How do people retire now?

Who can apply

In Art. 32 of Law 1032-1 of April 19th. 1991 (hereinafter referred to as Law 1032) states that some citizens of our country have the right to retire:

- earlier reaching the generally established age according to the new standards;

- and even before reaching the age that gives the right to early appointment in accordance with Art. 30, 32 Federal Law No. 400 (also according to new standards).

In any case, they will be able to assign a pension early no earlier than 2 years before retirement age (on the basis of general or early appointment). The specific deadline for early appointment is determined by the Employment Center.

Conditions for registration

To take advantage of this opportunity, a citizen must meet certain conditions, in particular:

- he must give his consent to the premature appointment;

- he must be recognized as unemployed in the prescribed manner;

- the Employment Center should not be able to find a citizen a suitable job in accordance with his profile or qualifications;

- the total experience must be at least 25 years (for men) and at least 20 years (for women);

- According to the new rules, 2 years or less should remain until retirement age;

- the reason for dismissal from the last place of work must be one of the following - either liquidation of the enterprise, individual entrepreneur, or reduction in headcount or staff;

- the citizen has enough pension points required in the corresponding year (in 2019 - no less than 16.2 IPC, in 2020 - no less than 18.6 IPC, more details in the table below).

Example No. 1. A man will reach 60 years of age in 2021. This means that he will be granted a pension only in 2024, that is, upon reaching 63 years of age. But he can exercise the right specified in Part. 2 stat. 32 of Law 1032, that is, apply for a pension not at 63, but a little earlier (for example, at 62 years and 8 months or at 61 years and 10 months), but in any case not earlier than at 61 years.

“What happens if I get a job after my appointment?”

According to Part 3 of Art. 32 of Law 1032, if during the period of payment of a pension assigned 2 years before the retirement age, its recipient gets an official job, then this pension will stop being paid. If you quit your job, your pension will be resumed.

Other benefits for pre-retirees

To assign an early pension 2 or less years before retirement age is the right, not the obligation of the central pension fund. Accordingly, they may refuse – even if the citizen meets all the requirements. The amount of the benefit will be determined in accordance with Part 3 and Part 4 of Art. 34.2. Law 1032 and depend on the length of service of a person of pre-retirement age:

| Experience in the last year before being declared unemployed | Unemployment benefit amount |

| Less than 26 weeks | 1500 rubles |

| Over 26 weeks | 75% of average earnings - in the first 3 months, 60% - in the next 4 months and 45% - in the remaining time, but not less than 1,500 rubles and not more than 11,280 rubles (in accordance with Government Decree No. 1375 of November 15. 2018) |

In this case, the benefit is paid only for a certain time, then it stops being paid, and after some more time, payments resume again.

In general, benefit payment periods are as follows:

- 1 year;

- further suspension of payments for six months;

- then again 1 year;

- again suspension for six months and so on.

This payment period is valid for citizens who applied to the Employment Center and were declared unemployed no later than 1 year after dismissal.

Based on part. 2 tbsp. 34.2. Law 1032, if a person has 25 years of service or more (male) or 20 years or more (female), then the benefit accrual period increases by 2 weeks for each year of service in excess of the specified value. For example, if a man has 27 years of experience, then he will be paid benefits like this:

- first – within 12 months. and 4 weeks (i.e. 13 months);

- then – a break of 5 months;

- again 13 months. payments are coming;

- again a break of 5 months. and so on.

In other cases (if the application to the Central Labor Protection Center occurred after 1 year from the date of dismissal, or upon dismissal for guilty actions), benefits will be paid in accordance with paragraph. 2 hours 4 tbsp. 31 Law 1032:

- 3 months;

- then suspension of payments for 9 months;

- again 3 months payments are coming;

- break 9 months And. etc.

So, pre-retirees can apply for an insurance pension for 24 months. before reaching the age according to the new rules established by the recently carried out pension reform.

Rules for early retirement for unemployed citizens

Almost everyone knows that a person officially recognized as unemployed has the right to receive benefits, albeit for a limited period of time.

But not everyone knows that a citizen who is left without a permanent job and has almost reached retirement age has the right to retire early.

