- home

- Reference

- Funded pension

Information technologies are increasingly becoming part of our lives every year. Moreover, this applies not only to individual individuals. Government bodies are also actively developing interaction among themselves and with citizens through information systems and services.

One of the most popular resources of this kind is the Gosuslugi portal, through which, among other things, you can obtain the necessary information online, for example, information about the status of your pension account.

What does the document contain?

An extract from the individual personal account of the insured person has a format established at the legislative level. Regulation of pension accruals is carried out on the basis of the following regulations:

| Federal Law No. 173 of December 17, 2001 | Regulates issues related to the calculation of labor pensions |

| Federal Law No. 400 dated December 28, 2013 | Regulates insurance savings |

| Government Decree No. 192 of July 31, 2006 | Sets the format for recording and providing information |

The document is presented in a table and includes the main points about the insured person. The following sections are required:

- record number;

- Full Name;

- individual personal account number;

- the name of the insurance company that distributes accruals;

- insurance part;

- accumulative amount;

- organizations from which contributions were made.

Information about places of work and periods of work is also included. Information is provided in the most convenient and understandable form, without causing the possibility of double interpretation.

Attention! Deciphering the recordings is not difficult. Only sections from the document with the closest issue date are taken into account. It is always taken into account that deductions are made monthly. Information is also updated regularly.

What to do if you have no pension savings

According to the new standards, additional savings to pension payments begin to form among working citizens born in 1967 and later. At the beginning of the changes (2014-2015), this category of persons was given the opportunity to independently determine when paying insurance premiums: 6% for the funded portion and 16% for the insurance part of the future pension.

A citizen checks the status of a personal personal account in which savings are stored in several ways: through special Internet services, as well as in person by visiting the relevant state or non-state institutions. If a lack of funds is detected in a savings account, a person needs to deal with the current situation by contacting specialists from the service that regulates the movement of funds forming a pension. There are a number of reasons why a citizen’s account does not contain savings:

- year of birth that does not correspond to the designated date of formation of savings;

- violations committed by the employer making the contributions;

- maintenance of a special savings part in the non-state pension fund;

- reformation of funds by government agencies, “freezing” of the funded part.

Having found out the reason, a person will be able to find savings and receive them. If necessary, a citizen has the right to recover savings through the court.

How to find out about savings

An extract from the PFR personal account is provided online in one of the following ways:

- in your personal account on the Pension Fund website;

- through Sberbank Internet banking;

- on the Gosuslug portal.

Upon personal receipt, a passport and SNILS are provided. If the document is received online, the details are confirmed in advance when registering on the appropriate resources. Therefore, information is provided in the shortest possible time, and you do not have to apply in person for the prepared result. You must pick up the document yourself if you require a paper copy with a stamp and signature.

How is the data received by the Pension Fund?

Data is transferred to the Pension Fund from the employer, who is responsible for transferring contributions from employee salaries. But this is only possible if the employee works under an employment contract. Those who receive a salary in an envelope cannot count on decent deductions in the future.

Citizens working under an employment contract are not responsible for transferring funds to the fund. This responsibility must be fulfilled by their direct employer. But data and funds from employees are not always received in the required volume and on time. Incorrect information may result in incorrect calculation of contributions in the future and retirement later than expected.

All information about the contributions that the client is entitled to upon retirement, his length of service, and the status of his individual personal account is indicated in the extract from the Pension Fund. If, when ordering a document, a citizen discovered that not all years were taken into account when assigning length of service (or other errors in the extract), then it is necessary to apply for correction to the Pension Fund of the Russian Federation at the place of registration.

Request via Sberbank

To plan for a certain level of wealth, you need to start by collecting and analyzing information. First of all, it is important to familiarize yourself with the data on pension accruals.

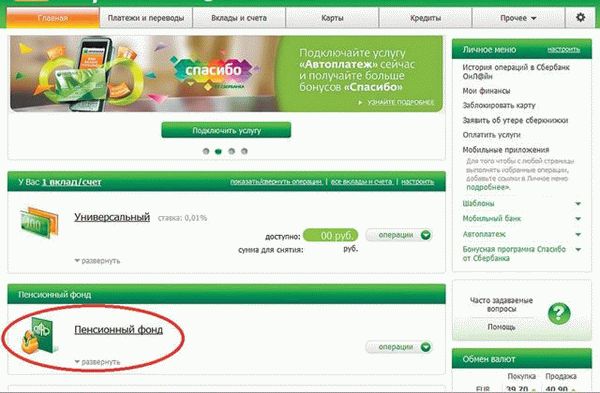

One of the most convenient options for Sberbank clients is Internet banking. To gain access, you must enter into a universal service agreement at a bank branch. The employee will provide a login and password for access, which will then be changed to a suitable one. Next, you should submit an application for registration in the system that carries out the exchange between the pension fund and Sberbank. After this, a special subsection appears on the main page.

