According to last year, more than 40 million people were registered with the Russian Pension Fund. According to current data from the Pension Fund of Russia, 3 million of them live in Moscow, another 2 million in the Moscow Region.

Today, the average pension in Russia is fixed at 14,163 rubles . Muscovites, taking advantage of all the opportunities of local social programs, receive an order of magnitude more than the average Russian pensioner.

MOSCOW PENSIONERS:

- The amount of regional pension supplement in Moscow and the region

- The cost of living for Moscow pensioners in 2020

- What is the minimum pension in Moscow and Moscow Region for working pensioners

- Minimum pension in Russia: new table by region

In September 2020, the Moscow government, on the eve of the elections, increased pensions for local residents. Both citizens receiving a social pension and an insurance pension, including for old age, disability, loss of a breadwinner, etc., were able to apply for increased benefits.

From April 1, 2020, pensions were indexed for non-working citizens by 6.1-6.6%, depending on the type of payments: social or insurance. Former military personnel expect a 3% increase in October.

What is an insurance pension in simple words?

When it comes to pensions, we mainly mean payments to people who have reached a certain age and have completed their working career. However, this concept is broader and includes social benefits for preferential categories of citizens.

Insurance pension is a monthly benefit paid to citizens who have lost the opportunity to work. This payment compensates for the wages that a person loses if he becomes disabled.

The cause of incapacity for work may be injury, old age, loss of health, disability, as well as inability to work due to being a minor (for example, a survivor's pension).

The fact that a person is registered in the pension insurance system is confirmed by SNILS. However, the basis for receiving an insurance pension is official length of service and the transfer of contributions to the personal account of the Pension Fund. These contributions will serve as a source of old-age pension payments.

What legislation governs it?

The general rules for organizing pension provision are established by Federal Law No. 167 of December 15, 2001 “On compulsory pension insurance in the Russian Federation.” This regulatory act regulates the legal relations of subjects of compulsory pension insurance (CPI), determines the procedure for exercising rights and obligations, as well as the responsibility of the subjects, the powers of authorities and sources of financing pension payments.

The Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ provides legal regulation in the field of insurance pension payments. It specifies a list of persons entitled to such payment, types and conditions for the appointment of an insurance pension, calculation formulas, as well as the concept of length of service and the procedure for calculating it.

Calculation and confirmation of length of service for the assignment of an insurance pension is carried out in accordance with Government Decree No. 1015 dated October 2, 2014.

The document explains:

- what requirements must an employer comply with when preparing a work book;

- how to correctly calculate the number of years worked for different categories of workers (for example, in hazardous conditions, etc.);

- what documents confirm the length of service and other periods included in the time worked (for example, studying at a university or maternity leave).

Another important law is “On funded pensions” (No. 424 Federal Law of December 28, 2013). It concerns issues related to the formation of the funded part of the pension, assignment, calculation of the amount, and also explains the procedure for suspending and resuming payments. An important criterion is the expected period of payment of a funded pension; it is established by a separate Federal Law No. 446. The indicator depends on life expectancy and is adjusted annually based on statistical data. So, in 2020 this period was 252 months, and in 2020 it was increased to 258 months.

Federal Law No. 111 of July 24, 2002 “On investing funds to finance funded pensions in the Russian Federation” and Federal Law No. 75 of May 7, 1998 “On non-state pension funds” deal with issues of financing payments and also regulate the activities of institutions involved in managing pension savings of citizens. Regulatory acts contain requirements for the investment policy of funds, the conditions of liability insurance, the procedure and deadlines for submitting reports to regulatory authorities.

The procedure for assigning pensions to certain categories of citizens is regulated by Federal Law No. 166 “On state pension provision in the Russian Federation”. Such pensions are paid to officials, pilots, cosmonauts, security forces, military personnel and their relatives, and World War II participants who suffered as a result of man-made or radiation disasters. These pensions are considered state pensions and not insurance ones, since they are paid from the federal budget and not from the Pension Fund.