Not so long ago, domestic legislation did not even know what unemployment was, but after the end of the Soviet years this concept became an integral part of life.

As it turned out, the development of a market economy and, which are its essence, profitability and profitability, can not only increase the well-being of citizens, but also cause a number of adverse consequences, for example, the liquidation of an organization and a reduction in the number of employees.

Loss of a job is a generally recognized and significant social risk, in the event of which the state must not only provide employment for its citizens, but also provide social support to the unemployed (provide him with a means of subsistence).

Source: https://kalibr20.ru/urkons/dosrochnaja-pensija-dlja-bezrabotnyh-po-novym/

Stopped receiving accruals: reasons and solution to the problem

The labor exchange may stop calculating payments to a person of pre-retirement age for the following reasons:

- Completion of the benefit payment period;

- Official employment of a person;

- Missing scheduled consultations;

- Frequent rejection of proposed vacancies;

- Violation of registration conditions.

The period during which a person at pre-retirement age will receive financial assistance depends on individual characteristics. It can last from one and a half to three years.

You can end your registration by accepting one of the job offers

It doesn’t matter whether you chose from a list of vacancies from the employment center or found a job on your own - you are obliged to report your employment immediately and stop receiving benefits

Scheduled meetings with labor exchange employees are organized twice a month. At these consultations, the unemployed must confirm the absence of a permanent place of work by presenting a work book. Also at such meetings, labor exchange employees offer free job offers.

Frequent rejection of vacancies may indicate reluctance to get hired. If a pre-retirement worker rejects job offers more than three times in six months, he risks losing benefits.

Violations of the conditions of registration may be considered:

- Combining the receipt of benefits with any form of employment or receiving payments from the pension fund;

- Submitting false documents (including work books);

- Submitting documents to the labor exchange if you have a criminal record or an open individual entrepreneur.

In this case, payments will be canceled. In addition, the violator faces punishment in the form of a fine.

USEFUL INFORMATION: Documents when buying an apartment in 2020: resale, new building, mortgage

If the termination of payments occurred due to an error by a labor exchange employee, you can contact the administration of the employment center and clarify the exciting nuances.

If the cessation of accruals occurred due to missed consultations, payments can be restored by providing proof of a valid reason why you did not come to the labor exchange on the appointed day.

Important. If you come to the labor exchange less than ten days after the appointed date, this will not be considered a pass

How to retire two years early

Since 2020, there have been changes in the rules for assigning early pensions to the unemployed. Here's how it works. This is a benefit for the unemployed - those people who do not officially work and are registered with the employment service. That is, the status of unemployed must be official.

If such a person is registered, but no one offers him a job and there is almost no chance of finding one, the employment service may assign him an old-age pension two years earlier.

Not all unemployed pre-retirees will be given early retirement. Here are the conditions that must be met at the same time:

- The person was laid off, his organization was liquidated, or he ceased to be an individual entrepreneur.

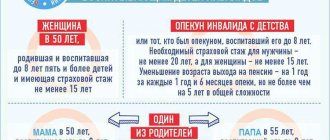

- A woman has 20 years of insurance experience, a man has 25 years.

- The required number of points has been accumulated to grant a pension. In 2019 - 16.2.

- The pre-pensioner registered as unemployed.

- He still has two years left until his old age pension.

- The Employment Service approved the appointment of an insurance pension two years earlier.

- The unemployed person agrees to receive an early pension.

That is, early retirement will be given only to those who have accumulated experience and points, but have not yet reached the required age.

Early retirement is assigned by the employment service. Moreover, this is her right, not her obligation. You can’t come and demand: give me a pension two years earlier. But if you meet all the conditions, you can’t find a job, and the employment service doesn’t offer a pension, you need to ask the question: why, actually?

Early retirement

Pension and labor legislation in Russia in 2020 provides several grounds for granting early retirement.

One of them provides the opportunity to retire 2 years before reaching retirement age if a person is unemployed and has lost his job due to staff reduction or liquidation (bankruptcy) of the organization.

