In the context of constantly changing pension legislation and the decreasing role of the state in providing for non-working citizens, the increased interest of Russians in other investment options is quite understandable. It would seem that non-state pension funds, designed to become an alternative to the traditional accumulation of funds for paying pensions, allow you to save for a dignified old age. However, not all of them successfully cope with their task. Let's find out whether NPF Alliance is able to preserve and increase the pension savings of investors.

Information about the fund

Basic information about NPF Alliance JSC is available on the Bank of Russia website. Here you can find the legal address of the company, its details, license number to operate, as well as information about the founders and ultimate beneficiaries. They are WESTELCOM JSC (51% of shares), April Group LLC (44%) and Arkady Anatolyevich Nedbay (5%).

Details of the fund's activities can be found on its official portal. There is information here about Rostetecom PJSC, the management of the non-state pension fund, the composition of the board of trustees, the list of services provided, as well as other information, the disclosure of which is provided for by the regulations of the Russian Federation.

Official site

Official website: https://ppafond.ru.

The Fund informs about pension programs for individuals and corporate entities, publishes general information about itself, information disclosure and contact information.

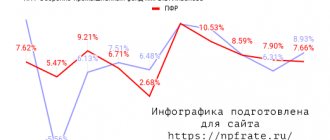

Profitability

The profitability of any non-state pension fund is best analyzed over several years. High rates may indicate that he is investing in risky projects. Below is a table of profitability (in percentage) by year, based on official reports of the Central Bank of the Russian Federation.

- 2015 — 13,34

- 2016 — 13,05

- 2017 — 10,81

- 2018 — 10,37

Information for 2020 is indicated based on the results of the fund’s activities for 9 months.

Reliability rating

The rating agency RA Expert withdrew the rating in 2020 without confirmation. In 2020, o was at level “A”, and in 2020 - “ruA”, in 2020 - A+.

What is the fund's return?

On the NPF website, clients can learn about profitability and reliability ratings. What speaks in favor of the fund is that it is a participant in the system of guaranteeing the rights of insured persons in the OPS. In addition, the Alliance pension fund is part of the SRO National Association of Non-State Pension Funds. Rating actions regarding the fund were carried out by leading industry experts: Expert RA assigned the company a ruAA reliability rating, meaning high solvency and excellent development prospects.

However, the fund's profitability turned out to be lower than its reliability. In 2018 it was 4.2%, in 2020 – 7%, in 2020 – 9%, in 2020 – 11.7%. Fund managers explain the drop in the indicator by high market volatility, sanctions of foreign countries, and high transaction costs.

Fund returns by year

In the profitability rating posted on the website of the Central Bank, NPF Alliance (Rostelecom) ranks 16th with an indicator of 9.76% at the end of 2020 - beginning of 2020. The yield on non-state collateral is 9.54%.

| Year | 2011 | 2012 | 2013 | 2014 | 2015 |

| Profitability, % | 6,50 | 7,30 | 9,84 | 0 | 12,15 |

Please note: too high profitability of any non-state pension fund is suspicious. Perhaps he invests in risky projects.

It is best to track over a longer period of time: one year can bring random indicators, but constant numbers from time to time are the key to stable and correct financial management.

What programs exist

The existing list of pension programs of the non-state pension fund "Alliance" is divided into two groups: for private and corporate clients.

The line of corporate programs is aimed at high-income clients who want to independently form their future pension. Investors working in large companies can join co-financing schemes offered to corporate clients.

Types of programs for pensioners – individuals:

- Additional non-state pension - participation in the program allows the client to independently regulate the amount and frequency of payment of contributions, receive an additional pension or terminate the contract early, transfer the unpaid amount to his heirs.

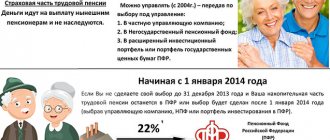

- Cumulative pension under compulsory pension insurance – the advantage is receiving an increased pension at the expense of accumulated investment income, as well as succession (the possibility of inheritance) of pension savings.

