Every year, government programs come into force that allow certain categories of citizens to receive financial assistance.

One of these areas is pensions.

When a citizen approaches retirement age, he needs to prepare documents confirming his earnings and required for calculating monthly payments.

This form is a salary certificate.

In what cases and who needs

To apply for benefits, an elderly citizen must bring a package of documents to the Pension Fund. It includes a work book, passport and SNILS. At the same time, the work book is the main document certifying periods of work before 2002. After 2002, labor data is contained in the Pension Fund of Russia - in the personalized accounting system (SPA). To confirm earnings before 2002, two methods are used to calculate the average monthly salary:

- The average monthly income for 2000-2001 is taken. At this time, the Pension Fund of the Russian Federation already had an STC in force, so no additional documents need to be provided in this case;

- if the employee’s income in 2000-2001 was very modest or the person did not work at all at that time, a salary certificate for pension may be required for any 5 consecutive years in the period before 01/01/2002. This will help increase your retirement benefits.

Let us say right away that the need to provide a certificate was due to the requirements of the Ministry of Labor Resolution No. 16, Pension Fund of the Russian Federation No. 19pa dated February 27, 2002, but currently this document has lost its force (see Order of the Ministry of Labor No. 1027n, Pension Fund of the Russian Federation No. 494p dated December 11, 2014) . However, the Pension Fund pretends that it doesn’t seem to know about this and continues to demand that this information be provided. You can complain and go to court... but this is extra time, it’s easier to do what they demand.

We check certificates from other employers

- Security option. You have a question: how do I find out where my pension contributions are transferred? Look at your year of birth. If you are older than 1967, then they go to the insurance and funded parts of the pension. If you are younger, go only to insurance.

- The value of the individual pension coefficient. The number of points you have earned towards retirement. Below we will describe how they are calculated.

- The length of service taken into account for the purpose of pension. How long have you worked until today?

If you are a client of a non-state pension fund, then you will not be able to find out about contributions through the website of government services or the Pension Fund of the Russian Federation. In this case, you will have to either send a request to the organization’s office, presenting your passport and SNILS, or use the website of the non-state pension fund with which you signed an agreement.

- The addressee, that is, the recipient of your paper, is indicated in the upper right corner. Traditionally, his role is played by the manager of a State institution - the corresponding pension fund. Next is his last name and initials.

- The main part of the application contains a request to provide a certificate confirming the absence of debts to the fund. This part contains indicative text: “I ask you to provide a certificate confirming the absence of arrears in contributions to the Pension Fund...”.

- After this, indicate the full name of the organization or individual entrepreneur who is interested in receiving the document in question.

- This is followed by an indication of the registration number combination, which can be obtained from the state registration certificate, as well as from some other constituent documents.

- Next comes the line “as of...”, followed by the exact date in the traditional format **.**.****. It must be remembered that a letter to the Pension Fund (sample) to obtain a certificate confirming the absence of debts also has its own statute of limitations, so indicating the date is mandatory.

- After compiling the main part of this document, the entry “manager” is written, followed by the signature and initials. All this information is certified by the official seal under which the individual entrepreneur operates.

Compilation rules

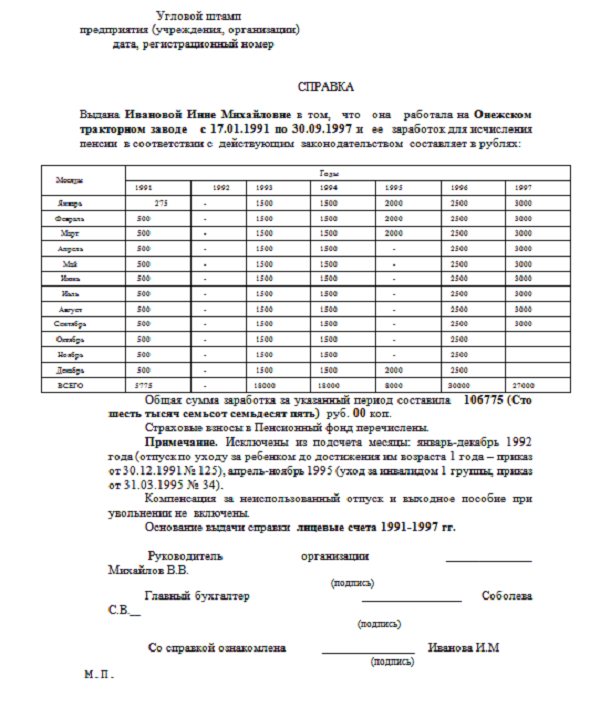

The document is drawn up in any form. It should contain:

- corner stamp, date of issue and document number;

- FULL NAME. and the applicant's date of birth;

- work periods and organization;

- salary indicated monthly, reflecting the total amounts by year;

- an indication of the currency in which the accruals took place;

- amounts are reflected as accrued, and not actually paid (due to the deduction of taxes).

The following are excluded from earnings:

- compensation for unused vacation;

- child care allowance.

In the note you need to indicate the months of accrual and the amount of certificates of incapacity for work, periods of vacation at your own expense.

Below it is written that for all accruals, deductions were made to the Pension Fund of the Russian Federation at established rates. The basis for issuing the form (personal accounts, pay slips) is also included.

The document is certified by the signature of the chief accountant, the head of the enterprise and a seal.

Carefully study the sample salary certificate for calculating a pension and the rules for filling it out. Judicial practice shows that it is the employer who will be punished for errors made in this form. Thus, the Arbitration Court of the Central District issued a Resolution dated June 11, 2019 in case No. A83-4304/2018, in which it agreed with the decision of the Pension Fund of Russia to recover about 150 thousand rubles from the company for the fact that an error was made in the certificate. From the case materials it follows that the employee asked the employer for a certificate from the Pension Fund for the purpose of assigning an old-age pension. The employer provided the certificate, but incorrectly indicated the amount of the employee’s salary in the period from January 1986 to February 1992. Fund employees calculated the pension taking into account these data, but then they doubted it and carried out a check. It turned out that due to an error, the pensioner was paid more than he should have been paid for 32 months. The total amount of the overpayment was 144,742.82 rubles. This money was not demanded from the pensioner, but was collected from the company, since it was the employer who was considered guilty. The arbitration court agreed with this decision. In addition to the overpayment, the organization had to pay a state fee in the amount of over 5 thousand rubles. As a result, an error in the salary certificate cost the employer almost 150 thousand rubles.

What is this document and why is it needed?

Including for the registration of preferential pensions (for length of service and for harmful working conditions).

In this case, all types of activities are taken into account when deductions were made from income to the Pension Fund:

Other publications: What MTPL forms look like

If you want to find out how to solve your particular problem in 2020, please contact us through the online consultant form or call :

- Moscow: +7(499)350-6630.

- St. Petersburg: +7(812)309-3667.

- under an employment contract;

- from an individual entrepreneur or an individual;

- under an agency agreement;

- under a contract.

In essence, a certificate is official information about a particular event, certified according to the rules of document flow . Its main task is to prove at what time and where a person worked. If a preferential pension is issued, for example, due to harmful working conditions, the certificate will confirm that the profession (or position) in which the citizen worked actually gives the right to early retirement.

What documents must be submitted to the Pension Fund to apply for a pension?

To receive a pension, a citizen must collect a package of documents and submit them to the Pension Fund at the place of residence. In paragraph 6 of Art. 21 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ states that the list of documents required to establish a pension is determined by the Government of the Russian Federation. Turning to the order of the Ministry of Labor dated January 19, 2016 No. 14n, we find in paragraph 17 a list of documents that a citizen must submit to the Pension Fund:

- application for a pension;

- document proving the identity, age and citizenship of the person applying for a pension (passport);

- documents confirming periods of work and other periods included in the insurance period (work book, labor and civil contracts, personal accounts and salary statements);

- other documents to confirm special circumstances.