Early pension provision can be assigned to an unemployed citizen only at the proposal of the employment service (PES) and only if it cannot offer a new position to a specialist of pre-retirement age.

To count on early retirement in 2018 in case of staff reduction or liquidation of an organization, in general, you need:

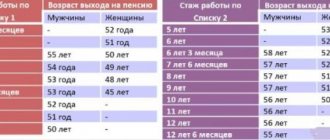

- reach pre-retirement age (this is “minus 2 years” from the generally established retirement age - in 2020 this is respectively 58 years for men and 53 years for women

- have sufficient insurance (work) experience - for early retirement, an unemployed person must have 25 years and 20 years of experience (for a man and a woman, respectively);

- have the required number of pension points (in 2020 you need 13.8 points, but from 2020 this figure increases annually in increments of 2.4 points).

The necessary documents for registration of an early pension are submitted by the unemployed to the branch of the Pension Fund (PFR) at the place of residence. Calculation of pension benefits for early workers is carried out on a general basis. Upon reaching retirement age, you will need to re-apply to the Pension Fund for transfer to a regular old-age insurance pension.

It is very difficult for people approaching retirement age to find a new job. Unfortunately, now it is not always possible to find it even at 40-50 years old, when retirement is still far away. Employers are not “eager” to employ a person who is guaranteed to leave his position in a year or two upon reaching retirement age.

Therefore, for such cases, Part 2 of Art. 32 of the Law of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation” provides that a pension can be assigned for the period before retirement age (which, in essence, is an early old-age pension for the unemployed).

However, for this you need to meet a number of conditions - in general, they are the same as when receiving an old-age insurance pension upon reaching 60/55 years of age (these conditions are established by Article 8 of Law No. 400-FZ of December 28, 2013), but with minor changes. Unemployed people can count on early payment if the following conditions are met:

- The pre-pensioner lost his job due to staff reduction or liquidation of the enterprise (termination of the activities of an individual entrepreneur) and

- The citizen is declared unemployed (he is registered with the Employment Center to look for a new job), but they cannot offer anything in his specialty.

- An unemployed person has two years or less left to qualify for an old-age insurance pension (in 2020 this corresponds to an age over 58 for men or 53 for women, but from 2019 due to the pension age reform this period will increase by 1 year annually until the ages of 63 and 61 respectively).

- The citizen has extensive insurance experience. According to the Law “On Employment,” in order to obtain the right to early retirement, the required work experience of an unemployed person must be 25 and 20 years, respectively, for men and women.

For comparison: To obtain the right to an old-age insurance pension on a general basis in 2020, men and women need only 9 years of experience (in 2020 it will be necessary to have 10 years of experience). Those.

in any case, this is significantly less than what is required for “early term” workers. At the same time, now the length of service takes into account not only the number of years actually worked, but also periods of child care up to 1.

5 years and other “non-insurance periods” provided for in Art. 12 of Law No. 400-FZ of December 28, 2013

You must have the required number of pension points - at least 13.8 in 2020. It should be noted that every year this standard increases by 2.4 points (from 6.6 in 2020 to 30 by 2025).

If all the above conditions are simultaneously met, the employment service prepares a proposal to the Pension Fund for the early granting of a pension to the unemployed. However, you need to understand that in the future the retirement age will increase, which means the age for early registration will also increase.

How to retire early for an unemployed person.

To receive an early pension, first of all, you need to register with the employment service as unemployed. If the Center cannot offer employment to a person of pre-retirement age, it prepares an offer for his early retirement.

The proposal is a separate document that is submitted to the Pension Fund and without which early retirement from the labor exchange is impossible. Along with it, the employment service issues a certificate about the periods included in the insurance period. The insured person independently submits these and other documents to the Pension Fund.

In some cases, the Pension Fund may refuse to grant early pension benefits. Then the applicant returns to the labor exchange to look for work. In practice, refusal most often occurs for the following reasons:

- failure to reach the required age (retirement age minus 2 years), lack of insurance coverage or pension points;

- the applicant retains the average salary from his last place of work;

- payment of unemployment benefits is suspended or its amount is reduced;

- the applicant has refused a job offered by the employment center three or more times within a year.