Differences between an insurance pension and a funded pension

Since 2002, Russia has had a distribution-savings system, which divides pensions into three components: basic (it is paid by the state to all citizens without exception), insurance, and funded. Despite the fact that the last two payments are also components of a pension, they have nothing in common. Let's figure out what are their differences?

| Criterion | Insurance | Cumulative |

| Formation method | Calculated in accordance with regulations using annually indexed coefficients. | Similar to a bank deposit. Its value is influenced by only one parameter – investment return. |

| Form | It is calculated in conditional indicators - points or pension coefficients. The cost of a point is set at the state level and can be revised in any direction. | Calculated only in cash. All contributions of the insured person are accumulated in his individual personal account in a state or non-state pension fund. |

| By type of ownership | The points are a conditional indicator, acting as an obligation of the state to transfer a certain amount to the citizen every month in the future. There is no provision for targeted accumulation of funds, i.e. all contributions are directed towards payments to those who have already retired. | Belongs only to the citizen. The state cannot dispose of these funds at its discretion and withdraw them from the personal account of the insured. |

| Indexing method | Indexed by the state depending on the demographic situation and the state of the economy. | Increases by the percentage earned by the management company or state pension fund. Profitability is distributed among all personal account holders in proportion to the amount of the deposit. |

| Right of inheritance | No. | Yes, the right of inheritance is assigned to relatives in the event of the death of the account owner. |

| Depending on the will | Mandatory and provided for all citizens with insurance experience. | It is formed voluntarily for citizens born in 1967 and later, if an application for splitting up savings was submitted before 2020. |

Labor, social and insurance pensions - what are the differences?

Previously, a labor pension was assigned to all citizens who had reached a certain age and had accumulated work experience. Since 2020, the changes provided for by Federal Law No. 400 and Federal Law No. 424 have come into force. From that moment on, the concept of a “labor” pension ceased to exist, and two new ones appeared in its place - funded and insurance payments.

ATTENTION! A citizen can receive both parts at the same time, provided that he has the necessary length of service, as well as savings in his personal account.

The insurance pension is paid when a citizen reaches retirement age ; it depends on the number of accumulated pension points, their value, length of service and salary. It is formed through contributions from the employer; out of 22% of the total amount, 16% is used to finance it. All pensions are paid from funds accumulated in the Pension Fund.

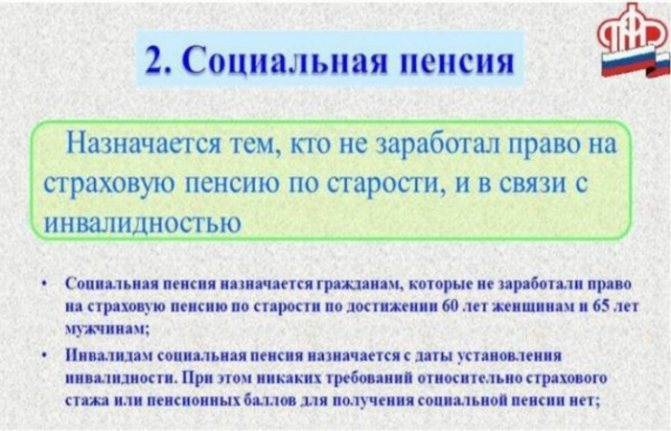

The social pension is state and is paid to citizens who are not entitled to insurance payments. It is prescribed to disabled people without work experience, to all victims of man-made disasters, as well as to military personnel, pilots and senior officials (Article 4 of Federal Law-166 “On State Pension Provision in the Russian Federation”). The source of funds is the federal budget, and the minimum amount of the insurance pension is revised annually depending on the level of inflation in the country.

Federal Law No. 400 “On Insurance Pensions” - main provisions

The procedure for the appointment, formation and payment of insurance pensions is regulated by Federal Law No. 400 of December 28, 2013. The purpose of the document is to protect the rights of every citizen to a monthly payment, which should compensate for his lost source of income.

Chapter 2 contains basic terminology and defines concepts such as IPC, length of service, and pension. Art. 6 contains a list of insurance pensions (for old age, disability, loss of a breadwinner), and in Art. 4 provides a list of persons entitled to receive them:

- citizens of the Russian Federation insured in accordance with Federal Law No. 167 “On compulsory pension insurance in the Russian Federation”;

- disabled family members who have lost their breadwinner;

- foreign citizens or stateless persons, subject to compliance with the conditions of this Federal Law.