The salary certificate we mentioned to the Pension Fund is not listed in the list of documents. However, it is mentioned in the no longer valid Resolution of the Ministry of Labor dated February 27, 2002 No. 16. Nevertheless, the Pension Fund continues to require a salary certificate, and it appears in the list of documents required for registration of a pension posted on the Pension Fund website. Therefore, despite doubts about the legality of the requirement to submit a salary certificate, we will analyze what information needs to be included in it and where to get it.

Confirmation of work experience

The topic of retirement is constantly relevant, since every year certain generations of people finally become pensioners and can go on indefinite leave, doing all the things for which they simply did not have enough time before. Of course, once the job goes away, that means the wages go with it.

A pensioner needs funds for subsistence, and what their amount will be depends on the information contained in the work book

However, the pensioner continues to live, which means he must pay some money for his needs. As a result, the state assumes the responsibility to support him until the end of his days , thereby compensating for all the years of his work, during which the great honor of the time, health and strength of the current pensioner was spent working for the benefit of society.

The length of a person’s working life is also called seniority. So, the document that confirms the required length of service is a work book, which every person engaged in labor activity has, at least officially.

The following characteristics of a citizen’s retirement period will depend on how correctly the data is entered into the document we are interested in:

- retirement age;

- social services potentially received in the future;

- social benefits potentially accrued to the pensioner;

- pension amount.

However, depending on the labor data, not only the amount of the pension is determined, but also the subsequent provision of social services to the pensioner free of charge and other nuances

The letter of the law in force on the territory of our country indicates very clear nuances of registration and entering information into the document in question. Unfortunately, any deviation from the rules or a mistake made will not be easy to correct, especially if several years pass after they are entered into the book, and subsequently this may not have the best effect on the pensioner’s receipt of funds. Therefore, we advise you throughout your life to monitor what information employers enter into your pension book, or, if retirement age has already approached and you have not carried out such tracking, study the contents of the work book before applying for a pension.

It is necessary to ensure that the information entered in the personnel department inside the tour book contains true information, that is, corresponding to reality

So, here is what information in your work book will need to be carefully checked for truth:

- the date of your entry into a specific position;

- coincidence of the position with the staff or staffing schedule;

- date of dismissal with exact information (article, reason);

- the full and correct name of the employing organization in which the pensioner previously worked;

- the time period during which the pensioner underwent advanced training.

To make a record in the labor department, the personnel department of your organization must draw up an order each time, the storage of which subsequently gives us a chance to discover valuable information that affects the payment of pensions

Absolutely all information entered in the work book corresponds to a specific document of the title type - order . Unfortunately, sometimes, due to the illiteracy of personnel department employees, the information in books and orders differs, or both are entered incorrectly. As a result, inaccuracies and errors in documents again bring trouble to you, and finding and establishing true information can sometimes be incredibly difficult.

Where can I get a salary certificate?

A salary certificate can be issued by the accounting department of the enterprise where the citizen worked in the years selected for calculating the pension. It is better to apply for a certificate of average monthly earnings by submitting a written application drawn up in free form. Art. 62 of the Labor Code of the Russian Federation obliges the employer to issue a certificate within 3 days from the date of the employee’s application. This article of the Labor Code does not specify whether this norm applies only to current employees or to former ones too. However, based on the situation (and Rostrud agrees with this position), we can conclude that former employees have the same rights as current employees to receive information directly related to their work.

The employer has the right to determine the form of the certificate independently, taking into account the necessary information that must be included in such a certificate. A new salary certificate form can be found here.

If the enterprise where the citizen worked in past years does not currently exist, you can find the legal successors of the old organization. If any are not found or are missing, you will have to contact the archive at the former location of the company where the documents are stored.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

What certificate should I use to confirm my work experience in order to be accepted into the Pension Fund?

In Art. 62 states that the basis for preparing a certificate to the Pension Fund about work experience according to the company’s internal sample is a written statement from the employee. The law does not provide a unified form for such a document. It can be prepared in any form, including the following information:

Why is a Pension Fund certificate required?