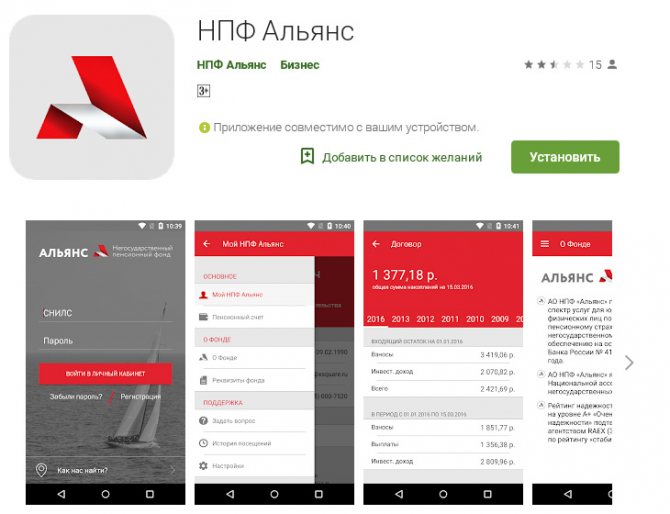

Mobile app

To improve the ease of use of the service and to make the Alliance personal account accessible to a wider audience, the company has released a special mobile application. It allows you to access the main functions of your personal account even when away from your computer.

The mobile application allows :

- View the status of accounts under agreements concluded with the pension fund;

- Ask questions to support staff;

- View information about the location of the nearest branches of the Alliance pension fund on the map;

- Request the generation of reports on the status of the pension account (with subsequent automatic sending by email).

The application is available for download in the official AppStore and GooglePlay stores. The application is distributed free of charge; login is also carried out using your SNILS number and password. If you have not yet registered an account on the site, you can do so directly in the application.

How to join NPF

Employees of a specialized company can join the current corporate program. To do this, they need to contact the employee responsible for interaction with NPF Alliance.

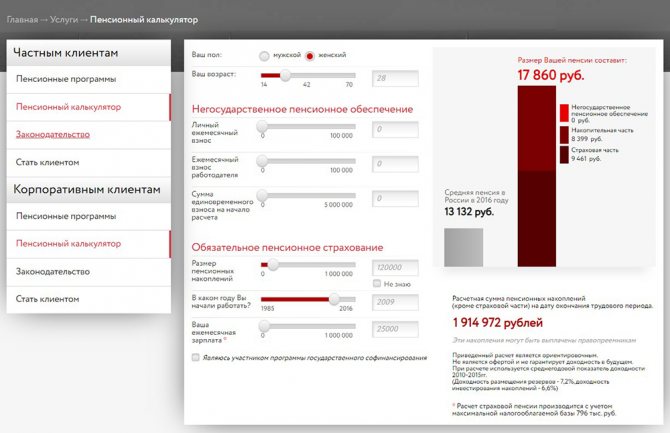

If this option does not suit you or your company does not cooperate with the fund, you can choose a pension plan yourself. To do this, go to the NPF website and use the online calculator. To calculate the amount of the monthly contribution, you need to enter your gender, age, monthly salary, amount of pension savings and start date of work in special fields. As a result, you will be able to calculate the increase in your future pension.

If you are satisfied with the preliminary calculation, send an application for concluding an agreement through the NPF website or contact one of the company’s offices to consult with a manager about choosing a suitable program and concluding an agreement for pension services. To join the fund, you only need a passport and SNILS.

Official website of NPF First Industrial Alliance

Currently, the non-state pension fund uses the website https://ppafond.ru. Through this resource, the organization provides information about existing programs for citizens and organizations, reflects information about the organization, and indicates contact information.

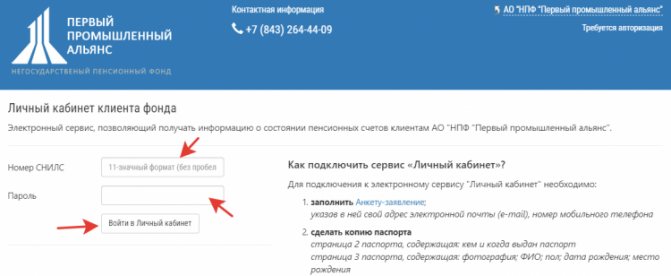

Personal Area

In order to gain access to a personal account, a citizen will need to enter personal data into a form and indicate complete information about himself. A copy of the act by which the citizen’s identity is verified is attached to the application.

The application can be submitted:

- to the fund branch during a personal visit;

- sent by mail to the address: 420097, Kazan, st. Vishnevsky, 2E.

30 days after the NPF application is accepted, the citizen receives a response. To enter your personal account, you will need to use SNILS. When difficulties arise, you can contact support for assistance.