What documents are needed for early retirement from the labor exchange?

The unemployed person receives an offer from the Employment Center and a certificate of periods of work experience. Next, it is sent to the territorial representative office of the Pension Fund of the Russian Federation, writes an application with a request to grant early retirement and provides the following documents:

- passport (or other identification document confirming citizenship and place of residence);

- SNILS;

- a certificate of average monthly earnings for any 60 months before 2002;

- work book or certificates confirming work experience;

- Sometimes documents may be required about a change of name, presence of dependents, etc.

Legal regulation

Russian legislation provides for the receipt of a labor pension by all citizens after reaching the generally established retirement age. For women in 2020 it is 55 years old, and for men it is 60 years old. Retirement at pre-retirement age is regulated by the following federal laws:

- No. 400-FZ dated December 28, 2013;

- No. 173-FZ dated December 17, 2001;

- No. 1032-FZ dated April 19, 1991;

- No. 166-FZ dated December 15, 2001

- Cucumber face mask - beneficial properties and step-by-step recipes for preparing it at home with photos

- 6 best scanners for car diagnostics

- 6 very first signs of menopause in a woman

Who can retire early if there is a reduction in staff in 2018?

Is it true that if a worker nearing retirement age is laid off, it is possible to retire early? Yes, indeed, in such a situation you can retire early. But only if certain conditions are met. We will talk about them in this article.

The law on early retirement

A person who has been laid off at work may be assigned a pension early - for the period until the age entitling him to an old-age insurance pension, including one assigned early, but not earlier than two years before the corresponding age (clause 2 of Art. 32 of the Law of the Russian Federation of April 19, 1991 N 1032-1 “On employment in the Russian Federation”)

The retirement age is 60 and 55 years (for men and women). For persons holding state and municipal positions, as well as positions in the state civil and municipal service, in 2020, pensions are assigned respectively from 61 and 56 years, with a subsequent annual increase in age until reaching 65 and 63 years in 2032 (for men and women).

Thus, if we talk about a regular insurance pension, a laid-off employee can get it earlier:

- man – no earlier than 58 years of age;

- woman - no earlier than 53 years old.

What conditions must be met

To grant a pension early, the following conditions must be simultaneously met:

- the person must be officially recognized as unemployed;

- the person must have an official document from the employment service - an offer for early retirement, since it is impossible to find a suitable job;

- personal consent to the early assignment of a pension;

- availability of appropriate insurance experience (in 2020, at least nine years, followed by an annual increase until reaching 15 years in 2024);

- the presence of an appropriate value of the individual pension coefficient (in 2020, not lower than 13.8, followed by an annual increase of 2.4 until reaching a value of 30).

Upon entering work or resuming other activities, the period of which is included in the insurance period, the payment of pensions to unemployed citizens is terminated. After the termination of this work (activity), the payment of the pension begins again.

Source: https://buhguru.com/pensiya/dosrochnaya-pensiya-sokrashhenie.html

How to retire early as an unemployed person in 2020 - 2020

Russians of pre-retirement age can retire early if there is no employment opportunity, Rossiyskaya Gazeta writes.

So, in order to retire two years before the required age, taking into account the transition period, you must obtain appropriate confirmation from the employment center. As of July 1 of this year, payments were received by 23.5 thousand Russians who could not find work.

The Pension Fund noted that 4.4 billion rubles have been allocated for these purposes next year. It is planned to spend 5.6 billion rubles in 2021, and 6.4 billion rubles in 2022.

How to retire early for pre-retirees who are not hired: advice from the Pension Fund of the Russian Federation

For many, raising the retirement age has resulted in the impossibility of getting a job: to be honest, employers are not really looking forward to pre-retirement workers. The Pension Fund of Russia told what to do for elderly people left without work (albeit in a greatly truncated form). We will look at everything in detail.

Who can retire early

The Pension Fund of the Russian Federation notes that Federal Law No. 350-FZ dated October 3, 2018 established not only an increased retirement age, but also prescribed conditions for early retirement.