According to the provisions of Art. 62 of the Labor Code of the Russian Federation, the employer is obliged to provide the specialist with documents related to his work within three days from the receipt of the request. The papers are certified by an authorized person of the company and a seal. It is illegal to charge a fee for their production.

If an employee managed to work in another organization before returning to the enterprise, then the income received in another company should have been taken into account by it . For example, after working for three months, A.I. Ivanov quit and returned to Mechta LLC. For the three months he worked, the personnel officers of the Stroymat enterprise were supposed to make transfers.

- Name of the organization;

- number of the employer registered with the Pension Fund of Russia;

- taxpayer number and reason code for registration (TIN and KPP);

- date of sending the information to the Pension Fund;

- the period for which information is provided;

- employee's insurance certificate number;

- surname, name, patronymic of the insured;

- the form is indicated (original - if it is submitted for the first time for this individual, corrective - if the information that was submitted earlier has changed, or canceling - cancellation of previously submitted information);

- funds credited and paid for the insurance part of the pension;

- the amount transferred and paid for the funded part of the pension(overpaid amounts are not indicated);

- length of service (including vacation, temporary disability);

- working conditions (full time, part time)

We recommend reading: List of documents for purchasing an apartment in 2020

The procedure for contributions to the Pension Fund for employees (PFR) in 2020

The employer gives the former employee a work book. If an employee requires other documents, he can make a request in writing. In this case, copies of them (Article 62 of the Labor Code of the Russian Federation) are provided. The organization must submit the documents on the day the employee is dismissed or no later than three days following the filing of the application. Information about transfers may be useful in the future.

Before carrying out the reconciliation, the company should prepare the necessary documents. The first step is to send an official request to the Pension Fund for the issuance of a certificate reflecting the status of settlements with the fund as of the current date. This request can be sent either in writing or via the Internet. The fund will additionally need to obtain information about the status of settlements.

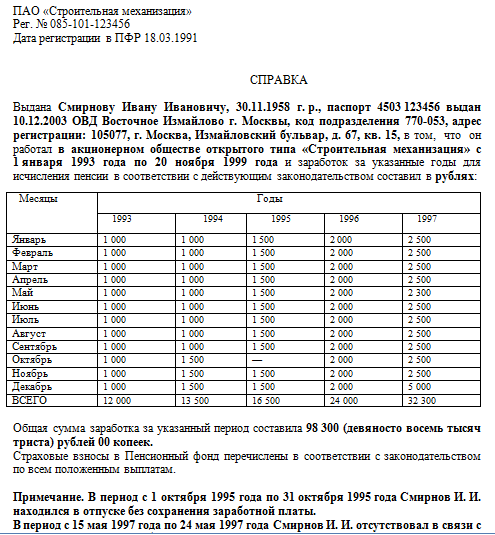

What does a salary certificate look like?

The salary certificate does not have an approved form, so it is filled out in free form, but must contain the following mandatory information:

- name and details of the organization where the citizen worked;

- personal data (full name, date of birth) of the citizen;

- work period;

- monthly salary;

- name of the currency in which the accruals were made;

- the total amount of earnings received for the entire period specified in the certificate;

- an indication that contributions to the Pension Fund from the amounts paid have been transferred;

- separately in the note - the periods of being on sick leave and on administrative leave;

- the document on the basis of which this certificate was issued (this could be pay slips or personal accounts of employees);

- signature of the head and seal of the organization.

Monthly earnings are indicated in compliance with the following rules:

- it includes all types of payments as part of the performance of labor duties: vacation pay, sick leave, bonuses, payments for overtime work, work on weekends, part-time work, and so on;

- it does not include compensation for unused vacation, upon dismissal, and child care benefits;

- if desired, you can replace incomplete months of work in connection with its beginning or end, periods of parental leave, caring for a disabled person of the 1st group with months preceding or after the specified period.

A sample of the completed certificate can be downloaded here.

***

The certificate is submitted to the Pension Fund for pension calculation. It must be compiled for 5 consecutive years of work until 2000, where the citizen’s earnings will be listed monthly. You can obtain a certificate at the enterprise where the employee was registered in the specified years, or in the archive if the company was liquidated.