An extract from the personal account of the insured person is available after performing certain actions. You need to log into the Sberbank Online system and go to the Pension Fund section. The function becomes available on the main page.

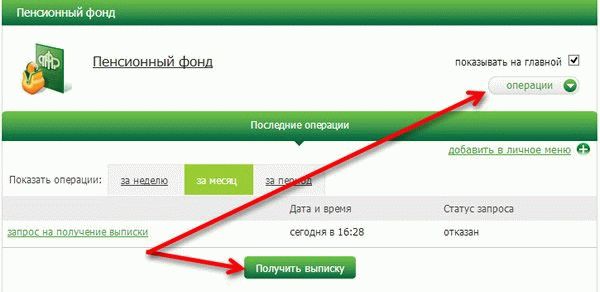

In the window that appears, you need to select “Get an extract.” You can click on the operations icon and select a similar function.

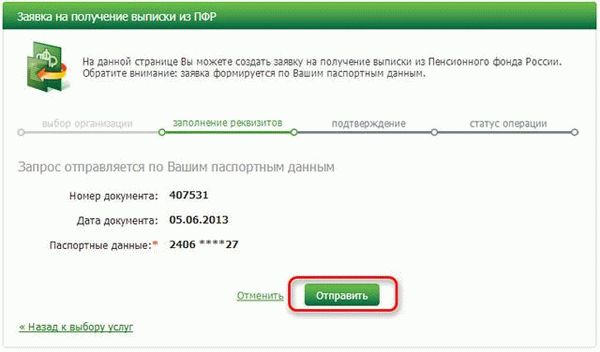

The “Request for an extract” section opens. The information is provided with the passport details that were specified at the time the section was activated in the account. If they change, you must notify a bank employee about this.

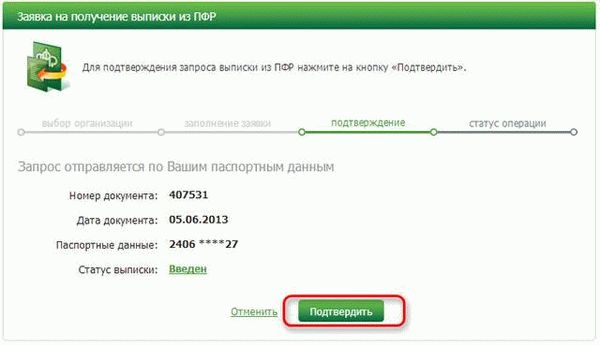

A page appears through which the request is sent. You must confirm it on the next page.

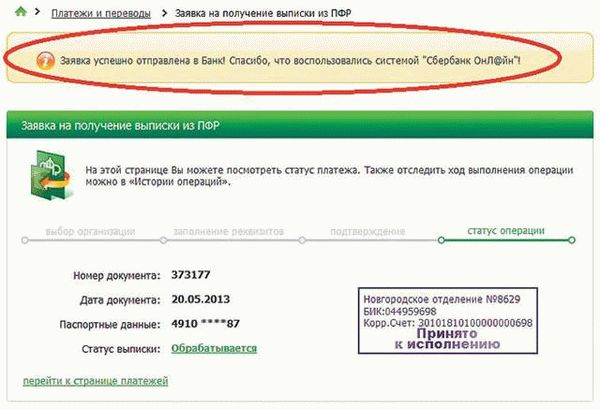

Next, a notification appears that the application has been sent for consideration. After this, it becomes possible to track the status of the operation.

