What are pension contributions

A citizen can apply for regular pension payments from the state when his work experience ends. This is possible if he was officially employed, and his employer regularly transferred funds to the Pension Fund. The size of the superannuation pension is determined by several factors.

Among them:

- insurance experience;

- wage;

- insurance contributions to the Pension Fund from the place of work;

- individual savings.

Reference! The size of the pension varies depending on other factors, but for most Russians its level is low. Therefore, many people are thinking about how to refuse contributions to the Pension Fund.

Download: Application for refusal to receive an assigned pension (sample of completion).doc Application for refusal to receive an assigned pension.doc

Exemption from payments to the Pension Fund of the Russian Federation: documentary evidence

Get a temporary exemption or how can an individual entrepreneur not pay contributions to the Pension Fund of the Russian Federation? Today this is possible if no economic activity was carried out.

For conscripted military personnel, the following is provided:

- military ID;

- certificates from the military registration and enlistment office (or military unit) indicating the period of service.

Individual entrepreneurs caring for a child in order to receive “benefits” for paying mandatory insurance contributions are required to provide:

- documents confirming the birth of children;

- a certificate from the Social Insurance Fund or the Social Security Administration confirming that individual entrepreneurs have received child benefits for the period of maternity leave until the child is one and a half years old.

Instead of a document from the Social Insurance Fund (USZN), entrepreneurs present:

- confirmation of cohabitation with a child under 1.5 years of age;

- a certificate from the other spouse’s place of work confirming that he is not on parental leave and does not receive child benefits;

- a document from the Social Insurance Fund or the Social Security Administration stating that the non-working spouse does not receive child benefits.

If the entrepreneur is officially employed as an employee, the employer must confirm that the employee has been granted parental leave, but such cases are rare.

On video: Insurance premiums for individual entrepreneurs: how to recalculate the maximum contributions to the Pension Fund

Sometimes, in order to provide benefits for paying contributions to the Pension Fund, the following is requested:

- marriage certificate;

- a certificate from the registry office on the issuance of a birth certificate or death certificate of one of the parents.

Individual entrepreneurs caring for elderly relatives starting from 80 years old or persons (children) with the first group of disability can take advantage of the “grace period”.

They are required to present:

- an excerpt from the ITU act that certified the recognition of disability;

- passport of a citizen over 80 years of age who needs care;

- birth certificate of a child with a disability;

- a certificate from the passport office or a copy of the passport pages indicating residence with the person in need of service;

- written confirmation from the elderly citizen or his guardian indicating the details of the person who cared for the pensioner and the period of care.

On video: Reporting to the Pension Fund of Russia

In the event of the death or serious health condition of a person in need of constant care, other family members of the specified citizen, as well as employees of the Pension Fund of Russia, can confirm in writing the fact of service by drawing up an examination report during the visit.

To confirm residence in a territory where military spouses could not find employment during contract service, it is necessary to provide a certificate:

- from the office of a military unit, military registration and enlistment office, institution or organization;

- employment center.

Spouses of civil servants posted abroad have the right to take advantage of the “benefits” from paying insurance premiums while living in foreign countries. They must present documents from the authorities that sent civil servants to work.

On video: Insurance contribution of individual entrepreneurs to the Pension Fund of Russia

What part of the salary do we transfer to the Pension Fund each month?

In the Russian Federation, there is a limit on the annual salary (1,021,000 rubles) that an employee can receive. Within these limits, the rate for pension contributions will be up to 22%. If a citizen receives salaries above the maximum norm established by law, then the insurance deduction from the difference will be 10%.

For some groups of the population, the state provides a lower percentage of insurance contributions, among them employees of such organizations:

- Innovative – 14%;

- companies with a simplified taxation system working in the scientific field for government agencies – 13%;

- STS companies whose activities are related to the SEZ – 13%;

- organizations developing information technologies – 8%;

- SEZ companies in Crimea – 6%.

Attention! According to the legislation of the Russian Federation, organizations that are listed in the Russian International Ship Register are entitled not to pay an insurance premium for ship crew members.