Chapter 2 explains the conditions for assigning payments for old age, disability and in the event of loss of a breadwinner. The requirements for persons applying for an insurance pension are given.

Chapter 3 examines one of the most important criteria - seniority. It indicates which periods of work and other activities are included in it, and also establishes requirements for supporting documents.

Chapter 4 explains what components the insurance pension is divided into, as well as what formulas are used to calculate payments and bonuses.

Chapter 5 describes the mechanisms, terms and methods of payment of the insurance pension. Issues related to termination, suspension and resumption of payments are also raised.

Chapter 6 is devoted to the issues of early registration of pensions, listing the categories of citizens who have the right to such a benefit and the conditions for registration.

Chapter 7 contains transitional and final provisions governing the entry into force of this law and its individual provisions.

Changes to the Federal Law on insurance pensions in 2020

In 2020, four important changes were made to the legislation. Firstly, the cost of a pension point has been increased, now it is 93 rubles. Secondly, the monthly fixed payment increased to 5,686.25 rubles.

ATTENTION! The average pension in 2020 was 16,389.62 rubles.

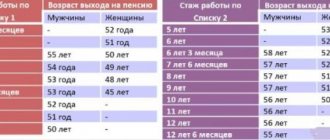

Thirdly, since 2020, the legislation has introduced the concept of “deferment” for early retirement. At the same time, the requirements for special length of service will not be revised, but the retirement period will change. According to the new regulations, you can go on a well-deserved rest only 5 years from the moment the required length of service has been completed.

The latest change affected rural workers directly involved in the production and processing of agricultural products. From 2020, the insurance pension will increase by 1,333.54 rubles.

Types of insurance pension and details of appointment

In accordance with Art. 3 Federal Law No. 400 “On Insurance Pensions”, a citizen has the right to a monthly cash payment that compensates him for the loss of a source of income. In Art. 6 of this law establishes the following types of insurance pension payments:

- due to old age;

- on disability;

- due to the loss of a breadwinner.

Each of them has its own characteristics and is calculated in compliance with the requirements established by federal laws.

By old age

An old-age pension is a monthly payment to a citizen for the rest of his life, assigned in connection with his reaching a certain age.

The following persons have the right to receive an old-age pension:

- have reached the age of 65 for men and 60 years for women;

- having a work experience of at least 11 years (in 2024 its duration will increase to 15 years);

- individual pension coefficient (IPC) of which is not less than 18.6. Every year the value of the IPC will increase by 2.4 until it reaches a value of 30 points;

- eligible for early retirement.

IMPORTANT! If a citizen does not have enough points or insurance experience, he is assigned a social pension.

By disability

A disability insurance pension is assigned to a person recognized as disabled and who has at least one day of work experience. Only a federal institution that has the right to conduct a medical and social examination can recognize a person as disabled and establish a group (I, II or III).

According to Art. 9 Federal Law No. 400 “On Insurance Pensions”, disability payments are assigned regardless of:

- on the length of work experience, which can be 1 day or several years;

- on the reason why the person became disabled;

- from the moment of disability (before entering work, during the period of employment or after termination);

- on the availability of work at the time of examination by a medical commission and recognition as disabled.

ATTENTION! The length of the insurance period does not affect the amount of the disability insurance pension.

In the case when a citizen does not have work experience, in accordance with Federal Law No. 166 of December 15, 2001 “On state pension provision in the Russian Federation,” he is assigned a social pension benefit. As a rule, children and people who do not have official work experience are entitled to receive such a pension. Payment of the pension is carried out during the period for which disability is established, or until the citizen reaches retirement age (65–70 years if there is no insurance experience, 60–65 if there is one).

ATTENTION! The amount of the old-age pension assigned to a disabled person cannot be less than the disability benefit.

For the loss of a breadwinner

In accordance with Federal Law No. 400 of December 28, 2013 “On Insurance Pensions,” disabled family members who have lost their sole breadwinner have the right to receive such payment. Payments are also due to relatives of persons recognized as missing in accordance with the legislation of the Russian Federation.

