pension reserves.

2. Pension reserves are formed through:

pension contributions;

the fund's income from the placement of pension contributions.

3. Pension reserves are created for each type of pension obligations in amounts sufficient to ensure coverage of these obligations. The standard amount of pension reserves is established by the state authorized body.

Chapter V. GUARANTEES OF FULFILLMENT OF OBLIGATIONS BY THE FUND FOR NON-STATE PENSION PROVISION OF THE POPULATION Article 19. Total contribution of the founders (contribution of the founder) of the fund

In order to ensure the protection of the rights of participants, the total contribution of the founders (founder's contribution) of the fund on the day the fund submits documents to the state authorized body to obtain permission (license) to carry out activities on non-state pension provision, contributed to the fund in cash, must be at least fifteen thousand times the established amount minimum wage law.

Article 20. Formation of an insurance reserve

To ensure the sustainability of the fulfillment of obligations to participants, the fund creates an insurance reserve.

The standard size of the insurance reserve and the procedure for its formation and use are established by the state authorized body.

Article 21. Actuarial assessment of the fund’s activities

Funds are required to annually conduct an actuarial assessment of the results of non-state pension provision and income from the placement of pension reserves at the end of the financial year.

Actuarial valuation is carried out by an actuary.

Article 22. Audit

Funds are required to conduct an independent audit annually at the end of the financial year.

This verification is carried out by an independent auditor.

Article 23. United guarantee funds and insurance

In order to ensure the fulfillment of obligations to participants, funds have the right to create, on a voluntary basis, united guarantee funds.

The principles for creating united guarantee funds and the procedure for managing them are determined by the funds included in them in accordance with the legislation of the Russian Federation.

Funds have the right to participate in mutual insurance companies, as well as enter into insurance contracts that provide additional guarantees for the fulfillment of the funds’ obligations to participants.

Control over the activities of the united guarantee funds is carried out by the state authorized body.

Chapter VI. PLACEMENT OF PENSION RESERVES Article 24. Principles of placement of pension reserves

The placement of pension reserves is carried out on the principles of reliability, safety, liquidity, profitability and diversification in accordance with the rules for the placement of pension reserves of funds approved by the Government of the Russian Federation.

Article 25. Management of pension reserves

The placement of pension reserves formed in accordance with the rules of the fund is carried out solely for the purpose of maintaining and increasing pension reserves in the interests of participants.

The funds place pension reserves through a manager (managers), who must, in the ways provided for by the civil legislation of the Russian Federation, ensure the return of the pension reserves transferred to him (them) by the fund under trust management agreements and other agreements in accordance with the legislation of the Russian Federation , with the exception of cases of placement of pension reserves in government securities, securities of constituent entities of the Russian Federation, bank deposits and other cases provided for by the Government of the Russian Federation.

The manager (managers) is (are) responsible to the fund (funds) and its (their) participants for improper performance of the duties assigned to him (them) in accordance with the legislation of the Russian Federation. The manager (managers) is not (are) not liable to the participants for the obligations of the fund (funds).

To manage the pension reserves of the fund (funds), the manager (managers) must have the necessary permits (licenses) in accordance with the requirements established by the legislation of the Russian Federation.

The state authorized body determines the requirements for the composition and structure of pension reserves in accordance with the rules for the placement of pension reserves approved by the Government of the Russian Federation.

When placing pension reserves in real estate, the fund is obliged to provide the state authorized body with data on the assessment of the real estate property carried out by an independent appraiser who has a permit (license) to carry out this type of activity in accordance with the requirements established by the legislation of the Russian Federation.

The Fund enters into an agreement with the manager (managers), which must comply with the conditions approved by the state authorized body, in accordance with the requirements of this Federal Law and the civil legislation of the Russian Federation.

Pension reserves cannot be subject to collection for debts of the fund, depositors, manager(s) and depository.

The activities of funds in placing pension reserves are not considered entrepreneurial.

The procedure for placing pension reserves and monitoring their placement is established by the Government of the Russian Federation.

Article 26. Storage of pension reserves placed in securities

Storage of securities certificates and (or) accounting and transfer of rights to securities in which pension reserves are placed are carried out on the basis of a fund agreement for depository services, concluded in the manner established by the Government of the Russian Federation.

A depository may be a legal entity that has a permit (license) to operate as a depository in accordance with the requirements established by the legislation of the Russian Federation. The specifics of the activities of the depositary servicing the fund are established by the Government of the Russian Federation.

The depository must carry out accounting of rights to securities that make up pension reserves, including government securities and securities of constituent entities of the Russian Federation, separately from accounting for rights to property owned by the depositary and other persons with whom the depositary has entered into agreements, by opening and maintaining a separate account on name of the manager(s) and/or fund.

The depositary is responsible to the fund for improper performance of its duties in accordance with the legislation of the Russian Federation.

Article 27. Distribution of income from the placement of pension reserves

Income received from the placement of pension reserves is used to replenish pension reserves and cover expenses associated with ensuring the activities of the fund, in accordance with the rules of the fund.

Covering the costs associated with ensuring the activities of the fund is carried out through the use of property intended to ensure the statutory activities of the fund, and income received from the placement of pension reserves.

At the same time, deductions for the formation of property intended to support the statutory activities of the fund should not exceed 20 percent of the income received from the placement of pension reserves in the first three years of the fund’s activity, and 15 percent of the income received from the placement of pension reserves in the future.

Chapter VII. MANAGEMENT BODIES OF THE FUND AND CONTROL OVER ITS ACTIVITIES Article 28. Management bodies of the fund and control over its activities

The governing bodies of the fund are the fund council and the executive (general) directorate.