***

You will also be interested in reading the materials that we wrote specifically for our Zen channel.

Similar questions

Is it necessary for a daughter, after graduating from school, when entering higher educational institutions of the Ministry of Internal Affairs or JUSTICE, to have certificates of no criminal record (criminal record) of her parents?

Is financial compensation for studying at a higher educational institution provided for everyone?

Can I transfer from a technical school to a higher education institution after passing the Unified State Exam and having an academic certificate?

Is it possible to study at two higher educational institutions simultaneously via correspondence courses?

What to do if a higher education institution does not issue a diploma?

Where can I get information about income for calculating pension payments?

Old-age pension for men begins at the age of 60 years, for women - 55 years. But some professions (preferential ones) imply retirement at an earlier age.

A certificate of the employee’s average salary for the purpose of an old-age pension is requested from the organization’s accounting department.

As a rule, an employee of pre-retirement age only asks for a certificate orally. This practice is used in small companies; in large enterprises, a corresponding application is also drawn up.

Each enterprise can develop the salary certificate form for the Pension Fund independently; it is also possible to fill it out using an existing document taken from another organization as a basis.

The completed certificate is signed by the head of the human resources department, chief accountant, and head of the enterprise.

If the organization has been liquidated, it is necessary to send a written request to the archive department that accepted the papers of the deregistered company, and issue an extract from the salary documents.

The form of the certificate for the Pension Fund is known to the archive workers; they help collect the necessary documents for assigning a pension.

It is not always possible for an archive employee to draw up a certificate in the approved form, but he has the right to fill out the document himself according to the information he has.

Additionally, on our website you can download samples of earnings certificates:

- for subsidies;

- for unemployment benefits from the employment center;

- for social security benefits.

Validity period for a certificate of full-time study at higher educational institutions

My niece lost her mother (she doesn’t have a father) on October 2, 2012, she provided all the documents to the pension fund to receive a survivor’s pension, she is 18 years old and she is studying full-time at the institute, but they say that the certificate of full-time study is expired! What is the validity period for this certificate?

Hello! Similar questions have already been addressed, try looking here:

Today we have already answered 826 questions. The average wait for a response is 14 minutes.

Lawyers are already working on the issue.

Where should the salary form be submitted?

Order No. 884n of the Ministry of Labor and Social Development (dated November 17, 2014) states that citizens, in order to apply for a pension, send their applications to the territorial bodies of the Pension Fund located at their place of registration.

Persons whose registration and place of actual residence are different can submit a set of documents for calculating a pension at their place of residence.

Convicted citizens submit the form to the Pension Fund through the administration of the correctional colony at their location.

The deadline for applying to the Pension Fund for accrual of an old-age pension is not limited by law.

For what period is it compiled for assigning and calculating a pension?

The pension legislation currently in force allows 2 methods of calculating the average monthly salary to determine the size of the future pension:

- based on personalized accounting information, average monthly earnings in 2000-2001 are taken into account;

- in accordance with the submitted salary certificate for 5 consecutive years of work.

As practice shows, with a permanent place of work, it is more profitable for a citizen to take the salary received in the period 1976-1986 for calculation.

A salary certificate for 5 years is not needed in cases where the employee’s monthly earnings in 2000-2001 are equal to:

- 2100 rub. — for regions where wages are multiplied by a regional coefficient of up to 1.5 (for example, 1.5 for the Udmurt Republic);

- 2600 rub. — for areas with an established coefficient in the range from 1.5 to 1.8 (Murmansk region);

- 2900 rub. — for areas with a coefficient over 1.8 (Yakutia).

Otherwise, an employee planning to retire must prepare in advance for the Pension Fund a certificate for 5 years of work with a higher salary, if there were any for a different period of work.

The earnings certificate submitted to the Pension Fund serves as one of the main documents from the entire necessary package for calculating a pension.

The amount of the accrued pension depends on the amount of income. Every citizen is very interested in providing this form.

Filling out for Pension Fund authorities

An employee’s earnings certificate for applying for a pension must include information on the salary amounts paid for each individual year.