ATTENTION! A pension is not awarded in cases where illegal actions were committed against the breadwinner that resulted in his death. This fact is confirmed by a court decision that has entered into legal force.

The circle of persons entitled to receive survivor benefits is limited by Art. 10 No. 400:

- disabled family members who are unable to work due to their minority or loss of health and who were dependent (children, brothers, sisters, grandchildren under the age of 18 or studying full-time, including outside Russia);

- parents, spouses, grandparents, if they do not work due to caring for a child under 14 years of age;

- disabled spouse or parents, if they were dependent on the deceased and do not have their own sources of income.

ATTENTION! The benefit may be paid indefinitely or until the recipient becomes able to work.

The pension is due to all families in which the breadwinner had work experience (even one day). However, there is no need to prove the fact of dependent children under 18 years of age. The payment is assigned to disabled parents and the spouse of the deceased if they previously had a source of income, but have now lost it.

Conditions for obtaining Moscow pensioner status

- reaching age: 63 years for women, 65 for men;

- contributions to the Pension Fund of the Russian Federation (PFR) of a percentage of wages;

- availability of the required work experience (at least 10 years);

- accumulation of a certain number of pension points (at least 16.2).

If a person does not have the required work experience, then he has the right to receive a social pension under the following conditions:

- permanent residence in the Russian Federation;

- reaching the age of 60 years (woman) or 65 (man);

- lack of official work.

- 5 health tips for men over 50

- What medications are prescribed for menopause?

- Why do people develop weather sensitivity?

Registration deadline in the capital

This period directly affects the size of the pension payment received. If a person has not lived in the capital for 10 years, he can only count on an increase up to the cost of living, that is, up to 12,115 rubles.

A pensioner whose registration period in the capital is at least 10 years is entitled to a payment of at least 19,500 rubles. monthly.

Is it possible to become a Moscow pensioner with temporary registration?

The Constitution of the Russian Federation enshrines the right to free movement of citizens and choice of place of residence. Therefore, a pensioner can arrange payments at the Pension Fund branch at the temporary registration address, if such a need arises.

State pensions

State pensions are another type of support for disabled citizens, provided from the federal budget.

Their appointment and payment are regulated by Law No. 166-FZ “On State Pension Security in the Russian Federation”, and the types are listed in Art. 5 of this Federal Law:

- By length of service.

- Due to old age. Provided to citizens affected by radiation or man-made disasters, as well as those living in contaminated areas.

- Due to disability. Veterans, participants of the Second World War, survivors of the siege, military personnel who became disabled as a result of military operations, etc. have the right to obtain it.

- For the loss of a breadwinner. Paid to relatives and family members of the deceased serviceman.

- Social payments. Intended for persons who do not have the right to insurance payments, who are unable to work due to disability or old age.

The long-service pension is assigned to the following groups of citizens:

- civil servants with at least 15 years of experience;

- military;

- cosmonauts with 25 years of experience for men (of which at least 10 calendar years must be spent as flight test personnel) and 20 years for women (7.5 calendar years spent as flight test personnel);

- test pilots with 20 and 25 years of experience, while 2/3 should be in flight test personnel.

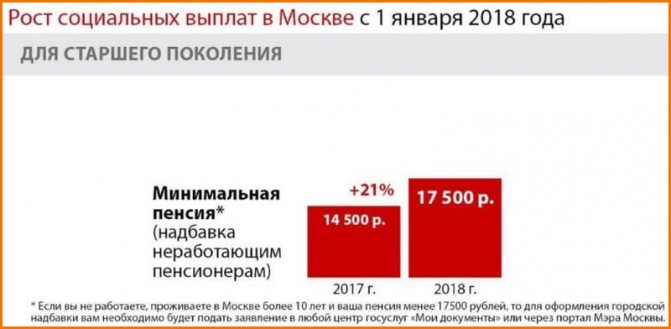

Pension amounts in Moscow

The basic amount of payments in the capital is no different from the Russian average. However, in Moscow there is a city social standard (or, as it is popularly called, the “Luzhkov pension”) - the lower limit is set at 17,500 rubles. In cases where the pension does not reach the required minimum, the city budget issues an increase to the pensioner. This measure of social assistance was established in 2007, during the work of Mayor Yuri Luzhkov.