In particular, citizens with an experience of at least 37 (for women) and 42 years (for men), as well as mothers of large families with 3 and 4 children, have the right to early retirement.

Pre-retirees who cannot find a job also have the opportunity to retire early.

How to retire for those who are not hired

The Pension Fund names the following mandatory conditions:

- Condition one.

The pension is assigned no earlier than 2 years before your retirement age according to the new rules (taking into account the transition period). To understand when this moment comes for you, subtract 2 years from the age indicated in the table below. For example, a woman born in 1966. will be entitled to early retirement in 2022. - Condition two.

Insurance experience is at least 25 years for men and 20 years for women. - Condition three.

Inability to find a job. - Condition four.

The employment service approves the assignment of an early pension to you (this is its right, but it may not approve). The Pension Fund calls these four conditions mandatory for early retirement. But here is what the Pension Fund for some reason does not talk about in its explanation (but in vain - complete information must be given): - Condition five:

The dismissal of the pre-retirement employee occurred due to layoffs or liquidation. That is, if you yourself quit your job, you won’t see early retirement. Or you were laid off, forced, but you are entered into the labor record at your own request (although you can fight here). - Condition six

. You are registered as unemployed with the employment service. - Condition seven

. You have earned points sufficient for an old-age pension (in 2019 - 16.2 points, in 2020 - 18.6 points).

New procedure for registering pensions for doctors and teachers

Early registration of pension benefits for medical workers is not related to age restrictions and the amount of total length of service. To qualify for benefits, you must have 25-30 years of medical experience. The exact number of years required to obtain pensioner status depends on the working conditions. This procedure for retirement existed even before the reform. Since 2019, the benefits have been preserved, but a new condition is provided - a deferment before applying for a pension. Its duration depends on the year of special experience. Every year the deferment amount will increase until it reaches a five-year value (in 2023). The increase will be gradual (12 months each year) starting in 2020.

USEFUL INFORMATION: How is the inheritance divided between the wife and children from the first marriage?

For medical workers who became pioneers in the reform, special conditions are provided. In 2020 and 2020, it will be possible to register length of service six months earlier than planned. So, for example, for doctors who completed their service in the first half of 2020, the deferment will be 6 months. That is, it will be possible to apply for benefits in the second half of 2020. The transition period is reflected in the table.

| Year of experience | Year of retirement |

| 1st half of 2019 | 2nd half of 2019 |

| 2nd half of 2019 | 1st half of 2020 |

| 1st half of 2020 | 2nd half of 2021 |

| 2nd half of 2020 | 1st half of 2022 |

| 2021 | 2024 |

| 2022 | 2026 |

| 2023 | 2028 |

Similarly, early retirement is granted to teaching staff. The work activity of a long-service teacher must include work specifically in the educational field for over 25 years. The transition period for teaching staff began in January 2020 and will last until 2028. Over these years, the age limit for teachers will increase in increments of 1 year every 12 months.

In addition to special experience, according to the new rules, in order to assign a pension benefit to medical workers and teachers, it is necessary to have a sufficient number of pension points. The minimum that needs to be accumulated is given in the table.

| Year of retirement, including deferment | IPB |

| 2019 (January-June) | 16.2 |

| 2019 (July-December) | 18.6 |

| 2020 (January-June) | 21 |

| 2020 (July-December) | 23.4 |

| 2021 | 28.2 |

| 2022 | 30 |

| 2023 | 30 |

Thus, in order to obtain the right to rest, you need to earn the required number of points (IPB). Their number depends on the size of insurance premiums. That is, the higher the salary, the more deductions and, accordingly, individual pension points. To calculate the IPB, you can contact specialists in the PF. If there is a shortage, there are several ways to increase their quantity:

- purchase them from the Pension Fund (make a contribution);

- delay retirement for several years;

- one spouse with a higher salary can contribute to the other.

Women also receive additional points for each child. The maximum quantity can be obtained for 4 children. The IPI for a woman with four children will be 24.3.

From the moment of completion of special experience until the appointment of a pension, workers in the teaching and medical professions can, if they wish, leave their place of work or continue their work activity.