Is it possible to refuse pension contributions and how to do it?

The legal reform that has entered into force allows Russians to form their pension in two ways:

- the employer pays the employee’s insurance premiums at his own expense;

- The citizen independently pays the funded part.

The first option provides for a direct relationship between a person’s salary without taking into account taxation. All payments are made at the expense of the enterprise. In the second option, a citizen can influence the size of his future pension.

Every citizen has the right to know that 6% of contributions go to the maintenance of state funds, and the remaining 16% participate in the formation of a pension on an individual basis. 10% consists of a fixed insurance part, and 6% - from a funded part.

The state does not give a citizen of the Russian Federation the right to refuse pension contributions, but he can shift this responsibility only to the employer.

How to pay less

Optimize the tax regime. If you are an individual entrepreneur, you must pay taxes and fees. You need to come to terms with this. But you can pay less. To do this, you need to choose the right tax regime and apply deductions. Read about this in the section “Taxes for individual entrepreneurs”.

Become self-employed. Take a closer look at the new regime for the self-employed. There is no reporting at all, low tax rates and no mandatory insurance premiums to pay. But you will have to save for your pension yourself: the insurance period of the self-employed is not taken into account and they are not awarded points.

Close IP. Take the inspector's advice. Perhaps she didn't mean to offend you. If you take one-time orders, it is not necessary to register as an individual entrepreneur. You can only pay personal income tax at a rate of 13% on each order. Tax can be significantly reduced by applying tax deductions. There is no need to pay insurance premiums.

Main reasons for refusal

All registered entrepreneurs are required to make insurance contributions to the Pension Fund of the Russian Federation for each hired employee. But there is a funded part, which is formed by the employee himself. Depending on the situation, the employee may qualify for a waiver of this portion.

This happens in most cases for the reason that citizens are not confident in the reliability of the PF operation.

The following reasons explain this:

- Low standard of living for pensioners in the country.

- Ambiguous relationship between insurance contributions and real pension payments after completion of work experience.

- If the state received insurance premiums for him throughout the life of an individual citizen, then in the event of his death before retirement, the money remains in the treasury and is not transferred to his heirs.

- Citizens do not have the right to withdraw funds from their own savings fund before retirement age, even for a good reason.

- Since the establishment of the Pension Fund, not a single official audit has been registered. This gives citizens reason to doubt its “transparency.”

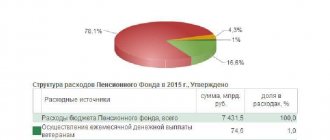

- According to statistics, most of the funds in the Pension Fund are spent monthly on payments for 20% of the population. This indicates a significant difference in the amount of pensions for different segments of the population.

- Changes are constantly being made to the regulations for calculating insurance payments.

Important! The list could include a number of other reasons why people do not want to lose part of their current salary for the sake of an ambiguous pension when their working career ends.

Fixed contributions for individual entrepreneurs for themselves

Based on Federal Law No. 172-FZ dated 06/08/2020 with amendments to the Tax Code of the Russian Federation (valid from 06/08/2020, hereinafter referred to as Law No. 172-FZ), Art. 430, which establishes the amount of insurance premiums paid by those who do not make payments and other remuneration to individuals.

According to its new clause 1.1, insurance contributions of individual entrepreneurs for compulsory pension insurance (OPS) in a fixed amount for themselves (without employees) now amount to 20,318 rubles . Moreover, for the entire billing period of 2020.

Let us remind you that this amount of contributions does not depend on the amount of income of the entrepreneur.

Where did this amount come from? It's simple: it's 32,448 rubles. (general tariff for individual entrepreneurs) minus 1 minimum wage (RUB 12,130).

To take advantage of this benefit, an individual entrepreneur must meet the same criteria as to receive a subsidy:

- The main type of activity according to OKVED 2 is classified as one of the industries most affected by the coronavirus.

- The entrepreneur was included in the Register of SMEs as of 03/01/2020.

The procedure for recognition as a victim is similar to determining the right to extend the deadlines for paying taxes (advances), fees, and insurance premiums.