Important! In the Moscow region, the bonus no longer works - the bonus is available only to residents of the capital. Residents of the region are also paid a much lower minimum pension for visitors.

What are the requirements to receive Moscow payments? The conditions are quite simple: the pensioner must live within the city limits for ten years or more. The average pension for visitors who have not lived in the capital for more than 10 years is close to the all-Russian one. The lower limit is drawn according to the subsistence level, which for 2019 is 12,115 rubles in Moscow and 9,908 rubles in the region.

Annual indexation

Indexation of old-age insurance pensions for non-working pensioners

The increase in pensions of Muscovites takes place in three stages. The first step is the January indexation, which takes place throughout the country at the beginning of the year for non-working old-age pensioners. In 2020, the growth rate was 7 percent, or about a thousand rubles per month.

The second step was the April increase in social pensions. These include pensions for the disabled and those who have lost their breadwinner. For 2019, the indexation amount will be “percent.”

Finally, in August, insurance pensions will increase for those pensioners who worked in 2020. The increase during recalculation will be small - as last year, up to three pension points or 261.72 rubles.

Additional payments and benefits

Additional payments and benefits for Moscow pensioners

The capital's social protection program offers significant assistance to low-income pensioners, disabled people and the elderly. The following benefits can be highlighted:

- city social standard, raising the level of payments to 17,500 rubles for indigenous residents of the capital;

- an all-Russian resolution for visitors, establishing minimum payments in the amount of 12,115 rubles;

- pension increase when a pensioner reaches 80 years of age;

- for low-income and non-working pensioners - 50% compensation for housing and communal services;

- standard monetization of available benefits.

Among the targeted non-monetary benefits and benefits it is worth highlighting:

- helping the poor with food, basic necessities and hygiene products;

- purchasing prescription medications at a significant discount;

- reduction of transport tax on a type of vehicle that is personally owned;

- free travel on municipal transport;

- walk-in service in public hospitals and clinics;

- production of free prostheses;

- using a landline phone.

Benefits for pensioners - free travel on public transport

In order to find out the possibility of receiving a specific benefit, a pensioner must contact the city’s social services. It should be noted that assistance from the second list is targeted and is provided only to those citizens who really need it.

Video - Benefits for Moscow pensioners

Special benefits

The city also provides benefits to certain categories of beneficiaries. Payment amounts for 2020 can be viewed in the table below:

| Categories of citizens | Payment amount |

| Honorary Citizen of Moscow | 50,000 rubles |

| People's and Honored Artists | 30,000 rubles |

| Heroes of the Russian Federation and the USSR, full holders of the Order of Glory | 25,000 rubles |

| Widows and widowers of heroes who have not entered into a second official marriage, as well as their parents | 15,000 rubles |

| Children of military personnel who died in peacetime | 13,000 rubles |

| Compensation payment for a guardian of a disabled child or a disabled child under 23 years of age | 12000 rubles |

| Assistance to parents of minor children who are disabled of the first or second group | 12000 rubles |

| Payment to families of disabled children for the purchase of clothing | 10,000 rubles (once a year) |

| Veterans who defended Moscow | 8000 rubles |

| Disabled people with disabilities in the Caucasus and Afghanistan (groups I and II) | 6000 rubles |

| Parents of military personnel killed in combat | 3000 rubles |

| WWII participants, disabled people | 2000 rubles |

| Disabled people with disabilities in the Caucasus and Afghanistan (Group III) | 2300 rubles |

| Rehabilitated and victims of repression | 2000 rubles |

| Home front workers | 1500 rubles |

| Veterans of labor and military service | 1000 rubles |

There is no increase or indexation of these payments for 2020 in the budget.

Calculation of the surcharge amount

Calculation of the surcharge amount

With Moscow bonuses, not only the pension is taken into account, but the total amount of funds paid to the applicant by the city. Monthly social payments, monetization of services and all types of additional support are taken into account.

In the case where a citizen has not lived in Moscow for more than 10 years, the city only compensates the difference between total income and the cost of living. If we take into account that the minimum possible pension is about 6,100 rubles, then the maximum additional payment will be up to 6 thousand rubles for visitors and up to 11.4 thousand for permanent residents of the capital.