A personal account gives a citizen the following opportunities:

- obtaining information about the current status of the contract and the conditions under it;

- checking account savings;

- contact NPF specialists.

To obtain information about savings, a client of a non-governmental organization initially needs to enter into an agreement, and then register in his personal account. The information is located in the appropriate section on the portal.

How to terminate a contract

Not everyone is satisfied with the modest results of investing in non-state pension funds. If you have selected a more effective non-state pension fund, you can transfer your savings to it. However, you need to keep in mind that, according to current legislation, withdrawal of funds without loss of investment income is allowed once every five years.

The contract can be terminated on the basis of a corresponding application. All the nuances of the procedure should be clarified with NPF specialists by calling the hotline or through the “Ask a Question/Feedback” service.

Personal Area

To gain access to your personal account, the fund’s client needs to fill out a form, indicating his name and contact information. A photocopy of the passport is additionally attached to the application - only pages 2 and 3.

Where to send the collected package of documents:

- hand it over to the fund’s branch personally to an employee;

- by letter to the address: 420097, Kazan, st. Vishnevsky, 2E.

An email with a login password will be sent within 30 days after receiving the application. To enter you will also need your SNILS number.

If you have any difficulties logging into your personal account, contact our technical support service.

- +7

Describe the problem and wait for a specialist response.

Possibilities

- viewing the current contract and its terms;

- checking pension savings;

- specialist.

How to find out your savings?

The personal account allows the client to obtain information about his savings. To do this, you need to gain access to the service, log in to the portal and open the appropriate section.

Advantages and disadvantages

Among the advantages of investing in non-state funds, the opportunity to influence the size of a future pension by choosing a comfortable contribution transfer scheme is often cited. The main disadvantage is considered to be the low profitability of NPFs, poor management of depositors’ money, and the retention of part of the funds upon early termination of the contract.

Real reviews of NPF "Alliance" indicate that the fund's clients hope for an increase in profitability in the coming years. However, no matter what NPF investors think, everyone should make the decision to transfer funds to a particular fund independently based on an analysis of the company’s performance indicators, and not based on the opinions of unknown bloggers.

Contact details

Head office address

420097, Kazan, st. Vishnevsky, 2e

Reception

Requisites

Joint Stock Company "Non-state pension fund "First Industrial Alliance"

INN: 1655319199 Checkpoint: 165501001 OGRN: 1151600000210

Phones

Accounting

Pension Department (NPO)

Pension Insurance Department (PID)

Corporate Development Department (OCD), 264-37-66

Anti-corruption

Hotline of the ROSTEC Group of Companies

Hotline of KAMAZ PJSC for receiving reports of possible violations in the field of compliance, +7 (960) 070-61-11

Attention

Before concluding a pension agreement or an agreement on compulsory pension insurance for the transfer of pension savings, you must carefully read the Charter of NPF First Industrial Alliance JSC, its Pension or Insurance Rules. We draw the attention of investors, participants, insured persons of NPF First Industrial Alliance JSC and other interested parties to the fact that:

- the results of placing pension reserves and investing pension savings in the past do not determine future income;

- the state does not guarantee the profitability of placing pension reserves and investing pension savings;

- You must carefully read the Charter, pension and insurance rules of the Fund before concluding a pension agreement or transferring pension savings to the Fund.

The non-state pension fund notifies investors, participants and insured persons that on January 1, 2013, changes to the Federal Law dated May 7, 1998 No. 75-FZ “On Non-State Pension Funds” came into force, canceling the fund’s obligation to send annual information on the status of pension savings accounts parts of labor pensions, pension accounts for non-state pension provision. Information on the status of pension accounts is provided exclusively upon request from investors, participants and insured persons for this information within 10 days from the date of the corresponding request.

In accordance with Federal Law No. 424-FZ dated December 28, 2013 “On funded pensions”, notifications to insured persons about changes in the name of payment from pension savings provided for in contracts on compulsory pension insurance concluded between the fund and insured persons before the date of entry into force Federal Law. Cumulative parts of old-age labor pensions established for citizens before January 1, 2020 in accordance with the legislation of the Russian Federation that was in force before the date of entry into force of the Federal Law, from this date are considered funded pensions (Article 18 of the Federal Law No. 424-FZ dated December 28, 2013 “ About funded pension")