The bodies exercising control over the activities of the fund are the board of trustees and the audit commission.

Article 29. Foundation Council

The highest governing body of the foundation is the foundation council.

The structure, competence, procedure for formation, powers and term of office of the foundation council, the procedure for making decisions by it are determined by the legislation of the Russian Federation and the charter of the foundation.

Article 30. Executive (General) Directorate

The executive (general) directorate carries out operational management of the fund's activities in accordance with the legislation of the Russian Federation, the fund's charter and the regulations on the executive (general) directorate, approved by the fund's council.

Article 31. Board of Trustees

In order to control the activities of the fund and protect the interests of investors and participants, the fund creates a board of trustees.

The procedure for the formation and powers of the board of trustees are determined by the charter of the fund and the regulations on the board of trustees, approved by the board of the fund. The fund's board of trustees includes authorized representatives of investors and participants, who hold at least half of the votes when making decisions.

Members of the board of trustees perform their duties free of charge.

Chapter VIII. ACCOUNTING AND REPORTING Article 32. Accounting and reporting

The Fund carries out accounting and reporting in the manner established by the Federal Law “On Accounting”.

The specifics of the procedure for accounting of fund operations for non-state pension provision are established by the Government of the Russian Federation.

The fund is obliged, when carrying out accounting, not to allow mixing of property intended to support the statutory activities of the fund and property constituting pension reserves.

The Fund keeps records of pension savings, formed pension reserves and paid pensions for each pension scheme with a fixed amount of pension contributions (non-solidarity pension scheme).

The reporting year of the fund is the calendar year - from January 1 to December 31 inclusive.

The fund's financial statements at the end of the reporting year are confirmed by the conclusion of an independent auditor.

The conclusion based on the results of an independent audit is an integral part of the annual report on the activities of the fund.

The Fund submits a report on its activities in the manner and within the time limits established by the state authorized body.

The Fund submits to the state authorized body once a year a conclusion based on the results of an actuarial assessment conducted by an actuary. This conclusion is an integral part of the fund's annual report.

The Foundation is obliged to publish a report on its activities in periodicals at least once a year.

The fund is obliged to ensure the safety of documents on the pension accounts of depositors and participants for three years from the date the fund completes its obligations.

The manager is obliged to keep separate records of the property that makes up pension reserves, his own property, as well as other property under his management, avoiding confusion.

The depository servicing the fund is obliged to keep separate records of the property that makes up the pension reserves, its own property, as well as the property of other persons who have entered into an agreement with it, without allowing confusion.

The procedure for maintaining accounting records and presenting reports of managers and depositories is established by the Government of the Russian Federation.

Chapter IX. REORGANIZATION AND LIQUIDATION OF THE FUND Article 33. Reorganization and liquidation of the fund

1. Termination of the fund’s activities can be carried out in the form of reorganization (merger, division, accession and spin-off) or liquidation.

2. The reorganization of the fund is carried out on the basis of a decision of the fund council in agreement with the state authorized body in the event that the conditions of non-state pension provision for participants do not worsen in accordance with the conclusions of an independent auditor and actuary.

3. Liquidation of the fund is carried out on the basis and in the manner provided for by the legislation of the Russian Federation and this Federal Law.

When a fund is liquidated, pension reserves are directed to satisfy the claims of investors and participants; funds from the sale of property intended to ensure the statutory activities of the fund are directed to satisfy the claims of all creditors in accordance with the priority established by the legislation of the Russian Federation.

When a fund is liquidated, the powers to manage the affairs of the fund are transferred to the liquidation commission formed by the founders of the fund or the body that made the decision to liquidate the fund, in agreement with the body carrying out state registration of legal entities and the state authorized body.

Chapter X. STATE REGULATION OF ACTIVITIES IN THE FIELD OF NON-STATE PENSION PROVISION OF THE POPULATION AND CONTROL OVER ITS IMPLEMENTATION Article 34. State regulation of activities in the field of non-state pension provision of the population and control over its implementation

In order to comply with the requirements of this Federal Law, protect the rights and interests of participants, other interested parties and the state, state regulation of activities in the field of non-state pension provision of the population and control over these activities is carried out by a state authorized body acting on the basis of this Federal Law and in the manner established by the Government Russian Federation.

Article 35. Prevention, limitation and suppression of monopolistic activities of funds and managers and their unfair competition

Prevention, limitation and suppression of monopolistic activities of funds and managers and their unfair competition are ensured by a specially authorized federal executive body.

Article 36. Tax benefits

The Fund has the right to benefits on taxes, customs and other federal fees and payments in accordance with the tax legislation of the Russian Federation.

Chapter XI. FINAL PROVISIONS Article 37. Dispute consideration

Disputes between the fund and legal entities and individuals are considered in court in the manner prescribed by the legislation of the Russian Federation.

Article 38. Entry into force of this Federal Law

This Federal Law comes into force on the date of its official publication.

Article 26 of this Federal Law comes into force after the Government of the Russian Federation approves the procedure and conditions for concluding an agreement between the fund and the depositary.

Funds created before the entry into force of this Federal Law must bring their constituent documents into compliance with the requirements of this Federal Law within one year from the date of its official publication.

Legal entities, when registering a change in their legal status in connection with bringing it into compliance with this Federal Law, are exempt from paying the registration fee.

To propose to the President of the Russian Federation and instruct the Government of the Russian Federation to bring its legal acts into compliance with this Federal Law.

President

of the Russian Federation B.YELTSIN

Moscow, Kremlin

May 7, 1998

N 75-ФЗ