For each case, the amount is calculated individually.

Conditions for assigning an insurance pension

In accordance with Federal Law 400, the following persons have the right to receive an insurance pension:

- Those who have reached retirement age. For women – 60 years, for men – 65.

- Having sufficient insurance experience. In 2020, its value is 10 years, by 2024 it will increase to 15 years.

- With a pension coefficient of at least 18.6.

ATTENTION! Early retirement is granted to citizens if they are included in a preferential category and have accumulated at least 30 points.

Formula for calculating old-age insurance pension

Old-age pension is calculated in rubles using the formula:

cost of 1 pension coefficient (PC) at the time of pension establishment * sum of pension coefficients + fixed additional payment

The cost of a PC is increasing annually, by 2024 it will be 116.63 points. If a citizen applies for a pension not upon reaching age, but later, he will be able to increase the amount of payments. The fact is that for “delay” he will be charged increasing coefficients.

The fixed surcharge is also reviewed annually and increased by no less than the percentage of inflation. In 2020, its amount was 5,686.25 rubles.

What is social old age pension and who is entitled to it?

Social pension benefits are provided monthly. It provides financial assistance to disabled Russians who have no work experience. Social benefits are assigned to help people who have no other sources of livelihood.

Money for such pensions is allocated from the Russian treasury, and not from contributions from employers. This is the difference between social benefits and insurance benefits. Socially vulnerable citizens who:

- have a disability of the first, second, third group;

- Russians who have reached retirement age and do not have insurance coverage (social old-age pension).

What is a fixed payment of an insurance pension and its size?

The concept of a fixed payment first appeared in 2020. It was assigned and paid to pensioners along with the insurance pension. It was indexed annually for inflation, and persons over 80 years of age and disabled people of group I received an additional payment of 100% to their pension.

ATTENTION! Currently, the fixed payment of the insurance pension is 5,686.5 rubles; by 2024, it will increase to 7,131.34 rubles.

The following categories of persons receive a fixed payment:

- who have reached retirement age and have accumulated sufficient points;

- people with disabilities, provided that they have official work experience. The amount of additional payment depends on the disability group: group 1 – 10,668.38 rubles, group 2 – 5,334.19 rubles, group 3 – 2,667.10 rubles;

- disabled citizens due to the loss of a breadwinner.

The procedure for obtaining an insurance pension

Step 1. Registration of an insurance pension should begin with the collection of documents. You will need a certificate from the employer about income, a work record book, information about awards, work in difficult or harmful conditions. If there are benefits (for example, disability), Pension Fund specialists will definitely request a certificate certified properly.

Step 2. Contact the local branch of the Pension Fund or MFC with a package of documents and fill out an application for a pension. You can also send documents by mail, submit through a representative or via the Internet (personal account on the State Services or on the PFR portal).

ATTENTION! The legislation allows submitting documents a month before the citizen reaches retirement age.

Step 3. After the preliminary check, the applicant will be informed whether all documents are properly completed and whether additional evidence of work experience needs to be provided.

Step 4. After eliminating the comments, the Pension Fund specialist accepts the documents, after which a decision is made to assign an insurance pension.

List of documents

To receive an insurance pension you will need the following documents:

- application for the appointment of monthly insurance pension payments;

- passport (copy and original), SNILS;

- employment history;

- certificate of earnings for the last 60 months or information from the Pension Fund on average monthly earnings;

- documents confirming the right to benefits.

Where to contact?

You can apply for an appointment at any territorial branch of the Pension Fund of the Russian Federation, or at the MFC at the pensioner’s place of residence. The opportunity to submit an application is also provided in your personal account on the Pension Fund website, as well as on the State Services portal. Citizens who have traveled outside the Russian Federation, as well as those who do not have permanent registration, should apply for a pension by mail directly to the Pension Fund of Russia at the address: Moscow, st. Shabolovka, 4.