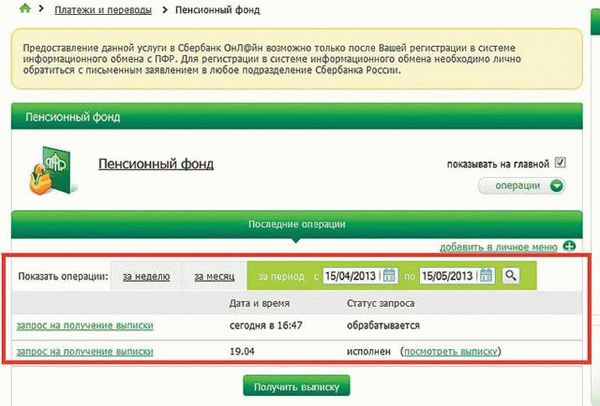

Important! You will be able to view the information when the request is processed by a specialist. Not only a record about this will appear on the main page, but also a link to the document.

Extract from the personal account of the Pension Fund

Ordering instructions:

- Go to the Pension Fund page.

- Find the “Citizen’s Personal Account” tab at the top.

- Click on “Login” on the right side of the site.

- Log in to the system by confirming all the data (click on the “Login” and “Confirm” buttons).

- In the “Individual personal account” column, find the service “Order a certificate (extract) on the status of an individual personal account” and click on the active line.

- Click the “Request” button. At this step, you can additionally check the box so that information about the readiness of the document is sent to your email address.

- Go to “Call History”. The active line will be displayed immediately after sending the statement request.

The “History of Applications” section describes all services provided to the citizen on the Pension Fund website. To familiarize yourself with the document, you need to find information about ordering an extract from the Pension Fund about the state of your personal account and click on the word “Certificate”. The document will be automatically downloaded to the device memory.

What to do with the document

It can be left online, downloaded and printed, or sent by email. The information obtained is used for personal purposes and compared with information from the employer.

If the document is needed to defend interests in government agencies, at work or in court, you will have to submit a request to receive a paper version. This is due to the fact that only the version with the seal and signature of the responsible person has legal force. It is better to obtain it immediately before contacting a certain authority.

Pension fund specialists recommend requesting a statement at least once a year to monitor savings. This is due to the fact that the indicators are entered manually, so inaccuracies due to the human factor cannot be ruled out. It is also recommended to obtain a 2-NDFL certificate from the employer, which indicates deductions. If an error is identified in the transfers, the situation is corrected promptly upon application to the employer. Otherwise, it will remain unnoticed.

Thus, the resulting accrual statement is available via the Internet. To do this, use several services, choosing the most convenient one. Detailed information is provided to support the determination of employer contributions.

What to do if you have no pension contributions

If it is revealed that there are no savings held by a non-state pension fund, a citizen must contact official representatives of the organization, where he will be provided with complete information about his account and actions with it. If a violation is committed by the employer, the person applies to the courts to restore the rights of the insured. The state guarantees the safety of savings and their transfer to the Pension Fund, even if the NPF ceases operation.

A person can secure his pension account by entrusting its contents to a proven and reliable pension fund.

To summarize, we note that today it is easy to find out pension contributions using SNILS. Information is open to citizens. Reasonable control creates a prosperous future.

Receiving a statement for a third party

If a citizen cannot visit the branch in person or order a certificate online, he has the right to entrust the representation of his interests to a loved one. To transfer authority, you will need to provide a document confirming the rights of the representative. This could be, for example, a notarized power of attorney.

If there are supporting documents, an authorized person can receive an account statement. Without a power of attorney, it is impossible to find out about the status of a personal account for third parties, including spouses, parents and other relatives.

Purpose of discharge

Previously, the pension fund sent updated data en masse “chain letters” by Russian Post annually. Since 2013, Federal Law No. 242-FZ has abolished them. To receive them again on a permanent basis, you must submit an application to the Pension Fund. In return, the state offered several alternative ways to obtain an extract at any convenient time.

Why an extract might be needed:

- for registration of long-service, preferential, and disability pensions;

- to control and clarify the correctness of accruals (if any of the employers provided incorrect information or did not provide it at all, the citizen can immediately find out the situation and correct it);

- as an alternative to personal income tax certificate 2: when applying for loans from a bank (this can speed up the process of reviewing the application and encourage a positive answer);

- when preparing a package of documents to the USZN for the issuance of social benefits.

The extract in this situation is considered more informative. And in the future it is planned to completely replace 2 personal income taxes.