Also see “Companies and individual entrepreneurs from which industries will receive help due to coronavirus: official list.”

If the individual entrepreneur does not meet the specified criteria, insurance premiums for compulsory insurance must be paid in the total amount - 32,448 rubles. (Clause 1 of Article 430 of the Tax Code of the Russian Federation).

Note that the compulsory medical insurance contribution in both cases is 8,426 rubles. He didn't change.

An additional contribution of individual entrepreneurs for themselves is also in force for income from 300,000 rubles per year.

How not to pay

As discussed above, a person cannot refuse insurance premiums. At the same time , he can apply for payments to the Pension Fund at the expense of the employer . To do this, he needs to submit documents to waive the funded part. In this case, additional investments will no longer be able to affect the size of the future pension.

Refusal procedure

A citizen who has chosen a system of insurance contributions through a funded account must write a corresponding application to his employer and to the Pension Fund. He has the right to withdraw his application within 12 months.

Download:

- application for refusal to receive an assigned pension .doc

- application for refusal to receive an assigned pension (filling sample).doc

- application for termination of pension payment .doc

- application for termination of pension payment (filling sample).doc

The employee does not need to take any additional actions to implement his decision. Once his application is reviewed, the accumulation of pension savings will be completed automatically.

For those who have decided to abandon the savings system, the relevant question is what will happen to the savings that have already been generated up to now. The pension fund guarantees that all savings will be paid during the pension period.

The size of the future pension is determined by several parts, including the funded one. A citizen of the Russian Federation has the right to refuse the funded component in favor of a fixed insurance component. As a result, the accumulation part will cease to form.

Reference! If a citizen does not understand the legal acts of the Russian Federation, then he can delegate his powers to a trusted person. Any notary office can endorse actions on behalf of the applicant, including the right to sign.

Having abandoned the funded pension, it will no longer be possible to return to it after one year. Therefore, the applicant should carefully consider their decision before submitting documents. One of the advantages of the funded system is, in the event of the death of a citizen, the possibility of transferring unpaid insurance benefits to the relatives of the deceased.

Every citizen has the right to receive advice from a Pension Fund employee on any issues related to insurance premiums.

To begin the procedure, the employee must contact his employer with a corresponding application. Before submitting an application to waive a funded pension, it is worth familiarizing yourself with the main stages of the procedure. This will allow the issue to be quickly resolved in favor of the applicant.

Next, the person will have to go to the nearest PF branch. The application will be formed from the following aspects:

- name of the Pension Fund;

- Full name of the citizen or authorized representative;

- purpose of the application (refusal of accumulative contributions in favor of fixed insurance);

- date, signature.

After studying the details of the case, the applicant's employer will continue to pay 22% for the employee in the PF. The funds received will be distributed as follows:

- 16% for the formation of an insurance pension;

- 6% for the maintenance of state funds and current fixed payments.

Reference. In the Russian Federation, private non-state pension funds officially exist. Any Russian, at his own discretion, can apply to such an organization to form a funded pension. The size and frequency of contributions, as well as the right to dispose of the accumulated capital, are strictly specified in the agreement between the parties.

This article examines the following questions: how a pension is calculated in the Russian Federation, why a person might want to refuse insurance contributions and how to do this.

Attention! By law, every citizen of the Russian Federation will receive a pension in old age if he was previously officially employed and his employer regularly made contributions to the Pension Fund.

A Russian has the right to abandon the funded system in favor of a fixed insurance pension . As a result, the size of the pension will depend on the actual salary. In this case, all deductions will be made by the enterprise at its own expense. This is the only legal way to avoid insurance deductions.

Who pays insurance premiums

Contributions to the Pension Fund of the Russian Federation are required to be made by the following categories of persons and enterprises:

- Organizations making payments under any agreements in favor of individuals.

- Individual entrepreneur: for persons in whose favor payments were made for work or services under contracts of any kind, as well as for themselves.

- Notaries, lawyers and other categories of self-employed citizens.

- Individuals, in situations where they make payments under any agreements, and in situations where they do not act as individual entrepreneurs.