Registration of a survivor's pension

To apply for a survivor's pension at the Pension Fund of Russia, the following documents are provided:

- passport, residence permit of a foreign citizen with registration marks;

- SNILS of the applicant and SNILS of the deceased breadwinner;

- death certificate of the breadwinner;

- work book (for assigning an insurance pension);

- documents confirming the applicant’s incapacity for work;

- documents confirming the fact of dependency (court decision on an application to establish the fact of being dependent, birth certificates of children, etc.);

- certificate of study at an educational organization (for students under 23 years of age who are entitled to receive a survivor's pension);

- certificate (FMS, HOA) about the fact of cohabitation with the deceased;

- other documents, the list of which depends on the specific basis for applying for this type of pension.

The application review period is 10 days from the date of submission of all documents.

Registration of a pension ends with the issuance of a certificate (instead of a pension certificate) to the applicant and the accrual of a pension.

Early pension – who is entitled to it and how is it processed?

In accordance with Art. 30, art. 31, art. 32 Federal Law No. 400 “On Insurance Pensions”, an old-age pension can be issued early.

The following categories of persons have this right:

- those who worked in harmful conditions that are dangerous to life and health (lists 1 and 2 of professions);

- living in the Far North, as well as in areas equivalent to it;

- those with a certain social status, for example, mothers of many children;

- by length of service (medics, teachers).

In accordance with Art. 32 FZ-400 the following have the right to early pension provision:

- mothers of many children (5 or more children) who raised children under 8 years of age with at least 15 years of experience;

- guardian or parent of a child with a disability who raised him until he was 8 years old and has 20 years of experience for men and 15 for women;

- mother of 2 or more children who worked in the Far North for at least 12 years (in equivalent regions - 17 years);

- military personnel wounded during military or combat operations at 55 years for men and 50 years for women;

- visually impaired people of group I (men aged 50 and women aged 40);

- patients with dwarfism (at 45 years old for men, at 40 years old for women).

To apply for a pension, you need to submit a package of documents to the territorial branch of the Pension Fund. This can be done in person, through a representative, or by sending an application by mail. After checking the documents, the specialist makes a decision on the assignment of payments, or notifies the citizen of the need to provide additional evidence of length of service or entitlement to benefits.

ATTENTION! The citizen is given 3 months to eliminate the comments. Before the deadline expires, he must re-apply to the Pension Fund.

Insurance part upon early retirement

Certain categories of citizens may qualify for early retirement. This applies mainly to persons working in special working conditions. These include, among others:

- medical workers;

- teaching staff;

- workers in environmentally unfavorable and hazardous industries.

Also, some citizens may retire earlier than due not due to difficult working conditions, but due to special circumstances. These include, for example:

- persons carrying out labor activities in territories belonging to the Far North with at least 15 years of experience;

- parents of disabled children;

- disabled combatants.

It is calculated using a similar method as the regular old-age insurance benefit and its amount is also based on wages and, as a consequence, the amount of contributions to the Pension Fund.

The old-age insurance pension is the most important measure of material support that senior citizens of working age have the right to count on. Its peculiarity is that its size is largely influenced by the amount of contributions to the Pension Fund, which means that if an employee receives a high salary, then in old age he can count on a high pension. If the length of service is not enough, then the state will only pay social benefits, the amount of which barely allows to satisfy the basic needs of a person.

Minimum insurance pension in 2020

Paid to all non-working pensioners if their income is below the subsistence level. The amount of the payment is revised annually, and it itself consists of two parts: federal and regional. The federal part is paid extra if the pensioner’s cost of living (PLS) is lower than the average for all regions.

For 2020, the average PMP value is set at 9,311 rubles, the highest value is in the Chukotka Administrative District (19,000 rubles), and the lowest in the Belgorod Region (8,016 rubles).

The insurance pension is an important tool for state support for the elderly, as well as the most vulnerable categories of citizens.

Payment is assigned:

- for old age (men - at 65, women - at 60 years), disabled people (if there is a confirmed conclusion), as well as family members in connection with the loss of a breadwinner;

- The categories of citizens specified in Art. have the right to early exit. 32 Federal Law No. 400.

To obtain it, you must contact the territorial branch of the Pension Fund of Russia or the MFC with your passport, employment document and documents confirming your right to receive benefits. The average insurance pension in 2020 was 9,311 rubles.