If necessary, citizens of the Russian Federation can receive an extract on the status of their pension account

How to receive an extract from a pension fund in person

Visit the customer service department of the local UPFR. This is the simplest and most logical way. You should contact the place of registration, and it does not matter whether it is temporary or permanent. Be sure to have your passport and SNILS with you.

You can pick up the certificate in person or it will be delivered by mail. According to the regulations, both options are generated within 10 days from the date of your application.

Important! If the document is needed urgently, then the pension fund employees can meet halfway and do it earlier. They may even be able to provide it to you on the same day.

You can also obtain an extract from the Pension Fund from the Multifunctional Center for the Provision of State and Municipal Services. It is especially convenient if, in addition to the extract, you need to fill out other papers. In this case, the procedure is not particularly different from the previous one. To register an application, you must present your passport and SNILS. The readiness of the certificate is also determined by the standard period of up to 10 days. But keep in mind that it will no longer be possible to receive a certificate on this day, since the extract will be ordered through the Pension Fund of the Russian Federation, and this will take several days.

You can receive a statement through the Bank. This opportunity appeared relatively recently, so it has not yet gained such popularity among citizens. like previous options. Although it has an undeniable advantage, you will receive a certified certificate in your hands immediately after applying.

As with any other banking service, to obtain a statement, you should contact the operator or through an ATM.

Important: you can get an extract from the ILS at any Bank, regardless of whether you have used its services before or not.

You can receive the statement in person or online

Some subtleties associated with obtaining a certificate

The administrative regulations of the Pension Fund of Russia standardize the procedure for its registration. Some subtleties should be taken into account:

- The representative may be refused to receive a certificate due to lack of consent to the processing of personal data. Without this, the issuance of a certificate is possible only by law enforcement agencies upon an official request.

- The reason for the appeal is not stated.

- The number of requests is not limited by law.

- There is no state fee for the certificate.

- Before issuance, the slip is registered in the journal of outgoing correspondence, which allows the information to be used as a document with legal force.

- The pension certificate does not have a validity period, but due to frequent changes in the amount of payments, it requires updating.

Features of ordering through the MFC

You can get a certificate by contacting one of the MFC branches located at your place of residence. But you will have to wait for the interaction of several authorities, so the period for receiving documents also increases. It often takes up to 5 days to forward a message from the MFC to the Pension Fund.

The procedure will be the same as in the case of applying to the Pension Fund:

- Collection of necessary documents.

- Drawing up an application right on the spot.

- Submission of papers and appeal.

- The reply is in process.

Then all that remains is to pick up the certificate. It’s easier to use the State Services service if you already have an account there.

Help form

The legislation does not regulate the form of the pension document. It is established by the administrative regulations of the Pension Fund. The following information is provided on the standard form:

- about the date, number and place of issue;

- about the authority that issued the document;

- personal data of the benefit recipient;

- type of payment received - insurance, social, labor pension;

- the amount of the monthly payment as of the date of the certificate;

- signature of officials responsible for the accuracy of the data and seal of the government agency.

In addition to basic information, facts of increase, indexation and the amount of payments received for a certain period may be included.

The certificate indicates only the amount of the pension, without providing calculations. To receive a checklist to verify the correctness of the accruals, you must submit a different type of request.

What documents are needed for the request?

It will be necessary to confirm that the citizen really has the right to receive information.

In the case of a personal appeal, the following grounds are used for this:

- A certificate that will serve as proof of the right to maternal capital.

- A certificate for each child and an application in the prescribed form.

- Identification card of the person receiving the benefit.

It is important to have a civil ID or passport on hand when applying. We need the original. Copies are made on site when the need arises. The series and passport number are sufficient for the online paperwork method. Details of other documents will also be needed.

By TIN

How to view pension contributions to the Pension Fund if SNILS is unknown, but you have an INN? You can send a request through the Federal Tax Service website.

On the website of the Federal Tax Service, you need to select an item in the service called “Business Risks” - “Search by TIN or OGRN”.

After entering the TIN data and the code from the picture, press the button to get the results. They are output as a file that can either be downloaded or viewed online. It indicates the PF number.

Another way is to find out your number online on the PF website. First you need to determine the region code using the classifier.

The code has three digits. For example, for Moscow it is 087. Then, by logging into the PF LC, enter the data in a special window for the regional code.

Then select the “Forgot registration number” option. At the next stage, enter your TIN. If everything is done correctly, a 12-digit number should be displayed on the screen.