Average values (for 3 or 6 months) are not taken into account when calculating pensions.

To accrue and calculate a pension, the Pension Fund accepts any official payment to an employee:

part-time wages, overtime, days off, with the exception of dismissal benefits or compensation for unused vacation, child care benefits.

The certificate for the Pension Fund is drawn up in any form; it must contain the following information:

- company stamp (corner) with the date of issue of the document and its number;

- FULL NAME. (in full) of the employee who applied;

- date of birth of the worker;

- period of work;

- monthly salary amount and calculation of annual income;

- Payroll currency (ruble).

The form in the Pension Fund must also contain information about the organization that issued it:

- full name of the legal entity (in accordance with the constituent documentation);

- address of registration of the enterprise with the tax authority;

- company telephone numbers, tax identification number.

It is necessary to take into account in the certificate the amount of wages actually paid to the employee, and not accrued.

As a note, you should note the periods of sick leave and unpaid leave, and also record the presence of a certificate of incapacity for work before and after the birth of the child.

At the bottom of the form, the fact of deductions of insurance contributions to the Pension Fund of the Russian Federation for all employee accruals at accepted tariffs, as well as the grounds for issuing a salary certificate (personal accounts, payroll statements) must be recorded.

The certificate is signed by the company's responsible persons and the company's seal is affixed.

to the Pension Fund of Russia

Download a free sample of filling out a certificate to the Pension Fund for the calculation and assignment of a pension –word.

Useful video

What documents are needed to calculate a pension and important points to pay attention to can be found in this video:

Useful topics:

- Methods for calculating depreciation in accounting

- Accrual and cash method

- Postings for accrual of dividends to the founder

- Production method of depreciation

- Accrual accounting

- Certificate of expenses

- 2 Personal income tax certificate

- Help 182n

How is it processed?

Since this is an official document, it must be executed either on letterhead or on A4 paper with a corner stamp. The stamp or form must contain the company details:

- full title;

- postal and legal addresses;

- telephones.

If the certificate is issued upon an official request, its details are indicated - date and reference number.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

At the beginning it is written to whom the certificate was issued: full name, patronymic, surname, date of birth (this information is entered on the basis of the passport). If your last name has changed, you will need to attach a supporting document (marriage or divorce certificate, change of last name).

The description of work activity begins with an indication of the organization, profession and position of the employee during employment. Next, write the date of return to work and the details of the order. The end of work is indicated - when the employee was fired, by what order (it is not necessary to write the reason for dismissal).

The next stage is a description of work activity:

- translations;

- assignment of ranks;

- combination of professions.

In this case, you must indicate the numbers and dates of the orders.

If the company changed its name, this also needs to be written in the certificate.

Next, the addressee is indicated (for example, at the Pension Fund or at the place of request) and the purpose of the document (for registration of a pension).

The certificate is signed by the head of the company and sealed. If

The personnel officer has a power of attorney for the preparation and issuance of certificates; he has the right to independently endorse the document, but indicating the power of attorney number.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

An algorithm for issuing a certificate for a preferential pension is given. If you only need general experience, everything is simpler. The simple form includes only the total time worked in all organizations. The personnel officer simply adds up the periods (according to information from the work book) and writes the result into the document.

Calculation of average earnings for a pension according to the new rules in Excel

- The estimated pension for citizens with a length of service coefficient over 0.55 is calculated as the product of the length of service coefficient, the average monthly salary coefficient and 1671 rubles. If the resulting value is less than 660 rubles, then you need to subtract 450 rubles. The amount of 1671 rubles is the SWP - the average monthly salary in Russia for the period 07/01/01-09/30/01 (constant value);

- If the length of service coefficient is 0.55, then a formula of the form is applied: (0.55 * average monthly salary coefficient * 1671 - 450) * (experience until 2002 / 25). This is for men. For women, the second multiplier is (experience until 2002/20). If the calculated value turns out to be less than 660 rubles, then for men - 210 * (experience until 2002/25), for women - 210 * (experience until 2002/20).